Electric Mobility Market Synopsis

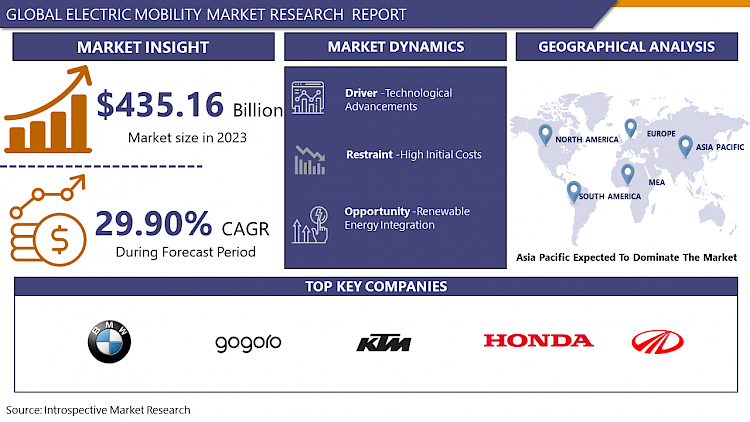

Electric Mobility Market Size Was Valued at USD 435.16 Billion in 2023, and is Projected to Reach USD 4582.80 Billion by 2032, Growing at a CAGR of 29.90% From 2024-2032.

The electric mobility market encompasses all vehicles powered by electric propulsion systems, including electric vehicles (EVs), e-bikes, e-scooters, and electric buses, along with the necessary infrastructure like charging stations and energy management systems. Driven by the need to reduce greenhouse gas emissions, improve air quality, and decrease reliance on fossil fuels, this market is expanding rapidly. Advances in battery technology, government incentives, and growing environmental awareness are key factors propelling its growth. The market's evolution promises significant reductions in global carbon emissions and a transformative impact on transportation.

- The market for electric mobility has grown at an exponential rate in recent years thanks to government policies that are supportive of the industry, technological breakthroughs, and environmental concerns. Electric vehicles (EVs), which include cars, buses, motorcycles, and scooters, as well as the infrastructure that supports them, such as battery technology and charging stations, are all part of this quickly expanding industry. Well-known automakers, tech companies, and a few startups are among the notable players in the market, all vying for a piece of this rapidly expanding market. The transition from traditional internal combustion engine vehicles to electric alternatives, which also significantly reduce greenhouse gas emissions, is transforming the automobile industry.

- The demand for electric cars is rising as consumers become more conscious of environmental issues including climate change and the effects of fossil fuels. All throughout the world, governments are passing stringent pollution regulations and offering incentives to speed up the adoption of electric vehicles. These policies, which include tax incentives, grants, and subsidies, lower the overall cost of buying an electric vehicle (EV). Additionally, as battery technology advances, electric vehicles' performance and range increase, making them more competitive with traditional cars. Expanding the infrastructure for charging is also crucial since it makes driving an electric car easier and less stressful when one is out of range.

- Despite the positive trends, the electric transportation market faces some challenges. Many still believe electric vehicles to be unreasonably expensive at first, even if the price is gradually declining. The availability of raw materials like cobalt and lithium, which are used to make batteries, poses risks to the supply chain. Moreover, more needs to be done to build a strong infrastructure for charging, especially in remote and underdeveloped places. Still, further research and development, as well as astute partnerships and capital expenditures, are expected to resolve these problems and drive market growth.

- Forecasts show that infrastructure development and automobile sales will both continue to rise, which is encouraging for the market for electric mobility. Thanks to advancements like solid-state batteries, wireless charging, and autonomous driving technology, the industry is set to experience a significant upheaval. It will be crucial to achieving the goals of global sustainability and transforming urban mobility as the market grows. Governments, corporate executives, and consumers working together will make transportation in the future greener, more efficient, and sustainable.

