High Power Transformers Market Synopsis

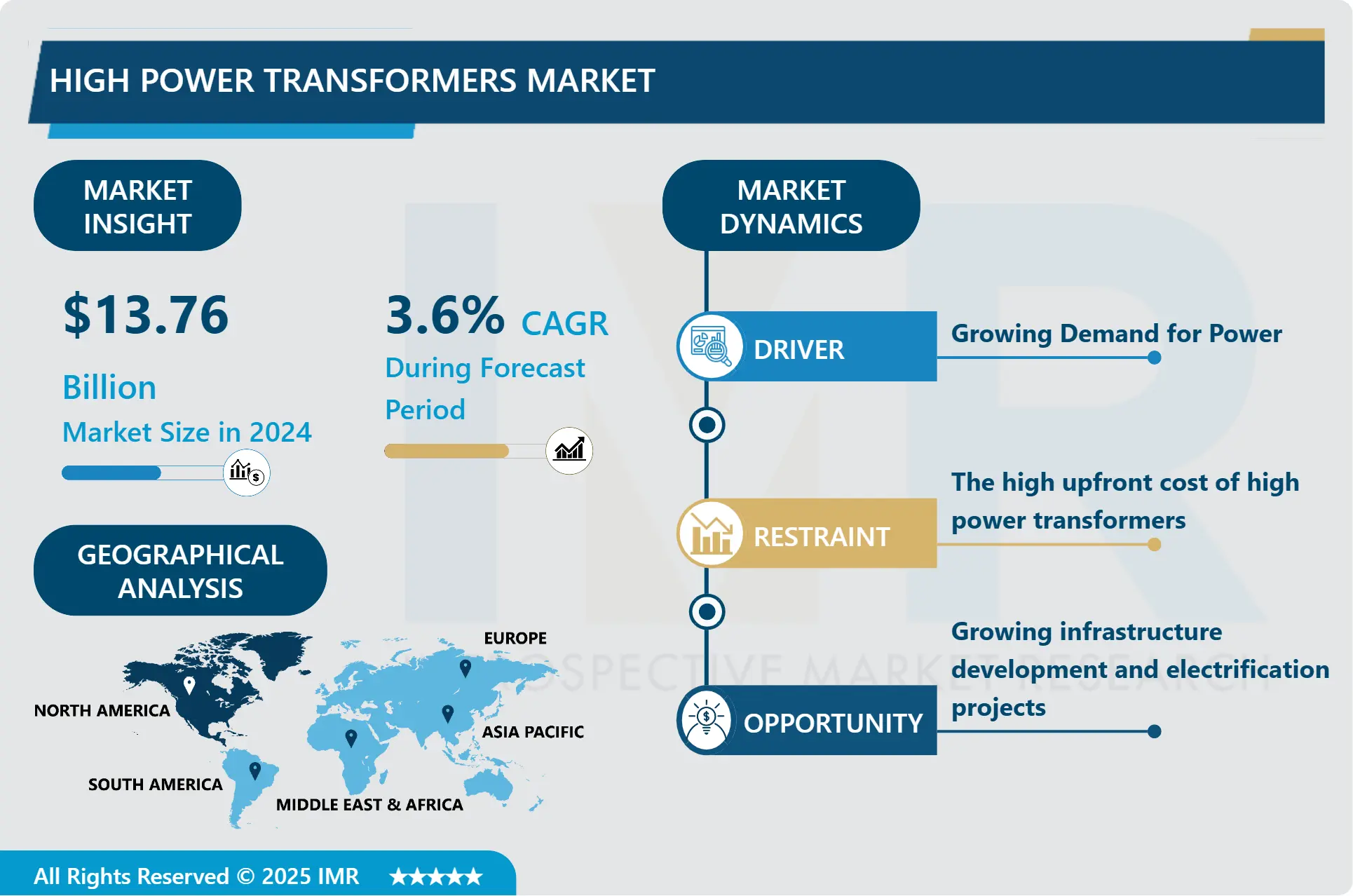

High Power Transformers Market Size Was Valued at USD 13.76 Billion in 2024, and is Projected to Reach USD 18.26 Billion by 2032, Growing at a CAGR of 3.6% From 2025-2032.

High-power transformers are indispensable loads and parts of electrical circuits designed to transfer electrical energy from one circuit to another in the shortest amount of time with the least level of power loss. Such transformers are defined by their capability of transmitting high electrical power contacts with varying from several hundred kVA to several thousand MVA.

