Awning Market Synopsis

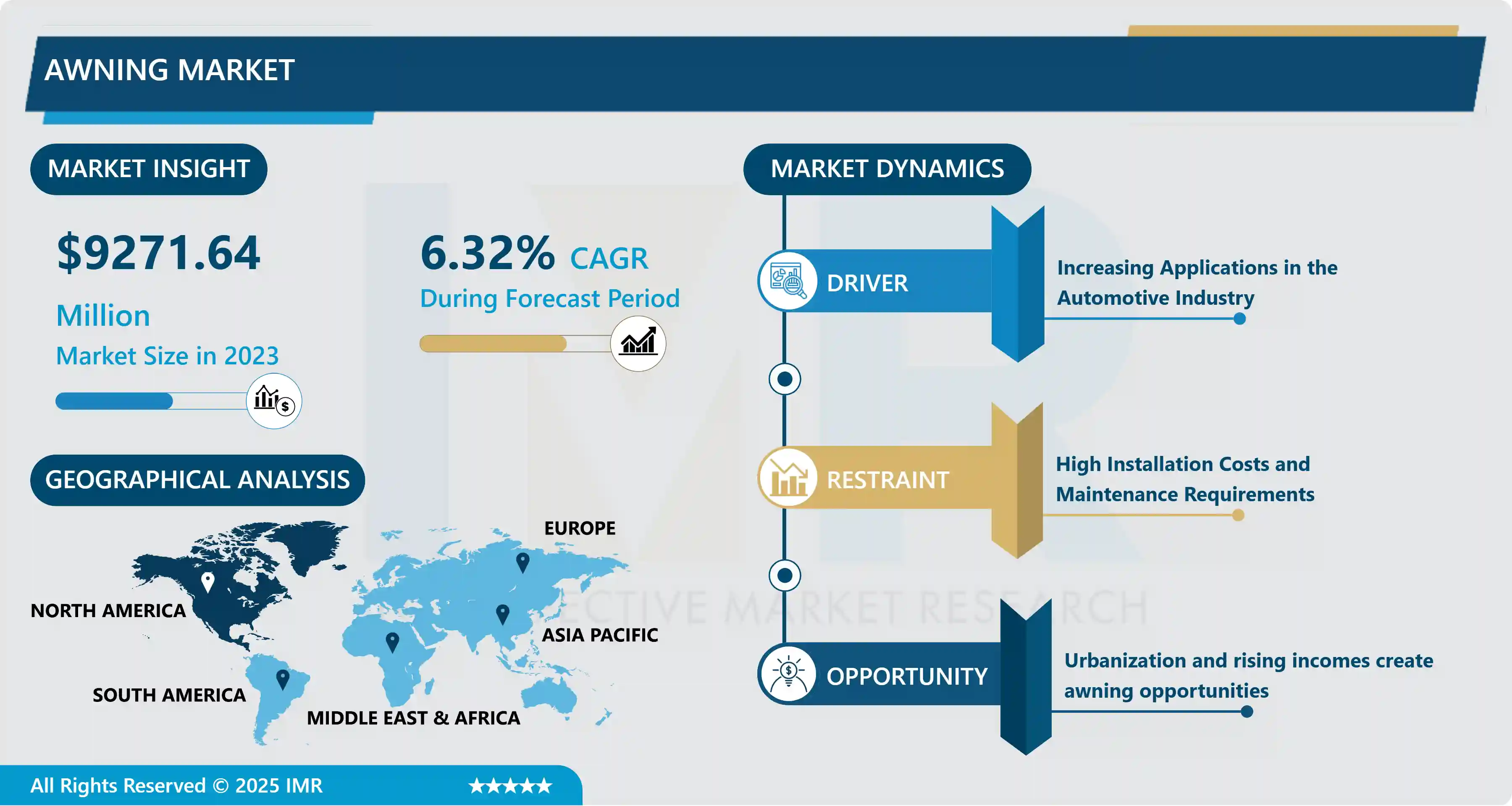

The awning Market Size Was Valued at USD 9271.64 Million in 2023 and is Projected to Reach USD 16095.01 Million by 2032, Growing at a CAGR of 6.32% From 2024-2032.

