Integrated Passive Devices Market Synopsis:

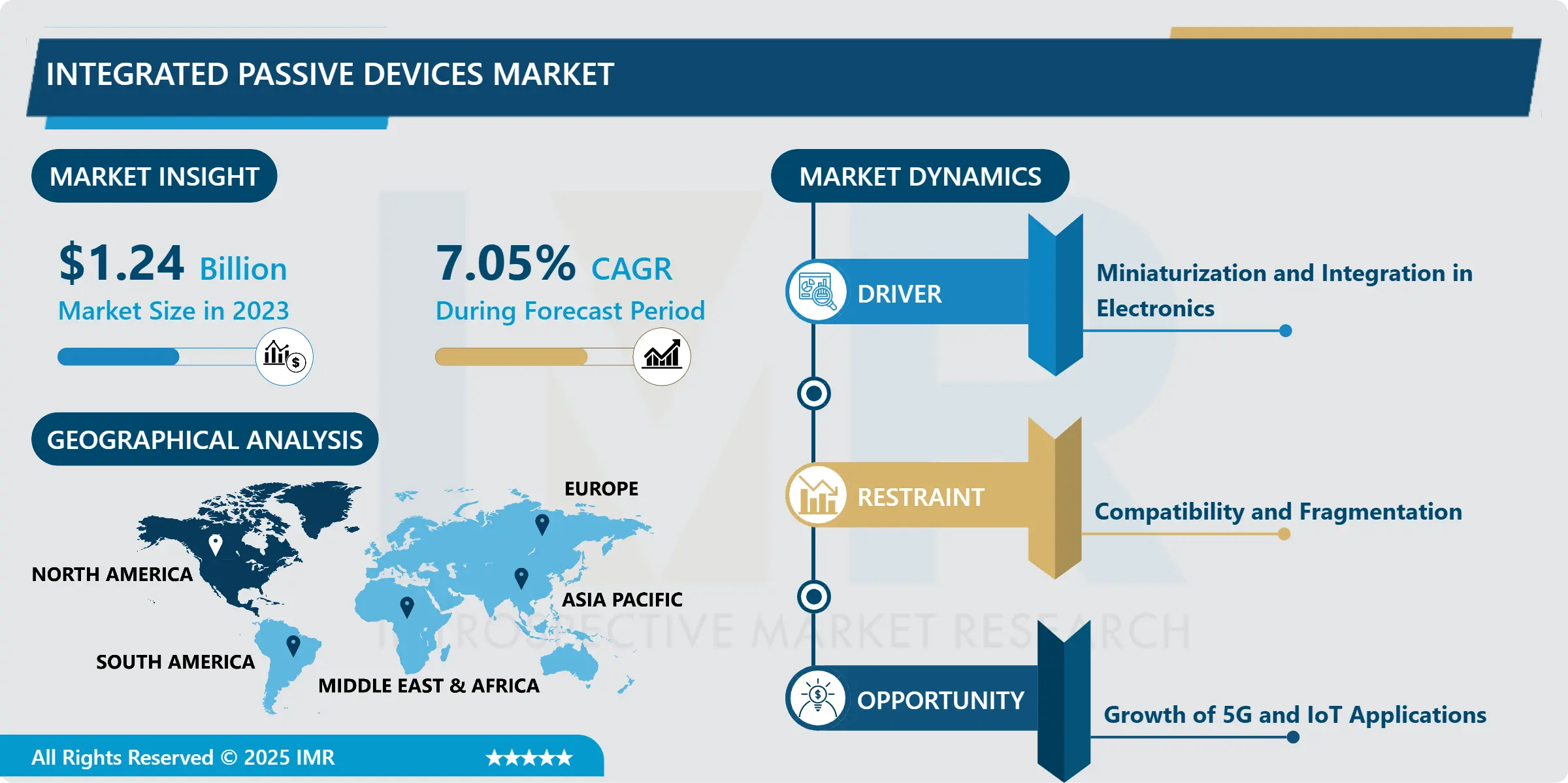

Integrated Passive Devices Market Size Was Valued at USD 1.24 Billion in 2023, and is Projected to Reach USD 2.38 Billion by 2032, Growing at a CAGR of 7.05% From 2024-2032.

Integrated passive devices or integrated circuits, as it suggests is a single device, integrated package or chip which contain a number of integrated resistors, capacitors, inductors, filters etc in it. Compared to discrete component solutions these systems allow for miniaturization, greater efficiency and lower cost, performance improvements, lower power consumption and higher reliability. The flexibility in application of course makes IPDs invaluable where they are used in consumer electronics, telecommunications, automobile and industrial applications because they are useful in power distribution, signal handling and EMI control in modern electronics.

