Key Market Highlights

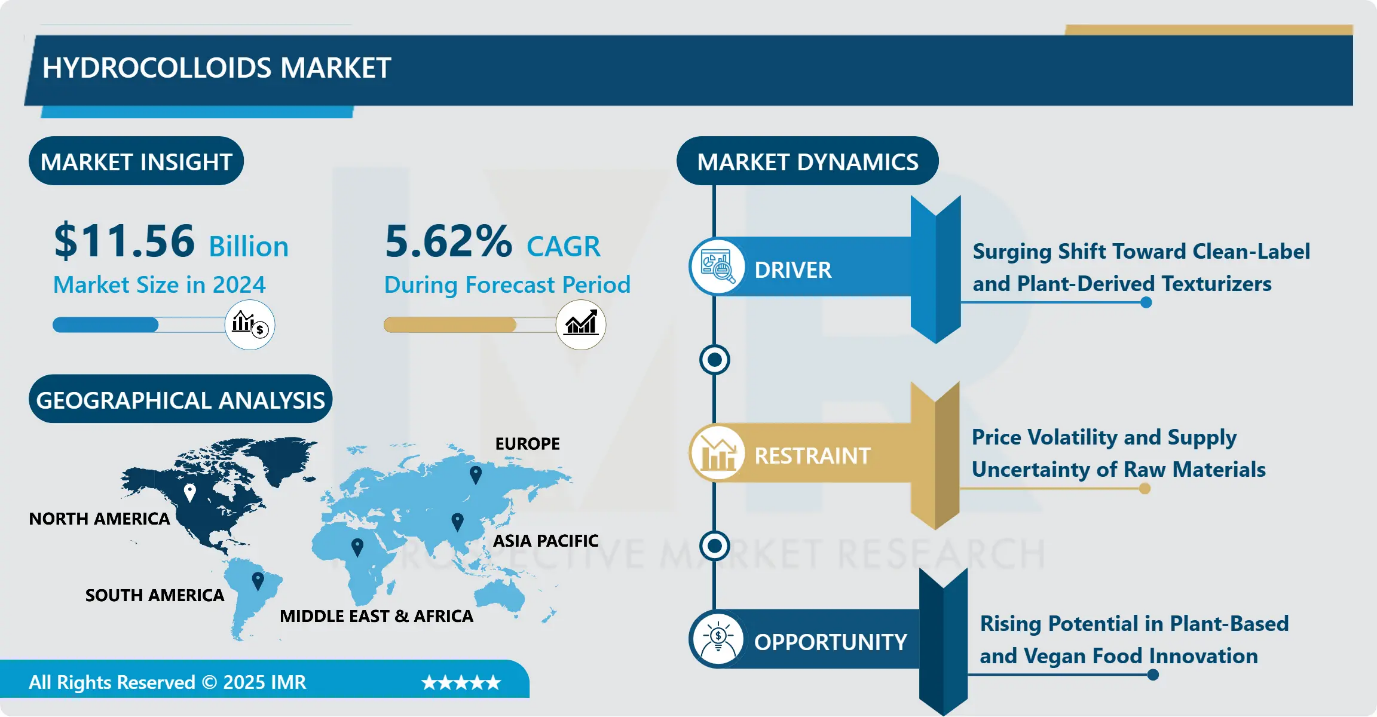

Hydrocolloids Market Size Was Valued at USD 11.56 Billion in 2024, and is Projected to Reach USD 15.72 Billion by 2035, Growing at a CAGR of 5.62% from 2025-2035.

- Market Size in 2024: USD 11.56 Billion

- Projected Market Size by 2035: USD 15.72 Billion

- CAGR (2025–2035): 5.62%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia-Pacific

- By Source: The Animal segment is anticipated to lead the market by accounting for 28.45% of the market share throughout the forecast period.

- By Type: The Gelatine segment is expected to capture 22.68% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 31.64% of the market share during the forecast period.

- Active Players: Flavors & Fragrances Inc. (US), Ingredion (US), Cargill, Incorporated (US), Kerry Group plc (Ireland), Associated Archer Daniels Midland Company (US), Palsgaard A/S (Denmark), Darling Ingredients Inc. (US), DSM (Netherlands), Ashland (US), Tate & Lyle (UK), CP Kelco U.S., Inc. (US), Nexira (France), Deosen Biochemical (Ordos) Ltd. (China), Fufeng Group (China), and BASF SE (Germany), and Other Active Players.

