Biodegradable Packaging Market Synopsis:

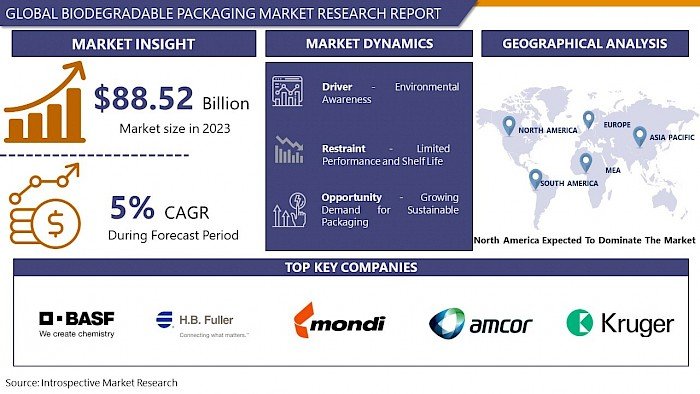

Biodegradable Packaging Market size was valued at USD 88.52 Billion in 2023 and is projected to reach USD 137.32 Billion by 2032, growing at a CAGR of 5% from 2024 to 2032.

The biodegradable packaging market is a part of the larger packaging sector, with a focus on materials that are created to break down and decay naturally. These supplies include variety of items such as bags, films, containers, and wraps, designed for various industries like food and beverage, cosmetics, healthcare, and consumer goods. In exchange to regular plastics that can last for centuries in the environment, biodegradable packaging materials decompose into harmless compounds with the help of microorganisms. Significantly, the market consists of materials sourced from renewable sources such as plants (bio-based) and non-renewable sources like fossil fuels as long as they have the necessary molecular structure for proper breakdown. This means biodegradable packaging can be made from bio-based and fossil-based polymers.

- Many important factors are driving the increasing need for biodegradable packaging. The concern is the growing environmental urgency, which is driven by the increasing effect of the negative ecological effects of plastic pollution. Growing awareness has led governments around the globe to implement strict laws focused on decreasing plastic waste and encouraging sustainable options. At the same time, an evolving consumer environment marked by increasing eco-awareness has sparked a need for items wrapped in eco-friendly materials.

- As sustainability becomes more important for companies, they are more pressured to use biodegradable packaging to improve their reputation and reduce environmental risks. Anticipated technological advancements will enable progress in materials, tackling issues related to expense, size, and performance. Yet, fully tapping into the market's potential requires united attempts to tackle cost concerns and enhance waste management facilities. In general, the market for biodegradable packaging is primed for significant growth, providing profitable chances for companies to adapt to changing sustainability preferences and fulfill the increasing need for environmentally friendly packaging options.

There are several biodegradable packaging types, however, not all are suitable for food packaging. Here is a list of common and uncommon types of biodegradable packaging in use:

Hemp: Sourced from the cannabis plant, hemp is highly biodegradable, resilient, and versatile. However, hemp is still an expensive source of bioplastics and is not yet commercially available in its polymerized form.

Paper: Paper is one of the oldest, traditional forms of compostable packaging. It biodegrades very rapidly and can easily and efficiently be recycled. The downside is that paper does not provide the same protection or sealing as other kinds of packaging, so it’s not appropriate for a lot of food packaging.

PLA: PLA is bio-based and can be molded like conventional plastic into packaging, however, it’s slow-composting, even in an industrial composter.

Cellulose: Plant-based packaging degrades very easily and is a great solution for short-term packaging, but it can’t provide a shelf-life or proper barrier for food products and easily discolors when stored.

Seaweed: Like cellulose, seaweed-based material is highly biodegradable and great for short-term packaging, but unstable and unsuitable for food packaging, transport, and storage.

The Biodegradable Packaging Market Trend Analysis

Environmental Awareness

- Growing awareness among consumers and businesses about the harmful impact of traditional plastic packaging on the environment is driving the demand for biodegradable alternatives. Biodegradable packaging offers a more sustainable and eco-friendly option.

