Friedreich’s Ataxia Market Synopsis:

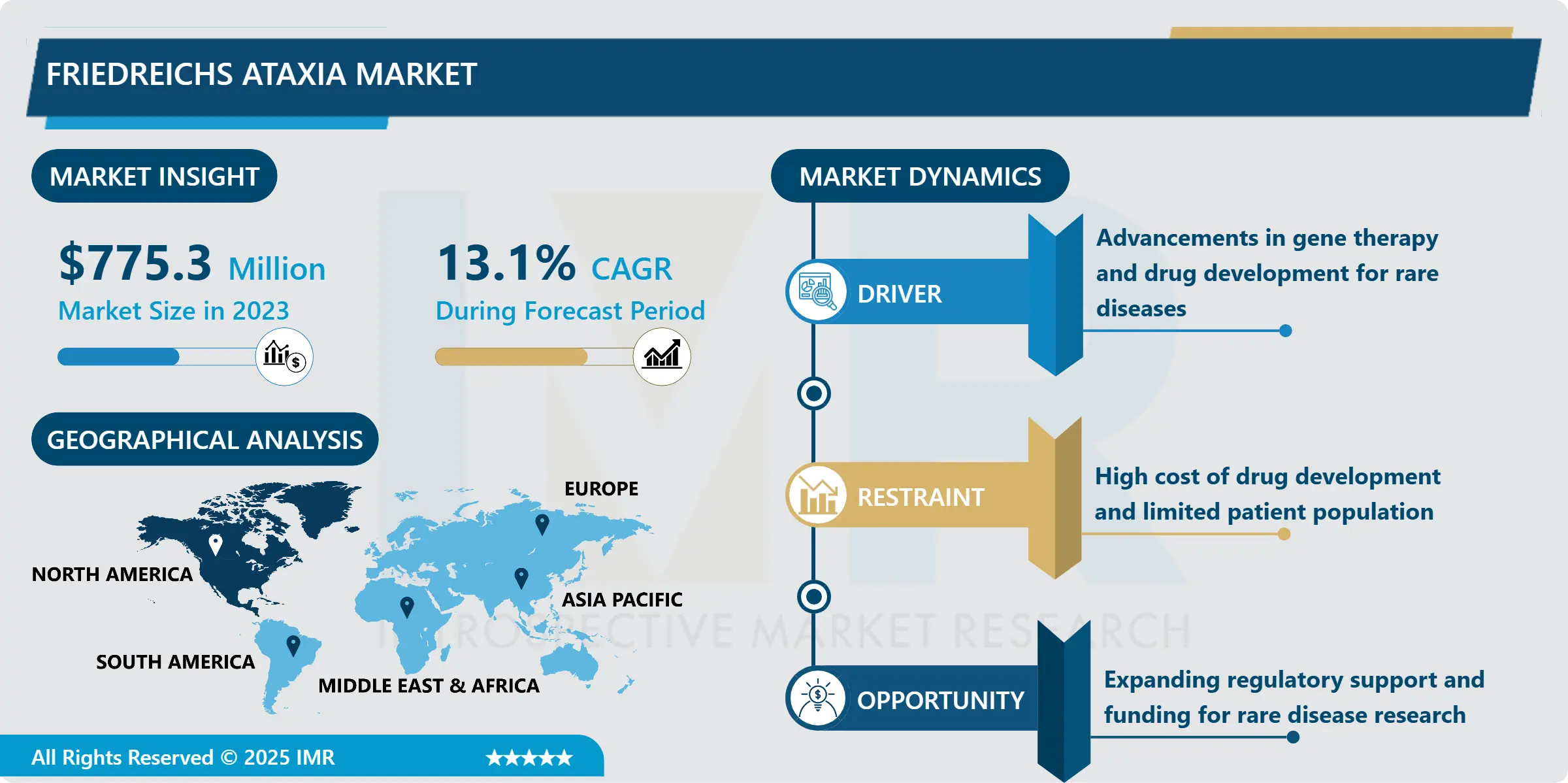

Friedreich’s Ataxia Market Size Was Valued at USD 775.3 Million in 2023, and is Projected to Reach USD 2,347.6 Million by 2032, Growing at a CAGR of 13.1% From 2024-2032.