These are widely used in power generation, transmission and distribution systems, to provide efficient means for transmitting electric energy from the site of generation to the distribution centre and consumers.

Power transformer can be defined as transformer which works at the highest power level and consists of laminated core made up of steel sheets to reduce eddy current and leakage flux. around the center is a spiral of insulated copper or aluminium wire, called the windings through which electrical current flows.

While the primary winding directly connects with the input circuit receiving the electrical power, the secondary winding is responsible to supply the after-transformation power to the output circuit. The number of turns in the primary winding to that of the secondary winding is what defines the transformation ratio and the power output.

There are several types of transformers as follows, voltage transformers which include: Step up transformers these transform voltages to high voltage for transmission and step down transformers, which transform the voltage to low voltage for use by various users.

also consist of cooling means such as oil or air-cooling to ensure reheating of the equipments in a bid to expel heat that arises from their operations. Furthermore, in high-power transformers they incorporate special protections and metering features for monitoring and protection against overloads, short circuits, model electrical faults to enforce the integrity of the electrical power delivery system.

High Power Transformers Market Trend Analysis

High Power Transformers Market Growth Driver- Compact Designs and Eco-friendly Materials

- There are several reasons that buyers of high power transformers and manufacturers have started preferring high power transformers with compact dimensions and environmentally friendly materials over the past few years. Firstly, with increased globalization, urbanization results in place a major high demand for efficient utilization of the limited space available. Some transformer designs consume less space due to their compactness; hence they are well suited for undertaking within densely developed regions such as the cities. This trend is especially important when referring to recent constructions of infrastructural installations as it is fundamental to make the most out of the land available.

- Secondly, one has observed the aspect of environmental sustainability in the growth of many organizations and industries. Why becoming ecological is so important for the manufacturers and how they looking for opportunities to minimize their damage to the environment, This development objectives are achieved in transformers since the use of environmental friendly material are preferred than the conventional material that may cause the environment. Greener materials like biodegradable oils, green metal and low impact insulating material like wool are getting much attention because of their environmental impact.

- Besides, the implementation of compact designs and the use of eco-friendly materials is more than the protection of the environment, it is also good to know that there are advantages. For example, small scale transformers are usually more reliable and cost-effective often involving less maintenance from the utility companies as well as end consumers.

- Further, introduction of durability concepts have seen the introduction of environment-friendly materials for construction that have better performance parameters than the previous material used; for instance, those that have better thermal conductivity or better insulating properties than the previous material. Consequently, opportunities for individuals to incorporate these materials into transformers create a better-performing power system, boosting the market for these products.

High Power Transformers Market Opportunity- Demand for Refurbishment and Retrofitting

- The need to refurbishment and retrofitting which has been expanding within the market for high –power transformers is a potential for business development and expansion. There are instances where the existing transformer systems require upgrade or a new one has to be installed where existing aged transformer structures are becoming burdens on the user country and as more aged transformer structures come up across the globe especially in the developed nations where most of the electrical grid was developed in early half of the twentieth century, upgrading of the existing transformer systems have become necessary. Improvement encompasses renovating and rejuvenating transformers with the aim of optimising transformer performance and reliability.

- On the same note, retrofitting is the process of adapting new technologies and additional features into existing transformers to make them perform better, or to provide new features not originally provided such as increased efficiency, better monitoring devices, and safety mechanisms.

- The trend towards refurbishment and retrofitting is, thus, being catalyzed by several factors. First of all, the current condition of many electrical networks might be catastrophic to provide safe, reliable, and efficient energy supply according to the contemporary needs. Further, due to modernization and technology improvements, it is also possible to increment the efficiency and the working capability of transformers which not only reduces the cost of transformers but also improve the overall efficiency throughout its service period.

- In addition, altering a building for better efficiency to save energy and cut emissions is now in high demand because of growing environmental consciousness around the globe to fight climate change.

- These industries: For companies in the high-power transformers market, the need for reboring and retrofitting is already a promising avenue for development. As such, to a wide variety of clients in utilities, industries, and development, comprehensive refurbishment services and new-state of-art retrofitting solutions are provided.

- Furthermore, committing funds to research and innovation geared toward the enhancement and new technologies in the refurbishment and retrofitting of the transformers can place the corporations as key players in the industry, thereby enabling competitive advantage and sustainable market growth. In sum, the concept of refurbishment and retrofitting is set to be symbiotic for the high-power transformer market in terms of both innovation and business prospect.

High Power Transformers Market Segment Analysis:

High Power Transformers Market Segmented on the basis of Phase, Mounting and Applications.

