Global Electrically Conductive Adhesives Market Overview

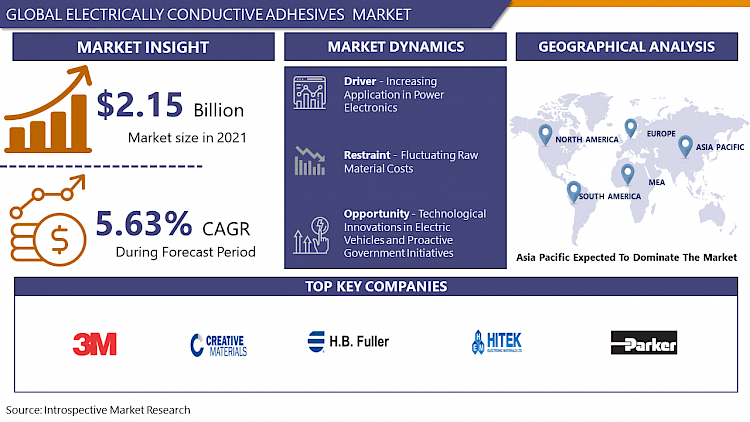

Global Electrically Conductive Adhesives Market Size Was Valued at USD 2.27 Billion In 2022 And Is Projected to Reach USD 3.52 Billion By 2030, Growing at A CAGR of 16.2% From 2023 To 2030.

Electrically conductive adhesives are generally employed in electronics applications where components must be held in place during electrical current can flow between them. Some common general such as anaerobic, cyanoacrylates, epoxies, and acrylic-based adhesives play as an electrical insulator depending on the space between components. Many supplies are good thermal conductivity to help in the thermal management of electronic components and heat sinks by directing heat away from sensitive components. As long as, there is no glue line control in some circumstances primarily when utilizing an anaerobic or cyanoacrylate adhesive and parts are effectively touching with adhesives filling in microscopic crevices, many electrical charges can still be changed due to there is adequate metal to metal contact.

Electronic components that are temperature-fragile cannot be cemented. This type of application necessitates the application of an electrically conductive adhesive alternative for solder. By the electrically conductive adhesive on a PCB with components mounted on both sides makes the assembly process easier and removes the possibility of components sliding off the underside when parts are soldered on the top. The usage of electrically conductive adhesive for a full electrical assembly removes the need for solder re-flow.

COVID-19 Impact on Electrically Conductive Adhesives Market

COVID-19 pandemic has affected the global economy by some factors such as by directly affecting production and demand, by creating supply chain and market disturbance, and by its financial impact on firms and financial markets. Covid-19 pandemic influence on the global market size, Electronic Adhesives industry share, consumer behavior, recovery, and forecast analysis. Massive demand for Conductive Adhesive market noticed from huge producing economies, which are rapidly affected by the spread of coronavirus.

Market Dynamics And Factor

Drivers

Increasing Application In Power Electronics

Electrically conductive adhesives find a broad range of applications in various power electronics assembly. These adhesives are applied for electrical interconnection and are also appropriate for structural and thermal bonding applications, providing enhanced reliability in electronic systems. Electrically conductive adhesives are processes where heat curing or hot soldering can be altered, as they offer superior adhesion, excellent electrical conductivity, and good physical strength at a high temperature. During the manufacturing of precision electronic products, often, the heat generated by soldering causes problems and solder reflow temperatures can hinder temperature-sensitive componentry usage. Therefore, to overcome this challenge, manufacturers generally prefer electrically conductive adhesives and electrically conductive pastes as an alternative, as they do not need to be heated to the same high temperatures as solder. Owing to the growing demand from the electronics industry for high-efficient and compact semiconductors, the demand for semiconductors is expected to propel during the forecast period, owing to the growing demand for compact devices.

Restraints:

Due to fluctuating raw material costs, the global electrically conductive adhesive market's growth is being suppressed. This is the key factor that hindering the market growth over the forecast period.