An architectural fabric projection that provides weather protection, identity, or decoration and is wholly supported by the building to which it is attached. An awning is comprised of a lightweight, frame structure over which a cover is attached. An awning purpose would satisfy any one or all of the following functional objectives, energy savings weather protection (sun, rain, snow, sleet, hail. wind), identification, or aesthetics (architecture).

Most awnings consist of fabric stretched over and secured to a fixed metal frame that is secured by laces or screws. These frames may be welded, bolted, or otherwise connected. Other awnings and canopies that consist of individual fabric panels can be attached using the staple-in method Still other awnings and canopies consist of rollers and lateral arms that can be retracted manually or automatically. It should be noted, however, that the possible combinations of styles, configurations, and colors are limitless. Creative designers and architects can develop useful and intriguing designs for modern awning and canopy systems that incorporate shape, light, color, texture, graphics, and structure, at a modest cost. Most awning frames are custom made by cutting, bending, and welding metal tubing, and fitting the fabric to the frame. With these custom methods, almost any shape and size can be attained and covered with awning fabric. Hence, the same surface can serve at least three necessary functions: weather protection, identification, and architecture.

Awning Market Trend Analysis

Increasing Applications in the Automotive Industry

- Both aesthetic and functional improvements are being highlighted in awning designs, enhancing the architectural appeal of buildings. Extra components such as lights, heaters, and side panels are being added to improve comfort and functionality in various weather conditions. These patterns emphasize a market that is innovative, customizable, and sustainable, leading to increased customer adoption and satisfaction.

- Increasing need for awnings in both commercial and residential areas. Businesses utilize awnings to enhance their appearance, promote their brand, and provide outdoor seating. Awnings are utilized by homeowners to increase energy efficiency, establish outdoor living areas, and improve the appearance of their homes. Businesses and homeowners look for personalized options for awnings, choosing materials, colors, and designs, and incorporating logos. Customization meets unique individual needs, attracting a varied customer base by improving both visual appeal and functionality.

- Motorized retractable awnings are becoming more popular, controlled via remote, mobile apps, or automated weather sensors for convenience. Integration of smart home technology enables users to effortlessly control their homes using voice commands or mobile devices, improving the overall user experience and attractiveness in contemporary residences.

- Awnings are appreciated for their ability to save energy, which decreases reliance on air conditioning and cuts down on energy expenses. The use of sustainable materials and environmentally conscious production techniques is becoming increasingly widespread. New types of materials such as acrylic and polyester are used to make long-lasting awnings that are weather-resistant and provide UV protection, making them perfect for tough conditions.

Urbanization and rising incomes create awning opportunities.

- Due to the increase in urbanization and disposable incomes in developing markets, there is a significant opportunity for awning manufacturers to tap into regions experiencing growth in construction projects and the need for outdoor areas.

- Companies can increase their range of products by providing a selection of different styles of awnings that include features such as motorization and compatibility with smart home systems. Emphasizing sustainability and eco-friendly construction methods can present awnings as environmentally responsible choices that support energy conservation, resulting in market expansion by collaborating with builders and architects.

- Creating new technology and automation can provide businesses with a competitive advantage. Promoting the advantages of awnings, such as saving energy and enhancing appearance, with successful marketing tactics can draw in customers. Utilizing online marketing and collaborating with home improvement influencers can boost brand exposure and increase sales.

- Offering services such as maintenance, repairs, and customization can enhance customer satisfaction and loyalty, while warranties and spare parts availability establish consumer confidence. The canopy industry is expanding due to requests from both residential and commercial areas, as well as advancements in technology and an emphasis on sustainability. Manufacturers and suppliers can achieve success in the global market by embracing trends and taking advantage of new opportunities.

Awning Market Segment Analysis:

Awning Market Segmented based on Type, Product, Nature, Material, and End-Use.

