Functional Safety Market Synopsis:

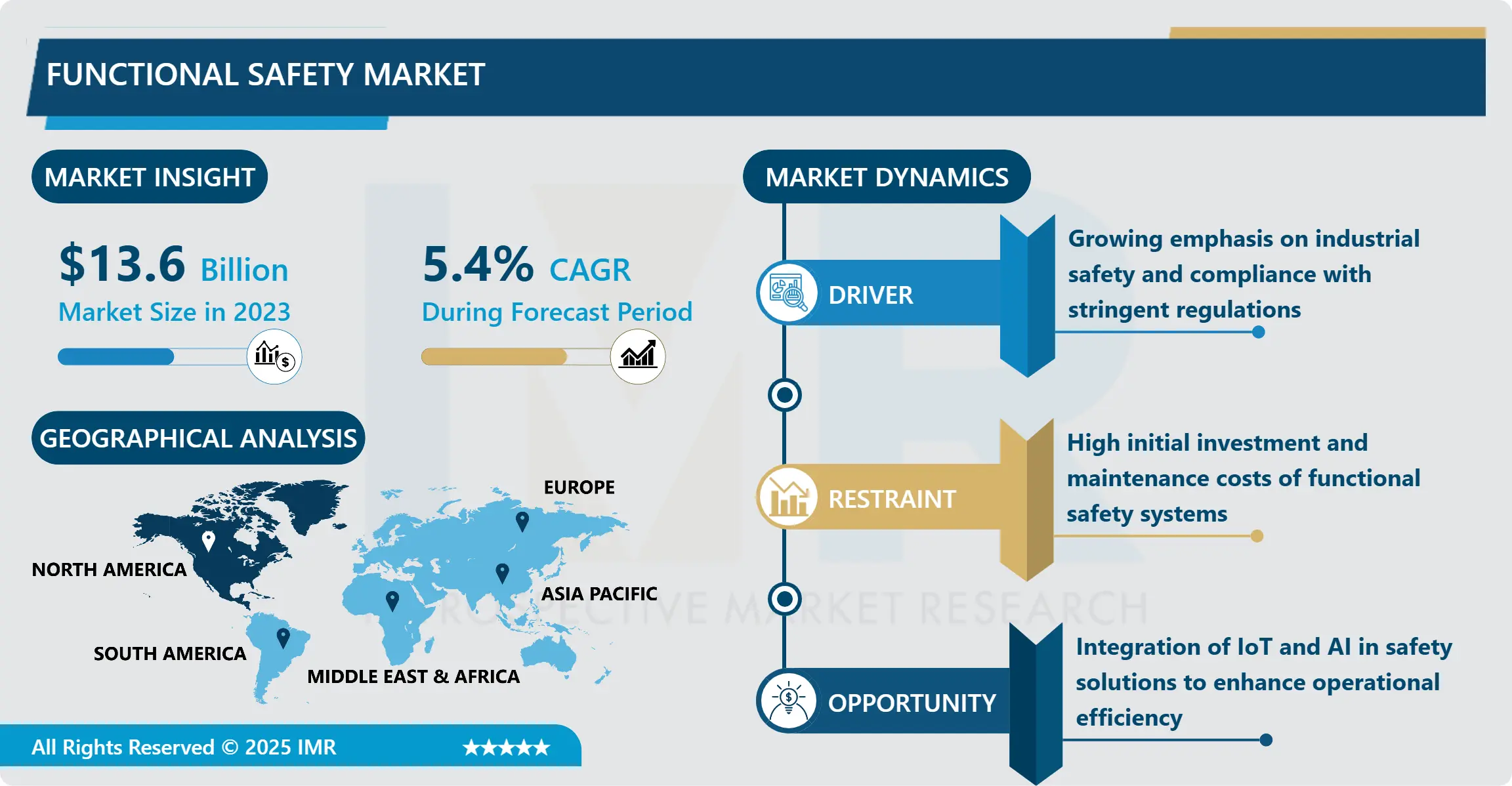

Functional Safety Market Size Was Valued at USD 13.6 Billion in 2023, and is Projected to Reach USD 22.0 Billion by 2032, Growing at a CAGR of 5.4% From 2024-2032.

