EV Battery Recycling Market Synopsis

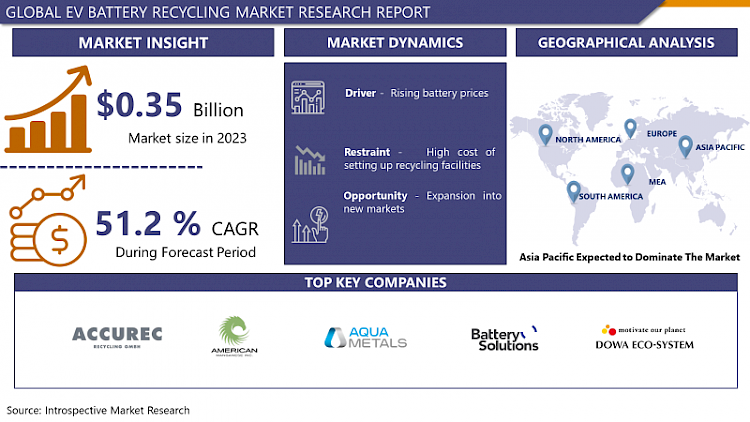

EV Battery Recycling Market Size Was Valued at USD 0.35 Billion in 2023 and is Projected to Reach USD 14.36 Billion by 2032, Growing at a CAGR of 51.2% From 2024-2032.

Battery recycling is the reprocessing of the battery that has been used in electric vehicles reduced to its constituent materials. These are often Lithium Ion batteries and suffer from what is known as the ‘memory effect’, where the batteries slowly lose their ability to amass a charge. The recycling of EV batteries has been initiated to address issues with battery disposal as most dump batteries have the potential of causing harm to land and underground water sources by discharging toxic compounds.

- Rebuff lost precious elements like lithium, cobalt, and nickel as they are narrow, although qualificatory important for electronics functioning and are difficult to obtain from the ground.

- Recycling also has its phases and they include collection, disintegration, and separation of materials, shredding, and refining. The batteries undergo disassembling where solid components are segregated according to the chemical type. The batteries are then shredded for disposal to enable the uncovering of materials that can be retrieved. In the last stage, the recovered materials are further collected and processed for recycling or to be recycled for new batteries or any other usage that shuts the cycle of the battery.

- Recycling batteries used in EVs not only solves environmental issues but also supports the future growth of the EV business through the concept of resource efficiency and circulation system innovation.

EV Battery Recycling Market Trend Analysis

Increasing adoption of lightweight materials

- The shift to using lightweight materials in the EV battery recycling market is a result of the industry’s push to model ways to improve efficiency and increase driving distance. Aluminum and composite materials thus enjoy frequent usage due to the prospects they hold in reducing the overall weight of the electric vehicle which in turn enhances energy efficiency and power.

- Therefore, these materials are gradually being adopted in EV design as a means of meeting the strict fuel economy requirements and user expectations of advanced EVs with higher driving ranges.

- In particular, the use of lightweight materials is helpful in recycling not only because of the marked effect it has on a product’s weight but also due to other benefits that can be seen with the aid of such materials in the actual recycling process. They often require less energy to manage and sort, and they are typically lighter than other, denser materials, meaning that it is easier to dismantle recycling plants that work with them.

- Furthermore, many lightweight materials are moderately CFRPs (carbon fiber reinforced plastics) which are lighter in comparison to other normal materials in transportation, and when recycled need considerably less energy to recycle them completely, thus reflecting the sustainability agenda of the EV market. All in all, the weight reduction trend seen today not only positively impacts the Electric vehicle from the functional standpoint but also gives a boost to the present prospects of the EV battery recycling market.

Development of new battery chemistries

- The opportunities that the new battery chemistries offer the EV battery recycling market are myriad, and the key points include: First, changed by the introduction of new battery technologies, old battery technologies may either be outdated or not so popular in the market.

- This transition defines the need for proper management or recycling of the old batteries and at the same time, the efficient recovery of metals for new uses. To discuss, by coming up with value-added recycling processes that are relevant to these changing chemistries, the industry can improve the management of resources and the resulting environmental expenditures.

- The development of new battery chemistries frequently presents enhancements in battery power density, efficiency, and durability and, thus, can spur on more utilization of electric vehicles. While the EV manufacturers do this as a way to improve the performances of their automobiles, the resultant effect will be more batteries with the new chemistries required to improve the cars.

