Iron Deficiency Injectable Market Synopsis

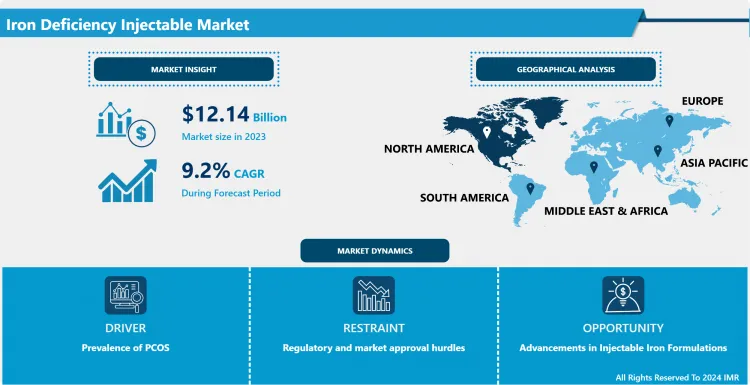

Iron Deficiency Injectable Market Size Was Valued at USD 12.14 Billion in 2023, and is Projected to Reach USD 26.81 Billion by 2032, Growing at a CAGR of 9.20% From 2024-2032.

The realm of interest in this report is the Iron Deficiency Injectable Market which covers the market sub-sector in the pharmaceutical value chain that deals in manufacture and distribution of injectable iron preparations for the treatment of iron deficiency and iron deficiency anemia. These injectables are used when iron orally cannot be given, is not well absorbed or when there is need to replenish Body Iron quickly, in patients with CKD, heart failure or GI pathology. This market pertains iron preparations in the form of intravenous or intramuscular to enhance the haemoglobin levels and compensate iron-deficient patients.

- Overall, the iron deficiency injectable market is steadily growing due to the constantly rising cases of iron deficiency anemia, estimated to afflict millions of people all over the world, mainly in LMICs. Iron deficiency anemia is prevalent across different populations; pregnant women, children and others with chronic illnesses such as CKD and heart failure. Oral iron supplements have in the past been recommended as the first-line therapy since they are the only class of therapy that was available has major problems such as intestinal absorption and side effects such as stomachaches, which lower patient compliance.

- This makes injectable iron formulations favorable especially where patients have severe reductions of this important mineral in their bodies, or where they are unable to take oral medications. The use of injectable iron performs a better and more effective iron replacement, so patients recover quickly in hospitals or any clinical environment. Eventual innovations where products include ferric carboxymaltose and iron isomaltoside have helped to propel the market since such formulations reduce chances of an allergic reaction and enhance patient results. Furthermore, the increasing need for optimum anemia management in diseases such as CKD and IBD have paved for the use injectable iron products.

- On a regional level, North America takes the largest share for the iron deficiency injectable market due to well-developed health care facilities, increased awareness among the affected population and availability of augmented treatment. Conveniently, the injections appeal to patients and healthcare providers within Asia Pacific because this region has a high incidence of CKD and gastrointestinal diseases, which cause iron deficiency. The same trends are experienced in Europe, where good health care and increasing awareness lead to the growth of the market. It has also observed an increase in the use of injectable iron in the cases of iron deficiency related to heart failure common among geriatrics. On the other hand, the Asia-Pacific region is expected to realize the highest level of growth, owing to the huge unmet needs in this region, improvement in healthcare infrastructure, and enhanced government concern in lesser developed countries toward controlling anemia, especially in women and children.

- Nevertheless, high cost of injectable treatments in comparison to oral ones; or scares connected with possible side effects including hypersensitivity remain the issues that complicate the growth of market. However, constant work on the enhancement of safety and effectiveness of injectable iron products is anticipated to mitigate these factors and catalyse market growth over the next couple of years.

