Global Recycled PET (r-PET) Bottles Market Overview

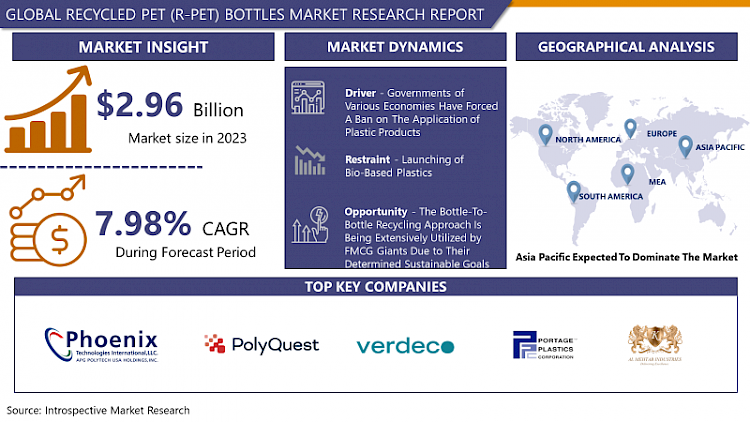

Recycled PET (r-PET) Bottles Market Size Was Valued at USD 2.96 Billion in 2023 and is Projected to Reach USD 5.91 Billion by 2032, Growing at a CAGR of 7.98% From 2024-2032

PET is used as a basic substance for the manufacturing of packaging materials. This PET material, which has been already applied for the packaging of food and non-food products is used for the production of bottles with the help of the recycling process is called Recycled PET (r-PET) bottles. In terms of type, recycled PET (r-PET) bottles are generally categorized into two types such as clear and colored. In addition, two types of methods that are used in the recycling process are mechanical and chemical. The mechanical recycling method is mainly used for PET recycling, whereas the chemical recycling method is still in the phase of development. Furthermore, the circular economy is of great interest for consumers, legislative bodies, and industry similar to allow sustainable growth.

In addition, plastic packaging has been focused in the European Union with significance on recycling. Polyethylene terephthalate (PET) is observed to be the most promising food-packaging plastic for recycling and is being used widely. For instance, in 2018, about 4.3 million tons of rigid PET packaging were placed on the European market (EU28+2) of which an estimated 79% were bottles and the remainder trays. Of this, about 1.9 million tons (45%) were collected. In Europe, PET beverage bottles are composed through a combination of deposit return schemes (DRS) and separate collections. DRS records for about 35% of collected PET bottles and the average collection rate for PET bottles in 2018 was 58.2%. Given losses within the sorting process, an estimated 52% of PET bottles are sent for recycling which helps to increase the growth of the market over the forecast period.

COVID-19 Impact on Recycled PET (r-PET) Bottles Market

COVID-19 pandemic has harmed the market as demand saw a steep reduction, mainly attributed to a drop in prices for virgin PET. Hence, top recycled PET food & beverage container producers were seen shifting back for the application of convention virgin PET. Nevertheless, FMCG's commitments for sustainable practices ensured the continued demand for recycled PET, thus helping in stabilizing the market. The outbreak of COVID-19 over the globe has thrust the operations throughout the value chain of the recycled polymer industry. Moreover, the COVID-19 had the main influence on the petrochemical industry, hampering the global supply chain, change in the downstream demand, reduction in long-term investments. Additionally, the crude demand and supply plunged leading to instability in the crude oil prices. Moreover, one of the major effects witnessed is reduced collection rates, leading to scarcity of raw material. The demand for recycled polyethylene terephthalate is anticipated to overcome for the non-food grade application shortly. While the demand for recycled polyethylene terephthalate is established to pour for packaged food and water application amidst the COVID-19 scenario.

Market Dynamics and Forecast for the Recycled PET (r-PET) Bottles Market

Drivers:

The global recycled PET bottles market is expected to grow at a significant pace over the forecast period, as the governments of various economies have forced a ban on the application of plastic products. Growth in government support for the recycling of products is also triggering the demand for r-PET bottles.

The switch toward a circular economy is turning the global demand for recycled PET bottles. Under the circular economy, producers operating in the plastic packaging market are required to reuse or recycle plastic in a cost-effective way. Based on the concept of a circular economy, reusing, recycling, and upcycling reduces landfill waste.