Opportunities:

Growth in the application of electronic components in the aerospace, automotive, and various other sectors will further propel several new opportunities for the electrically conductive adhesive market to grow in the upcoming years. In addition, technological innovations in electric vehicles and proactive government initiatives are anticipated to create lucrative opportunities for the growth of the market.

Market Future Trends

Increasing Usage From Electric Vehicles

Electrically conductive adhesives are extensively used in the manufacturing of electric vehicles. They are used as an assembly and circuit adhesives in the PCB level electronics of the electric vehicle components. Electrically conductive adhesives additionally provide protection and thermal conductivity to the components. For electric vehicles, electrically conductive epoxy adhesives are utilized for electromagnetic interference (EMI) shielding applications. EMI shielding is required in several usages within an electric vehicle, including data transmission systems and shielding between components and functions. With the increase in the sales of electric vehicles and growing concerns about global warming and CO2 emissions, electric vehicles are likely to become a norm rather than a novelty shortly. The resilience in the sales of EVs is fuelled by the supportive CO2 regulatory frameworks, incentives for safeguarding in the European countries, and the fall in the costs of batteries, which is reducing the vehicle prices. Hence, the various usages and the importance of electrically conductive adhesives in EVs, fuelled by robust growth in the sales of electric vehicles, are likely to provide a significant growth opportunity for the electrically conductive adhesives market.

Market Segmentation

Segmentation Insights

Based on Chemistry Type, the epoxy segment accounted for the largest share, with about 33.43% of the total revenue of the global electrically conductive adhesives market, in 2020. However, the acrylic segment is expected to witness the fastest CAGR over the forecast period. Epoxy-based electrically conductive adhesives (ECAs) are lead-free solder alternatives for attaching components and printed circuit board (PCB) interconnections. Electrically conductive silicone adhesives are a thixotropic, non-corrosive silicone paste filled with electrically conductive particles such as graphite, nickel-graphite, silver-plated glass, silver-plated nickel, silver-plated aluminum, silver-plated copper, or even pure silver. Owing to varying applications and the increasing demand for silicone-based ECAs from various end-user sectors, such as aerospace, telecom, consume, and others. The demand for the electrically conductive adhesives market is anticipated to grow in the forecast period.

Based on Type, the anisotropic segment accounted for the largest share, with about 82.22% of the total revenue of the global electrically conductive adhesives market, in 2020. Moreover, the anisotropic segment is expected to witness the fastest CAGR over the forecast period. Isotropic electrically conductive adhesives are composites of adhesive resins with conductive fillers, such as silver flakes. Therefore, considering the increasing applications of Isotropic ECAs from various end-user sectors, the demand for the market studied is likely to rise in the coming years.

Based on Application, the printed circuit board segment accounted for the largest share, with about 34.82% of the total revenue of the global electrically conductive adhesives market, in 2020. However, the automotive electronics segment is expected to witness the fastest CAGR over the forecast period.

Regional Insights

By geography, Asia-Pacific accounted for the largest share, with about 50.33% of the total revenue of the global electrically conductive adhesives market, in 2020. Moreover, the Asia-Pacific region is expected to witness the fastest CAGR over the forecast period.

Germany is one of Europe's largest producers and consumers of electric vehicles. Even though general car sales in the country have been in decline, electric vehicle registrations have shown tremendous growth over the past few years. The German economy has been forecasted to take a high hit due to the ongoing COVID-19 impact.

Key Industry Developments

- In 2017, H.B. fuller purchased the royal adhesive & sealants to extend its manufacturing capacity, and another collaboration in September 2017, among Dow chemical company and DuPont happened.

- 3M had developed a new plant to improve the capacity of Sodium Formate-based Pergrip Run NF. By the new partner Dalshult, 3M has accepted to build the plant to granulate solid Sodium Formate Deicer. The new plant is huge funding and will improve the availability and security of distribution for Pergrip Run NF.

