Global Hazelnut Market Overview

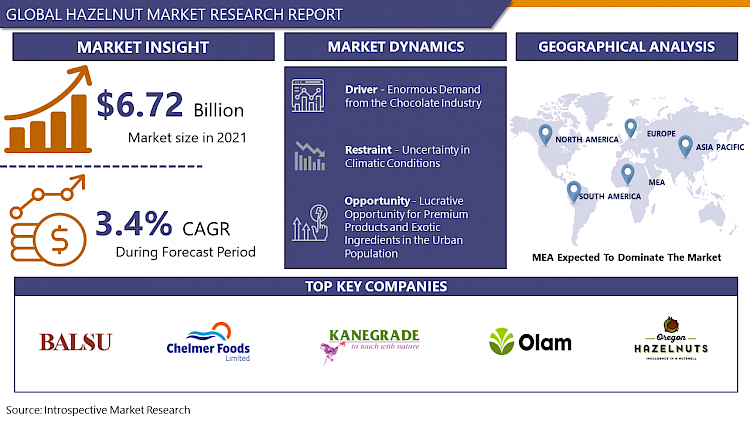

The Global Hazelnut Market size is expected to grow from USD 6.95 billion in 2022 to USD 9.08 billion by 2030, at a CAGR of 3.4% during the forecast period (2023-2030).

Hazelnuts are the nuts obtained from the hazel tree and can be found whole, raw, ground, sliced, or roasted. Hazelnuts are used primarily as a snack or added to baked goods. According to the International Nut and Dried Fruit Council, Hazelnut production has shown a rise in growth of 21% in 2021 and is estimated to increase between 1% to 5% in the upcoming years. Hazelnuts add taste and flavor to the chocolate truffles and are ground into flour for biscuits, and cakes. Furthermore, when compared to peanut butter, Chocolate-hazelnut spreads are majorly used, and numerous versions of this spread are available in supermarkets. Hazelnuts are also used as an ingredient in confectionery such as chocolate, breakfast cereals, nougat cookies, chopped nuts, pralines, nut spreads, and processed formulations. Hazelnut oil is used extensively for aromatherapy and massage purposes, as well as in various hair care products. Owing to the presence of essential skincare elements, hazelnut is also used widely in the preparation of soaps, facial oils, lotions, creams, and many more, which further drives the growth of the hazelnut market.

Market Dynamics And Factors For Hazelnut Market

Drivers:

Enormous Demand from the Chocolate Industry

Along with the rapid growth in the chocolate industry, the rise in demand from consumers for tasty and nutritious chocolates and chocolate spreads has proved to be a boon for hazelnut market growth. This rapidly rising demand encourages the key manufacturers of the chocolate industry to innovate and introduce new chocolate products with hazelnuts added to them. Chocolate hazelnut spreads are gaining popularity among health-conscious consumers along with peanut butter, which boosts the growth of the hazelnut market. Furthermore, hazelnut chocolate spreads and chocolates are vital in improving fertility, boosting metabolism rate, lowering cholesterol, weight loss, and digestion, which motivates the chocolate manufacturers to use them in appropriate quantities in their products. For instance, the key manufacturer of chocolate Lindt introduced a chocolate spread with 40% hazelnut in it and made it available in the UK and European markets. Additionally, Ferrero considers hazelnuts to be their key ingredient, and in fact, 25% of the world’s supply of hazelnuts is used in Ferrero products. Ferrero has utilized hazelnuts effectively in its trademark products such as Kinder Bueno, Ferrero Rocher, and Nutella, which has led to increasing demand for hazelnuts all across the world. Moreover, the chocolate manufacturers re-launch their chocolate products during the festive seasons with enhanced taste or with luxury nuts incorporated into chocolates, which is further anticipated to drive the market growth of hazelnuts over the forecast period.

Restraints:

Uncertainty in Climatic Conditions

Hazelnuts are great for the environment, but hazelnut trees are vulnerable to changing climatic conditions. In recent years, severe storms, heat waves, and drought conditions have harmed the production of hazelnut trees, which has led to a decline in the growth of the hazelnut market. Hazelnut plants need adequate and regular rainfall, but unpredictable rainfall patterns have led to a loss in production and crop quality. This is also due to the high rainfall which leads to massive storm conditions causing landslides and floods, thereby hampering the growth of hazelnut plants. Additionally, massive storms along with high winds are becoming common, which further uproots hazelnut trees and increases soil erosions. The rising temperature conditions also create temporal mismatches during pollination, which thereby reduces crop quality and yields, and is further expected to hinder the market growth of hazelnuts in the forecasted years.