Hydrocolloids Market Synopsis:

Hydrocolloids are long-chain polymers, primarily polysaccharides and proteins, that form gels or viscous solutions when mixed with water. They are derived from natural sources like plants, seaweed, and microbial fermentation, and are used in food and other industries to thicken, stabilize, emulsify, and gel products, affecting texture, shelf life, and other sensory properties. Common examples include xanthan gum, agar-agar, pectin, and carrageenan.

Hydrocolloids Market Dynamics and Trend Analysis:

Hydrocolloids Market Growth Driver - Surging Shift Toward Clean-Label and Plant-Derived Texturizers

-

The hydrocolloid market is primarily driven by the rising demand for clean-label and natural ingredients across the food and beverage industry. Consumers increasingly seek products with simplified ingredient lists and plant-based additives, pushing manufacturers to adopt hydrocolloids such as pectin, guar gum, and alginates for natural thickening, gelling, and stabilization functions.

- Another key growth driver is the expanding application of hydrocolloids in pharmaceuticals and cosmetics. Their ability to enhance texture, improve shelf life, and act as controlled-release agents in drug delivery systems is boosting demand, particularly within premium skincare and oral drug products.

Hydrocolloids Market Limiting Factor - Price Volatility and Supply Uncertainty of Raw Materials

-

One major challenge for the hydrocolloid market is the fluctuating cost and availability of raw materials sourced from seaweed, plants, and microbial processes. Seasonal variations, climate impact, and supply chain disruptions often lead to inconsistent pricing and limited supply, making it difficult for manufacturers to maintain stable production costs.

- Another key limiting factor is growing competition from cheaper thickening and stabilizing agents such as modified starches and synthetic additives. These alternatives often provide similar performance at a lower price, reducing demand for premium hydrocolloids, especially in cost-sensitive food and beverage applications.

Hydrocolloids Market Expansion Opportunity - Rising Potential in Plant-Based and Vegan Food Innovation

-

The global shift toward vegan, vegetarian, and plant-based diets presents a significant growth opportunity for hydrocolloids. Their ability to replicate texture, mouthfeel, and binding properties makes them essential in plant-based dairy, meat alternatives, and clean-label formulations. As consumer preference for sustainable and healthy foods accelerates, manufacturers are exploring new hydrocolloid blends to enhance product quality.

- The expanding medical and wound care industry offers another strong opportunity. Hydrocolloids are increasingly used in advanced dressings due to their moisture-retention, healing support, and biocompatibility features. Rising chronic wounds, diabetes cases, and surgical procedures are boosting demand for hydrocolloid-based medical solutions.

Hydrocolloids Market Challenge and Risk - Complex Regulatory Compliance and Approval Requirements

-

One major challenge for the hydrocolloid market is navigating strict regulatory frameworks across different regions. Variations in food safety standards, labeling rules, and approval processes for ingredients such as carrageenan or synthetic hydrocolloids can delay product launches and increase compliance costs. This creates uncertainty for manufacturers and limits market expansion.

- Hydrocolloids sourced from natural materials such as seaweed or plants can show variability in purity, texture performance, and functional stability. This inconsistency can affect product output, forcing manufacturers to invest heavily in quality control and reformulation. Such risks complicate large-scale production, especially for pharmaceutical and premium food applications.

Hydrocolloids Market Trend - Increasing Focus on Customized and Multi-Functional Hydrocolloid Blends

-

A key market trend is the rising development of customized hydrocolloid blends designed to deliver multiple functionalities such as gelling, stabilizing, fat replacement, and texture enhancement in a single formulation. Food and cosmetic manufacturers are increasingly seeking flexible solutions to improve product efficiency, reduce ingredient lists, and support clean-label positioning, driving innovation in tailored hydrocolloid combinations.

- Another strong trend is the shift toward sustainable sourcing and green processing technologies. Producers are investing in environmentally friendly extraction methods, seaweed farming expansion, and reduced-waste manufacturing to meet sustainability goals and align with consumer expectations for ethical and climate-responsible ingredients.

Hydrocolloids Market Segment Analysis:

Hydrocolloids Market is segmented based on Type, Source, Application, Functionality, and Region

By Source, Animal-based segment is expected to dominate the market with around 28.45% share during the forecast period.

-

Animal-based hydrocolloids dominate the market due to the strong presence of gelatine, which is primarily produced from animal by-products such as bones, hides, and connective tissues. These materials are easily accessible and relatively economical to process, supporting stable supply and large-scale production.

