EV Transmission Market Synopsis

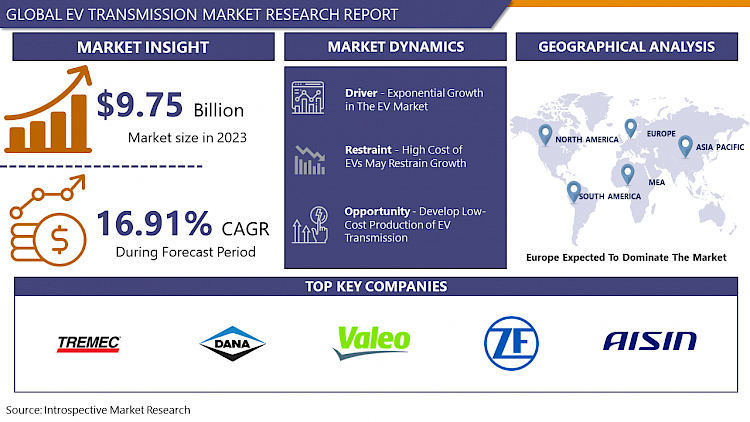

The Global EV Transmission Market size is expected to grow from USD 9.75 billion in 2023 to USD 39.78 billion by 2030, at a CAGR of 16.91% during the forecast period (2024-2032).

Transmission for electric vehicles is used to transmit mechanical power from the electric traction motor to the wheels of an electric vehicle. The majority of electric cars only have a single-speed transmission since, in today's world, it is sufficient for efficient operation. There are other vehicle types, though, for which using a multi-speed gearbox makes sense.

- Since discrete power devices and obscure design methodologies predominated in the field of power electronics a few years ago, where they were often closely supervised by professional power engineers, the field has advanced significantly. Power electronics are now being integrated into systems by integrating with high-speed networking, microprocessors, converters for smart power designs, and cutting-edge thermal management techniques.

- In terms of power density, compact size, weight, and power consumption, power electronics are also keeping up with technological advances (SWaP). Therefore, the development of contemporary power electronics will accelerate market growth in the years to come.

- Power electronics play a significant part in several industries, including aircraft, consumer goods, heavy industry, and automobiles. Additionally, it aids in enhancing the usefulness, safety, and performance of automobiles.

EV Transmission Market Trend Analysis

Exponential Growth in The EV Market

- Exponential growth serves as the dynamic force propelling the Electric Vehicle (EV) market into a transformative era. The intersection of technological advancements, environmental consciousness, and policy incentives has catalyzed a surge in EV adoption, creating a self-reinforcing cycle of expansion. The improving energy density of batteries, coupled with declining costs, has fueled the exponential rise of EVs, enhancing their viability and attractiveness to consumers.

- Governments worldwide are increasingly committing to sustainability goals, offering incentives, subsidies, and regulatory support that further amplify the growth trajectory of the EV market. This supportive environment encourages innovation and investment, fostering a robust ecosystem for electric mobility solutions.

- The network effect comes into play as a growing infrastructure of charging stations addresses range anxiety, reinforcing consumer confidence and facilitating mass adoption. As EVs become more prevalent, economies of scale drive down production costs, making electric vehicles increasingly cost-competitive with traditional internal combustion engine vehicles.

- This exponential growth is reshaping the automotive landscape, ushering in a cleaner and more sustainable future. The EV market's upward trajectory signifies a paradigm shift towards environmentally conscious transportation, with the potential to revolutionize the entire automotive industry.

Opportunity to Develop Low-Cost Production of EV Transmission

- The growing demand for electric vehicles (EVs) presents a significant opportunity for developing low-cost production of EV transmissions, contributing to the advancement of the EV market. As the automotive industry undergoes a transformative shift toward sustainable and clean transportation, the need for cost-effective solutions becomes paramount.

- By focusing on the development of affordable electric vehicle transmissions, manufacturers can address a critical component in the production process, potentially reducing the overall cost of EVs. This cost efficiency is vital for making EVs more accessible to a broader consumer base, fostering increased adoption and market penetration.