Iron Deficiency Injectable Market Trend Analysis

Increasing Demand for Injectable Iron Solutions Driven by Chronic Diseases and Limitations of Oral Supplements

- The awareness of IDA and its global effects on health is one of the leaders of utilization of the injectable solutions. IDA may cause severe fatigue, immuno-compromised status of a patient and limited cognitive ability affecting the quality of life and may causefone complications in patient with special needs including pregnant women, the elderly and children. As public health campaigns and education continue to increase, more patients and healthcare providers understand the drawbacks of oral iron tablets, particularly for individuals with severe IDA in whom restoration of iron balance is an essential requirement. Unfortunately, oral iron supplements are not well absorbed by patients with GI problems like absorption abnormalities or lead to side effects like constipation, nausea making patients reluctant to continue using them. As a result the patient preferred iron injection for treating these deficiencies since iron injections are faster and more reliable methods of replenishing the body’s iron stores.

- This growth is being fuelled by an increase in the prevalence of chronic diseases, especially those associated with iron deficiency, including; CKD and IBD. Chronic kidney disease patients present a poor iron availability and ineffective erythropoiesis, making IV iron administration more appropriate to treat anemia. It is for this reason that, patients with IBD have difficulties in absorbing iron through the use of oral supplements, given that their intestines are inflamed; where there is normal iron in the market, it is in that form of injection. Such chronic diseases have recently become more widespread; therefore, hospital-based IV iron therapy can be resumed as being more effective in restoring iron levels and requires fewer sessions than oral iron replacement. Iron injections being administered increasingly to anemic patients in clinics and hospitals, especially in patients with multiple comorbidities, and higher speeds of therapy driving the development of this market.

Technological Innovations and Targeted Patient Groups Drive Growth of Iron Injectables Market Amidst Cost Challenges

- Advancements with iron injectables has been majorly instrumental in changing the market by providing safer injection that does not pose significant adverse effects to the patient. Currently available iron preparations include newer ones like the ferric carboxymaltose and iron isomaltoside which appear to impart lower risk of hypersensitivity compared to older preparations, and provide more stable iron complexes that are administered in larger doses over shorter time intervals. Such changes have gone a long way in enhancing patient’s benefits by reducing the pain which comes with older formulations like iron dextran which normally took long durations of infusion and had high likelihood of causing severe reactions. Such development has enhanced attractiveness and usage of injectable iron therapies and therefore expanded the opportunities for treatment of patients with IDA in hospital and outpatient clinic since such therapies allow delivering quick and effective treatments.

- In addition to these technological advancements, the following are factors that are projected to offer rise to new opportunities in the market; The global market is also benefiting from the preference for iron injectables in specific population segment. Women in pregnancy, for instance, need more iron than usual, patients with cancer who require iron supplements during their chemotherapy sessions and other patients who develop stomach problems whenever they take tablets have started looking for injectable iron treatment. Furthermore, an increase in government-related programs designed to overcome anemia, especially in areas where the deficiency of iron is still a problem, shoulders this trend. This has in a way insisted on through national health programs to prioritize management of anemia and consequently contributed to the expansion of the market. But, these are overshadowed by the problems like high costs of injectable therapies, and risks of adverse reactions in underdeveloped health systems of emerging economies. Some of these might restrain access in some areas; therefore, caters to the call for improved proprieties to be cheaper and safer continually.

Iron Deficiency Injectable Market Segment Analysis:

Iron Deficiency Injectable Market Segmented based on By Products, By Application and By End User.

By Products, Iron Dextransegment is expected to dominate the market during the forecast period

- Iron dextran is a high molecular weight complex of iron that comprised of a source of iron to the body; consequently, it is helpful in treating iron deficiency anemia especially in patients with difficulty in absorbing oral iron supplements. The formulation of the product is in injectable form which when administered, is directly into the bloodstream; hence better absorption. The former is especially essential for patients with CKD in whom anemia is severe as a result of decreased rate of erythropoietin synthesis and recurrent hemorrhage during dialysis treatments. It is in these settings that iron dextran may be useful in the ability to quickly raise hemoglobin with significant improvement in fatigue and overall quality of life. Clinicians prefer iron dextran because of its effectiveness in iron reserve restoration which is important for patient suffering aggressive treatments such as dialysis.

