Inflammatory Bowel Disease Market Synopsis:

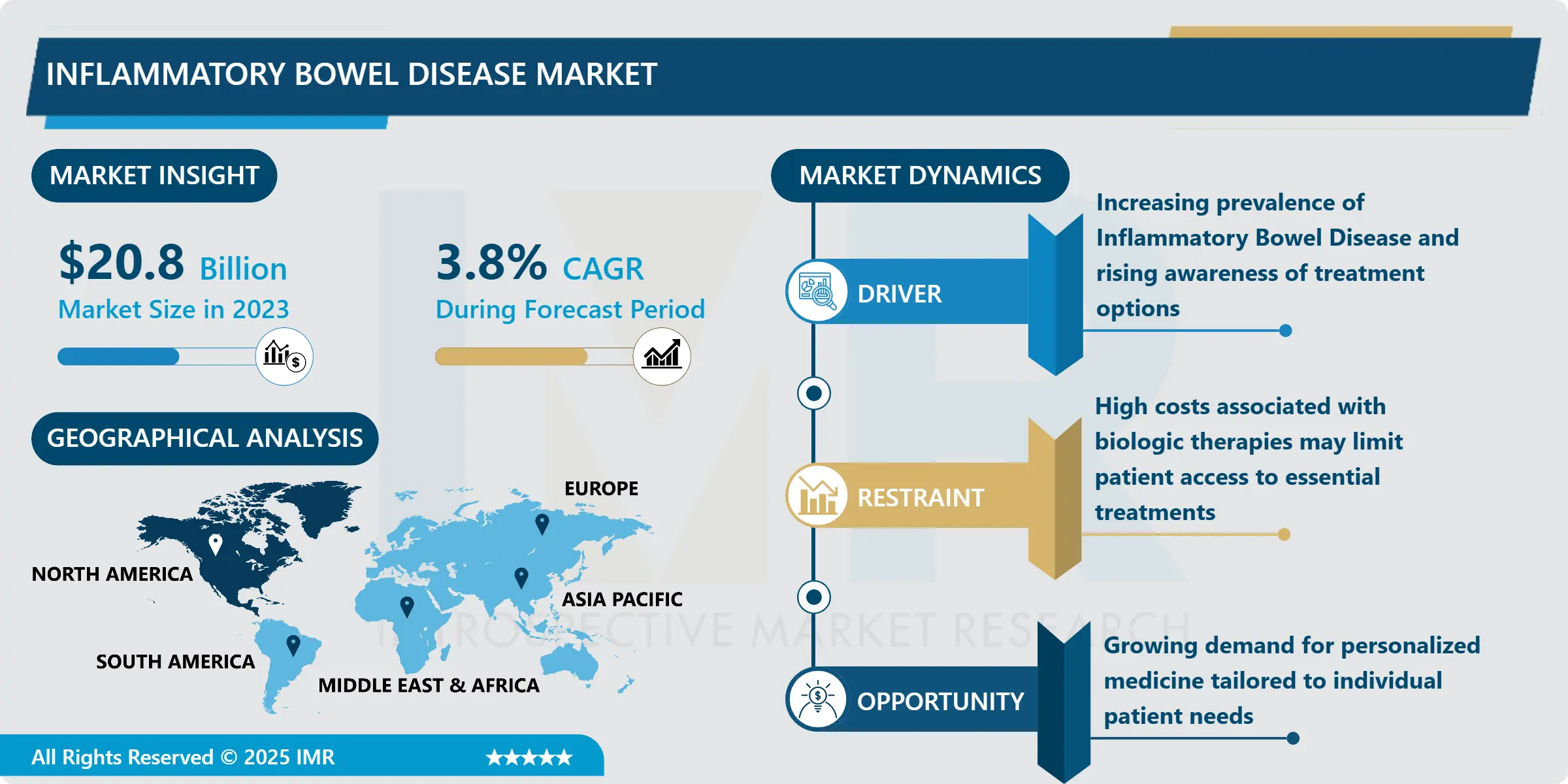

Inflammatory Bowel Disease Market Size Was Valued at USD 20.8 Billion in 2023, and is Projected to Reach USD 29.1 Billion by 2032, Growing at a CAGR of 3.8% From 2024-2032.