An increase in the demand for bottled water is also anticipated to accelerate the global recycled PET bottles market. The rising scarcity of drinking water around the globe, and augmenting in the demand for safe drinking water are anticipated to drive the recycled PET bottles market.

Furthermore, consumers are growingly demanding responsibility from companies regarding their carbon footprint and unsustainable practices. Hence, FMCG companies are incorporating strategies to raise the application of R-PET food & beverage bottles & containers for packaging purposes as well. For instance, major FMCG industries such as Nestle, PepsiCo, and L'Oréal have preferred the bottle-to-bottle recycling approach while participating with key distributors of R-PET sheets & films to manufacture end products. Additionally, different surveys indicate a growing trend of sustainable purchasing among consumers, with a majority of them admitting to the urgent need to design products that can be reused or recycled.

Restraints:

There is a key supply-demand gap observed in the market. Various companies have established ambitious goals to apply r-PET for packaging purposes, hence producing excess demand for the product. This demand is not being met, thereby hampering the market growth. Furthermore, the launching of bio-based plastics may also decrease demand for recycled PET fibers, as these are much more sustainable in their characteristics than r-PETs. The introductory factors may play as a restraint to the growth of r-PET during the projected period, thus declining demand for clear r-PET as well in the same timeframe.

Opportunities:

PepsiCo Inc. and Coca-Cola Company are disposed of recycled PET bottles for the packaging of their beverages. The Coca-Cola Company has set an aim to collect and recycle 100% of its packaging material by the end of 2030. The company is investing appreciably to support people understand what, where, and how to recycle. In addition, many other companies, consumers, industries, municipalities, retailers, and collectors are supporting the idea of PET recycling.

Laser sorting, the latest approach, can be used to eliminate the immoralities and separate colored and non-colored PET bottle flakes. This system is capable to remove polymer by type or grade. Nevertheless, this is still a novel approach and is currently employed in a small number of Europe-based recycling units, but may soon be used globally. The laser sorting of PET bottles provides profitable opportunities for apathetic bottle producers.

In addition, the bottle-to-bottle recycling approach is being extensively utilized by FMCG giants due to their determined sustainable goals. This has especially increased recycled PET food and beverage bottles demand. For instance, nestle has enacted 25% r-PET for bottle packaging by 2025, hence tuning demand forward.

Market Segmentation

Segmentation Analysis of Recycled PET (r-PET) Bottles Market:

Based on the Type, a clear type segment is expected to register the maximum market share during the forecast period. The segment will retain the leading position growing at a steady CAGR. Low energy necessity and ease of bottle-to-bottle recycling are anticipated to turn the demand for clear recycled PET during the projected period. Furthermore, clear r-PET is highly resistant or long-lasting, non-reactive, lightweight, and shatterproof. It is extensively utilized in food and non-food applications owing to the cheap cost of processing related to it. Most producers opted for clear granules or flakes to produce containers and bottles, as opposed to opaque or colored PET. In addition, clear r-PET support to determine changes in the products inside, such as changes in color, chemical reaction, and fungal growth.

Based on the End-Users, the fiber segment is expected to dominate the market over the forecast period. The segment will grow further at a steady CAGR, maintaining the leading position. High demand from the industries such as clothing & accessories, consumer goods, home furnishing sectors automobiles, textile, telecom, and FMCG is contributing to the growth of the market. Fiber is primarily used for making car seating, mattresses, cushions, and even insulation products. Different types of clothing, like t-shirts and jackets, use fiber produced from recycled PET.

Based on the Recycling Process, the chemical method is dominate the Recycled PET (r-PET) Bottles market, owing to retaining their chemical properties and time efficiency.

Regional Analysis of Recycled PET (r-PET) Bottles Market:

The Asia Pacific region is expected to dominate the market during the forecast period. It is projected to maintain the leading position throughout the period. The regional market is characterized by the easy accessibility of land along with a cheap-cost, skilled labor force. India is expected to be one of the most profitable markets for recycled PET with demand accelerating by the rising trend of recyclable products. The switch in the production landscape toward developing countries, especially China and India, is anticipated to positively influence the regional market growth during the projected period.

