Infant Formula Market Synopsis

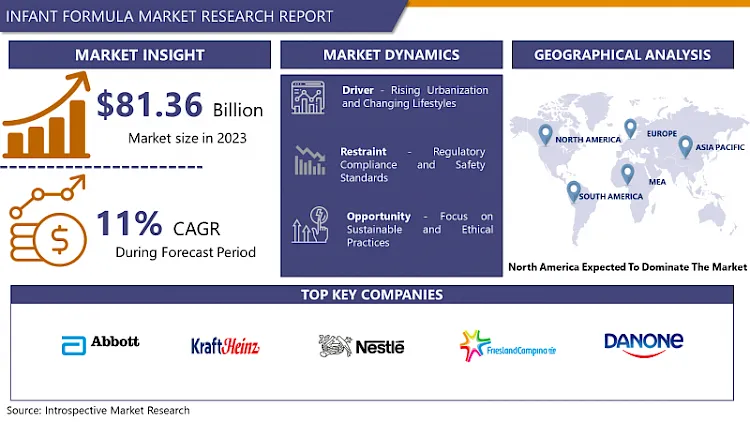

Infant Formula Market Size Was Valued at USD 90.31 Billion in 2024, and is Projected to Reach 208.11 Billion by 2032, Growing at a CAGR of 11% From 2025-2032.

Infant formula is a specially designed milk that is given to babies that do not breast feed, or who need additional food due to a ailment, or other reason. It ordinarily comprises different proportions of proteins, carbohydrates, fats, vitamins, and minerals necessary for the development of an infant. It is good to understand that there are several types of formulas that includes the cow’s milk-based formulas, soy-based formulas and others that are recommended for special needy cases. Stored with the intention of mirroring breast milk as closely as possible, the formula seeks to provide necessary nutrients for the proper growth and development of newborns and infants.

The infant formula market is a significant category and is expanding at a fast pace globally due to various factors such as changing life patterns, increasing per capita income levels, trend of urbanization, and enhanced consciousness about the nutritious needs of infants. Babies’ formula or baby food is a product meant for feeding babies since breast milk is not available to them, and they contain nutrients in form of vitamins needed for proper development and growth of the babies.

Another trend that contributes to the continual expansion of the volume of sales in the infant formula market is the growing number of working mothers, especially in big cities, who feed their babies only formula because it is much easier and saves time in comparison with breastfeeding. Furthermore, the rising global incidence of lactose intolerance and milk allergies especially in infant forcing a shift towards more diversified infant formulas include soy or hypoallergenic formulas.

On the basis of product segmentation, the market is vast with products targeting each age group of infants and the nutritional needs of the infant. There are different categories of formulas: powder, liquid concentrate and regardless of the type, all formulas are either good for parent’s convenience and consumer preferences. In addition, there has been an increased technological advancement in food production that sees manufactures put forward new products in the market with improved nutritional value better organic sources and other improved functional attributes to meet consumer preferences

Based on regional distribution, the Asia-Pacific region holds the largest share in the infant formula market worldwide due to the factors such as, large population, higher birth rates, and growing trend of the usage of the infant formula in countries like China and India. However, other areas including North America and Europe also comprises of impressive market shares due to toned up consumer purchasing power as well as enhanced perception regarding nutritional requirements of infants.

The market as it present currently is considerably saturated because it is highly fragmented with numerous global and regional leading players. Some of the market players include Nestlé S. A., Danone S. A, Abbott Laboratories ,Reckitt Benckiser Group plc, Mead Johnson Nutrition Company. These companies offer products that are usually differentiated by the quality, price quality, brand image, availability channels and marketing techniques that are used.

However, the infant formula market is not exempted from some challenges including tight regulatory measures relating to food safety, quality issues regarding food products, and the entrance of breast milk substitutes such as human milk banks or donor milk. Also controversy such as the unethical cases of promoting infant formula in the Third World especially with techniques like increasing birth rates have forced many organizations to limit their advertising through more restrictions and accurate information provision.

Therefore, the infant formula market should continue its upward trend due to the following factors; high urbanization, elevated birth rates, increasing per capita income levels, as well as a fast-growing population of working mothers. However, the buying sector is also expected to have more actions be taken by the regulatory bodies and consumer watchdog agencies as the latter has continued to observe manufactories’ persuasive and unveiling strategies and practices. In conclusion, the overall global market for infant formula remains a promising one, with enormous potential not only in sales and growth but also in innovation and diversification, given that players in this industry are positioned to overcome the myriad challenges that have derived from shifting consumer demands and expectations as well as the constantly shifting regulatory architecture of food industries around the globe.

