Functional Proteins Market Overview

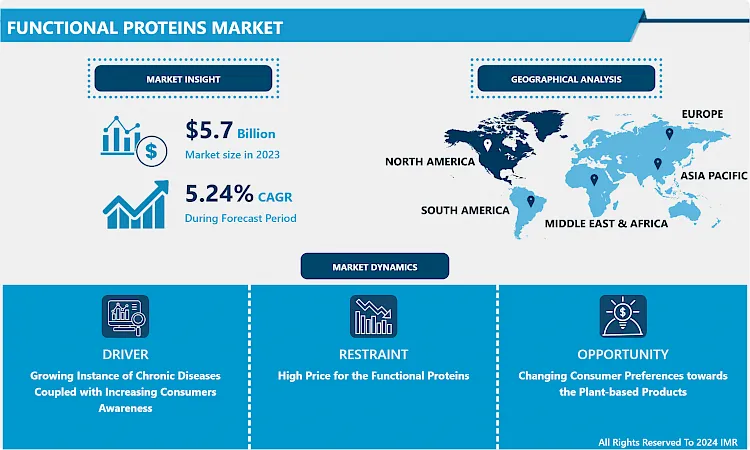

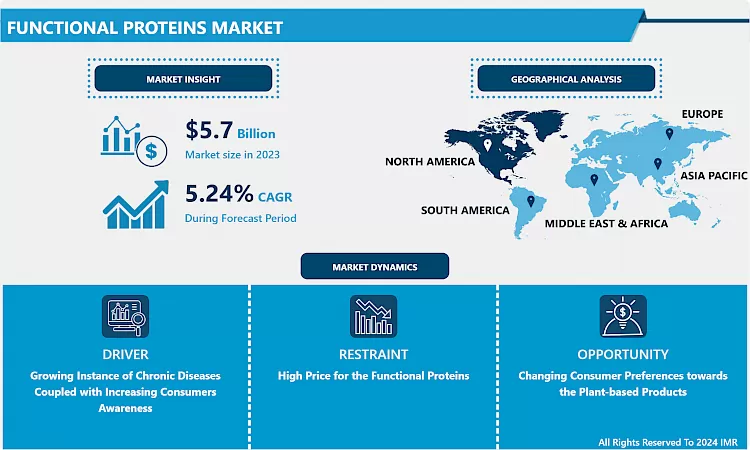

The Global Functional Proteins Market was estimated at USD 5.7 billion in 2023, and is anticipated to reach USD 9.03 billion by 2032, growing at a CAGR of 5.24 %over the analysis period 2024-2032.

- Functional proteins are biochemical compounds intricated virtually in every cell function. They contain polypeptides that conduct biological activities. Some proteins are involved in the protection against germs while some contribute to structural help. Functional proteins are critical to keeping the body working. They support growth, development, and maintain every part of our body i.e., including skin & hair to the digestive enzymes and immune systems. For example, the immunoglobulins present in colostrum has a beneficial impact on the immune system of animals. These functional proteins have various significance such as mitigate the effect of pathogens, improve health, and overcome recovery time after intestinal disorder. The global functional proteins market is turned by growth in demand for animal-derived proteins in sports and fitness nutrition and the development of various protein ingredients such as concentrates and isolates for utilization in the food industry. Moreover, recent advancements in protein powder production to encourage health benefits such as muscle gain and fat loss creates profitable opportunities for the functional proteins market players over the forecast period.

Market Dynamics and Factors for the Functional Proteins Market:

Drivers:

Growing Instance of Chronic Diseases Coupled with Increasing Consumers Awareness

- Growing demand for nutraceuticals and increasing consciousness towards maintaining healthy food and boosting the nutritional value of the human body is rising the growth of the functional protein market over the forecast period. Nutraceuticals are referred to as health supplements that support boosting health, defense chronic diseases, increase life expectancy, or help the structure or function of the body. Functional proteins are a composite mixture of biologically active proteins that supports and control normal immune function. Currently, the populace globally is likely toward a healthy lifestyle and is spending significantly on nutritional products. Functional proteins support declining blood pressure that is a major cause of strokes, heart attracts, and chronic kidney diseases. As per the estimates of the Centers for Disease Control and Prevention, about half of adults in the US are influenced by hypertension and are taking medication for hypertension. Moreover, the rate of patients suffering from obesity is escalating over the world. Obesity leads to different health problems such as certain types of cancer, heart disease, type 2 diabetes, and stroke. For example, as per the Centers for Disease Control and Prevention, the frequency of obesity in the US was 42.4% in 2017–2018. To reduce such problems, the populace is exploring new methods to stay fit and prefer healthy lifestyles. Such instances are expected to grow the demand for foods enhanced with functional proteins, helping in the market growth.