By Type, Retractable Awning Segment Is Expected to Dominate the Market During the Forecast Period

- Based on type, the market is bifurcated into fixed awnings and retractable awnings. Retractable awnings are widely liked around the world because of their versatility and flexibility. By extending or retracting them, users can modify coverage to get the shade or sunlight they want. This characteristic is attractive to homeowners and businesses in search of flexible outdoor areas.

- Retractable awnings are constructed using sturdy materials such as aluminum and weather-proof textiles to promote durability. They shield outdoor furniture and indoor areas from UV rays and rain, offering improved durability and safeguarding against different weather conditions. Retractable awnings come in a range of colors, patterns, and designs, which can be coordinated with different architectural styles. Their smooth aesthetic seamlessly blends with architecture, improving outdoor areas without changing the visual appeal.

- Retractable awnings increase energy efficiency by reducing heat gain, lowering indoor temperatures, and decreasing the necessity for air conditioning. These are attractive to those who care about the environment because they can be operated with a motor or manually and need little maintenance. Increasing need for retractable awnings in homes and businesses. Homeowners use outdoor living spaces to improve their homes and raise property value, while businesses use them to draw in customers and enhance their overall environment. Improvements consist of intelligent functions such as remote-control operation and weather sensors. Consumer demand for versatile, durable, and attractive outdoor shading will continue to make retractable awnings the preferred option in the awning market.

By Product, Patio Segment Held the Largest Share In 2023

- The Patio awning sector is projected to be at the forefront of the worldwide awning industry because of its appeal to both consumers and businesses. The growing desire for outdoor living spaces is leading to an increased use of patio awnings for shade and protection. Patio awnings help shield against the sun and improve energy efficiency by blocking sunlight, which decreases heat gain inside. They provide a range of customization options including different materials, colors, and designs to complement decor and architectural style. Their flexibility in design is favored by both residential and commercial settings, enhancing energy efficiency and visual attractiveness.

- Patio awnings have a range of choices for fixed or retractable styles, making them versatile and practical. Retractable awnings are well-liked for their ability to easily adjust sunlight and shade. Remote controls with motorized features add convenience. These are utilized in business environments such as restaurants, cafes, hotels, and resorts to design welcoming outdoor areas.

- Recent advancements in materials and production techniques have enhanced awnings, resulting in greater durability and ease of maintenance. This rise in quality has led to their popularity in both residential and commercial markets worldwide. Patio awnings can also lower energy usage and shield outdoor furniture from harm. The patio awning sector is at the forefront of the global market due to its advantages such as sun protection, energy efficiency, and aesthetic customization. Attracts customers and companies looking to improve outdoor living areas for increased functionality and relaxation.

Awning Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- The diverse climate of North America, characterized by hot summers and cold winters, positions it as the top player in the global awning market. Awnings offer protection from extreme heat, lower heat from the sun, and improve outdoor leisure. Regions such as the southern United States rely on them to save on cooling expenses and improve energy efficiency.

- The need for residential and commercial awnings in North America has grown with the rise of urbanization, as green space in urban areas becomes scarce. Awnings improve the quality of urban living by offering shade and protection in outdoor spaces such as decks and patios. North American architecture frequently incorporates elements such as expansive windows and outdoor living areas that are complemented by awnings, which also provide buildings with added color and texture.

- Consumers in North America have a strong demand for awnings in both residential and commercial sectors due to their recognized energy-saving benefits. Motorized and retractable options appeal to individuals looking for contemporary, high-tech shading solutions to enhance outdoor comfort and provide UV protection.

- In North America, building codes encourage energy-efficient practices by utilizing awnings to lower energy consumption for cooling and heating purposes. In sectors such as hospitality and retail, awnings are utilized to improve outdoor areas, storefronts, and entrances, ultimately enhancing customer comfort and aesthetics. North America dominates the awning industry because of its climate requirements, architectural preferences, consumer awareness, technological advancements, and regulations. This fact highlights the importance of this market for awning companies catering to both residential and commercial customers.

