Global Intravenous Product Packaging Market Overview

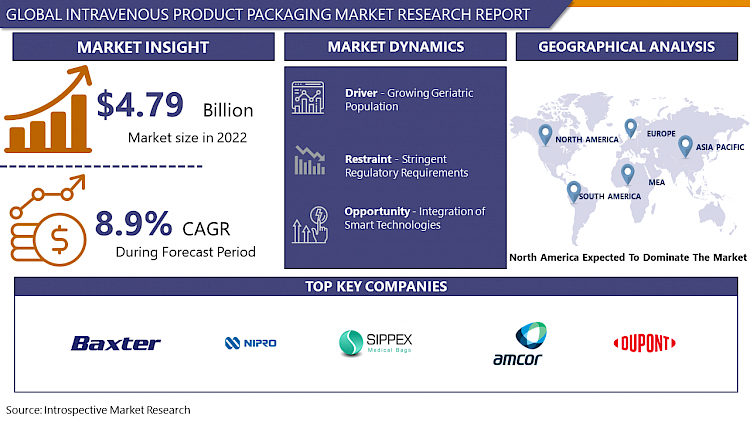

Global Intravenous Product Packaging Market size is expected to grow from USD 4.79 Billion in 2022 to USD 9.47 Billion by 2030, at a CAGR of 8.9% during the forecast period (2023–2030).

-

Intravenous product packaging is a medical device used to store and protect intravenous (IV) products, which are medications or fluids administered directly into a vein. It must meet several requirements, including sterility, compatibility, permeability, integrity, transparency, and ease of use. IV products must be sterile to prevent contamination, and the packaging must be compatible with the IV product to prevent any adverse reactions.

-

The packaging must be impermeable to bacteria and contaminants while allowing the IV product to pass. It must withstand shipping, handling, and storage without leaking or breaking. Transparency is essential for visual inspection and ease of use, even for healthcare professionals wearing gloves. Common types of IV product packaging include IV bags, cannulas, syringes, and infusion pumps. Intravenous product packaging is crucial in the healthcare industry, as it ensures the safety and effectiveness of IV products for patients.

-

The primary benefit of IV product packaging is to protect the sterility and integrity of the contents. This is essential to prevent contamination and ensure that patients receive the intended medication or fluid. IV product packaging also plays an important role in drug delivery, allowing for precise administration of medications and fluids. IV product packaging offers advantages over other methods of medication delivery, such as fast delivery, controlled delivery, and direct delivery. Fast delivery ensures quick absorption into the bloodstream, while controlled delivery allows for precise dosage and timing. Direct delivery bypasses the digestive system, ensuring full absorption.

Intravenous Product Packaging Market Analysis:

Growing Geriatric Population

-

The increasing elderly population worldwide has led to a surge in demand for healthcare services, including intravenous therapies, due to chronic illnesses requiring frequent medical interventions. This has intensified the need for efficient and secure packaging solutions for intravenous products.

-

The ageing population, with a higher prevalence of conditions like cardiovascular diseases, diabetes, and cancer, demands targeted medical interventions. This has increased demand for intravenous therapies, driving the growth of the IV product packaging market. Packaging ensures the safety, sterility, and efficacy of intravenous products, and as healthcare providers cater to the unique needs of the geriatric population, demand for advanced packaging solutions has surged.

-

The geriatric population faces mobility and medication self-administration challenges, leading to increased reliance on healthcare facilities for intravenous treatments. This shift has increased demand for user-friendly packaging, catering to healthcare professionals and patients. Manufacturers in the intravenous product packaging market are focusing on innovations to enhance ease of use, reduce contamination risks, and ensure medication integrity.

-

The IV product packaging market is experiencing robust expansion due to the growing geriatric population and the increasing demand for intravenous therapies. The market is poised for sustained growth, driven by the imperative to deliver safe, effective, and convenient intravenous treatments to this demographic, highlighting the need for advanced packaging solutions in the evolving healthcare landscape.

Integration of Smart Technologies

-

The healthcare industry is embracing smart solutions to improve patient care, streamline processes, and enhance efficiency, particularly in intravenous product packaging, where the incorporation of smart technologies opens new opportunities for innovation and value addition.

-

Smart technologies like RFID and the IoT are revolutionizing intravenous product management and monitoring. They enable real-time tracking and monitoring from manufacturing to healthcare institutions, ensuring supply chain integrity and reducing errors and tampering. This enhances the safety and quality of intravenous therapies, reducing the risk of tampering.