Restraints:

High Price for the Functional Proteins

- Science and technology are supporting the consumer to choose foods that will help people manage their weight and overall health. Functional protein food items and dietary supplements involve remarkably high costs, which could play as a restraint for the growth of the functional proteins market. These products being less economic might hamper the growth of the functional proteins market, especially in price-sensitive countries such as South Africa and Mexico. Also, animal-based proteins are facing hinder as the vegan population is on the increase and the health benefits of vegetarianism are trending among consumers. The increasing demand for plant-based proteins is hurting the sale and consumption of animal-based proteins, which is hindering functional proteins market growth.

Stringent Regulations for Animal-Sourced Proteins

- The US Food & Drug Administration (US FDA) has strict regulations concerning proteins from mammalian tissues. For instance, New Zealand's Ministry of Agriculture and Forestry (MAF) restraint ruminant protein feeding in any type, composition, or admixture to ruminants, owing to the risk of spreading Bovine Spongiform Encephalopathy (BSE), also known as mad cow disease. As a result, the ban has poorly influenced the supply of animal-based protein ingredients globally, as it restricts the trade and accessibility of some animal-based proteins intended for human use.

Challenges:

Growing Allergic Disease

- Some of the factors that can hold back the growth of the functional proteins market are growing allergic diseases of plants or outbursts of diseases in poultry as plants and animals are the predominant sources of functional proteins.

Opportunities:

Changing Consumer Preferences towards the Plant-based Products

- The market for plant proteins is rising at a high rate as consumers are drifting away from animal proteins to plant-based proteins. Rising shifts to environmental biodiversity, veganism, and animal compassion are the major factors progressive leading to the demand for plant-based proteins as substitute's functional ingredient. Hence, the plant-based protein market is anticipated to observe high demand and surging growth rate, presenting the number of opportunities for expansion and investment in the functional proteins market.

Market Segmentation

Segmentation for the Functional Proteins Market:

- Based on the source, the plant source segment is expected to register the maximum functional proteins market share, owing to the growing demand for plant-based or vegan food diets. Plant-based ingredients have been known to disrupt the organoleptic value of a certain class of products. The major key players are investing in R&D of solutions to enhance the quality of the plant-based function ingredients including protein. For instance, in October 2019, Merit Functional Foods launched pea and canola protein ingredients the exceed industry standard for purity, solubility, taste, and other major attributes.

- Based on the product type, hydrolysate segment is anticipated to dominates the functional protein market during the forecast period. Hydrolysate referred to any product of hydrolysis. Protein hydrolysate has special application in sports medicine due to its utilization which allows amino acids to be absorbed by the body more rapidly than intact proteins, therefore high nutrient delivery to muscle tissues. It is also utilized in the biotechnology industry as a supplement to cell cultures. These products are anti-micro biotic, antioxidants, prebiotic, hypertensive protein products aimed at utilizing in producing products for infant and clinical nutrition. Nevertheless, the high cost of hydrolysates as compared to other whey product forms is anticipated to restrict their market reach shortly. Furthermore, Casein is a source of various functional peptides comprising different characteristics such as structure formation, foaming, heat stability, water binding, and emulsification. Moreover, casein derivatives are employed in the food as well as the non-food application segments including animal nutrition where they offer functional significance.

- Based on the form, the liquid segment accounted for the maximum functional proteins market share over the forecast period. growing sales volumes of dietary protein-based juices and functional beverages in emerged markets of North America and Europe on account of huge and wide brand campaigns by social advertising and electronics media is anticipated to have a positive impact of the functional protein market.

- Based on the application, functional food is expected to register the largest functional proteins market share during the forecast period. Functional foods have a probably positive effect on health beyond basic nutrition. Promoters of functional foods encourage optimal health and support overcoming the risk of disease. The rising significance of nutritional fortification in the food processing industry on a global level as a result of changing climate patterns and hectic work life is anticipated to force buyers to focus on new convenience food products fortified with functional proteins.

Players Covered in Functional Proteins market are :

- ADM (US)

- DuPont (US)

- Cargill (US)

- Ingredion (US)

- Arla Foods (UK)

- Roquette (France)

- BASF (Germany)

- Glanbia (Ireland)

- Fonterra (New Zealand)

- DSM (Netherlands)

- FrieslandCampina (Netherlands)

- Essentia Protein Solutions (UK)

- Amai Proteins (Israel)

- Mycorena (Sweden)

- Merit Functional Foods (Canada)

- Plantible Foods (US)

- BENEO (Germany)

- ProtiFarm (Gelderland)

- Omega Protein (US) and other major players.

