Electric Vehicle (EV) Battery Leasing Service Market Synopsis

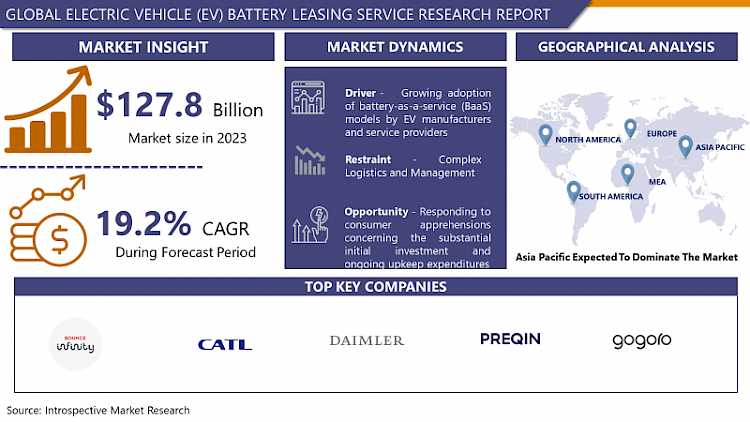

Electric Vehicle (EV) Battery Leasing Service Market Size Was Valued at USD 127.8 Million in 2023, and is Projected to Reach USD 620.9 Million by 2032, Growing at a CAGR of 19.2% From 2024-2032.

The energy accumulators that keep the electricity moving around the engine round-the-clock rank the battery as the most important element of electric vehicles. It is battery leasing service that buyers acquire the vehicle only and not battery along with the car. An electric vehicle battery is bought with a monthly installment. With this service, patrons borrow the batteries. The service has various advantages including the affordability and power pack maintenance. Moreover, owning batteries for electric vehicles can be a life saving exercise. In the last few years, the electric vehicle battery leasing industry has expanded side by side with the increasing need of electric cars.

- Globally, approximately 16. According to Statista, 50 million electric vehicles were operational. As a result, the growing number of electric cars increasingly produces battery failures leading to more vehicle breakdowns. With the rising expense of fuel and the increasing anxiety about global warming both governments all over the world are investing more efforts in the promotion of electric cars in the recent years. Hence, automobile companies are significantly increasing their financial contributions in the field of electric vehicle development which are advanced technologically.

- As an instance, Xpeng, a Chinese EV manufacturer, provided an original battery service to the US market in 2020. These kinds of customers can actually make separate payments for their battery and car body as part of the purchase process. This disruption helps grow EV battery leasing business.

Electric Vehicle (EV) Battery Leasing Service Market Trend Analysis

Growing adoption of battery-as-a-service (BaaS) models by EV manufacturers and service providers

- This trend is not just a shift in traditional ownership of batteries for EVs, but also provides another way for consumers to access and utilize battery technology. In a BaaS agreement, consumers will be required to lease the battery separately and pay a regular fee for the usage of it instead of purchasing the battery with the vehicle. This model accounts for the high initial cost of EVs through the reduction of the upfront purchase price, thus leading to the increased affordability of EVs by more consumers.

- Furthermore, BaaS also ensures flexibility and peace of mind when it comes to EV owners by carrying out battery maintenance, upgrades, and warranty coverage as part of the service package. This is achieved through the disconnection of the battery from the vehicle. This means that manufacturers of EVs can standardize the battery packs in different models of vehicles, simplify the production process, and speed up the innovation in battery technologies. As sustainability and affordability are the key to consumers decisions, BaaS business models are expected to foster market expansion and to alter the landscape of the electric vehicle market in the near future.

Responding to consumer apprehensions concerning the substantial initial investment and ongoing upkeep expenditures

- A potential involving the electric vehicle (EV) battery leasing service, the consumer skepticism of the high initial buying price and long-term maintenance costs can be addressed. Through the leasing of batteries, automakers and third-party providers can remove the financial impediment to EV adoption for many prospective EV owners. Through this model customers can lease the battery as a separate asset from the vehicle, lowering the initial cost and offering the customer flexibility in ownership.

- Furthermore, battery leasing facilities can also offer maintenance, repair, and replacement of the battery as part of the lease agreement, which is a plus for the customers who are worried about the battery degradation with time. Also, leasing provides EV owners with the opportunity to upgrade to the latest battery technologies as they are released thus ensuring continued performance and range enhancement. It not only widens the horizon for electric vehicles which in turn create sustainable transport solutions by promoting EV adoption and cutting carbon emissions.

Electric Vehicle (EV) Battery Leasing Service Market Segment Analysis:

Electric Vehicle (EV) Battery Leasing Service Market is segmented on the basis of Product Type, and Application.