North America region is driven by the recycling trends in the U.S. are collecting pace with key FMCG companies are collaborating with PET recycling companies to purchase raw materials such as resins, flakes, and fibers, converting them into packaging and non-packaging materials. Over the years, there has been remarkable growth in the number of recyclers setting up their plants over the U.S. Also, growth in the application of r-PET can be seen in the country assigned to switch in consumer buying behavior.

In Europe, demand for r-PET bottles is seeing a boom with key market players setting their recycling capacities in the region. Also, determined focused to reach around 77% of plastic recycling by 2025 is setting a positive tone for the industry. Attributed to these factors, sales of r-PET food and beverage containers applied for packaging purposes are established to turn the European market over the forecast period.

The growing demand for food and non-food bottles over a large number of end-use industries and the rising economies are estimated to turn the product demand in Latin America. Growing per capita income coupled with the rising FMCG industry is helping the r-PET market develop in the region.

Players Covered in Recycled PET (r-PET) Bottles Market are:

- Phoenix Technologies International LLC.

- PolyQuest

- Verdeco Recycling

- Portage Plastics

- AL Mehtab Industries

- UMA SCHREIBGERÄTE ULLMANN GMBH

- Peninsula Plastics Recycling

- ALPLA

- Bantam Materials

- Carbonlite Industries LLC

- Clean Tech U.K. Ltd

- Clear Path Recycling LLC

- DuFor

- Evergreen Plastics Inc.

- Indorama Ventures

- Libolon

- Marglen Industries

- PLACON Corporation

- UltrePET

- Unifi Inc. and other major players.

Key Industry Developments in the Recycled PET (r-PET) Bottles Market

- In August 2023, Indorama Ventures, AMB Spa partner to use rPET in food packaging AMB will use flake from recycled PET trays to produce a film for new food packaging trays the partnership aims to divert more than 150 million postconsumer PET trays away from landfills or incineration by the end of 2025. They add that new technology will allow Indorama Ventures to supply rPET flakes from post-consumer trays for AMB to use in making a food-grade transparent film, increasing the recycled content sourced from trays in AMB’s end products.

- In May 2023, Verdeco announced its third recycled polyethylene terephthalate (R-PET) manufacturing facility in Greenville, South Carolina, with over 40,800 tonnes/year of flake-to-pellet capacity. The US R-PET market faces an excess supply due to economic sentiments and customer limits. While the beverage packaging industry is expected to increase its use of post-consumer recycled content, some brand companies and packaging converters are experiencing slow progress.

|

Global Recycled PET (r-PET) Bottles Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.96 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.98% |

Market Size in 2032: |

USD 5.91 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Source |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Product Type

3.2 By Source

3.3 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Recycled PET (r-PET) Bottles Market by Product Type

5.1 Recycled PET (r-PET) Bottles Market Overview Snapshot and Growth Engine

5.2 Recycled PET (r-PET) Bottles Market Overview

5.3 Pet Straps

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Pet Straps: Grographic Segmentation

5.4 Pet Staple Fiber

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Pet Staple Fiber: Grographic Segmentation

5.5 Pet Sheets or Films

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Pet Sheets or Films: Grographic Segmentation

Chapter 6: Recycled PET (r-PET) Bottles Market by Source

6.1 Recycled PET (r-PET) Bottles Market Overview Snapshot and Growth Engine

6.2 Recycled PET (r-PET) Bottles Market Overview

6.3 Post-Consumer Pet

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Post-Consumer Pet: Grographic Segmentation

6.4 Post-Industrial Pet

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Post-Industrial Pet: Grographic Segmentation

Chapter 7: Recycled PET (r-PET) Bottles Market by Application

7.1 Recycled PET (r-PET) Bottles Market Overview Snapshot and Growth Engine

7.2 Recycled PET (r-PET) Bottles Market Overview

7.3 Mono-Filaments

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Mono-Filaments: Grographic Segmentation

7.4 Packaging

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Packaging: Grographic Segmentation

7.5 Industrial Yarn

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Industrial Yarn: Grographic Segmentation

7.6 Strapping

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2016-2028F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Strapping: Grographic Segmentation

7.7 Building Materials

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size (2016-2028F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Building Materials: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Recycled PET (r-PET) Bottles Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Recycled PET (r-PET) Bottles Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Recycled PET (r-PET) Bottles Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 PHOENIX TECHNOLOGIES INTERNATIONAL LLC.

