India Biomass Briquettes Market Synopsis:

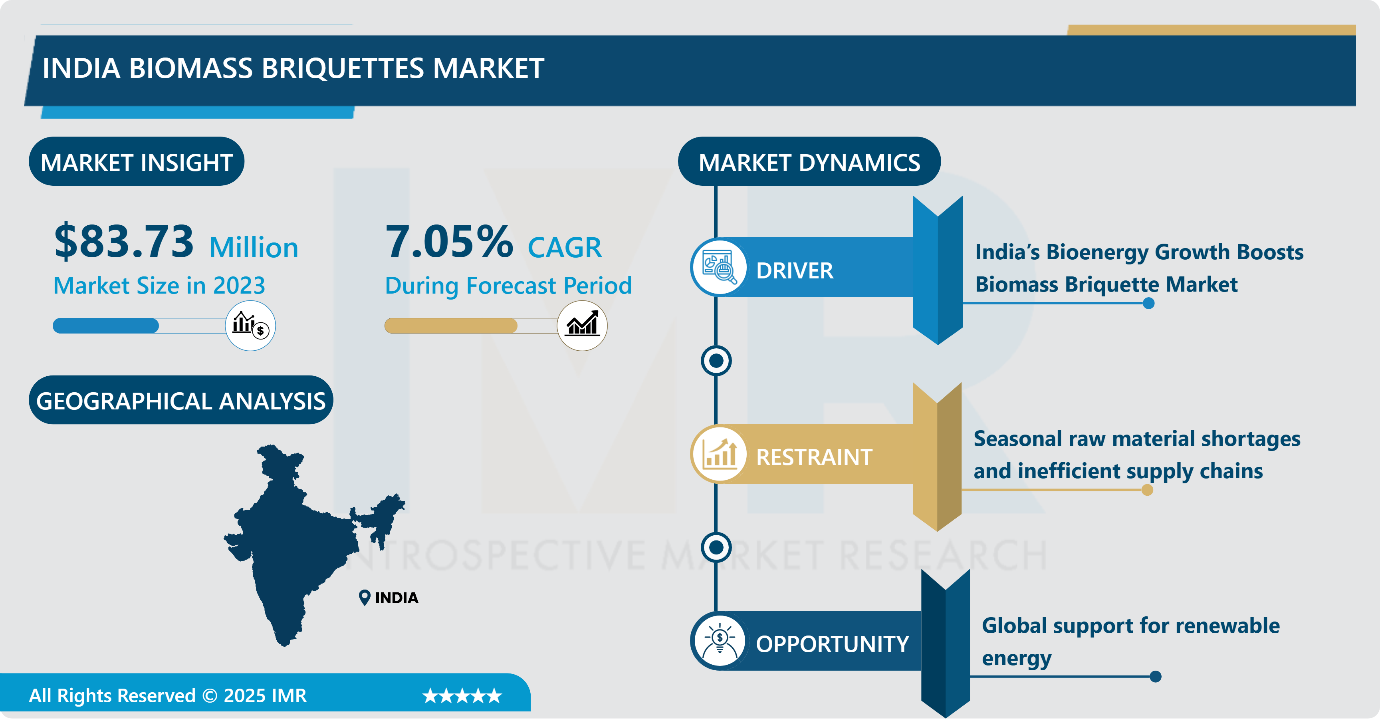

India Biomass Briquettes Market Size Was Valued at USD 83.73 Million in 2023 and is Projected to Reach USD 153.55 Million by 2032, Growing at a CAGR of 7.05% From 2024-2032.

Biomass briquettes are a renewable source of energy produced from agricultural and forestry waste such as wheat, straw, cotton stalks, wood chips, sawdust, etc. These briquettes can be used in place of firewood and charcoal to generate heat and electricity.

Biomass briquettes and pellets are key in developing sustainable energy alternatives for renewable power systems. Organic materials including wood together with agricultural residues and industrial waste contribute to the creation of both biomass forms which deliver sustainable energy-saving packages. The production chain and material base of briquettes and pellets share similarities, yet their material composition produces substantial physical differences which drive various economic values and industrial applications between them.