Electric Mobility Market Trend Analysis

Global Surge in Electric Vehicle Adoption

- Globally, the use of electric cars (EVs) has increased as a result of a number of forces coming together to change the automotive sector. The urgency of environmental issues has grown, with the main focus being on lowering greenhouse gas emissions and enhancing urban air quality. Globally, governments are enforcing strict policies and goals to reduce carbon emissions, frequently providing incentives for the purchase of electric vehicles (EVs). These regulations, which encourage automakers to engage in the development and manufacturing of electric vehicles, take the form of tax breaks, mandates, and subsidies. Because of this, big automakers are moving more quickly to switch from internal combustion engines (ICEs) to electric powertrains and are investing a large amount of money in EV research and development.

- Innovations in technology have also been a major factor in the adoption of EVs. The development of high-energy-density lithium-ion batteries has shortened charging periods and increased vehicle range thanks to advancements in battery technology. The efficiency and performance of EVs have been significantly improved by innovations in energy management systems and electric drivetrains, making them more and more competitive with conventional ICE vehicles. In addition, worries regarding range anxiety have subsided thanks to the development of the infrastructure for charging, which has been financed by both public and private investments. This has made electric vehicles more feasible for everyday usage.

- When taken as a whole, these elements are not only revolutionizing the car sector but also accelerating the general transition to environmentally friendly modes of transportation. One important step in lowering reliance on fossil fuels and lessening the environmental effect of transportation is the rise of electric automobiles. The trajectory of electric mobility seems set for further expansion, altering both the global automobile markets and urban mobility in the future as technology and regulatory frameworks continue to advance.

Infrastructure Development in Electric Vehicle Charging

- In order to overcome range anxiety, one of the main obstacles to the broad adoption of electric vehicles (EVs), charging infrastructure growth is essential. Around the world, governments and private businesses understand how important infrastructure is to hastening the shift to electric vehicles. Along major highways, fast-charging stations are positioned strategically to allay worries about long-distance driving and facilitate swift recharging for electric vehicle drivers. These stations usually use high-power chargers that can quickly and significantly restore battery capacity, enabling EV owners to go on lengthy trips.

- Slower chargers, such Level 2 chargers, are also widely used in offices and metropolitan regions. These chargers are made for residential use and offer convenience to EV owners who park their cars for long stretches of time. They can be used for overnight or continuous charging. By incorporating charging effortlessly into everyday routines, workplace charging stations not only enable employees to commute with a full charge by the end of the workday, but they also help to the general expansion of EV adoption. These infrastructure investments are essential to fostering customer confidence in EV purchases because they provide convenient and dependable charging choices that allay worries about running out of battery juice on a daily basis.

- Furthermore, the development of charging infrastructure serves a strategic purpose in creating an environment that is favorable to electric mobility, going beyond merely resolving pragmatic issues. Governments and corporations are helping to lower carbon emissions and improve urban air quality by supporting the adoption of EVs. The expansion of infrastructure also supports greener transportation options and lessens reliance on fossil fuels, which are more broadly aligned with sustainability objectives. The basis for a sustainable future of mobility is further cemented as the network of charging stations grows and changes in response to technological improvements and demand, which benefits both people and society as a whole.

Electric Mobility Market Segment Analysis:

Electric Mobility Market Segmented based on By Product, By Drive, By Battery, By End-user.

By Product, Electric Scooterssegment is expected to dominate the market during the forecast period

- Because they are ideal for short-distance and urban commuting, electric scooters have become the market leader in the electric two-wheeler category. Their appeal is due to a number of things, such as their affordability, simplicity of usage, and cheaper maintenance as compared to electric bikes and motorbikes. Due to their small size and ease of use, electric scooters are a useful option in crowded areas where traffic congestion is a problem. Because they can maneuver through confined places and get to their destinations quickly, they are frequently chosen by commuters because they save down on travel time and fuel expenses. Furthermore, a variety of users, including novice and expert riders, can utilize electric scooters due to their ease of use, as most models come equipped with automated transmissions and user-friendly controls.