- Increasing environmental awareness has drawn attention to the detrimental effects of plastic pollution on ecosystems, marine life, and human health. Traditional plastic packaging, which takes hundreds of years to decompose, is a significant contributor to this pollution. Biodegradable packaging offers a more sustainable alternative that breaks down more quickly in natural environments, reducing its negative impact on the planet.

- The increased focus on environmental issues has prompted governments around the world to implement regulations and policies aimed at reducing plastic waste and promoting sustainable packaging solutions. These regulations often incentivize the adoption of biodegradable packaging or impose restrictions on single-use plastics, driving businesses to explore more eco-friendly alternatives.

- Traditional plastic packaging poses significant challenges in waste management, recycling, and disposal. Biodegradable packaging offers a potential solution to reduce the burden on waste management systems and landfills, as it can be composted and converted into organic matter. These factors drive the biodegradable packing market.

Growing Demand for Sustainable Packaging

- Over recent years the packaging market has seen a significant rise in demand for sustainable alternatives. Concern about single-use plastic waste and changes in consumer attitudes are just some of the trends that have accelerated this drive for change within the industry. The Global Buying Green Report conducted by Trivium Packaging in 2020 found that 53% of consumers are actively looking for sustainability or recycling information on packaging as businesses adapt their operations to meet such demands.

- In addition to this growing consumer demand, many brands are also turning their attention to sustainable packaging as the importance of Corporate Social Responsibility (CSR) and carbon footprint reduction increases.

- This shift in consumer attitude toward sustainable packaging and the environment has significantly increased in recent years, with Covid-19 one of the leading reasons for this change. In 2021, Mastercard conducted a global study on consumer attitudes toward the environment after Covid-19, with 58% of consumers saying they are now more mindful of their environmental impact after Covid-19.

- Increased news coverage through social media platforms opened the eyes of consumers to issues such as climate change and environmental impact, with many shocking revelations impacting future purchasing decisions. Covid-19 has not only influenced consumer perception of the environment, but it has also resulted in consumers seeking products with less packaging. Since the pandemic, 64% of consumers are prepared to shop elsewhere if it means less packaging.

Segmentation Analysis Of The Biodegradable Packaging Market

Biodegradable Packaging market segments cover the Type, Material, and End-User. By Material, the Paper & Paperboard, segment is Anticipated to Dominate the Market Over the Forecast period.

- The Paper & Paperboard Biodegradable Packaging Market is driven by several factors that make it an attractive and environmentally friendly alternative to traditional packaging materials. Paper and paperboard are derived from renewable resources, primarily trees, making them biodegradable and compostable. They break down naturally over time, reducing their impact on the environment compared to non-biodegradable materials like plastic, these factors drive the market during the forecast period.

- Growing awareness of environmental issues, particularly plastic pollution and its adverse effects on ecosystems has led to increased demand for sustainable packaging solutions. Paper and paperboard biodegradable packaging offer a greener option, as they do not persist in the environment for extended periods like plastic.

- Governments and regulatory bodies in various regions are introducing stricter regulations and policies to limit the use of single-use plastics and promote environmentally friendly alternatives. Paper and paperboard biodegradable packaging align with these regulations, leading to increased adoption.

- Consumers are increasingly seeking products packaged in environmentally friendly materials. Paper and paperboard biodegradable packaging resonate with environmentally conscious consumers, who are willing to choose products with eco-friendly packaging.

Regional Analysis of the Biodegradable Packaging Market

North America is Expected to Dominate the Market Over the Forecast Period.

- North American countries, particularly the United States and Canada, have implemented strict environmental regulations and policies aimed at reducing plastic waste and promoting sustainable packaging solutions. These regulations have created a favorable environment for the adoption of biodegradable packaging.

