High Performance Elastomer Market Synopsis

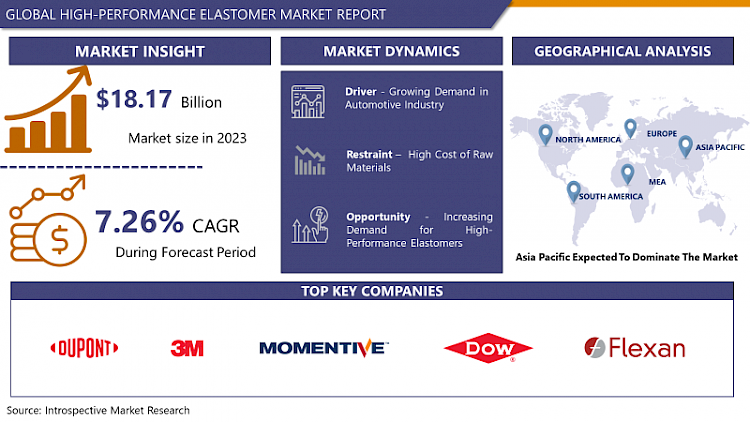

High-Performance Elastomer Market Size Was Valued at USD 18.17 Billion in 2023 and is Projected to Reach USD 34.14 Billion by 2032, Growing at a CAGR of 7.26% From 2024-2032.

A High-Performance Elastomer is a type of synthetic polymer known for its exceptional elasticity, resilience, and durability in demanding conditions. These elastomers exhibit superior mechanical properties, such as high tensile strength and resistance to abrasion, chemicals, and extreme temperatures. They are widely used in industries like automotive, aerospace, electronics, and healthcare for applications requiring reliable and long-lasting flexible components.

- The high-performance elastomer market is increasing demand across various end-use industries such as automotive, aerospace, industrial, and healthcare. High-performance elastomers are known for their exceptional mechanical properties, chemical resistance, and thermal stability.

- The Industry is experiencing continuous innovation and development of advanced elastomeric materials by manufacturers and meeting stringent performance requirements of modern applications. There is a rising focus on lightweight materials to enhance fuel efficiency and reduce emissions in the automotive and aerospace sectors further boosting the demand for high-performance elastomers.

- Furthermore, the expanding applications in medical devices in implantable and surgical instruments, are contributing to market growth. High-performance elastomers offer biocompatibility, sterilization resistance, and long-term durability, making them suitable for critical healthcare applications.

- The ongoing research and development efforts expected to enhance material performance and sustainability are anticipated to create lucrative opportunities for market players in the coming years.

High Performance Elastomer Market Trend Analysis

Growing Demand in the Automotive Industry

- High Performance Elastomers are crucial components in modern vehicles, finding applications in various parts such as tires, seals, hoses, gaskets, and more. The automotive sector is constantly evolving to enhance consumer preferences and regulatory standards. There is a growing need for elastomers that offer exceptional performance characteristics like durability, heat resistance, chemical resistance, and flexibility.

- Automotive manufacturers are enhancing vehicle performance, fuel efficiency, and safety, they rely heavily on advanced elastomer materials to meet these objectives. Furthermore, the expansion of electric and hybrid vehicle segments further increases the demand for specialized elastomers personalized to withstand the unique operating conditions of these vehicles.

- The global push towards sustainability and eco-friendly mobility solutions is driving the development of elastomers with enhanced recyclability and reduced environmental impact. These factors are contributing to the demand for High Performance Elastomers within the automotive industry.

Increasing Demand for High-Performance Elastomers

- High-performance elastomers offer enhanced properties such as temperature resistance, chemical inertness, and mechanical strength, making them crucial in industries like automotive, aerospace, healthcare, and electronics.

- In the automotive sector, high-performance elastomers are utilized in seals, gaskets, hoses, and vibration-damping components to withstand harsh operating conditions and ensure reliability. Similarly, in aerospace, these elastomers play a dynamic role in sealing systems, fuel seals, and O-rings, where performance under extreme temperatures and pressures is essential.

- The elastomers also contribute to the healthcare industry in medical devices, pharmaceutical packaging, and surgical equipment due to their biocompatibility and sterilization resistance. They utilize these elastomers in connectors, seals, and gaskets for their electrical insulation properties and reliability.