- A low-cost EV transmission system not only benefits consumers but also supports the broader goals of environmental sustainability. The reduction in production costs could translate into more competitive pricing for EVs, making them an attractive option compared to traditional internal combustion engine vehicles. This, in turn, can accelerate the transition to a greener automotive landscape, aligning with global efforts to combat climate change and reduce reliance on fossil fuels.

EV Transmission Market Segment Analysis:

EV Transmission Market Segmented on the basis of Transmission System, Transmission Type, and Vehicle Type,

By Transmission System, AMT Transmission segment is expected to dominate the market during the forecast period

- Automated Manual Transmission (AMT) is poised to dominate the Electric Vehicle (EV) market within the Transmission System segment. AMT offers a seamless blend of manual and automatic transmission characteristics, providing drivers with the convenience of automatic gear changes while retaining the option for manual control. This technology is gaining traction in the EV market due to its cost-effectiveness, fuel efficiency, and ease of integration into electric drivetrains.

- AMT transmissions contribute significantly to enhancing the overall driving experience in electric vehicles by optimizing power delivery and improving energy efficiency. The simplicity of design and reduced manufacturing complexity make AMT an attractive choice for EV manufacturers looking to streamline production processes and reduce costs, ultimately benefiting end consumers.

By Transmission Type, Multi-Speed segment held the largest share of 44.72% in 2022

- The Multi-Speed segment is poised to assert dominance in the Electric Vehicle (EV) market by Transmission Type. As technological advancements and consumer demands converge, the Multi-Speed transmission system offers a compelling solution to enhance overall EV performance and efficiency. Unlike traditional single-speed transmissions, Multi-Speed transmissions enable better optimization of power delivery across varying driving conditions.

- This dominance can be attributed to several key advantages. Multi-Speed transmissions facilitate improved acceleration and deceleration, addressing a common concern in the EV market. This enhancement in dynamic performance contributes to a more enjoyable driving experience, potentially attracting a broader consumer base.

EV Transmission Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast period

- Europe is poised to emerge as a dominant force in the Electric Vehicle (EV) market, showcasing a robust and progressive stance toward sustainable transportation. The region's commitment to environmental goals, stringent emission regulations, and substantial investments in EV infrastructure contribute to its anticipated leadership.

- Government initiatives and incentives, such as tax breaks, subsidies, and charging station development, further propel the adoption of electric vehicles across European countries. Key players in the automotive industry are strategically aligning themselves with this trend, unveiling an array of electric models to meet the rising demand. Additionally, the European Union's ambitious targets for reducing carbon emissions and promoting green technologies underscore the continent's dedication to fostering a cleaner and greener automotive landscape.

- The collaborative efforts between governments, industry stakeholders, and consumers in embracing electric mobility contribute to Europe's projected dominance in the EV market.

EV Transmission Market Top Key Players:

- BorgWarner Inc. (USA)

- Allison Transmission Inc. (USA)

- TREMEC Holding Corporation (USA)

- Dana Incorporated (USA)

- Magna International Inc. (Canada)

- Valeo S.A. (France)

- Voith GmbH (Germany)

- ZF Friedrichshafen AG (Germany)

- Aisin Seiki Co., Ltd. (Japan)

- Bosch Rexroth AG (Germany)

- ThyssenKrupp AG (Germany)

- AVL Schrick GmbH (Germany)

- AVL Speed GmbH (Germany)

- Schaeffler AG (Germany)

- Eaton Corporation plc (Ireland)

- Marelli S.p.A. (Italy)

- GKN Automotive (UK)

- TE Connectivity Ltd. (Switzerland)

- AVL List GmbH (Austria)

- AVL DiTEST GmbH (Austria)

- AVL India Pvt Ltd (India)

- JATCO Ltd. (Japan)

- Mitsubishi Electric Corporation (Japan)

- HYUNDAI WIA Corporation (South Korea)

Key Industry Developments in the EV Transmission Market:

- In January 2023, Weber Drivetrain announced a strategic partnership with Wuxi Lingbo Electronic Technology (China) to manufacture controllers and BMS for electric two-wheelers in India. This represents a significant step towards localized production of EV components in India.

