Grid-forming Inverter Market Synopsis:

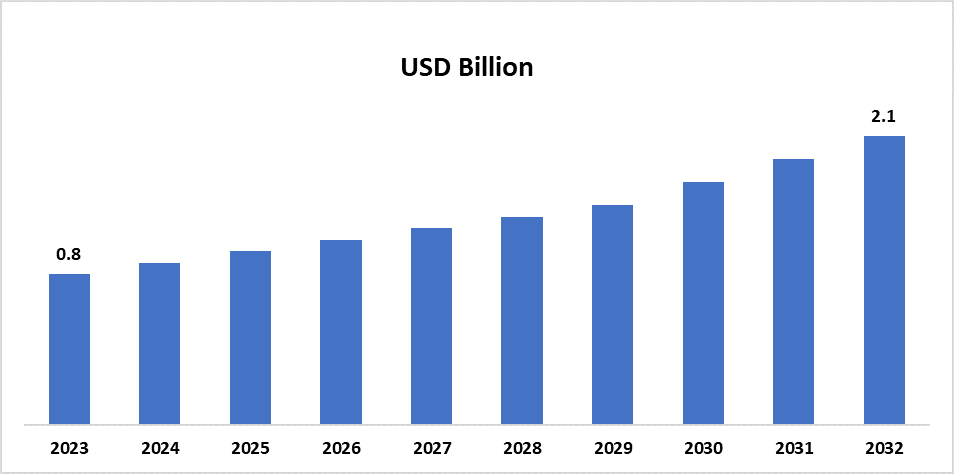

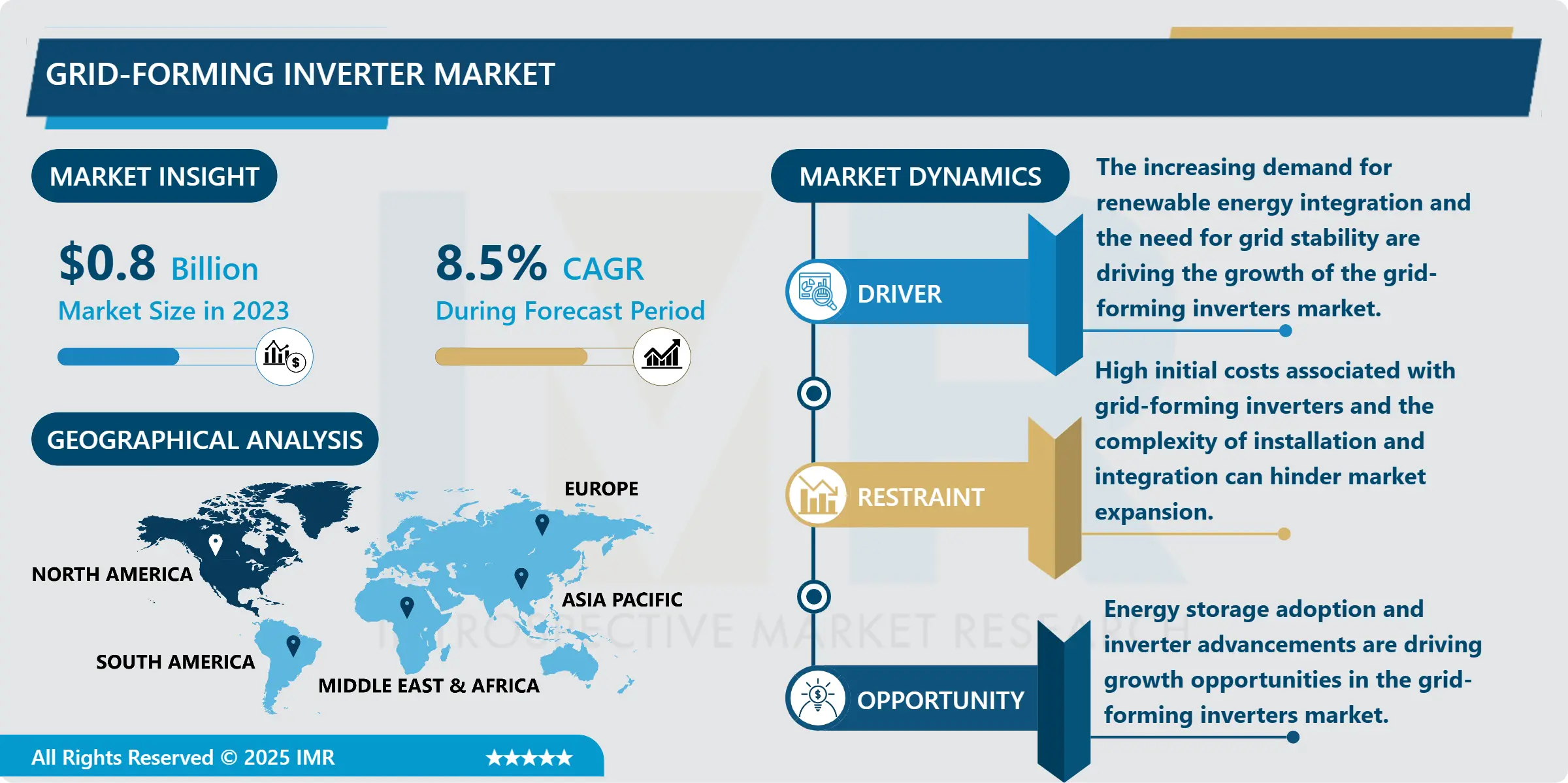

Grid-forming Inverter Market Size Was Valued at USD 0.8 Billion in 2023, and is Projected to Reach USD 2.1 Billion by 2032, Growing at a CAGR of 8.5% From 2024-2032.

The grid-forming inverter market is seeing increasing interest because of the importance of grid modernization alongside higher adoption of wind and solar power. Deriving these inverters from the grid-following inverters, these inverters verify their ability to manipulate the grid and support voltage and frequency, meaning that they can help create a stronger, more efficient power grid. As climate change continues to be a worry to the policymakers across the world and the focus towards renewable energy sources the grid forming inverters has been established as crucial to sustain the grid during instabilities caused by fluctuations in power input from renewable energy sources.

In regard to the market development, the usage of VFIs is in demand due to rising tendencies in the implementation of decentralized energy systems and microgrids. Many governments and utilities today are either building new renewable energy systems, or planning to integrate renewable energy into their grids hence the need for better quality inverters that can make up for short comings in the event of grid instabilities. Further, the opportunity to minimize dependence on standard grid sources and enhance energy usage efficiency is an advantage for developed and developing countries. The market is also gaining from an increasing adoption of energy storage systems that combine with grid-forming inverters to ensure continued power during periods of load spike or when the general grid system is down.