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 POLYQUEST

8.4 VERDECO RECYCLING

8.5 PORTAGE PLASTICS

8.6 AL MEHTAB INDUSTRIES

8.7 UMA SCHREIBGERÄTE ULLMANN GMBH

8.8 PENINSULA PLASTICS RECYCLING

8.9 ALPLA

8.10 BANTAM MATERIALS

8.11 CARBONLITE INDUSTRIES LLC

8.12 CLEAN TECH U.K. LTD

8.13 CLEAR PATH RECYCLING LLC

8.14 DUFOR

8.15 EVERGREEN PLASTICS INC.

8.16 INDORAMA VENTURES

8.17 LIBOLON

8.18 MARGLEN INDUSTRIES

8.19 PLACON CORPORATION

8.20 ULTREPET

8.21 UNIFI INC

8.22 OTHER MAJOR PLAYERS

Chapter 9: Global Recycled PET (r-PET) Bottles Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Product Type

9.2.1 Pet Straps

9.2.2 Pet Staple Fiber

9.2.3 Pet Sheets or Films

9.3 Historic and Forecasted Market Size By Source

9.3.1 Post-Consumer Pet

9.3.2 Post-Industrial Pet

9.4 Historic and Forecasted Market Size By Application

9.4.1 Mono-Filaments

9.4.2 Packaging

9.4.3 Industrial Yarn

9.4.4 Strapping

9.4.5 Building Materials

Chapter 10: North America Recycled PET (r-PET) Bottles Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Product Type

10.4.1 Pet Straps

10.4.2 Pet Staple Fiber

10.4.3 Pet Sheets or Films

10.5 Historic and Forecasted Market Size By Source

10.5.1 Post-Consumer Pet

10.5.2 Post-Industrial Pet

10.6 Historic and Forecasted Market Size By Application

10.6.1 Mono-Filaments

10.6.2 Packaging

10.6.3 Industrial Yarn

10.6.4 Strapping

10.6.5 Building Materials

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Recycled PET (r-PET) Bottles Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Product Type

11.4.1 Pet Straps

11.4.2 Pet Staple Fiber

11.4.3 Pet Sheets or Films

11.5 Historic and Forecasted Market Size By Source

11.5.1 Post-Consumer Pet

11.5.2 Post-Industrial Pet

11.6 Historic and Forecasted Market Size By Application

11.6.1 Mono-Filaments

11.6.2 Packaging

11.6.3 Industrial Yarn

11.6.4 Strapping

11.6.5 Building Materials

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Recycled PET (r-PET) Bottles Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Product Type

12.4.1 Pet Straps

12.4.2 Pet Staple Fiber

12.4.3 Pet Sheets or Films

12.5 Historic and Forecasted Market Size By Source

12.5.1 Post-Consumer Pet

12.5.2 Post-Industrial Pet

12.6 Historic and Forecasted Market Size By Application

12.6.1 Mono-Filaments

12.6.2 Packaging

12.6.3 Industrial Yarn

12.6.4 Strapping

12.6.5 Building Materials

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Recycled PET (r-PET) Bottles Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Product Type

13.4.1 Pet Straps

13.4.2 Pet Staple Fiber

13.4.3 Pet Sheets or Films

13.5 Historic and Forecasted Market Size By Source

13.5.1 Post-Consumer Pet

13.5.2 Post-Industrial Pet

13.6 Historic and Forecasted Market Size By Application

13.6.1 Mono-Filaments

13.6.2 Packaging

13.6.3 Industrial Yarn

13.6.4 Strapping

13.6.5 Building Materials

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Recycled PET (r-PET) Bottles Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Product Type

14.4.1 Pet Straps

14.4.2 Pet Staple Fiber

14.4.3 Pet Sheets or Films

14.5 Historic and Forecasted Market Size By Source

14.5.1 Post-Consumer Pet

14.5.2 Post-Industrial Pet

14.6 Historic and Forecasted Market Size By Application

14.6.1 Mono-Filaments

14.6.2 Packaging

14.6.3 Industrial Yarn

14.6.4 Strapping

14.6.5 Building Materials

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Recycled PET (r-PET) Bottles Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.96 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.98% |

Market Size in 2032: |

USD 5.91 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Source |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. RECYCLED PET (R-PET) BOTTLES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. RECYCLED PET (R-PET) BOTTLES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. RECYCLED PET (R-PET) BOTTLES MARKET COMPETITIVE RIVALRY

