EV Power Inverter Market Synopsis

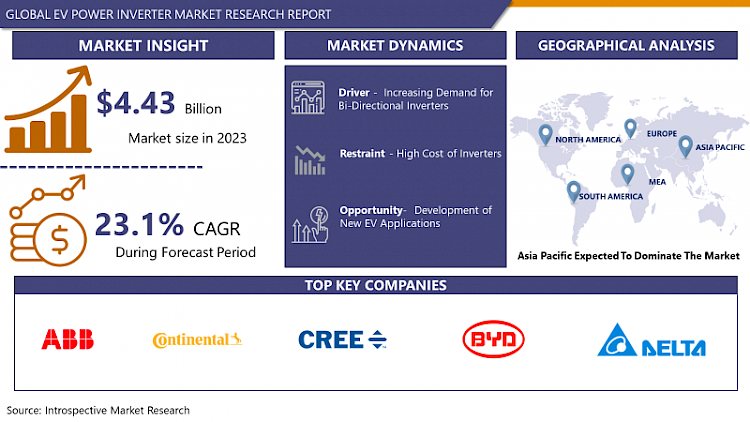

EV Power Inverter Market Size Was Valued at USD 4.43 Billion in 2023, and is Projected to Reach USD 28.77 Billion by 2032, Growing at a CAGR of 23.1% From 2024-2032.

The power inverter in an electric vehicle (EV) is an important component that transforms the direct current (DC) store in the battery to alternating current (AC) utilised in the driving of the motors.

- This conversion is of utmost importance since most motors in electric vehicles run on AC forms of power supply, and they offer improved performance and control over the direct current counterparts. The inverter is also pivotarily involved in the regenerative braking as it transforms the AC electricity produced by the motor back into DC to recharge the battery.

- Not only is the EV power inverter responsible for changing the electric power format, it also plays a centralized role in the management of the entire vehicle. This it controls with the battery management system (BMS) and the motor controller to balance energy consumption and make sure everything is running efficiently in the car.

- Normal inverters have very basic control circuits, but modern inverters have better control circuits that can control varying frequencies and voltages hence enhancing the efficiency and performance of the EV. Systems such as these play a significant role in the acceleration of the car, speed of the system and of course, the distance the battery can take before needing recharge which is why the overall functionality of the inverter is important in making better electric cars a reality.

EV Power Inverter Market Trend Analysis

Shift towards silicon carbide (SiC) and gallium nitride (GaN) semiconductors

- Changing the existing systems to SiC and GaN semiconductors in the EV power inverter market is a sophisticated plan focused on enhancing technological progress towards electric vehicles. Compared to the more universally-used silicon semiconductors, both SiC and GaN have enhanced electrical characteristics.

- These control devices can work at higher voltages, frequencies and temperature than the traditional switches and they mean that there will be improved power control, low power loss and better heat dissipation in the power inverters. Since this is the case, most EVs fitted with inverters containing SiC or GaN will have long range and high performance, hence driving the market’s demand.

- Similarly, the materials such as SiC and GaN semiconductors make it possible for more compact, lighter inverter designs because of higher efficiency and better heat dissipation properties. This reduction in size and weight forms part of the whole package and add up the efficiency of the vehicle and openness in accommodating new units within the overall electric vehicle architecture.

- The higher performance and efficiency SiC and GaN semiconductors offer the industry an answer to the growth strategies in the EV space by allowing the manufacturer to provide consumers with vehicles with more range, faster charging, and lower operational costs. Therefore, the use of these innovative semiconductors as vital in the creation of further higher-end EV power inverters styles.

Growing demand for premium EVs

- The conditions stated above indicate the increasing demand for premium electric vehicles (EVs), which is a prime opportunity for the EV power inverter market. The next step, premium EVs, especially those that can boast higher performance, more features, and potentially greater range, are equipped with even more sophisticated and arguably more efficient power electronics.

- Tesla, Porsche, and Lucid Motors, among other high-end car manufacturers, are striving to make better performant EVs, and to do that, new-fangled electricity-to-velocity inversion solutions are also becoming necessary for managing increased power requirements and overall car utility. When these vehicles aim to provide the best driving experience with faster acceleration, high top speed and efficient energy management systems, the efforts made by high-performance power inverters becomes most essential.