- Hydrocolloids sourced from animals have been widely used for decades across food, pharmaceutical, and personal care sectors because of their proven performance, dependable texture-forming properties, and high functional consistency. Their long regulatory history and established safety approvals further strengthen their acceptance among manufacturers, making animal-derived options the preferred choice compared to alternative sources in many applications.

By Type, Gelatine is expected to dominate with close to 22.68% market share during the forecast period.

-

Gelatine consistently leads the hydrocolloids market, holding the largest share among all types. Its dominance stems from its wide-ranging applications: gelatine is heavily used across the food sector (desserts, confectionery, dairy, jellies), pharmaceuticals (capsules, wound dressings), and even in cosmetics making it highly versatile.

- Moreover, its well-established supply and long history in industrial use contribute to stable demand, which reinforces its leading position in the hydrocolloid mix.

Hydrocolloids Market Regional Insights:

North America region is estimated to lead the market with around 31.64% share during the forecast period.

-

North America leads the hydrocolloids market due to its well-established food and beverage processing industry, which is one of the largest global consumers of hydrocolloids for thickening, stabilizing, and texture enhancement. Strong demand for clean-label, low-fat, and convenience foods continues to drive large-scale adoption.

- The region also benefits from advanced pharmaceutical and personal care manufacturing, where hydrocolloids are widely used in drug delivery systems, capsules, skincare, and wound-care dressings. Additionally, the presence of major hydrocolloid producers, strong R&D capabilities, and supportive regulatory infrastructure create a favorable environment for innovation and high-value product development, reinforcing North America’s leading position.

Hydrocolloids Market Active Players:

- Ashland (US)

- Associated Archer Daniels Midland Company (US)

- BASF SE (Germany)

- CP Kelco U.S., Inc. (US)

- Darling Ingredients Inc. (US)

- Deosen Biochemical (Ordos) Ltd. (China)

- DSM (Netherlands)

- Flavors & Fragrances Inc. (US)

- Fufeng Group (China)

- Ingredion (US), Cargill

- Kerry Group plc (Ireland)

- Nexira (France)

- Palsgaard A/S (Denmark)

- Tate & Lyle (UK)

- Other Active Players

Key Industry Developments in the Hydrocolloids Market:

-

In September 2024, Ingredion Incorporated a leading global provider of specialty ingredient solutions and innovator of clean label ingredients for the food and beverage industry, announced the APAC launch of FIBERTEX® CF 500 and FIBERTEX® CF 100, multi-benefit citrus fibres that provide enhanced texturizing properties and a clean label for consumer-preferred products.

Overview of Hydrocolloids: Extraction, Functional Mechanism & Recent Innovations

-

Hydrocolloids are a diverse group of polysaccharides and proteins that interact with water to form gels, thicken solutions, or stabilize dispersions. Their core function is based on the ability to bind water molecules and modify the rheological properties of food, pharmaceutical, and cosmetic formulations. When added to aqueous systems, hydrocolloids create structured networks that influence viscosity, texture, and moisture retention, making them essential in applications like emulsification, gelling, coating, and fat replacement.

Extraction and Production Process

- Hydrocolloids are extracted from multiple natural and microbial sources. Plant-derived hydrocolloids like pectin and guar gum are processed through mechanical milling or chemical extraction from fruits and seeds. Seaweed-based hydrocolloids such as alginates, carrageenan, and agar are obtained through alkaline treatment and filtration of marine algae. Microbial hydrocolloids like xanthan gum are produced through controlled fermentation, followed by purification and drying. Animal-derived gelatine is extracted from collagen by thermal hydrolysis of bones and hides. The extraction process aims to retain functionality while ensuring purity, consistency, and safety.

Why Hydrocolloids Are Important

- Hydrocolloids play a vital role in enhancing product stability, improving shelf life, and creating desirable mouthfeel and texture. They enable manufacturers to reduce sugar and fat without compromising sensory quality and contribute significantly to clean-label and plant-based product development. In pharmaceuticals, they are used in controlled drug release and wound dressings due to their moisture-locking and film-forming characteristics.