Opportunities:

Lucrative Opportunity for Premium Products and Exotic Ingredients in the Urban Population

Demand for hazelnut is expected to witness a rapid increase among various end-use industries. The increase in urbanization and disposable incomes have led to a rapid rise in the market growth of the premium products and further provided a profitable opportunity for hazelnut products to grow at a faster rate, especially, in the North American and the European region. Consumers in the regions are willing to pay premium prices for products with exotic ingredients including frozen and confectionery products. The inclination toward products such as chocolates, muffins, cakes, pastries, praline, and icecreams that contain hazelnuts is also expected to grow rapidly in the South Asian regions. Furthermore, the key manufacturers of these products consistently bring innovative product to the market that generates a lucrative opportunity for hazelnut market growth. For instance, M&M'S recently launched its Hazelnut Spread Chocolate Candies which features a hazelnut spread center covered in delicious milk chocolate, and showed immense growth from the millennials and urban population immediately after the launch.

Segmentation Analysis Of Hazelnut Market

By Type, the processed hazelnut segment dominates the hazelnut market. Processed hazelnuts are easily accessible to the consumers, processed to suit different consumer preferences and tastes, and are available in many forms. Processed hazelnuts hold 58% of the market growth and are majorly used by the snack market which further drives the hazelnut market growth. Additionally, the high demand for dairy & frozen desserts, bakery & confectionery, and spreads & creams, have led to the dominance of this segment. They are also used further in the production of cosmetics and personal care products as well as an ingredient in animal feed.

By Application, the food & beverages segment dominates the global hazelnut market. The rapid growth is attributed to the rising hazelnut usage in chocolates, icecreams, cakes, spreads, creams, and bars. Also, owing to the innovative and attractive product range offered by food & beverage manufacturers fuels the segment growth. For instance, in March 2019, Cadbury Dairy Milk Silk brought into the market a Novelty - Silk Hazelnut chocolate with whole Turkish hazelnuts. In addition, strong consumer acceptance of shelled nuts because of their nutritional content, high consumption of functional drinks, and specialty coffee blends in the North American and European regions drive the market growth. Also, to serve the growing demand for organic food and beverages, growers are engaged in producing organic hazelnut.

By Distribution channel, the offline segment dominates the hazelnut market growth. Both the inshell and kernel-based hazelnuts are available on a large scale in various supermarkets and hypermarkets propels the market growth. Additionally, the ease and convenience of purchasing products offline, and the availability of varied brands and product range attracts more consumers, thereby driving the growth of this segment.

Regional Analysis Of Hazelnut Market

The Middle East and Africa is the major dominating region for the hazelnut market. Turkey is the largest producer of Hazelnuts and it accounts for around 70% of the world’s hazelnut supply owing to the rising demand from the millennials and urban population as well as the favorable climatic conditions in this region. Also, according to the latest data from the International Nut and Dried Fruit Council (INC), the global hazelnut crop in 2021-2022 is estimated to amount to 1.16 million mt of inshell form of hazelnuts, 8% more than the last year. Turkey can also increase its production to 790,000 mt - a good 23% more than in the previous season and is undoubtedly the undisputed leader of the hazelnut market, owing to the major manufacturers present in the country. Additionally, the innovative product offerings from key players such as Balsu Gida, Basa foods, and Arslantürk, have propelled the rapid growth of the hazelnut market in this region.

Europe is the second dominating and fastest growing region of the hazelnut market. Italy holds the largest share in the European region for hazelnut production and export. Hazelnuts are sold both shelled and in-shell; the shelled nuts are sold majorly to the confectioneries and bakeries whereas the in-shell hazelnuts are sold in the form of daily snacks, which drives the market growth. Around 90% of the hazelnuts that are produced in the Italian country are provided to the processing companies, whereas the remaining 10% are stored for fresh consumption. The hazelnut production was around 1,60,000 mt in 2021 and is expected to grow steadily in this country owing to the increasing urbanization, and inclination of consumers towards seeds, nuts, and fruits. Italy typically cultivates the Corylus avellana variety of hazelnut, which, unlike the Turkish type, detaches automatically from the husk and falls to the ground. This variety has shown immense growth in recent years which has further led to the rapid growth of hazelnut production in the European region.