The Inflammatory Bowel Disease (IBD) market refers to the products, external modalities, methods, strategies, service and treatments that targets IBD majorly including Crohn and Colitis and Ulcerative Colitis. IBD is a long-standing inflammatory disease of unknown cause that involves the gastrointestinal tract in a relapsing and remitting pattern. It extends to drugs and substances used in the treatment of severe diseases and includes therapeutic interventions such as drugs, biologics aimed at managing symptoms, achieving remission or enhancing patient’s quality of life once affected by such diseases. Given the increasing prevalence of IBD in population, caused by genetic factors, environmental conditions and lifestyle, the market has a great potential for development.

The size of the IBD market has been growing rapidly due to the growing incidence of IBD around the world, the development of new treatments for it, and increased awareness of such conditions among doctors and patients. From several researches, there is increasing global trends in the occurrence of IBD especially in the North America and European countries in occasions to require better therapy. This market is further complex and differentiated by available therapeutic intervention options, such as conventional medical drugs and modern biotherapy, which is a type of pharmacotherapy based on blocking some cytokine signaling that occurs during inflammation stages. Furthermore, the increasing popularity of the targeted therapy will additionally augment value, as treatments will be adapted to correspond to patient requirements.

Thirdly the IBD market is also affected by the continued R & D work done on identifying new therapeutic agents and enhancing on the protocols of offering treatment for the disorders. Perhaps, many companies are exploring the clinical trials option to determine the safety and efficacy of new therapeutic options that should significantly grow the treatment portfolio in the near future. Market players are also getting support from various regulatory bodies as more and more drug approval and treatment modalities are being sanctioned at a much faster rate. Among the population affected by IBD, limited access to effective therapeutic regimens and a growing disease burden on health care systems create large opportunities for participants throughout the healthcare chain.

Inflammatory Bowel Disease Market Trend Analysis:

Rise in Biologic Therapies

- Current trend in managing IBD is toward biologic therapies as is evident from above directing change in treatment strategy. Compared to the empties, biologics represent agents of biological origin that provide selective patterns of action that focus on the different phases of inflammation characteristic of IBD. These therapies have been proven to have positive outcomes in the trials, resulting to better patient experiences, symptoms relief and remission . Additional factors that drive the uptake of biologics are the expanding repertoire of biologic products, choices of therapy options by prescribers and authorization of biosimilar products that are more affordable. This trend is bound to characterise the future of IBD treatment as more and more people become enlightened on the effectiveness of biologics.

Growing Demand for Personalized Medicine

- To this regard, the market offers opportunity for growth in personalized medicines for Inflammatory Bowel Disease patients. The use of genome-related techniques and increased advances in the field of biotechnology have allowed health care deliverers to administer treatments more carefully personalised to a patient’s phenotype and disease characteristics. For clinicians and patients thus reveals this approach as one of the most effective because it offers individualized care and relatively low probability of harming the patient. With more studies in this field and advancement in technologies for DNA testing the chance of offering patient specific treatment for IBD patients should greatly enhance the management of these disorders. This is clearly an attractive opportunity for the companies that will be able to establish a better therapeutic approach and companion diagnostics for this biomarker.

Inflammatory Bowel Disease Market Segment Analysis:

Inflammatory Bowel Disease Market is Segmented on the basis of type, Drug Class, Route of Administration, and Region

By Type, Crohn’s Disease segment is expected to dominate the market during the forecast period

- The segment of Crohn’s disease is expected to possess the largest share of the Inflammatory Bowel Disease market throughout the forecast period due to the rising incidence of the disease and due to the challenging nature of the disease. Crohn’s disease can develop in any site of the gastrointestinal tract and symptoms of the illness may include abdominal pain, diarrhea, weight loss, fever, and fatigue. This disease demands a hence, multiple modality management; this is fueling the need for immunosuppressant drugs, biologic agents, and corticosteroids. Besides, advanced precaution and treatment methods increase the prospective diagnosis rates of Crohn’s diseases driving the market for Crohn’s disease therapies. Given this advancement in the field of research, new drugs more centralized to Crohn’s disease treatment will be developed to improve disease treatment and increase patient reach.

