Key Market Highlights

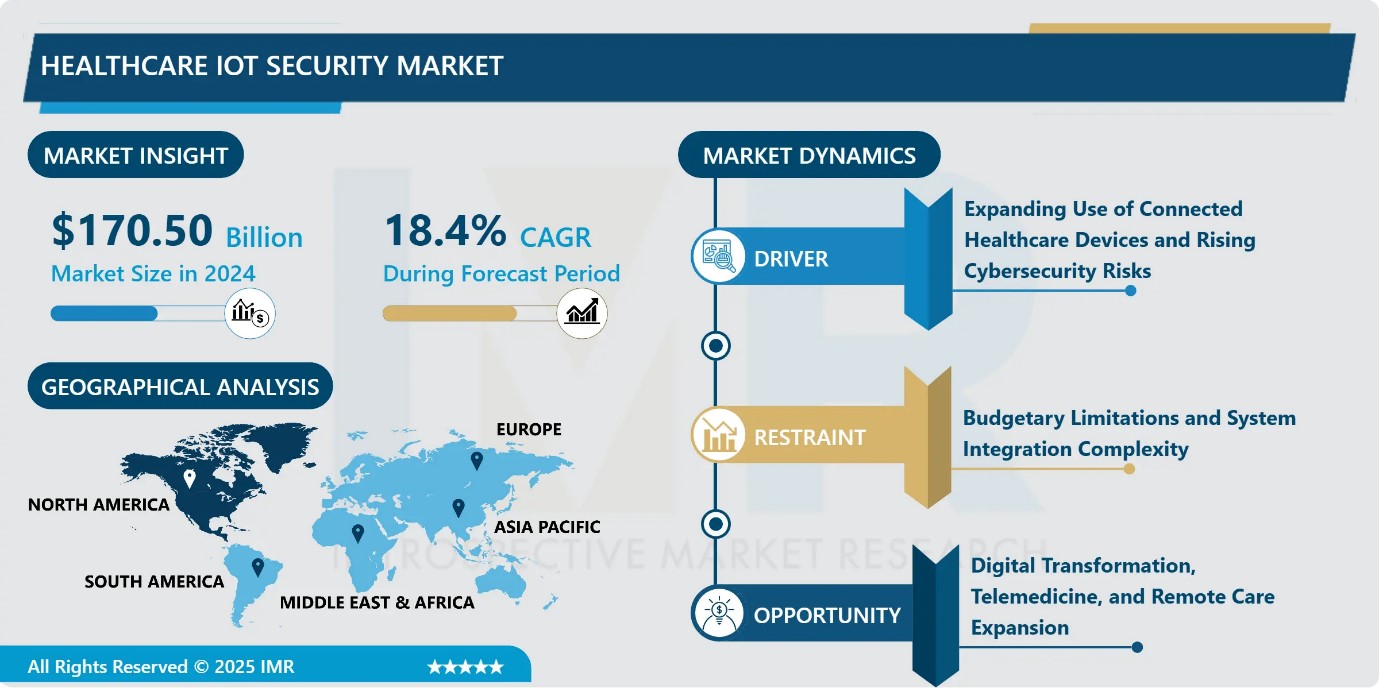

Healthcare IoT Security Market Size Was Valued at USD 170.50 Billion in 2024, and is Projected to Reach USD 1,092.93 Billion by 2035, Growing at a CAGR of 18.4% from 2025-2035.

- Market Size in 2024: USD 170.50 Billion

- Projected Market Size by 2035: USD 1092.93 Billion

- CAGR (2025–2035): 18.4%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia-Pacific

- By Connectivity Technology: The Wi-Fi segment is anticipated to lead the market by accounting for 37.8% of the market share throughout the forecast period.

- By Deployment Model: The Cloud segment is expected to capture 56.34% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 31.90% of the market share during the forecast period.

- Active Players: Cisco Systems, Inc. (United States), Dell Technologies Inc. (United States), Deutsche Telekom AG (Germany), Eurotech S.p.A. (Italy), GE Healthcare (United States), and Other Active Players.

Healthcare IoT Security Market Synopsis:

The Healthcare IoT Security Market refers to solutions and services designed to protect interconnected IoT devices, networks, and data used across healthcare environments. These systems secure sensitive patient information, including electronic health records and real-time monitoring data, from cyber threats such as data breaches, unauthorized access, and malware attacks. With the rapid adoption of IoT-enabled medical devices, wearables, and remote patient monitoring systems, the need for robust security frameworks has become critical. The market is driven by the rising digitalisation of healthcare, the increasing prevalence of chronic diseases, regulatory compliance requirements, and heightened awareness of cybersecurity risks. Ensuring data integrity, privacy, and system reliability remains central to sustaining trust and safe healthcare delivery.