The Functional Safety Market involves a vast number of technologies, devices, and systems intended to provide dependable safety for industrial processes, tools, and assemblies. It is concerned with identification and mitigation of risks that may be occasioned by the failure of a system to prevent mishaps, enhance the safety of individuals and preserve resources. Functional safety systems meet such high standard requirements of IEC 61508 and ISO 26262 and are adopted across the safety-critical industries and sectors including but not limited to oil & gas, power generation, automobiles, drugs & pharma, and food processing & packaging. The global demand for functional safety has been significantly boosted by alarmingly growing focus on operational safety and escalating industrial process complexity.

The Functional Safety Market is also under much growth in the global market due to expanding automation technologies and higher demand for sophisticated safety systems in crucial industrial operations. The improved pace of industrialization and growing complication of the production processes have increased the vulnerability of the systems causing the industries to develop a strong functional safety management system. Some of the common solutions where functional safety has been implemented, include oil and gas, chemical processing and power generation. Functional safety is well implemented in the top plant projects and the usage of approximately safety devices, sensors, controllers, and emergency shutdown systems has been deemed necessary for continuous plant operations as well as the compliance to regulatory requirements.

Foreseen developments of still more sophisticated technologies such as programmable safety controllers and safety integrated control systems have also boosted the market in question. As the trends of Industry 4.0 and smart manufacturing are gradually implemented, companies are bringing in inter-connected safety systems that combine IoT and AI to perform safety and maintenance based on IoT data analytics. These innovations have ensured that systems dealing with functional safety become more reliable and efficient thus becoming compulsory for the infrastructure of modern industry.

Functional Safety Market Trend Analysis:

The Rise of Integrated Safety and Cybersecurity Solutions

-

One pattern that is emerging in the Functional Safety Market is the integration of functional safety with cybersecurity. In the process of socialization and digitization of industries, multiple interconnected safety systems are at risk of being targeted by cyber criminals. This has spawned the integrated use of safety and security functions, which also solve functional and cyber security threats. These systems master the features of high encryption, anomaly detection and thus intrusion prevention of physical as well as virtual properties. This two-fold approach helps avoid disruption in operations while addressing new threats that modern business encounters in the sphere of cyber security.

Growing Adoption of Functional Safety in Emerging Economies

-

Industry experts agree that the Functional Safety Market in emerging economies is set to take off mainly due to increased industrialization and infrastructure development. South Asian and Middle-Eastern and Latin American countries in particular are investing more heavily in sectors like oil and gas, manufacturing and transportation industries where operational safety is of paramount importance. Further, governmental safety regulatory measures in the regions are applying pressure on the industries to install functional safety standards. With these markets yet to reach their full potential, and increasing concerns on workplace safety across the world, the next couple of years are likely to offer significant business opportunities for the firms active in the market.

Functional Safety Market Segment Analysis:

Functional Safety Market is Segmented on the basis of Device, System, Verticals, and Region

By Device, Safety Sensors segment is expected to dominate the market during the forecast period

-

The Safety Sensors segment is expected to hold the largest share in the Functional Safety Market in the forecasted period due to its responsibility of identifying pot hazardous situations and avoiding them. Proximity sensors, temperature sensors and pressure sensors are essential parts of safety equipment in hazardous settings. They become crucial on the premise that they offer real-time data and lead to taking prevention measures for safe functioning. The increase in Industry 4.0 and smart manufacturing has also increased the need for new safety sensors added with IoT integration and increased accuracy.

- Therefore, sensor development, specifically, wireless capabilities, and miniaturization has broadened their adoption across sectors. For instance, the automotive industry has the use of safety sensors as a trend to address the ISO 26262 requirements for safety of vehicles and their passengers. Subsequently, industries such as pharmaceuticals and food processing cannot afford to have these sensors they use for regulatory purposes and avoiding accidents and so continue to cement their place at the summit of the market.

By System, Emergency Shutdown Systems segment expected to held the largest share

-

The Functional Safety Market’s Emergency Shutdown Systems (ESD) segment is expected to be the largest because it mitigates risks of system failure in risky industries. ESD systems are specifically used in the oil and gas industries, chemical processing plants, and power plants to prevent hazards related to equipment failure, leakage or blast. Such probabilistic models reduce risk, protect workers and assets, and can conform with various international safety standards such as IEC 61511.