By Drug Class, Aminosalicylates segment expected to held the largest share

- Aminosalicylates is likely to emerge dominant in the Inflammatory Bowel Disease market because it has been observed that these drugs are most effective and safe in treating mild to moderate Inflammatory bowel diseases such as ulcerative colitis and Crohn’s disease. 5-Aminosalicylates including mesalamine have been the mainstays of IBD therapy for years and are used to treat most IBD patients initially identified. Anti-inflammatory properties of their form a vital plank and assist in management of inflammation within the gastrointestinal tract thereby helping in eradicating inflammation signs and achieving remission among the patients. More so, as care providers and other healthcare facilities press on the requisite for early administration of IBD to avoid aggravation of the disease, Aminosalicylates are expected to be in demand. In addition there is constant development of new formulation and delivery systems of Aminosalicylates which is set to improve market positioning.

Inflammatory Bowel Disease Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- According to the study, North America is the largest revenue generating market of Inflammatory Bowel Disease in 2023 with a market share of approximately 40%. This dominance is explainable by high IBD incidence in the identified countries, as well as highly developed healthcare, and the increased level of both clinical trials and research dedicated to the finding of new IBD treatment methods. The United States has well-developed market for IBD treatment due to formulated research focus and policies for reimbursement concerning latest and effective therapeutic interventions. Moreover, the rise in the diagnosis of IBD through improved healthcare practitioner and public knowledge influences early drug prescription and comprehensive market expansion in this region.

Active Key Players in the Inflammatory Bowel Disease Market:

- AbbVie (USA)

- Amgen Inc. (USA)

- Bristol-Myers Squibb Company (USA)

- Celgene Corporation (USA)

- Eli Lilly and Company (USA)

- Ferring Pharmaceuticals (Switzerland)

- Gilead Sciences, Inc. (USA)

- Johnson & Johnson (USA)

- Merck & Co., Inc. (USA)

- Mylan N.V. (USA)

- Pfizer Inc. (USA)

- Roche Holding AG (Switzerland)

- Sandoz (Germany)

- Sanofi (France)

- Takeda Pharmaceutical Company Limited (Japan)

- Other Active Players

|

Inflammatory Bowel Disease Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 20.8 Billion |

|

Forecast Period 2024-32 CAGR: |

3.8% |

Market Size in 2032: |

USD 29.1 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Drug Class |

|

||

|

By Route of Administration |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Inflammatory Bowel Disease Market by Type

4.1 Inflammatory Bowel Disease Market Snapshot and Growth Engine

4.2 Inflammatory Bowel Disease Market Overview

4.3 Crohn’s Disease

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Crohn’s Disease: Geographic Segmentation Analysis

4.4 Ulcerative Colitis

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Ulcerative Colitis: Geographic Segmentation Analysis

Chapter 5: Inflammatory Bowel Disease Market by Drug Class

5.1 Inflammatory Bowel Disease Market Snapshot and Growth Engine

5.2 Inflammatory Bowel Disease Market Overview

5.3 Aminosalicylates

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Aminosalicylates: Geographic Segmentation Analysis

5.4 Corticosteroids

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Corticosteroids: Geographic Segmentation Analysis

5.5 TNF inhibitors

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 TNF inhibitors: Geographic Segmentation Analysis

5.6 IL inhibitors

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 IL inhibitors: Geographic Segmentation Analysis

5.7 Anti-integrin

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Anti-integrin: Geographic Segmentation Analysis

5.8 JAK inhibitors

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 JAK inhibitors: Geographic Segmentation Analysis

5.9 Other

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 Other: Geographic Segmentation Analysis

Chapter 6: Inflammatory Bowel Disease Market by Route of Administration

6.1 Inflammatory Bowel Disease Market Snapshot and Growth Engine

6.2 Inflammatory Bowel Disease Market Overview

6.3 Oral

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Oral: Geographic Segmentation Analysis

6.4 Injectable

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Injectable: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Inflammatory Bowel Disease Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABBVIE (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 JOHNSON & JOHNSON (USA)