- Environmental consciousness is on the rise in North America, with consumers becoming more concerned about the impact of plastic pollution on the environment. As a result, there is a growing demand for eco-friendly and sustainable packaging options, including biodegradable packaging.

- Consumers in North America are generally receptive to sustainable and environmentally friendly products. There is a willingness to pay a premium for products that use biodegradable packaging, which drives manufacturers and businesses to adopt these solutions to meet consumer demands.

- Many companies in North America have embraced sustainability as part of their corporate social responsibility (CSR) strategies. The adoption of biodegradable packaging aligns with their sustainability goals and helps enhance their brand image among environmentally conscious consumers. These are some factors that are driving the biodegradable packing market in North America.

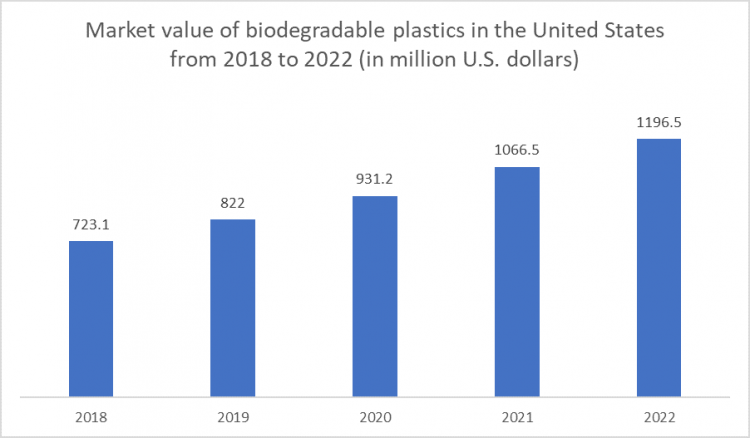

- The below graph shows biodegradable plastics had a market value amounting to approximately 723 million U.S. dollars in 2018. Biodegradable plastics are expected to help to mitigate the environmental pressures associated with conventional, single-use plastics, though biodegradable plastics have a few shortcomings as well. The leading end-use sector of biodegradable plastics is packaging, both flexible and rigid.

COVID-19 Impact Analysis On Biodegradable Packaging Market

The COVID-19 pandemic had a mixed impact on the biodegradable packaging market. During the initial stages of the pandemic, there was an increased demand for single-use plastics, such as disposable gloves, masks, and packaging for food delivery and takeaway. This surge in plastic usage was driven by hygiene concerns and the need for safety measures. Due to the short-term emphasis on hygiene and safety, some businesses and consumers might have temporarily reduced their focus on sustainability and environmentally friendly practices, including biodegradable packaging. The pandemic led to disruptions in global supply chains, affecting the availability and distribution of raw materials required for biodegradable packaging production. Manufacturers faced challenges in sourcing materials, leading to potential delays or production issues. The pandemic induced changes in consumer behavior, with an increased focus on e-commerce and home deliveries. This shift led to a surge in packaging waste, including non-biodegradable materials.

Top Key Players Covered in The Biodegradable Packaging Market

- BASF SE

- Smurfit Kappa Group

- Mondi Group

- Rocktenn

- Stora Enso

- Clearwater Paper Corporation

- Amcor

- Novamont S.P.A.

- Kruger Inc.

- H.B. Fuller Company

- Reynolds Group Holding Limited

- International Corp. and Other Major Players.

Key Industry Developments in the Biodegradable Packaging Market

- In May 2023, Coca-Cola has embarked on a groundbreaking pilot program in Chile, unveiling bottles crafted from plant-based materials. This transformative move signifies a crucial step forward in the quest to replace conventional plastic bottles with more sustainable alternatives.

