Glucose Excipient Market Synopsis:

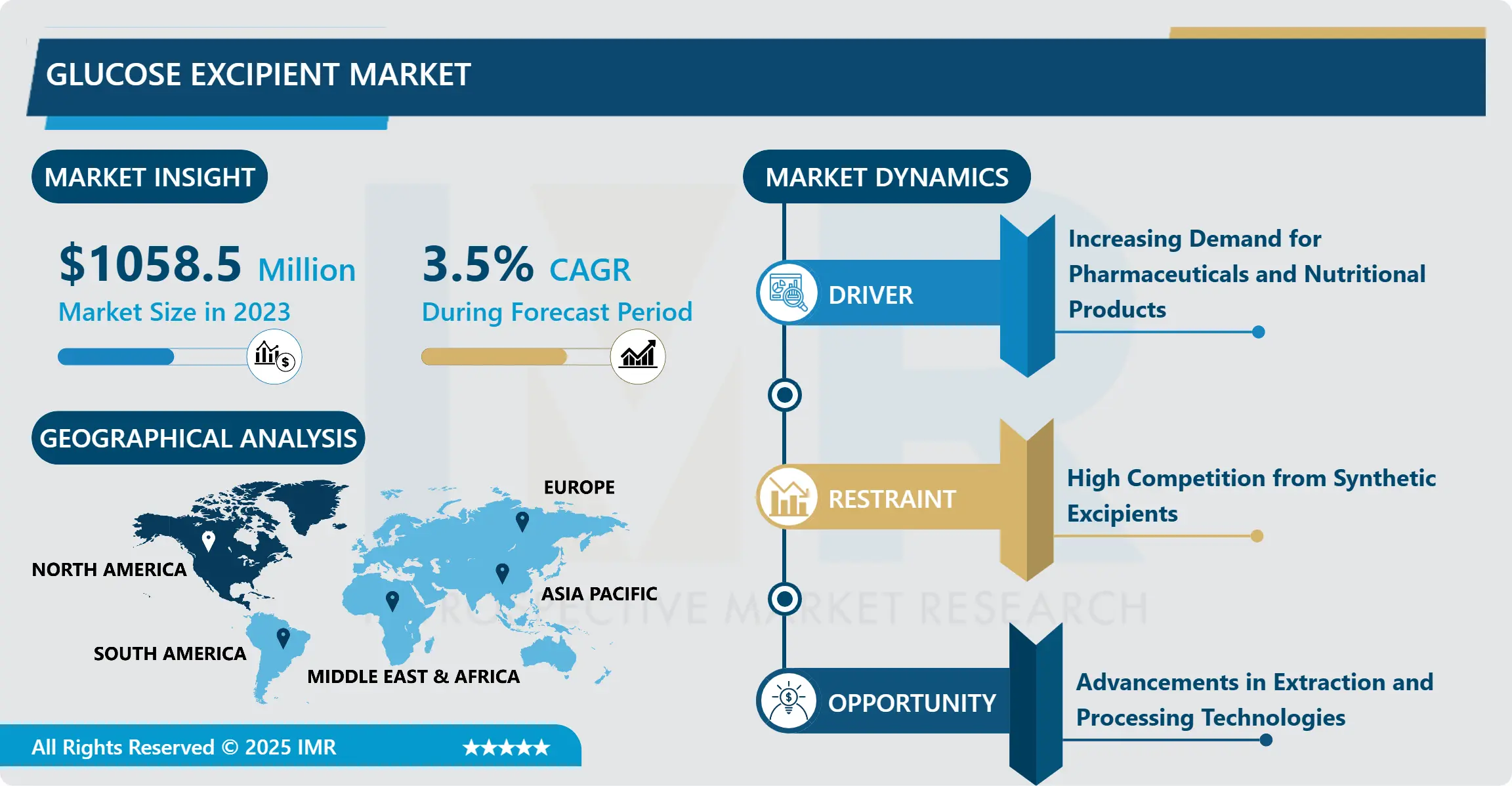

Glucose Excipient Market Size Was Valued at USD 1058.5 Million in 2023, and is Projected to Reach USD 1,442.63 Million by 2032, Growing at a CAGR of 3.5% From 2024-2032.

The Glucose Excipient Market can be defined as the generation and usage of glucose-related products that act as non-active ingredients in drugs, food items, and other products. These are substances that enhance the shelf life, taste, and manner in which active components are administered in drugs and nutraceuticals. Glucose excipients like dextrose monohydrate, powdered glucose, and liquid glucose are critical in improving the performance of a product and satisfying the consumer’s need for safe, effective, and acceptable products.

