Hemostats Market Synopsis:

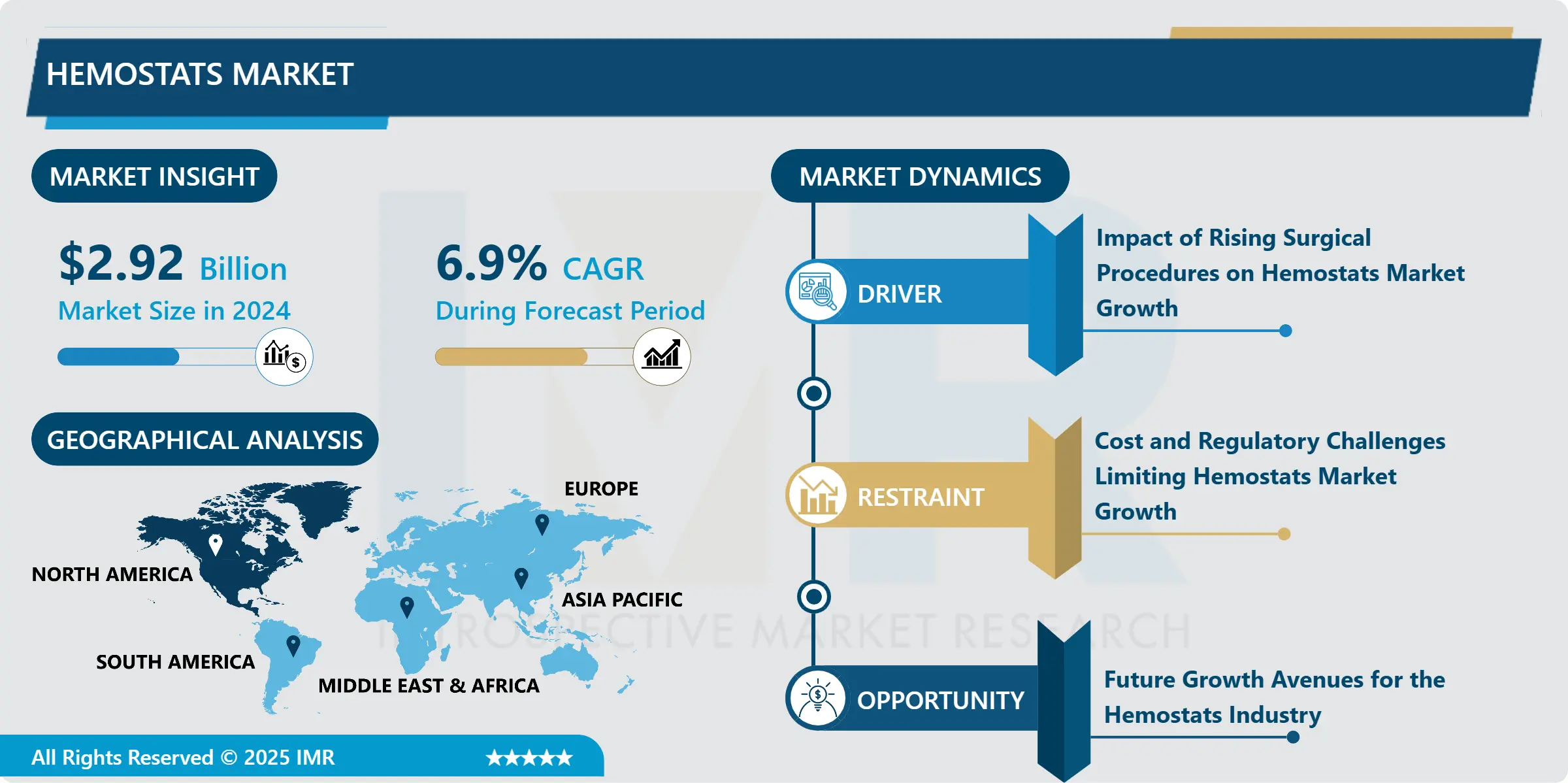

Hemostats Market Size Was Valued at USD 2.92 Billion in 2024, and is Projected to Reach USD 6.08 Billion by 2035, Growing at a CAGR of 6.9% from 2025-2035.