Covid-19 Impact Analysis On Hazelnut Market

The COVID-19 pandemic had a strong impact on numerous agriculture and food industries. However, due to the sudden emergence of the virus, the population all around the world began to opt for healthy and safe food products, which boosted the development of the hazelnut market in the post covid era. Further, with the impact of COVID-19, there has been an inclination toward fruits, nuts, etc., which increased the sales of hazelnut products. The Hazelnut market is quickly reaching its pre-COVID levels and a steady growth rate is forecasted in the upcoming years, fuelled by the economic revival in the developing nations. However, unprecedented things due to more virus waves are expected to slow the production.

Top Key Players Covered In Hazelnut Market

- Balsu Gida (Turkey)

- Chelmer Foods (North Essex)

- Kane grade (U.K)

- Olam International (Singapore)

- Oregon Hazelnuts (U.S.)

- Aydin Kuruyemis (Istanbul)

- GEONUTS (Georgia)

- Poyraz Tarimsal (Istanbul)

- Barry Callebaut AG (Switzerland)

- Arslantürk (Turkey)

- Karimex (Brazil)

- Gursoy Tarimsal Urunler Gida (Turkey)

- Fruits of Turkey (Turkey)

- BATA Food (Turkey)

- Durak Findik (Turkey), and other major players.

Key Industry Development In The Hazelnut Market

In July 2021, the Italian food brand Fabulous declared the launch of a line of organic hazelnut and cocoa spreads that are created with a combination of hazelnuts, chickpea, and cocoa. The original Hazelnut Cocoa product further will be followed by the launch of the Savoury Orange Hazelnut as well as Crunchy Hazelnut flavors.

In April, 2021, Hazelnut Growers of Oregon (HGO) and its parent company Wilco happily announced that they are seeking a partner with a track record of building great brands to further form a joint venture to grow HGO’s retail hazelnut consumer product business.

|

Global Hazelnut Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2021 |

Market Size in 2022: |

USD 6.95 Bn. |

|

Forecast Period 2023-30 CAGR: |

3.4% |

Market Size in 2030: |

USD 9.08 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Application

3.3 By Distribution Channel

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Hazelnut Market by Type

5.1 Hazelnut Market Overview Snapshot and Growth Engine

5.2 Hazelnut Market Overview

5.3 Processed Hazelnut

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Processed Hazelnut: Grographic Segmentation

5.4 Unprocessed Hazelnut

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Unprocessed Hazelnut: Grographic Segmentation

Chapter 6: Hazelnut Market by Application

6.1 Hazelnut Market Overview Snapshot and Growth Engine

6.2 Hazelnut Market Overview

6.3 Hazelnut-Based Foods & Beverages

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hazelnut-Based Foods & Beverages: Grographic Segmentation

6.4 Hazelnut Oil

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Hazelnut Oil: Grographic Segmentation

6.5 Pharmaceuticals

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Pharmaceuticals: Grographic Segmentation

6.6 Cosmetics

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Cosmetics: Grographic Segmentation

Chapter 7: Hazelnut Market by Distribution Channel

7.1 Hazelnut Market Overview Snapshot and Growth Engine

7.2 Hazelnut Market Overview

7.3 Online

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Online: Grographic Segmentation

7.4 Offline

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Offline: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Hazelnut Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Hazelnut Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Hazelnut Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 BALSU GIDA (TURKEY)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 CHELMER FOODS (NORTH ESSEX)

8.4 KANE GRADE (U.K)

8.5 OLAM INTERNATIONAL (SINGAPORE)

8.6 OREGON HAZELNUTS (U.S.)

8.7 AYDIN KURUYEMIS (ISTANBUL)

8.8 GEONUTS (GEORGIA)

8.9 POYRAZ TARIMSAL (ISTANBUL)

8.10 BARRY CALLEBAUT AG (SWITZERLAND)

8.11 ARSLANTÜRK (TURKEY)

8.12 KARIMEX (BRAZIL)

8.13 GURSOY TARIMSAL URUNLER GIDA (TURKEY)

8.14 FRUITS OF TURKEY (TURKEY)

8.15 BATA FOOD (TURKEY)

8.16 DURAK FINDIK (TURKEY)

8.17 OTHER MAJOR PLAYERS

Chapter 9: Global Hazelnut Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Type