- The growing technological advancements and stringent performance requirements across various industries are demanding high-performance elastomers to continue growing in the vast market. Manufacturers and suppliers are leveraging this opportunity to develop advanced elastomeric materials for diverse applications, thereby driving the growth of the high-performance elastomer market.

High Performance Elastomer Market Segment Analysis:

High Performance Elastomer Market Segmented Based on Type and End-User.

By Type, the Nitrile-based Elastomers segment is expected to dominate the market during the forecast period

- The nitrile-based elastomers are a wide range of fluids ideal for use in hydraulic systems, fuel handling equipment, and industrial machinery exposure to diverse substances. The advancements in polymer chemistry have led to the development of specialty nitrile-based elastomers to meet specific performance requirements strengthening their market dominance.

- The growing emphasis on sustainability and regulatory agreement has prompted manufacturers to innovate greener formulations of nitrile-based elastomers, enhancing demand for environmentally conscious industries. The demand for high-performance materials is capable of withstanding extreme conditions offering longevity and reliability. The Nitrile-based Elastomers segment dominates the high-performance elastomer market, driving innovation and shaping the future of elastomeric applications.

By Application, the Automotive & Transportation segment held the largest share of 30% in 2022

- The Automotive & Transportation segment offers exceptional performance characteristics such as high durability, temperature resistance, and flexibility, making them ideal for various automotive applications. These elastomers are extensively used in the production of automotive components like seals, gaskets, hoses, and tires, contributing to their widespread adoption in the industry.

- The stringent regulatory requirements for fuel efficiency, emissions reduction, and safety standards drive the demand for high-performance materials like HPEs in the automotive sector. Manufacturers rely on these elastomers to enhance vehicle performance, reliability, and longevity while meeting regulatory compliance.

- The growing trend towards light-weighting vehicles is improving fuel efficiency and boosting the demand for HPEs, as they offer excellent strength-to-weight ratios compared to traditional materials. The automotive industry's continuous innovation and adoption of advanced technologies also propel the market for high-performance elastomers.

High Performance Elastomer Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region is of growing importance in various industries, such as automotive, aerospace, electronics, and healthcare. The region's rapid industrialization and growth in these sectors are driving a significant increase in the demand for high-performance elastomers. The automotive sector, particularly in countries like China and India, is experiencing substantial growth, leading to a growing need for elastomers to enhance vehicle performance, fuel efficiency, and sustainability.

- The region's strong manufacturing infrastructure and technological landscape fuel the demand for high-performance elastomers. Countries like China, Japan, South Korea, and India are home to leading manufacturers of elastomers. The skilled workforce and government initiatives promote industrial growth and support the market predictions for high-performance elastomers in the region.

- Investments in research and development, innovate and develop advanced elastomeric materials in the Asia Pacific. The region's demographic trends, urbanization, and rising disposable incomes drive the demand for consumer goods and automotive products. Manufacturers are adopting high-performance elastomers to meet the stringent quality standards and performance requirements of these expanding markets. The favorable economic conditions, expanding industrial sectors, and technological advancements are dominating the high-performance elastomer market in the forecast period.

High Performance Elastomer Market Top Key Players:

- Dupont (USA)

- 3M Company (USA)

- Momentive Performance Materials Inc (USA)

- Zeon Chemicals L.P. (USA)

- Dow Chemical Company (USA)

- Flexan LLC (USA)

- Exxon Mobil Corporation (USA)

- The Chemours Company (USA)

- Reiss Manufacturing Inc. (USA)

- Kaco GmbH + Co. Kg (Germany)

- Kraiburg TPE GmbH & Co. Kg (Germany)

- Wacker Chemie AG (Germany)

- Precision Polymer Engineering Ltd. (UK)

- Daikin Industries Ltd. (Japan)

- JSR Corporation (Japan)

- Asahi Glass Co. Ltd (Japan)

- Mitsui Chemicals Inc. (Japan)

- Tosoh Corporation (Japan)

- Showa Denko K.K. (Japan)

- Shin-Etsu Chemical Co. Ltd. (Japan), and Other Major Players.