- Thus, given the fact that higher volumes of spent batteries are being disposed of in the recycling process, the recycling market has the potential to benefit. By enhancing and upgrading recyclability, recycling solutions for these progressing chemistries will create new opportunities for the benefit of stakeholders of electric vehicles, promoting a circular economy approach for a more sustainable recycling and resource recovery.

EV Battery Recycling Market Segment Analysis:

EV Battery Recycling Market Segmented based on Type, Sources, and Vehicle Type.

By Type, lithium-ion is expected to dominate the market during the forecast period

- Analyzing the structure of the market, it can be seen that the segment with the lithium-ion battery has dominated the EV battery recycling market in recent years. This popularity is a result of the energy density, the long cycle span, lighter and superior to the conventional Lead-acid batteries utilized in a variety of electronic apparatus and electric cars in particular.

- Since the electric vehicle market has adopted very fast due to forces such as environmental conservationism and incentives given by governments among others, lithium-ion batteries have been in high demand. As a result, the volume of spent Li-ion batteries that enter the recycling chain has also been rising, thus boosting the lithium-ion recycling market segment.

- In addition, there are great prospects in recycling lithium-ion batteries, as we said before, laying special emphasis on the recovery of such components as lithium, cobalt, nickel, and manganese required for the production of lithium-ion batteries. These are _limited resources_ since they are finite in supply and given the increasing costs of extracting these resources from the earth, recycling batteries offers a sustainable way of meeting the increasing demand for these battery materials.

- In addition, recycling technologies have progressed to make lithium-ion materials easy to recycle, meaning that recycling these materials from old lithium-ion batteries becomes less expensive, hence making the lithium-ion segment control the EV battery recycling market. With the global transition to electric vehicles being highly likely, it also remains expected the lithium-ion segment will remain at the helm of driving the EV battery recycling market.

By Sources, End of life segment held the largest share in 2023

- The battery recycling market grouped according to the phase of a battery’s lifecycle makes a bigger part of the EV battery recycling market focus on the end-of-life segment. This is because batteries with high depth, volume, and density of discharge are nearing their cycle in EVs. Many countries particularly in Asia Pacific, Europe, and North America are implementing policies that promote the use of electric vehicles and as the adoption spreads it will only be reasonable to expect more electric vehicles on the road.

- Therefore there is a large supply of spent batteries which originate from these vehicles to offer for recycling. End-of-life batteries include batteries that are no longer capable of delivering power due to natural wear and tear or because they have come full circle in their operational cycle and need to be recycled for raw materials that can be used to manufacture new batteries or other relevant products

- Though the EO-Life segment shall continue to form a large proportion of the EV Battery Recycling market shortly, the production scrap segment is also expected to gather pace. Production scrap embraces batteries that are dilapidated or which are more than the required amount as a result of manufacturing electric vehicles and their batteries.

- Scavenging and recycling from the automotive industry to the electric vehicle industry remains a crucial sector of resource conservation as more and more manufacturers increase the efficiency of production, and reduce waste. Nonetheless, born of a previously unanticipated abundance of perfectionism, the practice of minimizing production scrap is widely maintained, which leaves an unavoidable degree of waste inherent to manufacturing processes. Recycling of production scrap is the process of reusing materials after they have been part of a manufacturing process which in the long run reduces the environmental footprint by having to go to the production line to make new stuff. The innovations that have taken place in the production of electric vehicles have an implication on the End-of-life and production scrap segments that are very essential for the growth of the EV Battery recycling market.

EV Battery Recycling Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The following are some of the reasons why Asia Pacific is leading the EV battery recycling market As explained above, Asia Pacific leads the EV battery recycling market for the following reasons. In the first instance, the region is a manufacturing hub for electric vehicles, with prominent economies such as China, Japan, and South Korea, which are the pioneers in manufacturing electric vehicles and related components including batteries.

- The concentration of EV manufacturing activities draws a large amount of spent battery, which creates a need for recycling solutions. In the same effort to address the end-of-life of EV batteries, strict environmental laws in countries such as China have pushed policymakers and key players to recycle the batteries promoting the recycling market’s growth in the area.

- Asia Pacific is said to have a proper structure and skilled manpower to deal with recycling infrastructure and related technology. East Asian nations such as South Korea and Japan have traditionally been identified with the growth of technology especially in areas that touch on materials science and engineering disciplines. The technological advancement thus facilitates the enhancement of efficient recycling strategies which works well in the reclamation of useful material from the batteries.