- Moreover, the inverters in high-end EVs are usually required to carry out operations with higher power levels and work efficiently under conditions that can be more taxing than basic EVs. This led to a need to create inverters with better semiconductor material like silicon carbide (SiC) and Gallium Nitride (GaN) which gave the needed performance.

- As the high end electric vehicles or indeed emerging high-end cars must feature luxury, performance, and advanced technology, this segment influences or rather challenges the inverter market, to come up with the best performing, small, lightweight and more reliable power conversion devices. Therefore, growth in sales of premium EVs pulls more demand towards the EV power inverters market besides propelling innovation in technology of this sub-sector.

EV Power Inverter Market Segment Analysis:

EV Power Inverter Market is Segmented based on Propulsion Type, and Vehicle Type.

By Propulsion Type, Battery Electric Vehicle is expected to dominate the market during the forecast period

- The BEV Power segment can attributed to being the largest segment within the EV power inverter market currently. IHS also classified BEVs to electric vehicles that only operate on electricity and employed large battery packs and electric motors, resulting to high-use of inverters to convert DC electricity from battery to AC electricity required to power the motor.

- One of the main trends that have influenced the popularity of BEVs emerged from the rising consumer consciousness and awareness of the environmental impacts of generating emissions and the consequent legislation’s strict control over the emission levels. First, battery improvement and fast charging implementation of the BEVs can surfaced their practicality and demand in the market, which strengthens EV manufacturers’ leadership.

- Furthermore, there is robust commitment to research and production of BEVs evident with key players as well as new entrants into the automobile industry. Tesla motors limited, nissan and Volkswagen companies are among those that have put in efforts to come up with fascinating models and innovative technologies that will suit the needs of the market with increasing battery range, high performance and affordable prices.

- Government stimulus plans and subsidies and supports such vehicles that use BEVs propulsion types more than other types due to their environmental friendliness. Therefore, not only does the BEV segment contribute to a large part of the overall EV market but also it work as a catalyst for the demand of sophisticated power inverters given the increased power handling capabilities and consequently higher efficiency and performance of the BEV autos. This is typical to continue as technologies advance and more clients as well as producers turn to fully electrical drives.

By Vehicle Type, Passenger Cars of life segment held the largest share in 2023

- As of now, the electric vehicle, particularly the passenger car space accounts for the most significant portion of the EV power inverter. This is widely ascribed to enhanced electric passenger cars due to universal environmental awareness, new stringent emission norms, and development in battery systems.

- The following are the key findings on the current state of affairs of electric passenger cars: The production of electric passenger cars is attracting majority of the major car manufacturers to enter in to the market since they launch many models with different range of prices, ranges of drives and performances. In consequence, high efficiency power inverters are used to meet the requirements of these electric passenger cars and convert the DC electricity available in batteries to AC electricity to drive the motors effectively for the propulsion systems.

- This is especially the case as even buses and trucks, which are also recorded to be in the process of moving to electric propulsion, are not currently consuming as much power inverter for electric vehicles as the passenger car segment. Due to the fact that most commercial vehicles tend to have larger power demands than normal vehicles they may also need a special power inverter optimized for the vehicle type in question. But there is a growing trend in the use of electric commercial vehicles because in most areas, costs associated with the use of the vehicles are cheaper than those of traditional commercial vehicles, governments incentivize their use for greener and cleaner solutions and with the growing population and demand for transport in the urban center.

- The commercial vehicle market is also progressing at an increasing rate in terms of electric power, though not as rapidly as the passenger car market; consequently, the market for EV power inverters for commercial vehicles will also grow over time.

EV Power Inverter Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia-Pacific region dominates the EV power inverter market primarily due to its robust automotive and electronics manufacturing infrastructure, coupled with strong government support for electric vehicle adoption. Countries like China, Japan, and South Korea are at the forefront of EV production and innovation. China, in particular, is the largest EV market globally, driven by aggressive government policies, subsidies, and incentives aimed at reducing carbon emissions and combating air pollution.

- This governmental support includes investments in charging infrastructure, research and development in EV technologies, and financial incentives for both manufacturers and consumers. As a result, there is a high demand for EV components, including power inverters, in the region.

- Moreover, the Asia-Pacific region is home to several leading semiconductor manufacturers and suppliers who are crucial in the production of advanced power inverters. Companies such as BYD, Panasonic, and Mitsubishi Electric have significant capabilities in developing and manufacturing high-performance power electronics, including SiC and GaN semiconductors.