The Integrated Passive Devices IPD market has grown rapidly over the last decade due to the rising need for small-form factor electronics in different applications. IPDs are becoming a leading contender in high-performance and miniaturized electronic systems as a replacement for conventional discrete passive components for their size and cost and performance benefits. These advantages are crucial in the industries such as Mobile devices, automotive electronics and telecommunication where space and cost control are vital facts to consider.

Moreover, they enhance active and dynamic power, signal interconnect integrity, and power savings, and are invaluable for 5G, IoT and automotive applications. With a gradual introduction of new and advanced electronic devices in the global market, the usage of IPDs has found its way in diverse applications. In addition, ongoing growth in semiconductor technologies including MEMS and other miniaturization technologies have played a part by creating devices that are compact, highly efficient, expenses and good performing integrated passive devices. The use of integrated solutions has further been occasioned by the growing sophistication of the present-day electronics circuits for efficiency and low assembly costs.

Integrated Passive Devices Market Trend Analysis:

Miniaturization and Integration in Electronics

-

One of the key factors boosting the growth of Integrated Passive Devices (IPD) market is the industry trend of miniaturization and integration of devices. Due to operational use in electronic products such as consumer electronics, telecommunications and automobile industries which require powerful and highly compact energy efficient devices, there arises pressure to integrate as many passive elements within a single chip or a device as possible. This trend has resulted in the development of much more complex circuitry, which in turn has given rise to much more increased coverage of IPDs since they allow a circuit designer to construct very compact designs that are just as effective as larger, more cumbersome designs.

- Manufacturers strive to make these devices as small as possible while improving their efficiency; which is in line with the general industry self-identity of ‘smaller, faster, smarter’ electronics. Further, the integration of these components also assists in simplification of actual manufacturing as well as increasing durability of the devices hence enhancing the usage of IPDs in many applications.

Growth of 5G and IoT Applications

-

Increased adoption of 5G networks coupled with fast-growing IoT applications that are increasingly being adopted around the world offer a big market for the Integrated Passive Devices (IPD) market. In fact, with the ability offered by 5G technology to develop faster, more reliable communication infrastructures, there is a growing demand for sophisticated, small-sized, and differentiated componentise. IPDs given their size, efficiency, and improved immunity to electromagnetic interference are suitable for networking in 5G, mobile gadgets as well as other wireless equipment.

- In addition, IoT is a very broad segment with countless interconnected devices, and in most of these connections small, low power and high frequency passive components for filtering, powering and transmitting the signal are needed. With the growth of both 5G and IoT technologies, the implementation of Integrated Passive Devices in the two sectors is likely to grow, giving good prospects to parties within the supply chain.

Integrated Passive Devices Market Segment Analysis:

Integrated Passive Devices Market is Segmented on the basis of Type, Application End User, and Region.

By Type, Capacitors segment is expected to dominate the market during the forecast period

-

The segmentation of the Integrated Passive Devices (IPD) market includes capacitors, inductors, resistors, filters, and other unspecified products that provide various features for specific electronic applications. It is known that capacitors are used for energy storage, voltage control as well as filtering in numerous circuits and are usually highly valued in the modern consumer electronics, telecommunication and automotive industries. Inductors have significance uses in filter circuits and energy storage and are used in power supplies, wireless device, and power management circuits. Resistors can be used to manage the amount of the electric current which flows through circuits and are incorporated in designs that require such details of power consumption and signal strength of circuits as in the sensors and automotive.

- Most systems need to apply the SI and EMI management to filters since they are common for telecommunications and wireless communication devices used for separating the frequencies. The others category includes some sorts of passive parts such as transformers, diodes and varistors which can be included in respect of IPDs as per the application requirement. These components find use in specified areas such as power conversion, automotive chipsets, and RF applications. The segmentation by type corresponds to the variety of the functions that integrated passive devices serve in various industries, different designs’ ability to boost the performance, optimize energy consumption and miniaturize advanced electronic systems.

By Application, Consumer Electronics segment expected to held the largest share

-

Integrated Passive Devices (IPD) market is used in various applications in most industries, but the major interest is seen in consumer electronics. This segment comprises smartphones, wearable devices, laptops, and home appliances that require IPDs for optimization of their performance, size reduction and integration efficiency. IPDs are implemented in base stations, routers, and other networking devices because their wide operational bandwidth and efficient power control are crucial to accommodate for the increasing need for the speed and reliability of the emerging 5G systems. They are also extensively used in automotive electronics, such as power control units, sensors and infotainment systems, for the promotion of EVs and ADAS.

