Lab Automation Market Synopsis

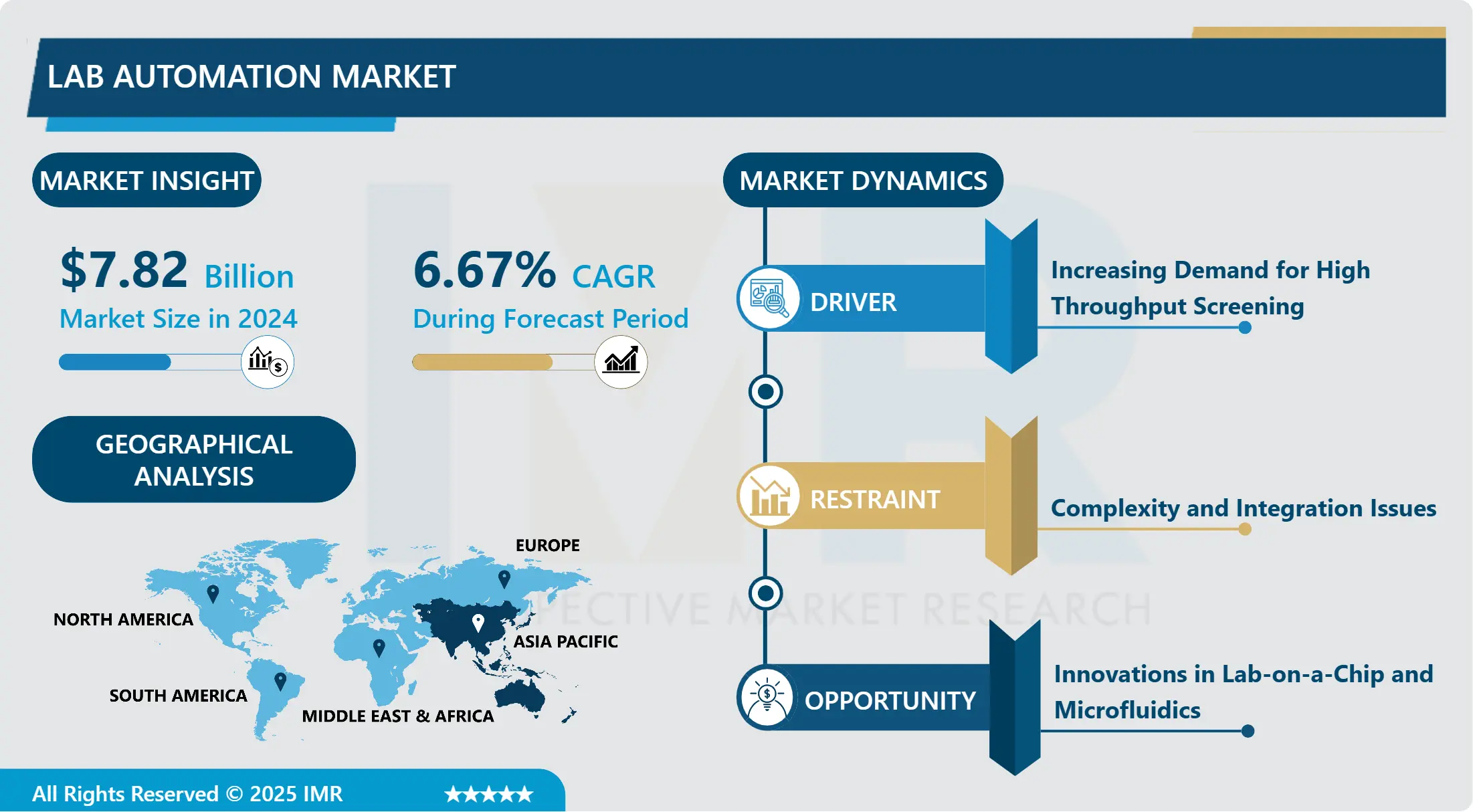

Lab Automation Market Size Was Valued at USD 7.82 Billion in 2024, and is Projected to Reach USD 13.11 Billion by 2032, Growing at a CAGR of 6.67% From 2025-2032.