9.2.1 Processed Hazelnut

9.2.2 Unprocessed Hazelnut

9.3 Historic and Forecasted Market Size By Application

9.3.1 Hazelnut-Based Foods & Beverages

9.3.2 Hazelnut Oil

9.3.3 Pharmaceuticals

9.3.4 Cosmetics

9.4 Historic and Forecasted Market Size By Distribution Channel

9.4.1 Online

9.4.2 Offline

Chapter 10: North America Hazelnut Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Processed Hazelnut

10.4.2 Unprocessed Hazelnut

10.5 Historic and Forecasted Market Size By Application

10.5.1 Hazelnut-Based Foods & Beverages

10.5.2 Hazelnut Oil

10.5.3 Pharmaceuticals

10.5.4 Cosmetics

10.6 Historic and Forecasted Market Size By Distribution Channel

10.6.1 Online

10.6.2 Offline

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Hazelnut Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Processed Hazelnut

11.4.2 Unprocessed Hazelnut

11.5 Historic and Forecasted Market Size By Application

11.5.1 Hazelnut-Based Foods & Beverages

11.5.2 Hazelnut Oil

11.5.3 Pharmaceuticals

11.5.4 Cosmetics

11.6 Historic and Forecasted Market Size By Distribution Channel

11.6.1 Online

11.6.2 Offline

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Hazelnut Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Processed Hazelnut

12.4.2 Unprocessed Hazelnut

12.5 Historic and Forecasted Market Size By Application

12.5.1 Hazelnut-Based Foods & Beverages

12.5.2 Hazelnut Oil

12.5.3 Pharmaceuticals

12.5.4 Cosmetics

12.6 Historic and Forecasted Market Size By Distribution Channel

12.6.1 Online

12.6.2 Offline

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Hazelnut Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Processed Hazelnut

13.4.2 Unprocessed Hazelnut

13.5 Historic and Forecasted Market Size By Application

13.5.1 Hazelnut-Based Foods & Beverages

13.5.2 Hazelnut Oil

13.5.3 Pharmaceuticals

13.5.4 Cosmetics

13.6 Historic and Forecasted Market Size By Distribution Channel

13.6.1 Online

13.6.2 Offline

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Hazelnut Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Processed Hazelnut

14.4.2 Unprocessed Hazelnut

14.5 Historic and Forecasted Market Size By Application

14.5.1 Hazelnut-Based Foods & Beverages

14.5.2 Hazelnut Oil

14.5.3 Pharmaceuticals

14.5.4 Cosmetics

14.6 Historic and Forecasted Market Size By Distribution Channel

14.6.1 Online

14.6.2 Offline

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Hazelnut Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2021 |

Market Size in 2022: |

USD 6.95 Bn. |

|

Forecast Period 2023-30 CAGR: |

3.4% |

Market Size in 2030: |

USD 9.08 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. HAZELNUT MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. HAZELNUT MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. HAZELNUT MARKET COMPETITIVE RIVALRY

TABLE 005. HAZELNUT MARKET THREAT OF NEW ENTRANTS

TABLE 006. HAZELNUT MARKET THREAT OF SUBSTITUTES

TABLE 007. HAZELNUT MARKET BY TYPE

TABLE 008. PROCESSED HAZELNUT MARKET OVERVIEW (2016-2028)

TABLE 009. UNPROCESSED HAZELNUT MARKET OVERVIEW (2016-2028)

TABLE 010. HAZELNUT MARKET BY APPLICATION

TABLE 011. HAZELNUT-BASED FOODS & BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 012. HAZELNUT OIL MARKET OVERVIEW (2016-2028)

TABLE 013. PHARMACEUTICALS MARKET OVERVIEW (2016-2028)

TABLE 014. COSMETICS MARKET OVERVIEW (2016-2028)

TABLE 015. HAZELNUT MARKET BY DISTRIBUTION CHANNEL

TABLE 016. ONLINE MARKET OVERVIEW (2016-2028)

TABLE 017. OFFLINE MARKET OVERVIEW (2016-2028)

TABLE 018. NORTH AMERICA HAZELNUT MARKET, BY TYPE (2016-2028)

TABLE 019. NORTH AMERICA HAZELNUT MARKET, BY APPLICATION (2016-2028)

TABLE 020. NORTH AMERICA HAZELNUT MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 021. N HAZELNUT MARKET, BY COUNTRY (2016-2028)