The hemostats market is growing steadily due to the increasing number of surgeries being performed around the world. Hemostats are products used to stop bleeding quickly during operations or after injuries. They are especially important in surgeries involving the heart, liver, or other organs where blood loss can be serious.

One of the main reasons for market growth is the rising number of people with chronic diseases such as cancer, heart disease, and diabetes. These conditions often lead to surgeries where hemostats are needed. Additionally, the growing elderly population, who are more likely to need surgical care, is further boosting demand. There are several types of hemostats available, including mechanical, active, and combination products. Many companies are also working on advanced hemostatic agents that are more effective and safer to use. These innovations make surgeries faster and help patients recover more quickly.

Hospitals and surgical centers, especially in developing countries, are increasingly adopting these products as healthcare systems improve. However, the high cost of some advanced hemostats and strict regulations can limit their wider use. Major companies in this field are focused on research, product development, and expanding their reach to new regions. With ongoing advancements and growing healthcare needs, the hemostats market is expected to keep expanding in the coming years.

Hemostats Market Growth and Trend Analysis:

Hemostats Market Growth Driver - Impact of Rising Surgical Procedures on Hemostats Market Growth

-

One of the main reasons for the growth of the hemostats market is the rising number of surgeries being performed across the world. As medical technology improves and access to healthcare increases, more people are undergoing surgeries for different health conditions. These include complex procedures like heart surgeries, joint replacements, brain surgeries, and even organ transplants.

- During most surgeries, managing bleeding is very important. If bleeding is not controlled properly, it can lead to serious complications or even death. This is where hemostats play a key role. Hemostats are special products or tools that help stop bleeding quickly and safely. They make the surgeon’s job easier and help patients recover faster.

- The increase in surgeries is being driven by several factors. More people are being diagnosed with chronic illnesses like heart disease, cancer, and diabetes. Many of these conditions eventually require surgical treatment. Also, with people living longer, age-related health issues that need surgery are becoming more common.

- In addition, improvements in surgical techniques and better hospital infrastructure, especially in developing countries, are allowing more surgeries to be performed. As a result, the demand for effective bleeding control solutions like hemostats is growing steadily. This trend is expected to continue, making surgical volume one of the strongest drivers of market growth.

Hemostats Market Limiting Factor - Cost and Regulatory Challenges Limiting Hemostats Market Growth

-

While the hemostats market is growing steadily, there are certain factors that can slow down its progress. One of the major challenges is the high cost of advanced hemostatic products. Many of the newer, more effective hemostats are expensive to produce, store, and use. This makes them less affordable for smaller hospitals, clinics, or healthcare centers, especially in low- and middle-income countries.

- In addition to the cost, strict regulatory requirements also pose a challenge. Since hemostats are used during surgeries and directly affect patient safety, they must meet high safety and quality standards. Getting approval from regulatory agencies like the U.S. FDA or the European Medicines Agency involves time consuming and expensive testing. This can delay the launch of new products and limit the entry of smaller companies into the market.

- Another concern is the potential for side effects or complications, such as allergic reactions or interference with wound healing. These risks make doctors cautious about using certain types of hemostats unless absolutely necessary.

- Together, these factors high cost, complex regulations, and safety concerns can limit the widespread use of hemostats, especially in resource-limited settings. Overcoming these barriers will be important for companies that want to expand their market reach and provide affordable, safe options for bleeding control during surgery.

Hemostats Market Expansion Opportunity – Future Growth Avenues for the Hemostats Industry

-

The hemostats market holds strong potential for growth, especially in emerging markets and through technological innovation. Countries in Asia-Pacific, Latin America, and the Middle East are expanding their healthcare infrastructure and increasing investments in hospitals and surgical facilities. As more people in these regions gain access to healthcare and health insurance, the demand for surgical tools like hemostats is rising quickly. These developing markets represent a major opportunity for companies to introduce affordable and effective hemostatic products.

- Another key area for expansion is the development of advanced and innovative products. As surgical methods evolve especially with the rise of minimally invasive and robotic surgeries there is a growing need for hemostats that are easier to apply, faster-acting, and safer. New types of hemostats, such as sprays, gels, and absorbable patches, are being designed to work efficiently in delicate or small surgical areas. These products offer better outcomes and are increasingly preferred by surgeons.