- Chronic kidney disease, growing incidence rates and an ageing population will continue to promote the use of iron dextran in clinical practice. Since more patients are being diagnosed with CKD and other disease states that cause low iron levels, these therapies will be needed in the future. Furthermore, with an increase in the general population’s understanding of iron deficiency anemia and its consequential ramifications, the iron dextran industry in the anticipant to expand drastically. Future developments may include further improvements to the potency of the iron formulations to meet these needs and make it an ideal candidate for use in outpatient care and other self-administered treatments that patients with chronic conditions may prefer. Consequently, the market size of Iron dextran is forecasted to increase as it is already utilized in the management of anemia, and as more improvements are made in this area.

By End User, Hospitals, segment held the largest share in 2023

- Health facilities are one of the main locations, where iron containing preparations are dispensed, especially intravenous forms which should be administered under strict conditions. This environment is necessarily required for managing patients with multiple medical issues, including chronic kidney disease, cancer or inflammatory bowel disease. Iron deficiency anaemia is common in these patient populations due to their diseases and treatments and this has to be addressed effectively and on time. The hospital administration of iron supplements is also fast, which enables the care givers to treat the anemia quickly; this enhances the hemoglobin status of the patients and consequently their global status. Since acute care and management of co morbid conditions form the core of healthcare delivery today, the need for supplementation of iron supplies in health care organizations are becoming essential.

- In addition, the changes in the processes and scope of treatments as well as rising importance of patient centered care make the use of iron supplements in hospitals continue to increase. Organization care delivery structures such as that which entails a number of distinct professionals as well as departments allow proper congruent patient care to be offered. This kind of relationship let patient with anemia be treated according to their disorder and need specific types and measures of iron intake. Thus, as more and more hospitals transition toward these models, and as the quality of their anemia management programs are strengthened, the market for iron supplements will likely expand. Furthermore, the increasing understanding of the significance of nutritional deficiencies to patients admitted in hospitals is likely to propel the expansion of iron treatment which will remain as the major customers in the hospitals.

Iron Deficiency Injectable Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In North America there has been a rising tide of IDA, including pregnant women; this has collectively changed the consumption of injectable iron supplements. This is due to high risk which pregnant women are bound to experience as a result of iron requirements during the pregnancy, therefore, efficiency in supplementation is important for both the mother and the unborn baby. Also, since about half of the patients with chronic diseases may suffer from iron deficiency, kidney diseases and cancers are some examples of diseases that that affect iron absorption either due to the diseases themselves or their treatments such as chemotherapy. This demographic requires a faster and more efficient way of getting their bodies replenished with iron and doctors have started to prescribe injection iron supplements over the traditional oral supplements thus boosting the market place. The concept of precision medicine, as well as the focus on extended pharmacological effect customization, also supports this trend, because healthcare professionals try to chose targeted therapy for certain patients.

- Further, the well-developed healthcare industry in North America is instrumental in the development of healthcare TCAM market. Coordination with well developed healthcare facilities and with strong networks of healthcare personnel guarantees that the iron-deficiency anemic patients are treated promptly and efficiently. Accompanying the recent identification of IDF anemia as a public health crisis, educational strategies have been established to promote both clinical practitioners’ and patients’ understanding of the role of diagnostic and timely treatment efforts. This demand is being met with more firms’ commitment to research and development for new and improved inventions that offer better solutions, effectiveness and compliance to the patient. Such innovations include newer injectable formulations that have less side effects and that are well tolerated hence making treatment more attractive to the clients. Therefore, owing to these factors, the regions indulged in the iron deficiency injectable market including North America is expected to provide massive growth opportunity due to proper and enhanced healthcare policies, advanced medical facilities, and constant biopharmaceutical development.

Active Key Players in the Iron Deficiency Injectable Market

- AbbVie Inc. (U.S.)

- Covis Pharma GmbH (U.S.)