- In June 2023, The European Union Commission has put forth a groundbreaking proposal, advocating a comprehensive ban on single-use plastics within the EU. This monumental move encompasses disposable plates, cutlery, and straws, aiming to curtail plastic pollution by promoting the widespread adoption of biodegradable alternatives.

|

Global Biodegradable Packaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 88.52 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.0% |

Market Size in 2032: |

USD 137.32 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Packaging Format |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

TABLE OF CONTENT

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On The Overall Market

- Impact On The Supply Chain

- Impact On The Key Manufacturers

- Impact On The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- BIODEGRADABLE PACKAGING MARKET BY TYPE (2017- 2032)

- BIODEGRADABLE PACKAGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RECYCLED CONTENT PACKAGING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017- 2032F)

- Historic And Forecasted Market Size in Volume (2017- 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- REUSABLE PACKAGING

- DEGRADABLE PACKAGING

- BIODEGRADABLE PACKAGING MARKET BY MATERIAL (2017- 2032)

- BIODEGRADABLE PACKAGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PAPER & PAPERBOARD

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017- 2032F)

- Historic And Forecasted Market Size in Volume (2017- 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BIO-PLASTIC

- BAGASSE

- BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (2017- 2032)

- BIODEGRADABLE PACKAGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BOTTLES & JARS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017- 2032F)

- Historic And Forecasted Market Size in Volume (2017- 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BOXES & CARTONS

- CANS

- CUPS & BOWLS

- POUCHES & BAGS

- OTHER

- BIODEGRADABLE PACKAGING MARKET BY END USE (2017- 2032)

- BIODEGRADABLE PACKAGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FOOD & BEVERAGE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017- 2032F)

- Historic And Forecasted Market Size in Volume (2017- 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PERSONAL CARE & COSMETICS

- PHARMACEUTICALS

- HOMECARE

- OTHER CONSUMER GOODS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- BIODEGRADABLE PACKAGING Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- BASF SE

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- Smurfit Kappa Group

- Mondi Group

- Rocktenn

- Stora Enso

- Clearwater Paper Corporation

- Amcor

- Novamont S.P.A.

- Kruger Inc.

- H.B. Fuller Company

- Reynolds Group Holding Limited

- International Corp. and Other Major Players.

- COMPETITIVE LANDSCAPE

- GLOBAL BIODEGRADABLE PACKAGING MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By TYPE

- Historic And Forecasted Market Size By MATERIAL

- Historic And Forecasted Market Size By PACKAGING FORMAT

- Historic And Forecasted Market Size By END USE

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Biodegradable Packaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 88.52 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.0% |

Market Size in 2032: |

USD 137.32 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Packaging Format |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BIODEGRADABLE PACKAGING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BIODEGRADABLE PACKAGING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BIODEGRADABLE PACKAGING MARKET COMPETITIVE RIVALRY

TABLE 005. BIODEGRADABLE PACKAGING MARKET THREAT OF NEW ENTRANTS

TABLE 006. BIODEGRADABLE PACKAGING MARKET THREAT OF SUBSTITUTES

TABLE 007. BIODEGRADABLE PACKAGING MARKET BY TYPE

TABLE 008. RECYCLED CONTENT PACKAGING MARKET OVERVIEW (2016-2030)

TABLE 009. REUSABLE PACKAGING MARKET OVERVIEW (2016-2030)

TABLE 010. DEGRADABLE PACKAGING MARKET OVERVIEW (2016-2030)

TABLE 011. BIODEGRADABLE PACKAGING MARKET BY MATERIAL

TABLE 012. PAPER & PAPERBOARD MARKET OVERVIEW (2016-2030)

TABLE 013. BIO-PLASTIC MARKET OVERVIEW (2016-2030)

TABLE 014. BAGASSE MARKET OVERVIEW (2016-2030)

TABLE 015. BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT

TABLE 016. BOTTLES & JARS MARKET OVERVIEW (2016-2030)

TABLE 017. BOXES & CARTONS MARKET OVERVIEW (2016-2030)

TABLE 018. CANS MARKET OVERVIEW (2016-2030)

TABLE 019. CUPS & BOWLS MARKET OVERVIEW (2016-2030)