The glucose excipient market is in the growth stage for the same reasons, which are the high usage of excipients across the pharmaceutical and food industries. In pharmaceuticals, glucose excipients find application in oral dosage forms especially in tablet, capsules, and liquid dosage forms because of its properties such as a binding agent, a filler, and a stabilizer. This has been led by the increasing incidence of chronic diseases and consumers’ awareness of health supplements in the form of dietary supplements, energy drinks, and functional foods containing glucose-based excipients.

In the food industry, glucose excipients have uses as sweetening agents and texturizers on different products. This has been supported by the increased convenience foods and ready to consume drinks across the world hence promoting the use of glucose-based excipients. The market has also been able to take other forms of glucose which include corn and tapioca which have been made possible by advance production procedure. The growing approval of these excipients for safe application in food and pharmaceutical products is also fueling market development.

Glucose Excipient Market Trend Analysis:

Rising Use of Natural and Plant-Based Glucose Excipients

-

One of the crucial trends building the future of the glucose excipient industry is that consumers insist on natural and plant-origin glucose. Due to the current global standard for sustainability and clean labeling, customers are moving away from synthetic components. To achieve this, manufacturers are importing glucose excipients derived from purely renewable plant bases such as corn, wheat, and Tapioca in conforming to the existing environmental and health-conscious trends.This shift is most pronounced in the companies operating in the food and nutraceutical industries, especially since customers today demand more transparency and products made from natural components. The all-natural glucose base also provides a competitive advantage because the new excipients do not contain animal products that vegetarians or vegans avoid.

Growth in Emerging Markets

-

These regions include Asia-Pacific, Latin America and the Middle East new upcoming markets offers a bright future for the glucose excipient industry. Some of the main drivers for such products include factors such as latex, increased ASIA demand, reduced cost of aspartame, and changing perception towards health and enhancements of health knowledge. Leading industries such as the pharmaceutical and food services in the Asia Pacific region including India, China and Brazil are also propelling market growth. Moreover, government policies responding to supporting local factories for producing active pharmaceutical ingredients and excipients establish a good opportunity within these territories for other market participants to enter. Global players will be able to exploit these opportunities through increased funding on research and development also cooperation with local manufacturers.

Glucose Excipient Market Segment Analysis:

Glucose Excipient Market is Segmented on the basis of Type, Form, Function, and Region

By Type, Dextrose Monohydrate segment is expected to dominate the market during the forecast period

-

Among the demand type, the dextrose monohydrate segment shall hold a large share in the glucose excipient market during the forecast period due to its usage over a broad range of applications in the industries of pharmaceuticals, food, and beverages. There are occasionally used stabilizers and fillers in the preparation of oral and injectable suspensions in the pharmaceutical market. The unique properties of this supply are high solubility in water, comparatively low cost and compatibility with other excipients. The dextrose monohydrate is used as the sweetening agent, preservative and as texturising agent in most foods for the baking, confectionary and beverage sectors. The segment is quite versatile and is well accepted due to its safety and efficacy profile as an excipient as supported by approval globally.

By Form, the Powdered Glucose segment expected to held the largest share

-

The powdered glucose segment is expected to dominate the market due to the massive application of glucose in multiple industries. Because it is stable, easy to store and handle and can be used in combination with other ingredients, it finds preference especially in pharmaceutical and food industries. The powdered glucose is widely used in cases where tablets, capsules and even some powdered drink mixes are produced, it keeps constant high quality and a very long shelf life. Powdered glucose is also equally indispensable to food and beverage industry since it gives improvement on the sweetening, textural and mouth appeal to numerous specialties. With such factors like versatility and relatively cheap manufacturing, it keeps holding on the high rank for glucose excipient market share.

Glucose Excipient Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

Geographically, the glucose excipient market is expected to be dominated by North America during the time of the forecast with the presence of well-developed pharmaceutical and food industry. First, the healthcare connotations of the concerned region and high consumer CPP for health and wellness products are also significantly contributing to the demand for glucose excipients. In particular, the USA has a large share in the market for the increased focus on the research and development of pharmaceutical formulations.

- Canada also occupies a very important position in the North American market and the need for glucose excipients in food and beverage industries is increasing. This coupled with the region's commitment to quality standards and regulatory compliances adds to the production and distribution of glucose-based excipients making North America territory unassailable in the global market place.

