Gluten Flour Market Synopsis

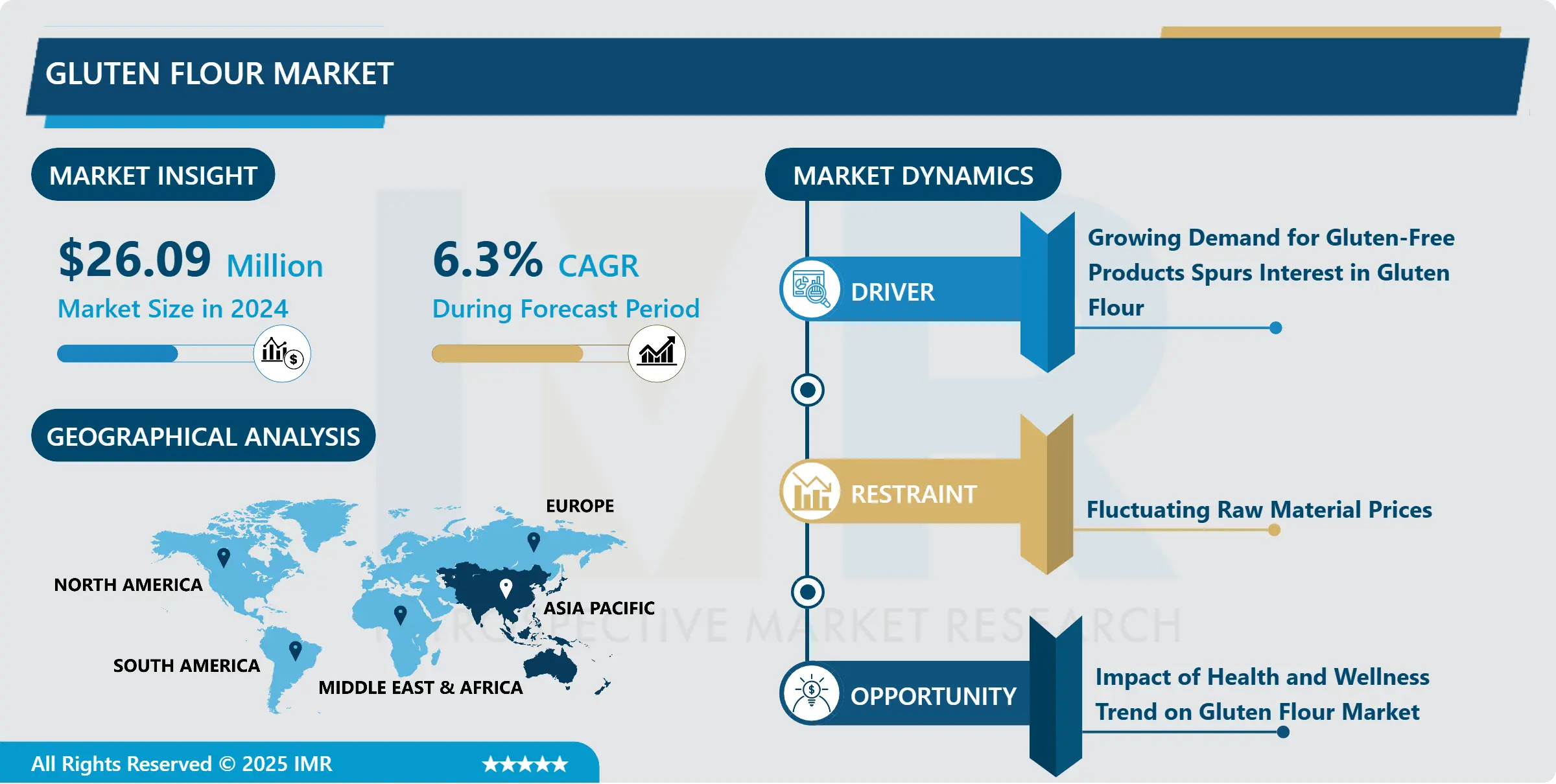

Gluten Flour Market Size Was Valued at USD 26.09 Billion in 2024, and is Projected to Reach USD 42.53 Billion by 2032, Growing at a CAGR of 6.3% From 2025-2032.