- There is also opportunity in creating biodegradable and bioactive hemostats that naturally dissolve in the body after use, reducing the risk of complications. These innovations also align with sustainability goals in healthcare. Lastly, partnerships with local distributors and healthcare providers can help companies reach new markets faster and build stronger trust with healthcare professionals. Together, these opportunities position the market for strong future growth.

Hemostats Market Challenge and Risk – Barriers to Growth in the Hemostats Market

-

While the hemostats market is growing, it also faces several challenges and risks that could slow down progress. One of the biggest challenges is the high cost of advanced hemostatic products. Many modern hemostats use specialized ingredients and technologies, making them expensive to produce. This limits access, especially in low- and middle-income countries where healthcare budgets are tight.

- Another major challenge is strict regulatory requirements. Hemostats are used in surgeries, which means they must meet very high safety and quality standards. Getting approval from agencies like the FDA (U.S.) or EMA (Europe) requires time-consuming and expensive testing. These regulations protect patients, but they also make it harder and slower for new products to enter the market.

- There are also risks of side effects or complications, such as allergic reactions or delayed wound healing. If products are not used properly or react poorly in a patient’s body, it can lead to medical issues and legal consequences. This makes some doctors hesitant to use new or unfamiliar hemostats.

- Additionally, strong competition among leading players can be a barrier for smaller companies trying to enter the market. Larger firms often dominate contracts with hospitals through better pricing and long-term relationships. To succeed, companies must focus on safety, affordability, and innovation while navigating a highly regulated and competitive environment.

Hemostats Market Segment Analysis:

Hemostats Market is segmented based on Type, Application, End-Users, and Region

By Type, Hemostats Segment is Expected to Dominate the Market During the Forecast Period

-

Active hemostats are a special type of surgical product used to stop bleeding quickly during medical procedures. Unlike passive hemostats that only provide a physical barrier, active hemostats contain biological agents, such as thrombin, which work directly with the body’s natural clotting system. Thrombin helps convert fibrinogen (a blood protein) into fibrin, which forms a stable blood clot. This process helps stop bleeding more efficiently, especially in situations where the body’s natural ability to clot may be slow or impaired.

- Active hemostats are especially useful in complex or high-risk surgeries, such as cardiovascular, liver, or neurological procedures, where fast and reliable bleeding control is essential. In these cases, uncontrolled bleeding can lead to longer surgery times, higher risk of complications, or even life-threatening situations. That’s why surgeons prefer using active hemostats—they help save time, reduce blood loss, and improve patient safety.

- These products are often used when pressure or stitching is not enough to stop the bleeding. They come in different forms such as powders, foams, or gels, making them suitable for use in hard-to-reach areas inside the body.

- Although they tend to be more expensive than traditional hemostatic products, their effectiveness and ability to reduce complications make them a valuable tool in modern surgical care. With ongoing advancements in biotechnology, active hemostats are becoming even more reliable and widely adopted in hospitals around the world.

By Application, Hemostats Segment Held the Largest Share in 2024

-

General surgery refers to a wide range of common surgical procedures that are performed to treat various health conditions. These include operations on the stomach, intestines, appendix, gallbladder, hernias, and other parts of the abdominal area. Because general surgeries are performed so frequently in hospitals and clinics around the world, they represent a large portion of the overall demand for hemostats.

- During any surgical procedure, there is always a risk of bleeding. In general surgeries, even though most procedures are routine, controlling bleeding quickly and safely is still very important. Excessive blood loss can lead to longer surgery times, infections, or slower recovery for the patient. That’s why surgeons rely on hemostatic products to manage bleeding efficiently during these operations.

- Hemostats used in general surgery can include gauze pads, sponges, gels, and powders, depending on the type and location of the bleeding. These products help by either physically stopping the flow of blood or by supporting the body’s natural clotting process.

- As the number of general surgeries continues to increase due to rising cases of digestive issues, hernias, and other common health problems the demand for reliable bleeding control solutions also grows. In both developed and developing countries, general surgery is often the first line of surgical care, making it a key application area for hemostats. This strong and steady demand makes general surgery one of the most important segments in the global hemostats market.