- This local availability of advanced materials and expertise enhances the region's ability to produce efficient and high-quality power inverters. Additionally, the region's established supply chain networks and lower manufacturing costs make it an attractive hub for the production and export of EV components. These factors collectively contribute to the Asia-Pacific region's dominance in the EV power inverter market, positioning it as a key player in the global transition to electric mobility.

Active Key Players in the EV Power Inverter Market

- ABB Ltd. (Switzerland)

- BYD Company Limited (China)

- Continental AG (Germany)

- Cree, Inc. (United States)

- Delta Electronics, Inc. (Taiwan)

- Fuji Electric Co., Ltd. (Japan)

- Hitachi Automotive Systems, Ltd. (Japan)

- Hyundai Mobis Co., Ltd. (South Korea)

- Infineon Technologies AG (Germany)

- Mitsubishi Electric Corporation (Japan)

- NXP Semiconductors N.V. (Netherlands)

- ON Semiconductor Corporation (United States)

- Panasonic Corporation (Japan)

- Renesas Electronics Corporation (Japan)

- Robert Bosch GmbH (Germany)

- Siemens AG (Germany)

- STMicroelectronics NV (Switzerland)

- Texas Instruments Incorporated (United States)

- Toshiba Corporation (Japan)

- Vishay Intertechnology, Inc. (United States)

- Other Key Players

|

Global EV Power Inverter Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.43 Bn. |

|

Forecast Period 2023-32 CAGR: |

23.1% |

Market Size in 2032: |

USD 28.77 Bn. |

|

Segments Covered: |

By Propulsion Type |

|

|

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- EV POWER INVERTER MARKET BY PROPULSION TYPE (2017-2032)

- EV POWER INVERTER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HYBRID ELECTRIC VEHICLES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PLUG-IN HYBRID ELECTRIC VEHICLE

- BATTERY ELECTRIC VEHICLE

- FUEL CELL ELECTRIC VEHICLE

- EV POWER INVERTER MARKET BY VEHICLE TYPE (2017-2032)

- EV POWER INVERTER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PASSENGER CARS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COMMERCIAL VEHICLES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- EV POWER INVERTER Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ABB LTD. (SWITZERLAND)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- BYD COMPANY LIMITED (CHINA)

- CONTINENTAL AG (GERMANY)

- CREE, INC. (UNITED STATES)

- DELTA ELECTRONICS, INC. (TAIWAN)

- FUJI ELECTRIC CO., LTD. (JAPAN)

- HITACHI AUTOMOTIVE SYSTEMS, LTD. (JAPAN)

- HYUNDAI MOBIS CO., LTD. (SOUTH KOREA)

- INFINEON TECHNOLOGIES AG (GERMANY)

- MITSUBISHI ELECTRIC CORPORATION (JAPAN)

- NXP SEMICONDUCTORS N.V. (NETHERLANDS)

- ON SEMICONDUCTOR CORPORATION (UNITED STATES)

- PANASONIC CORPORATION (JAPAN)

- RENESAS ELECTRONICS CORPORATION (JAPAN)

- ROBERT BOSCH GMBH (GERMANY)

- SIEMENS AG (GERMANY)

- STMICROELECTRONICS NV (SWITZERLAND)

- TEXAS INSTRUMENTS INCORPORATED (UNITED STATES)

- TOSHIBA CORPORATION (JAPAN)

- VISHAY INTERTECHNOLOGY, INC. (UNITED STATES)

- COMPETITIVE LANDSCAPE

- GLOBAL EV POWER INVERTER MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Propulsion Type

- Historic And Forecasted Market Size By Vehicle Type

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global EV Power Inverter Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.43 Bn. |

|

Forecast Period 2023-32 CAGR: |

23.1% |

Market Size in 2032: |

USD 28.77 Bn. |

|

Segments Covered: |

By Propulsion Type |

|

|

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. EV POWER INVERTER MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. EV POWER INVERTER MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. EV POWER INVERTER MARKET COMPETITIVE RIVALRY

TABLE 005. EV POWER INVERTER MARKET THREAT OF NEW ENTRANTS

TABLE 006. EV POWER INVERTER MARKET THREAT OF SUBSTITUTES

TABLE 007. EV POWER INVERTER MARKET BY PROPULSION

TABLE 008. FULL HYBRID VEHICLE MARKET OVERVIEW (2016-2028)

