Green Tea Market Synopsis

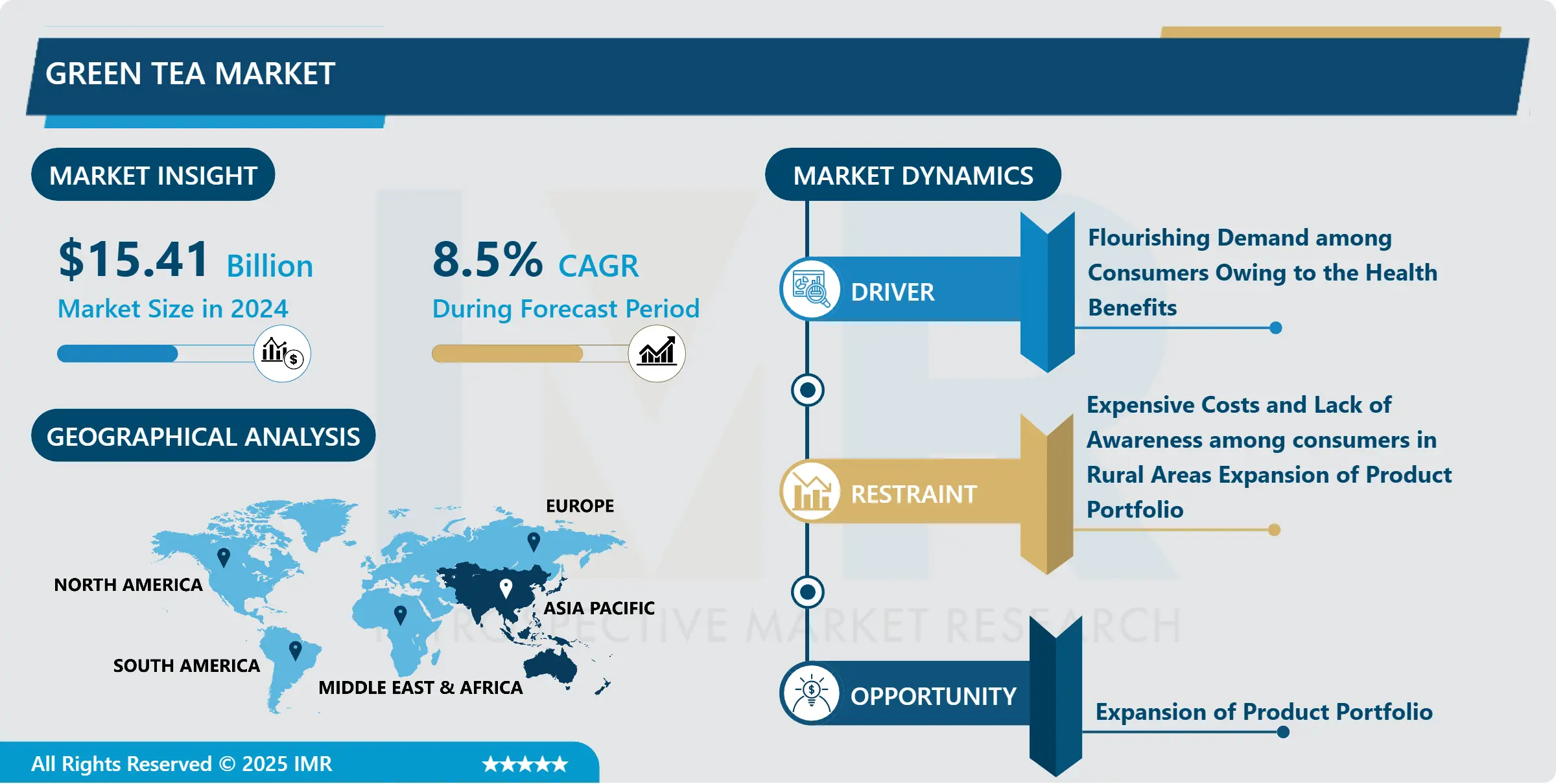

Green Tea Market Was Valued at USD 15.41 Billion in 2024 and is Projected to Reach USD 29.59 Billion by 2032, Growing at a CAGR of 8.5% from 2025 to 2032.

Green tea is a pale green beverage or dietary supplement made from the unoxidized leaves of Camellia sinensis and has a slightly bitter taste.

Green tea is a type of tea that is least processed and is employed as a medicine in India and China for easing digestion, improving heart and mental health, regulating body temperature, healing wounds as well as controlling bleeding problems.

Green tea is also used as a raw material in the production of dietary supplements, cosmetic products, beverages, and dental care items widely. Regular consumption of green tea helps maintain an ideal weight within desired limits, boosts the immune system, relieves physical and mental stress, and keeps check on skin redness.

Consumers all across the world prefer such beverages that offer functional benefits, encouraging them to opt for green tea products as a healthy alternative to sugar-laden beverages, thereby supporting the development of the green tea market over the analysis period.