Regional Analysis for the Functional Proteins Market:

- North America is anticipated to dominate the functional proteins market over the forecast period due to the high frequency of chronic diseases in countries such as the US. Whey protein concentrates are reaching traction as consumers are switching to dairy proteins to accomplish their nutritional needs. Growing utilization of functional foods and dietary supplements. Moreover, the shifting lifestyle of consumers and the rapid growth of the middle-class population along with the rising consumer awareness regarding health and fitness is growing the growth of the functional protein market in this region.

- The Asia Pacific is expected to register a significant functional protein market share throughout the forecast period. The rising urban population, busy lifestyle, and growing disposable income are anticipated to remain key factors responsible for growing the sales of dietary supplements. This trend is anticipated to encourage the dietary supplement manufacturers to establish their production units in the vicinity and thus, in turn, will create new industry avenues.

Key Industry Developments in the Functional Proteins Market:

- In March 2024, Protein Industries Canada announced the launch of a collaborative project to address the growing demand for innovative food ingredients. In partnership with HPS Food & Ingredients, Burcon NutraScience, and Puratos Canada, the project aimed to develop high-value protein isolates and concentrates from sunflower and hemp flour. Burcon played a key role in extracting these innovative ingredients, enhancing the value of each crop. These advancements were designed to meet the evolving needs of food and beverage companies, offering sustainable and functional solutions for product development.

- In March 2024, NETZSCH and ProteinDistillery announced a groundbreaking partnership to revolutionize protein production. This collaboration focused on developing sustainable and efficient protein sources to address the growing global demand for alternative proteins. By combining NETZSCH's advanced technological expertise with ProteinDistillery's innovative approaches, the partnership aimed to enhance the production processes and scalability of high-quality protein solutions.

|

Functional Proteins Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.7 billion |

|

Forecast Period 2024-32 CAGR: |

5.24 % |

Market Size in 2032: |

USD 9.03 billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Source |

|

||

|

By Form |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Functional Proteins Market by Type (2018-2032)

4.1 Functional Proteins Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Whey Protein Concentrates

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Isolates

4.5 Hydrolysates

4.6 Casein

4.7 Soy Protein

Chapter 5: Functional Proteins Market by Application (2018-2032)

5.1 Functional Proteins Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Dietary Supplements

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Functional Beverages

5.5 Functional Foods

5.6 Animal Nutrition

5.7 Others

Chapter 6: Functional Proteins Market by Source (2018-2032)

6.1 Functional Proteins Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Plant

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Animal

Chapter 7: Functional Proteins Market by Form (2018-2032)

7.1 Functional Proteins Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Liquid

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Dry

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Functional Proteins Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 LOCKHEED MARTIN CORPORATION (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 FLIR SYSTEMS (US)

8.4 ELBIT SYSTEMS LTD. (ISRAEL)

8.5 TESTO (GERMANY)

8.6 FLUKE CORPORATION (US)

8.7 OPGAL (ISRAEL)

8.8 LEONARDO (ITALY)

8.9 L3HARRIS TECHNOLOGIES (US)

8.10 UNITED TECHNOLOGIES (US)

8.11 AXIS COMMUNICATIONS (SWEDEN)

8.12 RAYTHEON COMPANY (US)

8.13 SOFRADIR GROUP (US)

8.14 BAE SYSTEMS PLC (UK)

8.15 XENICS (BELGIUM)

8.16 THERMOTEKNIX SYSTEMS (UK)

8.17 L-3 COMMUNICATIONS HOLDINGS INC. (THE US)

8.18 LEONARDO DRS (US)

8.19 AND OTHERS MAJOR PLAYERS.

Chapter 9: Global Functional Proteins Market By Region

9.1 Overview

9.2. North America Functional Proteins Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Whey Protein Concentrates

9.2.4.2 Isolates

9.2.4.3 Hydrolysates

9.2.4.4 Casein

9.2.4.5 Soy Protein

9.2.5 Historic and Forecasted Market Size by Application

9.2.5.1 Dietary Supplements

9.2.5.2 Functional Beverages

9.2.5.3 Functional Foods

9.2.5.4 Animal Nutrition

9.2.5.5 Others

9.2.6 Historic and Forecasted Market Size by Source

9.2.6.1 Plant

9.2.6.2 Animal

9.2.7 Historic and Forecasted Market Size by Form

9.2.7.1 Liquid

9.2.7.2 Dry

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Functional Proteins Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Whey Protein Concentrates