The lab automation market refers to the industry segment focused on the development and deployment of automated technologies and systems within laboratory settings. These technologies aim to streamline and optimize various laboratory processes, such as sample preparation, analysis, and data management, by reducing manual intervention, enhancing accuracy, and increasing throughput. Lab automation solutions typically integrate advanced robotics, software systems, and instrumentation to enable repetitive tasks to be performed with minimal human intervention, thereby improving efficiency, standardization, and overall productivity in scientific research, diagnostics, and other laboratory operations. This market encompasses a wide range of applications across pharmaceuticals, biotechnology, clinical diagnostics, and academic research, driven by the growing demand for high-throughput capabilities and consistent quality in laboratory workflows.

The lab automation market has witnessed significant growth, driven by the increasing demand for high-throughput screening, advancements in technology, and the rising need for efficient and reliable laboratory processes. Automation in laboratories has become essential in managing the complexities and growing volumes of data generated, enhancing the reproducibility and accuracy of experimental results. This market covers a spectrum of automated devices, software, and services meant to improve laboratory workflows, eliminate human participation, and minimize errors.

The necessity for quicker drug discovery and development processes in the biotechnology and pharmaceutical industries is one of the main factors propelling the market for lab automation. Automated systems enable high-throughput screening, allowing researchers to quickly test and analyze thousands of compounds. This efficiency is crucial in accelerating the identification of potential drug candidates and bringing new therapies to market more rapidly. Automation also lessens the possibility of human error, which guarantees more regular and dependable outcomes and is essential for quality control and regulatory compliance.

Technological advancements have played a pivotal role in the growth of the lab automation market. Innovations such as robotic systems, automated liquid handling, and advanced imaging technologies have revolutionized laboratory operations. These advancements have made it possible to handle complex tasks with greater precision and speed, further driving the adoption of automation in various research and clinical settings. Moreover, the integration of artificial intelligence (AI) and machine learning (ML) in lab automation systems is enhancing data analysis capabilities, enabling researchers to derive deeper insights from their experiments.

The market is also benefiting from the rising emphasis on customized treatment and genomics. For customized treatment plans, large-scale sequencing and data analysis must be handled by automated systems. As the demand for tailored therapies grows, the need for sophisticated lab automation solutions will continue to rise. Moreover, the COVID-19 pandemic has emphasized the significance of automation in overseeing extensive testing and research endeavors, hence driving additional market expansion.

The market for lab automation has many benefits, but it also has drawbacks, like high upfront costs and the requirement for specialized training to operate sophisticated automated systems. However, many laboratories are investing in automation due to the long-term advantages of higher productivity, lower staff costs, and enhanced data accuracy. Furthermore, it is anticipated that continued research and development will reduce prices and improve automated systems' usability, opening them up to a wider range of facilities.

Lab Automation Market Trend Analysis

Lab Automation Market Growth Driver- Increasing R&D Investments in Lab Automation

- Increased spending on research and development (R&D) is driving the lab automation market in a number of different industries. The urgent need to improve the speed, precision, and efficiency of laboratory procedures is what is driving this development. Automation technologies are being used, for example, in the pharmaceutical business to expedite drug research and discovery procedures. High-throughput screening, compound management, and other monotonous duties can be handled by automated systems, freeing up researchers to concentrate on more intricate and valuable work. This expedites the process of developing new drugs while lowering expenses and minimizing human error, producing outcomes that are more consistent and repeatable.

- Furthermore, the biotechnology and life sciences industries are seeing a rise in research and development (R&D) activity, mostly as a result of the expanding need for customized medicine, enhanced diagnostic tools, and genetic research. Large datasets and sophisticated studies can be handled more quickly and precisely in various disciplines because to automation. Automated sequencers and sample preparation technologies, for instance, drastically cut down on the time and labor needed for sequencing operations in genomic research. This makes it possible to conduct more thorough and in-depth research, which advances our knowledge of hereditary illnesses and the creation of focused treatments. All things considered, the incorporation of automated technologies into research and development is revolutionizing laboratory operations, spurring creativity, and improving the caliber and productivity of scientific study.

Lab Automation Market Expansion Opportunity- Government Funding and Initiatives

- Governments everywhere are spending more money on automation and laboratory equipment to improve research capacity and healthcare services. These expenditures are a component of larger plans to enhance public health outcomes, quicken the pace of medical research, and guarantee that healthcare institutions are able to effectively manage expanding demand. For example, government-funded initiatives frequently encourage the development of high-throughput screening and diagnostic tools, update laboratory facilities, and incorporate cutting-edge technologies. The emphasis on automation lowers human error, expedites testing procedures, and improves overall laboratory result accuracy all of which are critical for the prompt and efficient provision of healthcare.?

