Food Stabilizer Market Overview

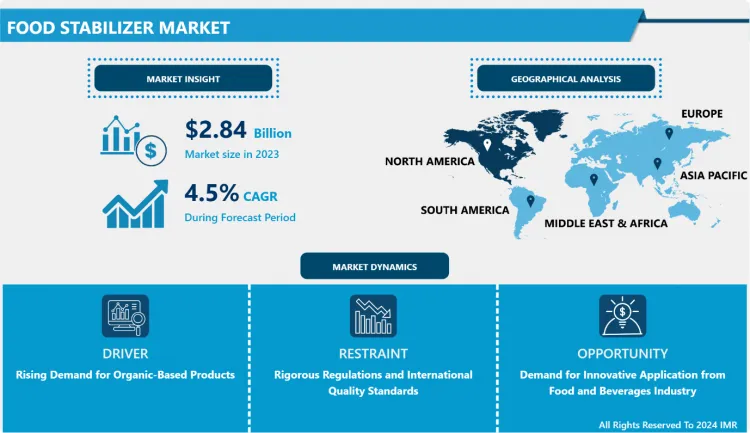

Food Stabilizer Market Size Was Valued at USD 2.84 Billion in 2023 and is Projected to Reach USD 4.22 Billion by 2032, Growing at a CAGR of 4.5 % From 2024-2032.

- Food Stabilizer are substances that help in increasing stability and thickness by helping foods retain their physical characteristics and remain in an emulsion. Substances that normally do not mix, such as water and oil, need stabilizer. Many low-fat foods are dependent on stabilizer. Food stabilizer are substances mostly produced from naturally occurring raw materials and they maintain the food's physiochemical state. Growing consumer awareness towards safe and healthy food products is an important factor enhancing the market growth effectively. Furthermore, rise in alcoholic beverage consumption in North America and APAC and rise in choices of consumption of processed and convenience foods in this region are contributing to the rising market growth. However various key factors such as increasing disposable wastes income, increasing adoption of food stabilizer in a wide range of food products such as beverages, sauces and bakery among others and rising demand for food stabilizer in the confectionery and dairy are thereby projected to boost the growth of food stabilizer market. Additionally, increasing modernization and rising research and development activities in the new products offered in the food stabilizer market will create new opportunities and expand the growth in the forecasted period.

Market Dynamics And Factors For Food Stabilizer Market

Drivers:

Rising Demand for Organic-Based Products

- Expanding global population, the growing harm to the safety of food supplies and usage, and the intense growth of the middle-class population in different developing nations, are the major driving producers and factors of food and beverages. These factors help focus on developing creative and innovative solutions to meet the emerging trends and challenges. For instance, xanthan is mostly used in bakery products as it helps in the retention of water in baking food and thus increases the shelf life of the food products. Another effective trend driving market growth and expansion is the increasing consumer fondness for food and beverage products that are highly processed. Moreover, changing lifestyles, trends, and improvement in the economic scenario has added to an increase in the number of customers eating in hotels and restaurants, which often use various additional ingredients to improve food aesthetics. Also, the increasing demand for stabilizer in bakery food products convenience food and beverages is expected to enhance the market growth in various developed countries.

Restraints:

Rigorous Regulations and International Quality Standards

- International bodies like the World Health Organization (WHO), National Food Safety and Quality Service (SENASA), U.S. Food and Drug Administration (FDA), Canadian Food Inspection Agency (CFIA), and Committee on the Environment, Food Safety (EU), and Public Health are associated with food safety rules and regulations. These International Bodies have control over the application of different materials and chemicals used in food processing, indirectly or directly. With strict international regulations, regulatory and complete approval of a food ingredient is important. Without approval of the suitable government bodies, the food additive has function or market in food. Obtaining statutory approval for a new food ingredient is becoming comparatively expensive and a stagnant process.

Opportunity:

Demand for Innovative Application from Food and Beverages Industry

- Food ingredients and food additives are crucial for manufacturing of processed products, which drives the markets. The growing market demand for food products is driven by the economic development and increasing population. The ever-widening global population enforces pressure on obtainability of scarce resources. Rising raw material costs and High energy prices impact food prices directly or indirectly, thus influencing low-income consumers. The increasing market for food products such as meat products, bakery, beverages, and convenience food are estimated to offer tremendous growth opportunities for the stabilizer blends and systems market. Consumers in developing nations are characterized by emerging change in lifestyles and higher income, which helps in driving the market for processed food products.