Players Covered in Electrically Conductive Adhesives market are :

- 3M

- Aremco

- Creative Materials Inc.

- Dow

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- HITEK Electronic

- Materials Ltd

- Master Bond Inc.

- MG Chemicals

- Panadol-Elosol GmbH

- Parker Hannifin Corp.

- Permabond LLC

- Bostik and others major players.

|

Global Electrically Conductive Adhesives Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2016 to 2021 |

Market Size in 2022: |

USD 2.27 Bn. |

|

Forecast Period 2023-30 CAGR: |

16.2% |

Market Size in 2030: |

USD 3.52 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Chemistry Type

3.2 By Type

3.3 By Application

3.4 By Filler Material

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

3.5.1 Drivers

3.5.2 Restraints

3.5.3 Opportunities

3.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 4: Electrically Conductive Adhesives Market by Chemistry Type

4.1 Electrically Conductive Adhesives Market Overview Snapshot and Growth Engine

4.2 Electrically Conductive Adhesives Market Overview

4.3 Epoxy

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size (2016-2028F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Epoxy: Grographic Segmentation

4.4 Silicone

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size (2016-2028F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Silicone: Grographic Segmentation

4.5 Polyurethane

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size (2016-2028F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Polyurethane: Grographic Segmentation

4.6 Acrylic

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size (2016-2028F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Acrylic: Grographic Segmentation

4.7 Other Chemistry Types

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size (2016-2028F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Other Chemistry Types: Grographic Segmentation

Chapter 5: Electrically Conductive Adhesives Market by Type

5.1 Electrically Conductive Adhesives Market Overview Snapshot and Growth Engine

5.2 Electrically Conductive Adhesives Market Overview

5.3 Isotropic

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Isotropic: Grographic Segmentation

5.4 Anisotropic

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Anisotropic: Grographic Segmentation

Chapter 6: Electrically Conductive Adhesives Market by Application

6.1 Electrically Conductive Adhesives Market Overview Snapshot and Growth Engine

6.2 Electrically Conductive Adhesives Market Overview

6.3 Solar Cells

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Solar Cells: Grographic Segmentation

6.4 Automotive Electronics

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Automotive Electronics: Grographic Segmentation

6.5 Led Lighting

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Led Lighting: Grographic Segmentation

6.6 Printed Circuit Board

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Printed Circuit Board: Grographic Segmentation

6.7 Lcd Displays

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2016-2028F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Lcd Displays: Grographic Segmentation

6.8 Other Applications

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size (2016-2028F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Other Applications: Grographic Segmentation

Chapter 7: Electrically Conductive Adhesives Market by Filler Material

7.1 Electrically Conductive Adhesives Market Overview Snapshot and Growth Engine

7.2 Electrically Conductive Adhesives Market Overview

7.3 Silver Fillers

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Silver Fillers: Grographic Segmentation

7.4 Carbon Fillers

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Carbon Fillers: Grographic Segmentation

7.5 Copper Fillers

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Copper Fillers: Grographic Segmentation

7.6 Others

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2016-2028F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Others: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Electrically Conductive Adhesives Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Electrically Conductive Adhesives Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Electrically Conductive Adhesives Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 3M

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 AREMCO

8.4 CREATIVE MATERIALS INC.

8.5 DOW

8.6 H.B. FULLER COMPANY

8.7 HENKEL AG & CO. KGAA

8.8 HITEK ELECTRONIC

8.9 MATERIALS LTD

8.10 MASTER BOND INC.

8.11 MG CHEMICALS

8.12 PANADOL-ELOSOL GMBH

8.13 PARKER HANNIFIN CORP.

8.14 PERMABOND LLC

8.15 BOSTIK

Chapter 9: Global Electrically Conductive Adhesives Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Chemistry Type