Products containing gluten flour both locally and globally are a part of the gluten flour market industry, which includes the Gluten flour manufacture, Gluten flour transportation, and Gluten flour Conventional. Due to its unique stretch and hold characteristics, essential wheat gluten, or gluten flour as it is occasionally called, is primarily used as a functional ingredient in cooking and baking. This enhances protein content in a range of baked and other processed foods, enhances texture, as well as increases dough extensibility.

Some of the stakeholders in the market include manufacturers, suppliers, distributors, bakeries, food processors and customers who seek the consumption of gluten enhanced products for functional requirement or personal preference. The market for this product is also dictated by the consumer needs for higher protein and low fat products, shift towards plant based and gluten free diets, and new technologies in food science to improve the nutritional content of the products.

Gluten Flour Market Trend Analysis

Gluten Flour Market Growth Drivers- Growing Demand for Gluten-Free Products Spurs Interest in Gluten Flour

- However, now the food sector has a strange opportunity for gluten flour due to the release of gluten-free products into the market. He notes that gluten flour still finds its demand for some uses in culinary while more customers go gluten-free for reasons such as dietary preference or illness. For example, baking industry requires gluten flour in making coated baked items so as to achieve the right texture and structure. Gluten which is mostly found in doughs is a protein that provides needed elasticity for pleasing volume, chewiness, and crumb texture to breads, pastries, and cakes.

- Moreover, gluten flour is appreciated not only for the functional properties in baking industry but also for other functional characteristics. In confectionery, it is applied as a functional ingredient for modifying texture and bringing tackifier features in comparable products such as cookies, biscuits, and snacks. Most of the desired characteristics in many confectionary items such as thoroughly light and airy is attributed to gluten’s ability to retain air during mixing and even during baking. Since it is quite challenging to produce the same quality using replace ingredients, gluten flour is the best solution to use by the food producers who intend to meet the taste and satisfaction of their customers.

- This is another reason why the market is increasing its demand for gluten-free substitutes plus the progression of knowledge regarding gluten-free diets in general. But also for those individuals who are not conditionally bound by gluten sensitivity or allergy, gluten flour remains indispensable for achieving certain effects. Based on its flexibility and unique baking characteristics, it is still considered an important ingredient in the production of high quality bakery and confectionery products that meet various customers’ demands and provide the final products’ appeal to the consumers’ senses. Therefore, despite the observed shift to gluten-free food, a demand for gluten flour remains and is increasing in those spheres in which people notice the presence of certain features of the product at their advantage.

Gluten Flour Market Opportunities- Impact of Health and Wellness Trend on Gluten Flour Market

- The major trend which has affected the market of gluten flour is the health and the quality of the consumed food and the shift toward healthy eating. Due to its quantity of protein which is high in its composition gluten flour has met the requisite of health conscious product or nutrition supplement making and has been used in the manufacturing of food. With the rising choice of going vegan or for protein goods, gluten flour is the ultimate solution that is easy and versatile. It enhances the nutritional value of a variety of foods not only its protein component serves as a formulative aid for goods to be employed by athlete energetic individuals and individuals who seek to gain more proteins without the use of animal products.

- Further, gluten flour serves more uses than its protein performance in foods that are supposed to be healthy. As it has additional nutritional value for instance vitamins, minerals, and dietary fiber it is also a vital component of balanced diets. The following are some of these qualities that are being employed by producers to formulate functional foods such as energy bar, meal replacement and fortified snacks with compelling health needs. This serving customer request for more healthful products also diversifies the product range that the gluten flour business has thus catering for other types of foods. The use of gluten flour in enhancing nutritional values and as support toward dietary goals is expected to increase with passage of time due to continually increasing consumer trends of health consciousness. This should probably lead to the development of various products to decongest the health food markets.

Gluten Flour Market Segment Analysis:

Gluten Flour Market Segmented based on By Product Types and By Applications.