Challenges:

Rise in Raw Material Prices

- Hydrocolloids are the raw materials for blends and systems. The prices in such type of raw materials have been varying again and again, resulting in instability in the market. A natural raw source for Hydrocolloid namely Seaweed is available in the market which is further used in food & beverages for various processes like gelling, stabilizing, thickening, and others. The rates of hydrocolloid raw materials impact the price of the hydrocolloids, which directly or indirectly affects the price of the end food product. Gum sources like the agar, alginates, carrageenan, etc. are also obtained from seaweed. When preferring gum sources for such usages as ice cream and tortillas, formulators mainly consider price factor. This increase in prices of raw material will give rise to the operational and product costs of food stabilizer manufacturers.

Segmentation Analysis Of Food Stabilizer Market

- By Source, the plant segment is estimated to dominate the market and be the fastest-growing during the forecasted period. The plant segment is rapidly growing due to the increasing demand for various natural ingredients as well as increase in trend for varied vegan food. Consumer’s attitude and perception towards the nutritional factors of plant-sourced food stabilizer have also been enhancing the adoption rate of such naturally sourced stabilizer. Food & beverage producers and manufacturers prefer plant-sourced food stabilizer in order to fulfil the consumer's rising demand for natural food additives. Thus, the plant segment is expected to continue its dominance in the upcoming years.

- By Application, the food stabilizer market was expected to dominate by the dairy & dairy products segment. There has been an enormous increase in the application of food stabilizer in many dairy products such as frozen desserts and ice-creams, and flavoured milk. Food Stabilizer such as carrageenan and guar gum are the most used ingredients for dairy applications, and with the growing innovations in dairy products industry, the market for dairy products and dairy is expected to dominate in the forecasted time. In the food and the food stabilizer industry, the demand for dairy & dairy products is rapidly growing due to the changing trends, lifestyles and eating habits thereby fuelling the growth of food stabilizer market.

- By Function, the texturizing segment is predicted to dominate the market to account for the highest share in the food stabilizer market. In the food industry, the usage of food stabilizer is helping widely for the improvement of the appearance of the product, which, in turn, boosts the buying nature of consumers to purchase their products. The texturizing segment also finds an opportunity in many food and confectionary industries, which thereby boosts the food stabilizer market growth. Thus, the demand for such texturizing segment and the stabilizer in the food industry is increasing rapidly.

Regional Analysis Of Food Stabilizer Market

- North America is estimated to dominate the food stabilizer market in the upcoming year. Developed economies in the North America is projected to dominate the market growth due to the increasing demand for convenience and packaged foods and the growing awareness among people for the healthy food. The food processing industries which are very well-established and the presence of innumerable large-scale food companies in the United States remain a significant driving force for the food stabilizer market. This US region is witnessing secured increase in demand for natural food stabilizer, because of the growing awareness about natural and healthy foods among consumers.

- Asia Pacific expected to grow significantly in the Food Stabilizer Market during forecasted period. China being the world`s second largest economic country, is projected to grow rapidly through the forecasted period. China, with the development of emerging technologies, holds more than 40 pectin authorized manufacturers and producers. The resources for extracting pectin are apple pomace and citrus. Although, being the developing country, China still can’t meet the rising demands of the market due to the low utilization rate of materials. The improved infrastructure on Research & Development sector to develop new, flavors, textures, products, tastes is slowly improvising in the country. ? The domestic pectin output is expected to grow rapidly in the next few years which is impactful in driving the growth of the Food Stabilizer Market. Kappa is the majorly utilized carrageenan in China, as it acts as a natural Food stabilizer, bodying agent and emulsifier in ice cream, cheese, chocolate, and puddings. ?