Healthcare IoT Security Market Dynamics and Trend Analysis:

Healthcare IoT Security Market Growth Driver-Expanding Use of Connected Healthcare Devices and Rising Cybersecurity Risks

- The Healthcare IoT Security market is primarily driven by the rapid adoption of connected medical devices across healthcare operations. Wearables, remote patient monitoring systems, smart diagnostic equipment, and networked medical devices are increasingly used to enable real-time data collection and improved patient care. However, this expanding ecosystem significantly increases the attack surface, exposing sensitive health data to cyber threats.

- The growing reliance on remote care and digital health platforms further intensifies security challenges, as data is continuously transmitted across networks and cloud systems. Frequent cyberattacks, malware incidents, and network vulnerabilities have heightened awareness among healthcare providers, compelling them to invest in comprehensive IoT security solutions to protect devices, networks, and patient information.

Healthcare IoT Security Market Limiting Factor-Budgetary Limitations and System Integration Complexity

- Budgetary constraints remain a major restraint for the Healthcare IoT Security Market, as cybersecurity investments often represent a small share of overall healthcare spending. Providers tend to prioritize direct patient-care assets and clinical staffing over security infrastructure, despite the high financial and operational risks of data breaches. This challenge is more pronounced among small and mid-sized facilities and healthcare organizations in developing regions, where limited capital restricts adoption of advanced security solutions and skilled cybersecurity personnel.

- Additionally, the highly heterogeneous healthcare IT ecosystem comprising diverse devices, operating systems, and proprietary applications creates significant integration challenges. Implementing and managing IoT security across fragmented environments requires extensive customization, testing, and ongoing maintenance, leading to delayed deployments and leaving vulnerabilities insufficiently addressed.

Healthcare IoT Security Market Expansion Opportunity-Digital Transformation, Telemedicine, and Remote Care Expansion

- The rapid digital transformation of healthcare presents a strong growth opportunity for the market, driven by the expansion of telemedicine, remote patient monitoring, and hospital-at-home models. Programs such as Acute Hospital Care at Home demonstrate scalability, with thousands of discharges managed remotely, while commercial payors increasingly align with Medicare by integrating IoT-driven metrics into value-based care contracts.

- This reimbursement clarity reduces investment risk and accelerates adoption of connected healthcare technologies. Simultaneously, rising telehealth utilization and the emergence of 5G-enabled medical IoT devices increase demand for secure, high-performance digital infrastructure. As care delivery shifts beyond hospital settings, decentralized and connected healthcare solutions gain sustained outpatient growth momentum.

Healthcare IoT Security Market Challenge and Risk-Standardization Gaps, Skills Shortages, and Device Constraints

- The Healthcare IoT Security Market faces critical challenges stemming from a lack of standardization and interoperability across the fragmented Internet of Medical Things (IoMT) ecosystem. Devices from multiple vendors rely on proprietary protocols, complicating unified security deployment and increasing integration risks. This fragmentation often forces healthcare providers to adopt costly, piecemeal security solutions that hinder scalability. Additionally, limited cybersecurity awareness and a shortage of professionals with combined IT and clinical expertise restrict effective implementation and management of security frameworks. Compounding these issues, many medical IoT devices have constrained processing power, memory, and battery life, limiting the deployment of advanced security features without compromising device performance or patient safety.

Healthcare IoT Security Market Trend

Accelerated Adoption of Intelligent, Patient-Centric, and Advanced Security Technologies in the Healthcare IoT Ecosystem

- The Healthcare IoT Security market is witnessing a strong shift toward advanced and intelligent security technologies. Healthcare organizations are increasingly adopting artificial intelligence and machine learning to enable real-time threat detection, predictive analytics, and adaptive security responses. At the same time, there is a growing focus on patient-centric security solutions that protect sensitive data while ensuring a seamless user experience, helping to build patient trust and engagement.

- The rapid integration of IoT devices across healthcare operations has further intensified the need for comprehensive security frameworks. Innovations such as zero-trust architectures, advanced encryption, secure communication protocols, and emerging technologies like blockchain and federated security are enhancing resilience and strengthening overall healthcare IoT protection.

Healthcare IoT Security Market Segment Analysis:

Healthcare IoT Security Market is segmented based on Component, Security Type, End-User, Connectivity Technology, Deployment Model, and Region.

By Connectivity Technology, Wi-Fi segment is expected to dominate the market with around 37.8% share during the forecast period.