9.2.1 Epoxy

9.2.2 Silicone

9.2.3 Polyurethane

9.2.4 Acrylic

9.2.5 Other Chemistry Types

9.3 Historic and Forecasted Market Size By Type

9.3.1 Isotropic

9.3.2 Anisotropic

9.4 Historic and Forecasted Market Size By Application

9.4.1 Solar Cells

9.4.2 Automotive Electronics

9.4.3 Led Lighting

9.4.4 Printed Circuit Board

9.4.5 Lcd Displays

9.4.6 Other Applications

9.5 Historic and Forecasted Market Size By Filler Material

9.5.1 Silver Fillers

9.5.2 Carbon Fillers

9.5.3 Copper Fillers

9.5.4 Others

Chapter 10: North America Electrically Conductive Adhesives Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Chemistry Type

10.4.1 Epoxy

10.4.2 Silicone

10.4.3 Polyurethane

10.4.4 Acrylic

10.4.5 Other Chemistry Types

10.5 Historic and Forecasted Market Size By Type

10.5.1 Isotropic

10.5.2 Anisotropic

10.6 Historic and Forecasted Market Size By Application

10.6.1 Solar Cells

10.6.2 Automotive Electronics

10.6.3 Led Lighting

10.6.4 Printed Circuit Board

10.6.5 Lcd Displays

10.6.6 Other Applications

10.7 Historic and Forecasted Market Size By Filler Material

10.7.1 Silver Fillers

10.7.2 Carbon Fillers

10.7.3 Copper Fillers

10.7.4 Others

10.8 Historic and Forecast Market Size by Country

10.8.1 U.S.

10.8.2 Canada

10.8.3 Mexico

Chapter 11: Europe Electrically Conductive Adhesives Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Chemistry Type

11.4.1 Epoxy

11.4.2 Silicone

11.4.3 Polyurethane

11.4.4 Acrylic

11.4.5 Other Chemistry Types

11.5 Historic and Forecasted Market Size By Type

11.5.1 Isotropic

11.5.2 Anisotropic

11.6 Historic and Forecasted Market Size By Application

11.6.1 Solar Cells

11.6.2 Automotive Electronics

11.6.3 Led Lighting

11.6.4 Printed Circuit Board

11.6.5 Lcd Displays

11.6.6 Other Applications

11.7 Historic and Forecasted Market Size By Filler Material

11.7.1 Silver Fillers

11.7.2 Carbon Fillers

11.7.3 Copper Fillers

11.7.4 Others

11.8 Historic and Forecast Market Size by Country

11.8.1 Germany

11.8.2 U.K.

11.8.3 France

11.8.4 Italy

11.8.5 Russia

11.8.6 Spain

Chapter 12: Asia-Pacific Electrically Conductive Adhesives Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Chemistry Type

12.4.1 Epoxy

12.4.2 Silicone

12.4.3 Polyurethane

12.4.4 Acrylic

12.4.5 Other Chemistry Types

12.5 Historic and Forecasted Market Size By Type

12.5.1 Isotropic

12.5.2 Anisotropic

12.6 Historic and Forecasted Market Size By Application

12.6.1 Solar Cells

12.6.2 Automotive Electronics

12.6.3 Led Lighting

12.6.4 Printed Circuit Board

12.6.5 Lcd Displays

12.6.6 Other Applications

12.7 Historic and Forecasted Market Size By Filler Material

12.7.1 Silver Fillers

12.7.2 Carbon Fillers

12.7.3 Copper Fillers

12.7.4 Others

12.8 Historic and Forecast Market Size by Country

12.8.1 China

12.8.2 India

12.8.3 Japan

12.8.4 Southeast Asia

Chapter 13: South America Electrically Conductive Adhesives Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Chemistry Type