-

Smart technologies are revolutionizing medication management in IV packaging. They enable the monitoring of medication temperature and integrity during storage and transportation, ensuring optimal conditions for healthcare providers and patients. This transparency and traceability are especially crucial in intravenous therapies, where the efficacy of medications is closely linked to their handling and storage.

-

Smart packaging provides real-time data on patient adherence and treatment progress through smartphone apps or web interfaces. This enhances patient experience and contributes to personalized healthcare delivery by providing valuable information about administered intravenous therapies, improving the overall patient experience. The intravenous product packaging market is poised for significant growth due to the integration of smart technologies like RFID and IoT. These solutions not only improve the safety and efficiency of intravenous therapies but also provide data-driven insights and improved patient outcomes. As the healthcare industry embraces digital transformation, the IV product packaging market will benefit from this innovation.

Intravenous Product Packaging Market Segment Analysis:

Intravenous Product Packaging Market Segmented on the basis of Type, Material, and Application

By Type, IV bags segment is expected to dominate the market during the forecast period

-

The widespread adoption of intravenous therapies across diverse medical disciplines, ranging from critical care to routine medical procedures, has led to a consistent and high demand for IV bags. These bags provide a versatile and convenient solution for administering fluids, medications, and nutrients directly into the bloodstream

-

Material technology advancements in manufacturing processes have significantly impacted the development of IV bags in healthcare. These bags offer enhanced features like compatibility with medications, improved durability, and advanced safety measures. Their popularity among healthcare professionals is driven by their cost-effectiveness, ease of use, and reduced risk of contamination. The flexibility and scalability of IV bags make them a preferred choice in hospital settings and home healthcare environments, ensuring a steady demand in the broader intravenous product packaging market.

Intravenous Product Packaging Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

The healthcare industry in North America is thriving due to advanced facilities, research institutions, and a robust regulatory framework. The widespread adoption of intravenous therapies and the ageing population, coupled with chronic diseases, have increased the demand for efficient and secure IV product packaging solutions, driving the growth of the IV product packaging market in the region.

-

North America is at the forefront of IV product packaging developments due to key market players, innovation culture, and early adoption of advanced technologies. The region's commitment to patient safety, product quality, and regulatory compliance reinforces its dominance. Strategic collaborations between healthcare institutions, pharmaceutical companies, and packaging manufacturers contribute to the strength of the North American market, setting the standard for best practices and advancements in healthcare delivery.

Key Players Covered in Intravenous Product Packaging Market:

- Baxter (U.S.)

- Dupont(U.S.)

- Minigrip (U.S.)

- Smith Medical (U.S.)

- BD (U.S.)

- Cardinal Health (U.S.)

- Sippex IV bag (France)

- B. Braun Medicals (Germany)

- Neotec Medical Industries (Singapore)

- SSY Group Limited (Hong Kong)

- Nipro (Japan)

- Technoflex (Japan)

- Terumo Medical Corporation (Japan)

- Forlong Medical Co., Ltd. (China)

- Amcor Plc (Australia)

- MRK Healthcare Private Limited (India), and Other Major Players

Key Industry Developments in the Intravenous Product Packaging Market:

-

In August 2023, Amcor, a global leader in developing and producing responsible packaging solutions, announced it had agreed to acquire Phoenix Flexibles, expanding Amcor’s capacity in the high-growth Indian market. Amcor currently has four flexible packaging plants in India. The business has delivered double-digit organic sales growth per year over the last three years, significantly outpacing growth in the underlying market, and is also investing to double its local footprint in the pharmaceutical and medical packaging categories.

|

Global Intravenous Product Packaging Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 4.79 Bn. |

|

Forecast Period 2023-30 CAGR: |

8.9% |

Market Size in 2030: |

USD 9.47 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- INTRAVENOUS PRODUCT PACKAGING MARKET BY TYPE (2016-2030)

- INTRAVENOUS PRODUCT PACKAGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- IV BAGS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CANNULAS

- EXTENSION SETS

- INFUSION PUMPS

- STOPCOCKS

- INTRAVENOUS PRODUCT PACKAGING MARKET BY MATERIAL (2016-2030)

- INTRAVENOUS PRODUCT PACKAGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PVC

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- NON-PVC

- POLYOLEFIN

- POLYPROPYLENE

- INTRAVENOUS PRODUCT PACKAGING MARKET BY APPLICATION (2016-2030)

- INTRAVENOUS PRODUCT PACKAGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HOSPITALS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CLINICS

- AMBULATORY

- SURGICAL CENTERS

- HOME CARE

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Intravenous Product Packaging Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- BAXTER (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- DUPONT (U.S.)

- MINIGRIP (U.S.)

- SMITH MEDICAL (U.S.)

- BD (U.S.)