.webp)

Infant Formula Market Trend Analysis

Rising Popularity of Specialty and Functional Infant Formulas

- Focusing on the IFA market, it is necessary to accentuate the volume of shares belonging to specialty and functional formulas, which have been receiving competitive amounts of attention in the last few years. The change in the second year consumption of juice can be attributed to the following reasons: there is increasing parental concern about early childhood nutrition and the quest for value added products. This is especially because there are specialty formulas that are developed to suit the needs of infants who have food sensitivities like lactose intolerance or those infants who suffers from the cow’s milk protein allergy because they need to be fed on foods that will not cause allergic reactions while at the same time being very healthy for them. Furthermore, functional formulas are receiving more attention because of what they bring to the nutrition table such as cognitive functions or immune system boosting capabilities. In general, parents are shifting towards more individualized nutrition wants for their babies, the specialty and functional infant formula is likely to fuel growth in the focalized category and propel product differentiation in the market.

- The progressive discovery of scientific effects and engineering helps producers to create the infant formulas which components can resemble to the breast milk. More often, these formulas include prebiotics, probiotics, the beneficial fats, and other necessary nutrients required by a developing baby. The advantages of such formulas include the promotion of the complete and balanced diet that would have a positive impact on the physical and mental growth of the child; besides those formulas provide the guarantee of nutritional security to the parents who are unable to breast feed the child exclusively. Also, specialty and functional infant formulas’ convenience and availability create consumer appeal for parents who need suitable subgroups of the traditional milk. Thus, the market of infant formula is gradually changing, there is not only focusing on the mass production of standard milk formula but also progressing towards the segmentation of the products with Relation to specialty and functional infant formulas which are more innovative and interesting to the parents and other caretakers of an infant.

Focus on Sustainable and Ethical Practices

- The importance of the new and different elements which are the key indicators of ethical and sustainable infant formula is evident in the modern market. Many manufacturers have been placing a higher emphasis on sustainability in the organization, especially concerning purchasing materials, making products and delivering goods. This covers aspects such as administering green packaging, lowering carbon footprint, and sustainable procurement of various materials like organic milk and products from plant sources. Also, macro factors such as consumers’ ethical beliefs including and involving issues to fair labor and animal rights are becoming more important as they impact the buying behaviours and brand preferences.

- To address such shifts in demand, there are efforts being put in by manufacturers in the industry to explore formulistic environmental improvement with compilations that fit nutritional value production while at the same time observing bearing impact. This involves learning new types of protein molecules to include in foods, increasing the rate at which protein products are processed and handing out information regarding sustainability of the protein products to the consumers. However, it is now increasingly common to work with NGOs and certification bodies to support the authenticity of ethical statements and the constant requirements towards socially sensitive issues. This work further asserts that the infant formula industry is on the right track towards sustained ethical improvement as sustainability and ethics remain emerging trends in consumerism.

Infant Formula Market Segment Analysis:

Infant Formula Market is segmented based on Product Type, Source, Form, Distribution Channels, and Region.

By Product Type, First Infant Formula segment is expected to dominate the market during the forecast period

- The most critical strategies in the infant formula market segmentation, it is Categorization by Product Type which forms a broad framework for segmenting the consumers and their requirement. First Infant Formula mainly to feed the child from birth up to about six months and is formulated to match human breast milk as it contains nutrients that might be taken by a new born baby. Follow-on Formula comes in to play as a complementary food, once the infant has started taking other foods which may include; complementary foods that contains complementary nutrients that are required for the growth and development of the infant. For children aged between one to three years, there is the Growing-up Formula to complement their diet by providing the nutrients that will make the kids grow even more. Hydrolyzed formulas are unique when it comes to specialty baby formula in terms of sensitivities or medical concerns that a baby may have. This helps the manufacturers to make formulation which addresses the nutritive requirements of every age of infancy and health issues which the group encounters making it very effective in covering the whole infancy segment.