Green Tea Market Trend Analysis

Green Tea Market Growth Drivers- Flourishing Demand among Consumers Owing to the Health Benefits

- Green tea has several restorative and antioxidant characteristics that help to treat and prevent diseases such as diabetes, tooth decay, and heart disease. The antioxidant properties present in green tea play a vital role in maintaining blood pressure and cholesterol levels in the body. It further helps in detoxifying the body and healing scars. The rising obesity problem all over the world has also contributed in driving the growth of the green tea market worldwide. Owing to the major characteristics of reducing extra fat and maintaining weight, the green tea market is estimated to gain a significant traction in coming years.

- Due to the growing weight gain and obesity problems, the Food & Drug Administration stated that green tea production is anticipated to increase by 7.5% each year and witness a huge demand further. Also, several clinical studies have mentioned that the consumption of antioxidants and flavonoids boosts the mental stress response and cardiovascular health. Green tea is also known for its purifying and healing properties and is used widely to treat serious illnesses like cancer and reduce the effects of cancer cells. Owing to the varied health benefits of regular consumption, the green tea market is gaining immense popularity worldwide thereby, driving the growth of the green tea market over the analysis period.

Green Tea Market Opportunities- Expansion of Product Portfolio

- Green tea is known to be quite effective against anxiety, stress, depression, and various types of cancers such as liver cancer, lung cancer, gastric cancer, and colon cancer. Major scientific studies have also proven that regular consumption of green tea boosts the immune system, helps enhance thinking skills as well as lowers cholesterol and triglycerides levels in the body.

- Henceforth, due to these health benefits, there is a huge demand for green tea all over the world. Further, to meet this demand, major manufacturers bring innovations in the flavours and expand their product portfolio.

- With the extensive improvement in the product range of green tea, as well as the introduction of attractive packaging of green tea products, many consumers can be attracted which will further create a lucrative opportunity for the green tea market.

Green Tea Market Segment Analysis:

Green Tea Market Segmented on the basis of type, Form and distribution channel.

By Type, the flavoured green tea segment is expected to dominate the market during the forecast period

- By type, the flavoured green tea segment is expected to dominate the market growth of global green tea. The immense growth of this segment is due to the consumer interest in varied flavoured tea products and the availability of different flavours in the green tea market.

- Green tea is found in various flavours such as cinnamon, basil, lemon, aloe vera, vanilla, and many others, which attracts more consumers to purchase and consume green tea regularly. Also, due to the rising health benefits, consumers opt for healthy beverages like green tea, and the flavoured varieties boost the consumer interest for healthy beverages thereby, driving the development of the segment.

By Form, green tea bags segment held the largest share in 2024

- By form, green tea bags segment is anticipated to lead the growth of the green tea market in the studied period. Green tea bags are easy and convenient to use and making tea from them is quick and simple than any other method.

- Also, they are hassle-free, portable, and lightweight which makes them easier to carry during traveling. Apart from that, green tea bags are used to treat various skin conditions such as dark circles, acne, itching, and rashes by young people and millennials worldwide, driving the demand for the green tea bags.

Green Tea Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is anticipated to dominate the growth of the green tea market over the analysis period. The existence of major green tea-producing nations such as Pakistan, China, India, and Sri Lanka in the world, is most likely to drive the growth of this region. Additionally, various natural features, such as temperature, soil texture as well as humidity in the Asia Pacific region are conducive to tea growth, which thereby contributes to a rapid rise in demand for green tea in this region.

- Various countries, including China and India, have further focused on planting tea plants across vast swathes of territory thus, increasing the production of green tea. Furthermore, China is considered to be the biggest consumer and producer of tea in the Asia Pacific region and has the largest consumption of functional beverages such as green tea, matcha tea, and specialty teas that are a rich source of nutrition.

Green Tea Market Top Key Players:

- Rishi Tea (United States)

- Numi Organic Tea (United States)

- Stash Tea (United States)

- Republic of Tea (United States)

- Harney & Sons (United States)

- Celestial Seasonings (United States)

- PepsiCo (United States)

- Coca-Cola Company (United States)

- Nestlé(Switzerland)

- Unilever (United Kingdom)

- James Finlay (United Kingdom)

- Twinings (United Kingdom)

- Twinings of London (United Kingdom)

- Tetley (United Kingdom)

- Yorkshire Tea (United Kingdom)

- Typhoo (United Kingdom)

- Associated British Foods (United Kingdom)

- Ito En (Japan)

- Kirin Holdings (Japan)

- Suntory Beverage & Food (Japan)

- Tata Global Beverages (India)

- Dilmah (Sri Lanka)

- Yutaka (Japan)

- OSulloc (South Korea)

- Ten Ren's Tea (Taiwan)

- Other Active Players

Key Industry Developments in the Green Tea Market:

- In February 2023, Unilever, the consumer goods giant, acquired Pukka Herbs, a leading UK-based organic herbal tea brand, for an undisclosed amount. This move strengthens Unilever's position in the growing organic tea market and expands its green tea offerings.

- In May 2023, Tata Global Beverages, the Indian tea giant, acquired Tetley, a British tea brand known for its green tea offerings, for £315 million. This acquisition gives Tata Global Beverages a strong foothold in the European green tea market.