TABLE 022. EUROPE HAZELNUT MARKET, BY TYPE (2016-2028)

TABLE 023. EUROPE HAZELNUT MARKET, BY APPLICATION (2016-2028)

TABLE 024. EUROPE HAZELNUT MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 025. HAZELNUT MARKET, BY COUNTRY (2016-2028)

TABLE 026. ASIA PACIFIC HAZELNUT MARKET, BY TYPE (2016-2028)

TABLE 027. ASIA PACIFIC HAZELNUT MARKET, BY APPLICATION (2016-2028)

TABLE 028. ASIA PACIFIC HAZELNUT MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 029. HAZELNUT MARKET, BY COUNTRY (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA HAZELNUT MARKET, BY TYPE (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA HAZELNUT MARKET, BY APPLICATION (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA HAZELNUT MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 033. HAZELNUT MARKET, BY COUNTRY (2016-2028)

TABLE 034. SOUTH AMERICA HAZELNUT MARKET, BY TYPE (2016-2028)

TABLE 035. SOUTH AMERICA HAZELNUT MARKET, BY APPLICATION (2016-2028)

TABLE 036. SOUTH AMERICA HAZELNUT MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 037. HAZELNUT MARKET, BY COUNTRY (2016-2028)

TABLE 038. BALSU GIDA (TURKEY): SNAPSHOT

TABLE 039. BALSU GIDA (TURKEY): BUSINESS PERFORMANCE

TABLE 040. BALSU GIDA (TURKEY): PRODUCT PORTFOLIO

TABLE 041. BALSU GIDA (TURKEY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. CHELMER FOODS (NORTH ESSEX): SNAPSHOT

TABLE 042. CHELMER FOODS (NORTH ESSEX): BUSINESS PERFORMANCE

TABLE 043. CHELMER FOODS (NORTH ESSEX): PRODUCT PORTFOLIO

TABLE 044. CHELMER FOODS (NORTH ESSEX): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. KANE GRADE (U.K): SNAPSHOT

TABLE 045. KANE GRADE (U.K): BUSINESS PERFORMANCE

TABLE 046. KANE GRADE (U.K): PRODUCT PORTFOLIO

TABLE 047. KANE GRADE (U.K): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. OLAM INTERNATIONAL (SINGAPORE): SNAPSHOT

TABLE 048. OLAM INTERNATIONAL (SINGAPORE): BUSINESS PERFORMANCE

TABLE 049. OLAM INTERNATIONAL (SINGAPORE): PRODUCT PORTFOLIO

TABLE 050. OLAM INTERNATIONAL (SINGAPORE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. OREGON HAZELNUTS (U.S.): SNAPSHOT

TABLE 051. OREGON HAZELNUTS (U.S.): BUSINESS PERFORMANCE

TABLE 052. OREGON HAZELNUTS (U.S.): PRODUCT PORTFOLIO

TABLE 053. OREGON HAZELNUTS (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. AYDIN KURUYEMIS (ISTANBUL): SNAPSHOT

TABLE 054. AYDIN KURUYEMIS (ISTANBUL): BUSINESS PERFORMANCE

TABLE 055. AYDIN KURUYEMIS (ISTANBUL): PRODUCT PORTFOLIO

TABLE 056. AYDIN KURUYEMIS (ISTANBUL): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. GEONUTS (GEORGIA): SNAPSHOT

TABLE 057. GEONUTS (GEORGIA): BUSINESS PERFORMANCE

TABLE 058. GEONUTS (GEORGIA): PRODUCT PORTFOLIO

TABLE 059. GEONUTS (GEORGIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. POYRAZ TARIMSAL (ISTANBUL): SNAPSHOT

TABLE 060. POYRAZ TARIMSAL (ISTANBUL): BUSINESS PERFORMANCE

TABLE 061. POYRAZ TARIMSAL (ISTANBUL): PRODUCT PORTFOLIO

TABLE 062. POYRAZ TARIMSAL (ISTANBUL): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. BARRY CALLEBAUT AG (SWITZERLAND): SNAPSHOT

TABLE 063. BARRY CALLEBAUT AG (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 064. BARRY CALLEBAUT AG (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 065. BARRY CALLEBAUT AG (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. ARSLANTÜRK (TURKEY): SNAPSHOT