TABLE 009. PLUG-IN HYBRID VEHICLE MARKET OVERVIEW (2016-2028)

TABLE 010. BATTERY ELECTRIC VEHICLE MARKET OVERVIEW (2016-2028)

TABLE 011. EV POWER INVERTER MARKET BY INVERTER TYPE

TABLE 012. TRACTION INVERTER MARKET OVERVIEW (2016-2028)

TABLE 013. SOFT SWITCHING INVERTER MARKET OVERVIEW (2016-2028)

TABLE 014. EV POWER INVERTER MARKET BY VEHICLE TYPE

TABLE 015. PASSENGER VEHICLE MARKET OVERVIEW (2016-2028)

TABLE 016. COMMERCIAL VEHICLE MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA EV POWER INVERTER MARKET, BY PROPULSION (2016-2028)

TABLE 018. NORTH AMERICA EV POWER INVERTER MARKET, BY INVERTER TYPE (2016-2028)

TABLE 019. NORTH AMERICA EV POWER INVERTER MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 020. N EV POWER INVERTER MARKET, BY COUNTRY (2016-2028)

TABLE 021. EUROPE EV POWER INVERTER MARKET, BY PROPULSION (2016-2028)

TABLE 022. EUROPE EV POWER INVERTER MARKET, BY INVERTER TYPE (2016-2028)

TABLE 023. EUROPE EV POWER INVERTER MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 024. EV POWER INVERTER MARKET, BY COUNTRY (2016-2028)

TABLE 025. ASIA PACIFIC EV POWER INVERTER MARKET, BY PROPULSION (2016-2028)

TABLE 026. ASIA PACIFIC EV POWER INVERTER MARKET, BY INVERTER TYPE (2016-2028)

TABLE 027. ASIA PACIFIC EV POWER INVERTER MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 028. EV POWER INVERTER MARKET, BY COUNTRY (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA EV POWER INVERTER MARKET, BY PROPULSION (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA EV POWER INVERTER MARKET, BY INVERTER TYPE (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA EV POWER INVERTER MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 032. EV POWER INVERTER MARKET, BY COUNTRY (2016-2028)

TABLE 033. SOUTH AMERICA EV POWER INVERTER MARKET, BY PROPULSION (2016-2028)

TABLE 034. SOUTH AMERICA EV POWER INVERTER MARKET, BY INVERTER TYPE (2016-2028)

TABLE 035. SOUTH AMERICA EV POWER INVERTER MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 036. EV POWER INVERTER MARKET, BY COUNTRY (2016-2028)

TABLE 037. APTIV: SNAPSHOT

TABLE 038. APTIV: BUSINESS PERFORMANCE

TABLE 039. APTIV: PRODUCT PORTFOLIO

TABLE 040. APTIV: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. CONTINENTAL AG: SNAPSHOT

TABLE 041. CONTINENTAL AG: BUSINESS PERFORMANCE

TABLE 042. CONTINENTAL AG: PRODUCT PORTFOLIO

TABLE 043. CONTINENTAL AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. DENSO CORPORATION: SNAPSHOT

TABLE 044. DENSO CORPORATION: BUSINESS PERFORMANCE

TABLE 045. DENSO CORPORATION: PRODUCT PORTFOLIO

TABLE 046. DENSO CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. HITACHI AUTOMOTIVE SYSTEMS LTD: SNAPSHOT

TABLE 047. HITACHI AUTOMOTIVE SYSTEMS LTD: BUSINESS PERFORMANCE

TABLE 048. HITACHI AUTOMOTIVE SYSTEMS LTD: PRODUCT PORTFOLIO

TABLE 049. HITACHI AUTOMOTIVE SYSTEMS LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. INFINEON TECHNOLOGIES AG: SNAPSHOT