TABLE 005. RECYCLED PET (R-PET) BOTTLES MARKET THREAT OF NEW ENTRANTS

TABLE 006. RECYCLED PET (R-PET) BOTTLES MARKET THREAT OF SUBSTITUTES

TABLE 007. RECYCLED PET (R-PET) BOTTLES MARKET BY PRODUCT TYPE

TABLE 008. PET STRAPS MARKET OVERVIEW (2016-2028)

TABLE 009. PET STAPLE FIBER MARKET OVERVIEW (2016-2028)

TABLE 010. PET SHEETS OR FILMS MARKET OVERVIEW (2016-2028)

TABLE 011. RECYCLED PET (R-PET) BOTTLES MARKET BY SOURCE

TABLE 012. POST-CONSUMER PET MARKET OVERVIEW (2016-2028)

TABLE 013. POST-INDUSTRIAL PET MARKET OVERVIEW (2016-2028)

TABLE 014. RECYCLED PET (R-PET) BOTTLES MARKET BY APPLICATION

TABLE 015. MONO-FILAMENTS MARKET OVERVIEW (2016-2028)

TABLE 016. PACKAGING MARKET OVERVIEW (2016-2028)

TABLE 017. INDUSTRIAL YARN MARKET OVERVIEW (2016-2028)

TABLE 018. STRAPPING MARKET OVERVIEW (2016-2028)

TABLE 019. BUILDING MATERIALS MARKET OVERVIEW (2016-2028)

TABLE 020. NORTH AMERICA RECYCLED PET (R-PET) BOTTLES MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 021. NORTH AMERICA RECYCLED PET (R-PET) BOTTLES MARKET, BY SOURCE (2016-2028)

TABLE 022. NORTH AMERICA RECYCLED PET (R-PET) BOTTLES MARKET, BY APPLICATION (2016-2028)

TABLE 023. N RECYCLED PET (R-PET) BOTTLES MARKET, BY COUNTRY (2016-2028)

TABLE 024. EUROPE RECYCLED PET (R-PET) BOTTLES MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 025. EUROPE RECYCLED PET (R-PET) BOTTLES MARKET, BY SOURCE (2016-2028)

TABLE 026. EUROPE RECYCLED PET (R-PET) BOTTLES MARKET, BY APPLICATION (2016-2028)

TABLE 027. RECYCLED PET (R-PET) BOTTLES MARKET, BY COUNTRY (2016-2028)

TABLE 028. ASIA PACIFIC RECYCLED PET (R-PET) BOTTLES MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 029. ASIA PACIFIC RECYCLED PET (R-PET) BOTTLES MARKET, BY SOURCE (2016-2028)

TABLE 030. ASIA PACIFIC RECYCLED PET (R-PET) BOTTLES MARKET, BY APPLICATION (2016-2028)

TABLE 031. RECYCLED PET (R-PET) BOTTLES MARKET, BY COUNTRY (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA RECYCLED PET (R-PET) BOTTLES MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA RECYCLED PET (R-PET) BOTTLES MARKET, BY SOURCE (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA RECYCLED PET (R-PET) BOTTLES MARKET, BY APPLICATION (2016-2028)

TABLE 035. RECYCLED PET (R-PET) BOTTLES MARKET, BY COUNTRY (2016-2028)

TABLE 036. SOUTH AMERICA RECYCLED PET (R-PET) BOTTLES MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 037. SOUTH AMERICA RECYCLED PET (R-PET) BOTTLES MARKET, BY SOURCE (2016-2028)

TABLE 038. SOUTH AMERICA RECYCLED PET (R-PET) BOTTLES MARKET, BY APPLICATION (2016-2028)

TABLE 039. RECYCLED PET (R-PET) BOTTLES MARKET, BY COUNTRY (2016-2028)

TABLE 040. PHOENIX TECHNOLOGIES INTERNATIONAL LLC.: SNAPSHOT

TABLE 041. PHOENIX TECHNOLOGIES INTERNATIONAL LLC.: BUSINESS PERFORMANCE

TABLE 042. PHOENIX TECHNOLOGIES INTERNATIONAL LLC.: PRODUCT PORTFOLIO

TABLE 043. PHOENIX TECHNOLOGIES INTERNATIONAL LLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. POLYQUEST: SNAPSHOT