Biomass briquettes utilize large size and lower density to meet industrial needs, but residential heating alongside small-scale power generation requires the high-density pellets. The Indian briquettes and pellets market demonstrates stable development through the Compound Annual Growth Rate (CAGR) which shows expanding usage among different industries. The Indian briquettes market grows because government policies include subsidies and incentive programs that expand the market while empowering small and medium enterprises.

The growing production capacity positions India to satisfy the expanding market need for environmentally friendly renewable energy solutions through briquettes. The Indian market for briquettes will experience remarkable growth because industries actively search for sustainable fuel alternatives for their operations.

India Biomass Briquettes Market Growth and Trend Analysis:

India’s Bioenergy Growth Boosts Biomass Briquette Market

- The rise of biogas and biomass-based power generation technologies promotes biofuel market expansion primarily through biomass briquette demand used for heating systems and power production as well as industrial processes. The increase in bioenergy capacity finds precise alignment with biomass briquettes produced from organic waste materials including agricultural residue along with wood chips because these sectors work jointly to lower fossil fuel dependency and advance sustainable renewable power generation. The existing market conditions position India strongly for biomass briquette market leadership during the upcoming years. The biomass briquette market will become a dominant force in global industries as India promotes renewable energy development and expands its bioenergy capacity.

- India has reached 209.44 GW of renewable energy capacity by December 2024 through significant growth of 15.84% since 2023. The increase in bioenergy capacity stands as the primary driver behind renewable energy growth since December 2023 when bioenergy reached 10.84 GW until December 2024 when it rose to 11.35 GW with a corresponding 4.70% growth. A rise in bioenergy capacity has an immediate effect on increasing biomass industry size including biomass briquettes.

Seasonal raw material shortages and inefficient supply chains

- Large quantities of agricultural residues sustain biomass resources during times of the year which generally occur after harvesting periods. Raw material availability declines beyond seasonal periods thus influencing both supply quantity and costs typically rise during these periods of restricted raw material access. Seasonal trends in biomass production create obstacles to sustained pellet manufacturing which impacts the total market expansion potential.

- Biomass relies on a complex supply chain that spans collection, storage, transportation, and conversion into pellets. However, due to the decentralized nature of biomass production (largely sourced from rural areas), creating a reliable supply chain becomes difficult. Inconsistent or inefficient supply chains create bottlenecks in biomass pellet production and delivery to thermal power plants. A lack of infrastructure and transportation links can result in an imbalance of supply, limiting access to power plants that require a constant, uninterrupted supply of pellets.

Global support for renewable energy

- A rising number of countries actively support renewable energy and sustainable practices which drives the biomass briquette market expansion worldwide. Biomass briquette manufacturers find new business opportunities through international partnerships which help them reach different markets. The industry's global expansion provides new distribution prospects that boost the overall development capabilities of biomass briquette manufacturers.

- The biomass briquette industry faces a bright outlook because governments support renewable energy initiatives and advanced technology combined with growing demand and environmental advantages while showing expanded marketplace potential. The energy future of the world depends heavily on biomass briquettes since they serve as an essential element in modern sustainable power systems. Businesses in this sector provide substantial prospects for all stakeholders looking to advance renewable energy while building a sustainable future.

India Biomass Briquettes Market Segment Analysis:

India Biomass Briquettes Market is segmented based on Feedstock, application, and region

By Feedstock, Agriculture Waste segment is expected to dominate the market during the forecast period

- The raw material base for biomass briquette production in India can be sustained by its massive crop residue generation estimated at 500–550 million Tons (MT) yearly as per the MNRE study and its additional yearly surplus of 228 MT. Agricultural waste transformed from all major agro-processing industries such as rice mills and oil mills combined with sugarcane processing facilities and other food processors becomes fundamental for industry growth.

- The Agriculture Waste segment is expected to hold a dominant position in the Indian biomass briquettes market throughout the forecast period, driven by its abundant availability and the growing demand for green energy solutions. The economic value of agricultural residues is estimated to exceed USD 32 million annually, although only 60% of this waste is currently utilized. The market's leadership can be further reinforced through government support and increasing environmental awareness regarding the energy potential of agricultural waste.