Friedreich’s Ataxia (FA) is a rare, hereditary and progressive neurological disorder, caused by the mutation of the FXN gene which results in decreased levels of frataxin protein. The symptoms linked with this disorder include a loss of coordination especially balance and co-ordination (ataxia), muscle weakness, heart diseases and diabetes. FA tends to be still in some children and adolescents and progresses throughout the disease course, causing considerable reduction in the patients’ quality of life and life expectancy. Friedreich’s Ataxia is an orphan disease and, up to date, there is no specific treatment of the disease; therefore, existing approaches are limited to interventions aimed at relieving the symptoms and enhancing patient prognosis. The FA market therefore includes drugs, therapies and diagnostics aimed at meeting the medical needs of these patients and investing in the new therapeutic approaches to FA such as gene therapy with frataxin deficiency.

The Friedreich’s Ataxia market has recently shown a steady growth resulting from greater knowledge, more precise diagnosis, and further research in the sphere of new treatments. Although AF is a low incidence disorder, increasing need and demands for treatment of the disease affects individual and families have boosted research and development efforts, with funding from governments, nonprofit organizations, and pharmaceuticals. The increasing emphasis on rare disease treatment has filled a pipeline of potentially valuable drug targets and disease modifying agents targeted at the genetic basis of FA. These efforts are stronger backed up by synergies between research institutions and biotech firms aimed at fast tracking clinical application of new therapies.

The FA market is also experiencing new products related to supportive care of the diseases that are related to it such as cardiac problems or diabetes. More emphasis has also been placed towards differentiation within patient populations as pharmacogenomic testing and biomarker analysis have been utilised to enhance treatment regimens. Due to inadequate cure, the market for Friedreich’s Ataxia has its prospects in the distribution of disease-modifying therapies over the forecast period for effective treatments. But still there are some barriers that restrict higher growth rate in the market, including the high cost of development of such drugs, relatively few number of patients, and strict requirements in the field of regulation.

Friedreich’s Ataxia Market Trend Analysis:

Advancements in Gene Therapy

-

Much of the change in the Friedreich’s Ataxia market is associated with the emergence of gene therapy as one of the most potent approaches capable of offering long-term or even one-shot treatment to the FA patients. Some genetic treatments address bringing in a healthy FXN gene to compensate for the mutated one or increasing production of frataxin protein to achieve the proper function of the cells. Currently, several commercial entities have clinical trial programs in gene therapies, and it seems initially that they are safe and effective. Furthermore, RNA-based treatments including antisense nucleotides and assured mRNA platform are also on the rise across this sector. If these therapies are as effective as currently envisioned, they could redefine the treatment approach to FA and will translate into healthy growth in the market in the future.

Rising Focus on Orphan Drug Designation

-

The increasing global focus on rare diseases market is a great opportunity for the Friedreich’s Ataxia market. Organizations like the FDA and the EMA have mechanisms through which they offer rewards for the development of drugs to treat rare diseases like FA, these rewards include orphan drugs, fast-track approvals and market exclusivity. Also, the bets by governments and pharmaceutical companies in rare diseases research, and clinical trials have provided fertile ground for innovations. Such partnership between academic institutions, bio-tech companies and patient activists are actually stepping up the rate of identification of new treatments. This collective effort does not only increase the treatment outcomes but also increases the market pool for FA drugs.

Friedreich’s Ataxia Market Segment Analysis:

Friedreich’s Ataxia Market is Segmented on the basis of Drug Class, Route of Administration, Distribution Channel, and Region

By Drug Class, ACE Inhibitors segment is expected to dominate the market during the forecast period

-

Out of the two therapeutic classes, the ACE inhibitors segment is expected to have the largest share of the Friedreich’s Ataxia market during the forecast period owing to broad use in managing cardiomyopathy-one of the significant complications seen in FA patients. These drugs are commonly prescribed for making heart work better and for slowing down the worsening of the heart related symptoms of the illness. Because they are relatively inexpensive and their safety records have been well-documented, they are popular with physicians as well as with their patients.