- Wi-Fi remains the dominant connectivity technology in the IoT in healthcare market, holding the largest share due to extensive existing infrastructure and widespread compatibility with medical devices and clinical systems. Hospitals and healthcare facilities have long relied on Wi-Fi networks for internal data transmission, enabling seamless integration with electronic health records, monitoring systems, and connected medical equipment. Its cost-effectiveness, ease of deployment, and ability to support high device density make Wi-Fi the preferred choice for in-facility applications such as patient monitoring and diagnostics. The continued reliance on Wi-Fi ensures stable connectivity, operational continuity, and scalability within established healthcare environments.

By Deployment Model, Cloud is expected to dominate with close to 56.34% market share during the forecast period.

- Cloud-based deployment continues to dominate the Healthcare IoT Security Market, accounting for the largest revenue share due to its scalability, centralized analytics, and operational efficiency. Cloud platforms enable healthcare organizations to process massive volumes of clinical and imaging data, support seamless software updates, and integrate easily with existing IT systems.

- Robust security frameworks, continuous monitoring, and compliance support further strengthen cloud adoption across hospitals and large healthcare networks. Its dominance is driven by lower upfront costs, faster deployment, and the ability to manage distributed IoT environments from a single platform. While edge and hybrid models are gaining traction for latency-sensitive and data-sovereignty needs, cloud solutions remain the preferred foundation for enterprise-wide healthcare IoT security.

Healthcare IoT Security Market Regional Insights:

North America region is estimated to lead the market with around 31.90% share during the forecast period.

- North America continues to dominate the Healthcare IoT Security market due to its advanced healthcare infrastructure, mature IT ecosystems, and strong emphasis on cybersecurity. The region benefits from widespread adoption of connected medical devices, which has increased the need for robust security solutions to protect sensitive patient information. Strict regulatory frameworks and compliance requirements further drive demand, encouraging healthcare organizations to prioritize data protection and system integrity.

- The presence of leading technology companies such as Cisco Systems, IBM, and Palo Alto Networks supports continuous innovation through sustained investments in research and development. The United States leads the region, supported by government initiatives and a proactive approach to cybersecurity. North America’s dominance is driven by technological leadership, regulatory readiness, and heightened awareness of evolving cyber threats.

Healthcare IoT Security Market Active Players:

- Cisco Systems, Inc. (United States)

- Dell Technologies Inc. (United States)

- Deutsche Telekom AG (Germany)

- Eurotech S.p.A. (Italy)

- GE Healthcare (United States)

- IBM Corporation (United States)

- Intel Corporation (United States)

- Kaspersky Lab (Russia)

- Medtronic plc (Ireland)

- Microsoft Corporation (United States)

- Oracle Corporation (United States)

- Koninklijke Philips N.V. (Netherlands)

- Sophos Group Plc (United Kingdom)

- Trend Micro Inc. (Japan)

- Fortinet, Inc. (United States)

- Other Active Players

Key Industry Developments in the Healthcare IoT Security Market:

- In February 2025: Oracle launched its Clinical Digital Assistant for ambulatory care settings, designed to automate clinical documentation processes. The solution significantly reduces physician administrative workload, lowering daily note-taking time by approximately 20–40% and improving workflow efficiency.

Advanced Security Architecture and Technologies Safeguarding the Healthcare IoT Ecosystem: Device-Level Protection, Network Defense, and Intelligent Threat Management

- The technical framework of the Healthcare IoT Security Market centers on protecting the Internet of Medical Things (IoMT) ecosystem through multilayered security architectures. Core technologies include device authentication, secure boot, firmware integrity checks, and end-to-end encryption to safeguard data in transit and at rest. Network security solutions such as segmentation, intrusion detection systems, and zero-trust architectures help prevent lateral movement of threats across connected devices. Advanced platforms leverage artificial intelligence and machine learning to enable real-time threat detection, behavioral analytics, and anomaly identification across large device fleets.

- Cloud-based security management systems provide centralized visibility, automated updates, and policy enforcement, while edge security solutions support low-latency protection for time-critical clinical applications. Compliance with healthcare regulations such as HIPAA and GDPR is embedded through audit logging, access controls, and data governance mechanisms. Overall, the market’s technical evolution focuses on scalability, interoperability, and continuous risk mitigation across distributed healthcare environments.

|

Healthcare IoT Security Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 170.50 Bn. |

|

Forecast Period 2025-35 CAGR: |

18.4% |

Market Size in 2035: |

USD 1092.93 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Security Type |

|

||

|

By End-User

|

|

||

|

By Connectivity Technology |

|

||

|

By Deployment Model |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Healthcare IoT Security Market by Component (2018-2035)