- The reasons for the tendency towards the implementation of ESD systems are based on the continuously increasing complexity of modern industrial processes and the absence of a fail-safe mechanism. Also, the availability and adoption of the contemporary technologies have boosted the utilization and effectiveness of ESD systems through provisions of predictive analytics and the artificial intelligence featured in the systems. These technological improvements combined with strict safety standards across various industries are hoped to keep the segment leading throughout the forecast period.

Functional Safety Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

Based on the data collected, the Functional Safety Market was dominated by North America in 2023 with a market share of over 35%. The reason concerning such dominance is the existence of the mature industrial market, high requirements to security and the use of the up-to-date security systems. Oil & gas, automotive and Power generation sectors are the main proponents of functional safety solutions in this region. Further, there is an intense concentration of market players, and constant implementation of Industry 4.0 solutions propel North America to the forefront of the market.

Active Key Players in the Functional Safety Market:

- ABB Ltd. (Switzerland)

- Balluff GmbH (Germany)

- Emerson Electric Co. (United States)

- General Electric Company (United States)

- HIMA Paul Hildebrandt GmbH (Germany)

- Honeywell International Inc. (United States)

- Johnson Controls (Ireland)

- Mitsubishi Electric Corporation (Japan)

- OMRON Corporation (Japan)

- Pilz GmbH & Co. KG (Germany)

- Rockwell Automation, Inc. (United States)

- Schneider Electric SE (France)

- Siemens AG (Germany)

- Yokogawa Electric Corporation (Japan)

- TUV Rheinland (Germany)

- Other Active Players

|

Functional Safety Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 13.6 Billion |

|

Forecast Period 2024-32 CAGR: |

5.4% |

Market Size in 2032: |

USD 22.0 Billion |

|

Segments Covered: |

By Device |

|

|

|

By System |

|

||

|

By Verticals |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Functional Safety Market by Device

4.1 Functional Safety Market Snapshot and Growth Engine

4.2 Functional Safety Market Overview

4.3 Safety Sensors

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Safety Sensors: Geographic Segmentation Analysis

4.4 Safety Modules

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Safety Modules: Geographic Segmentation Analysis

4.5 Valves

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Valves: Geographic Segmentation Analysis

4.6 Programmable Safety Systems

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Programmable Safety Systems: Geographic Segmentation Analysis

4.7 Safety Switches

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Safety Switches: Geographic Segmentation Analysis

4.8 Actuators

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Actuators: Geographic Segmentation Analysis

4.9 Emergency Stop Devices

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 Emergency Stop Devices: Geographic Segmentation Analysis

4.10 Others

4.10.1 Introduction and Market Overview

4.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.10.3 Key Market Trends, Growth Factors and Opportunities

4.10.4 Others: Geographic Segmentation Analysis

Chapter 5: Functional Safety Market by System

5.1 Functional Safety Market Snapshot and Growth Engine

5.2 Functional Safety Market Overview

5.3 Emergency Shutdown Systems

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Emergency Shutdown Systems: Geographic Segmentation Analysis

5.4 Fire & Gas Monitoring Controls

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Fire & Gas Monitoring Controls: Geographic Segmentation Analysis

5.5 Turbomachinery Controls Systems

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Turbomachinery Controls Systems: Geographic Segmentation Analysis

5.6 Burner Management Systems

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Burner Management Systems: Geographic Segmentation Analysis

5.7 High Integrity Pressure Protection Systems

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 High Integrity Pressure Protection Systems: Geographic Segmentation Analysis

5.8 Distributed Control Systems

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Distributed Control Systems: Geographic Segmentation Analysis

5.9 Supervisory Control and Data Acquisition Systems

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 Supervisory Control and Data Acquisition Systems: Geographic Segmentation Analysis

Chapter 6: Functional Safety Market by Verticals

6.1 Functional Safety Market Snapshot and Growth Engine

6.2 Functional Safety Market Overview

6.3 Oil & Gas

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Oil & Gas: Geographic Segmentation Analysis

6.4 Power Generation

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Power Generation: Geographic Segmentation Analysis

6.5 Chemicals

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Chemicals: Geographic Segmentation Analysis

6.6 Food & Beverages

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Food & Beverages: Geographic Segmentation Analysis