- Europe region is anticipated to grow rapidly in the forecasted years due to the increasing consumption of ready-to-drink and ready-to-eat beverages has extended the application of various food stabilizer in the European market. The market is further uplifted by the increasing demand for organic food and convenience food across this region. In the European Union, pectin is entirely approved for usage in accordance with Regulation (EC) 1333/2008 on all the food stabilizer and food additives which in turn is leading to gain consumer trust in the final products. It is especially used in the production of jellies and jams, as a stabilizing agent. European consumers are preferring natural ingredients rather than the artificial ingredients in food products. Thus, driving the rising demand in the region. Various Technological advancements have led to the overall development of various stabilizer blends in the European market, which are multi-functional as well as cost-effective at the same time. Continuous innovations and developments in the food stabilizer market are estimated to offer potential opportunities to the producers and manufacturers operating in the Europe region.

Top Key Players Covered In Food Stabilizer Market

- AshlandInc. (US)

- BASF SE(Germany)

- Cargill Inc. (US)

- CP Kelco (US)

- DowDuPont Inc. (US)

- Hydrosol GmbH & Co. KG(Germany)

- Ingredion Inc. (US)

- Kerry Group PLC (Ireland)

- NEXIRA (Normandie)

- Palsgaard A/S (Denmark)

- Tate & Lyle PLC (UK)

- Glanbiaplc (Ireland)

- Advanced Food Systems Inc (New Jersey)

- Chemelco (Netherlands)

- Associated British Foods plc (UK), and other major players.

Key Industry Development In The Food Stabilizer Market

- In November 2024, Tate & Lyle Completes Acquisition of CP Kelco. Tate & Lyle has completed its acquisition of CP Kelco, including CP Kelco U.S., CP Kelco China, CP Kelco ApS, and their subsidiaries, purchased from J.M. Huber Corporation. CP Kelco, a global leader in pectin, specialty gums, and nature-based ingredients, enhances Tate & Lyle’s position as a leading provider of specialty food and beverage solutions.

- In September 2024, Ingredion Incorporated, a global leader in specialty ingredient solutions, announced the APAC launch of FIBERTEX CF 500 and FIBERTEX CF 100, innovative citrus fibers offering enhanced texturizing properties and clean-label benefits. These multi-functional ingredients were designed to meet the growing consumer demand for cleaner, more sustainable food and beverage products.

|

Food Stabilizer Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.84 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.5% |

Market Size in 2032: |

USD 4.22 Bn. |

|

Segments Covered: |

By Source |

|

|

|

By Application |

|

||

|

By Function |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Food Stabilizer Market by Source (2018-2032)

4.1 Food Stabilizer Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Plant

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Microbial

4.5 Seaweed

4.6 Synthetic

4.7 Animal

Chapter 5: Food Stabilizer Market by Application (2018-2032)

5.1 Food Stabilizer Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Dairy

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Bakery

5.5 Confectionary

5.6 Beverages

5.7 Others

Chapter 6: Food Stabilizer Market by Function (2018-2032)

6.1 Food Stabilizer Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Stability

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Texture

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Food Stabilizer Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 THE HAIN CELESTIAL GROUP INC. (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ORGANICGIRL INC. (UNITED STATES)