- These symptomatic effects are in addition to the drugs forming part of a comprehensive multitarget therapy approach to manage the multisystem disorder that characterizes FA. As more attention is being paid to treating FA patients holistically, there will always be a continued need for ACE inhibitors. In the FA patient segment, their continued clinical use to assess long-term benefits is also expected to bolster dominance in this segment.

By Route of Administration, Oral segment expected to held the largest share

-

The oral segment should dominate the Friedreich’s Ataxia market because of its high accessibility, compliance, and availability of orally administered medicine. Oral therapies are conservative and the clients’ first preference for the long-term management of the disease. Besides, the innovations in the kind of formulations have led to the improved treatment outcome and lessening of frequency of dosing thereby increasing this segment.

- Oral route dominance is also because the current symptomatic disease-modifying FA treatment pipeline and experimental therapies are easily administrable through this route. Existing clinical research studies for oral formulations regarding gene-modulating drugs are encouraging, which indicates that the concept of changing the face of FA treatment is possible. As more complex oral therapies receive approval for marketing, this segment is expected to show a higher CAGR during the forecast period.

Friedreich’s Ataxia Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America had the highest market share in 2023 of nearly 40-45% for Friedreich’s Ataxia.B This leadership is as a result of enhanced healthcare facility, improved research on the orphan drugs and better regulatory laws that support the use of the orphan drugs. The US uniquely defines the regional revenue contribution because of the high FA incidence, growing patient awareness, and research funding for rare diseases. Furthermore, the fact that most market players are located in North America and several clinical trials of novel therapies are being conducted also increases the region’s share. Europe also comes closely behind in view of the active governmental policies and effective lobbying from patient groups.

Active Key Players in the Friedreich’s Ataxia Market:

-

BioMarin Pharmaceutical (USA)

- Chondrial Therapeutics (USA)

- Cyclerion Therapeutics (USA)

- Edgewise Therapeutics (USA)

- Larimar Therapeutics (USA)

- Lexeo Therapeutics (USA)

- Minoryx Therapeutics (Spain)

- Neurocrine Biosciences (USA)

- Novartis AG (Switzerland)

- Pfizer Inc. (USA)

- PTC Therapeutics (USA)

- Reata Pharmaceuticals (USA)

- Retrotope Inc. (USA)

- Stealth BioTherapeutics (USA)

- Voyager Therapeutics (USA)

- Other Active Players

|

Global Friedreich’s Ataxia Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 775.3 Million |

|

Forecast Period 2024-32 CAGR: |

13.1% |

Market Size in 2032: |

USD 2,347.6 Million |

|

Segments Covered: |

By Drug Class |

|

|

|

By Route of Administration |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Friedreich’s Ataxia Market by Drug Class

4.1 Friedreich’s Ataxia Market Snapshot and Growth Engine

4.2 Friedreich’s Ataxia Market Overview

4.3 ACE Inhibitors

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 ACE Inhibitors: Geographic Segmentation Analysis

4.4 Beta Blockers

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Beta Blockers: Geographic Segmentation Analysis

4.5 Diuretics

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Diuretics: Geographic Segmentation Analysis

4.6 Para-Benzoquinone

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Para-Benzoquinone: Geographic Segmentation Analysis

4.7 Others

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Others: Geographic Segmentation Analysis

Chapter 5: Friedreich’s Ataxia Market by Route of Administration

5.1 Friedreich’s Ataxia Market Snapshot and Growth Engine

5.2 Friedreich’s Ataxia Market Overview

5.3 Oral

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Oral: Geographic Segmentation Analysis

5.4 Injectable

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Injectable: Geographic Segmentation Analysis

Chapter 6: Friedreich’s Ataxia Market by Distribution Channel

6.1 Friedreich’s Ataxia Market Snapshot and Growth Engine

6.2 Friedreich’s Ataxia Market Overview

6.3 Hospital Pharmacies

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospital Pharmacies: Geographic Segmentation Analysis

6.4 Retail Pharmacies

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Retail Pharmacies: Geographic Segmentation Analysis

6.5 Online Pharmacies

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Online Pharmacies: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Friedreich’s Ataxia Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BIOMARIN PHARMACEUTICAL (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CHONDRIAL THERAPEUTICS (USA)