TABLE 044. POLYQUEST: BUSINESS PERFORMANCE

TABLE 045. POLYQUEST: PRODUCT PORTFOLIO

TABLE 046. POLYQUEST: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. VERDECO RECYCLING: SNAPSHOT

TABLE 047. VERDECO RECYCLING: BUSINESS PERFORMANCE

TABLE 048. VERDECO RECYCLING: PRODUCT PORTFOLIO

TABLE 049. VERDECO RECYCLING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. PORTAGE PLASTICS: SNAPSHOT

TABLE 050. PORTAGE PLASTICS: BUSINESS PERFORMANCE

TABLE 051. PORTAGE PLASTICS: PRODUCT PORTFOLIO

TABLE 052. PORTAGE PLASTICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. AL MEHTAB INDUSTRIES: SNAPSHOT

TABLE 053. AL MEHTAB INDUSTRIES: BUSINESS PERFORMANCE

TABLE 054. AL MEHTAB INDUSTRIES: PRODUCT PORTFOLIO

TABLE 055. AL MEHTAB INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. UMA SCHREIBGERÄTE ULLMANN GMBH: SNAPSHOT

TABLE 056. UMA SCHREIBGERÄTE ULLMANN GMBH: BUSINESS PERFORMANCE

TABLE 057. UMA SCHREIBGERÄTE ULLMANN GMBH: PRODUCT PORTFOLIO

TABLE 058. UMA SCHREIBGERÄTE ULLMANN GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. PENINSULA PLASTICS RECYCLING: SNAPSHOT

TABLE 059. PENINSULA PLASTICS RECYCLING: BUSINESS PERFORMANCE

TABLE 060. PENINSULA PLASTICS RECYCLING: PRODUCT PORTFOLIO

TABLE 061. PENINSULA PLASTICS RECYCLING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. ALPLA: SNAPSHOT

TABLE 062. ALPLA: BUSINESS PERFORMANCE

TABLE 063. ALPLA: PRODUCT PORTFOLIO

TABLE 064. ALPLA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. BANTAM MATERIALS: SNAPSHOT