TABLE 020. POUCHES & BAGS MARKET OVERVIEW (2016-2030)

TABLE 021. OTHER MARKET OVERVIEW (2016-2030)

TABLE 022. BIODEGRADABLE PACKAGING MARKET BY END USE

TABLE 023. FOOD & BEVERAGE MARKET OVERVIEW (2016-2030)

TABLE 024. PERSONAL CARE & COSMETICS MARKET OVERVIEW (2016-2030)

TABLE 025. PHARMACEUTICALS MARKET OVERVIEW (2016-2030)

TABLE 026. HOMECARE MARKET OVERVIEW (2016-2030)

TABLE 027. OTHER CONSUMER GOODS MARKET OVERVIEW (2016-2030)

TABLE 028. NORTH AMERICA BIODEGRADABLE PACKAGING MARKET, BY TYPE (2016-2030)

TABLE 029. NORTH AMERICA BIODEGRADABLE PACKAGING MARKET, BY MATERIAL (2016-2030)

TABLE 030. NORTH AMERICA BIODEGRADABLE PACKAGING MARKET, BY PACKAGING FORMAT (2016-2030)

TABLE 031. NORTH AMERICA BIODEGRADABLE PACKAGING MARKET, BY END USE (2016-2030)

TABLE 032. N BIODEGRADABLE PACKAGING MARKET, BY COUNTRY (2016-2030)

TABLE 033. EASTERN EUROPE BIODEGRADABLE PACKAGING MARKET, BY TYPE (2016-2030)

TABLE 034. EASTERN EUROPE BIODEGRADABLE PACKAGING MARKET, BY MATERIAL (2016-2030)

TABLE 035. EASTERN EUROPE BIODEGRADABLE PACKAGING MARKET, BY PACKAGING FORMAT (2016-2030)

TABLE 036. EASTERN EUROPE BIODEGRADABLE PACKAGING MARKET, BY END USE (2016-2030)

TABLE 037. BIODEGRADABLE PACKAGING MARKET, BY COUNTRY (2016-2030)

TABLE 038. WESTERN EUROPE BIODEGRADABLE PACKAGING MARKET, BY TYPE (2016-2030)

TABLE 039. WESTERN EUROPE BIODEGRADABLE PACKAGING MARKET, BY MATERIAL (2016-2030)

TABLE 040. WESTERN EUROPE BIODEGRADABLE PACKAGING MARKET, BY PACKAGING FORMAT (2016-2030)

TABLE 041. WESTERN EUROPE BIODEGRADABLE PACKAGING MARKET, BY END USE (2016-2030)

TABLE 042. BIODEGRADABLE PACKAGING MARKET, BY COUNTRY (2016-2030)

TABLE 043. ASIA PACIFIC BIODEGRADABLE PACKAGING MARKET, BY TYPE (2016-2030)

TABLE 044. ASIA PACIFIC BIODEGRADABLE PACKAGING MARKET, BY MATERIAL (2016-2030)

TABLE 045. ASIA PACIFIC BIODEGRADABLE PACKAGING MARKET, BY PACKAGING FORMAT (2016-2030)

TABLE 046. ASIA PACIFIC BIODEGRADABLE PACKAGING MARKET, BY END USE (2016-2030)

TABLE 047. BIODEGRADABLE PACKAGING MARKET, BY COUNTRY (2016-2030)

TABLE 048. MIDDLE EAST & AFRICA BIODEGRADABLE PACKAGING MARKET, BY TYPE (2016-2030)

TABLE 049. MIDDLE EAST & AFRICA BIODEGRADABLE PACKAGING MARKET, BY MATERIAL (2016-2030)

TABLE 050. MIDDLE EAST & AFRICA BIODEGRADABLE PACKAGING MARKET, BY PACKAGING FORMAT (2016-2030)

TABLE 051. MIDDLE EAST & AFRICA BIODEGRADABLE PACKAGING MARKET, BY END USE (2016-2030)

