Green Electronics Manufacturing Market Synopsis:

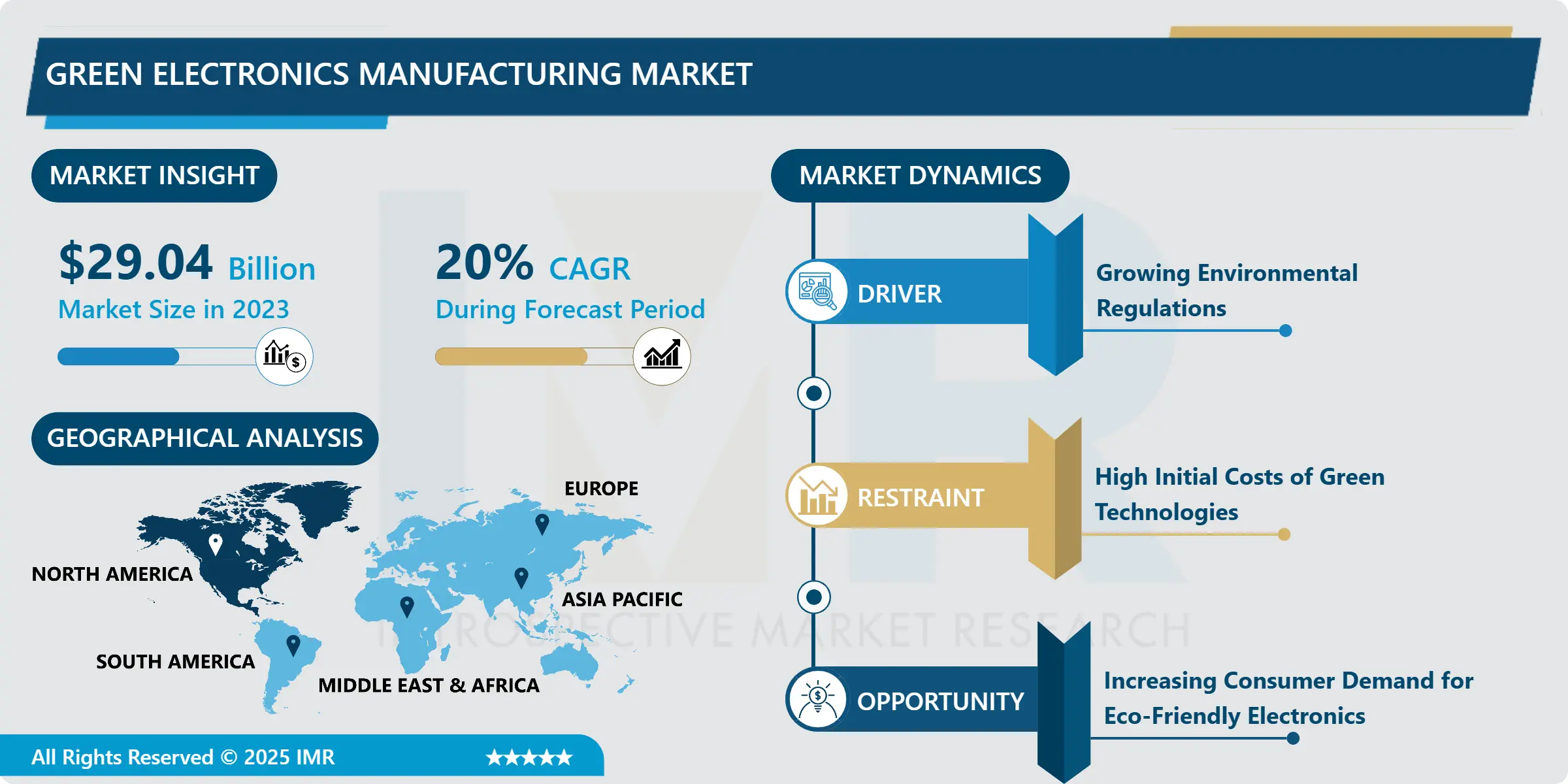

Green Electronics Manufacturing Market Size Was Valued at USD 29.04 Billion in 2023, and is Projected to Reach USD 150 Billion by 2032, Growing at a CAGR of 20% From 2024-2032.

Green electronics manufacturing could be defined as manufacturing of electronics devices through techniques, components and processes, which are least hazardous to environment. This include use of renewable energy, the reduction of hazardous substances in production and efficient management and recycling of wastes. It also fulfills the needs of the environmental regulation policies needed for the market and consumers’ expectations of sustainable technology products.