- The cross-analysis of these product types shows different trends in the market rise due to the fluctuations in consumer preferences over time, restrictions regarding the consumption of foods intended for children, and the general population’s awareness of a product’s necessity or availability without a prescription. First, Infant Formula who has a relatively high market share because it is necessary for babies, especially when mothers cannot breast-feed and has been recommended by various health experts. Consumption of Follow-on Formula is buoyant with infants advancing through the stages of feeding and Growing-up Formula also holds a stable market, supporting the nutritional demands of toddlers. The Specialty Baby Formula, though a niche category, is experiencing growth due to the prevalence of these issues and the parents growing concern towards allergens and intolerances in babies. Altogether, such a division helps to promote consistent and suitable sales campaigns, product development, and continual adaptation that can maintain the market’s fluidity and development in providing infant formula.

By Source, Cow Milk segment held the largest share in 2024

- The Infant formula market involves so many factors that play an important role towards it and among this the kind of source of the formula is so crucial. Looking at these sources it is evident that cow milk is the leading one to the market since it is easily available in the market and is well renowned for providing necessary nutrients. It also forms the backbone of many infant formulas and is thus favored by a considerable number of customers. The soy-based formulas are therefore used for infants who cannot tolerate lactose or milk protein, thus coming as a result of accounting for a large fraction of overall consumption. Cow’s milk or soy based protein hydrolysates, are used for particular requirement of the infants whether they are allergic to proteins. Beginner goat- and camel-based baby formula products may be gaining consumers’ attention because of their perceived health benefits, especially when fed to sensitive babies. Furthermore, there are formulating from other sources in the market, which further demonstrate that the market is constantly searching for new directions to develop new products to satisfy the consumers’ different needs as well as nutrient needs.

- Nevertheless, the final point has unique roles for consumers, regulations, and culture as influential factors of the market. Cow milk is however more popular than ever with an emerging market in goat milk and camel milk due to health consciousness. Also, owing to the growing incidence of lactose intolerance and food Allergies, soy based formulas are experiencing a steady rise in demand. While protein hydrolysates are relatively small market segment, they serve the specialised needs of infants who require special consumption products, and thus can also help to diversify the market. The growth in the Infant Formula market suggests that manufacturers are most likely to try to introduce new products, improve the quality, and actively promote their goods, taking into account all the needs and tendencies in the global market.

Infant Formula Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Several factors have contributed to why North America is forecasted to lead in the market share of infant formula in the Asia Pacific region. First of all, it is crucial to recognize that the region provides a solid foundation for the development of healthcare and nutrition, which guarantees the high availability of the identified product among most consumers interested in the purchase of the goods. Furthermore, the increasing parental concern for the health of the child, particularly with regard to the effects of proper nutrition on infants, along with higher levels of disposable income, influence the sales of the superior-quality and expensive infant formulas in North America. Furthermore, the regulatory structure of the region is quite sound and only standard and quality products are allowed into the market, and this helps consumers and others to gain confidence in the infant formula products, thus fostering the growth of the market.

- In addition, market growth in North America is supported by constant developments in the manufacturing of the infant formulas that target customer demands appropriately in a continuous manner. Some new trends prevailing in the regional markets include breastfeeding alongside supplementing infant food with infant formula, thus fueling the market growth. This has been further supported by strategies that various stakeholders in the industry have been implementing, including launching new products, creating brand image, and forming linkages for production and distribution of infant formulas in North America. Thus, North America remains in a strong position to retain its position as the largest consumer of IFE in the global market in the forecast period.

Active Key Players in the Infant Formula Market

- Abbott Nutrition. (US)

- The Kraft Heinz Company.(US)

- Nestle S.A.(Switzerland)

- FrieslandCampina N.V. Group (Netherlands)

- Danone S.A (France)

- Synutra International Inc.(US)

- Mead Johnson Nutrition.(US)

- Meiji Holdings Co. Ltd (Japan)

- Beingmate Baby & Child Food Co. Ltd.(China)

- Pfizer Inc.(US)

- Yili Group (China)

- Bellamy's Organic (Australia)

- Other Active Players

Key Industry Developments in the Infant Formula Market

- In October 2023, the Fingy3D startup firm, managed by Mon Health's Intermed Labs, will continue to position West Virginia at the forefront of medical technology. The firm offers online purchasing of 3D-printed prosthetic fingers through Mon Health's Intermed Labs. The worldwide event received entries from 21 nations and states, with five finalists competing for a $350,000 prize.

