Glass Door Merchandiser Market Synopsis

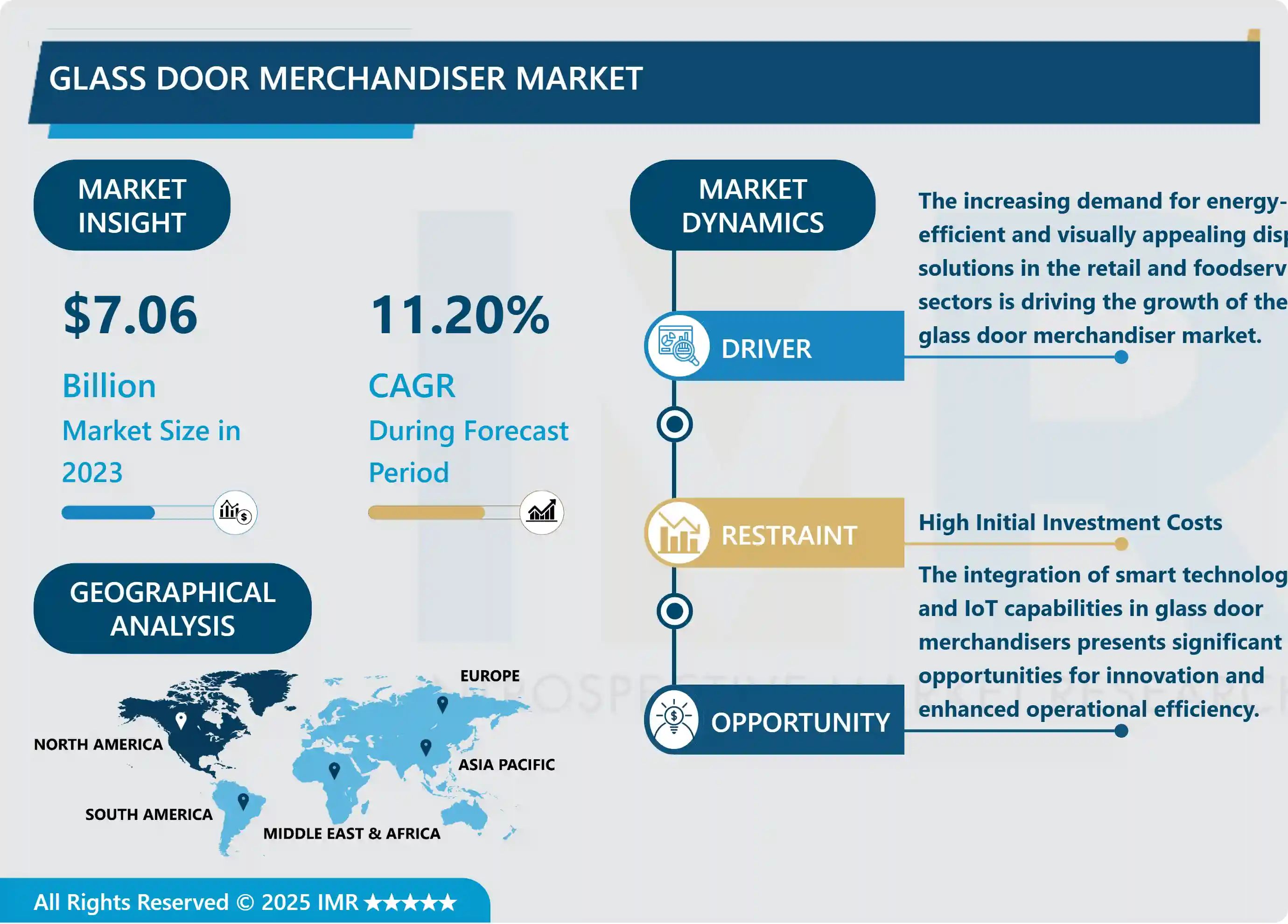

Glass Door Merchandiser Market Size is Valued at USD 7.06 Billion in 2023 and is Projected to Reach USD 16.51 Billion by 2032, Growing at a CAGR of 11.20% From 2024-2032.

The Glass Door Merchandiser Market has recently been moving upwards continually, due to the increasing consumer awareness of aesthetic and energy-efficient merchandisers to sell products and display food in the retail and food service industries. The subsequently described units are employed in supermarkets, convenient stores, restaurants, and cafes to display beverages, snacks, and perishable products while preserving the ideal temperature. Because of the awareness of consumers, where many prefer easy and suitable shopping environments, glass door merchandisers act as tools for shopper attraction and optimal offers. Moreover the global shift towards the intake of fresh foods and refrigerated drinks has even served as further catalyst to their use these creative merchandising solutions.