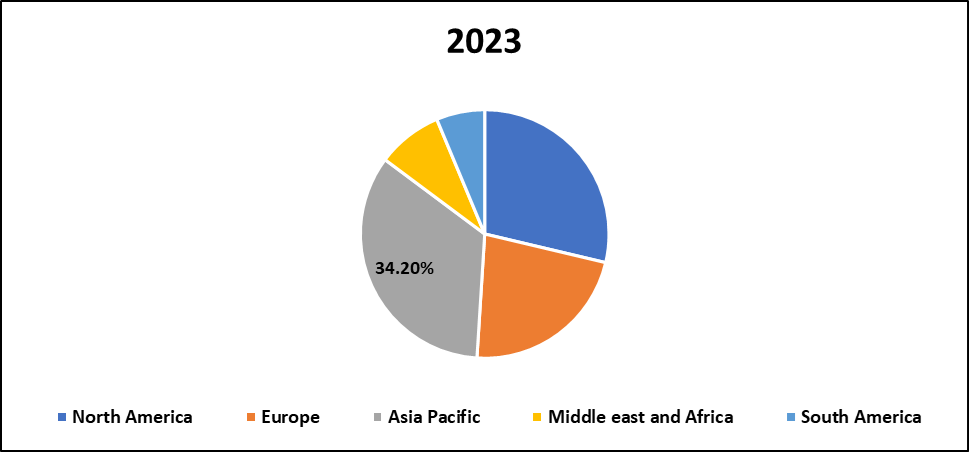

Specifically, North America and Europe are dominating the grid-forming inverter market because of higher tendencies to introduce renewable power sources, established legal requirements for shift towards cleaner energy, and high rates of grid upgrade expenditures. Still, the Asia-Pacific region is projected to be the fastest growing sector due to the continued installation of more renewable energy and the rapidly growing electricity consumption in different developing countries. The concentration in the market is on developments, improving the functionality of grid-forming inverters, and providing flexible solutions for multiple applications ranging from utility scale power plants to rooftop solar systems.

Grid-forming Inverter Market Trend Analysis

Increased Adoption of Microgrids

-

The increase in demand for energy independence and green energy sources has encouraged a substantial increase in the use of microgrids. Grid-forming inverters are of significant importance in these systems because they allow other local solutions of energy generation and storage to operate independently. This trend is especially noticeable in particular or even in the regions where the connections to the grid cannot be accomplished easily. Microgrids with the use of grid forming inverters provide improvement in energy supply and availability, better integration with renewable energy sources, and efficient control of micro-grid distributed energy resources for improving the pro-sustainability power system.

Advancements in Energy Storage Integration

-

Another important trend within the grid-forming inverter market is the continuous development of energy storage systems, especially batteries, that are applied along with grid-forming inverters. The latter improve energy storage systems by offering important grid services like frequency and voltage stabilization which are key to the stability of the power grid. This can be evidenced by the growing demand of grid-forming inverters and energy storage systems as the share of intermittent renewable energy sources rises; and the symbiosis between those two categories is closely associated with the development of new trends and new potential market areas. They also help ensure a stronger grid and better energy usage as well as a higher reliability of renewable energy applications.

Grid-forming Inverter Market Segment Analysis:

Grid-forming Inverter Market Segmented on the basis of By Type, By Power Rating, By Voltage and By End User.

By Type, micro inverters segment is expected to dominate the market during the forecast period

-

The grid-forming inverters market by type classified into micro inverters, string inverters, and central inverters for various applications. Micro inverters are employed in residential applications for solar power conversion and enable configurations that modify the performance of each panel enhancing the energy and sectional capture and performance under partial shading. String inverters are used in commercial and utility scale solar systems where a number of solar panels are connected in series again providing cheap but competitive solution. Central inverters are used in large scale utility solar farm applications, handling large amount of power output and are capable of handling high voltage requirements. However, the selection of inverter type when employing RE sources remains a critical determiner of energy yield, system stability, and applicability across multiple areas, which all contribute to the overall growth of the grid-forming inverter market.

By Voltage, 100-300 V segment expected to held the largest share

-

The grid-forming inverter market classification by voltage ranges comprises 100-300 V, 300-500 V, and greater than 500 V. The 100-300 V segment mostly targets residential users where smaller systems connect PV panels and batteries, thus ensuring people are not influenced by traditional utility companies. The 300–500Vac range is mostly applicable in the commercial and industrial applications providing opportunities for deploying more significant solar power plant volumes while ensuring energy storage and supporting the stability of the grid infrastructure. The segment above 500 V is dominating the utility-scale solar photovoltaic systems, which require high-power converters for managing the power generated and improving the stability of the electrical grid. This diverse voltage segmentation shows the industry’s need for grid-forming inverters in various applications due to the increasing adoption of renewable energy and the need for sound energy management systems.

