Guanabana Market Synopsis

The global Guanabana market was valued at USD 206.11 million in 2023 and is likely to reach USD 540.20 million by 2032, increasing at a CAGR of 11.3% from 2024 to 2032.

Guanabana, sometimes referred to as soursop or graviola, is mostly sold as fruit and in a variety of derivative goods. Originally from tropical parts of the Americas, guanabana is grown in several Caribbean countries, Brazil, Mexico, and Colombia.

- The market for guanabana products consists of sales of fresh fruit as well as processed goods like ice cream, jams, juices, nectars, and dietary supplements. Because more people are becoming aware of guanabana's possible health benefits—including its supposed anti-inflammatory and antioxidant properties.

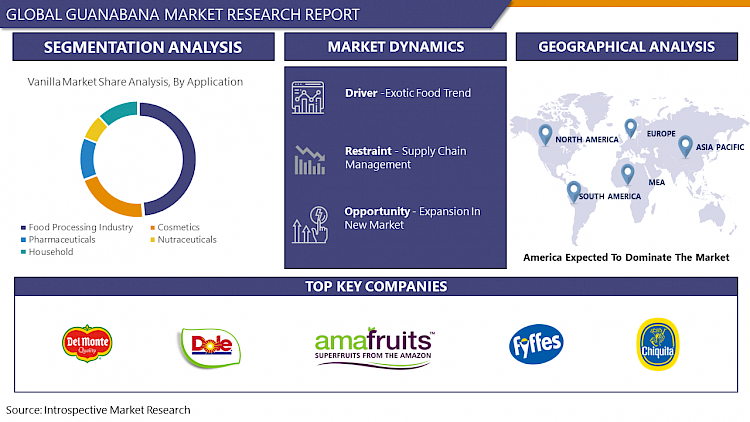

- The market for guanabana products is influenced by factors such as consumer demand for exotic fruits, health consciousness trends, availability of raw materials, and government regulations related to food safety and import/export. Additionally, the market may vary regionally depending on local preferences cultural factors, and antioxidant qualities—the fruit's popularity has been rising internationally.

Guanabana Market Trend Analysis

Exotic Fruit Trends

- Consumer interest in exotic fruits is increasing, contributing to the popularity of guanabana in markets around the world.

- Globalization and an increase in worldwide travel have introduced customers to a greater range of cuisines from other cultures and geographical areas. People encounter and develop a fascination with unusual fruits like guanabana when they travel to tropical regions where guanabana is grown.

- Many people believe that exotic fruits are more nutrient-dense or offer special health advantages. Due to their purported health benefits, such as being high in vitamins, minerals, and antioxidants, consumers may turn to exotic fruits like guanabana as they grow more health-conscious and look for foods with functional qualities.

- In addition to offering gastronomic variety, exotic fruits can liven up dishes and recipes. Cooks and food fans are frequently drawn to experimenting with exciting ingredients in a variety of recipes, desserts, and drinks, including exotic fruits like guanabana.

Opportunities

Health and Wellness Industry

- The increasing focus on health and wellness presents opportunities to position guanabana products as part of a healthy diet and lifestyle, appealing to health-conscious consumers.

- Nutritional Content: Packed with vitamins, especially C, which is critical for healthy immune system, guanabana is high in vitamin C. Significant levels of B vitamins, especially B6, which supports nerve and metabolic function, are also present in it.

- Fruit's anti-oxidant properties include flavonoids, alkaloids, and acetogenins, which are abundant in the fruit. These substances may lessen the chance of developing chronic illnesses like cancer and heart disease by shielding cells from oxidative stress and free radical damage.

- Anti-Inflammatory Effects: Research indicates that guanabana may have anti-inflammatory qualities that could help reduce the discomfort associated with inflammatory diseases including asthma and arthritis.

Market Segment Analysis:

Market Segmented based on Type, by Application, by Distribution Channel and region.

By Type, Processed Guanabana Is Expected to Dominate the Market During the Forecast Period

There are two segmentations by type Raw and Processed.

- Processing guanabana into products like juices, nectars, purees, and concentrates allows for a longer shelf life compared to fresh fruit. This makes it easier to transport and store, reducing waste and increasing accessibility to consumers, especially in regions where fresh guanabana may not be readily available.

- Processed guanabana products offer convenience to consumers. They are ready-to-consume or require minimal preparation, making them suitable for busy lifestyles. This convenience factor contributes to their popularity, particularly in urban areas where consumers seek convenient food and beverage options.

By Application, The Food Processing Industry Segment Held the Largest Share

By applications, there are many segmentations like Pharmaceuticals, Cosmetics and Personal Care, Nutraceuticals, Food Processing Industry, and household but the Food Processing Industry held the largest share.