By Application, the Power Generation segment held the largest share in 2023

- Biomass briquettes are emerging as a major source of green energy in India because of the ease of raw material availability. The Indian government’s push to increase biomass briquette for co-firing in thermal power plants has given a boost to the industry. The industry can overcome current logistical and supply challenges through digitization, production incentives, and inventory and demand planning

- In the context of power generation, biomass briquettes play a pivotal role in India's efforts to transition to renewable energy and reduce its dependence on fossil fuels. As part of the National Bioenergy Programme, the government has focused on promoting biomass-based power generation through the Biomass Programme, which supports the manufacturing of briquettes and pellets. These biomass briquettes, made from agricultural residues and other biomass waste, are used to co-fire with coal in thermal power plants, significantly contributing to cleaner power generation. This initiative aligns with India’s ambitious target of achieving 50% of its electricity capacity from non-fossil fuel sources by 2030.

India Biomass Briquettes Market Active Players:

- Briquetting Plant India

- EcoStan

- Ecostan India

- GEMCO Energy

- GEO Green Power

- Green India Tech

- Hi-Tech Engineers

- Indian Biomass Pellets

- Jay Khodiyar Group

- K. R. Associates

- KPR Briquettes

- Radhe Industrial Corporation

- Ravi Engineering Works

- Renewable Energy Systems India Pvt Ltd

- Ronak Engineering

- Sambhav Energy

- Shree Vishwakarma Engineering

- Sree Engineering Works

- Universal Biofuels

- Vira Engineering

- Other Active Players

Key Industry Developments in the India Biomass Briquettes Market:

- In July 2024, in a push to ‘waste to wealth’ drive of the government, the Bhubaneswar Municipal Corporation (BMC) has planned to produce biomass briquettes by processing the green waste generated in the capital city separately.

- In April 2024, Vedanta Aluminium, India’s largest producer of aluminum, is making its fuel mix more sustainable with the deployment of biomass briquettes for power generation. The company is now utilizing 20 tonnes of biomass briquettes per day at its world-class alumina refinery in Lanjigarh, Odisha. This will help potentially decrease the unit’s greenhouse gas (GHG) emissions by more than 10,000 tonnes of CO2 equivalent each year, in addition to reducing its reliance on fossil fuels. On Earth Day 2024, this comes as a significant step forward in the company’s journey to achieve Net Zero Carbon by 2050 or sooner.

|

India Biomass Briquettes Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 83.73 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.05 % |

Market Size in 2032: |

USD 153.55 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Biomass Briquettes Market by Type

4.1 Biomass Briquettes Market Snapshot and Growth Engine

4.2 Biomass Briquettes Market Overview

4.3 Sawdust Biomass Briquette

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Sawdust Biomass Briquette: Geographic Segmentation Analysis

4.4 Agromass Biomass Briquettes

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Agromass Biomass Briquettes: Geographic Segmentation Analysis

4.5 and Wood Biomass Briquettes

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 and Wood Biomass Briquettes: Geographic Segmentation Analysis

Chapter 5: Biomass Briquettes Market by Feedstock

5.1 Biomass Briquettes Market Snapshot and Growth Engine

5.2 Biomass Briquettes Market Overview

5.3 Agriculture Waste

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Agriculture Waste: Geographic Segmentation Analysis

5.4 Wood and Woody Residue

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Wood and Woody Residue: Geographic Segmentation Analysis

5.5 Solid Municipal Waste

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Solid Municipal Waste: Geographic Segmentation Analysis

5.6 and Other Feedstocks

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 and Other Feedstocks: Geographic Segmentation Analysis

Chapter 6: Biomass Briquettes Market by Application

6.1 Biomass Briquettes Market Snapshot and Growth Engine

6.2 Biomass Briquettes Market Overview

6.3 Power Generation

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Power Generation: Geographic Segmentation Analysis

6.4 Thermal Energy

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Thermal Energy: Geographic Segmentation Analysis

6.5 and Others

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 and Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Biomass Briquettes Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AGRO ENERGY (INDIA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BIOMASS POWER SOLUTIONS (USA)