Key Industry Developments in the High-Performance Elastomer Market:

- In September 2023, Carbon, a leader in product development and manufacturing technology, announced the launch of EPU 46, its latest elastomer material. EPU 46 delivers high-performance properties, exceptional durability, and a variety of vibrant color options. This innovative material enables the customizable production of premium products such as saddles, footwear, and grips. Carbon continues to push the boundaries of material science, offering superior solutions for diverse applications

- In April 2023, DuPont announced the introduction of new low-cyclosiloxane silicone elastomer blends and silicone resin blends. These developments were aimed at meeting consumer demand for skincare products addressing various skin conditions. The formulations also aimed to comply with evolving REACH regulatory requirements while supporting DuPont and its customers' commitment to Health and Well-Being.

- In September 2021, DuPont celebrated the inauguration of its new medical elastomers mixers at the Healthcare Industries Materials Site (HIMS) in Hemlock, Michigan, USA, with a formal ribbon-cutting ceremony. The investment in the new mixers responded to increased supply needs from DuPont™ Liveo™ Healthcare Solutions customers. The capacity expansion included the expansion of in-house medical-grade silicone elastomer manufacturing capabilities and supported sustainable growth in Liveo™ medical elastomer product lines. It also facilitated the strong growth of in-house production of Liveo™ pharmaceutical tubing dedicated to biopharmaceutical processing, and of medical devices and topical blends.

|

Global High Performance Elastomer Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 18.17 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.26% |

Market Size in 2032: |

USD 34.14 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- HIGH PERFORMANCE ELASTOMER MARKET BY TYPE (2017-2032)

- HIGH PERFORMANCE ELASTOMER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- NITRILE BASED ELASTOMERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SILICONE ELASTOMERS

- FLUOROELASTOMERS

- HIGH PERFORMANCE ELASTOMER MARKET BY END-USER (2017-2032)

- HIGH PERFORMANCE ELASTOMER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HEALTHCARE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- INDUSTRIAL MACHINERY

- AUTOMOTIVE & TRANSPORTATION

- BUILDING & CONSTRUCTION

- ELECTRICAL & ELECTRONICS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- High Performance Elastomer Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- DUPONT (USA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- 3M COMPANY (USA)

- MOMENTIVE PERFORMANCE MATERIALS INC (USA)

- ZEON CHEMICALS L.P. (USA)

- DOW CHEMICAL COMPANY (USA)

- FLEXAN LLC (USA)

- EXXON MOBIL CORPORATION (USA)

- THE CHEMOURS COMPANY (USA)

- REISS MANUFACTURING INC. (USA)

- KACO GMBH + CO. KG (GERMANY)

- KRAIBURG TPE GMBH & CO. KG (GERMANY)

- WACKER CHEMIE AG (GERMANY)

- PRECISION POLYMER ENGINEERING LTD. (UK)

- DAIKIN INDUSTRIES LTD. (JAPAN)

- JSR CORPORATION (JAPAN)

- ASAHI GLASS CO. LTD (JAPAN)

- MITSUI CHEMICALS INC. (JAPAN)

- TOSOH CORPORATION (JAPAN)

- SHOWA DENKO K.K. (JAPAN)

- SHIN-ETSU CHEMICAL CO. LTD. (JAPAN)

- COMPETITIVE LANDSCAPE

- GLOBAL HIGH PERFORMANCE ELASTOMER MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global High Performance Elastomer Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 18.17 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.26% |

Market Size in 2032: |

USD 34.14 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. HIGH PERFORMANCE ELASTOMER MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. HIGH PERFORMANCE ELASTOMER MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. HIGH PERFORMANCE ELASTOMER MARKET COMPETITIVE RIVALRY

TABLE 005. HIGH PERFORMANCE ELASTOMER MARKET THREAT OF NEW ENTRANTS

TABLE 006. HIGH PERFORMANCE ELASTOMER MARKET THREAT OF SUBSTITUTES

TABLE 007. HIGH PERFORMANCE ELASTOMER MARKET BY TYPE

TABLE 008. NITRILE-BASED ELASTOMERS MARKET OVERVIEW (2016-2028)

TABLE 009. SILICONE ELASTOMERS MARKET OVERVIEW (2016-2028)

TABLE 010. FLUOROELASTOMERS MARKET OVERVIEW (2016-2028)

TABLE 011. HIGH PERFORMANCE ELASTOMER MARKET BY APPLICATION

TABLE 012. AUTOMOTIVE AND TRANSPORTATION MARKET OVERVIEW (2016-2028)