13.4.1 Epoxy

13.4.2 Silicone

13.4.3 Polyurethane

13.4.4 Acrylic

13.4.5 Other Chemistry Types

13.5 Historic and Forecasted Market Size By Type

13.5.1 Isotropic

13.5.2 Anisotropic

13.6 Historic and Forecasted Market Size By Application

13.6.1 Solar Cells

13.6.2 Automotive Electronics

13.6.3 Led Lighting

13.6.4 Printed Circuit Board

13.6.5 Lcd Displays

13.6.6 Other Applications

13.7 Historic and Forecasted Market Size By Filler Material

13.7.1 Silver Fillers

13.7.2 Carbon Fillers

13.7.3 Copper Fillers

13.7.4 Others

13.8 Historic and Forecast Market Size by Country

13.8.1 Brazil

13.8.2 Argentina

Chapter 14: Middle East & Africa Electrically Conductive Adhesives Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Chemistry Type

14.4.1 Epoxy

14.4.2 Silicone

14.4.3 Polyurethane

14.4.4 Acrylic

14.4.5 Other Chemistry Types

14.5 Historic and Forecasted Market Size By Type

14.5.1 Isotropic

14.5.2 Anisotropic

14.6 Historic and Forecasted Market Size By Application

14.6.1 Solar Cells

14.6.2 Automotive Electronics

14.6.3 Led Lighting

14.6.4 Printed Circuit Board

14.6.5 Lcd Displays

14.6.6 Other Applications

14.7 Historic and Forecasted Market Size By Filler Material

14.7.1 Silver Fillers

14.7.2 Carbon Fillers

14.7.3 Copper Fillers

14.7.4 Others

14.8 Historic and Forecast Market Size by Country

14.8.1 Saudi Arabia

14.8.2 South Africa

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Electrically Conductive Adhesives Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2016 to 2021 |

Market Size in 2022: |

USD 2.27 Bn. |

|

Forecast Period 2023-30 CAGR: |

16.2% |

Market Size in 2030: |

USD 3.52 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ELECTRICALLY CONDUCTIVE ADHESIVES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ELECTRICALLY CONDUCTIVE ADHESIVES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ELECTRICALLY CONDUCTIVE ADHESIVES MARKET COMPETITIVE RIVALRY

TABLE 005. ELECTRICALLY CONDUCTIVE ADHESIVES MARKET THREAT OF NEW ENTRANTS

TABLE 006. ELECTRICALLY CONDUCTIVE ADHESIVES MARKET THREAT OF SUBSTITUTES

TABLE 007. ELECTRICALLY CONDUCTIVE ADHESIVES MARKET BY CHEMISTRY TYPE

TABLE 008. EPOXY MARKET OVERVIEW (2016-2028)

TABLE 009. SILICONE MARKET OVERVIEW (2016-2028)

TABLE 010. POLYURETHANE MARKET OVERVIEW (2016-2028)

TABLE 011. ACRYLIC MARKET OVERVIEW (2016-2028)

TABLE 012. OTHER CHEMISTRY TYPES MARKET OVERVIEW (2016-2028)

TABLE 013. ELECTRICALLY CONDUCTIVE ADHESIVES MARKET BY TYPE

TABLE 014. ISOTROPIC MARKET OVERVIEW (2016-2028)

TABLE 015. ANISOTROPIC MARKET OVERVIEW (2016-2028)

TABLE 016. ELECTRICALLY CONDUCTIVE ADHESIVES MARKET BY APPLICATION

TABLE 017. SOLAR CELLS MARKET OVERVIEW (2016-2028)

TABLE 018. AUTOMOTIVE ELECTRONICS MARKET OVERVIEW (2016-2028)

TABLE 019. LED LIGHTING MARKET OVERVIEW (2016-2028)

TABLE 020. PRINTED CIRCUIT BOARD MARKET OVERVIEW (2016-2028)

TABLE 021. LCD DISPLAYS MARKET OVERVIEW (2016-2028)

TABLE 022. OTHER APPLICATIONS MARKET OVERVIEW (2016-2028)

TABLE 023. ELECTRICALLY CONDUCTIVE ADHESIVES MARKET BY FILLER MATERIAL

TABLE 024. SILVER FILLERS MARKET OVERVIEW (2016-2028)