- In addition, many recycling facilities are located in the region and have established partnerships with battery manufacturers, which enhances the capability of collecting, processing, and reusing them to cater to the growth of the EV battery recycling market. In conclusion, the Asia Pacific region comes out as a key player in EV manufacturing encouraged by technology know-how and favorable policies thus making the Asia Pacific region a global hub in the EV battery recycling market.

Active Key Players in the EV Battery Recycling Market

- Accurec Recycling GmbH (Germany)

- American Manganese Inc. (Canada)

- Aqua Metals Inc. (United States)

- Battery Solutions LLC (United States)

- DOWA Eco-System Co., Ltd. (Japan)

- GEM Co., Ltd. (China)

- Glencore International AG (Switzerland)

- Li-Cycle Corp. (Canada)

- Neometals Ltd. (Australia)

- Raw Materials Company Inc. (Canada)

- Recupyl (France)

- Redux GmbH (Germany)

- Redwood Materials (United States)

- Retriev Technologies Inc. (United States)

- Retriev Technologies Inc. (United States)

- SNAM (Italy)

- SNAM (Italy)

- Tes-Amm (Singapore)

- The Doe Run Company (United States)

- Umicore (Belgium)

- Other Key Players

Key Industry Developments In the EV Battery Recycling Market

- In March 2024, Renault is pioneering a groundbreaking initiative to develop a closed-loop recycling process for EV batteries in Europe, positioning itself as a trailblazer in the industry and aiming to significantly diminish Europe’s reliance on imported battery materials, particularly from China.

- In January 2023, Aqua Metals, Inc. a pioneer in sustainable lithium battery recycling, announced the completion of due diligence on a property in Tahoe-Reno, as well as plans to commence phased development of a five-acre recycling campus designed to process more than 20 million pounds of lithium-ion battery material each year with its innovative Li AquaRefining™ technology.

|

Global EV Battery Recycling Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.35 Bn. |

|

Forecast Period 2024-32 CAGR: |

51.2% |

Market Size in 2032: |

USD 14.36 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- EV BATTERY RECYCLING MARKET BY TYPE (2017-2032)

- EV BATTERY RECYCLING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LITHIUM-ION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LEAD-ACID

- OTHERS

- EV BATTERY RECYCLING MARKET BY SOURCE (2017-2032)

- EV BATTERY RECYCLING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- END OF LIFE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PRODUCTION SCRAP

- EV BATTERY RECYCLING MARKET BY VEHICLE TYPE (2017-2032)

- EV BATTERY RECYCLING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PASSENGER CARS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BUSES

- VANS

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- EV BATTERY RECYCLING Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ACCUREC RECYCLING GMBH (GERMANY)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- AMERICAN MANGANESE INC. (CANADA)

- AQUA METALS INC. (UNITED STATES)

- BATTERY SOLUTIONS LLC (UNITED STATES)

- DOWA ECO-SYSTEM CO., LTD. (JAPAN)

- GEM CO., LTD. (CHINA)

- GLENCORE INTERNATIONAL AG (SWITZERLAND)

- LI-CYCLE CORP. (CANADA)

- NEOMETALS LTD. (AUSTRALIA)

- RAW MATERIALS COMPANY INC. (CANADA)

- RECUPYL (FRANCE)

- REDUX GMBH (GERMANY)

- REDWOOD MATERIALS (UNITED STATES)

- RETRIEV TECHNOLOGIES INC. (UNITED STATES)

- RETRIEV TECHNOLOGIES INC. (UNITED STATES)

- SNAM (ITALY)

- SNAM (ITALY)

- TES-AMM (SINGAPORE)

- THE DOE RUN COMPANY (UNITED STATES)

- UMICORE (BELGIUM)

- COMPETITIVE LANDSCAPE

- GLOBAL EV BATTERY RECYCLING MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Source

- Historic And Forecasted Market Size By Vehicle Type

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global EV Battery Recycling Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.35 Bn. |

|

Forecast Period 2024-32 CAGR: |

51.2% |

Market Size in 2032: |

USD 14.36 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. EV BATTERY RECYCLING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. EV BATTERY RECYCLING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. EV BATTERY RECYCLING MARKET COMPETITIVE RIVALRY