TABLE 013. INDUSTRIAL MACHINERY MARKET OVERVIEW (2016-2028)

TABLE 014. BUILDING AND CONSTRUCTION MARKET OVERVIEW (2016-2028)

TABLE 015. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 016. ELECTRICAL AND ELECTRONICS MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA HIGH PERFORMANCE ELASTOMER MARKET, BY TYPE (2016-2028)

TABLE 018. NORTH AMERICA HIGH PERFORMANCE ELASTOMER MARKET, BY APPLICATION (2016-2028)

TABLE 019. N HIGH PERFORMANCE ELASTOMER MARKET, BY COUNTRY (2016-2028)

TABLE 020. EUROPE HIGH PERFORMANCE ELASTOMER MARKET, BY TYPE (2016-2028)

TABLE 021. EUROPE HIGH PERFORMANCE ELASTOMER MARKET, BY APPLICATION (2016-2028)

TABLE 022. HIGH PERFORMANCE ELASTOMER MARKET, BY COUNTRY (2016-2028)

TABLE 023. ASIA PACIFIC HIGH PERFORMANCE ELASTOMER MARKET, BY TYPE (2016-2028)

TABLE 024. ASIA PACIFIC HIGH PERFORMANCE ELASTOMER MARKET, BY APPLICATION (2016-2028)

TABLE 025. HIGH PERFORMANCE ELASTOMER MARKET, BY COUNTRY (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA HIGH PERFORMANCE ELASTOMER MARKET, BY TYPE (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA HIGH PERFORMANCE ELASTOMER MARKET, BY APPLICATION (2016-2028)

TABLE 028. HIGH PERFORMANCE ELASTOMER MARKET, BY COUNTRY (2016-2028)

TABLE 029. SOUTH AMERICA HIGH PERFORMANCE ELASTOMER MARKET, BY TYPE (2016-2028)

TABLE 030. SOUTH AMERICA HIGH PERFORMANCE ELASTOMER MARKET, BY APPLICATION (2016-2028)

TABLE 031. HIGH PERFORMANCE ELASTOMER MARKET, BY COUNTRY (2016-2028)

TABLE 032. DUPONT: SNAPSHOT

TABLE 033. DUPONT: BUSINESS PERFORMANCE

TABLE 034. DUPONT: PRODUCT PORTFOLIO

TABLE 035. DUPONT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. 3M COMPANY: SNAPSHOT

TABLE 036. 3M COMPANY: BUSINESS PERFORMANCE

TABLE 037. 3M COMPANY: PRODUCT PORTFOLIO

TABLE 038. 3M COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. SOLVAY S.A.: SNAPSHOT

TABLE 039. SOLVAY S.A.: BUSINESS PERFORMANCE

TABLE 040. SOLVAY S.A.: PRODUCT PORTFOLIO

TABLE 041. SOLVAY S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. ARLANXEO: SNAPSHOT

TABLE 042. ARLANXEO: BUSINESS PERFORMANCE

TABLE 043. ARLANXEO: PRODUCT PORTFOLIO

TABLE 044. ARLANXEO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. MOMENTIVE PERFORMANCE MATERIALS INC: SNAPSHOT

TABLE 045. MOMENTIVE PERFORMANCE MATERIALS INC: BUSINESS PERFORMANCE

TABLE 046. MOMENTIVE PERFORMANCE MATERIALS INC: PRODUCT PORTFOLIO

TABLE 047. MOMENTIVE PERFORMANCE MATERIALS INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. ZEON CHEMICALS L.P.: SNAPSHOT