9.3.4.2 Isolates

9.3.4.3 Hydrolysates

9.3.4.4 Casein

9.3.4.5 Soy Protein

9.3.5 Historic and Forecasted Market Size by Application

9.3.5.1 Dietary Supplements

9.3.5.2 Functional Beverages

9.3.5.3 Functional Foods

9.3.5.4 Animal Nutrition

9.3.5.5 Others

9.3.6 Historic and Forecasted Market Size by Source

9.3.6.1 Plant

9.3.6.2 Animal

9.3.7 Historic and Forecasted Market Size by Form

9.3.7.1 Liquid

9.3.7.2 Dry

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Functional Proteins Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Whey Protein Concentrates

9.4.4.2 Isolates

9.4.4.3 Hydrolysates

9.4.4.4 Casein

9.4.4.5 Soy Protein

9.4.5 Historic and Forecasted Market Size by Application

9.4.5.1 Dietary Supplements

9.4.5.2 Functional Beverages

9.4.5.3 Functional Foods

9.4.5.4 Animal Nutrition

9.4.5.5 Others

9.4.6 Historic and Forecasted Market Size by Source

9.4.6.1 Plant

9.4.6.2 Animal

9.4.7 Historic and Forecasted Market Size by Form

9.4.7.1 Liquid

9.4.7.2 Dry

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Functional Proteins Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Whey Protein Concentrates

9.5.4.2 Isolates

9.5.4.3 Hydrolysates

9.5.4.4 Casein

9.5.4.5 Soy Protein

9.5.5 Historic and Forecasted Market Size by Application

9.5.5.1 Dietary Supplements

9.5.5.2 Functional Beverages

9.5.5.3 Functional Foods

9.5.5.4 Animal Nutrition

9.5.5.5 Others

9.5.6 Historic and Forecasted Market Size by Source

9.5.6.1 Plant

9.5.6.2 Animal

9.5.7 Historic and Forecasted Market Size by Form

9.5.7.1 Liquid

9.5.7.2 Dry

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Functional Proteins Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Whey Protein Concentrates

9.6.4.2 Isolates

9.6.4.3 Hydrolysates

9.6.4.4 Casein

9.6.4.5 Soy Protein

9.6.5 Historic and Forecasted Market Size by Application

9.6.5.1 Dietary Supplements

9.6.5.2 Functional Beverages

9.6.5.3 Functional Foods

9.6.5.4 Animal Nutrition

9.6.5.5 Others

9.6.6 Historic and Forecasted Market Size by Source

9.6.6.1 Plant

9.6.6.2 Animal

9.6.7 Historic and Forecasted Market Size by Form

9.6.7.1 Liquid

9.6.7.2 Dry

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Functional Proteins Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Whey Protein Concentrates

9.7.4.2 Isolates

9.7.4.3 Hydrolysates

9.7.4.4 Casein

9.7.4.5 Soy Protein

9.7.5 Historic and Forecasted Market Size by Application

9.7.5.1 Dietary Supplements

9.7.5.2 Functional Beverages

9.7.5.3 Functional Foods

9.7.5.4 Animal Nutrition

9.7.5.5 Others

9.7.6 Historic and Forecasted Market Size by Source

9.7.6.1 Plant

9.7.6.2 Animal

9.7.7 Historic and Forecasted Market Size by Form

9.7.7.1 Liquid

9.7.7.2 Dry

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Functional Proteins Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.7 billion |

|

Forecast Period 2024-32 CAGR: |

5.24 % |

Market Size in 2032: |

USD 9.03 billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Source |

|

||

|

By Form |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Functional Proteins Market research report is 2024-2032.

ADM (US), DuPont (US), Cargill (US), Ingredion (US), Arla Foods (UK), Roquette (France), BASF (Germany), Glanbia (Ireland), Fonterra (New Zealand), DSM (Netherlands), FrieslandCampina (Netherlands), Essentia Protein Solutions (UK), Amai Proteins (Israel), Mycorena (Sweden), Merit Functional Foods (Canada), Plantible Foods (US), BENEO (Germany), ProtiFarm (Gelderland), Omega Protein (US), and other major players.

The Functional Proteins Market is segmented into type, application, source, form, and region. By Type, the market is categorized into Whey Protein Concentrates, Isolates, Hydrolysates, Casein, and Soy Protein. By Application, the market is categorized into Dietary Supplements, Functional Beverages, Functional Foods, Animal Nutrition, and Others. By Source, the market is categorized into Plant and Animal. By Form, the market is categorized into Liquid and Dry. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Functional proteins are biochemical compounds intricated virtually in every cell function. They contain polypeptides that conduct biological activities. Some proteins are involved in the protection against germs while some contribute to structural help.

The Global Functional Proteins Market was estimated at USD 5.7 billion in 2023, and is anticipated to reach USD 9.03 billion by 2032, growing at a CAGR of 5.24 %over the analysis period 2024-2032.