A major driver that has been aiding the market growth of glass door merchandiser includes Energy Efficiency and Sustainability aspect being core focus among retailers. There is evidence that manufacturers have been working hard to improve their products in aspects such as refrigeration technologies that reduce energy usage and adverse effects or the environment. Technologies such as the LED lighting, better insulation, and effective compressor systems are already inherent in most of the advanced glass door merchandisers which gives those products a better appeal to environmental conscience customers and firms. In addition, regulations that are currently in place forcing the use of energy efficient appliances in the market are forcing retailers to improve on their equipment thus contributing to the growth of the market.

Apart from the focus, there is a trend in integrating smart technology into glass door merchandisers within the market. Internet of Things is making it easier for the retailers to control temperatures, manage inventories, and receive alarms that the equipment requires maintenance. This technology also increases operation capacity as well as customers’ satisfaction since products are always in the right condition. So overall, the Global Glass Door Merchandiser Market is expected to grow with innovation, sustainability and rising demand for merchandising space in the retail market due to changing consumer behaviour.

Glass Door Merchandiser Market Trend Analysis

Growing Demand for Energy-Efficient Solutions

- Increasing use of glass door merchandisers have been observed particularly by the retail firms due to the need for requisite thermal efficiency to cut on energy bills and go green. Rising costs of energy, coupled with the growing concern for conserving natural resources, has forced firms to purchase more efficient refrigeration technologies. Today some of the glass door merchandisers are manufactured with LED lighting, high performance insulation and energy efficient compressors in order to operate effectively and yet consume less energy. This trend is advantageous in that it saves the environment while tapping into the contemporary consumer trend of conserving energy, making merchandisers energy efficient models a favourite among retailers in the market.

- Thus, it is evident that the main strategy of manufacturers presently concers the provision of efficient solutions that do not reduce performance but are energy-saving at the same time. These merchandisers can incorporate smart technology and IoT and this way, they will be able to inform retailers in real-time over energy usage, which in return will enable the management to make the right decisions. The increasing concern towards sustainable and cost efficient solutions this is likely to create demand for energy efficient glass door merchandisers, thus growing the market.

Smart Technology Integration

- Retail environments are being revolutionized by integration of smart technology on glass door merchandisers. IoT based gadgets equipped with virtual interfaces that enable retailers to monitor and control merchandisers remotely have become common in the current supply chains. Admiral characteristics like temperature monitoring, inventory control and maintenance alerts depending on the real time situation are now a normal part of modern designs. It goes beyond increasing the organisation’s efficiency and productivity to also increasing the quality of the products that are produced through monitoring and maintaining appropriate conditions for perishable products to be stored in.

- Further, smart glass door merchandisers offer integral data mining to the retailers in the selection of products and its positioning to get the most customer interest. Thus, the willingness of retailers to follow certain consumer patterns allows minimizing the errors of marketing planning and stock management. As the world goes fully digital on almost everything, the use of smart technology in glass door merchandisers is bound to form part of the larger future retail picture both in terms of customer experience and business processes.

Glass Door Merchandiser Market Segment Analysis:

Glass Door Merchandiser Market Segmented on the basis of Design, Configuration, End-User, and Region

By Design, Hinged Door Type segment is expected to dominate the market during the forecast period

- Hinged door merchandisers and sliding door merchandisers and each of this type has its own benefits for a retailer. Conventionally, built-in merchandisers are hinged door varieties that possess a classic look and can quickly open for consumers personnel to stock the stored item as well as to pull out the existing stock. Most usually are designed with several sections, which makes it easier to store different items, including drinks, and foods. This design is most appropriate for general retail stores that are designed in a small space in which store visibility and product accessibility can significantly impact sales. Each door in the enclosure can also be opened or closed individually, thus helping to control the temperatures inside, which retains the product freshness whilst optimally reducing ill effects of the AC on energy consumptions.