- In January 2023, ARENQ forged a three-year association with KAL for the distribution of e-vehicles in Kerala and Maharashtra. This expands reach and accessibility of EVs in these key Indian markets.

|

Global EV Transmission Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.75 Bn. |

|

Forecast Period 2023-30 CAGR: |

16.91% |

Market Size in 2032: |

USD 39.78 Bn. |

|

Segments Covered: |

By Transmission System |

|

|

|

By Transmission Type |

|

||

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- EV TRANSMISSION MARKET BY TRANSMISSION SYSTEM (2016-2030)

- EV TRANSMISSION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AMT TRANSMISSION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CVT TRANSMISSION

- AT TRANSMISSION

- EV TRANSMISSION MARKET BY TRANSMISSION TYPE (2016-2030)

- EV TRANSMISSION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SINGLE SPEED

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MULTI-SPEED

- EV TRANSMISSION MARKET BY VEHICLE TYPE (2016-2030)

- EV TRANSMISSION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BATTERY ELECTRIC VEHICLE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PLUG-IN HYBRID ELECTRIC VEHICLE

- HYBRID ELECTRIC VEHICLE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- EV TRANSMISSION Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- BORGWARNER INC. (USA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ALLISON TRANSMISSION INC. (USA)

- TREMEC HOLDING CORPORATION (USA)

- DANA INCORPORATED (USA)

- MAGNA INTERNATIONAL INC. (CANADA)

- VALEO S.A. (FRANCE)

- VOITH GMBH (GERMANY)

- ZF FRIEDRICHSHAFEN AG (GERMANY)

- AISIN SEIKI CO., LTD. (JAPAN)

- BOSCH REXROTH AG (GERMANY)

- THYSSENKRUPP AG (GERMANY)

- AVL SCHRICK GMBH (GERMANY)

- AVL SPEED GMBH (GERMANY)

- SCHAEFFLER AG (GERMANY)

- EATON CORPORATION PLC (IRELAND)

- MARELLI S.P.A. (ITALY)

- GKN AUTOMOTIVE (UK)

- TE CONNECTIVITY LTD. (SWITZERLAND)

- AVL LIST GMBH (AUSTRIA)

- COMPETITIVE LANDSCAPE

- GLOBAL EV TRANSMISSION MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Transmission System

- Historic And Forecasted Market Size By Transmission Type

- Historic And Forecasted Market Size By Vehicle Type

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

Potential Market Strategies

|

Global EV Transmission Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.75 Bn. |

|

Forecast Period 2023-30 CAGR: |

16.91% |

Market Size in 2032: |

USD 39.78 Bn. |

|

Segments Covered: |

By Transmission System |

|

|

|

By Transmission Type |

|

||

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. EV TRANSMISSION MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. EV TRANSMISSION MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. EV TRANSMISSION MARKET COMPETITIVE RIVALRY

TABLE 005. EV TRANSMISSION MARKET THREAT OF NEW ENTRANTS

TABLE 006. EV TRANSMISSION MARKET THREAT OF SUBSTITUTES

TABLE 007. EV TRANSMISSION MARKET BY TRANSMISSION SYSTEM

TABLE 008. AMT TRANSMISSION MARKET OVERVIEW (2016-2028)

TABLE 009. CVT TRANSMISSION MARKET OVERVIEW (2016-2028)

TABLE 010. AT TRANSMISSION MARKET OVERVIEW (2016-2028)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 012. EV TRANSMISSION MARKET BY TRANSMISSION TYPE

TABLE 013. SINGLE SPEED MARKET OVERVIEW (2016-2028)

TABLE 014. MULTI-SPEED MARKET OVERVIEW (2016-2028)

TABLE 015. EV TRANSMISSION MARKET BY VEHICLE TYPE

TABLE 016. BATTERY ELECTRIC VEHICLE MARKET OVERVIEW (2016-2028)