7.4 SPROUTS FARMERS MARKET INC. (UNITED STATES)

7.5 WHOLE FOODS MARKET INC. (UNITED STATES)

7.6 WALMART INC. (UNITED STATES)

7.7 NATURE'S PRIDE (UNITED STATES)

7.8 DOLE FOOD COMPANY INC. (UNITED STATES)

7.9 CHIQUITA BRANDS INTERNATIONAL INC. (UNITED STATES)

7.10 OCEAN SPRAY CRANBERRIES INC. (UNITED STATES)

7.11 DRISCOLL'S BERRIES LLC (UNITED STATES)

7.12 LIMONEIRA COMPANY (UNITED STATES)

7.13 MISSION PRODUCE INC. (UNITED STATES)

7.14 THE WONDERFUL COMPANY LLC (UNITED STATES)

7.15 M DOLE FOOD COMPANY INC. (UNITED STATES)

7.16 ORGANIC PRODUCE NETWORK (UNITED STATES)

7.17 FRESH DEL MONTE PRODUCE INC. (UNITED STATES)

7.18 SUNOPTA INC. (CANADA)

7.19 TOTAL PRODUCE PLC (IRELAND)

7.20 FYFFES LTD. (IRELAND)

7.21 ANDALUCIA FRUIT (SPAIN)

7.22 GREENYARD FOODS (BELGIUM)

7.23 DEL MONTE FRESH PRODUCE N.V. (BELGIUM)

7.24 GROUPEMENT DES PRODUCTEURS D'AGRUMES DU MAROC (MOROCCO)

7.25 FRESH FRUIT MAROC (MOROCCO)

7.26 SUNRIPE CERTIFIED ORGANICS (AUSTRALIA)

Chapter 8: Global Food Stabilizer Market By Region

8.1 Overview

8.2. North America Food Stabilizer Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Source

8.2.4.1 Plant

8.2.4.2 Microbial

8.2.4.3 Seaweed

8.2.4.4 Synthetic

8.2.4.5 Animal

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Dairy

8.2.5.2 Bakery

8.2.5.3 Confectionary

8.2.5.4 Beverages

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size by Function

8.2.6.1 Stability

8.2.6.2 Texture

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Food Stabilizer Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Source

8.3.4.1 Plant

8.3.4.2 Microbial

8.3.4.3 Seaweed

8.3.4.4 Synthetic

8.3.4.5 Animal

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Dairy

8.3.5.2 Bakery

8.3.5.3 Confectionary

8.3.5.4 Beverages

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size by Function

8.3.6.1 Stability

8.3.6.2 Texture

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Food Stabilizer Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Source

8.4.4.1 Plant

8.4.4.2 Microbial

8.4.4.3 Seaweed

8.4.4.4 Synthetic

8.4.4.5 Animal

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Dairy

8.4.5.2 Bakery

8.4.5.3 Confectionary

8.4.5.4 Beverages

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size by Function

8.4.6.1 Stability

8.4.6.2 Texture

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Food Stabilizer Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Source

8.5.4.1 Plant

8.5.4.2 Microbial

8.5.4.3 Seaweed

8.5.4.4 Synthetic

8.5.4.5 Animal

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Dairy

8.5.5.2 Bakery

8.5.5.3 Confectionary

8.5.5.4 Beverages

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size by Function

8.5.6.1 Stability

8.5.6.2 Texture

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Food Stabilizer Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Source

8.6.4.1 Plant

8.6.4.2 Microbial

8.6.4.3 Seaweed

8.6.4.4 Synthetic

8.6.4.5 Animal

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Dairy

8.6.5.2 Bakery

8.6.5.3 Confectionary

8.6.5.4 Beverages

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size by Function

8.6.6.1 Stability

8.6.6.2 Texture

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Food Stabilizer Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Source

8.7.4.1 Plant

8.7.4.2 Microbial

8.7.4.3 Seaweed

8.7.4.4 Synthetic

8.7.4.5 Animal

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Dairy

8.7.5.2 Bakery

8.7.5.3 Confectionary

8.7.5.4 Beverages

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size by Function

8.7.6.1 Stability

8.7.6.2 Texture

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Food Stabilizer Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.84 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.5% |

Market Size in 2032: |

USD 4.22 Bn. |

|

Segments Covered: |

By Source |

|

|

|

By Application |

|

||

|

By Function |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Food Stabilizer Market research report is 2024-2032.

Ashland Inc. (US), BASF SE(Germany), Cargill Inc. (US), CP Kelco (US), DowDuPont Inc. (US), Hydrosol GmbH & Co. KG(Germany), Ingredion Inc. (US), Kerry Group PLC (Ireland), NEXIRA (Normandie), Palsgaard A/S (Denmark), Tate & Lyle PLC (UK), Glanbia plc (Ireland), Advanced Food Systems Inc (New Jersey), Chemelco (Netherlands), Associated British Foods plc (UK), and other major players.

The Food Stabilizer Market is segmented into source, application, function and region. By Source, the market is categorized into Plant, microbial, Seaweed, Synthetic and Animal. By Application, the market is categorized Dairy & Dairy Products, Bakery, Confectionary, Beverages, Others. By Function, the market is categorized into Stability, texture, moisture retention. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Food Stabilizer are substances that help in increasing stability and thickness by helping foods retain their physical characteristics and remain in an emulsion. Substances that normally do not mix, such as water and oil, need stabilizer.

Food Stabilizer Market Size Was Valued at USD 2.84 Billion in 2023 and is Projected to Reach USD 4.22 Billion by 2032, Growing at a CAGR of 4.5 % From 2024-2032.