7.4 CYCLERION THERAPEUTICS (USA)

7.5 EDGEWISE THERAPEUTICS (USA)

7.6 LARIMAR THERAPEUTICS (USA)

7.7 LEXEO THERAPEUTICS (USA)

7.8 MINORYX THERAPEUTICS (SPAIN)

7.9 NEUROCRINE BIOSCIENCES (USA)

7.10 NOVARTIS AG (SWITZERLAND)

7.11 PFIZER INC. (USA)

7.12 PTC THERAPEUTICS (USA)

7.13 REATA PHARMACEUTICALS (USA)

7.14 RETROTOPE INC. (USA)

7.15 STEALTH BIOTHERAPEUTICS (USA)

7.16 VOYAGER THERAPEUTICS (USA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Friedreich’s Ataxia Market By Region

8.1 Overview

8.2. North America Friedreich’s Ataxia Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Drug Class

8.2.4.1 ACE Inhibitors

8.2.4.2 Beta Blockers

8.2.4.3 Diuretics

8.2.4.4 Para-Benzoquinone

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size By Route of Administration

8.2.5.1 Oral

8.2.5.2 Injectable

8.2.6 Historic and Forecasted Market Size By Distribution Channel

8.2.6.1 Hospital Pharmacies

8.2.6.2 Retail Pharmacies

8.2.6.3 Online Pharmacies

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Friedreich’s Ataxia Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Drug Class

8.3.4.1 ACE Inhibitors

8.3.4.2 Beta Blockers

8.3.4.3 Diuretics

8.3.4.4 Para-Benzoquinone

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size By Route of Administration

8.3.5.1 Oral

8.3.5.2 Injectable

8.3.6 Historic and Forecasted Market Size By Distribution Channel

8.3.6.1 Hospital Pharmacies

8.3.6.2 Retail Pharmacies

8.3.6.3 Online Pharmacies

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Friedreich’s Ataxia Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Drug Class

8.4.4.1 ACE Inhibitors

8.4.4.2 Beta Blockers

8.4.4.3 Diuretics

8.4.4.4 Para-Benzoquinone

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size By Route of Administration

8.4.5.1 Oral

8.4.5.2 Injectable

8.4.6 Historic and Forecasted Market Size By Distribution Channel

8.4.6.1 Hospital Pharmacies

8.4.6.2 Retail Pharmacies

8.4.6.3 Online Pharmacies

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Friedreich’s Ataxia Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Drug Class

8.5.4.1 ACE Inhibitors

8.5.4.2 Beta Blockers

8.5.4.3 Diuretics

8.5.4.4 Para-Benzoquinone

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size By Route of Administration

8.5.5.1 Oral

8.5.5.2 Injectable

8.5.6 Historic and Forecasted Market Size By Distribution Channel

8.5.6.1 Hospital Pharmacies

8.5.6.2 Retail Pharmacies

8.5.6.3 Online Pharmacies

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Friedreich’s Ataxia Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Drug Class

8.6.4.1 ACE Inhibitors

8.6.4.2 Beta Blockers

8.6.4.3 Diuretics

8.6.4.4 Para-Benzoquinone

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size By Route of Administration

8.6.5.1 Oral

8.6.5.2 Injectable

8.6.6 Historic and Forecasted Market Size By Distribution Channel

8.6.6.1 Hospital Pharmacies

8.6.6.2 Retail Pharmacies

8.6.6.3 Online Pharmacies

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Friedreich’s Ataxia Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Drug Class

8.7.4.1 ACE Inhibitors

8.7.4.2 Beta Blockers

8.7.4.3 Diuretics

8.7.4.4 Para-Benzoquinone

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size By Route of Administration

8.7.5.1 Oral

8.7.5.2 Injectable

8.7.6 Historic and Forecasted Market Size By Distribution Channel

8.7.6.1 Hospital Pharmacies

8.7.6.2 Retail Pharmacies

8.7.6.3 Online Pharmacies

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Friedreich’s Ataxia Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 775.3 Million |

|

Forecast Period 2024-32 CAGR: |

13.1% |

Market Size in 2032: |

USD 2,347.6 Million |

|

Segments Covered: |

By Drug Class |

|

|

|

By Route of Administration |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||