Awning Market Active Players

- Advanced Design Awnings & Signs (USA)

- Aristocrat (USA)

- A&A International (USA)

- Astrup Larsen (Denmark)

- Caravanserai (Australia)

- Durasol Awnings Inc. (USA)

- Eide Industries Inc. (USA)

- Gibraltar Industries (USA)

- GLI International Inc. (USA)

- Herculite Products Inc. (USA)

- Levens Australia (Australia)

- Nulmage (USA)

- Orion Blinds (Australia)

- Serge Ferrari Group (France)

- Somfy (France)

- Sunair Awnings (USA)

- Sunesta (USA)

- Sunsetter Products (USA)

- Thompson Awning Company (USA)

- Ware Awning Company (USA)

- The Shade Factor (USA)

- Sunsetter Products (USA)

- Carroll Architectural Shade (USA)

- Marygrove Awnings (USA)

- Astrup Larsen (Denmark)

- Caravanserai (Australia)

- Herculite Products Inc. (USA)

- The Shade Factor (USA)

|

Awning Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 9271.64 Mn. |

|

Forecast Period 2024-32 CAGR: |

6.32 % |

Market Size in 2032: |

USD 16095.01 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Product |

|

||

|

By Nature, |

|

||

|

By Material |

|

||

|

By End-Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Awning Market by Type (2018-2032)

4.1 Awning Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Fixed

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Retractable

Chapter 5: Awning Market by Product (2018-2032)

5.1 Awning Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Patio

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Window

5.5 Freestanding

Chapter 6: Awning Market by Nature, (2018-2032)

6.1 Awning Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Manual

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Motorized

Chapter 7: Awning Market by Material (2018-2032)

7.1 Awning Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Fabric

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Metal

7.5 Wood

7.6 Composites

7.7 Plastic

Chapter 8: Awning Market by End-Use (2018-2032)

8.1 Awning Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Residential

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Commercial

8.5 Industrial

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Awning Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 ADVANCED DESIGN AWNINGS & SIGNS (USA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 ARISTOCRAT (USA)

9.4 A&A INTERNATIONAL (USA)

9.5 ASTRUP LARSEN (DENMARK)

9.6 CARAVANSERAI (AUSTRALIA)

9.7 DURASOL AWNINGS INC. (USA)

9.8 EIDE INDUSTRIES INC. (USA)

9.9 GIBRALTAR INDUSTRIES (USA)

9.10 GLI INTERNATIONAL INC. (USA)

9.11 HERCULITE PRODUCTS INC. (USA)

9.12 LEVENS AUSTRALIA (AUSTRALIA)

9.13 NULMAGE (USA)

9.14 ORION BLINDS (AUSTRALIA)

9.15 SERGE FERRARI GROUP (FRANCE)

9.16 SOMFY (FRANCE)

9.17 SUNAIR AWNINGS (USA)

9.18 SUNESTA (USA)

9.19 SUNSETTER PRODUCTS (USA)

9.20 THOMPSON AWNING COMPANY (USA)

9.21 WARE AWNING COMPANY (USA)

9.22 THE SHADE FACTOR (USA)

9.23 SUNSETTER PRODUCTS (USA)

9.24 CARROLL ARCHITECTURAL SHADE (USA)

9.25 MARYGROVE AWNINGS (USA)

9.26 ASTRUP LARSEN (DENMARK)

9.27 CARAVANSERAI (AUSTRALIA)

9.28 HERCULITE PRODUCTS INC. (USA)

9.29 THE SHADE FACTOR (USA)

9.30 GLI INTERNATIONAL INC. (USA)

9.31 SERGE FERRARI GROUP (FRANCE)

9.32 WARE AWNING COMPANY (USA)

Chapter 10: Global Awning Market By Region

10.1 Overview

10.2. North America Awning Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Type

10.2.4.1 Fixed

10.2.4.2 Retractable

10.2.5 Historic and Forecasted Market Size by Product

10.2.5.1 Patio

10.2.5.2 Window

10.2.5.3 Freestanding

10.2.6 Historic and Forecasted Market Size by Nature,

10.2.6.1 Manual

10.2.6.2 Motorized

10.2.7 Historic and Forecasted Market Size by Material

10.2.7.1 Fabric

10.2.7.2 Metal

10.2.7.3 Wood

10.2.7.4 Composites

10.2.7.5 Plastic

10.2.8 Historic and Forecasted Market Size by End-Use

10.2.8.1 Residential

10.2.8.2 Commercial

10.2.8.3 Industrial

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Awning Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Type