Hemostats Market Regional Insights:

Noth America is Expected to Dominate the Market Over the Forecast Period

-

North America, especially the United States, holds the largest share of the global hemostats market. This strong position is driven by several key factors that make the region highly favorable for the use and development of surgical hemostatic products.

- One of the main reasons is the high number of surgeries performed annually. In the U.S. and Canada, there is a large volume of procedures ranging from general surgeries to complex cardiovascular and orthopedic operations. Each of these surgeries requires effective bleeding control, increasing the demand for reliable hemostats.

- The region also benefits from a well-developed healthcare system with advanced hospitals, skilled surgeons, and easy access to modern surgical tools. Most medical facilities in North America are equipped with the latest technology, and healthcare providers are open to adopting new and innovative hemostatic solutions to improve patient outcomes.

- In addition, favorable reimbursement policies allow hospitals and clinics to invest in high-quality hemostats without financial strain. This encourages the use of premium products, including active and combination hemostats.

- North America is also home to several leading medical device companies that continuously develop and launch advanced hemostatic products. Strong research and development activities, along with regulatory support from agencies like the FDA, help bring new technologies to market faster. Overall, North America's strong infrastructure, innovation, and high surgical volume make it the most dominant and mature region in the global hemostats market.

Hemostats Market Active Players :

- Advanced Medical Solutions Group plc (UK)

- Anika Therapeutics (USA)

- ARCH Therapeutics Inc. (USA)

- B. Braun Melsungen AG (Germany)

- Baxter International Inc. (USA)

- BD (USA)

- BioCer Entwicklungs GmbH (Germany)

- Biotak (USA)

- CryoLife Inc. (USA)

- CSL Behring (Australia/USA)

- CuraMedical BV (Netherlands)

- Equimedical (Netherlands)

- Gelita Medical GmbH (Germany)

- Hemarus Therapeutics (India)

- Hemostasis LLC (USA)

- Johnson & Johnson (USA)

- LifeScience PLUS, Inc. (USA)

- Macropore Biosurgery (USA)

- Marine Polymer Technologies (USA)

- Medtronic plc (Ireland/USA)

- Pfizer Inc. (USA)

- Quick-Med Technologies, Inc. (USA)

- Samyang Holdings Corporation (South Korea)

- Scion Cardio-Vascular, Inc. (USA)

- Starch Medical Inc. (USA)

- Stryker Corporation (USA)

- Teleflex Incorporated (USA)

- Vascular Solutions Inc. (USA)

- Zimmer Biomet Holdings Inc. (USA)

- Z-Medica LLC (USA)

- Other Active Players

Key Industry Developments in the Hemostats Market:

- In July 2023, Baxter launched PERCLOT Absorbable Hemostatic Powder in the U.S., expanding its active and passive product line for bleeding control

- In 2025, on April 30th the Teleflex received expanded FDA 510(k) clearance for its QuikClot Control+™, now approved for all grades of internal and external bleeding. This broadens its use in emergency, trauma, general, gynecologic, and orthopedic surgeries, and adds an estimated $150 million in addressable market in the U.S.

|

Hemostats Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 2.92 Billion |

|

Forecast Period 2025-35 CAGR: |

6.9 % |

Market Size in 2035: |

USD 6.08 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application

|

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Hemostats Market by Product (2018-2035)

4.1 Hemostats Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Active Hemostats

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Passive Hemostats

4.5 Combination Hemostats

4.6 Others

Chapter 5: Hemostats Market by Application (2018-2035)

5.1 Hemostats Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Trauma

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cardiovascular Surgery

5.5 General Surgery

5.6 Plastic Surgery

5.7 Orthopedic Surgery

5.8 Neurosurgery

5.9 Others

Chapter 6: Hemostats Market by End-User (2018-2035)

6.1 Hemostats Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals & ASCs

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Tactical Combat Casualty Care Centers

6.5 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Hemostats Market Share by Manufacturer/Service Provider(2024)

7.1.3 Industry BCG Matrix

7.1.4 PArtnerships, Mergers & Acquisitions

7.2 ADVANCED MEDICAL SOLUTIONS GROUP PLC (UK)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Recent News & Developments