- DAIICHI SANKYO COMPANY, LIMITED (Japan)

- Fresenius Kabi AG (Germany)

- Vifor Pharma Management Ltd.(Switzerland)

- PHARMACOSMOS A/S (Denmark)

- Shield Therapeutics plc (U.K.)

- American Regent, Inc. (U.S.)

- Rockwell Medical, Inc. (U.S.)

- Apotex Inc (Canada)

- Bayer AG (Germany)

- Akebia Therapeutics, Inc. (U.S.)

- GSK plc (U.K.)

- Novartis AG (Switzerland)

- Aetna Inc.(U.S.)

- Pfizer Inc (U.S.)

- Systacare Remedies (India)

- BSA Pharma Inc. (India)

- Other Key Players

Key Industry Developments in the Iron Deficiency Injectable Market Market Name Market:

- In March, 2024 Cadila Pharmaceuticals launches an iron injectable to treat anaemia. Redshot injection is an intravenous iron preparation with greater tolerability and little to no risk of allergy, the injection speeds haemoglobin level improvement while rapidly replenishing depleted iron stores.

- In May, 2024 Indian medical scientists at AIIMS Delhi have developed a cheap one-shot intravenous (IV) iron injection that has no side effects, a potential health aid in a country with some of the world's highest iron deficiency rates.

|

Global Iron Deficiency Injectable Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.14 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.20% |

Market Size in 2032: |

USD 26.81 Bn. |

|

Segments Covered: |

By Products |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Iron Deficiency Injectable Market by Products (2018-2032)

4.1 Iron Deficiency Injectable Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Iron Dextran

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Iron Sucrose

4.5 Ferric Carboxymaltose

4.6 Others

Chapter 5: Iron Deficiency Injectable Market by Application (2018-2032)

5.1 Iron Deficiency Injectable Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Chronic Kidney Disease

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Inflammatory Bowel Disease

5.5 Cancer

5.6 Others

Chapter 6: Iron Deficiency Injectable Market by End User (2018-2032)

6.1 Iron Deficiency Injectable Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Homecare

6.5 Specialty Clinics

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Iron Deficiency Injectable Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABBVIE INC. (U.S.)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 COVIS PHARMA GMBH (U.S.)

7.4 DAIICHI SANKYO COMPANY

7.5 LIMITED (JAPAN)

7.6 FRESENIUS KABI AG (GERMANY)

7.7 VIFOR PHARMA MANAGEMENT LTD.(SWITZERLAND)

7.8 PHARMACOSMOS A/S (DENMARK)

7.9 SHIELD THERAPEUTICS PLC (U.K.)

7.10 AMERICAN REGENT INC. (U.S.)

7.11 ROCKWELL MEDICAL INC. (U.S.)

7.12 APOTEX INC (CANADA)

7.13 BAYER AG (GERMANY)

7.14 AKEBIA THERAPEUTICS INC. (U.S.)

7.15 GSK PLC (U.K.)

7.16 NOVARTIS AG (SWITZERLAND)

7.17 AETNA INC.(U.S.)

7.18 PFIZER INC (U.S.)

7.19 SYSTACARE REMEDIES (INDIA)

7.20 BSA PHARMA INC. (INDIA)

7.21 OTHER KEY PLAYERS

Chapter 8: Global Iron Deficiency Injectable Market By Region

8.1 Overview

8.2. North America Iron Deficiency Injectable Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Products

8.2.4.1 Iron Dextran

8.2.4.2 Iron Sucrose

8.2.4.3 Ferric Carboxymaltose

8.2.4.4 Others

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Chronic Kidney Disease

8.2.5.2 Inflammatory Bowel Disease

8.2.5.3 Cancer

8.2.5.4 Others

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Hospitals

8.2.6.2 Homecare

8.2.6.3 Specialty Clinics

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Iron Deficiency Injectable Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Products

8.3.4.1 Iron Dextran

8.3.4.2 Iron Sucrose

8.3.4.3 Ferric Carboxymaltose

8.3.4.4 Others

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Chronic Kidney Disease

8.3.5.2 Inflammatory Bowel Disease

8.3.5.3 Cancer

8.3.5.4 Others

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Hospitals

8.3.6.2 Homecare

8.3.6.3 Specialty Clinics

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Iron Deficiency Injectable Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Products