The green Electronics manufacturing market has become popular over the years mainly due to awareness of sustainability by industries and governments all over the world. Growth of knowledge in climate change effects and the strict environmental standards such as the RoHS directive within the European Union is causes green manufacturing in electronics. Top players are also promoting cleaner production technologies as well as using energy efficiency in production to reduce on carbon emission. Not only does this change decrease the consequences on the external environment but it also has shifted the advantage of companies in terms of organizational management towards the achievement of sustainable development goals on the international level.

Increasing demand for products is being observed across consumer electronics, automotive and industrial device market. As the investments in R & D are increasing the manufacturers are using the renewable resources and are advocating the use of smart technologies like AI and IoT to optimize the resource constraints. In addition, incentive policies by governments, and increasing awareness among the consumers regarding global sustainability are driving the demand for green electronics and making the manufacturing of green electronics as an indispensable part of the worldwide green movement.

Green Electronics Manufacturing Market Trend Analysis:

Rising Integration of AI for Sustainable Manufacturing

- The adoption of artificial intelligence (AI) is already revolutionizing the manufacture of green electronics through such methods as the cutting down on resource wastage. Smart systems in manufacturing can track production line in real time, detect bottlenecks, and provide recommendations with regard to energy and material use. Proactive maintenance based on artificial intelligence keeps the equipment as effective as possible and reduces time waste and resource consumption when compared to regular breakdown maintenance .

- Also, through AI, it is easier to conduct sophisticated simulations of the product during its designing stages to improve on the choice of materials, to design a product that can be easily recycled or reused. With improved development of the AI technology its application in green electronics manufacturing will expand thus improving the manufacturing processes for environmentally friendly electronics.

Circular Economy Adoption in Green Electronics

- The market for green electronics manufacturing has a key opportunity in circular economy. While the linear model is “make-use-dispose”, the circular economy integrates aspects of product design at the end of its life cycle, encouraging reuse, repair and recycling. This idea parallels green electronics manufacturing which is the practice of incorporating eco design philosophies directly into manufacturing to enhance device life span while considering resource recycling.

- Those businesses that start embracing closed-loop recycling systems and refurbishment are discovering additional revenue sources, not to mention saving the environment. With growing consumer and policy maker awareness towards CE and a desire to shop for products that are more circular in nature, industrial players with Circular opportunities can leverage these aspects to develop competitive advantage and to meet the changing circular expectations of consumers and policymakers, respectively.

Green Electronics Manufacturing Market Segment Analysis:

Green Electronics Manufacturing Market is Segmented on the basis of Product Type, Technology, End User, and Region

By Product Type, Consumer Electronics segment is expected to dominate the market during the forecast period

- The consumer electronics share the largest green electronics manufacturing industry as consumers express their preference for green Electronics such as green smartphones, laptops and home electronic appliances. Consumer demand of appliances that have an energy-efficient design and those that leave minimal carbon footprints continues to rise. Currently, large electronics manufacturers such as Apple, Samsung, and HP have stepped up their innovation, using recyclable material and renewable power in production. Moreover, calls for sustainable or eco-friendly packaging and embracing circular economy standards make this segment drive the green transition as a form of consumer electronics.

- The other manufacturing segments that are experiencing increased application of the green manufacturing principles include industrial, automotive, and healthcare electronics. For industrial electronics, elements like renewable energy operating the equipment and energy saving components propel market progress. The automotive electronics sector gains because of the increasing adoption of electric vehicles (EVs) whereby sustainability of manufacturing processes is essential in development of environmentally sustainable batteries and controls. Likewise, the healthcare electronics segment witnesses demands for green medical tools and appliances with biocompatible materials, and less electronic waste. Although these sectors are smaller in scale than consumer electronics they offer the potential for fast growth as green manufacturing technologies develop.

By Technology, Energy-Efficient Manufacturing segment expected to held the largest share

- Sustainable manufacturing practices and clean energy technology are two major foundations of green electronic assembly. Thai defines efficient manufacturing as a scenario where there is stringent usage of energy in the manufacturing process through the use of low power equipment and long chain supply systems among others. This approach reduces the cost of production but at the same time meets the international plan towards sustainability. At the same time, the electrification of manufacturing is intensifying, and implementing renewable energy is prevalent, and companies are using solar, wind, and other kinds of green energy to produce electrical energy for their factories. Firms embracing these technologies not only reduce their emissions to the atmosphere but also improve on the image of their brands in the eyes

- Closed-loop system and optimised smart manufacturing for green circuit board technologies are the new wave of change for electronics by employing advanced recycling technologies. Sophisticated recycling techniques produce the possibility to extract base metals such as gold, silver, and rare earth materials from waste electronic gadgets, thus conserving new resource mining. On the other hand, smart manufacturing makes use of AI, IoT and automation to enhance the process, minimize waste and check the effects of the manufacturing processes to the environment in real time. They enable manufacturers to use resources and emissions much more efficiently, gaining higher levels of profit in green electronics industry. All together these developments represent a new trend characterized by the sustainable and intelligent production.