10.3.4.1 Fixed

10.3.4.2 Retractable

10.3.5 Historic and Forecasted Market Size by Product

10.3.5.1 Patio

10.3.5.2 Window

10.3.5.3 Freestanding

10.3.6 Historic and Forecasted Market Size by Nature,

10.3.6.1 Manual

10.3.6.2 Motorized

10.3.7 Historic and Forecasted Market Size by Material

10.3.7.1 Fabric

10.3.7.2 Metal

10.3.7.3 Wood

10.3.7.4 Composites

10.3.7.5 Plastic

10.3.8 Historic and Forecasted Market Size by End-Use

10.3.8.1 Residential

10.3.8.2 Commercial

10.3.8.3 Industrial

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Awning Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Type

10.4.4.1 Fixed

10.4.4.2 Retractable

10.4.5 Historic and Forecasted Market Size by Product

10.4.5.1 Patio

10.4.5.2 Window

10.4.5.3 Freestanding

10.4.6 Historic and Forecasted Market Size by Nature,

10.4.6.1 Manual

10.4.6.2 Motorized

10.4.7 Historic and Forecasted Market Size by Material

10.4.7.1 Fabric

10.4.7.2 Metal

10.4.7.3 Wood

10.4.7.4 Composites

10.4.7.5 Plastic

10.4.8 Historic and Forecasted Market Size by End-Use

10.4.8.1 Residential

10.4.8.2 Commercial

10.4.8.3 Industrial

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Awning Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Type

10.5.4.1 Fixed

10.5.4.2 Retractable

10.5.5 Historic and Forecasted Market Size by Product

10.5.5.1 Patio

10.5.5.2 Window

10.5.5.3 Freestanding

10.5.6 Historic and Forecasted Market Size by Nature,

10.5.6.1 Manual

10.5.6.2 Motorized

10.5.7 Historic and Forecasted Market Size by Material

10.5.7.1 Fabric

10.5.7.2 Metal

10.5.7.3 Wood

10.5.7.4 Composites

10.5.7.5 Plastic

10.5.8 Historic and Forecasted Market Size by End-Use

10.5.8.1 Residential

10.5.8.2 Commercial

10.5.8.3 Industrial

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Awning Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Type

10.6.4.1 Fixed

10.6.4.2 Retractable

10.6.5 Historic and Forecasted Market Size by Product

10.6.5.1 Patio

10.6.5.2 Window

10.6.5.3 Freestanding

10.6.6 Historic and Forecasted Market Size by Nature,

10.6.6.1 Manual

10.6.6.2 Motorized

10.6.7 Historic and Forecasted Market Size by Material

10.6.7.1 Fabric

10.6.7.2 Metal

10.6.7.3 Wood

10.6.7.4 Composites

10.6.7.5 Plastic

10.6.8 Historic and Forecasted Market Size by End-Use

10.6.8.1 Residential

10.6.8.2 Commercial

10.6.8.3 Industrial

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Awning Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Type

10.7.4.1 Fixed

10.7.4.2 Retractable

10.7.5 Historic and Forecasted Market Size by Product

10.7.5.1 Patio

10.7.5.2 Window

10.7.5.3 Freestanding

10.7.6 Historic and Forecasted Market Size by Nature,

10.7.6.1 Manual

10.7.6.2 Motorized

10.7.7 Historic and Forecasted Market Size by Material

10.7.7.1 Fabric

10.7.7.2 Metal

10.7.7.3 Wood

10.7.7.4 Composites

10.7.7.5 Plastic

10.7.8 Historic and Forecasted Market Size by End-Use

10.7.8.1 Residential

10.7.8.2 Commercial

10.7.8.3 Industrial

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Awning Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 9271.64 Mn. |

|

Forecast Period 2024-32 CAGR: |

6.32 % |

Market Size in 2032: |

USD 16095.01 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Product |

|

||

|

By Nature, |

|

||

|

By Material |

|

||

|

By End-Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||