By Product Types, Vital wheat gluten segment is expected to dominate the market during the forecast period

- VWG is made from wheat flour, using a procedure of washing out the starch component of the wheat through sedimentation, and is appreciated for a particularly high level of protein and functionality. Then in the baking industry, it plays the important role of an additive that has greatly improved the quality and texture of baked foods. Among them, the most important is the function of dough elasticity enhancement. As an ingredient in dough, the vital wheat gluten is a dough improver that creates a woven mass of gluten strands throughout the dough. A mesh-like structure comprised from proteins is created that captures gases generated by yeast fermentation and results in uniform dough expansion during the baking process. This leads to a bread and pastry with a texture that is both soft and springy and a mouthfeel, which consumers would prefer.

- Furthermore, there is no other ingredient that is as significant as the vital wheat gluten as it gives structure to most baked products. It plays the role of a glue, meaning that it binds the other ingredients which is especially desirable in absorbing high moisture doughs used to prepare breads and pastry products. It is therefore helpful in providing better volume and shape retaining capacity to baked products in the interest of the structural appearance that such products require. In addition to being a mechanical functionality, the vital wheat gluten also has a nutritional role because of its protein-enriching abilities of the baked foods. This is especially important in the present day time consumer where there is are high demands for commodities rich in protein.

- Vital wheat gluten is not limited to being used as a baking aid as has been depicted above. It also finds application in meat substitutes and vegetarian products, in which case it creates a fibrous structure of the desired texture. Furthermore, it has great binding potentials thereby making it a supplemental in many different processed food products including soups sauces and breakfast cereals where it offers positive attributes for texture and stability. In particular, the overall share of vital wheat gluten in the global market is explainable by its versatile application potential across all sectors of the food industry where its special functional characteristics create more and more demand among the global food manufacturers.

By Applications, Baking segment held the largest share in 2024

- Baking has been recognized as one of the pillars of the culinary industry and it once again accounts for the largest share of the gluten products market. This segment is as a result of the understanding that Baker’s products or baked products in general are consumed almost all round the world by all people regardless of their region. This ingredient becomes critical in the improvement of baked products quality and conformity with standards. Being a natural dough conditioner and improve it is function is very much helpful in enhancing the gluten structure in the bread and pastry formulations. As a result of this, vital wheat gluten can be useful in altering the gluten network with the required characteristics including better elasticity, improved dough handling properties as well as improved gas retention during fermentation. All these factors play a role in producing lighter, fluffier breads and high volume pastry products which have excellent texture.

- One of the usual reasons behind the application of vital wheat gluten is the requirement for a finer quality and better loaf volume for breads and other baked food products. It plays the role of an emulsifier and this does help in better moisture distribution and makes the crumbs of the finished products more uniformly charged. This is especially major in bakery organizations where the quality of products must meet a particular standards regarding such qualities like appearance. Also, the characteristic of vital wheat gluten to help in the shelf preservation across baked products is another bonus factor making manufacturing firms seek to include it in their production cycles to meet the demands of their clients for products with longer shelf lives, enhanced quality.

- In addition, browsers consuming bakery items around the world support the key role of baking as a first and foremost use of gluten products. Traditional breads, as well as trending pastries and cakes necessitating improved dough characteristics and better quality products make vital wheat gluten have a relevant and ongoing substantial market share in this fast changing market. With their increasing concern for healthy and high-quality baked products, the role of vital wheat gluten as the ingredient that can contribute to set these standards cannot be overestimated.

Gluten Flour Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Gluten flour market in Asia Pacific: Several factors have contributed to the growth of gluten flour market in Asia pacific region. First of all, the shift in consumer behavior with regard to diet and preference for gluten free products is behind the overall growth. Owing to this awareness of health and increased concern about our diet, many people are embracing foods that are prepared without wheat. This is even more conspicuous in urban regions where those lifestyles are gradually shifting towards the global diets.

- Secondly, rising disposable per capita income worldwide especially in the fast-growing nations such as China, India, Japan, South Korea and others are fuelling the market for specialty food and gourmet segment including gluten free products. With consumers becoming more wealthy they are willing to spend extra money in order to obtain gluten flour and related goods form the category; especially if they are restricted in their diets or only need special goods.