6.7 Pharmaceuticals

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Pharmaceuticals: Geographic Segmentation Analysis

6.8 Automotive

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Automotive: Geographic Segmentation Analysis

6.9 Railways

6.9.1 Introduction and Market Overview

6.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.9.3 Key Market Trends, Growth Factors and Opportunities

6.9.4 Railways: Geographic Segmentation Analysis

6.10 Others

6.10.1 Introduction and Market Overview

6.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.10.3 Key Market Trends, Growth Factors and Opportunities

6.10.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Functional Safety Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABB LTD. (SWITZERLAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BALLUFF GMBH (GERMANY)

7.4 EMERSON ELECTRIC CO. (UNITED STATES)

7.5 GENERAL ELECTRIC COMPANY (UNITED STATES)

7.6 HIMA PAUL HILDEBRANDT GMBH (GERMANY)

7.7 HONEYWELL INTERNATIONAL INC. (UNITED STATES)

7.8 JOHNSON CONTROLS (IRELAND)

7.9 MITSUBISHI ELECTRIC CORPORATION (JAPAN)

7.10 OMRON CORPORATION (JAPAN)

7.11 PILZ GMBH & CO. KG (GERMANY)

7.12 ROCKWELL AUTOMATION INC. (UNITED STATES)

7.13 SCHNEIDER ELECTRIC SE (FRANCE)

7.14 SIEMENS AG (GERMANY)

7.15 YOKOGAWA ELECTRIC CORPORATION (JAPAN)

7.16 TUV RHEINLAND (GERMANY)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Functional Safety Market By Region

8.1 Overview

8.2. North America Functional Safety Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Device

8.2.4.1 Safety Sensors

8.2.4.2 Safety Modules

8.2.4.3 Valves

8.2.4.4 Programmable Safety Systems

8.2.4.5 Safety Switches

8.2.4.6 Actuators

8.2.4.7 Emergency Stop Devices

8.2.4.8 Others

8.2.5 Historic and Forecasted Market Size By System

8.2.5.1 Emergency Shutdown Systems

8.2.5.2 Fire & Gas Monitoring Controls

8.2.5.3 Turbomachinery Controls Systems

8.2.5.4 Burner Management Systems

8.2.5.5 High Integrity Pressure Protection Systems

8.2.5.6 Distributed Control Systems

8.2.5.7 Supervisory Control and Data Acquisition Systems

8.2.6 Historic and Forecasted Market Size By Verticals

8.2.6.1 Oil & Gas

8.2.6.2 Power Generation

8.2.6.3 Chemicals

8.2.6.4 Food & Beverages

8.2.6.5 Pharmaceuticals

8.2.6.6 Automotive

8.2.6.7 Railways

8.2.6.8 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Functional Safety Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Device

8.3.4.1 Safety Sensors

8.3.4.2 Safety Modules

8.3.4.3 Valves

8.3.4.4 Programmable Safety Systems

8.3.4.5 Safety Switches

8.3.4.6 Actuators

8.3.4.7 Emergency Stop Devices

8.3.4.8 Others

8.3.5 Historic and Forecasted Market Size By System

8.3.5.1 Emergency Shutdown Systems

8.3.5.2 Fire & Gas Monitoring Controls

8.3.5.3 Turbomachinery Controls Systems

8.3.5.4 Burner Management Systems

8.3.5.5 High Integrity Pressure Protection Systems

8.3.5.6 Distributed Control Systems

8.3.5.7 Supervisory Control and Data Acquisition Systems

8.3.6 Historic and Forecasted Market Size By Verticals

8.3.6.1 Oil & Gas

8.3.6.2 Power Generation

8.3.6.3 Chemicals

8.3.6.4 Food & Beverages

8.3.6.5 Pharmaceuticals

8.3.6.6 Automotive

8.3.6.7 Railways

8.3.6.8 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Functional Safety Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Device