Grid-forming Inverter Market Outlook, 2023 and 2032: Future Outlook

Grid-forming Inverter Market Regional Insights:

Asia-Pacific Grid-forming Inverter Market is witnessing significant developments.

-

Currently, the Asia-Pacific Grid-forming Inverter Market is observing major evolution mainly because of the increasing use of energy storage systems especially the battery storage solutions. Due to increasing renewable energy generation and grid stability amongst countries in the region, there has been an increasing demand for grid-forming inverters. These inverters enable efficient integration of energy storage systems so that they can perform critical ancillary services by supporting the frequency and voltage of the grid. As more investments are made in renewable energy projects and as the importance of efficient energy control rises, the market will grow even bigger. Moreover, favourable government policies and emerging programmes for increasing energy security and reliability are fueling grid-forming inverters market growth in the Asia-Pacific region, which is an emerging market globally.

Grid-forming Inverter Market Share, by Geography, 2023 (%)

Active Key Players in the Grid-forming Inverter Market

-

Huawei Technologies Co., Ltd (China)

- SMA Solar Technology AG (Germany)

- Gamesa Electric (Spain)

- Fimer Group (Italy)

- Delta Electronics, Inc (Taiwan)

- Solectria Solar (United States)

- ABB (Switzerland)

- SolarEdge Technologies Inc (Israel)

- General Electric (United States)

- Sineng Electric Co Ltd (China)

- others

|

Global Grid-forming Inverter Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.8 Billion |

|

Forecast Period 2024-32 CAGR: |

8.5% |

Market Size in 2032: |

USD 2.1 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Power Rating |

|

||

|

By Voltage |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Grid-forming Inverter Market by Type

4.1 Grid-forming Inverter Market Snapshot and Growth Engine

4.2 Grid-forming Inverter Market Overview

4.3 micro inverters

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 micro inverters: Geographic Segmentation Analysis

4.4 string inverters and central inverters

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 string inverters and central inverters: Geographic Segmentation Analysis

Chapter 5: Grid-forming Inverter Market by Power Rating

5.1 Grid-forming Inverter Market Snapshot and Growth Engine

5.2 Grid-forming Inverter Market Overview

5.3 below 50 kW

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 below 50 kW: Geographic Segmentation Analysis

5.4 50-100 kW

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 50-100 kW: Geographic Segmentation Analysis

5.5 and above 100 kW

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 and above 100 kW: Geographic Segmentation Analysis

Chapter 6: Grid-forming Inverter Market by Voltage

6.1 Grid-forming Inverter Market Snapshot and Growth Engine

6.2 Grid-forming Inverter Market Overview

6.3 100-300 V

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 100-300 V: Geographic Segmentation Analysis

6.4 300-500 V and above 500 V

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 300-500 V and above 500 V: Geographic Segmentation Analysis

Chapter 7: Grid-forming Inverter Market by End User

7.1 Grid-forming Inverter Market Snapshot and Growth Engine

7.2 Grid-forming Inverter Market Overview

7.3 Residential

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Residential: Geographic Segmentation Analysis

7.4 Commercial

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Commercial: Geographic Segmentation Analysis

7.5 Others

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Others: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Grid-forming Inverter Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 HUAWEI TECHNOLOGIES CO. LTD (CHINA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 SMA SOLAR TECHNOLOGY AG (GERMANY)