- To further fortify laboratory infrastructures, numerous governments are also partnering and signing agreements with major participants in the lab automation market. These collaborations frequently entail training program support, research project financing, and subsidies for the adoption of cutting-edge technologies to guarantee that lab staff members are capable of using new automated systems. For instance, governments all around the world increased their investments in automated lab systems during the COVID-19 pandemic in order to manage the spike in diagnostic demands and enhance testing capabilities. These programs not only addressed pressing issues related to public health but also set the stage for long-term advancements in the effectiveness and capacity of laboratories. Because of this, government financing and initiatives are significantly increasing the market for lab automation, encouraging innovation, and guaranteeing that labs are prepared to handle the needs of future healthcare and research.?

Lab Automation Market Segment Analysis:

Lab Automation Market Segmented based on Process, Automation Type, end user, and Region.

By Process, (Discrete Processing- By Workflow- Independent Analysis) segment is expected to dominate the market during the forecast period

- Independent analysis represents a significant share in industries where the ability to conduct multiple, simultaneous tests without interdependence is crucial. In clinical diagnostics, for instance, laboratories often handle a vast number of samples daily, each requiring various tests such as blood counts, metabolic panels, and pathogen screenings. The independent analysis workflow enables these labs to process multiple tests at once, regardless of the order or outcomes of other tests. This flexibility reduces bottlenecks and improves overall efficiency, leading to faster diagnostic results and better patient care. Additionally, the scalability of independent analysis allows laboratories to manage increasing workloads without substantial delays, making it an indispensable approach in modern medical diagnostics.

- In environmental testing, independent analysis plays a vital role in monitoring and assessing various environmental parameters such as water quality, air pollution, and soil contamination. Environmental testing labs must quickly and accurately analyze numerous samples to ensure compliance with regulatory standards and to address potential environmental hazards. Independent analysis allows these labs to conduct diverse tests concurrently, such as measuring chemical pollutants, biological contaminants, and physical properties, all without waiting for preceding test results. This capability not only enhances the lab's throughput but also ensures timely reporting and swift action in response to environmental concerns. Consequently, independent analysis has emerged as the dominant share in industries requiring high-volume, high-speed, and flexible testing capabilities.

By End-user, Photometry & Fluorometry segment held the largest share in 2024

- Photometry and fluorometry represent the cornerstone of clinical diagnostics, commanding the largest share due to their critical role in analyzing biological samples with precision and accuracy. Photometry is essential for colorimetric tests because it makes use of the principle of measuring the intensity of light absorbed or transmitted by a substance. Photometric assays are widely used in clinical settings to measure biomolecules such as proteins, cholesterol, and glucose. In order to help with the diagnosis and ongoing care of ailments like diabetes, cardiovascular disease, and kidney disorders, these tests offer vital diagnostic information. Photometric methods are widely adopted in healthcare facilities because to their simplicity, dependability, and wide availability, which solidifies their leading position in the clinical diagnostics market.

- Fluorometry is a complementary technique to photometry that measures the fluorescence that certain substances release when exposed to a certain wavelength of light. This method is quite sensitive, which makes it useful for finding analytes in biological samples at low concentrations. When it comes to high-sensitivity applications like genetic analysis, therapeutic medication monitoring, and biomarker detection, fluorometric assays are essential. Fluorometry is an essential tool in clinical laboratories for improving the precision of diagnoses, particularly when it comes to measuring minuscule amounts of chemicals. Its popularity in clinical diagnostics is largely due to its quick and accurate quantitative data delivery. Combining their powerful ability to analyze biological samples, photometry and fluorometry provide the foundation of contemporary diagnostic technology, spurring innovation and improving healthcare results.

Lab Automation Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific is positioned as a burgeoning hub for lab automation, propelled by several key factors driving market growth. As the three largest economies in the region, China, Japan, and India, significant investments in healthcare infrastructure are being made with the goal of improving research facilities and diagnostic capacities. For example, China has been rapidly growing its healthcare industry, helped along by government programs like the Healthy China 2030 plan, which prioritizes innovation and reform in the field. This effort, which aims to increase diagnostic accuracy and operational efficiency across healthcare facilities countrywide, includes substantial investments in cutting-edge medical technologies such as lab automation systems.