TABLE 050. INFINEON TECHNOLOGIES AG: BUSINESS PERFORMANCE

TABLE 051. INFINEON TECHNOLOGIES AG: PRODUCT PORTFOLIO

TABLE 052. INFINEON TECHNOLOGIES AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. MEIDENSHA CORPORATION: SNAPSHOT

TABLE 053. MEIDENSHA CORPORATION: BUSINESS PERFORMANCE

TABLE 054. MEIDENSHA CORPORATION: PRODUCT PORTFOLIO

TABLE 055. MEIDENSHA CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. MITSUBISHI ELECTRIC CORPORATION: SNAPSHOT

TABLE 056. MITSUBISHI ELECTRIC CORPORATION: BUSINESS PERFORMANCE

TABLE 057. MITSUBISHI ELECTRIC CORPORATION: PRODUCT PORTFOLIO

TABLE 058. MITSUBISHI ELECTRIC CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. ROBERT BOSCH GMBH: SNAPSHOT

TABLE 059. ROBERT BOSCH GMBH: BUSINESS PERFORMANCE

TABLE 060. ROBERT BOSCH GMBH: PRODUCT PORTFOLIO

TABLE 061. ROBERT BOSCH GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. TOYOTA INDUSTRIES CORPORATION: SNAPSHOT

TABLE 062. TOYOTA INDUSTRIES CORPORATION: BUSINESS PERFORMANCE

TABLE 063. TOYOTA INDUSTRIES CORPORATION: PRODUCT PORTFOLIO

TABLE 064. TOYOTA INDUSTRIES CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. VALEO GROUP: SNAPSHOT

TABLE 065. VALEO GROUP: BUSINESS PERFORMANCE

TABLE 066. VALEO GROUP: PRODUCT PORTFOLIO

TABLE 067. VALEO GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 068. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 069. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 070. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. EV POWER INVERTER MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. EV POWER INVERTER MARKET OVERVIEW BY PROPULSION

FIGURE 012. FULL HYBRID VEHICLE MARKET OVERVIEW (2016-2028)

FIGURE 013. PLUG-IN HYBRID VEHICLE MARKET OVERVIEW (2016-2028)

FIGURE 014. BATTERY ELECTRIC VEHICLE MARKET OVERVIEW (2016-2028)

FIGURE 015. EV POWER INVERTER MARKET OVERVIEW BY INVERTER TYPE

FIGURE 016. TRACTION INVERTER MARKET OVERVIEW (2016-2028)

FIGURE 017. SOFT SWITCHING INVERTER MARKET OVERVIEW (2016-2028)

FIGURE 018. EV POWER INVERTER MARKET OVERVIEW BY VEHICLE TYPE

FIGURE 019. PASSENGER VEHICLE MARKET OVERVIEW (2016-2028)

FIGURE 020. COMMERCIAL VEHICLE MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA EV POWER INVERTER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE EV POWER INVERTER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC EV POWER INVERTER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA EV POWER INVERTER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA EV POWER INVERTER MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the EV Power Inverter Market research report is 2024-2032.

ABB Ltd. (Switzerland), BYD Company Limited (China), Continental AG (Germany), Cree, Inc. (United States), Delta Electronics, Inc. (Taiwan), Fuji Electric Co., Ltd. (Japan), Hitachi Automotive Systems, Ltd. (Japan), Hyundai Mobis Co., Ltd. (South Korea), Infineon Technologies AG (Germany), Mitsubishi Electric Corporation (Japan), NXP Semiconductors N.V. (Netherlands), ON Semiconductor Corporation (United States), Panasonic Corporation (Japan), Renesas Electronics Corporation (Japan), Robert Bosch GmbH (Germany), Siemens AG (Germany), STMicroelectronics NV (Switzerland), Texas Instruments Incorporated (United States), Toshiba Corporation (Japan), Vishay Intertechnology, Inc. (United States) and Other Major Players.

The EV Power Inverter Market is segmented into Propulsion Type, Vehicle Type, and region. By Type, the market is categorized into Hybrid Electric Vehicles, Plug-in Hybrid Electric Vehicle, Battery Electric Vehicle, Fuel Cell Electric Vehicle. By Vehicle Type, the market is categorized into Passenger Cars, Commercial Vehicles. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The EV power inverter is arguably one of the most important components of the electric vehicle, as it recalibrates direct current (DC) electricity from the battery into alternating current (AC) electricity to drive the motor. This conversion makes it easy to control the electric motor within the vehicle so as to make it accelerate, decelerate, maintain or increase speed etc. Higher end power invertors also help in regenerative braking, that is converting AC electricity produced by the motor back to DC so as to recharge the battery to minimize energy consumed and to get better efficiency of car’s performance.

EV Power Inverter Market Size Was Valued at USD 4.43 Billion in 2023, and is Projected to Reach USD 28.77 Billion by 2032, Growing at a CAGR of 23.1% From 2024-2032.