Green Electronics Manufacturing Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In 2023, Asia-Pacific region contributed to 35% of world green electronics manufacturing market share. This is due to strong equipment manufacturing capacity within the region, high investments within the electronics industry on renewable energy integration, and efficiency-targeted government policies. Currently, manufacturers from nations such China, Japan, and South Korea are innovating to meet the environmental standards set all over the world.

- The relative advantage of the region in terms of production capacity and the large consumer market enhance the strengths of the market leader. However, other AI-based industrial policies like China’s “Made in China 2025” and Japan’s promise to be a carbon-free society by 2050 are fast propelling the use of Green manufacturing technologies in the region.

Active Key Players in the Green Electronics Manufacturing Market:

- Apple Inc. (United States)

- Dell Technologies (United States)

- Foxconn Technology Group (Taiwan)

- General Electric Company (United States)

- Hitachi, Ltd. (Japan)

- HP Inc. (United States)

- Intel Corporation (United States)

- LG Electronics (South Korea)

- Microsoft Corporation (United States)

- Panasonic Corporation (Japan)

- Samsung Electronics Co., Ltd. (South Korea)

- Schneider Electric (France)

- Siemens AG (Germany)

- Sony Corporation (Japan)

- Toshiba Corporation (Japan)

- Other Active Players

|

Green Electronics Manufacturing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 29.04 Billion |

|

Forecast Period 2024-32 CAGR: |

20 % |

Market Size in 2032: |

USD 150 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Green Electronics Manufacturing Market by Product Type

4.1 Green Electronics Manufacturing Market Snapshot and Growth Engine

4.2 Green Electronics Manufacturing Market Overview

4.3 Consumer Electronics

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Consumer Electronics: Geographic Segmentation Analysis

4.4 Industrial Electronics

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Industrial Electronics: Geographic Segmentation Analysis

4.5 Automotive Electronics

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Automotive Electronics: Geographic Segmentation Analysis

4.6 Healthcare Electronics

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Healthcare Electronics: Geographic Segmentation Analysis

Chapter 5: Green Electronics Manufacturing Market by Technology

5.1 Green Electronics Manufacturing Market Snapshot and Growth Engine

5.2 Green Electronics Manufacturing Market Overview

5.3 Energy-Efficient Manufacturing

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Energy-Efficient Manufacturing: Geographic Segmentation Analysis

5.4 Renewable Energy Integration

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Renewable Energy Integration: Geographic Segmentation Analysis

5.5 Advanced Recycling Technologies

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Advanced Recycling Technologies: Geographic Segmentation Analysis

5.6 Smart Manufacturing (AI

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Smart Manufacturing (AI: Geographic Segmentation Analysis

5.7 IoT

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 IoT: Geographic Segmentation Analysis

5.8 Automation)

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Automation): Geographic Segmentation Analysis

Chapter 6: Green Electronics Manufacturing Market by End User

6.1 Green Electronics Manufacturing Market Snapshot and Growth Engine

6.2 Green Electronics Manufacturing Market Overview

6.3 Residential

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Residential: Geographic Segmentation Analysis

6.4 Commercial

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Commercial: Geographic Segmentation Analysis

6.5 Industrial

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Industrial: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Green Electronics Manufacturing Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 APPLE INC. (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 DELL TECHNOLOGIES (UNITED STATES)