TABLE 048. ZEON CHEMICALS L.P.: BUSINESS PERFORMANCE

TABLE 049. ZEON CHEMICALS L.P.: PRODUCT PORTFOLIO

TABLE 050. ZEON CHEMICALS L.P.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. DAIKIN INDUSTRIES LTD.: SNAPSHOT

TABLE 051. DAIKIN INDUSTRIES LTD.: BUSINESS PERFORMANCE

TABLE 052. DAIKIN INDUSTRIES LTD.: PRODUCT PORTFOLIO

TABLE 053. DAIKIN INDUSTRIES LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. WACKER CHEMIE AG: SNAPSHOT

TABLE 054. WACKER CHEMIE AG: BUSINESS PERFORMANCE

TABLE 055. WACKER CHEMIE AG: PRODUCT PORTFOLIO

TABLE 056. WACKER CHEMIE AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. DOW CORNING CORPORATION: SNAPSHOT

TABLE 057. DOW CORNING CORPORATION: BUSINESS PERFORMANCE

TABLE 058. DOW CORNING CORPORATION: PRODUCT PORTFOLIO

TABLE 059. DOW CORNING CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. SHIN-ETSU CHEMICAL CO. LTD.: SNAPSHOT

TABLE 060. SHIN-ETSU CHEMICAL CO. LTD.: BUSINESS PERFORMANCE

TABLE 061. SHIN-ETSU CHEMICAL CO. LTD.: PRODUCT PORTFOLIO

TABLE 062. SHIN-ETSU CHEMICAL CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. JAMES WALKER & CO.: SNAPSHOT

TABLE 063. JAMES WALKER & CO.: BUSINESS PERFORMANCE

TABLE 064. JAMES WALKER & CO.: PRODUCT PORTFOLIO

TABLE 065. JAMES WALKER & CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. KRAIBURG TPE GMBH & CO. KG: SNAPSHOT

TABLE 066. KRAIBURG TPE GMBH & CO. KG: BUSINESS PERFORMANCE

TABLE 067. KRAIBURG TPE GMBH & CO. KG: PRODUCT PORTFOLIO

TABLE 068. KRAIBURG TPE GMBH & CO. KG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. DOW CHEMICAL COMPANY: SNAPSHOT

TABLE 069. DOW CHEMICAL COMPANY: BUSINESS PERFORMANCE

TABLE 070. DOW CHEMICAL COMPANY: PRODUCT PORTFOLIO

TABLE 071. DOW CHEMICAL COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. POLYCOMP: SNAPSHOT

TABLE 072. POLYCOMP: BUSINESS PERFORMANCE

TABLE 073. POLYCOMP: PRODUCT PORTFOLIO

TABLE 074. POLYCOMP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. JSR CORPORATION: SNAPSHOT

TABLE 075. JSR CORPORATION: BUSINESS PERFORMANCE

TABLE 076. JSR CORPORATION: PRODUCT PORTFOLIO

TABLE 077. JSR CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. FLEXAN: SNAPSHOT

TABLE 078. FLEXAN: BUSINESS PERFORMANCE

TABLE 079. FLEXAN: PRODUCT PORTFOLIO

TABLE 080. FLEXAN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. LLC: SNAPSHOT

TABLE 081. LLC: BUSINESS PERFORMANCE

TABLE 082. LLC: PRODUCT PORTFOLIO

TABLE 083. LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. ASAHI GLASS CO. LTD: SNAPSHOT

TABLE 084. ASAHI GLASS CO. LTD: BUSINESS PERFORMANCE

TABLE 085. ASAHI GLASS CO. LTD: PRODUCT PORTFOLIO

TABLE 086. ASAHI GLASS CO. LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. MITSUI CHEMICALS INC.: SNAPSHOT

TABLE 087. MITSUI CHEMICALS INC.: BUSINESS PERFORMANCE

TABLE 088. MITSUI CHEMICALS INC.: PRODUCT PORTFOLIO

TABLE 089. MITSUI CHEMICALS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. KACO GMBH + CO. KG: SNAPSHOT

TABLE 090. KACO GMBH + CO. KG: BUSINESS PERFORMANCE

TABLE 091. KACO GMBH + CO. KG: PRODUCT PORTFOLIO

TABLE 092. KACO GMBH + CO. KG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. EXXON MOBIL CORPORATION: SNAPSHOT

TABLE 093. EXXON MOBIL CORPORATION: BUSINESS PERFORMANCE

TABLE 094. EXXON MOBIL CORPORATION: PRODUCT PORTFOLIO

TABLE 095. EXXON MOBIL CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. PRECISION POLYMER ENGINEERING LTD.: SNAPSHOT

TABLE 096. PRECISION POLYMER ENGINEERING LTD.: BUSINESS PERFORMANCE

TABLE 097. PRECISION POLYMER ENGINEERING LTD.: PRODUCT PORTFOLIO

TABLE 098. PRECISION POLYMER ENGINEERING LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 098. TOSOH CORPORATION: SNAPSHOT