- In September 2023, scientists at the Lawrence Livermore National Laboratory (LLNL) and Meta created a new form of 3D printed material for real-world wearable applications. These novel materials can replicate biological materials, which may have implications for the future of enhanced humanity.

|

Global Infant Formula Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 90.31 Bn. |

|

Forecast Period 2025-32 CAGR: |

11.00% |

Market Size in 2032: |

USD 208.12 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Source |

|

||

|

By Form |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Infant Formula Market by Product Type (2018-2032)

4.1 Infant Formula Market Snapshot and Growth Engine

4.2 Market Overview

4.3 First Infant Formula

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Follow-on Formula

4.5 Growing-up Formula

4.6 Specialty Ba

Chapter 5: Infant Formula Market by Formula (2018-2032)

5.1 Infant Formula Market Snapshot and Growth Engine

5.2 Market Overview

5.3

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

Chapter 6: Infant Formula Market by Source (2018-2032)

6.1 Infant Formula Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Cow Milk

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Soy

6.5 Protein Hydrolysates

6.6 Goat Milk

6.7 Camel Milk

6.8 Others

Chapter 7: Infant Formula Market by Form (2018-2032)

7.1 Infant Formula Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Powder

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Liquid & Semi-Liquid

7.5 Ready-To-Drink

Chapter 8: Infant Formula Market by Distribution Channels (2018-2032)

8.1 Infant Formula Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Hypermarkets/Supermarkets

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Online Stores

8.5 Pharmacy/Medical Stores

8.6 Specialty Stores

8.7 Others

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Infant Formula Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 INDENA (ITALY)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 DSM (NETHERLANDS)

9.4 AMAX NUTRASOURCE (USA)

9.5 FRUTAROM (ISRAEL)

9.6 BIOSERAE (FRANCE)

9.7 LAYN NATURAL INGREDIENTS ( USA)

9.8 DUPONT-DANISCO ( USA)

9.9 FUTURECEUTICALS ( USA)

9.10 HERZA SCHOKOLADE (GERMANY)

9.11 MARTIN BAUER GROUP(GERMANY)

9.12 NATUREX (FRANCE)

9.13 PRINOVA ( USA)

9.14 SABINSA (INDIA)

9.15 SEPPIC (FRANCE)

9.16 OTHER KEY PLAYERS

9.17

Chapter 10: Global Infant Formula Market By Region

10.1 Overview

10.2. North America Infant Formula Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Product Type

10.2.4.1 First Infant Formula

10.2.4.2 Follow-on Formula

10.2.4.3 Growing-up Formula

10.2.4.4 Specialty Ba

10.2.5 Historic and Forecasted Market Size by Formula

10.2.5.1

10.2.6 Historic and Forecasted Market Size by Source

10.2.6.1 Cow Milk

10.2.6.2 Soy

10.2.6.3 Protein Hydrolysates

10.2.6.4 Goat Milk

10.2.6.5 Camel Milk

10.2.6.6 Others

10.2.7 Historic and Forecasted Market Size by Form

10.2.7.1 Powder

10.2.7.2 Liquid & Semi-Liquid

10.2.7.3 Ready-To-Drink

10.2.8 Historic and Forecasted Market Size by Distribution Channels

10.2.8.1 Hypermarkets/Supermarkets

10.2.8.2 Online Stores

10.2.8.3 Pharmacy/Medical Stores

10.2.8.4 Specialty Stores

10.2.8.5 Others

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Infant Formula Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Product Type

10.3.4.1 First Infant Formula

10.3.4.2 Follow-on Formula

10.3.4.3 Growing-up Formula

10.3.4.4 Specialty Ba

10.3.5 Historic and Forecasted Market Size by Formula

10.3.5.1

10.3.6 Historic and Forecasted Market Size by Source

10.3.6.1 Cow Milk

10.3.6.2 Soy

10.3.6.3 Protein Hydrolysates

10.3.6.4 Goat Milk

10.3.6.5 Camel Milk

10.3.6.6 Others

10.3.7 Historic and Forecasted Market Size by Form

10.3.7.1 Powder

10.3.7.2 Liquid & Semi-Liquid

10.3.7.3 Ready-To-Drink

10.3.8 Historic and Forecasted Market Size by Distribution Channels

10.3.8.1 Hypermarkets/Supermarkets

10.3.8.2 Online Stores

10.3.8.3 Pharmacy/Medical Stores

10.3.8.4 Specialty Stores

10.3.8.5 Others

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Infant Formula Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Product Type