Active Key Players in the Glucose Excipient Market:

- ADM (United States)

- Agrana Group (Austria)

- Avebe (Netherlands)

- Cargill, Inc. (United States)

- Corbion (Netherlands)

- Dow (United States)

- Emsland Group (Germany)

- Ingredion Incorporated (United States)

- Roquette Frères (France)

- Sanstar Bio-Polymers Ltd. (India)

- Shandong Fuyang Bio-Tech Co., Ltd. (China)

- Südzucker AG (Germany)

- Tate & Lyle PLC (United Kingdom)

- Tereos S.A. (France)

- Zhucheng Dongxiao Biotechnology Co., Ltd. (China)

- Other Active Players

|

Glucose Excipient Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD1,058.5 Million |

|

Forecast Period 2024-32 CAGR: |

3.5 % |

Market Size in 2032: |

USD 1,442.63 Million |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Function |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Glucose Excipient Market by Type

4.1 Glucose Excipient Market Snapshot and Growth Engine

4.2 Glucose Excipient Market Overview

4.3 Dextrose Monohydrate Anhydrous Dextrose Specialty Glucose Variants

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Dextrose Monohydrate Anhydrous Dextrose Specialty Glucose Variants: Geographic Segmentation Analysis

Chapter 5: Glucose Excipient Market by Form

5.1 Glucose Excipient Market Snapshot and Growth Engine

5.2 Glucose Excipient Market Overview

5.3 Powdered Glucose Crystalline Glucose Liquid Glucose

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Powdered Glucose Crystalline Glucose Liquid Glucose: Geographic Segmentation Analysis

Chapter 6: Glucose Excipient Market by Function

6.1 Glucose Excipient Market Snapshot and Growth Engine

6.2 Glucose Excipient Market Overview

6.3 Fillers & Binders Diluents Disintegrants Others

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Fillers & Binders Diluents Disintegrants Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Glucose Excipient Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ADM (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AGRANA GROUP (AUSTRIA)

7.4 AVEBE (NETHERLANDS)

7.5 CARGILL INC. (UNITED STATES)

7.6 CORBION (NETHERLANDS)

7.7 DOW (UNITED STATES)

7.8 EMSLAND GROUP (GERMANY)

7.9 INGREDION INCORPORATED (UNITED STATES)

7.10 ROQUETTE FRÈRES (FRANCE)

7.11 SANSTAR BIO-POLYMERS LTD. (INDIA)

7.12 SHANDONG FUYANG BIO-TECH CO. LTD. (CHINA)

7.13 SÜDZUCKER AG (GERMANY)

7.14 TATE & LYLE PLC (UNITED KINGDOM)

7.15 TEREOS S.A. (FRANCE)

7.16 ZHUCHENG DONGXIAO BIOTECHNOLOGY CO. LTD. (CHINA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Glucose Excipient Market By Region

8.1 Overview

8.2. North America Glucose Excipient Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Dextrose Monohydrate Anhydrous Dextrose Specialty Glucose Variants

8.2.5 Historic and Forecasted Market Size By Form

8.2.5.1 Powdered Glucose Crystalline Glucose Liquid Glucose

8.2.6 Historic and Forecasted Market Size By Function

8.2.6.1 Fillers & Binders Diluents Disintegrants Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Glucose Excipient Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Dextrose Monohydrate Anhydrous Dextrose Specialty Glucose Variants

8.3.5 Historic and Forecasted Market Size By Form

8.3.5.1 Powdered Glucose Crystalline Glucose Liquid Glucose

8.3.6 Historic and Forecasted Market Size By Function

8.3.6.1 Fillers & Binders Diluents Disintegrants Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Glucose Excipient Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Dextrose Monohydrate Anhydrous Dextrose Specialty Glucose Variants

8.4.5 Historic and Forecasted Market Size By Form

8.4.5.1 Powdered Glucose Crystalline Glucose Liquid Glucose

8.4.6 Historic and Forecasted Market Size By Function

8.4.6.1 Fillers & Binders Diluents Disintegrants Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Glucose Excipient Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Dextrose Monohydrate Anhydrous Dextrose Specialty Glucose Variants

8.5.5 Historic and Forecasted Market Size By Form

8.5.5.1 Powdered Glucose Crystalline Glucose Liquid Glucose

8.5.6 Historic and Forecasted Market Size By Function

8.5.6.1 Fillers & Binders Diluents Disintegrants Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Glucose Excipient Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Dextrose Monohydrate Anhydrous Dextrose Specialty Glucose Variants

8.6.5 Historic and Forecasted Market Size By Form

8.6.5.1 Powdered Glucose Crystalline Glucose Liquid Glucose

8.6.6 Historic and Forecasted Market Size By Function

8.6.6.1 Fillers & Binders Diluents Disintegrants Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Glucose Excipient Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Dextrose Monohydrate Anhydrous Dextrose Specialty Glucose Variants

8.7.5 Historic and Forecasted Market Size By Form

8.7.5.1 Powdered Glucose Crystalline Glucose Liquid Glucose

8.7.6 Historic and Forecasted Market Size By Function

8.7.6.1 Fillers & Binders Diluents Disintegrants Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Glucose Excipient Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD1,058.5 Million |

|

Forecast Period 2024-32 CAGR: |

3.5 % |

Market Size in 2032: |

USD 1,442.63 Million |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Function |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||