4.1 Healthcare IoT Security Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Solutions

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Services

Chapter 5: Healthcare IoT Security Market by Security Type (2018-2035)

5.1 Healthcare IoT Security Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Application Security

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Network Security

5.5 End-Point Security

5.6 Cloud Security

Chapter 6: Healthcare IoT Security Market by End User (2018-2035)

6.1 Healthcare IoT Security Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals & Clinics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Ambulatory Surgical Centers

6.5 Research & Diagnostic Laboratories

6.6 Pharmaceuticals

6.7 Medical Device Manufacturers

6.8 Biotechnology

Chapter 7: Healthcare IoT Security Market by Connectivity Technology (2018-2035)

7.1 Healthcare IoT Security Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Bluetooth Low Energy (BLE)

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Wi-Fi

7.5 Cellular & 5G

7.6 Others

Chapter 8: Healthcare IoT Security Market by Deployment Model (2018-2035)

8.1 Healthcare IoT Security Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Cloud

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 On-Premise/Edge

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Healthcare IoT Security Market Share by Manufacturer/Service Provider(2024)

9.1.3 Industry BCG Matrix

9.1.4 PArtnerships, Mergers & Acquisitions

9.2 CISCO SYSTEMS

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Recent News & Developments

9.2.10 SWOT Analysis

9.3 INC. (UNITED STATES)

9.4 DELL TECHNOLOGIES INC. (UNITED STATES)

9.5 DEUTSCHE TELEKOM AG (GERMANY)

9.6 EUROTECH S.P.A. (ITALY)

9.7 GE HEALTHCARE (UNITED STATES)

9.8 IBM CORPORATION (UNITED STATES)

9.9 INTEL CORPORATION (UNITED STATES)

9.10 KASPERSKY LAB (RUSSIA)

9.11 MEDTRONIC PLC (IRELAND)

9.12 MICROSOFT CORPORATION (UNITED STATES)

9.13 ORACLE CORPORATION (UNITED STATES)

9.14 KONINKLIJKE PHILIPS N.V. (NETHERLANDS)

9.15 SOPHOS GROUP PLC (UNITED KINGDOM)

9.16 TREND MICRO INC. (JAPAN)

9.17 FORTINET

9.18 INC. (UNITED STATES) AND OTHER ACTIVE PLAYERS

Chapter 10: Global Healthcare IoT Security Market By Region

10.1 Overview

10.2. North America Healthcare IoT Security Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecast Market Size by Country

10.2.4.1 US

10.2.4.2 Canada

10.2.4.3 Mexico

10.3. Eastern Europe Healthcare IoT Security Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecast Market Size by Country

10.3.4.1 Russia

10.3.4.2 Bulgaria

10.3.4.3 The Czech Republic

10.3.4.4 Hungary

10.3.4.5 Poland

10.3.4.6 Romania

10.3.4.7 Rest of Eastern Europe

10.4. Western Europe Healthcare IoT Security Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecast Market Size by Country

10.4.4.1 Germany

10.4.4.2 UK

10.4.4.3 France

10.4.4.4 The Netherlands

10.4.4.5 Italy

10.4.4.6 Spain

10.4.4.7 Rest of Western Europe

10.5. Asia Pacific Healthcare IoT Security Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecast Market Size by Country

10.5.4.1 China

10.5.4.2 India

10.5.4.3 Japan

10.5.4.4 South Korea

10.5.4.5 Malaysia

10.5.4.6 Thailand

10.5.4.7 Vietnam

10.5.4.8 The Philippines

10.5.4.9 Australia

10.5.4.10 New Zealand

10.5.4.11 Rest of APAC

10.6. Middle East & Africa Healthcare IoT Security Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecast Market Size by Country

10.6.4.1 Turkiye

10.6.4.2 Bahrain

10.6.4.3 Kuwait

10.6.4.4 Saudi Arabia

10.6.4.5 Qatar

10.6.4.6 UAE

10.6.4.7 Israel

10.6.4.8 South Africa

10.7. South America Healthcare IoT Security Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecast Market Size by Country

10.7.4.1 Brazil

10.7.4.2 Argentina

10.7.4.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

Chapter 12 Our Thematic Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Chapter 13 Case Study

Chapter 14 Appendix

14.1 Sources

14.2 List of Tables and figures

14.3 Short Forms and Citations

14.4 Assumption and Conversion

14.5 Disclaimer

|

Healthcare IoT Security Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 170.50 Bn. |

|

Forecast Period 2025-35 CAGR: |

18.4% |

Market Size in 2035: |

USD 1092.93 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Security Type |

|

||

|

By End-User

|

|

||

|

By Connectivity Technology |

|

||

|

By Deployment Model |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||