Recent Innovations

- Recent innovations focus on sustainable sourcing, biodegradable packaging films, and hybrid hydrocolloid blends that deliver multifunctional performance. Researchers are developing precision-formulated hydrocolloids to mimic animal-based textures in plant-based meat and dairy alternatives. Advances in enzymatic modification and nanotechnology are enabling enhanced functionality, improved solubility, and higher heat and pH tolerance. Additionally, seaweed farming and green extraction technologies are helping reduce environmental impact and production cost.

|

Hydrocolloids Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 11.56 Bn. |

|

Forecast Period 2025-35 CAGR: |

5.62 % |

Market Size in 2035: |

USD 15.72 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source

|

|

||

|

By Functionality |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Hydrocolloids Market by Type (2018-2032)

4.1 Hydrocolloids Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Gelatine

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Xanthum gum

4.5 Carrageenan

4.6 Alginates

4.7 Agar

4.8 Pectin

4.9 Guar gum and Others

Chapter 5: Hydrocolloids Market by Application (2018-2032)

5.1 Hydrocolloids Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Food and Beverage

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cosmetics and Personal care products

5.5 Pharmaceuticals)

Chapter 6: Hydrocolloids Market by Source (2018-2032)

6.1 Hydrocolloids Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Botanical

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Microbial

6.5 Seaweed

6.6 Animal

6.7 Synthetic

Chapter 7: Hydrocolloids Market by Functionality (2018-2032)

7.1 Hydrocolloids Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Thickeners

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Stabilizers

7.5 Gelling agents

7.6 Fat replacers

7.7 Coating materials

7.8 Others Active players

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Hydrocolloids Market Share by Manufacturer/Service Provider(2024)

8.1.3 Industry BCG Matrix

8.1.4 PArtnerships, Mergers & Acquisitions

8.2 ASHLAND (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Recent News & Developments

8.2.10 SWOT Analysis

8.3 ASSOCIATED ARCHER DANIELS MIDLAND COMPANY (US)

8.4 BASF SE (GERMANY)

8.5 CP KELCO U.S.

8.6 INC. (US)

8.7 DARLING INGREDIENTS INC. (US)

8.8 DEOSEN BIOCHEMICAL (ORDOS) LTD. (CHINA)

8.9 DSM (NETHERLANDS)

8.10 FLAVORS & FRAGRANCES INC. (US)

8.11 FUFENG GROUP (CHINA)

8.12 INGREDION (US)

8.13 CARGILL

8.14 KERRY GROUP PLC (IRELAND)

8.15 NEXIRA (FRANCE)

8.16 PALSGAARD A/S (DENMARK)

8.17 TATE & LYLE (UK)

8.18 OTHER ACTIVE PLAYERS

Chapter 9: Global Hydrocolloids Market By Region

9.1 Overview

9.2. North America Hydrocolloids Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecast Market Size by Country

9.2.4.1 US

9.2.4.2 Canada

9.2.4.3 Mexico

9.3. Eastern Europe Hydrocolloids Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecast Market Size by Country

9.3.4.1 Russia

9.3.4.2 Bulgaria

9.3.4.3 The Czech Republic

9.3.4.4 Hungary

9.3.4.5 Poland

9.3.4.6 Romania

9.3.4.7 Rest of Eastern Europe

9.4. Western Europe Hydrocolloids Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecast Market Size by Country

9.4.4.1 Germany

9.4.4.2 UK

9.4.4.3 France

9.4.4.4 The Netherlands

9.4.4.5 Italy

9.4.4.6 Spain

9.4.4.7 Rest of Western Europe

9.5. Asia Pacific Hydrocolloids Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecast Market Size by Country

9.5.4.1 China

9.5.4.2 India

9.5.4.3 Japan

9.5.4.4 South Korea

9.5.4.5 Malaysia

9.5.4.6 Thailand

9.5.4.7 Vietnam

9.5.4.8 The Philippines

9.5.4.9 Australia

9.5.4.10 New Zealand

9.5.4.11 Rest of APAC

9.6. Middle East & Africa Hydrocolloids Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecast Market Size by Country

9.6.4.1 Turkiye

9.6.4.2 Bahrain

9.6.4.3 Kuwait

9.6.4.4 Saudi Arabia

9.6.4.5 Qatar

9.6.4.6 UAE

9.6.4.7 Israel

9.6.4.8 South Africa

9.7. South America Hydrocolloids Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecast Market Size by Country

9.7.4.1 Brazil

9.7.4.2 Argentina

9.7.4.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

Chapter 11 Our Thematic Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Chapter 12 Case Study

Chapter 13 Appendix

13.1 Sources

13.2 List of Tables and figures

13.3 Short Forms and Citations

13.4 Assumption and Conversion

13.5 Disclaimer

|

Hydrocolloids Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 11.56 Bn. |

|

Forecast Period 2025-35 CAGR: |

5.62 % |

Market Size in 2035: |

USD 15.72 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source

|

|

||

|

By Functionality |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||