7.4 FOXCONN TECHNOLOGY GROUP (TAIWAN)

7.5 GENERAL ELECTRIC COMPANY (UNITED STATES)

7.6 HITACHI

7.7 LTD. (JAPAN)

7.8 HP INC. (UNITED STATES)

7.9 INTEL CORPORATION (UNITED STATES)

7.10 LG ELECTRONICS (SOUTH KOREA)

7.11 MICROSOFT CORPORATION (UNITED STATES)

7.12 PANASONIC CORPORATION (JAPAN)

7.13 SAMSUNG ELECTRONICS CO. LTD. (SOUTH KOREA)

7.14 SCHNEIDER ELECTRIC (FRANCE)

7.15 SIEMENS AG (GERMANY)

7.16 SONY CORPORATION (JAPAN)

7.17 TOSHIBA CORPORATION (JAPAN)

7.18 OTHER ACTIVE PLAYERS

Chapter 8: Global Green Electronics Manufacturing Market By Region

8.1 Overview

8.2. North America Green Electronics Manufacturing Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product Type

8.2.4.1 Consumer Electronics

8.2.4.2 Industrial Electronics

8.2.4.3 Automotive Electronics

8.2.4.4 Healthcare Electronics

8.2.5 Historic and Forecasted Market Size By Technology

8.2.5.1 Energy-Efficient Manufacturing

8.2.5.2 Renewable Energy Integration

8.2.5.3 Advanced Recycling Technologies

8.2.5.4 Smart Manufacturing (AI

8.2.5.5 IoT

8.2.5.6 Automation)

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Residential

8.2.6.2 Commercial

8.2.6.3 Industrial

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Green Electronics Manufacturing Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product Type

8.3.4.1 Consumer Electronics

8.3.4.2 Industrial Electronics

8.3.4.3 Automotive Electronics

8.3.4.4 Healthcare Electronics

8.3.5 Historic and Forecasted Market Size By Technology

8.3.5.1 Energy-Efficient Manufacturing

8.3.5.2 Renewable Energy Integration

8.3.5.3 Advanced Recycling Technologies

8.3.5.4 Smart Manufacturing (AI

8.3.5.5 IoT

8.3.5.6 Automation)

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Residential

8.3.6.2 Commercial

8.3.6.3 Industrial

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Bulgaria

8.3.7.2 The Czech Republic

8.3.7.3 Hungary

8.3.7.4 Poland

8.3.7.5 Romania

8.3.7.6 Rest of Eastern Europe

8.4. Western Europe Green Electronics Manufacturing Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product Type

8.4.4.1 Consumer Electronics

8.4.4.2 Industrial Electronics

8.4.4.3 Automotive Electronics

8.4.4.4 Healthcare Electronics

8.4.5 Historic and Forecasted Market Size By Technology

8.4.5.1 Energy-Efficient Manufacturing

8.4.5.2 Renewable Energy Integration

8.4.5.3 Advanced Recycling Technologies

8.4.5.4 Smart Manufacturing (AI

8.4.5.5 IoT

8.4.5.6 Automation)

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Residential

8.4.6.2 Commercial

8.4.6.3 Industrial

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 Netherlands

8.4.7.5 Italy

8.4.7.6 Russia

8.4.7.7 Spain

8.4.7.8 Rest of Western Europe

8.5. Asia Pacific Green Electronics Manufacturing Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product Type

8.5.4.1 Consumer Electronics

8.5.4.2 Industrial Electronics

8.5.4.3 Automotive Electronics

8.5.4.4 Healthcare Electronics

8.5.5 Historic and Forecasted Market Size By Technology

8.5.5.1 Energy-Efficient Manufacturing

8.5.5.2 Renewable Energy Integration

8.5.5.3 Advanced Recycling Technologies

8.5.5.4 Smart Manufacturing (AI

8.5.5.5 IoT

8.5.5.6 Automation)

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Residential

8.5.6.2 Commercial

8.5.6.3 Industrial

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Green Electronics Manufacturing Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product Type

8.6.4.1 Consumer Electronics

8.6.4.2 Industrial Electronics

8.6.4.3 Automotive Electronics

8.6.4.4 Healthcare Electronics

8.6.5 Historic and Forecasted Market Size By Technology

8.6.5.1 Energy-Efficient Manufacturing

8.6.5.2 Renewable Energy Integration

8.6.5.3 Advanced Recycling Technologies

8.6.5.4 Smart Manufacturing (AI

8.6.5.5 IoT

8.6.5.6 Automation)

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Residential

8.6.6.2 Commercial

8.6.6.3 Industrial

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkey

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Green Electronics Manufacturing Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product Type

8.7.4.1 Consumer Electronics

8.7.4.2 Industrial Electronics

8.7.4.3 Automotive Electronics

8.7.4.4 Healthcare Electronics

8.7.5 Historic and Forecasted Market Size By Technology

8.7.5.1 Energy-Efficient Manufacturing

8.7.5.2 Renewable Energy Integration

8.7.5.3 Advanced Recycling Technologies

8.7.5.4 Smart Manufacturing (AI

8.7.5.5 IoT

8.7.5.6 Automation)

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Residential

8.7.6.2 Commercial

8.7.6.3 Industrial

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Green Electronics Manufacturing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 29.04 Billion |

|

Forecast Period 2024-32 CAGR: |

20 % |

Market Size in 2032: |

USD 150 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||