- Japan, which is well-known for having highly developed technological skills, is still at the forefront of innovation in the biotechnology and healthcare industries. The nation is placing a great focus on individualized healthcare and precision medicine, which is increasing demand for advanced lab automation systems that can improve diagnostic accuracy and streamline laboratory operations. Similar to this, rising R&D expenditures are driving the quick growth of India's biotechnology and pharmaceutical sectors. Initiatives like "Made in India," which boost domestic manufacturing capacities for high-tech medical equipment like automated laboratory systems, are a contributing factor to this expansion.

- In addition, the aging population in Asia Pacific nations and the increased incidence of chronic diseases are driving up need for effective diagnostic techniques. Healthcare providers are being compelled by this shift in demographics to implement cutting-edge technologies that can enhance patient outcomes and operational effectiveness. Asia Pacific is therefore well-positioned to lead the world market for lab automation in the years to come, thanks to significant investments, technological developments, and a legal framework that supports healthcare innovation.

Active Key Players in the Lab Automation Market

- QIAGEN

- PerkinElmer Inc.

- Thermo Fisher Scientific, Inc.

- Siemens Healthcare GmbH

- Danaher

- Agilent Technologies, Inc.

- Eppendorf SE

- Hudson Robotics

- Aurora Biomed Inc.

- BMG LABTECH GmbH

- Tecan Trading AG

- Hamilton Company

- F. Hoffmann-La Roche Ltd

- Other Active Players

|

Global Lab Automation Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 7.82 Bn. |

|

Forecast Period 2025-32 CAGR: |

6.67% |

Market Size in 2032: |

USD 13.11 Bn. |

|

Segments Covered: |

By Process |

|

|

|

By Automation Type |

|

||

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Lab Automation Market by Process (2018-2032)

4.1 Lab Automation Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Continuous Flow

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

Chapter 5: Lab Automation Market by Workflow (2018-2032)

5.1 Lab Automation Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Sequential Processing

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Parallel Processing

Chapter 6: Lab Automation Market by Components (2018-2032)

6.1 Lab Automation Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Consumables

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Equipment

6.5 Discrete Processing

Chapter 7: Lab Automation Market by Method (2018-2032)

7.1 Lab Automation Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Centrifugal Discrete Processing

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Random Access Discrete Processing

Chapter 8: Lab Automation Market by Components (2018-2032)

8.1 Lab Automation Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Consumables

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Equipment

Chapter 9: Lab Automation Market by Workflow (2018-2032)

9.1 Lab Automation Market Snapshot and Growth Engine

9.2 Market Overview

9.3 Dependent Analysis

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 Independent Analysis

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Lab Automation Market Share by Manufacturer (2024)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 QIAGEN

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 PERKINELMER INCTHERMO FISHER SCIENTIFIC INCSIEMENS HEALTHCARE GMBH

10.4 DANAHER

10.5 AGILENT TECHNOLOGIES INCEPPENDORF SE

10.6 HUDSON ROBOTICS

10.7 AURORA BIOMED INCBMG LABTECH GMBH

10.8 TECAN TRADING AG

10.9 HAMILTON COMPANY

10.10 F. HOFFMANN-LA ROCHE LTD

10.11 OTHER KEY PLAYERS

10.12

Chapter 11: Global Lab Automation Market By Region

11.1 Overview

11.2. North America Lab Automation Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size by Process

11.2.4.1 Continuous Flow

11.2.5 Historic and Forecasted Market Size by Workflow

11.2.5.1 Sequential Processing

11.2.5.2 Parallel Processing

11.2.6 Historic and Forecasted Market Size by Components

11.2.6.1 Consumables

11.2.6.2 Equipment

11.2.6.3 Discrete Processing

11.2.7 Historic and Forecasted Market Size by Method

11.2.7.1 Centrifugal Discrete Processing

11.2.7.2 Random Access Discrete Processing

11.2.8 Historic and Forecasted Market Size by Components

11.2.8.1 Consumables

11.2.8.2 Equipment

11.2.9 Historic and Forecasted Market Size by Workflow

11.2.9.1 Dependent Analysis

11.2.9.2 Independent Analysis

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Lab Automation Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size by Process