TABLE 005. EV BATTERY RECYCLING MARKET THREAT OF NEW ENTRANTS

TABLE 006. EV BATTERY RECYCLING MARKET THREAT OF SUBSTITUTES

TABLE 007. EV BATTERY RECYCLING MARKET BY TYPE

TABLE 008. LITHIUM-ION MARKET OVERVIEW (2016-2028)

TABLE 009. LEAD-ACID MARKET OVERVIEW (2016-2028)

TABLE 010. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 011. EV BATTERY RECYCLING MARKET BY PROCESS

TABLE 012. HYDROMETALLURGICAL MARKET OVERVIEW (2016-2028)

TABLE 013. PYRO-METALLURGICAL MARKET OVERVIEW (2016-2028)

TABLE 014. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 015. EV BATTERY RECYCLING MARKET BY VEHICLE TYPE

TABLE 016. PASSENGER CARS MARKET OVERVIEW (2016-2028)

TABLE 017. COMMERCIAL VEHICLES MARKET OVERVIEW (2016-2028)

TABLE 018. NORTH AMERICA EV BATTERY RECYCLING MARKET, BY TYPE (2016-2028)

TABLE 019. NORTH AMERICA EV BATTERY RECYCLING MARKET, BY PROCESS (2016-2028)

TABLE 020. NORTH AMERICA EV BATTERY RECYCLING MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 021. N EV BATTERY RECYCLING MARKET, BY COUNTRY (2016-2028)

TABLE 022. EUROPE EV BATTERY RECYCLING MARKET, BY TYPE (2016-2028)

TABLE 023. EUROPE EV BATTERY RECYCLING MARKET, BY PROCESS (2016-2028)

TABLE 024. EUROPE EV BATTERY RECYCLING MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 025. EV BATTERY RECYCLING MARKET, BY COUNTRY (2016-2028)

TABLE 026. ASIA PACIFIC EV BATTERY RECYCLING MARKET, BY TYPE (2016-2028)

TABLE 027. ASIA PACIFIC EV BATTERY RECYCLING MARKET, BY PROCESS (2016-2028)

TABLE 028. ASIA PACIFIC EV BATTERY RECYCLING MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 029. EV BATTERY RECYCLING MARKET, BY COUNTRY (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA EV BATTERY RECYCLING MARKET, BY TYPE (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA EV BATTERY RECYCLING MARKET, BY PROCESS (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA EV BATTERY RECYCLING MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 033. EV BATTERY RECYCLING MARKET, BY COUNTRY (2016-2028)

TABLE 034. SOUTH AMERICA EV BATTERY RECYCLING MARKET, BY TYPE (2016-2028)

TABLE 035. SOUTH AMERICA EV BATTERY RECYCLING MARKET, BY PROCESS (2016-2028)

TABLE 036. SOUTH AMERICA EV BATTERY RECYCLING MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 037. EV BATTERY RECYCLING MARKET, BY COUNTRY (2016-2028)

TABLE 038. SNAM S.P.A.: SNAPSHOT

TABLE 039. SNAM S.P.A.: BUSINESS PERFORMANCE

TABLE 040. SNAM S.P.A.: PRODUCT PORTFOLIO

TABLE 041. SNAM S.P.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. RETRIEV TECHNOLOGIES: SNAPSHOT

TABLE 042. RETRIEV TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 043. RETRIEV TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 044. RETRIEV TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. AUSTRALIAN BATTERY RECYCLING INITIATIVES: SNAPSHOT

TABLE 045. AUSTRALIAN BATTERY RECYCLING INITIATIVES: BUSINESS PERFORMANCE

TABLE 046. AUSTRALIAN BATTERY RECYCLING INITIATIVES: PRODUCT PORTFOLIO

TABLE 047. AUSTRALIAN BATTERY RECYCLING INITIATIVES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. UMICORE N.V.: SNAPSHOT

TABLE 048. UMICORE N.V.: BUSINESS PERFORMANCE

TABLE 049. UMICORE N.V.: PRODUCT PORTFOLIO

TABLE 050. UMICORE N.V.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. LI-CYCLE CORP.: SNAPSHOT