TABLE 066. ARSLANTÜRK (TURKEY): BUSINESS PERFORMANCE

TABLE 067. ARSLANTÜRK (TURKEY): PRODUCT PORTFOLIO

TABLE 068. ARSLANTÜRK (TURKEY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. KARIMEX (BRAZIL): SNAPSHOT

TABLE 069. KARIMEX (BRAZIL): BUSINESS PERFORMANCE

TABLE 070. KARIMEX (BRAZIL): PRODUCT PORTFOLIO

TABLE 071. KARIMEX (BRAZIL): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. GURSOY TARIMSAL URUNLER GIDA (TURKEY): SNAPSHOT

TABLE 072. GURSOY TARIMSAL URUNLER GIDA (TURKEY): BUSINESS PERFORMANCE

TABLE 073. GURSOY TARIMSAL URUNLER GIDA (TURKEY): PRODUCT PORTFOLIO

TABLE 074. GURSOY TARIMSAL URUNLER GIDA (TURKEY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. FRUITS OF TURKEY (TURKEY): SNAPSHOT

TABLE 075. FRUITS OF TURKEY (TURKEY): BUSINESS PERFORMANCE

TABLE 076. FRUITS OF TURKEY (TURKEY): PRODUCT PORTFOLIO

TABLE 077. FRUITS OF TURKEY (TURKEY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. BATA FOOD (TURKEY): SNAPSHOT

TABLE 078. BATA FOOD (TURKEY): BUSINESS PERFORMANCE

TABLE 079. BATA FOOD (TURKEY): PRODUCT PORTFOLIO

TABLE 080. BATA FOOD (TURKEY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. DURAK FINDIK (TURKEY): SNAPSHOT

TABLE 081. DURAK FINDIK (TURKEY): BUSINESS PERFORMANCE

TABLE 082. DURAK FINDIK (TURKEY): PRODUCT PORTFOLIO

TABLE 083. DURAK FINDIK (TURKEY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 084. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 085. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 086. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. HAZELNUT MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. HAZELNUT MARKET OVERVIEW BY TYPE

FIGURE 012. PROCESSED HAZELNUT MARKET OVERVIEW (2016-2028)

FIGURE 013. UNPROCESSED HAZELNUT MARKET OVERVIEW (2016-2028)

FIGURE 014. HAZELNUT MARKET OVERVIEW BY APPLICATION

FIGURE 015. HAZELNUT-BASED FOODS & BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 016. HAZELNUT OIL MARKET OVERVIEW (2016-2028)

FIGURE 017. PHARMACEUTICALS MARKET OVERVIEW (2016-2028)

FIGURE 018. COSMETICS MARKET OVERVIEW (2016-2028)

FIGURE 019. HAZELNUT MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 020. ONLINE MARKET OVERVIEW (2016-2028)

FIGURE 021. OFFLINE MARKET OVERVIEW (2016-2028)

FIGURE 022. NORTH AMERICA HAZELNUT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. EUROPE HAZELNUT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. ASIA PACIFIC HAZELNUT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. MIDDLE EAST & AFRICA HAZELNUT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. SOUTH AMERICA HAZELNUT MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Hazelnut Market research report is 2023-2030.

Balsu Gida (Turkey), Chelmer Foods (North Essex), Kane grade (U.K), Olam International (Singapore), Oregon Hazelnuts (U.S.), Aydin Kuruyemis (Istanbul), GEONUTS (Georgia), Poyraz Tarimsal (Istanbul), Barry Callebaut AG (Switzerland), Arslantürk (Turkey), Karimex (Brazil), Gursoy Tarimsal Urunler Gida (Turkey), Fruits of Turkey (Turkey), BATA Food (Turkey), Durak Findik (Turkey), and other major players.

The Hazelnut Market is segmented into Type, Application, Distribution channel and region. By Type, the market is categorized into Processed Hazelnut, and Unprocessed Hazelnut. By Application, the market is categorized into Hazelnut-Based Foods & Beverages, Hazelnut Oil, Pharmaceuticals, and Cosmetics. By Distribution channel, the market is categorized into Online and Offline. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Hazelnuts are the nuts obtained from the hazel tree and can be found whole, raw, ground, sliced, or roasted. Hazelnuts are used primarily as a snack or added to baked goods.

The Global Hazelnut Market size is expected to grow from USD 6.95 billion in 2022 to USD 9.08 billion by 2030, at a CAGR of 3.4% during the forecast period (2023-2030).