TABLE 025. CARBON FILLERS MARKET OVERVIEW (2016-2028)

TABLE 026. COPPER FILLERS MARKET OVERVIEW (2016-2028)

TABLE 027. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 028. NORTH AMERICA ELECTRICALLY CONDUCTIVE ADHESIVES MARKET, BY CHEMISTRY TYPE (2016-2028)

TABLE 029. NORTH AMERICA ELECTRICALLY CONDUCTIVE ADHESIVES MARKET, BY TYPE (2016-2028)

TABLE 030. NORTH AMERICA ELECTRICALLY CONDUCTIVE ADHESIVES MARKET, BY APPLICATION (2016-2028)

TABLE 031. NORTH AMERICA ELECTRICALLY CONDUCTIVE ADHESIVES MARKET, BY FILLER MATERIAL (2016-2028)

TABLE 032. N ELECTRICALLY CONDUCTIVE ADHESIVES MARKET, BY COUNTRY (2016-2028)

TABLE 033. EUROPE ELECTRICALLY CONDUCTIVE ADHESIVES MARKET, BY CHEMISTRY TYPE (2016-2028)

TABLE 034. EUROPE ELECTRICALLY CONDUCTIVE ADHESIVES MARKET, BY TYPE (2016-2028)

TABLE 035. EUROPE ELECTRICALLY CONDUCTIVE ADHESIVES MARKET, BY APPLICATION (2016-2028)

TABLE 036. EUROPE ELECTRICALLY CONDUCTIVE ADHESIVES MARKET, BY FILLER MATERIAL (2016-2028)

TABLE 037. ELECTRICALLY CONDUCTIVE ADHESIVES MARKET, BY COUNTRY (2016-2028)

TABLE 038. ASIA PACIFIC ELECTRICALLY CONDUCTIVE ADHESIVES MARKET, BY CHEMISTRY TYPE (2016-2028)

TABLE 039. ASIA PACIFIC ELECTRICALLY CONDUCTIVE ADHESIVES MARKET, BY TYPE (2016-2028)

TABLE 040. ASIA PACIFIC ELECTRICALLY CONDUCTIVE ADHESIVES MARKET, BY APPLICATION (2016-2028)

TABLE 041. ASIA PACIFIC ELECTRICALLY CONDUCTIVE ADHESIVES MARKET, BY FILLER MATERIAL (2016-2028)

TABLE 042. ELECTRICALLY CONDUCTIVE ADHESIVES MARKET, BY COUNTRY (2016-2028)

TABLE 043. MIDDLE EAST & AFRICA ELECTRICALLY CONDUCTIVE ADHESIVES MARKET, BY CHEMISTRY TYPE (2016-2028)

TABLE 044. MIDDLE EAST & AFRICA ELECTRICALLY CONDUCTIVE ADHESIVES MARKET, BY TYPE (2016-2028)

TABLE 045. MIDDLE EAST & AFRICA ELECTRICALLY CONDUCTIVE ADHESIVES MARKET, BY APPLICATION (2016-2028)

TABLE 046. MIDDLE EAST & AFRICA ELECTRICALLY CONDUCTIVE ADHESIVES MARKET, BY FILLER MATERIAL (2016-2028)

TABLE 047. ELECTRICALLY CONDUCTIVE ADHESIVES MARKET, BY COUNTRY (2016-2028)

TABLE 048. SOUTH AMERICA ELECTRICALLY CONDUCTIVE ADHESIVES MARKET, BY CHEMISTRY TYPE (2016-2028)

TABLE 049. SOUTH AMERICA ELECTRICALLY CONDUCTIVE ADHESIVES MARKET, BY TYPE (2016-2028)

TABLE 050. SOUTH AMERICA ELECTRICALLY CONDUCTIVE ADHESIVES MARKET, BY APPLICATION (2016-2028)

