Food Pathogen Testing Market Synopsis

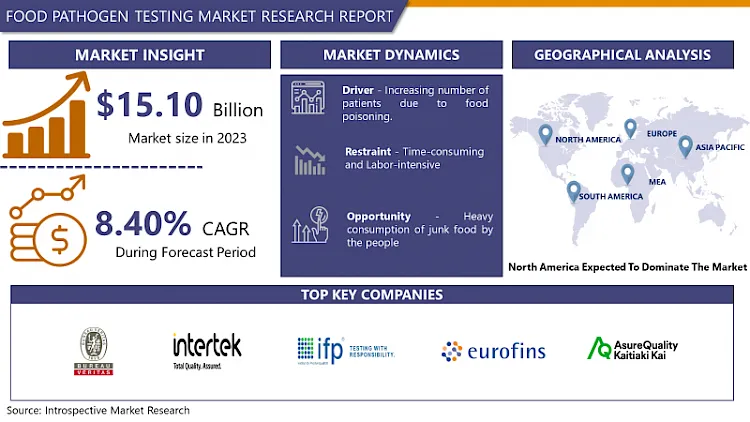

Food Pathogen Testing Market Size Was Valued at USD 16.37 Billion in 2024, and is Projected to Reach USD 31.21 Billion by 2032, Growing at a CAGR of 8.40% From 2025-2032.

The food pathogen testing market has been growing rapidly because of the growing awareness of the food contaminants and more especially governments setting higher standards concerning food quality. This market consists of the identification of pathogenic strains such as Salmonella, Listeria, E.coli, and others, which pose major threats to foods. Such factors include the awareness of consumers, trade of food products, and a growing prevalence of threats such as food diseases. Similarly technological aspects like the quick rapid testing methods, the automation of devices, etc. are also favouring market growth.

Main methodologies used in microbiological testing include PCR and immunoassays, these control the market due to efficiency and accuracy. Food processors and manufacturers, and regulatory authorities, and food testing laboratories are some of the key industries, with various applications in meat and poultry, dairy and processed foods, and beverages industries.

The North American region is dominating the market, and the factors behind it are well-developed infrastructure and responsible food safety regulations. Europe shares a similar trend while the Asia Pacific region is seen to have high growth potential with growing concerns on food safety and changing regulatory framework in the emerging markets of China and India for instance.

The competitors are major players in the market like SGS SA, Eurofins Scientific, Intertek Group, and Bio- Rad Laboratories that are continually expanding through strategic partnerships, acquisitions, and innovations. In summary, the food pathogen testing market is predicted to show strong development across the world due to the demand for food safety and prevention of any communicable illness.

Food Pathogen Testing Market Trend Analysis

Increasing Emphasis on Food Safety

- There is also concern growing in the recent past on the cases of food borne illnesses and this has led to the liefeld’s new standards regarding food safety in the global market. This requires increased safety measures during food preparation and better methods of testing for any pathogen, which in turn, is driving the food pathogen testing market.

- The demand today from the consumer’s side of things is that they are becoming more aware of the quality of food that they are consuming and they would like to know what it is that they are consuming since the food manufacturers are getting it from somewhere. This translates to a greater emphasis on enforcing strict measures towards quality management, with pathogen testing conducted along the food chain.

- It implies that when global food trade becomes more established there is a higher chance that food products will be affected by pathogens. Ensuring that food is safe has become a priority especially when this food is transported to other countries. This make it necessary for the food businesses industry to come up with efficient and fast pathogen testing methods to avoid any out break that may be fatal to consumers.

- Conventional improvements in technology act highly positively to the food pathogen testing market. By using improved and more efficient protocols, testing has been rendered less time-consuming and expensive and is being implemented across the entire food industry.

Technological Advancements

- Techniques such as available PCR and immunoassay produce short-time identification of pathogens, within hours, when necessary. This makes it easier to take preventative measures, reduce the cases of food recalls, and bolster the release of new products onto the market.

- The inclusion of tests automation in testing processes is fruitful compared to manual testing, increasing efficiency and minimizing human error chances. Moreover, we can observe trends of miniaturization, resulting in the development of compact and transportable diagnostic stations or test plates allowing for pathogen identification at any stage of the food chain.