7.4 BIOMASS SECURE POWER (CANADA)

7.5 BIOMASS UK (UNITED KINGDOM)

7.6 BMC (BIOMASS ENERGY CORPORATION) (USA)

7.7 BRIQUETTES EUROPE (FRANCE)

7.8 DRAX GROUP (UK)

7.9 ENVIVA (USA)

7.10 FUTUREMETRICS LLC (USA)

7.11 GERMAN PELLETS (GERMANY)

7.12 GRANULE GROUP (CHINA)

7.13 GREENWOOD RESOURCES (USA)

7.14 KRATON POLYMERS (USA)

7.15 PACIFIC BIOENERGY (CANADA)

7.16 RENTECH

7.17 INC. (USA)

7.18 SAMSON ENERGY (BRAZIL)

7.19 SIMEC GROUP (AUSTRALIA)

7.20 VÄXJÖ ENERGY (SWEDEN)

7.21 WESTERVELT RENEWABLE ENERGY (USA)

7.22 WOOD PELLET GROUP (DENMARK)

7.23 OTHER ACTIVE PLAYERS.

Chapter 8: Global Biomass Briquettes Market By Region

8.1 Overview

8.2. North America Biomass Briquettes Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Sawdust Biomass Briquette

8.2.4.2 Agromass Biomass Briquettes

8.2.4.3 and Wood Biomass Briquettes

8.2.5 Historic and Forecasted Market Size By Feedstock

8.2.5.1 Agriculture Waste

8.2.5.2 Wood and Woody Residue

8.2.5.3 Solid Municipal Waste

8.2.5.4 and Other Feedstocks

8.2.6 Historic and Forecasted Market Size By Application

8.2.6.1 Power Generation

8.2.6.2 Thermal Energy

8.2.6.3 and Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Biomass Briquettes Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Sawdust Biomass Briquette

8.3.4.2 Agromass Biomass Briquettes

8.3.4.3 and Wood Biomass Briquettes

8.3.5 Historic and Forecasted Market Size By Feedstock

8.3.5.1 Agriculture Waste

8.3.5.2 Wood and Woody Residue

8.3.5.3 Solid Municipal Waste

8.3.5.4 and Other Feedstocks

8.3.6 Historic and Forecasted Market Size By Application

8.3.6.1 Power Generation

8.3.6.2 Thermal Energy

8.3.6.3 and Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Biomass Briquettes Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Sawdust Biomass Briquette

8.4.4.2 Agromass Biomass Briquettes

8.4.4.3 and Wood Biomass Briquettes

8.4.5 Historic and Forecasted Market Size By Feedstock

8.4.5.1 Agriculture Waste

8.4.5.2 Wood and Woody Residue

8.4.5.3 Solid Municipal Waste

8.4.5.4 and Other Feedstocks

8.4.6 Historic and Forecasted Market Size By Application

8.4.6.1 Power Generation

8.4.6.2 Thermal Energy

8.4.6.3 and Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Biomass Briquettes Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Sawdust Biomass Briquette

8.5.4.2 Agromass Biomass Briquettes

8.5.4.3 and Wood Biomass Briquettes

8.5.5 Historic and Forecasted Market Size By Feedstock

8.5.5.1 Agriculture Waste

8.5.5.2 Wood and Woody Residue

8.5.5.3 Solid Municipal Waste

8.5.5.4 and Other Feedstocks

8.5.6 Historic and Forecasted Market Size By Application

8.5.6.1 Power Generation

8.5.6.2 Thermal Energy

8.5.6.3 and Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Biomass Briquettes Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Sawdust Biomass Briquette

8.6.4.2 Agromass Biomass Briquettes

8.6.4.3 and Wood Biomass Briquettes

8.6.5 Historic and Forecasted Market Size By Feedstock

8.6.5.1 Agriculture Waste

8.6.5.2 Wood and Woody Residue

8.6.5.3 Solid Municipal Waste

8.6.5.4 and Other Feedstocks

8.6.6 Historic and Forecasted Market Size By Application

8.6.6.1 Power Generation

8.6.6.2 Thermal Energy

8.6.6.3 and Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Biomass Briquettes Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Sawdust Biomass Briquette

8.7.4.2 Agromass Biomass Briquettes

8.7.4.3 and Wood Biomass Briquettes

8.7.5 Historic and Forecasted Market Size By Feedstock

8.7.5.1 Agriculture Waste

8.7.5.2 Wood and Woody Residue

8.7.5.3 Solid Municipal Waste

8.7.5.4 and Other Feedstocks

8.7.6 Historic and Forecasted Market Size By Application

8.7.6.1 Power Generation

8.7.6.2 Thermal Energy

8.7.6.3 and Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

India Biomass Briquettes Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 83.73 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.05 % |

Market Size in 2032: |

USD 153.55 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||