- Conversely, electric bikes serve a specialized market made up of enthusiasts and people looking for longer-distance solutions for commuting or recreational activities. In contrast to scooters, electric bikes frequently have throttle or pedal assist features that combine human effort and electric propulsion for more flexibility and range. This makes them perfect for fitness, relaxing rides, or traveling over uneven terrain when having extra help is helpful. Customers who care about the environment and want to lessen their carbon footprint without sacrificing the fun and health advantages of riding bikes will also be drawn to electric bikes. Even though they might not have as much of a market share as electric scooters, electric bikes are nevertheless very important for encouraging environmentally friendly transportation options and increasing the general uptake of electric two-wheelers among various consumer groups. As consumer preferences and technology progress, it is anticipated that electric bikes and scooters will play a major role in the continuous expansion and metamorphosis of the electric transportation scene.

By Drive, Hub Drive segment held the largest share in 2023

- Hub drives have emerged as the dominant choice in the electric bicycle market due to several compelling advantages that cater to a wide range of consumers. Their simplicity of incorporation into bicycle designs, which maintains the comfortable riding experience that traditional bikers value, is partly responsible for their appeal. Hub drives fit right into existing bike setups, unlike belt and chain drives, which could need changes to the frame and powertrain of a bicycle. This simplicity of installation guarantees that the whole functionality and aesthetics of the bike are not only little disrupted, but also less complicated than when converting a regular bicycle to an electric one.

- Hub drives are also praised for their dependability and little maintenance needs. These drive systems are intrinsically insulated from outside factors like dirt, water, and debris, which can shorten their lifespan and impair performance, because the motor is housed inside the wheel hub. Because of this design feature, electric bicycles with hub drives are more durable and are therefore favored by individual customers who value ease of use and hassle-free riding. Hub drives are also less complicated to maintain, which makes them attractive to a wider range of customers looking for dependable and effective transportation options. Because hub drives can be integrated into classic bicycle designs and provide dependable electric power for both leisure and daily riding, they have managed to hold the highest market share in the industry.

Electric Mobility Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- Electric mobility has exploded throughout the Asia-Pacific area thanks to a number of important causes. The greatest market for electric cars (EVs) worldwide, China, has had a tremendous impact on the development of the area. Growth has been boosted by the Chinese government's ambitious EV adoption targets and significant investments in charging infrastructure. In addition to boosting consumer confidence, policies like strict pollution rules and subsidies for electric vehicle purchases have also encouraged innovation among domestic manufacturers. Cities are facing air quality problems, thus the move to electric vehicles is in line with China's larger environmental objectives. This will encourage further adoption and technological breakthroughs in battery and renewable energy integration.

- Important participants in the regional electric mobility market are also emerging from India and Southeast Asia. To lessen its reliance on imported fossil fuels and minimize urban pollution, India, for example, has started ambitious plans to electrify its cities. To promote the adoption of EVs, the government is offering tax breaks, subsidies, and infrastructure expenditures for charging stations. Similar environmental concerns and pressures from urbanization are driving up interest in electric vehicles (EVs) in Southeast Asian countries including Thailand, Indonesia, and Vietnam. Innovations in battery production and alliances with foreign automakers are quickening the adoption curve even more. The Asia-Pacific region is seeing a strong push towards electric mobility despite obstacles related to infrastructure and the diverse economic conditions in various markets. This trend is being driven by a combination of factors such as increasing environmental awareness, technology breakthroughs, and legislative backing.

Active Key Players in the Electric Mobility Market

- BMW Motorrad International

- Gogoro, Inc.

- Honda Motor Co. Ltd.

- KTM AG

- Mahindra Group

- Ninebot Ltd.

- Suzuki Motor Corporation

- Terra Motors Corporation

- Vmoto Limited ABN

- Yamaha Motor Company Limited

- Other Key Players

Key Industry Developments in the Electric Mobility Market:

- In January 2024, Tesla announced that plans to make an inexpensive robotaxi and an entry-level, USD 25,000 electric car based on the same vehicle architecture in 2025. The model, which includes an entry-level car, would allow it to compete with cheaper gasolinepowered cars and a growing number of inexpensive EVs, such as those made by China's BYD.