- In contrast, sliding door merchandisers are on an upward trend since they are fashionable, take up little space and have minimal support surface. These units avoid the need for extra space for doors swings and built to be used in areas where people traffic is high such as supermarkets and convenience stores. The sliding mechanism of the dissolvable panel can add value to unlocking customer attentiveness by having a clear view of the merchandise while also maintaining an ideal temperature inside the store. Furthermore, with the understanding that sliding doors are used more frequently in commercial buildings, the working of the door systems has been enhanced to possess aspect such as automatic closing and better insulators. While retailers are on the lookout for ways and means of capturing the attention of their customers and ensure efficient functioning of operations, hinged and sliding door types have openned up great future potential for the industry of glass door merchandisers.

By End-User, Commercial Kitchens segment held the largest share in 2023

- Glass door merchandiser is being used in various end-use sectors with different applications due to need for product display and cooling mechanism. They are applied in retail point-of-sale structures in order to display beverages, snack, and chilled food products by using their attractive and energy saving designs. Supermarkets and convenient stores using glass door merchandisers to grab the customer attention and increase the product sale. Further, in commercial shopping areas such as malls, and shopping centres these units are employed to ensure that chilled items are more easily accessible to improve on the consumers shopping experience.

- Modern and developed commercial kitchens and other institutional facilities too have a strong andively increasing demand in glass door merchandisers. These merchandisers in restaurants or cafes they are important in displaying the beverages and displayed ready to eat meals in order to avoid food congestion and spoilage. Secondly, due to the continuous growth in airport and stations self-service food merchants such as glass door merchandisers have become popular. The convenience of displaying products and the ability to manage temperatures well is the reason why glass door merchandisers are popular in these diverse applications; the growth rate and probability of development will lead to better design and function in merchandisers.

Glass Door Merchandiser Market Regional Insights:

Asia-Pacific is projected to observe significant growth in the glass door merchandiser market

- In the Asia-Pacific region too, the market is expected to grow at a large scale in the future due to the increasing demands of the retail and food services in the Asia-Pacific region. Consumers show a growing trend towards convenience and more supermarkets, convenience stores and food outlets are coming up which makes the need for merchandising solutions. The Chinese, Indian and other emerging markets are urbanizing, becoming wealthier: this is when new retail formats, which provide better product shelf glare and convenience, begin.) While retailers are trying to develop more unique and engaging shopping experiences customers are also increasingly being used to market food and beverage products that must be kept behind glass.

- Moreover, over the Asia-Pacific region, there is an increase in the importance of energy efficiency and sustainability of the commercial refrigeration system. Due to the improvement of environmental consciousness and also increase in energy costs, more and more retailers are opting for the energy efficient glass door merchandisers which are able to cut on expenses while also embracing global environmental standards. As a response to this demand, manufacturers in the region have started to create sophisticated merchandiser models with new refrigeration technologies and intelligent functionalities. The reliance on energy efficient as well as, technologically innovative solutions is expected to continue pushing the glass door merchandiser market forward in the Asia-Pacific region and play a major role on the global retail market.

Active Key Players in the Glass Door Merchandiser Market

- Hobart (U.S.)

- Turbo Air Inc. (U.S.)

- ARNEG S.P.A. (Italy)

- Everest (India)

- Liebherr-International Deutschland GmbH (Germany)

- True Manufacturing Co., Inc. (U.S.)

- Migali (U.S.)

- ANTHONY INC. (U.S.)

- Procool Ltd (Ireland)

- TSSC Group (U.A.E)

- Traulsen (U.S.)

- UAB FEROR LT (Lithuania)

- HOSHIZAKI CORPORATION (Japan)

- others

|

Global Glass Door Merchandiser Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.06 Bn. |

|

Forecast Period 2024-32 CAGR: |

11.20% |

Market Size in 2032: |

USD 16.51 Bn. |

|

Segments Covered: |

By Design |

|

|

|

By Configuration |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Glass Door Merchandiser Market by Design (2018-2032)

4.1 Glass Door Merchandiser Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Hinged Door Type

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Sliding Door Type

Chapter 5: Glass Door Merchandiser Market by Configuration (2018-2032)

5.1 Glass Door Merchandiser Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Endless Remote

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Refrigeration System

5.5 Endless Self-Contained

Chapter 6: Glass Door Merchandiser Market by End-User (2018-2032)

6.1 Glass Door Merchandiser Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Retail Outlets

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Commercial Complexes

6.5 Commercial Kitchens

6.6 Airport and Stations

6.7 Institutional Facilities and Establishments

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Glass Door Merchandiser Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 HOBART (U.S.)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 TURBO AIR INC. (U.S.)