TABLE 051. SOUTH AMERICA ELECTRICALLY CONDUCTIVE ADHESIVES MARKET, BY FILLER MATERIAL (2016-2028)

TABLE 052. ELECTRICALLY CONDUCTIVE ADHESIVES MARKET, BY COUNTRY (2016-2028)

TABLE 053. 3M: SNAPSHOT

TABLE 054. 3M: BUSINESS PERFORMANCE

TABLE 055. 3M: PRODUCT PORTFOLIO

TABLE 056. 3M: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. AREMCO: SNAPSHOT

TABLE 057. AREMCO: BUSINESS PERFORMANCE

TABLE 058. AREMCO: PRODUCT PORTFOLIO

TABLE 059. AREMCO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. CREATIVE MATERIALS INC.: SNAPSHOT

TABLE 060. CREATIVE MATERIALS INC.: BUSINESS PERFORMANCE

TABLE 061. CREATIVE MATERIALS INC.: PRODUCT PORTFOLIO

TABLE 062. CREATIVE MATERIALS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. DOW: SNAPSHOT

TABLE 063. DOW: BUSINESS PERFORMANCE

TABLE 064. DOW: PRODUCT PORTFOLIO

TABLE 065. DOW: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. H.B. FULLER COMPANY: SNAPSHOT

TABLE 066. H.B. FULLER COMPANY: BUSINESS PERFORMANCE

TABLE 067. H.B. FULLER COMPANY: PRODUCT PORTFOLIO

TABLE 068. H.B. FULLER COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. HENKEL AG & CO. KGAA: SNAPSHOT

TABLE 069. HENKEL AG & CO. KGAA: BUSINESS PERFORMANCE

TABLE 070. HENKEL AG & CO. KGAA: PRODUCT PORTFOLIO

TABLE 071. HENKEL AG & CO. KGAA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. HITEK ELECTRONIC: SNAPSHOT

TABLE 072. HITEK ELECTRONIC: BUSINESS PERFORMANCE

TABLE 073. HITEK ELECTRONIC: PRODUCT PORTFOLIO

TABLE 074. HITEK ELECTRONIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. MATERIALS LTD: SNAPSHOT

TABLE 075. MATERIALS LTD: BUSINESS PERFORMANCE

TABLE 076. MATERIALS LTD: PRODUCT PORTFOLIO

TABLE 077. MATERIALS LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. MASTER BOND INC.: SNAPSHOT

TABLE 078. MASTER BOND INC.: BUSINESS PERFORMANCE

TABLE 079. MASTER BOND INC.: PRODUCT PORTFOLIO

TABLE 080. MASTER BOND INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. MG CHEMICALS: SNAPSHOT

TABLE 081. MG CHEMICALS: BUSINESS PERFORMANCE

TABLE 082. MG CHEMICALS: PRODUCT PORTFOLIO

TABLE 083. MG CHEMICALS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. PANADOL-ELOSOL GMBH: SNAPSHOT

TABLE 084. PANADOL-ELOSOL GMBH: BUSINESS PERFORMANCE

TABLE 085. PANADOL-ELOSOL GMBH: PRODUCT PORTFOLIO

TABLE 086. PANADOL-ELOSOL GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. PARKER HANNIFIN CORP.: SNAPSHOT

TABLE 087. PARKER HANNIFIN CORP.: BUSINESS PERFORMANCE

TABLE 088. PARKER HANNIFIN CORP.: PRODUCT PORTFOLIO

TABLE 089. PARKER HANNIFIN CORP.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. PERMABOND LLC: SNAPSHOT

TABLE 090. PERMABOND LLC: BUSINESS PERFORMANCE

TABLE 091. PERMABOND LLC: PRODUCT PORTFOLIO

TABLE 092. PERMABOND LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. BOSTIK: SNAPSHOT