- In June 2023, Ford announced that the company would receive USD 9.2 billion as part of a dependent loan from the US Department of Energy to assist in constructing three huge electric vehicle battery factories. The loan originates from the DOE’s Advanced Technology Vehicles Manufacturing (AVTM) program.

- In October 2023, Stellantis N.V. signed a MOU to establish a joint venture for recycling end-of-life electric vehicle batteries and scrap from gigafactories in Enlarged Europe and North America. The joint venture capitalizes on Orano’s innovative, low-carbon technology, which breaks with existing processes, allowing the recovery of all materials from lithium-ion batteries and manufacturing new cathode materials.

Global Electric Mobility Market Scope:

|

Global Electric Mobility Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 435.16 Bn. |

|

Forecast Period 2024-32 CAGR: |

29.90% |

Market Size in 2032: |

USD 4582.80 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Drive |

|

||

|

By Battery |

|

||

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ELECTRIC MOBILITY MARKET BY PRODUCT (2017-2032)

- ELECTRIC MOBILITY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ELECTRIC BIKES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- ELECTRIC SCOOTERS

- ELECTRIC MOTORIZED SCOOTERS

- ELECTRIC MOTORCYCLES

- ELECTRIC MOBILITY MARKET BY DRIVE (2017-2032)

- ELECTRIC MOBILITY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- Belt Drive

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CHAIN DRIVE

- HUB DRIVE

- ELECTRIC MOBILITY MARKET BY BATTERY (2017-2032)

- ELECTRIC MOBILITY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- Lead Acid Battery

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LI-ION BATTERY

- ELECTRIC MOBILITY MARKET BY END-USER (2017-2032)

- ELECTRIC MOBILITY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PERSONAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COMMERCIAL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- Electric Mobility Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- BMW MOTORRAD INTERNATIONAL

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- GOGORO, INC.

- HONDA MOTOR CO. LTD.

- KTM AG

- MAHINDRA GROUP

- NINEBOT LTD.

- SUZUKI MOTOR CORPORATION

- TERRA MOTORS CORPORATION

- VMOTO LIMITED ABN

- YAMAHA MOTOR COMPANY LIMITED

- COMPETITIVE LANDSCAPE

- GLOBAL ELECTRIC MOBILITY MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product

- Historic And Forecasted Market Size By Drive

- Historic And Forecasted Market Size By Battery

- Historic And Forecasted Market Size By End-user

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

-

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

-

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Electric Mobility Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 435.16 Bn. |

|

Forecast Period 2024-32 CAGR: |

29.90% |

Market Size in 2032: |

USD 4582.80 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Drive |

|

||

|

By Battery |

|

||

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ELECTRIC MOBILITY MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ELECTRIC MOBILITY MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ELECTRIC MOBILITY MARKET COMPETITIVE RIVALRY

TABLE 005. ELECTRIC MOBILITY MARKET THREAT OF NEW ENTRANTS

TABLE 006. ELECTRIC MOBILITY MARKET THREAT OF SUBSTITUTES

TABLE 007. ELECTRIC MOBILITY MARKET BY PRODUCT TYPE

TABLE 008. ELECTRIC BICYCLE MARKET OVERVIEW (2016-2028)

TABLE 009. ELECTRIC CAR MARKET OVERVIEW (2016-2028)

TABLE 010. ELECTRIC MOTORCYCLE MARKET OVERVIEW (2016-2028)

TABLE 011. ELECTRIC SCOOTER MARKET OVERVIEW (2016-2028)

TABLE 012. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 013. ELECTRIC MOBILITY MARKET BY BATTERY TYPE

TABLE 014. NIMH MARKET OVERVIEW (2016-2028)

TABLE 015. SEALED LEAD ACID MARKET OVERVIEW (2016-2028)

TABLE 016. LI-ION MARKET OVERVIEW (2016-2028)

TABLE 017. ELECTRIC MOBILITY MARKET BY VOLTAGE TYPE

TABLE 018. LESS THAN 24V MARKET OVERVIEW (2016-2028)

TABLE 019. 24V MARKET OVERVIEW (2016-2028)

TABLE 020. 36V MARKET OVERVIEW (2016-2028)