10.4.4.1 First Infant Formula

10.4.4.2 Follow-on Formula

10.4.4.3 Growing-up Formula

10.4.4.4 Specialty Ba

10.4.5 Historic and Forecasted Market Size by Formula

10.4.5.1

10.4.6 Historic and Forecasted Market Size by Source

10.4.6.1 Cow Milk

10.4.6.2 Soy

10.4.6.3 Protein Hydrolysates

10.4.6.4 Goat Milk

10.4.6.5 Camel Milk

10.4.6.6 Others

10.4.7 Historic and Forecasted Market Size by Form

10.4.7.1 Powder

10.4.7.2 Liquid & Semi-Liquid

10.4.7.3 Ready-To-Drink

10.4.8 Historic and Forecasted Market Size by Distribution Channels

10.4.8.1 Hypermarkets/Supermarkets

10.4.8.2 Online Stores

10.4.8.3 Pharmacy/Medical Stores

10.4.8.4 Specialty Stores

10.4.8.5 Others

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Infant Formula Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Product Type

10.5.4.1 First Infant Formula

10.5.4.2 Follow-on Formula

10.5.4.3 Growing-up Formula

10.5.4.4 Specialty Ba

10.5.5 Historic and Forecasted Market Size by Formula

10.5.5.1

10.5.6 Historic and Forecasted Market Size by Source

10.5.6.1 Cow Milk

10.5.6.2 Soy

10.5.6.3 Protein Hydrolysates

10.5.6.4 Goat Milk

10.5.6.5 Camel Milk

10.5.6.6 Others

10.5.7 Historic and Forecasted Market Size by Form

10.5.7.1 Powder

10.5.7.2 Liquid & Semi-Liquid

10.5.7.3 Ready-To-Drink

10.5.8 Historic and Forecasted Market Size by Distribution Channels

10.5.8.1 Hypermarkets/Supermarkets

10.5.8.2 Online Stores

10.5.8.3 Pharmacy/Medical Stores

10.5.8.4 Specialty Stores

10.5.8.5 Others

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Infant Formula Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Product Type

10.6.4.1 First Infant Formula

10.6.4.2 Follow-on Formula

10.6.4.3 Growing-up Formula

10.6.4.4 Specialty Ba

10.6.5 Historic and Forecasted Market Size by Formula

10.6.5.1

10.6.6 Historic and Forecasted Market Size by Source

10.6.6.1 Cow Milk

10.6.6.2 Soy

10.6.6.3 Protein Hydrolysates

10.6.6.4 Goat Milk

10.6.6.5 Camel Milk

10.6.6.6 Others

10.6.7 Historic and Forecasted Market Size by Form

10.6.7.1 Powder

10.6.7.2 Liquid & Semi-Liquid

10.6.7.3 Ready-To-Drink

10.6.8 Historic and Forecasted Market Size by Distribution Channels

10.6.8.1 Hypermarkets/Supermarkets

10.6.8.2 Online Stores

10.6.8.3 Pharmacy/Medical Stores

10.6.8.4 Specialty Stores

10.6.8.5 Others

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Infant Formula Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Product Type

10.7.4.1 First Infant Formula

10.7.4.2 Follow-on Formula

10.7.4.3 Growing-up Formula

10.7.4.4 Specialty Ba

10.7.5 Historic and Forecasted Market Size by Formula

10.7.5.1

10.7.6 Historic and Forecasted Market Size by Source

10.7.6.1 Cow Milk

10.7.6.2 Soy

10.7.6.3 Protein Hydrolysates

10.7.6.4 Goat Milk

10.7.6.5 Camel Milk

10.7.6.6 Others

10.7.7 Historic and Forecasted Market Size by Form

10.7.7.1 Powder

10.7.7.2 Liquid & Semi-Liquid

10.7.7.3 Ready-To-Drink

10.7.8 Historic and Forecasted Market Size by Distribution Channels

10.7.8.1 Hypermarkets/Supermarkets

10.7.8.2 Online Stores

10.7.8.3 Pharmacy/Medical Stores

10.7.8.4 Specialty Stores

10.7.8.5 Others

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Infant Formula Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 90.31 Bn. |

|

Forecast Period 2025-32 CAGR: |

11.00% |

Market Size in 2032: |

USD 208.12 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Source |

|

||

|

By Form |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||