TABLE 093. BOSTIK: BUSINESS PERFORMANCE

TABLE 094. BOSTIK: PRODUCT PORTFOLIO

TABLE 095. BOSTIK: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ELECTRICALLY CONDUCTIVE ADHESIVES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ELECTRICALLY CONDUCTIVE ADHESIVES MARKET OVERVIEW BY CHEMISTRY TYPE

FIGURE 012. EPOXY MARKET OVERVIEW (2016-2028)

FIGURE 013. SILICONE MARKET OVERVIEW (2016-2028)

FIGURE 014. POLYURETHANE MARKET OVERVIEW (2016-2028)

FIGURE 015. ACRYLIC MARKET OVERVIEW (2016-2028)

FIGURE 016. OTHER CHEMISTRY TYPES MARKET OVERVIEW (2016-2028)

FIGURE 017. ELECTRICALLY CONDUCTIVE ADHESIVES MARKET OVERVIEW BY TYPE

FIGURE 018. ISOTROPIC MARKET OVERVIEW (2016-2028)

FIGURE 019. ANISOTROPIC MARKET OVERVIEW (2016-2028)

FIGURE 020. ELECTRICALLY CONDUCTIVE ADHESIVES MARKET OVERVIEW BY APPLICATION

FIGURE 021. SOLAR CELLS MARKET OVERVIEW (2016-2028)

FIGURE 022. AUTOMOTIVE ELECTRONICS MARKET OVERVIEW (2016-2028)

FIGURE 023. LED LIGHTING MARKET OVERVIEW (2016-2028)

FIGURE 024. PRINTED CIRCUIT BOARD MARKET OVERVIEW (2016-2028)

FIGURE 025. LCD DISPLAYS MARKET OVERVIEW (2016-2028)

FIGURE 026. OTHER APPLICATIONS MARKET OVERVIEW (2016-2028)

FIGURE 027. ELECTRICALLY CONDUCTIVE ADHESIVES MARKET OVERVIEW BY FILLER MATERIAL

FIGURE 028. SILVER FILLERS MARKET OVERVIEW (2016-2028)

FIGURE 029. CARBON FILLERS MARKET OVERVIEW (2016-2028)

FIGURE 030. COPPER FILLERS MARKET OVERVIEW (2016-2028)

FIGURE 031. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 032. NORTH AMERICA ELECTRICALLY CONDUCTIVE ADHESIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. EUROPE ELECTRICALLY CONDUCTIVE ADHESIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. ASIA PACIFIC ELECTRICALLY CONDUCTIVE ADHESIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 035. MIDDLE EAST & AFRICA ELECTRICALLY CONDUCTIVE ADHESIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 036. SOUTH AMERICA ELECTRICALLY CONDUCTIVE ADHESIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Electrically Conductive Adhesives Market research report is 2023-2030.

3M, Aremco, Creative Materials Inc., Dow, H.B. Fuller Company, Henkel AG & Co. KGaA, HITEK Electronic, Materials Ltd, Master Bond Inc., MG Chemicals, Panadol-Elosol GmbH, Parker Hannifin Corp., Permabond LLC, Bostik, and other major players.

The Electrically Conductive Adhesives Market is segmented into Type, Application, and region. By Type, the market is categorized into Epoxy, Silicone, Polyurethane, Acrylic, and Others. By Application, the market is categorized into Automotive, Aerospace & Defence, Consumer Electronics, Bioscience, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Electrically conductive adhesives are generally employed in electronics applications where components must be held in place during electrical current can flow between them. Some common general such as anaerobic, cyanoacrylates, epoxies, and acrylic-based adhesives play as an electrical insulator depending on the space between components. Many supplies are good thermal conductivity to help in the thermal management of electronic components and heat sinks by directing heat away from sensitive components.

Global Electrically Conductive Adhesives Market Size Was Valued at USD 2.27 Billion In 2022 And Is Projected to Reach USD 3.52 Billion By 2030, Growing at A CAGR of 16.2% From 2023 To 2030.