TABLE 065. BANTAM MATERIALS: BUSINESS PERFORMANCE

TABLE 066. BANTAM MATERIALS: PRODUCT PORTFOLIO

TABLE 067. BANTAM MATERIALS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. CARBONLITE INDUSTRIES LLC: SNAPSHOT

TABLE 068. CARBONLITE INDUSTRIES LLC: BUSINESS PERFORMANCE

TABLE 069. CARBONLITE INDUSTRIES LLC: PRODUCT PORTFOLIO

TABLE 070. CARBONLITE INDUSTRIES LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. CLEAN TECH U.K. LTD: SNAPSHOT

TABLE 071. CLEAN TECH U.K. LTD: BUSINESS PERFORMANCE

TABLE 072. CLEAN TECH U.K. LTD: PRODUCT PORTFOLIO

TABLE 073. CLEAN TECH U.K. LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. CLEAR PATH RECYCLING LLC: SNAPSHOT

TABLE 074. CLEAR PATH RECYCLING LLC: BUSINESS PERFORMANCE

TABLE 075. CLEAR PATH RECYCLING LLC: PRODUCT PORTFOLIO

TABLE 076. CLEAR PATH RECYCLING LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. DUFOR: SNAPSHOT

TABLE 077. DUFOR: BUSINESS PERFORMANCE

TABLE 078. DUFOR: PRODUCT PORTFOLIO

TABLE 079. DUFOR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. EVERGREEN PLASTICS INC.: SNAPSHOT

TABLE 080. EVERGREEN PLASTICS INC.: BUSINESS PERFORMANCE

TABLE 081. EVERGREEN PLASTICS INC.: PRODUCT PORTFOLIO

TABLE 082. EVERGREEN PLASTICS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. INDORAMA VENTURES: SNAPSHOT

TABLE 083. INDORAMA VENTURES: BUSINESS PERFORMANCE

TABLE 084. INDORAMA VENTURES: PRODUCT PORTFOLIO

TABLE 085. INDORAMA VENTURES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. LIBOLON: SNAPSHOT

TABLE 086. LIBOLON: BUSINESS PERFORMANCE

TABLE 087. LIBOLON: PRODUCT PORTFOLIO

TABLE 088. LIBOLON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. MARGLEN INDUSTRIES: SNAPSHOT

TABLE 089. MARGLEN INDUSTRIES: BUSINESS PERFORMANCE

TABLE 090. MARGLEN INDUSTRIES: PRODUCT PORTFOLIO

TABLE 091. MARGLEN INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. PLACON CORPORATION: SNAPSHOT

TABLE 092. PLACON CORPORATION: BUSINESS PERFORMANCE

TABLE 093. PLACON CORPORATION: PRODUCT PORTFOLIO

TABLE 094. PLACON CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. ULTREPET: SNAPSHOT

TABLE 095. ULTREPET: BUSINESS PERFORMANCE

TABLE 096. ULTREPET: PRODUCT PORTFOLIO

TABLE 097. ULTREPET: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. UNIFI INC: SNAPSHOT

TABLE 098. UNIFI INC: BUSINESS PERFORMANCE

TABLE 099. UNIFI INC: PRODUCT PORTFOLIO

TABLE 100. UNIFI INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 100. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 101. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 102. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 103. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. RECYCLED PET (R-PET) BOTTLES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. RECYCLED PET (R-PET) BOTTLES MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 012. PET STRAPS MARKET OVERVIEW (2016-2028)

FIGURE 013. PET STAPLE FIBER MARKET OVERVIEW (2016-2028)

FIGURE 014. PET SHEETS OR FILMS MARKET OVERVIEW (2016-2028)

FIGURE 015. RECYCLED PET (R-PET) BOTTLES MARKET OVERVIEW BY SOURCE

FIGURE 016. POST-CONSUMER PET MARKET OVERVIEW (2016-2028)

FIGURE 017. POST-INDUSTRIAL PET MARKET OVERVIEW (2016-2028)

FIGURE 018. RECYCLED PET (R-PET) BOTTLES MARKET OVERVIEW BY APPLICATION

FIGURE 019. MONO-FILAMENTS MARKET OVERVIEW (2016-2028)

FIGURE 020. PACKAGING MARKET OVERVIEW (2016-2028)

FIGURE 021. INDUSTRIAL YARN MARKET OVERVIEW (2016-2028)

FIGURE 022. STRAPPING MARKET OVERVIEW (2016-2028)

FIGURE 023. BUILDING MATERIALS MARKET OVERVIEW (2016-2028)

FIGURE 024. NORTH AMERICA RECYCLED PET (R-PET) BOTTLES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. EUROPE RECYCLED PET (R-PET) BOTTLES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. ASIA PACIFIC RECYCLED PET (R-PET) BOTTLES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. MIDDLE EAST & AFRICA RECYCLED PET (R-PET) BOTTLES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. SOUTH AMERICA RECYCLED PET (R-PET) BOTTLES MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Recycled PET (r-PET) Bottles Market research report is 2024-2032.

Phoenix Technologies International LLC., PolyQuest, Verdeco Recycling, Portage Plastics, AL Mehtab Industries, UMA SCHREIBGERÄTE ULLMANN GMBH, Peninsula Plastics Recycling, ALPLA, Bantam Materials, Carbonlite Industries LLC, Clean Tech U.K. Ltd, Clear Path Recycling LLC, DuFor, Evergreen Plastics Inc., Indorama Ventures, Libolon, Marglen Industries, PLACON Corporation, UltrePET, Unifi Inc. and other major players.

The Recycled PET (r-PET) Bottles Market is segmented into Product Type, Source, Application, and region. By Product Type, the market is categorized into Pet Straps, Pet Staple Fiber, Pet Sheets or Films. By Source, the market is categorized into Post-Consumer Pet, Post-Industrial Pet. By Application, the market is categorized into Mono-Filaments, Packaging, Industrial Yarn, Strapping, Building Materials. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

PET is used as a basic substance for the manufacturing of packaging materials. This PET material, which has been already applied for the packaging of food and non-food products is used for the production of bottles with the help of the recycling process is called Recycled PET (r-PET) bottles.

Recycled PET (r-PET) Bottles Market Size Was Valued at USD 2.96 Billion in 2023 and is Projected to Reach USD 5.91 Billion by 2032, Growing at a CAGR of 7.98% From 2024-2032