By Phase, Three Phase segment is expected to dominate the market during the forecast period

- With regards to the transformer phase, it is notably evident that the three-phase transformer dominates the single-phase transformer section in the High Power Transformers Market. These include; Firstly, it can be argued that the dominance of past employees on hiring decisions can be attributed to their better understanding of the job requirements of the specific position.

- Firstly, three-phase transformers are widely employed in industrial and commerce power system because their applications generally involve high power demand such as manufacturing factories, power station and large construction projects. Due to their capacity of withstanding high power loads, they become invaluable in these sectors.

- Second, we have efficiency in the sense that three-phase transformers provide efficiency in terms of their performance. It is considered to supply power more equally in comparison to one-phase transformer and therefore it exhibits less pulsating effect and lower power loss when transmitted over larger distances. This makes them suitable for use in power distribution network and in electricity transmission and distribution systems whose performance relies very much on the stability of the voltage levels.

The last change which has occurred due to evolving technology is in the structure of the three-phase transformer in which there is increase in voltage rating, insulation techniques as well as cooling techniques. These innovations have added more impetus to the production of the three-phase transformers that are meeting the changing demands of industries calling for higher efficiency, reliability and maintenance free operation.

- Taken in overall, it is possible to conclude that the three-phase segment is dominating the High Power Transformers Market due to its universality of application in industrial and commercial products, its high efficiency and reliability indicators as well as the constantly improving performance thanks to the advancements in the technology front.

By Mounting, Pad segment expected to held the largest share

- The market share comparison of transformers mounted on pads is comparatively higher for the High Power Transformers Market than pole-mounted, PC/PCB-mounted, and other unique structures. These includes the following important factors that define the need for pad mounted transformers in various applications(Dbeye 15).

- pad-mounted transformers provide operational advantages ahead of handbook designs based on installation and maintenance considerations. They are getting mounted at ground level making it easier for the technicians to reach them without requiring a lot of equipment like it’s the case with the pole-mounted transformers which need elevated structures for installation and even for repairing.

- Second key advantage of pad-mounted transformers is in their design and appearance: they do not occupy a significant space and their design is more visually appealing. They can also be deployed in compact design which means utilization of space is well enhanced hence gaining more relevance in areas of high human and or structural density. Moreover, their housing is covered and hence, shield the public from any of the harsh environmental conditions, including weather, tampering, and even vandalism hence giving the maximum service.

- Finally, pad-mounted transformers are highly portable and general-purpose with voltage as well as power, making it almost suitable for all commercial, residential, and even industrial usage. The ability to vary the design and voltage of the substations as well as their strength and efficiency ensures that they are useful in power distribution for utility companies, infrastructural construction and for the diverse end users that require dependable power supply.

- To sum up, pad-mounted transformers offer clients higher convenience, thus remaining the most popular in the High Power Transformers Market due to more economical benefits, such as space and aesthetical efficiency, as well as subjectivity to multifaceted applications across sectors. Such benefits ensure that pad mounted transformer is widely considered as the most suitable option for enhancing the capacity of power distribution in different sectors and terrains.

High Power Transformers Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America's dominance in the High Power Transformers Market can be attributed to several key factors. Firstly, the region's robust industrial infrastructure, particularly in sectors such as energy, manufacturing, and utilities, drives the demand for high-power transformers. These transformers are vital components in power generation, transmission, and distribution systems, which are essential for supporting North America's large-scale industrial operations and urban development.

- Technological advancements and innovation in the power sector have propelled North American manufacturers to the forefront of high-power transformer production. Companies in the region invest heavily in research and development, leading to the creation of more efficient, durable, and technologically advanced transformers. This competitive edge allows North American manufacturers to meet the stringent performance standards required by utilities and industrial users, further solidifying their dominance in the market.

- Favorable government policies and regulations in North America support the growth of the high-power transformer industry. Initiatives aimed at modernizing power grids, promoting renewable energy integration, and ensuring grid reliability incentivize investment in new transformer infrastructure.

- Additionally, stringent quality and safety standards enforced by regulatory bodies ensure that North American transformers meet the highest industry benchmarks, enhancing their appeal to both domestic and international markets. Collectively, these factors contribute to North America's stronghold in the high-power transformers market.