TABLE 051. LI-CYCLE CORP.: BUSINESS PERFORMANCE

TABLE 052. LI-CYCLE CORP.: PRODUCT PORTFOLIO

TABLE 053. LI-CYCLE CORP.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. AMERICAN MANGANESE INC.: SNAPSHOT

TABLE 054. AMERICAN MANGANESE INC.: BUSINESS PERFORMANCE

TABLE 055. AMERICAN MANGANESE INC.: PRODUCT PORTFOLIO

TABLE 056. AMERICAN MANGANESE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. ACCUREC RECYCLING GMBH: SNAPSHOT

TABLE 057. ACCUREC RECYCLING GMBH: BUSINESS PERFORMANCE

TABLE 058. ACCUREC RECYCLING GMBH: PRODUCT PORTFOLIO

TABLE 059. ACCUREC RECYCLING GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. G&P BATTERIES: SNAPSHOT

TABLE 060. G&P BATTERIES: BUSINESS PERFORMANCE

TABLE 061. G&P BATTERIES: PRODUCT PORTFOLIO

TABLE 062. G&P BATTERIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. RECUPYL: SNAPSHOT

TABLE 063. RECUPYL: BUSINESS PERFORMANCE

TABLE 064. RECUPYL: PRODUCT PORTFOLIO

TABLE 065. RECUPYL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. BATTERY SOLUTIONS: SNAPSHOT

TABLE 066. BATTERY SOLUTIONS: BUSINESS PERFORMANCE

TABLE 067. BATTERY SOLUTIONS: PRODUCT PORTFOLIO

TABLE 068. BATTERY SOLUTIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 069. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 070. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 071. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. EV BATTERY RECYCLING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. EV BATTERY RECYCLING MARKET OVERVIEW BY TYPE

FIGURE 012. LITHIUM-ION MARKET OVERVIEW (2016-2028)

FIGURE 013. LEAD-ACID MARKET OVERVIEW (2016-2028)

FIGURE 014. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 015. EV BATTERY RECYCLING MARKET OVERVIEW BY PROCESS

FIGURE 016. HYDROMETALLURGICAL MARKET OVERVIEW (2016-2028)

FIGURE 017. PYRO-METALLURGICAL MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 019. EV BATTERY RECYCLING MARKET OVERVIEW BY VEHICLE TYPE

FIGURE 020. PASSENGER CARS MARKET OVERVIEW (2016-2028)

FIGURE 021. COMMERCIAL VEHICLES MARKET OVERVIEW (2016-2028)

FIGURE 022. NORTH AMERICA EV BATTERY RECYCLING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. EUROPE EV BATTERY RECYCLING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. ASIA PACIFIC EV BATTERY RECYCLING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. MIDDLE EAST & AFRICA EV BATTERY RECYCLING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. SOUTH AMERICA EV BATTERY RECYCLING MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the EV Battery Recycling Market research report is 2024-2032.

Accurec Recycling GmbH (Germany), American Manganese Inc. (Canada), Aqua Metals Inc. (United States), Battery Solutions LLC (United States), DOWA Eco-System Co., Ltd. (Japan), GEM Co., Ltd. (China), Glencore International AG (Switzerland), Li-Cycle Corp. (Canada), Neometals Ltd. (Australia), Raw Materials Company Inc. (Canada), Recupyl (France), Redux GmbH (Germany), Redwood Materials (United States), Retriev Technologies Inc. (United States), Retriev Technologies Inc. (United States), SNAM (Italy), SNAM (Italy), Tes-Amm (Singapore), The Doe Run Company (United States), Umicore (Belgium) and Other Major Players.

The EV Battery Recycling Market is segmented into Type, Sources, Vehicle Type, and region. By Type, the market is categorized into Lithium-ion, Lead Acid, and Others. By Sources, the market is categorized into End-of-life and production Scrap. By Vehicle Type, the market is Passenger Cars, Buses, Vans, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

EV battery recycling can be defined as the gathering of used batteries from electric vehicles, followed by disassembling and recycling the same batteries. This usually consists of batteries that are generally lithium-ion; these batteries will degrade in their capability to store charges. Recycling is done so that materials such as lithium, cobalt, and nickel, which are used in a new battery or for other uses, can be reused in new batteries to minimize the level of impact on the environment it has and to maximize the utilization demand on resources for the electric vehicle industry.

EV Battery Recycling Market Size Was Valued at USD 0.35 Billion in 2023 and is Projected to Reach USD 14.36 Billion by 2032, Growing at a CAGR of 51.2% From 2024-2032.