TABLE 017. PLUG-IN HYBRID ELECTRIC VEHICLE MARKET OVERVIEW (2016-2028)

TABLE 018. HYBRID ELECTRIC VEHICLE MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA EV TRANSMISSION MARKET, BY TRANSMISSION SYSTEM (2016-2028)

TABLE 020. NORTH AMERICA EV TRANSMISSION MARKET, BY TRANSMISSION TYPE (2016-2028)

TABLE 021. NORTH AMERICA EV TRANSMISSION MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 022. N EV TRANSMISSION MARKET, BY COUNTRY (2016-2028)

TABLE 023. EUROPE EV TRANSMISSION MARKET, BY TRANSMISSION SYSTEM (2016-2028)

TABLE 024. EUROPE EV TRANSMISSION MARKET, BY TRANSMISSION TYPE (2016-2028)

TABLE 025. EUROPE EV TRANSMISSION MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 026. EV TRANSMISSION MARKET, BY COUNTRY (2016-2028)

TABLE 027. ASIA PACIFIC EV TRANSMISSION MARKET, BY TRANSMISSION SYSTEM (2016-2028)

TABLE 028. ASIA PACIFIC EV TRANSMISSION MARKET, BY TRANSMISSION TYPE (2016-2028)

TABLE 029. ASIA PACIFIC EV TRANSMISSION MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 030. EV TRANSMISSION MARKET, BY COUNTRY (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA EV TRANSMISSION MARKET, BY TRANSMISSION SYSTEM (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA EV TRANSMISSION MARKET, BY TRANSMISSION TYPE (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA EV TRANSMISSION MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 034. EV TRANSMISSION MARKET, BY COUNTRY (2016-2028)

TABLE 035. SOUTH AMERICA EV TRANSMISSION MARKET, BY TRANSMISSION SYSTEM (2016-2028)

TABLE 036. SOUTH AMERICA EV TRANSMISSION MARKET, BY TRANSMISSION TYPE (2016-2028)

TABLE 037. SOUTH AMERICA EV TRANSMISSION MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 038. EV TRANSMISSION MARKET, BY COUNTRY (2016-2028)

TABLE 039. CONTINENTAL AG: SNAPSHOT

TABLE 040. CONTINENTAL AG: BUSINESS PERFORMANCE

TABLE 041. CONTINENTAL AG: PRODUCT PORTFOLIO

TABLE 042. CONTINENTAL AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. AISIN SEIKI CO.LTD: SNAPSHOT

TABLE 043. AISIN SEIKI CO.LTD: BUSINESS PERFORMANCE

TABLE 044. AISIN SEIKI CO.LTD: PRODUCT PORTFOLIO

TABLE 045. AISIN SEIKI CO.LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. ZF FRIEDRICHSHAFEN AG: SNAPSHOT

TABLE 046. ZF FRIEDRICHSHAFEN AG: BUSINESS PERFORMANCE

TABLE 047. ZF FRIEDRICHSHAFEN AG: PRODUCT PORTFOLIO

TABLE 048. ZF FRIEDRICHSHAFEN AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. AVL LIST GMBH: SNAPSHOT

TABLE 049. AVL LIST GMBH: BUSINESS PERFORMANCE

TABLE 050. AVL LIST GMBH: PRODUCT PORTFOLIO

TABLE 051. AVL LIST GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. BORGWARNER INC.: SNAPSHOT

TABLE 052. BORGWARNER INC.: BUSINESS PERFORMANCE

TABLE 053. BORGWARNER INC.: PRODUCT PORTFOLIO

TABLE 054. BORGWARNER INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. ALLISON TRANSMISSION INC: SNAPSHOT

TABLE 055. ALLISON TRANSMISSION INC: BUSINESS PERFORMANCE

TABLE 056. ALLISON TRANSMISSION INC: PRODUCT PORTFOLIO

TABLE 057. ALLISON TRANSMISSION INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. DANA LIMITED: SNAPSHOT

TABLE 058. DANA LIMITED: BUSINESS PERFORMANCE

TABLE 059. DANA LIMITED: PRODUCT PORTFOLIO

TABLE 060. DANA LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. JATCO LTD: SNAPSHOT