11.3.4.1 Continuous Flow

11.3.5 Historic and Forecasted Market Size by Workflow

11.3.5.1 Sequential Processing

11.3.5.2 Parallel Processing

11.3.6 Historic and Forecasted Market Size by Components

11.3.6.1 Consumables

11.3.6.2 Equipment

11.3.6.3 Discrete Processing

11.3.7 Historic and Forecasted Market Size by Method

11.3.7.1 Centrifugal Discrete Processing

11.3.7.2 Random Access Discrete Processing

11.3.8 Historic and Forecasted Market Size by Components

11.3.8.1 Consumables

11.3.8.2 Equipment

11.3.9 Historic and Forecasted Market Size by Workflow

11.3.9.1 Dependent Analysis

11.3.9.2 Independent Analysis

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Lab Automation Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size by Process

11.4.4.1 Continuous Flow

11.4.5 Historic and Forecasted Market Size by Workflow

11.4.5.1 Sequential Processing

11.4.5.2 Parallel Processing

11.4.6 Historic and Forecasted Market Size by Components

11.4.6.1 Consumables

11.4.6.2 Equipment

11.4.6.3 Discrete Processing

11.4.7 Historic and Forecasted Market Size by Method

11.4.7.1 Centrifugal Discrete Processing

11.4.7.2 Random Access Discrete Processing

11.4.8 Historic and Forecasted Market Size by Components

11.4.8.1 Consumables

11.4.8.2 Equipment

11.4.9 Historic and Forecasted Market Size by Workflow

11.4.9.1 Dependent Analysis

11.4.9.2 Independent Analysis

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Lab Automation Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size by Process

11.5.4.1 Continuous Flow

11.5.5 Historic and Forecasted Market Size by Workflow

11.5.5.1 Sequential Processing

11.5.5.2 Parallel Processing

11.5.6 Historic and Forecasted Market Size by Components

11.5.6.1 Consumables

11.5.6.2 Equipment

11.5.6.3 Discrete Processing

11.5.7 Historic and Forecasted Market Size by Method

11.5.7.1 Centrifugal Discrete Processing

11.5.7.2 Random Access Discrete Processing

11.5.8 Historic and Forecasted Market Size by Components

11.5.8.1 Consumables

11.5.8.2 Equipment

11.5.9 Historic and Forecasted Market Size by Workflow

11.5.9.1 Dependent Analysis

11.5.9.2 Independent Analysis

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Lab Automation Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size by Process

11.6.4.1 Continuous Flow

11.6.5 Historic and Forecasted Market Size by Workflow

11.6.5.1 Sequential Processing

11.6.5.2 Parallel Processing

11.6.6 Historic and Forecasted Market Size by Components

11.6.6.1 Consumables

11.6.6.2 Equipment

11.6.6.3 Discrete Processing

11.6.7 Historic and Forecasted Market Size by Method

11.6.7.1 Centrifugal Discrete Processing

11.6.7.2 Random Access Discrete Processing

11.6.8 Historic and Forecasted Market Size by Components

11.6.8.1 Consumables

11.6.8.2 Equipment

11.6.9 Historic and Forecasted Market Size by Workflow

11.6.9.1 Dependent Analysis

11.6.9.2 Independent Analysis

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Lab Automation Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size by Process

11.7.4.1 Continuous Flow

11.7.5 Historic and Forecasted Market Size by Workflow

11.7.5.1 Sequential Processing

11.7.5.2 Parallel Processing

11.7.6 Historic and Forecasted Market Size by Components

11.7.6.1 Consumables

11.7.6.2 Equipment

11.7.6.3 Discrete Processing

11.7.7 Historic and Forecasted Market Size by Method

11.7.7.1 Centrifugal Discrete Processing

11.7.7.2 Random Access Discrete Processing

11.7.8 Historic and Forecasted Market Size by Components

11.7.8.1 Consumables

11.7.8.2 Equipment

11.7.9 Historic and Forecasted Market Size by Workflow

11.7.9.1 Dependent Analysis

11.7.9.2 Independent Analysis

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

|

Global Lab Automation Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 7.82 Bn. |

|

Forecast Period 2025-32 CAGR: |

6.67% |

Market Size in 2032: |

USD 13.11 Bn. |

|

Segments Covered: |

By Process |

|

|

|

By Automation Type |

|

||

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||