8.4 GAMESA ELECTRIC (SPAIN)

8.5 FIMER GROUP (ITALY)

8.6 DELTA ELECTRONICS INC (TAIWAN)

8.7 SOLECTRIA SOLAR (UNITED STATES)

8.8 ABB (SWITZERLAND)

8.9 SOLAREDGE TECHNOLOGIES INC (ISRAEL)

8.10 GENERAL ELECTRIC (UNITED STATES)

8.11 SINENG ELECTRIC CO LTD (CHINA)

8.12 OTHER ACTIVE PLAYERS

Chapter 9: Global Grid-forming Inverter Market By Region

9.1 Overview

9.2. North America Grid-forming Inverter Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Type

9.2.4.1 micro inverters

9.2.4.2 string inverters and central inverters

9.2.5 Historic and Forecasted Market Size By Power Rating

9.2.5.1 below 50 kW

9.2.5.2 50-100 kW

9.2.5.3 and above 100 kW

9.2.6 Historic and Forecasted Market Size By Voltage

9.2.6.1 100-300 V

9.2.6.2 300-500 V and above 500 V

9.2.7 Historic and Forecasted Market Size By End User

9.2.7.1 Residential

9.2.7.2 Commercial

9.2.7.3 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Grid-forming Inverter Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Type

9.3.4.1 micro inverters

9.3.4.2 string inverters and central inverters

9.3.5 Historic and Forecasted Market Size By Power Rating

9.3.5.1 below 50 kW

9.3.5.2 50-100 kW

9.3.5.3 and above 100 kW

9.3.6 Historic and Forecasted Market Size By Voltage

9.3.6.1 100-300 V

9.3.6.2 300-500 V and above 500 V

9.3.7 Historic and Forecasted Market Size By End User

9.3.7.1 Residential

9.3.7.2 Commercial

9.3.7.3 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Grid-forming Inverter Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Type

9.4.4.1 micro inverters

9.4.4.2 string inverters and central inverters

9.4.5 Historic and Forecasted Market Size By Power Rating

9.4.5.1 below 50 kW

9.4.5.2 50-100 kW

9.4.5.3 and above 100 kW

9.4.6 Historic and Forecasted Market Size By Voltage

9.4.6.1 100-300 V

9.4.6.2 300-500 V and above 500 V

9.4.7 Historic and Forecasted Market Size By End User

9.4.7.1 Residential

9.4.7.2 Commercial

9.4.7.3 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Grid-forming Inverter Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Type

9.5.4.1 micro inverters

9.5.4.2 string inverters and central inverters

9.5.5 Historic and Forecasted Market Size By Power Rating

9.5.5.1 below 50 kW

9.5.5.2 50-100 kW

9.5.5.3 and above 100 kW

9.5.6 Historic and Forecasted Market Size By Voltage

9.5.6.1 100-300 V

9.5.6.2 300-500 V and above 500 V

9.5.7 Historic and Forecasted Market Size By End User

9.5.7.1 Residential

9.5.7.2 Commercial

9.5.7.3 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Grid-forming Inverter Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Type

9.6.4.1 micro inverters

9.6.4.2 string inverters and central inverters

9.6.5 Historic and Forecasted Market Size By Power Rating

9.6.5.1 below 50 kW

9.6.5.2 50-100 kW

9.6.5.3 and above 100 kW

9.6.6 Historic and Forecasted Market Size By Voltage

9.6.6.1 100-300 V

9.6.6.2 300-500 V and above 500 V

9.6.7 Historic and Forecasted Market Size By End User

9.6.7.1 Residential

9.6.7.2 Commercial

9.6.7.3 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Grid-forming Inverter Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Type

9.7.4.1 micro inverters

9.7.4.2 string inverters and central inverters

9.7.5 Historic and Forecasted Market Size By Power Rating

9.7.5.1 below 50 kW

9.7.5.2 50-100 kW

9.7.5.3 and above 100 kW

9.7.6 Historic and Forecasted Market Size By Voltage

9.7.6.1 100-300 V

9.7.6.2 300-500 V and above 500 V

9.7.7 Historic and Forecasted Market Size By End User

9.7.7.1 Residential

9.7.7.2 Commercial

9.7.7.3 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Grid-forming Inverter Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.8 Billion |

|

Forecast Period 2024-32 CAGR: |

8.5% |

Market Size in 2032: |

USD 2.1 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Power Rating |

|

||

|

By Voltage |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||