- CARDINAL HEALTH (U.S.)

- SIPPEX IV BAG (FRANCE)

- B. BRAUN MEDICALS (GERMNAY)

- NEOTEC MEDICAL INDUSTRIES (SINGAPORE)

- SSY GROUP LIMITED (HONG KONG)

- NIPRO (JAPAN)

- TECHNOFLEX (JAPAN)

- TERUMO MEDICAL CORPORATION (JAPAN)

- FORLONG MEDICAL CO., LTD. (CHINA)

- AMCOR PLC (AUSTRALIA)

- MRK HEALTHCARE PRIVATE LIMITED (INDIA),

- COMPETITIVE LANDSCAPE

- GLOBAL INTRAVENOUS PRODUCT PACKAGING MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Material

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Intravenous Product Packaging Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 4.79 Bn. |

|

Forecast Period 2023-30 CAGR: |

8.9% |

Market Size in 2030: |

USD 9.47 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. INTRAVENOUS PRODUCT PACKAGING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. INTRAVENOUS PRODUCT PACKAGING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. INTRAVENOUS PRODUCT PACKAGING MARKET COMPETITIVE RIVALRY

TABLE 005. INTRAVENOUS PRODUCT PACKAGING MARKET THREAT OF NEW ENTRANTS

TABLE 006. INTRAVENOUS PRODUCT PACKAGING MARKET THREAT OF SUBSTITUTES

TABLE 007. INTRAVENOUS PRODUCT PACKAGING MARKET BY TYPE

TABLE 008. IV BAGS MARKET OVERVIEW (2016-2028)

TABLE 009. CANNULAS MARKET OVERVIEW (2016-2028)

TABLE 010. OTHER MARKET OVERVIEW (2016-2028)

TABLE 011. INTRAVENOUS PRODUCT PACKAGING MARKET BY APPLICATION

TABLE 012. HOSPITALS MARKET OVERVIEW (2016-2028)

TABLE 013. CLINICS MARKET OVERVIEW (2016-2028)

TABLE 014. OTHER MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA INTRAVENOUS PRODUCT PACKAGING MARKET, BY TYPE (2016-2028)

TABLE 016. NORTH AMERICA INTRAVENOUS PRODUCT PACKAGING MARKET, BY APPLICATION (2016-2028)

TABLE 017. N INTRAVENOUS PRODUCT PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE INTRAVENOUS PRODUCT PACKAGING MARKET, BY TYPE (2016-2028)

TABLE 019. EUROPE INTRAVENOUS PRODUCT PACKAGING MARKET, BY APPLICATION (2016-2028)

TABLE 020. INTRAVENOUS PRODUCT PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC INTRAVENOUS PRODUCT PACKAGING MARKET, BY TYPE (2016-2028)

TABLE 022. ASIA PACIFIC INTRAVENOUS PRODUCT PACKAGING MARKET, BY APPLICATION (2016-2028)

TABLE 023. INTRAVENOUS PRODUCT PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA INTRAVENOUS PRODUCT PACKAGING MARKET, BY TYPE (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA INTRAVENOUS PRODUCT PACKAGING MARKET, BY APPLICATION (2016-2028)

TABLE 026. INTRAVENOUS PRODUCT PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA INTRAVENOUS PRODUCT PACKAGING MARKET, BY TYPE (2016-2028)

TABLE 028. SOUTH AMERICA INTRAVENOUS PRODUCT PACKAGING MARKET, BY APPLICATION (2016-2028)

TABLE 029. INTRAVENOUS PRODUCT PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 030. BAXTER: SNAPSHOT

TABLE 031. BAXTER: BUSINESS PERFORMANCE

TABLE 032. BAXTER: PRODUCT PORTFOLIO

TABLE 033. BAXTER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. NIPRO: SNAPSHOT

TABLE 034. NIPRO: BUSINESS PERFORMANCE

TABLE 035. NIPRO: PRODUCT PORTFOLIO

TABLE 036. NIPRO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. RENOLIT: SNAPSHOT

TABLE 037. RENOLIT: BUSINESS PERFORMANCE

TABLE 038. RENOLIT: PRODUCT PORTFOLIO

TABLE 039. RENOLIT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. SIPPEX: SNAPSHOT

TABLE 040. SIPPEX: BUSINESS PERFORMANCE

TABLE 041. SIPPEX: PRODUCT PORTFOLIO

TABLE 042. SIPPEX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. WIPAK: SNAPSHOT

TABLE 043. WIPAK: BUSINESS PERFORMANCE

TABLE 044. WIPAK: PRODUCT PORTFOLIO

TABLE 045. WIPAK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. AMCOR: SNAPSHOT