7.4 ARNEG S.P.A. (ITALY)

7.5 EVEREST (INDIA)

7.6 LIEBHERR-INTERNATIONAL DEUTSCHLAND GMBH (GERMANY)

7.7 TRUE MANUFACTURING COINC. (U.S.)

7.8 MIGALI (U.S.)

7.9 ANTHONY INC. (U.S.)

7.10 PROCOOL LTD (IRELAND)

7.11 TSSC GROUP (U.A.E)

7.12 TRAULSEN (U.S.)

7.13 UAB FEROR LT (LITHUANIA)

7.14 HOSHIZAKI CORPORATION (JAPAN)

7.15 OTHERS

7.16

Chapter 8: Global Glass Door Merchandiser Market By Region

8.1 Overview

8.2. North America Glass Door Merchandiser Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Design

8.2.4.1 Hinged Door Type

8.2.4.2 Sliding Door Type

8.2.5 Historic and Forecasted Market Size by Configuration

8.2.5.1 Endless Remote

8.2.5.2 Refrigeration System

8.2.5.3 Endless Self-Contained

8.2.6 Historic and Forecasted Market Size by End-User

8.2.6.1 Retail Outlets

8.2.6.2 Commercial Complexes

8.2.6.3 Commercial Kitchens

8.2.6.4 Airport and Stations

8.2.6.5 Institutional Facilities and Establishments

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Glass Door Merchandiser Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Design

8.3.4.1 Hinged Door Type

8.3.4.2 Sliding Door Type

8.3.5 Historic and Forecasted Market Size by Configuration

8.3.5.1 Endless Remote

8.3.5.2 Refrigeration System

8.3.5.3 Endless Self-Contained

8.3.6 Historic and Forecasted Market Size by End-User

8.3.6.1 Retail Outlets

8.3.6.2 Commercial Complexes

8.3.6.3 Commercial Kitchens

8.3.6.4 Airport and Stations

8.3.6.5 Institutional Facilities and Establishments

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Glass Door Merchandiser Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Design

8.4.4.1 Hinged Door Type

8.4.4.2 Sliding Door Type

8.4.5 Historic and Forecasted Market Size by Configuration

8.4.5.1 Endless Remote

8.4.5.2 Refrigeration System

8.4.5.3 Endless Self-Contained

8.4.6 Historic and Forecasted Market Size by End-User

8.4.6.1 Retail Outlets

8.4.6.2 Commercial Complexes

8.4.6.3 Commercial Kitchens

8.4.6.4 Airport and Stations

8.4.6.5 Institutional Facilities and Establishments

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Glass Door Merchandiser Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Design

8.5.4.1 Hinged Door Type

8.5.4.2 Sliding Door Type

8.5.5 Historic and Forecasted Market Size by Configuration

8.5.5.1 Endless Remote

8.5.5.2 Refrigeration System

8.5.5.3 Endless Self-Contained

8.5.6 Historic and Forecasted Market Size by End-User

8.5.6.1 Retail Outlets

8.5.6.2 Commercial Complexes

8.5.6.3 Commercial Kitchens

8.5.6.4 Airport and Stations

8.5.6.5 Institutional Facilities and Establishments

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Glass Door Merchandiser Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Design

8.6.4.1 Hinged Door Type

8.6.4.2 Sliding Door Type

8.6.5 Historic and Forecasted Market Size by Configuration

8.6.5.1 Endless Remote

8.6.5.2 Refrigeration System

8.6.5.3 Endless Self-Contained

8.6.6 Historic and Forecasted Market Size by End-User

8.6.6.1 Retail Outlets

8.6.6.2 Commercial Complexes

8.6.6.3 Commercial Kitchens

8.6.6.4 Airport and Stations

8.6.6.5 Institutional Facilities and Establishments

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Glass Door Merchandiser Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Design

8.7.4.1 Hinged Door Type

8.7.4.2 Sliding Door Type

8.7.5 Historic and Forecasted Market Size by Configuration

8.7.5.1 Endless Remote

8.7.5.2 Refrigeration System

8.7.5.3 Endless Self-Contained

8.7.6 Historic and Forecasted Market Size by End-User

8.7.6.1 Retail Outlets

8.7.6.2 Commercial Complexes

8.7.6.3 Commercial Kitchens

8.7.6.4 Airport and Stations

8.7.6.5 Institutional Facilities and Establishments

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Glass Door Merchandiser Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.06 Bn. |

|

Forecast Period 2024-32 CAGR: |

11.20% |

Market Size in 2032: |

USD 16.51 Bn. |

|

Segments Covered: |

By Design |

|

|

|

By Configuration |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||