TABLE 052. BIODEGRADABLE PACKAGING MARKET, BY COUNTRY (2016-2030)

TABLE 053. SOUTH AMERICA BIODEGRADABLE PACKAGING MARKET, BY TYPE (2016-2030)

TABLE 054. SOUTH AMERICA BIODEGRADABLE PACKAGING MARKET, BY MATERIAL (2016-2030)

TABLE 055. SOUTH AMERICA BIODEGRADABLE PACKAGING MARKET, BY PACKAGING FORMAT (2016-2030)

TABLE 056. SOUTH AMERICA BIODEGRADABLE PACKAGING MARKET, BY END USE (2016-2030)

TABLE 057. BIODEGRADABLE PACKAGING MARKET, BY COUNTRY (2016-2030)

TABLE 058. BASF SE: SNAPSHOT

TABLE 059. BASF SE: BUSINESS PERFORMANCE

TABLE 060. BASF SE: PRODUCT PORTFOLIO

TABLE 061. BASF SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. SMURFIT KAPPA GROUP: SNAPSHOT

TABLE 062. SMURFIT KAPPA GROUP: BUSINESS PERFORMANCE

TABLE 063. SMURFIT KAPPA GROUP: PRODUCT PORTFOLIO

TABLE 064. SMURFIT KAPPA GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. MONDI GROUP: SNAPSHOT

TABLE 065. MONDI GROUP: BUSINESS PERFORMANCE

TABLE 066. MONDI GROUP: PRODUCT PORTFOLIO

TABLE 067. MONDI GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. ROCKTENN: SNAPSHOT

TABLE 068. ROCKTENN: BUSINESS PERFORMANCE

TABLE 069. ROCKTENN: PRODUCT PORTFOLIO

TABLE 070. ROCKTENN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. STORA ENSO: SNAPSHOT

TABLE 071. STORA ENSO: BUSINESS PERFORMANCE

TABLE 072. STORA ENSO: PRODUCT PORTFOLIO

TABLE 073. STORA ENSO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. CLEARWATER PAPER CORPORATION: SNAPSHOT

TABLE 074. CLEARWATER PAPER CORPORATION: BUSINESS PERFORMANCE

TABLE 075. CLEARWATER PAPER CORPORATION: PRODUCT PORTFOLIO

TABLE 076. CLEARWATER PAPER CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. AMCOR: SNAPSHOT

TABLE 077. AMCOR: BUSINESS PERFORMANCE

TABLE 078. AMCOR: PRODUCT PORTFOLIO

TABLE 079. AMCOR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. NOVAMONT S.P.A.: SNAPSHOT

TABLE 080. NOVAMONT S.P.A.: BUSINESS PERFORMANCE

TABLE 081. NOVAMONT S.P.A.: PRODUCT PORTFOLIO

TABLE 082. NOVAMONT S.P.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. KRUGER INC.: SNAPSHOT

TABLE 083. KRUGER INC.: BUSINESS PERFORMANCE

TABLE 084. KRUGER INC.: PRODUCT PORTFOLIO

TABLE 085. KRUGER INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. H.B. FULLER COMPANY: SNAPSHOT

TABLE 086. H.B. FULLER COMPANY: BUSINESS PERFORMANCE

TABLE 087. H.B. FULLER COMPANY: PRODUCT PORTFOLIO

TABLE 088. H.B. FULLER COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. REYNOLDS GROUP HOLDING LIMITED: SNAPSHOT

TABLE 089. REYNOLDS GROUP HOLDING LIMITED: BUSINESS PERFORMANCE

TABLE 090. REYNOLDS GROUP HOLDING LIMITED: PRODUCT PORTFOLIO

TABLE 091. REYNOLDS GROUP HOLDING LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. INTERNATIONAL CORP.: SNAPSHOT

TABLE 092. INTERNATIONAL CORP.: BUSINESS PERFORMANCE

TABLE 093. INTERNATIONAL CORP.: PRODUCT PORTFOLIO

TABLE 094. INTERNATIONAL CORP.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 095. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 096. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 097. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BIODEGRADABLE PACKAGING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BIODEGRADABLE PACKAGING MARKET OVERVIEW BY TYPE