TABLE 061. JATCO LTD: BUSINESS PERFORMANCE

TABLE 062. JATCO LTD: PRODUCT PORTFOLIO

TABLE 063. JATCO LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. SCHAEFFLER TECHNOLOGIES AG & CO. KG: SNAPSHOT

TABLE 064. SCHAEFFLER TECHNOLOGIES AG & CO. KG: BUSINESS PERFORMANCE

TABLE 065. SCHAEFFLER TECHNOLOGIES AG & CO. KG: PRODUCT PORTFOLIO

TABLE 066. SCHAEFFLER TECHNOLOGIES AG & CO. KG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. EATON: SNAPSHOT

TABLE 067. EATON: BUSINESS PERFORMANCE

TABLE 068. EATON: PRODUCT PORTFOLIO

TABLE 069. EATON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 070. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 071. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 072. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. EV TRANSMISSION MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. EV TRANSMISSION MARKET OVERVIEW BY TRANSMISSION SYSTEM

FIGURE 012. AMT TRANSMISSION MARKET OVERVIEW (2016-2028)

FIGURE 013. CVT TRANSMISSION MARKET OVERVIEW (2016-2028)

FIGURE 014. AT TRANSMISSION MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 016. EV TRANSMISSION MARKET OVERVIEW BY TRANSMISSION TYPE

FIGURE 017. SINGLE SPEED MARKET OVERVIEW (2016-2028)

FIGURE 018. MULTI-SPEED MARKET OVERVIEW (2016-2028)

FIGURE 019. EV TRANSMISSION MARKET OVERVIEW BY VEHICLE TYPE

FIGURE 020. BATTERY ELECTRIC VEHICLE MARKET OVERVIEW (2016-2028)

FIGURE 021. PLUG-IN HYBRID ELECTRIC VEHICLE MARKET OVERVIEW (2016-2028)

FIGURE 022. HYBRID ELECTRIC VEHICLE MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA EV TRANSMISSION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE EV TRANSMISSION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC EV TRANSMISSION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA EV TRANSMISSION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA EV TRANSMISSION MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the EV Transmission Market research report is 2024-2032.

BorgWarner Inc. (USA),Allison Transmission Inc. (USA),TREMEC Holding Corporation (USA),Dana Incorporated (USA),Magna International Inc. (Canada),Valeo S.A. (France),Voith GmbH (Germany),ZF Friedrichshafen AG (Germany),Aisin Seiki Co., Ltd. (Japan),Bosch Rexroth AG (Germany),ThyssenKrupp AG (Germany),AVL Schrick GmbH (Germany),AVL Speed GmbH (Germany),Schaeffler AG (Germany),Eaton Corporation plc (Ireland),Marelli S.p.A. (Italy),GKN Automotive (UK),TE Connectivity Ltd. (Switzerland),AVL List GmbH (Austria),AVL DiTEST GmbH (Austria),AVL India Pvt Ltd (India),JATCO Ltd. (Japan),Mitsubishi Electric Corporation (Japan),HYUNDAI WIA Corporation (South Korea) and Other Major Players.

The EV Transmission market is segmented into Transmission System, Transmission Type, Vehicle Type and region. By Transmission System, the market is categorized into AMT Transmission, CVT Transmission, AT Transmission. By Transmission Type, it is classified into Single Speed and Multi-Speed. By Vehicle Type, it is classified into Battery Electric Vehicle, Plug-in Hybrid Electric Vehicle, Hybrid Electric Vehicle. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Transmission for electric vehicles is used to transmit mechanical power from the electric traction motor to the wheels of an electric vehicle. The majority of electric cars only have a single-speed transmission since, in today's world, it is sufficient for efficient operation. There are other vehicle types, though, for which using a multi-speed gearbox makes sense.

The Global EV Transmission Market size is expected to grow from USD 9.75 billion in 2023 to USD 39.78 billion by 2032, at a CAGR of 16.91% during the forecast period (2024-2032).