TABLE 021. 48V MARKET OVERVIEW (2016-2028)

TABLE 022. GREATER THAN 48V MARKET OVERVIEW (2016-2028)

TABLE 023. NORTH AMERICA ELECTRIC MOBILITY MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 024. NORTH AMERICA ELECTRIC MOBILITY MARKET, BY BATTERY TYPE (2016-2028)

TABLE 025. NORTH AMERICA ELECTRIC MOBILITY MARKET, BY VOLTAGE TYPE (2016-2028)

TABLE 026. N ELECTRIC MOBILITY MARKET, BY COUNTRY (2016-2028)

TABLE 027. EUROPE ELECTRIC MOBILITY MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 028. EUROPE ELECTRIC MOBILITY MARKET, BY BATTERY TYPE (2016-2028)

TABLE 029. EUROPE ELECTRIC MOBILITY MARKET, BY VOLTAGE TYPE (2016-2028)

TABLE 030. ELECTRIC MOBILITY MARKET, BY COUNTRY (2016-2028)

TABLE 031. ASIA PACIFIC ELECTRIC MOBILITY MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 032. ASIA PACIFIC ELECTRIC MOBILITY MARKET, BY BATTERY TYPE (2016-2028)

TABLE 033. ASIA PACIFIC ELECTRIC MOBILITY MARKET, BY VOLTAGE TYPE (2016-2028)

TABLE 034. ELECTRIC MOBILITY MARKET, BY COUNTRY (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA ELECTRIC MOBILITY MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA ELECTRIC MOBILITY MARKET, BY BATTERY TYPE (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA ELECTRIC MOBILITY MARKET, BY VOLTAGE TYPE (2016-2028)

TABLE 038. ELECTRIC MOBILITY MARKET, BY COUNTRY (2016-2028)

TABLE 039. SOUTH AMERICA ELECTRIC MOBILITY MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 040. SOUTH AMERICA ELECTRIC MOBILITY MARKET, BY BATTERY TYPE (2016-2028)

TABLE 041. SOUTH AMERICA ELECTRIC MOBILITY MARKET, BY VOLTAGE TYPE (2016-2028)

TABLE 042. ELECTRIC MOBILITY MARKET, BY COUNTRY (2016-2028)

TABLE 043. VMOTO LIMITED ABN: SNAPSHOT

TABLE 044. VMOTO LIMITED ABN: BUSINESS PERFORMANCE

TABLE 045. VMOTO LIMITED ABN: PRODUCT PORTFOLIO

TABLE 046. VMOTO LIMITED ABN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. TESLA: SNAPSHOT

TABLE 047. TESLA: BUSINESS PERFORMANCE

TABLE 048. TESLA: PRODUCT PORTFOLIO

TABLE 049. TESLA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. TERRA MOTORS: SNAPSHOT

TABLE 050. TERRA MOTORS: BUSINESS PERFORMANCE

TABLE 051. TERRA MOTORS: PRODUCT PORTFOLIO

TABLE 052. TERRA MOTORS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. CONTINENTAL AG: SNAPSHOT

TABLE 053. CONTINENTAL AG: BUSINESS PERFORMANCE

TABLE 054. CONTINENTAL AG: PRODUCT PORTFOLIO

TABLE 055. CONTINENTAL AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. ALTA MOTORS: SNAPSHOT

TABLE 056. ALTA MOTORS: BUSINESS PERFORMANCE

TABLE 057. ALTA MOTORS: PRODUCT PORTFOLIO

TABLE 058. ALTA MOTORS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. ACCELL GROUP: SNAPSHOT

TABLE 059. ACCELL GROUP: BUSINESS PERFORMANCE

TABLE 060. ACCELL GROUP: PRODUCT PORTFOLIO

TABLE 061. ACCELL GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. NISSAN MOTOR CORPORATION: SNAPSHOT

TABLE 062. NISSAN MOTOR CORPORATION: BUSINESS PERFORMANCE

TABLE 063. NISSAN MOTOR CORPORATION: PRODUCT PORTFOLIO

TABLE 064. NISSAN MOTOR CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. ZERO MOTORCYCLES INC.: SNAPSHOT

TABLE 065. ZERO MOTORCYCLES INC.: BUSINESS PERFORMANCE

TABLE 066. ZERO MOTORCYCLES INC.: PRODUCT PORTFOLIO

TABLE 067. ZERO MOTORCYCLES INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. KINETIC GREEN ENERGY & POWER SOLUTIONS LTD.: SNAPSHOT