FIGURE 012. RECYCLED CONTENT PACKAGING MARKET OVERVIEW (2016-2030)

FIGURE 013. REUSABLE PACKAGING MARKET OVERVIEW (2016-2030)

FIGURE 014. DEGRADABLE PACKAGING MARKET OVERVIEW (2016-2030)

FIGURE 015. BIODEGRADABLE PACKAGING MARKET OVERVIEW BY MATERIAL

FIGURE 016. PAPER & PAPERBOARD MARKET OVERVIEW (2016-2030)

FIGURE 017. BIO-PLASTIC MARKET OVERVIEW (2016-2030)

FIGURE 018. BAGASSE MARKET OVERVIEW (2016-2030)

FIGURE 019. BIODEGRADABLE PACKAGING MARKET OVERVIEW BY PACKAGING FORMAT

FIGURE 020. BOTTLES & JARS MARKET OVERVIEW (2016-2030)

FIGURE 021. BOXES & CARTONS MARKET OVERVIEW (2016-2030)

FIGURE 022. CANS MARKET OVERVIEW (2016-2030)

FIGURE 023. CUPS & BOWLS MARKET OVERVIEW (2016-2030)

FIGURE 024. POUCHES & BAGS MARKET OVERVIEW (2016-2030)

FIGURE 025. OTHER MARKET OVERVIEW (2016-2030)

FIGURE 026. BIODEGRADABLE PACKAGING MARKET OVERVIEW BY END USE

FIGURE 027. FOOD & BEVERAGE MARKET OVERVIEW (2016-2030)

FIGURE 028. PERSONAL CARE & COSMETICS MARKET OVERVIEW (2016-2030)

FIGURE 029. PHARMACEUTICALS MARKET OVERVIEW (2016-2030)

FIGURE 030. HOMECARE MARKET OVERVIEW (2016-2030)

FIGURE 031. OTHER CONSUMER GOODS MARKET OVERVIEW (2016-2030)

FIGURE 032. NORTH AMERICA BIODEGRADABLE PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 033. EASTERN EUROPE BIODEGRADABLE PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 034. WESTERN EUROPE BIODEGRADABLE PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 035. ASIA PACIFIC BIODEGRADABLE PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 036. MIDDLE EAST & AFRICA BIODEGRADABLE PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 037. SOUTH AMERICA BIODEGRADABLE PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Biodegradable Packaging Market research report is 2024-2032.

BASF SE, Smurfit Kappa Group, Mondi Group, Rocktenn, Stora Enso, Clearwater Paper Corporation, Amcor, Novamont S.P.A., Kruger Inc., H.B. Fuller Company, Reynolds Group Holding Limited, International Corp. and Other Major Players.

The Biodegradable Packaging Market is segmented into Type, Application, and region. By Type, the market is categorized into Recycled Content Packaging, Reusable Packaging, and Degradable Packaging. By Material, the market is categorized into Paper & Paperboard, Bio-plastic, and Bagasse. By Packaging Format, the market is categorized into Bottles & Jars, Boxes & Cartons, Cans, Cups & Bowls, Pouches & Bags, Other. By End Use, the market is categorized into Food & Beverage, Personal Care & Cosmetics, Pharmaceuticals, Homecare, and Other Consumer Goods. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Biodegradable packaging is generally defined as any form of packaging that will naturally disintegrate and decompose. The term “biodegradable” has typically been used very broadly for any sustainable packaging material that will naturally break down – under any conditions and in an undefined amount of time.

Biodegradable Packaging Market size was valued at USD 88.52 Billion in 2023 and is projected to reach USD 137.32 Billion by 2032, growing at a CAGR of 5% from 2024 to 2032.