By Product Type, Lithium-Ion Battery segment is expected to dominate the market during the forecast period

- This is mainly due to the high degree of adoption of lithium-ion battery technology in electric vehicles which is superior in energy density, charging times and lifespan. In terms of battery production and the cost reductions brought about by the improvement of the lithium-ion manufacturing processes and production efficiencies, leasing services for these batteries become more affordable for the consumers and the service providers.

- In addition to this, rising demand for electric vehicles, both in national and international markets as well as government incentives and regulations to promote clean mobility further drives the growth of the lithium-ion battery leasing market segment as the manufactures and service providers try to satisfy the growing market while offering cost-effective and sustainable mobility solutions.

- With the expansion of the EV market, Lithium-Ion Battery segment within the EV Battery Leasing Service Market is projected to sustain its leadership position through the ongoing research and development activities to improve the batteries' performance, energy efficiency and safety. In addition, technological developments which include solid-state lithium-ion batteries and advanced battery management systems are forecasted to improve even more the appeal of battery leasing for electric vehicles.

- Through leasing lithium-ion technology, manufacturers and leasing companies can speed up the transition towards electric mobility in a way that addresses issues related to battery ownership and performance longevity.

By Application, Passenger Vehicle segment held the largest share in 2023

- One of the main causes for this is the increasing demand for electric car owners and battery leasing companies in the passenger vehicle segment. First of all, rising consciousness of environmental sustainability and the need to reduce of carbon emissions has been propelling the shift towards electric driving in the passenger vehicle sector. Consumers are now willing to pay an extra price for eco-friendly transport options, which makes electric vehicles more attractive.

- Once again, the high capital expenditures associated with electric vehicles, especially due to the costly batteries, are a major impediment to adoption by many prospective consumers. Battery leasing services provide a solution to the affordability problem by separating the battery cost from the car purchase price, thus allowing more people access to electric vehicles.

- This trend has resulted in the rise of battery leasing services in the passenger vehicle segment, as the customers seek ownership options that are cost-effective without compromising on the performance and the range of their electric vehicles. Furthermore, leasing allows to update the battery models and technologies as the market is constantly changing, making the EV competitive and high-performing.

- With constant development in battery technology and increasing consumer adoption of electric cars, passenger vehicles in EV battery leasing service market would continue to dominate the entire segment, and thus lead the way of growth and innovation in the industry.

Electric Vehicle (EV) Battery Leasing Service Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The electric vehicle (EV) battery leasing service market in the Asia Pacific is experiencing a fast pace of growth and transformation, which is being driven by multiple factors. Firstly, sustainable transportation in the Asia Pacific region is undergoing a major transition to clean energy and electric mobility due to a variety of factors: urbanization, air pollution and government efforts to promote green energy.

- However, electric vehicles are becoming increasingly popular, especially in urban areas where air pollution is more severe. Battery leasing services provide a convenient option for the residents of this region with the advantage of lower initial costs for electric vehicles, thereby making them accessible to a wider cross-section of the society.

- The second aspect is that the Asia Pacific region has some of the world's largest and most dynamic automotive markets, comprising China, Japan, and South Korea. These countries are spearheading the adoption and innovation of electric vehicles along with solid backing from governments, rapid infrastructure developments and a developing EVs manufacturing and suppliers ecosystem.

- Consequently, we see battery leasing services take off, backed by a developing infrastructure of charging stations, state incentives and helpful regulations. Offering battery leasing services will become a critical factor that will determine the future of transportation in the Asia Pacific region as this area is forecasted to become an important battleground for electric vehicle dominance.

Active Key Players in the Electric Vehicle (EV) Battery Leasing Service Market

- Bounce Infinity

- Contemporary Amperex Technology

- Daimler

- E-Charge Up Solutions

- Gogoro

- Groupe Renault

- Honeywell

- KIA

- Leo Motors

- NIO NextEV

- Numocity Technologies

- Ocotillo Power Systems

- Oyika

- RCI BANK AND SERVICES

- Renault Group

- Sun Mobility

- Tesla

- VoltUp

- Other key players

Key Industry Developments in the Electric Vehicle (EV) Battery Leasing Service Market:

- In March 2024, Neuron Energy, a prominent EV battery manufacturer, partnered with Urja Mobility, a startup specializing in battery leasing for commercial EVs. During this partnership, Neuron Energy committed to supplying 2,400 battery packs for electric vehicles in the L5 category and 10,000 battery packs for electric vehicles in the L3 category by the end of the following year.