- Another interesting example is biosensors, which are being developed to be capable of detecting multiple pathogens in a single test. This also has the effect of time and cost efficiency as well as streamlining of the testing process for food producers.

- There are certain features that can be incorporated through integration with Big Data and cloud computing where the results of tests can be analyzed in real time. Some insights include: This assists in the monitoring of trends, foreseeing of outbreaks and put up of measures which guarantees the safety of food in the market or outlets.

Food Pathogen Testing Market Segment Analysis:

Food Pathogen Testing Market is Segmented based on Contaminant, Technology and Food Type

By Contaminant, Salmonella segment is expected to dominate the market during the forecast period

- Salmonella, Listeria, E. colly and Campylobacter are known to cause a majority of the food borne diseases; this has spurred the need for effective and efficient pathogen testing solutions that focus on these known pathogens.

- In this case, it is clear that each type of contamination has its own method or unique way of testing. Whereas, ELISA (Enzyme-Linked Immunosorbent Assay) is employed for rapid detection of Listeria and PCR exclusively to identify E. coli strains.

- In order to control the levels of such pollutants, the regulatory bodies have placed thresholds on the amounts of these contaminants acceptable in any given environment. Testing also remains imperative in ensuring conformity as well as avoiding product recall.

- Still, these four companies have established a firm hold on the market and companies are adjusting to cater for new and emerging diseases with the possibility of spreading epidemics. This calls for further, constant designing of whole testing approaches and strategies.

By Technology, Traditional held the largest share in 2024

- Established techniques like culturing and enrichment offer reliable results but can be slow (days) and labor-intensive. Technologies like PCR and immunoassays provide faster results (hours) for quicker intervention and product release.

- Advancements like portable test kits enable on-site pathogen detection at any point in the food supply chain, enhancing convenience. PCR (Polymerase Chain Reaction) offers highly specific and sensitive detection of pathogens, making it a valuable tool for ensuring food safety.

Food Pathogen Testing Market Regional Insights:

North America is expected to dominate the global food pathogen testing market in the year 2024

- In the region there are periodic incidences of food related diseases especially due to Salmonella and campylobacter. This fuels a need for advanced testing solutions to ensure public health is given the protection it deserves.

- The government of North American countries has put in place strict policies on the safety of food and the testing of food products from the supply chain. This ensures that food producers enhance the standard ways of identifying dangerous pathogens in the food chain.

- The regional R&D is well-developed, resulting in highly innovative and efficient diagnostic technologies concerning pathogenic organisms. This creates a market for innovations and effectiveness in testing and certification.

- Consumers who are updating their diets eat healthily and are conscious with the safety aspects of their food. This means improved awareness from food providers resulting in demand for transparent information from the food producers hence increasing the usage of pathogen testing solutions.

Active Key Players in the Food Pathogen Testing Market

- Bureau Veritas S.A

- Intertek Group PLC.

- IFP Institut Für Produktqualität GmbH

- Eurofins Scientific

- Asurequality.

- ALS Limited.

- Genetic Id Na Inc.

- Silliker, Inc

- Other Active Players

Key Industry Developments in the Food Pathogen Testing Market:

- In April 30, 2024, Neogen® Corporation launched the Neogen Molecular Detection Assay 2 Salmonella Enteritidis/Salmonella Typhimurium (MDA2SEST), joining its pathogen testing platform. Approved by the AOAC® PTM Program, the assay offers rapid, accurate detection of these serotypes in poultry, enhancing food safety with improved accuracy and streamlined workflow.

- In February 2023, Eurofins Viracor LLC announced the launch of the Eurofins Viracor ExPeCT CAR-T qPCR assay. This innovative test evaluates the expansion and persistence of CAR-T therapy in pre-B cell acute lymphoblastic leukemia and B cell lymphoma patients, aiding clinicians in monitoring and optimizing treatment effectiveness.

|

Global Food Pathogen Testing Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 16.37 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.40% |

Market Size in 2032: |

USD 31.21 Bn. |

|

Segments Covered: |

By Contaminant |

|

|

|

By Technology |

|

||

|

By Food Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Food Pathogen Testing Market by Contaminant (2018-2032)

4.1 Food Pathogen Testing Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Salmonella

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Listeria

4.5 E.Coli

4.6 Campylobacter

Chapter 5: Food Pathogen Testing Market by Technology (2018-2032)