- Beside these, more and more automation system for industries such as electronics uses the IPDs for robots, electrical power line management systems, and space saving, reliable, and high-performance control in productions. Medical devices industry employs the use of IPDs in the diagnostic equipment, the patient monitoring systems, and the imaging devices most of which ask for space, efficiency and reliability of specific components. Further, aerospace & defense industry needs IPD for satellite communication and military radar technology and avionics for they need high accuracy and long-lasting performance for operations. Integrated passive components for the others category are aimed at everything from power electronics, to renewable energy systems, and IoT devices as these systems all benefit from the space, cost, and performance advantages of integrated passive components.

Integrated Passive Devices Market Regional Insights:

Asia and Pacific is Expected to Dominate the Market Over the Forecast period

-

Asia and Pacific Integrated Passive Devices (IPD) market. It can be explained by the fact that the area specializes heavily in the semiconductor and electronics manufacturing sector with major countries, such as China, Japan, South Korea, and Taiwan in the field. Asia-Pacific alone has a vast number of OEMs and end-users industries that are using IPDs in their electronics goods. Many electronics industries are situated in the region with growing consumer electronics demand, automotive systems, and telecom infrastructure effectively driving integrated passive devices market growth.

- Further, the ISA and science parks benefit from the cluster of advanced semiconductor foundries and research & development centers for continuously emerging and expanding the market for IPD and for providing related manufacturers the trends toward creating new and efficient methods and products. Concurrently with the industry expansion and the increasing need for more compact electronic devices, the APAC region will remain the global leader in the IPD market in the following years.

Active Key Players in the Integrated Passive Devices Market

-

Analog Devices, Inc. (USA)

- Broadcom Inc. (USA)

- Cisco Systems, Inc. (USA)

- Murata Manufacturing Co. Ltd. (Japan)

- Murata Manufacturing Co., Ltd. (Japan)

- NXP Semiconductors (Netherlands)

- ON Semiconductor (USA)

- Panasonic Corporation (Japan)

- Qualcomm Technologies, Inc. (USA)

- Samsung Electronics Co., Ltd. (South Korea)

- Siemens AG (Germany)

- STMicroelectronics (Switzerland)

- TDK Corporation (Japan)

- Texas Instruments Incorporated (USA)

- Vishay Inter technology, Inc. (USA)

- Other Active Players.

|

Global Integrated Passive Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.24 Billion |

|

Forecast Period 2024-32 CAGR: |

7.05% |

Market Size in 2032: |

USD 2.38 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Integrated Passive Devices Market by Type

4.1 Integrated Passive Devices Market Snapshot and Growth Engine

4.2 Integrated Passive Devices Market Overview

4.3 Capacitors

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Capacitors: Geographic Segmentation Analysis

4.4 Inductors

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Inductors: Geographic Segmentation Analysis

4.5 Resistors

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Resistors: Geographic Segmentation Analysis

4.6 Filters

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Filters: Geographic Segmentation Analysis

4.7 Others

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Others: Geographic Segmentation Analysis

Chapter 5: Integrated Passive Devices Market by Application

5.1 Integrated Passive Devices Market Snapshot and Growth Engine

5.2 Integrated Passive Devices Market Overview

5.3 Consumer Electronics

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Consumer Electronics: Geographic Segmentation Analysis

5.4 Telecommunications

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Telecommunications: Geographic Segmentation Analysis

5.5 Automotive Electronics

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Automotive Electronics: Geographic Segmentation Analysis

5.6 Industrial Electronics

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Industrial Electronics: Geographic Segmentation Analysis

5.7 Medical Devices

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Medical Devices: Geographic Segmentation Analysis

5.8 Aerospace & Defense

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Aerospace & Defense: Geographic Segmentation Analysis

5.9 Others

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 Others: Geographic Segmentation Analysis

Chapter 6: Integrated Passive Devices Market by End User

6.1 Integrated Passive Devices Market Snapshot and Growth Engine

6.2 Integrated Passive Devices Market Overview

6.3 Automotive

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Automotive: Geographic Segmentation Analysis

6.4 Consumer Electronics

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Consumer Electronics: Geographic Segmentation Analysis

6.5 Telecommunications

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Telecommunications: Geographic Segmentation Analysis

6.6 Industrial & Manufacturing

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Industrial & Manufacturing: Geographic Segmentation Analysis

6.7 Healthcare

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Healthcare: Geographic Segmentation Analysis

6.8 Aerospace & Defense

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Aerospace & Defense: Geographic Segmentation Analysis

6.9 Others

6.9.1 Introduction and Market Overview

6.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.9.3 Key Market Trends, Growth Factors and Opportunities

6.9.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Integrated Passive Devices Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ANALOG DEVICES INC. (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BROADCOM INC. (USA)