8.4.4.1 Iron Dextran

8.4.4.2 Iron Sucrose

8.4.4.3 Ferric Carboxymaltose

8.4.4.4 Others

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Chronic Kidney Disease

8.4.5.2 Inflammatory Bowel Disease

8.4.5.3 Cancer

8.4.5.4 Others

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Hospitals

8.4.6.2 Homecare

8.4.6.3 Specialty Clinics

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Iron Deficiency Injectable Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Products

8.5.4.1 Iron Dextran

8.5.4.2 Iron Sucrose

8.5.4.3 Ferric Carboxymaltose

8.5.4.4 Others

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Chronic Kidney Disease

8.5.5.2 Inflammatory Bowel Disease

8.5.5.3 Cancer

8.5.5.4 Others

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Hospitals

8.5.6.2 Homecare

8.5.6.3 Specialty Clinics

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Iron Deficiency Injectable Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Products

8.6.4.1 Iron Dextran

8.6.4.2 Iron Sucrose

8.6.4.3 Ferric Carboxymaltose

8.6.4.4 Others

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Chronic Kidney Disease

8.6.5.2 Inflammatory Bowel Disease

8.6.5.3 Cancer

8.6.5.4 Others

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Hospitals

8.6.6.2 Homecare

8.6.6.3 Specialty Clinics

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Iron Deficiency Injectable Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Products

8.7.4.1 Iron Dextran

8.7.4.2 Iron Sucrose

8.7.4.3 Ferric Carboxymaltose

8.7.4.4 Others

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Chronic Kidney Disease

8.7.5.2 Inflammatory Bowel Disease

8.7.5.3 Cancer

8.7.5.4 Others

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Hospitals

8.7.6.2 Homecare

8.7.6.3 Specialty Clinics

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Iron Deficiency Injectable Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.14 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.20% |

Market Size in 2032: |

USD 26.81 Bn. |

|

Segments Covered: |

By Products |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Iron Deficiency Injectable Market research report is 2024-2032.

AbbVie Inc. (U.S.), Covis Pharma GmbH (U.S.), DAIICHI SANKYO COMPANY, LIMITED (Japan), Fresenius Kabi AG (Germany), Vifor Pharma Management Ltd.(Switzerland), PHARMACOSMOS A/S (Denmark), Shield Therapeutics plc (U.K.), American Regent, Inc. (U.S.), Rockwell Medical, Inc. (U.S.), Apotex Inc (Canada), Bayer AG (Germany), Akebia Therapeutics, Inc. (U.S.), GSK plc (U.K.), Novartis AG (Switzerland), Aetna Inc.(U.S.), Pfizer Inc (U.S.), Systacare Remedies (India), BSA Pharma Inc. (India) and Other Major Players.

The Iron Deficiency Injectable Market is segmented into By Products, By Application, By End User and region. By Products, the market is categorized into Iron Dextran, Iron Sucrose, Ferric Carboxymaltose, and Others. By Application, the market is categorized into Chronic Kidney Disease, Inflammatory Bowel Disease, Cancer and Others. By End User, the market is categorized into Hospitals, Homecare, Specialty Clinics, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

We define the Iron Deficiency Injectable Market as the subset of the pharmaceutical industry that is specialized in providing injectable iron products as a treatment for iron deficiency and iron deficiency anemia. These injectables are used in indicated when oral iron supplements fail, are contraindicated or when there is need for iron replenishment in conditions such as chronic kidney disease, heart failure or GI disorders. This market includes different forms of iron used intravenous or intramuscular to boost the hematologic index and correct disturbances of iron-dependent metabolism in patients.

Iron Deficiency Injectable Market Size Was Valued at USD 12.14 Billion in 2023, and is Projected to Reach USD 26.81 Billion by 2032, Growing at a CAGR of 9.20% From 2024-2032.