- Fresh fruit intake is common in guanabana-growing countries, especially during the fruit harvest season. Ripe fruit is delicious eaten raw or added to other foods like fruit salads.

- Guanabana is a popular ingredient in smoothies, juices, nectars, and other drinks. Commercially and domestically, its sweet and tangy flavor characteristic makes it a popular choice for refreshing cocktails.

- Ice creams, yogurts, jams, and desserts are just a few examples of processed foods that use guanabana. Customers seeking out exotic flavors will find these products interesting due to their distinct taste and aroma, which give them a tropical twist.

Market Regional Insights:

America Region is Expected to Dominate the Market Over the Forecast Period

- Latin American nations that produce a lot of guanabanas include Brazil, Colombia, and Mexico. The climate in these nations is ideal for guanabana fruit cultivation and large-scale production.

- Latin American nations have long been fans of guanabana, which is typically consumed raw or blended into regional specialties. Its popularity and cultural significance support the region's ongoing demand.

- Global consumer tastes are moving toward more varied and healthful meals, which is driving up demand for exotic fruits like guanabana. Latin American nations have the necessary industrial capacities to fulfill this need. Significant guanabana production capability in Latin American nations can also be used to take advantage of export potential to North America, Europe, and Asia.

- Normal leaf concentrations for N and K in soursop grown in Brazil are 1.6 to 2.0 times greater than those in deficient leaves. The difference in N compositionbetween normal and deficient leaves in Venezuela was much greater than that in Brazil but the difference in K was small.

Normal Concentrations of Macro-Nutrients and Some Micronutrients in Guanabana Leaves in Venezuela and Brazil

|

Plant part |

N |

P |

K |

Ca |

Mg |

S |

B |

|

|

|

|

|

|

|

|

|

|

|

--------- |

--------- |

gm/kg |

--------- |

--------- |

--------- |

mg/kg |

|

Normal leaves (1) |

17.6 |

2.9 |

26.0 |

17.6 |

0.20 |

- |

- |

|

Deficient leaves (1) |

11.0 |

1.1 |

12.6 |

10.8 |

0.08 |

- |

- |

|

Normal leaves (2) |

25.0-28.0 |

1.4-1.5 |

26.1 |

8.2-16.8 |

3.6-3.8 |

1.5-1.7 |

35-47 |

|

Deficient leaves (2) |

13.0-16.0 |

0.6-0.7 |

26.4 |

4.5-8.1 |

0.7-0.8 |

1.1-1.3 |

6-14 |

Market Top Key Players:

The key companies in the Global Guanabanas Market are:

- Del Monte Fresh Produce (United States)

- Fruits Of The Amazon (Brazil)

- Frutas Cantaloupe (Mexico)

- Dole Food Company (United States)

- Chiquita Brands International (United States)

- Fyffes (Ireland)

- Naturipe Farms (United States)

- Tropical Fruit Box (United States)

- Lgs Specialty Sales Ltd. (The Little Potato Company) (Canada)

- Paradise Exotic Fruit Company (United States)

- Tropicai (Germany)

- Exotic Fruits Usa (United States)

- Amafruits (United States)

- Herbal Goodness (United States)

- Pura Vida Farms (United States)

- Stepac L.A. Ltd. (Israel)

- Fresh Guanabana (United States)

- Virgin Fruit (United States)

- Ecoagricola S.A. (Brazil)

- Ami Fruits (France)

- Divine Fruits (United States)

- Frutería Wilson (Colombia)

- Natural Green Farms (United States)

- Southfruit Group (United States)

- Exotic Amazonia (Brazil)

- Frutamil (Brazil) and other Active Players.

Key Industry Developments in the Market:

- In Dec 2023, Grenada increases guanabana production to boost exports, Extension agents and farmers who have received training in appropriate agricultural techniques for growing soursop come to an agreement on a plan for modernizing the industry to take advantage of its export potential

- In April 2023, The Ecuadorian guanabana industry betting on the U.S. market to increase global consumption, a rather unknown fruit in the U.S. market is trying to make its way to supermarket shelves around the country from Ecuador

|

Global Guanabana Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017-2023 |

Market Size In 2023: |

USD 206.11 Mn |

|

Forecast Period 2024-32 CAGR: |

11.3% |

Market Size In 2032: |

USD 540.20 Mn |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

(Hypermarkets/Supermarkets Convenience Stores Food & Drink Speciality Store Online Retail)

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered In The Report: |

Del Monte Fresh Produce, Fruits Of The Amazon, Frutas Cantaloupe, Dole Food Company, Chiquita Brands International And Other Major Players |

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- GUANABANA MARKET BY TYPE (2017-2032)