8.4.4.1 Safety Sensors

8.4.4.2 Safety Modules

8.4.4.3 Valves

8.4.4.4 Programmable Safety Systems

8.4.4.5 Safety Switches

8.4.4.6 Actuators

8.4.4.7 Emergency Stop Devices

8.4.4.8 Others

8.4.5 Historic and Forecasted Market Size By System

8.4.5.1 Emergency Shutdown Systems

8.4.5.2 Fire & Gas Monitoring Controls

8.4.5.3 Turbomachinery Controls Systems

8.4.5.4 Burner Management Systems

8.4.5.5 High Integrity Pressure Protection Systems

8.4.5.6 Distributed Control Systems

8.4.5.7 Supervisory Control and Data Acquisition Systems

8.4.6 Historic and Forecasted Market Size By Verticals

8.4.6.1 Oil & Gas

8.4.6.2 Power Generation

8.4.6.3 Chemicals

8.4.6.4 Food & Beverages

8.4.6.5 Pharmaceuticals

8.4.6.6 Automotive

8.4.6.7 Railways

8.4.6.8 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Functional Safety Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Device

8.5.4.1 Safety Sensors

8.5.4.2 Safety Modules

8.5.4.3 Valves

8.5.4.4 Programmable Safety Systems

8.5.4.5 Safety Switches

8.5.4.6 Actuators

8.5.4.7 Emergency Stop Devices

8.5.4.8 Others

8.5.5 Historic and Forecasted Market Size By System

8.5.5.1 Emergency Shutdown Systems

8.5.5.2 Fire & Gas Monitoring Controls

8.5.5.3 Turbomachinery Controls Systems

8.5.5.4 Burner Management Systems

8.5.5.5 High Integrity Pressure Protection Systems

8.5.5.6 Distributed Control Systems

8.5.5.7 Supervisory Control and Data Acquisition Systems

8.5.6 Historic and Forecasted Market Size By Verticals

8.5.6.1 Oil & Gas

8.5.6.2 Power Generation

8.5.6.3 Chemicals

8.5.6.4 Food & Beverages

8.5.6.5 Pharmaceuticals

8.5.6.6 Automotive

8.5.6.7 Railways

8.5.6.8 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Functional Safety Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Device

8.6.4.1 Safety Sensors

8.6.4.2 Safety Modules

8.6.4.3 Valves

8.6.4.4 Programmable Safety Systems

8.6.4.5 Safety Switches

8.6.4.6 Actuators

8.6.4.7 Emergency Stop Devices

8.6.4.8 Others

8.6.5 Historic and Forecasted Market Size By System

8.6.5.1 Emergency Shutdown Systems

8.6.5.2 Fire & Gas Monitoring Controls

8.6.5.3 Turbomachinery Controls Systems

8.6.5.4 Burner Management Systems

8.6.5.5 High Integrity Pressure Protection Systems

8.6.5.6 Distributed Control Systems

8.6.5.7 Supervisory Control and Data Acquisition Systems

8.6.6 Historic and Forecasted Market Size By Verticals

8.6.6.1 Oil & Gas

8.6.6.2 Power Generation

8.6.6.3 Chemicals

8.6.6.4 Food & Beverages

8.6.6.5 Pharmaceuticals

8.6.6.6 Automotive

8.6.6.7 Railways

8.6.6.8 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Functional Safety Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Device

8.7.4.1 Safety Sensors

8.7.4.2 Safety Modules

8.7.4.3 Valves

8.7.4.4 Programmable Safety Systems

8.7.4.5 Safety Switches

8.7.4.6 Actuators

8.7.4.7 Emergency Stop Devices

8.7.4.8 Others

8.7.5 Historic and Forecasted Market Size By System

8.7.5.1 Emergency Shutdown Systems

8.7.5.2 Fire & Gas Monitoring Controls

8.7.5.3 Turbomachinery Controls Systems

8.7.5.4 Burner Management Systems

8.7.5.5 High Integrity Pressure Protection Systems

8.7.5.6 Distributed Control Systems

8.7.5.7 Supervisory Control and Data Acquisition Systems

8.7.6 Historic and Forecasted Market Size By Verticals

8.7.6.1 Oil & Gas

8.7.6.2 Power Generation

8.7.6.3 Chemicals

8.7.6.4 Food & Beverages

8.7.6.5 Pharmaceuticals

8.7.6.6 Automotive

8.7.6.7 Railways

8.7.6.8 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Functional Safety Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 13.6 Billion |

|

Forecast Period 2024-32 CAGR: |

5.4% |

Market Size in 2032: |

USD 22.0 Billion |

|

Segments Covered: |

By Device |

|

|

|

By System |

|

||

|

By Verticals |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||