Active Key Players in the High Power Transformers Market

- ABB (Switzerland)

- Bharat Heavy Electricals Limited (India)

- Celme S.r.l. (Italy)

- CG Power and Industrial Solutions Limited (India)

- Crompton Greaves Limited (India)

- Eaton Corporation (Ireland)

- Fuji Electric Co., Ltd. (Japan)

- General Electric (United States)

- Hitachi, Ltd. (Japan)

- Hyosung Heavy Industries Corporation (South Korea)

- Hyundai Electric & Energy Systems Co., Ltd. (South Korea)

- Mitsubishi Electric Corporation (Japan)

- Schneider Electric (France)

- Schneider Electric India Pvt. Ltd. (India)

- Siemens AG (Germany)

- SPX Transformer Solutions, Inc. (United States)

- TBEA Co., Ltd. (China)

- Toshiba Corporation (Japan)

- Virginia Transformer Corp. (United States)

- Wilson Transformer Company (Australia)

- Other Active Players

|

Global High Power Transformers Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 13.76 Bn. |

|

Forecast Period 2025-32 CAGR: |

3.6% |

Market Size in 2032: |

USD 18.26 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: High Power Transformers Market by Type (2018-2032)

4.1 High Power Transformers Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Socket Mount

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Chassis

4.5 Rear Mount

Chapter 5: High Power Transformers Market by Application (2018-2032)

5.1 High Power Transformers Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Automotive

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Heavy Industrial

5.5 General Industrial

5.6 Construction

5.7 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 High Power Transformers Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ABB (SWITZERLAND)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 BHARAT HEAVY ELECTRICALS LIMITED (INDIA)

6.4 CELME S.R.L. (ITALY)

6.5 CG POWER AND INDUSTRIAL SOLUTIONS LIMITED (INDIA)

6.6 CROMPTON GREAVES LIMITED (INDIA)

6.7 EATON CORPORATION (IRELAND)

6.8 FUJI ELECTRIC COLTD. (JAPAN)

6.9 GENERAL ELECTRIC (UNITED STATES)

6.10 HITACHI LTD. (JAPAN)

6.11 HYOSUNG HEAVY INDUSTRIES CORPORATION (SOUTH KOREA)

6.12 HYUNDAI ELECTRIC & ENERGY SYSTEMS COLTD. (SOUTH KOREA)

6.13 MITSUBISHI ELECTRIC CORPORATION (JAPAN)

6.14 SCHNEIDER ELECTRIC (FRANCE)

6.15 SCHNEIDER ELECTRIC INDIA PVT. LTD. (INDIA)

6.16 SIEMENS AG (GERMANY)

6.17 SPX TRANSFORMER SOLUTIONS INC. (UNITED STATES)

6.18 TBEA COLTD. (CHINA)

6.19 TOSHIBA CORPORATION (JAPAN)

6.20 VIRGINIA TRANSFORMER CORP. (UNITED STATES)

6.21 WILSON TRANSFORMER COMPANY (AUSTRALIA)

6.22 OTHER KEY PLAYERS

6.23

Chapter 7: Global High Power Transformers Market By Region

7.1 Overview

7.2. North America High Power Transformers Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Socket Mount

7.2.4.2 Chassis

7.2.4.3 Rear Mount

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Automotive

7.2.5.2 Heavy Industrial

7.2.5.3 General Industrial

7.2.5.4 Construction

7.2.5.5 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe High Power Transformers Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Socket Mount

7.3.4.2 Chassis

7.3.4.3 Rear Mount

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Automotive

7.3.5.2 Heavy Industrial

7.3.5.3 General Industrial

7.3.5.4 Construction

7.3.5.5 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe High Power Transformers Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Socket Mount

7.4.4.2 Chassis

7.4.4.3 Rear Mount

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Automotive

7.4.5.2 Heavy Industrial

7.4.5.3 General Industrial

7.4.5.4 Construction

7.4.5.5 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific High Power Transformers Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Socket Mount

7.5.4.2 Chassis

7.5.4.3 Rear Mount

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Automotive

7.5.5.2 Heavy Industrial

7.5.5.3 General Industrial

7.5.5.4 Construction

7.5.5.5 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa High Power Transformers Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Socket Mount

7.6.4.2 Chassis

7.6.4.3 Rear Mount

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Automotive

7.6.5.2 Heavy Industrial

7.6.5.3 General Industrial

7.6.5.4 Construction

7.6.5.5 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America High Power Transformers Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Socket Mount

7.7.4.2 Chassis

7.7.4.3 Rear Mount

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Automotive

7.7.5.2 Heavy Industrial

7.7.5.3 General Industrial

7.7.5.4 Construction

7.7.5.5 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global High Power Transformers Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 13.76 Bn. |

|

Forecast Period 2025-32 CAGR: |

3.6% |

Market Size in 2032: |

USD 18.26 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||