- In April 2024, Ecofy, a prominent green-only Non-Banking Financial Company (NBFC), and Vidyut, an innovative EV ownership platform focused on enhancing the affordability of electric three-wheelers, formed a strategic partnership to promote sustainable transportation solutions. Ecofy financed the initiative while Vidyut offered a subscription-based battery-as-a-service model, ensuring cost-effective EV solutions.

|

Global Electric Vehicle (EV) Battery Leasing Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 152.3 Mn. |

|

Forecast Period 2024-32 CAGR: |

19.2 % |

Market Size in 2032: |

USD 620.9 Mn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET BY PRODUCT TYPE (2017-2032)

- ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LITHIUM ION BATTERY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- NICKEL METAL HYBRID BATTERIES

- ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET BY APPLICATION (2017-2032)

- ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PASSENGER VEHICLE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COMMERCIAL VEHICLE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Luxury Goods Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- Bounce Infinity

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- CONTEMPORARY AMPEREX TECHNOLOGY

- DAIMLER

- E-CHARGE UP SOLUTIONS

- GOGORO

- GROUPE RENAULT

- HONEYWELL

- KIA

- LEO MOTORS

- NIO NEXTEV

- NUMOCITY TECHNOLOGIES

- OCOTILLO POWER SYSTEMS

- OYIKA

- RCI BANK AND SERVICES

- RENAULT GROUP

- SUN MOBILITY

- TESLA

- VOLTUP

- COMPETITIVE LANDSCAPE

- GLOBAL ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Electric Vehicle (EV) Battery Leasing Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 152.3 Mn. |

|

Forecast Period 2024-32 CAGR: |

19.2 % |

Market Size in 2032: |

USD 620.9 Mn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET COMPETITIVE RIVALRY

TABLE 005. ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET THREAT OF NEW ENTRANTS

TABLE 006. ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET THREAT OF SUBSTITUTES

TABLE 007. ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET BY TYPE

TABLE 008. LITHIUM ION BATTERY MARKET OVERVIEW (2016-2028)

TABLE 009. NICKEL METAL HYBRID BATTERIES MARKET OVERVIEW (2016-2028)

TABLE 010. ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET BY APPLICATION

TABLE 011. PASSENGER VEHICLE MARKET OVERVIEW (2016-2028)

TABLE 012. COMMERCIAL VEHICLE MARKET OVERVIEW (2016-2028)

TABLE 013. NORTH AMERICA ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET, BY TYPE (2016-2028)

TABLE 014. NORTH AMERICA ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 015. N ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 016. EUROPE ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET, BY TYPE (2016-2028)

TABLE 017. EUROPE ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 018. ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 019. ASIA PACIFIC ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET, BY TYPE (2016-2028)

TABLE 020. ASIA PACIFIC ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 021. ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 022. MIDDLE EAST & AFRICA ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET, BY TYPE (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 024. ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 025. SOUTH AMERICA ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET, BY TYPE (2016-2028)

TABLE 026. SOUTH AMERICA ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 027. ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 028. NIO NEXTEV: SNAPSHOT

TABLE 029. NIO NEXTEV: BUSINESS PERFORMANCE

TABLE 030. NIO NEXTEV: PRODUCT PORTFOLIO

TABLE 031. NIO NEXTEV: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 031. BOUNCE INFINITY: SNAPSHOT

TABLE 032. BOUNCE INFINITY: BUSINESS PERFORMANCE

TABLE 033. BOUNCE INFINITY: PRODUCT PORTFOLIO

TABLE 034. BOUNCE INFINITY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. TESLA: SNAPSHOT

TABLE 035. TESLA: BUSINESS PERFORMANCE

TABLE 036. TESLA: PRODUCT PORTFOLIO

TABLE 037. TESLA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. CONTEMPORARY AMPEREX TECHNOLOGY: SNAPSHOT

TABLE 038. CONTEMPORARY AMPEREX TECHNOLOGY: BUSINESS PERFORMANCE

TABLE 039. CONTEMPORARY AMPEREX TECHNOLOGY: PRODUCT PORTFOLIO

TABLE 040. CONTEMPORARY AMPEREX TECHNOLOGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. E-CHARGE UP SOLUTIONS: SNAPSHOT

TABLE 041. E-CHARGE UP SOLUTIONS: BUSINESS PERFORMANCE

TABLE 042. E-CHARGE UP SOLUTIONS: PRODUCT PORTFOLIO

TABLE 043. E-CHARGE UP SOLUTIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. DAIMLER: SNAPSHOT

TABLE 044. DAIMLER: BUSINESS PERFORMANCE

TABLE 045. DAIMLER: PRODUCT PORTFOLIO

TABLE 046. DAIMLER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. NUMOCITY TECHNOLOGIES: SNAPSHOT

TABLE 047. NUMOCITY TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 048. NUMOCITY TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 049. NUMOCITY TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. OCOTILLO POWER SYSTEMS: SNAPSHOT

TABLE 050. OCOTILLO POWER SYSTEMS: BUSINESS PERFORMANCE

TABLE 051. OCOTILLO POWER SYSTEMS: PRODUCT PORTFOLIO

TABLE 052. OCOTILLO POWER SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. OYIKA: SNAPSHOT