TABLE 046. AMCOR: BUSINESS PERFORMANCE

TABLE 047. AMCOR: PRODUCT PORTFOLIO

TABLE 048. AMCOR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. B.BRAUN MEDICALS: SNAPSHOT

TABLE 049. B.BRAUN MEDICALS: BUSINESS PERFORMANCE

TABLE 050. B.BRAUN MEDICALS: PRODUCT PORTFOLIO

TABLE 051. B.BRAUN MEDICALS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. DUPONT: SNAPSHOT

TABLE 052. DUPONT: BUSINESS PERFORMANCE

TABLE 053. DUPONT: PRODUCT PORTFOLIO

TABLE 054. DUPONT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. MRK HEALTHCARE: SNAPSHOT

TABLE 055. MRK HEALTHCARE: BUSINESS PERFORMANCE

TABLE 056. MRK HEALTHCARE: PRODUCT PORTFOLIO

TABLE 057. MRK HEALTHCARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. MINIGRIP: SNAPSHOT

TABLE 058. MINIGRIP: BUSINESS PERFORMANCE

TABLE 059. MINIGRIP: PRODUCT PORTFOLIO

TABLE 060. MINIGRIP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. NEOTEC MEDICAL INDUSTRIES: SNAPSHOT

TABLE 061. NEOTEC MEDICAL INDUSTRIES: BUSINESS PERFORMANCE

TABLE 062. NEOTEC MEDICAL INDUSTRIES: PRODUCT PORTFOLIO

TABLE 063. NEOTEC MEDICAL INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. SMITH MEDICAL: SNAPSHOT

TABLE 064. SMITH MEDICAL: BUSINESS PERFORMANCE

TABLE 065. SMITH MEDICAL: PRODUCT PORTFOLIO

TABLE 066. SMITH MEDICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. TERUMO: SNAPSHOT

TABLE 067. TERUMO: BUSINESS PERFORMANCE

TABLE 068. TERUMO: PRODUCT PORTFOLIO

TABLE 069. TERUMO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. TECHNOFLEX: SNAPSHOT

TABLE 070. TECHNOFLEX: BUSINESS PERFORMANCE

TABLE 071. TECHNOFLEX: PRODUCT PORTFOLIO

TABLE 072. TECHNOFLEX: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. INTRAVENOUS PRODUCT PACKAGING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. INTRAVENOUS PRODUCT PACKAGING MARKET OVERVIEW BY TYPE

FIGURE 012. IV BAGS MARKET OVERVIEW (2016-2028)

FIGURE 013. CANNULAS MARKET OVERVIEW (2016-2028)

FIGURE 014. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 015. INTRAVENOUS PRODUCT PACKAGING MARKET OVERVIEW BY APPLICATION

FIGURE 016. HOSPITALS MARKET OVERVIEW (2016-2028)

FIGURE 017. CLINICS MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA INTRAVENOUS PRODUCT PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE INTRAVENOUS PRODUCT PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC INTRAVENOUS PRODUCT PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA INTRAVENOUS PRODUCT PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA INTRAVENOUS PRODUCT PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the market research report is 2023–2030.

Baxter (U.S.), Dupont (U.S.), Minigrip (U.S.), Smith Medical (U.S.), BD (U.S.), Cardinal Health (U.S.), Sippex IV bag (France), B.Braun Medicals (Germany), Neotec Medical Industries (Singapore), SSY Group Limited (Hong Kong), Nipro (Japan), Technoflex (Japan), Terumo Medical Corporation (Japan), Forlong Medical Co., Ltd. (China), Amcor Plc (Australia), MRK Healthcare Private Limited (India), and other major players

The Intravenous Product Packaging Market is segmented into Type, Material, and Application region. By Type, the market is categorized into IV Bags, Cannulas, Extension Sets, Infusion Pumps, and Stopcocks. By Material, the market is categorized into PVC, Non-PVC, Polyolefin, and Polypropylene. By Application, the market is categorized into Hospitals, Clinics, Ambulatory, Surgical Centers, Home Care and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.)

Intravenous product packaging is a medical device used to store and protect intravenous (IV) products, which are medications or fluids administered directly into a vein. It must meet several requirements, including sterility, compatibility, permeability, integrity, transparency, and ease of use. IV products must be sterile to prevent contamination, and the packaging must be compatible with the IV product to prevent any adverse reactions.

Global Intravenous Product Packaging Market size is expected to grow from USD 4.79 Billion in 2022 to USD 9.47 Billion by 2030, at a CAGR of 8.9% during the forecast period (2023-2030).