TABLE 068. KINETIC GREEN ENERGY & POWER SOLUTIONS LTD.: BUSINESS PERFORMANCE

TABLE 069. KINETIC GREEN ENERGY & POWER SOLUTIONS LTD.: PRODUCT PORTFOLIO

TABLE 070. KINETIC GREEN ENERGY & POWER SOLUTIONS LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 071. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 072. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 073. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ELECTRIC MOBILITY MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ELECTRIC MOBILITY MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 012. ELECTRIC BICYCLE MARKET OVERVIEW (2016-2028)

FIGURE 013. ELECTRIC CAR MARKET OVERVIEW (2016-2028)

FIGURE 014. ELECTRIC MOTORCYCLE MARKET OVERVIEW (2016-2028)

FIGURE 015. ELECTRIC SCOOTER MARKET OVERVIEW (2016-2028)

FIGURE 016. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 017. ELECTRIC MOBILITY MARKET OVERVIEW BY BATTERY TYPE

FIGURE 018. NIMH MARKET OVERVIEW (2016-2028)

FIGURE 019. SEALED LEAD ACID MARKET OVERVIEW (2016-2028)

FIGURE 020. LI-ION MARKET OVERVIEW (2016-2028)

FIGURE 021. ELECTRIC MOBILITY MARKET OVERVIEW BY VOLTAGE TYPE

FIGURE 022. LESS THAN 24V MARKET OVERVIEW (2016-2028)

FIGURE 023. 24V MARKET OVERVIEW (2016-2028)

FIGURE 024. 36V MARKET OVERVIEW (2016-2028)

FIGURE 025. 48V MARKET OVERVIEW (2016-2028)

FIGURE 026. GREATER THAN 48V MARKET OVERVIEW (2016-2028)

FIGURE 027. NORTH AMERICA ELECTRIC MOBILITY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. EUROPE ELECTRIC MOBILITY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. ASIA PACIFIC ELECTRIC MOBILITY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. MIDDLE EAST & AFRICA ELECTRIC MOBILITY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. SOUTH AMERICA ELECTRIC MOBILITY MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Electric Mobility Market research report is 2023-2030.

BMW Motorrad International; Gogoro, Inc.; Honda Motor Co. Ltd.; KTM AG; Mahindra Group; Ninebot Ltd.; Suzuki Motor Corporation; Terra Motors Corporation; Vmoto Limited ABN; Yamaha Motor Company Limitedand Other Major Players.

The Electric Mobility Market is segmented into By Product, By Drive, By Battery, By End-user and region. By Product, the market is categorized into Electric Bikes,Electric Scooters, Electric Motorized Scooters and Electric Motorcycles. By Drive, the market is categorized into Belt Drive, Chain Drive and Hub Drive. By Battery, the market is categorized into Lead Acid Battery, Li-Ion Battery and Others. By End-user, the market is categorized into Personal and Commercial. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The electric mobility market encompasses all vehicles powered by electric propulsion systems, including electric vehicles (EVs), e-bikes, e-scooters, and electric buses, along with the necessary infrastructure like charging stations and energy management systems. Driven by the need to reduce greenhouse gas emissions, improve air quality, and decrease reliance on fossil fuels, this market is expanding rapidly. Advances in battery technology, government incentives, and growing environmental awareness are key factors propelling its growth. The market's evolution promises significant reductions in global carbon emissions and a transformative impact on transportation.

Electric Mobility Market Size Was Valued at USD 435.16 Billion in 2023, and is Projected to Reach USD 4582.80 Billion by 2032, Growing at a CAGR of 29.90% From 2024-2032.