TABLE 053. OYIKA: BUSINESS PERFORMANCE

TABLE 054. OYIKA: PRODUCT PORTFOLIO

TABLE 055. OYIKA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. RENAULT GROUP: SNAPSHOT

TABLE 056. RENAULT GROUP: BUSINESS PERFORMANCE

TABLE 057. RENAULT GROUP: PRODUCT PORTFOLIO

TABLE 058. RENAULT GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. SUN MOBILITY: SNAPSHOT

TABLE 059. SUN MOBILITY: BUSINESS PERFORMANCE

TABLE 060. SUN MOBILITY: PRODUCT PORTFOLIO

TABLE 061. SUN MOBILITY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. VOLTUP: SNAPSHOT

TABLE 062. VOLTUP: BUSINESS PERFORMANCE

TABLE 063. VOLTUP: PRODUCT PORTFOLIO

TABLE 064. VOLTUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. GROUPE RENAULT: SNAPSHOT

TABLE 065. GROUPE RENAULT: BUSINESS PERFORMANCE

TABLE 066. GROUPE RENAULT: PRODUCT PORTFOLIO

TABLE 067. GROUPE RENAULT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. RCI BANK AND SERVICES: SNAPSHOT

TABLE 068. RCI BANK AND SERVICES: BUSINESS PERFORMANCE

TABLE 069. RCI BANK AND SERVICES: PRODUCT PORTFOLIO

TABLE 070. RCI BANK AND SERVICES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. HONEYWELL: SNAPSHOT

TABLE 071. HONEYWELL: BUSINESS PERFORMANCE

TABLE 072. HONEYWELL: PRODUCT PORTFOLIO

TABLE 073. HONEYWELL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. KIA: SNAPSHOT

TABLE 074. KIA: BUSINESS PERFORMANCE

TABLE 075. KIA: PRODUCT PORTFOLIO

TABLE 076. KIA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. GOGORO: SNAPSHOT

TABLE 077. GOGORO: BUSINESS PERFORMANCE

TABLE 078. GOGORO: PRODUCT PORTFOLIO

TABLE 079. GOGORO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. LEO MOTORS: SNAPSHOT

TABLE 080. LEO MOTORS: BUSINESS PERFORMANCE

TABLE 081. LEO MOTORS: PRODUCT PORTFOLIO

TABLE 082. LEO MOTORS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 083. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 084. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 085. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET OVERVIEW BY TYPE

FIGURE 012. LITHIUM ION BATTERY MARKET OVERVIEW (2016-2028)

FIGURE 013. NICKEL METAL HYBRID BATTERIES MARKET OVERVIEW (2016-2028)

FIGURE 014. ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET OVERVIEW BY APPLICATION

FIGURE 015. PASSENGER VEHICLE MARKET OVERVIEW (2016-2028)

FIGURE 016. COMMERCIAL VEHICLE MARKET OVERVIEW (2016-2028)

FIGURE 017. NORTH AMERICA ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 018. EUROPE ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. ASIA PACIFIC ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. MIDDLE EAST & AFRICA ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. SOUTH AMERICA ELECTRIC VEHICLE (EV) BATTERY LEASING SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Electric Vehicle (EV) Battery Leasing Service Market research report is 2024-2032.

Bounce Infinity, Contemporary Amperex Technology, Daimler, E-Charge Up Solutions, Gogoro, Groupe Renault, Honeywell, KIA, Leo Motors, NIO NextEV, Numocity Technologies, Ocotillo Power Systems, Oyika, RCI BANK AND SERVICES, Renault Group, Sun Mobility, Tesla, VoltUp, Other key players

The Electric Vehicle (EV) Battery Leasing Service Market is segmented into Product Type, Application, and region. By Product Type, the market is categorized into Lithium Ion Battery, Nickel Metal Hybrid Batteries. By Application, the market is categorized into Passenger Vehicle, Commercial Vehicle. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Energy accumulators, which are responsible for storing and transferring electricity perpetually throughout the engine, consider the battery to be the most vital component of electric vehicles. The battery leasing service entails electric vehicle proprietors procuring solely the vehicle and not a battery concurrently with the car purchase. A periodic payment is made to acquire an electric vehicle battery. In the context of this service, patrons rent the batteries. This service has numerous advantages, including affordability and power pack maintenance. Additionally, renting batteries for electric vehicles can be a life-saving measure. In recent years, the electric vehicle battery leasing industry has expanded in tandem with the rising demand for electric vehicles.

Electric Vehicle (EV) Battery Leasing Service Market Size Was Valued at USD 127.8 Million in 2023, and is Projected to Reach USD 620.9 Million by 2032, Growing at a CAGR of 19.2% From 2024-2032.