- In August 2023, Ito En, the Japanese green tea giant, acquired Matcha.com, an online retailer of matcha, for an undisclosed amount. This move reflects the growing popularity of matcha, a type of green tea powder.

|

Global Green Tea Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 15.41 Billion |

|

Forecast Period 2024-32 CAGR: |

8.5 % |

Market Size in 2032: |

USD 29.59 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Green Tea Market by Type (2018-2032)

4.1 Green Tea Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Flavoured

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Unflavoured

Chapter 5: Green Tea Market by Form (2018-2032)

5.1 Green Tea Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Green Tea Bags

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Instant Green Tea Mixes

5.5 Loose Green Tea Leaves

Chapter 6: Green Tea Market by Distribution Channel (2018-2032)

6.1 Green Tea Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Supermarkets/Hypermarkets

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Specialty Stores

6.5 Convenience Stores

6.6 Online Stores

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Green Tea Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BALSU GIDA (TURKEY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CHELMER FOODS (NORTH ESSEX)

7.4 KANE GRADE (U.K)

7.5 OLAM INTERNATIONAL (SINGAPORE)

7.6 OREGON HAZELNUTS (U.S.)

7.7 AYDIN KURUYEMIS (ISTANBUL)

7.8 GEONUTS (GEORGIA)

7.9 POYRAZ TARIMSAL (ISTANBUL)

7.10 BARRY CALLEBAUT AG (SWITZERLAND)

7.11 ARSLANTÜRK (TURKEY)

7.12 KARIMEX (BRAZIL)

7.13 GURSOY TARIMSAL URUNLER GIDA (TURKEY)

7.14 FRUITS OF TURKEY (TURKEY)

7.15 BATA FOOD (TURKEY)

7.16 DURAK FINDIK (TURKEY)

7.17

Chapter 8: Global Green Tea Market By Region

8.1 Overview

8.2. North America Green Tea Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Flavoured

8.2.4.2 Unflavoured

8.2.5 Historic and Forecasted Market Size by Form

8.2.5.1 Green Tea Bags

8.2.5.2 Instant Green Tea Mixes

8.2.5.3 Loose Green Tea Leaves

8.2.6 Historic and Forecasted Market Size by Distribution Channel

8.2.6.1 Supermarkets/Hypermarkets

8.2.6.2 Specialty Stores

8.2.6.3 Convenience Stores

8.2.6.4 Online Stores

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Green Tea Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Flavoured

8.3.4.2 Unflavoured

8.3.5 Historic and Forecasted Market Size by Form

8.3.5.1 Green Tea Bags

8.3.5.2 Instant Green Tea Mixes

8.3.5.3 Loose Green Tea Leaves

8.3.6 Historic and Forecasted Market Size by Distribution Channel

8.3.6.1 Supermarkets/Hypermarkets

8.3.6.2 Specialty Stores

8.3.6.3 Convenience Stores

8.3.6.4 Online Stores

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Green Tea Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Flavoured

8.4.4.2 Unflavoured

8.4.5 Historic and Forecasted Market Size by Form

8.4.5.1 Green Tea Bags

8.4.5.2 Instant Green Tea Mixes

8.4.5.3 Loose Green Tea Leaves

8.4.6 Historic and Forecasted Market Size by Distribution Channel

8.4.6.1 Supermarkets/Hypermarkets

8.4.6.2 Specialty Stores

8.4.6.3 Convenience Stores

8.4.6.4 Online Stores

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Green Tea Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Flavoured

8.5.4.2 Unflavoured

8.5.5 Historic and Forecasted Market Size by Form

8.5.5.1 Green Tea Bags

8.5.5.2 Instant Green Tea Mixes

8.5.5.3 Loose Green Tea Leaves

8.5.6 Historic and Forecasted Market Size by Distribution Channel

8.5.6.1 Supermarkets/Hypermarkets

8.5.6.2 Specialty Stores

8.5.6.3 Convenience Stores

8.5.6.4 Online Stores

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Green Tea Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Flavoured

8.6.4.2 Unflavoured

8.6.5 Historic and Forecasted Market Size by Form

8.6.5.1 Green Tea Bags

8.6.5.2 Instant Green Tea Mixes

8.6.5.3 Loose Green Tea Leaves

8.6.6 Historic and Forecasted Market Size by Distribution Channel

8.6.6.1 Supermarkets/Hypermarkets

8.6.6.2 Specialty Stores

8.6.6.3 Convenience Stores

8.6.6.4 Online Stores

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Green Tea Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Flavoured

8.7.4.2 Unflavoured

8.7.5 Historic and Forecasted Market Size by Form

8.7.5.1 Green Tea Bags

8.7.5.2 Instant Green Tea Mixes

8.7.5.3 Loose Green Tea Leaves

8.7.6 Historic and Forecasted Market Size by Distribution Channel

8.7.6.1 Supermarkets/Hypermarkets

8.7.6.2 Specialty Stores

8.7.6.3 Convenience Stores

8.7.6.4 Online Stores

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Green Tea Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 15.41 Billion |

|

Forecast Period 2024-32 CAGR: |

8.5 % |

Market Size in 2032: |

USD 29.59 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||