- GUANABANA MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RAW GUANABANA

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PROCESSED GUANABANA

- GUANABANA MARKET BY APPLICATION (2017-2032)

- GUANABANA MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FOOD PROCESSING INDUSTRY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PHARMACEUTICAL

- COSMETICS AND PERSONAL CARE

- NUTRACEUTICALS

- HOUSEHOLD

- GUANABANA MARKET BY DISTRIBUTION CHANNEL (2017-2032)

- GUANABANA MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BUSINESS TO CONSUMER

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BUSINESS TO BUSINESS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- GUANABANA Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- DEL MONTE FRESH PRODUCE (UNITED STATES)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- FRUITS OF THE AMAZON (BRAZIL)

- FRUTAS CANTALOUPE (MEXICO)

- DOLE FOOD COMPANY (UNITED STATES)

- CHIQUITA BRANDS INTERNATIONAL (UNITED STATES)

- FYFFES (IRELAND)

- NATURIPE FARMS (UNITED STATES)

- TROPICAL FRUIT BOX (UNITED STATES)

- LGS SPECIALTY SALES LTD. (THE LITTLE POTATO COMPANY) (CANADA)

- PARADISE EXOTIC FRUIT COMPANY (UNITED STATES)

- TROPICAI (GERMANY)

- EXOTIC FRUITS USA (UNITED STATES)

- AMAFRUITS (UNITED STATES)

- HERBAL GOODNESS (UNITED STATES)

- PURA VIDA FARMS (UNITED STATES)

- STEPAC L.A. LTD. (ISRAEL)

- FRESH GUANABANA (UNITED STATES)

- VIRGIN FRUIT (UNITED STATES)

- ECOAGRICOLA S.A. (BRAZIL)

- AMI FRUITS (FRANCE)

- DIVINE FRUITS (UNITED STATES)

- FRUTERÍA WILSON (COLOMBIA)

- NATURAL GREEN FARMS (UNITED STATES)

- SOUTHFRUIT GROUP (UNITED STATES)

- EXOTIC AMAZONIA (BRAZIL)

- FRUTAMIL (BRAZIL)COMPANYF

- COMPETITIVE LANDSCAPE

- GLOBAL GUANABANA MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By TYPE

- Historic And Forecasted Market Size By APPLICATION

- Historic And Forecasted Market Size By DISTRIBUTION CHANNEL

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Guanabana Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017-2023 |

Market Size In 2023: |

USD 206.11 Mn |

|

Forecast Period 2024-32 CAGR: |

11.3% |

Market Size In 2032: |

USD 540.20 Mn |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

(Hypermarkets/Supermarkets Convenience Stores Food & Drink Speciality Store Online Retail)

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered In The Report: |

Del Monte Fresh Produce, Fruits Of The Amazon, Frutas Cantaloupe, Dole Food Company, Chiquita Brands International And Other Major Players |

||

Frequently Asked Questions :

The forecast period in the Guanabana Market research report is 2024-2032.

Del Monte Fresh Produce (United States), Fruits Of The Amazon (Brazil),Frutas Cantaloupe (Mexico),Dole Food Company (United States),Chiquita Brands International (United States),Fyffes (Ireland),Naturipe Farms (United States),Tropical Fruit Box (United States),Lgs Specialty Sales Ltd. (The Little Potato Company) (Canada),Paradise Exotic Fruit Company (United States),Tropicai (Germany),Exotic Fruits Usa (United States),Amafruits (United States),Herbal Goodness (United States),Pura Vida Farms (United States),Stepac L.A. Ltd. (Israel),Fresh Guanabana (United States),Virgin Fruit (United States),Ecoagricola S.A. (Brazil),Ami Fruits (France),Divine Fruits (United States),Frutería Wilson (Colombia),Natural Green Farms (United States), Southfruit Group (United States),Exotic Amazonia (Brazil), Frutamil (Brazil) and other Active Players.

The Guanabana Market is segmented into Type, Application, Distribution Channel, and region. By Type (Raw, Processed), By Application (Pharmaceuticals, Cosmetics and Personal Care, Nutraceuticals, Food Processing Industry, Household), By Distribution (B2B, B2C). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Guanabana, sometimes referred to as soursop or graviola, is mostly sold as fruit and in a variety of derivative goods. Originally from tropical parts of the Americas, guanabana is grown in several Caribbean countries, Brazil, Mexico, and Colombia. The market for guanabana products consists of sales of fresh fruit as well as processed goods like ice cream, jams, juices, nectars, and dietary supplements.

The global Guanabana market was valued at USD 206.11 million in 2023 and is likely to reach USD 540.20 million by 2032, increasing at a CAGR of 11.3% from 2024 to 2032.