- Secondly, the growth of more bakeries in the region also plays a huge factor. Gluten flour, which is widely used in western style baked products, has been found to be increasing its share in Asian markets. This trend is upheld by the rising number of bakery chains and cafes that sell all types of breads, pastries and cakes many of which are now being produced in gluten-free to capture a wider market.

- Similarly, knowledge of gluten sensitivity and celiac disease is growing in the Asia Pacific region. Health professionals and nutritionists are encouraging the gluten-free diet for people with these disorders. Such awareness is putting pressure on the manufacturers of food to come up with gluten free products hence creating a larger market for the gluten flour in the region.

Active Key Players in the Gluten Flour Market

- Archer Daniels Midland Company (ADM)

- Manildra Group

- Cargill, Incorporated

- General Mills, Inc

- Puratos Group

- Hain Celestial Group

- The Scoular Company

- Groupe Limagrain

- Ardent Mills

- Kerry Group

- Other Active Players

|

Gluten Flour Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 26.09 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.3% |

Market Size in 2032: |

USD 42.53 Bn. |

|

Segments Covered: |

By Product Types |

|

|

|

By Applications |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Gluten Flour Market by Product Types (2018-2032)

4.1 Gluten Flour Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Vital wheat gluten

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Modified gluten

4.5 Others

Chapter 5: Gluten Flour Market by Applications (2018-2032)

5.1 Gluten Flour Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Baking

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Food processing

5.5 Pet food

5.6 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Gluten Flour Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ARCHER DANIELS MIDLAND COMPANY (ADM)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 MANILDRA GROUP

6.4 CARGILL INCORPORATED

6.5 GENERAL MILLS INC

6.6 PURATOS GROUP

6.7 HAIN CELESTIAL GROUP

6.8 THE SCOULAR COMPANY

6.9 GROUPE LIMAGRAIN

6.10 ARDENT MILLS

6.11 KERRY GROUP

6.12 OTHER KEY PLAYERS

6.13

Chapter 7: Global Gluten Flour Market By Region

7.1 Overview

7.2. North America Gluten Flour Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Product Types

7.2.4.1 Vital wheat gluten

7.2.4.2 Modified gluten

7.2.4.3 Others

7.2.5 Historic and Forecasted Market Size by Applications

7.2.5.1 Baking

7.2.5.2 Food processing

7.2.5.3 Pet food

7.2.5.4 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Gluten Flour Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Product Types

7.3.4.1 Vital wheat gluten

7.3.4.2 Modified gluten

7.3.4.3 Others

7.3.5 Historic and Forecasted Market Size by Applications

7.3.5.1 Baking

7.3.5.2 Food processing

7.3.5.3 Pet food

7.3.5.4 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Gluten Flour Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Product Types

7.4.4.1 Vital wheat gluten

7.4.4.2 Modified gluten

7.4.4.3 Others

7.4.5 Historic and Forecasted Market Size by Applications

7.4.5.1 Baking

7.4.5.2 Food processing

7.4.5.3 Pet food

7.4.5.4 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Gluten Flour Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Product Types

7.5.4.1 Vital wheat gluten

7.5.4.2 Modified gluten

7.5.4.3 Others

7.5.5 Historic and Forecasted Market Size by Applications

7.5.5.1 Baking

7.5.5.2 Food processing

7.5.5.3 Pet food

7.5.5.4 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Gluten Flour Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Product Types

7.6.4.1 Vital wheat gluten

7.6.4.2 Modified gluten

7.6.4.3 Others

7.6.5 Historic and Forecasted Market Size by Applications

7.6.5.1 Baking

7.6.5.2 Food processing

7.6.5.3 Pet food

7.6.5.4 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Gluten Flour Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Product Types

7.7.4.1 Vital wheat gluten

7.7.4.2 Modified gluten

7.7.4.3 Others

7.7.5 Historic and Forecasted Market Size by Applications

7.7.5.1 Baking

7.7.5.2 Food processing

7.7.5.3 Pet food

7.7.5.4 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Gluten Flour Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 26.09 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.3% |

Market Size in 2032: |

USD 42.53 Bn. |

|

Segments Covered: |

By Product Types |

|

|

|

By Applications |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||