TABLE 099. TOSOH CORPORATION: BUSINESS PERFORMANCE

TABLE 100. TOSOH CORPORATION: PRODUCT PORTFOLIO

TABLE 101. TOSOH CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 101. THE CHEMOURS COMPANY: SNAPSHOT

TABLE 102. THE CHEMOURS COMPANY: BUSINESS PERFORMANCE

TABLE 103. THE CHEMOURS COMPANY: PRODUCT PORTFOLIO

TABLE 104. THE CHEMOURS COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 104. REISS MANUFACTURING INC.: SNAPSHOT

TABLE 105. REISS MANUFACTURING INC.: BUSINESS PERFORMANCE

TABLE 106. REISS MANUFACTURING INC.: PRODUCT PORTFOLIO

TABLE 107. REISS MANUFACTURING INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 107. SHOWA DENKO K.K.: SNAPSHOT

TABLE 108. SHOWA DENKO K.K.: BUSINESS PERFORMANCE

TABLE 109. SHOWA DENKO K.K.: PRODUCT PORTFOLIO

TABLE 110. SHOWA DENKO K.K.: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. HIGH PERFORMANCE ELASTOMER MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. HIGH PERFORMANCE ELASTOMER MARKET OVERVIEW BY TYPE

FIGURE 012. NITRILE-BASED ELASTOMERS MARKET OVERVIEW (2016-2028)

FIGURE 013. SILICONE ELASTOMERS MARKET OVERVIEW (2016-2028)

FIGURE 014. FLUOROELASTOMERS MARKET OVERVIEW (2016-2028)

FIGURE 015. HIGH PERFORMANCE ELASTOMER MARKET OVERVIEW BY APPLICATION

FIGURE 016. AUTOMOTIVE AND TRANSPORTATION MARKET OVERVIEW (2016-2028)

FIGURE 017. INDUSTRIAL MACHINERY MARKET OVERVIEW (2016-2028)

FIGURE 018. BUILDING AND CONSTRUCTION MARKET OVERVIEW (2016-2028)

FIGURE 019. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 020. ELECTRICAL AND ELECTRONICS MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA HIGH PERFORMANCE ELASTOMER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE HIGH PERFORMANCE ELASTOMER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC HIGH PERFORMANCE ELASTOMER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA HIGH PERFORMANCE ELASTOMER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA HIGH PERFORMANCE ELASTOMER MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the High Performance Elastomer Market research report is 2024-2032.

Dupont (USA), 3M Company (USA), Momentive Performance Materials Inc (USA), Zeon Chemicals L.P. (USA), Dow Corning Corporation (USA), Dow Chemical Company (USA), Flexan LLC (USA), Exxon Mobil Corporation (USA), The Chemours Company (USA), Reiss Manufacturing Inc. (USA), Kaco GmbH + Co. Kg (Germany), Kraiburg TPE GmbH & Co. Kg (Germany), Wacker Chemie AG (Germany), Precision Polymer Engineering Ltd. (UK), Daikin Industries Ltd. (Japan), JSR Corporation (Japan), Asahi Glass Co. Ltd (Japan), Mitsui Chemicals Inc. (Japan), Tosoh Corporation (Japan), Showa Denko K.K. (Japan), Shin-Etsu Chemical Co. Ltd. (Japan), and Other Major Players.

The High Performance Elastomer Market is segmented into Type, End-User, and Region. By Type, the market is categorized into Nitrile based Elastomers, Silicone Elastomers, and Fluoroelastomers. By End-User, the market is categorized into Healthcare, Industrial Machinery, Automotive & Transportation, Building & Construction, and Electrical & Electronics. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A High Performance Elastomer is a type of synthetic polymer known for its exceptional elasticity, resilience, and durability in demanding conditions. These elastomers exhibit superior mechanical properties, such as high tensile strength and resistance to abrasion, chemicals, and extreme temperatures. They are widely used in industries like automotive, aerospace, electronics, and healthcare for applications requiring reliable and long-lasting flexible components.

High-Performance Elastomer Market Size Was Valued at USD 18.17 Billion in 2023 and is Projected to Reach USD 34.14 Billion by 2032, Growing at a CAGR of 7.26% From 2024-2032.