7.4 TAKEDA PHARMACEUTICAL COMPANY LIMITED (JAPAN)

7.5 BRISTOL-MYERS SQUIBB COMPANY (USA)

7.6 OTHER ACTIVE PLAYERS

Chapter 8: Global Inflammatory Bowel Disease Market By Region

8.1 Overview

8.2. North America Inflammatory Bowel Disease Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Crohn’s Disease

8.2.4.2 Ulcerative Colitis

8.2.5 Historic and Forecasted Market Size By Drug Class

8.2.5.1 Aminosalicylates

8.2.5.2 Corticosteroids

8.2.5.3 TNF inhibitors

8.2.5.4 IL inhibitors

8.2.5.5 Anti-integrin

8.2.5.6 JAK inhibitors

8.2.5.7 Other

8.2.6 Historic and Forecasted Market Size By Route of Administration

8.2.6.1 Oral

8.2.6.2 Injectable

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Inflammatory Bowel Disease Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Crohn’s Disease

8.3.4.2 Ulcerative Colitis

8.3.5 Historic and Forecasted Market Size By Drug Class

8.3.5.1 Aminosalicylates

8.3.5.2 Corticosteroids

8.3.5.3 TNF inhibitors

8.3.5.4 IL inhibitors

8.3.5.5 Anti-integrin

8.3.5.6 JAK inhibitors

8.3.5.7 Other

8.3.6 Historic and Forecasted Market Size By Route of Administration

8.3.6.1 Oral

8.3.6.2 Injectable

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Inflammatory Bowel Disease Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Crohn’s Disease

8.4.4.2 Ulcerative Colitis

8.4.5 Historic and Forecasted Market Size By Drug Class

8.4.5.1 Aminosalicylates

8.4.5.2 Corticosteroids

8.4.5.3 TNF inhibitors

8.4.5.4 IL inhibitors

8.4.5.5 Anti-integrin

8.4.5.6 JAK inhibitors

8.4.5.7 Other

8.4.6 Historic and Forecasted Market Size By Route of Administration

8.4.6.1 Oral

8.4.6.2 Injectable

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Inflammatory Bowel Disease Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Crohn’s Disease

8.5.4.2 Ulcerative Colitis

8.5.5 Historic and Forecasted Market Size By Drug Class

8.5.5.1 Aminosalicylates

8.5.5.2 Corticosteroids

8.5.5.3 TNF inhibitors

8.5.5.4 IL inhibitors

8.5.5.5 Anti-integrin

8.5.5.6 JAK inhibitors

8.5.5.7 Other

8.5.6 Historic and Forecasted Market Size By Route of Administration

8.5.6.1 Oral

8.5.6.2 Injectable

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Inflammatory Bowel Disease Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Crohn’s Disease

8.6.4.2 Ulcerative Colitis

8.6.5 Historic and Forecasted Market Size By Drug Class

8.6.5.1 Aminosalicylates

8.6.5.2 Corticosteroids

8.6.5.3 TNF inhibitors

8.6.5.4 IL inhibitors

8.6.5.5 Anti-integrin

8.6.5.6 JAK inhibitors

8.6.5.7 Other

8.6.6 Historic and Forecasted Market Size By Route of Administration

8.6.6.1 Oral

8.6.6.2 Injectable

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Inflammatory Bowel Disease Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Crohn’s Disease

8.7.4.2 Ulcerative Colitis

8.7.5 Historic and Forecasted Market Size By Drug Class

8.7.5.1 Aminosalicylates

8.7.5.2 Corticosteroids

8.7.5.3 TNF inhibitors

8.7.5.4 IL inhibitors

8.7.5.5 Anti-integrin

8.7.5.6 JAK inhibitors

8.7.5.7 Other

8.7.6 Historic and Forecasted Market Size By Route of Administration

8.7.6.1 Oral

8.7.6.2 Injectable

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Inflammatory Bowel Disease Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 20.8 Billion |

|

Forecast Period 2024-32 CAGR: |

3.8% |

Market Size in 2032: |

USD 29.1 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Drug Class |

|

||

|

By Route of Administration |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||