7.4 CISCO SYSTEMS INC. (USA)

7.5 MURATA MANUFACTURING CO. LTD. (JAPAN)

7.6 NXP SEMICONDUCTORS (NETHERLANDS)

7.7 ON SEMICONDUCTOR (USA)

7.8 PANASONIC CORPORATION (JAPAN)

7.9 QUALCOMM TECHNOLOGIES INC. (USA)

7.10 SAMSUNG ELECTRONICS CO. LTD. (SOUTH KOREA)

7.11 SIEMENS AG (GERMANY)

7.12 TDK CORPORATION (JAPAN)

7.13 TEXAS INSTRUMENTS INCORPORATED (USA)

7.14 VISHAY INTER TECHNOLOGY INC. (USA)

7.15 STMICROELECTRONICS (SWITZERLAND)

7.16 MURATA MANUFACTURING CO. LTD. (JAPAN)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Integrated Passive Devices Market By Region

8.1 Overview

8.2. North America Integrated Passive Devices Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Capacitors

8.2.4.2 Inductors

8.2.4.3 Resistors

8.2.4.4 Filters

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Consumer Electronics

8.2.5.2 Telecommunications

8.2.5.3 Automotive Electronics

8.2.5.4 Industrial Electronics

8.2.5.5 Medical Devices

8.2.5.6 Aerospace & Defense

8.2.5.7 Others

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Automotive

8.2.6.2 Consumer Electronics

8.2.6.3 Telecommunications

8.2.6.4 Industrial & Manufacturing

8.2.6.5 Healthcare

8.2.6.6 Aerospace & Defense

8.2.6.7 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Integrated Passive Devices Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Capacitors

8.3.4.2 Inductors

8.3.4.3 Resistors

8.3.4.4 Filters

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Consumer Electronics

8.3.5.2 Telecommunications

8.3.5.3 Automotive Electronics

8.3.5.4 Industrial Electronics

8.3.5.5 Medical Devices

8.3.5.6 Aerospace & Defense

8.3.5.7 Others

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Automotive

8.3.6.2 Consumer Electronics

8.3.6.3 Telecommunications

8.3.6.4 Industrial & Manufacturing

8.3.6.5 Healthcare

8.3.6.6 Aerospace & Defense

8.3.6.7 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Integrated Passive Devices Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Capacitors

8.4.4.2 Inductors

8.4.4.3 Resistors

8.4.4.4 Filters

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Consumer Electronics

8.4.5.2 Telecommunications

8.4.5.3 Automotive Electronics

8.4.5.4 Industrial Electronics

8.4.5.5 Medical Devices

8.4.5.6 Aerospace & Defense

8.4.5.7 Others

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Automotive

8.4.6.2 Consumer Electronics

8.4.6.3 Telecommunications

8.4.6.4 Industrial & Manufacturing

8.4.6.5 Healthcare

8.4.6.6 Aerospace & Defense

8.4.6.7 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Integrated Passive Devices Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Capacitors

8.5.4.2 Inductors

8.5.4.3 Resistors

8.5.4.4 Filters

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Consumer Electronics

8.5.5.2 Telecommunications

8.5.5.3 Automotive Electronics

8.5.5.4 Industrial Electronics

8.5.5.5 Medical Devices

8.5.5.6 Aerospace & Defense

8.5.5.7 Others

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Automotive

8.5.6.2 Consumer Electronics

8.5.6.3 Telecommunications

8.5.6.4 Industrial & Manufacturing

8.5.6.5 Healthcare

8.5.6.6 Aerospace & Defense

8.5.6.7 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Integrated Passive Devices Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Capacitors

8.6.4.2 Inductors

8.6.4.3 Resistors

8.6.4.4 Filters

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Consumer Electronics

8.6.5.2 Telecommunications

8.6.5.3 Automotive Electronics

8.6.5.4 Industrial Electronics

8.6.5.5 Medical Devices

8.6.5.6 Aerospace & Defense

8.6.5.7 Others

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Automotive

8.6.6.2 Consumer Electronics

8.6.6.3 Telecommunications

8.6.6.4 Industrial & Manufacturing

8.6.6.5 Healthcare

8.6.6.6 Aerospace & Defense

8.6.6.7 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Integrated Passive Devices Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Capacitors

8.7.4.2 Inductors

8.7.4.3 Resistors

8.7.4.4 Filters

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Consumer Electronics

8.7.5.2 Telecommunications

8.7.5.3 Automotive Electronics

8.7.5.4 Industrial Electronics

8.7.5.5 Medical Devices

8.7.5.6 Aerospace & Defense

8.7.5.7 Others

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Automotive

8.7.6.2 Consumer Electronics

8.7.6.3 Telecommunications

8.7.6.4 Industrial & Manufacturing

8.7.6.5 Healthcare

8.7.6.6 Aerospace & Defense

8.7.6.7 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Integrated Passive Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.24 Billion |

|

Forecast Period 2024-32 CAGR: |

7.05% |

Market Size in 2032: |

USD 2.38 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||