7.2.10 SWOT Analysis

7.3 ANIKA THERAPEUTICS (USA)

7.4 ARCH THERAPEUTICS INC. (USA)

7.5 B. BRAUN MELSUNGEN AG (GERMANY)

7.6 BAXTER INTERNATIONAL INC. (USA)

7.7 BD (USA)

7.8 BIOCER ENTWICKLUNGS GMBH (GERMANY)

7.9 BIOTAK (USA)

7.10 CRYOLIFE INC. (USA)

7.11 CSL BEHRING (AUSTRALIA/USA)

7.12 CURAMEDICAL BV (NETHERLANDS)

7.13 EQUIMEDICAL (NETHERLANDS)

7.14 GELITA MEDICAL GMBH (GERMANY)

7.15 HEMARUS THERAPEUTICS (INDIA)

7.16 HEMOSTASIS LLC (USA)

7.17 JOHNSON & JOHNSON (USA)

7.18 LIFESCIENCE PLUS

7.19 INC. (USA)

7.20 MACROPORE BIOSURGERY (USA)

7.21 MARINE POLYMER TECHNOLOGIES (USA)

7.22 MEDTRONIC PLC (IRELAND/USA)

7.23 PFIZER INC. (USA)

7.24 QUICK-MED TECHNOLOGIES

7.25 INC. (USA)

7.26 SAMYANG HOLDINGS CORPORATION (SOUTH KOREA)

7.27 SCION CARDIO-VASCULAR

7.28 INC. (USA)

7.29 STARCH MEDICAL INC. (USA)

7.30 STRYKER CORPORATION (USA)

7.31 TELEFLEX INCORPORATED (USA)

7.32 VASCULAR SOLUTIONS INC. (USA)

7.33 ZIMMER BIOMET HOLDINGS INC. (USA)

7.34 Z-MEDICA LLC (USA)

7.35 AND OTHER ACTIVE PLAYERS.

Chapter 8: Global Hemostats Market By Region

8.1 Overview

8.2. North America Hemostats Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecast Market Size by Country

8.2.4.1 US

8.2.4.2 Canada

8.2.4.3 Mexico

8.3. Eastern Europe Hemostats Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecast Market Size by Country

8.3.4.1 Russia

8.3.4.2 Bulgaria

8.3.4.3 The Czech Republic

8.3.4.4 Hungary

8.3.4.5 Poland

8.3.4.6 Romania

8.3.4.7 Rest of Eastern Europe

8.4. Western Europe Hemostats Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecast Market Size by Country

8.4.4.1 Germany

8.4.4.2 UK

8.4.4.3 France

8.4.4.4 The Netherlands

8.4.4.5 Italy

8.4.4.6 Spain

8.4.4.7 Rest of Western Europe

8.5. Asia Pacific Hemostats Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecast Market Size by Country

8.5.4.1 China

8.5.4.2 India

8.5.4.3 Japan

8.5.4.4 South Korea

8.5.4.5 Malaysia

8.5.4.6 Thailand

8.5.4.7 Vietnam

8.5.4.8 The Philippines

8.5.4.9 Australia

8.5.4.10 New Zealand

8.5.4.11 Rest of APAC

8.6. Middle East & Africa Hemostats Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecast Market Size by Country

8.6.4.1 Turkiye

8.6.4.2 Bahrain

8.6.4.3 Kuwait

8.6.4.4 Saudi Arabia

8.6.4.5 Qatar

8.6.4.6 UAE

8.6.4.7 Israel

8.6.4.8 South Africa

8.7. South America Hemostats Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecast Market Size by Country

8.7.4.1 Brazil

8.7.4.2 Argentina

8.7.4.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

Chapter 10 Our Thematic Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 11 Case Study

Chapter 12 Appendix

12.1 Sources

12.2 List of Tables and figures

12.3 Short Forms and Citations

12.4 Assumption and Conversion

12.5 Disclaimer

|

Hemostats Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 2.92 Billion |

|

Forecast Period 2025-35 CAGR: |

6.9 % |

Market Size in 2035: |

USD 6.08 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application

|

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||