5.1 Food Pathogen Testing Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Traditional

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Rapid

5.5 Convenience

5.6 PCR

Chapter 6: Food Pathogen Testing Market by Food Type (2018-2032)

6.1 Food Pathogen Testing Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Meat & Poultry

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Dairy

6.5 Processed Food

6.6 Fruits & vegetables

6.7 Immunoassay Based

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Food Pathogen Testing Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 NATURE ESSENTIAL FOODS PVT LTD

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 LOTUS BAKERIES

7.4 GENERAL MILLS INCCLIF BAR & COMPANY

7.5 PROBAR LLC

7.6 POST HOLDINGS INCBUMBLEBAR INCPEPSICO INCEAT ANYTIME

7.7 TORQ LIMITED

7.8 OTE SPORTS LTD

7.9 KIND LLC

7.10 SCIENCE IN SPORTS PLC

7.11 KELLOGG COMPANY AND OTHERS.

Chapter 8: Global Food Pathogen Testing Market By Region

8.1 Overview

8.2. North America Food Pathogen Testing Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Contaminant

8.2.4.1 Salmonella

8.2.4.2 Listeria

8.2.4.3 E.Coli

8.2.4.4 Campylobacter

8.2.5 Historic and Forecasted Market Size by Technology

8.2.5.1 Traditional

8.2.5.2 Rapid

8.2.5.3 Convenience

8.2.5.4 PCR

8.2.6 Historic and Forecasted Market Size by Food Type

8.2.6.1 Meat & Poultry

8.2.6.2 Dairy

8.2.6.3 Processed Food

8.2.6.4 Fruits & vegetables

8.2.6.5 Immunoassay Based

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Food Pathogen Testing Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Contaminant

8.3.4.1 Salmonella

8.3.4.2 Listeria

8.3.4.3 E.Coli

8.3.4.4 Campylobacter

8.3.5 Historic and Forecasted Market Size by Technology

8.3.5.1 Traditional

8.3.5.2 Rapid

8.3.5.3 Convenience

8.3.5.4 PCR

8.3.6 Historic and Forecasted Market Size by Food Type

8.3.6.1 Meat & Poultry

8.3.6.2 Dairy

8.3.6.3 Processed Food

8.3.6.4 Fruits & vegetables

8.3.6.5 Immunoassay Based

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Food Pathogen Testing Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Contaminant

8.4.4.1 Salmonella

8.4.4.2 Listeria

8.4.4.3 E.Coli

8.4.4.4 Campylobacter

8.4.5 Historic and Forecasted Market Size by Technology

8.4.5.1 Traditional

8.4.5.2 Rapid

8.4.5.3 Convenience

8.4.5.4 PCR

8.4.6 Historic and Forecasted Market Size by Food Type

8.4.6.1 Meat & Poultry

8.4.6.2 Dairy

8.4.6.3 Processed Food

8.4.6.4 Fruits & vegetables

8.4.6.5 Immunoassay Based

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Food Pathogen Testing Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Contaminant

8.5.4.1 Salmonella

8.5.4.2 Listeria

8.5.4.3 E.Coli

8.5.4.4 Campylobacter

8.5.5 Historic and Forecasted Market Size by Technology

8.5.5.1 Traditional

8.5.5.2 Rapid

8.5.5.3 Convenience

8.5.5.4 PCR

8.5.6 Historic and Forecasted Market Size by Food Type

8.5.6.1 Meat & Poultry

8.5.6.2 Dairy

8.5.6.3 Processed Food

8.5.6.4 Fruits & vegetables

8.5.6.5 Immunoassay Based

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Food Pathogen Testing Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Contaminant

8.6.4.1 Salmonella

8.6.4.2 Listeria

8.6.4.3 E.Coli

8.6.4.4 Campylobacter

8.6.5 Historic and Forecasted Market Size by Technology

8.6.5.1 Traditional

8.6.5.2 Rapid

8.6.5.3 Convenience

8.6.5.4 PCR

8.6.6 Historic and Forecasted Market Size by Food Type

8.6.6.1 Meat & Poultry

8.6.6.2 Dairy

8.6.6.3 Processed Food

8.6.6.4 Fruits & vegetables

8.6.6.5 Immunoassay Based

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Food Pathogen Testing Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Contaminant

8.7.4.1 Salmonella

8.7.4.2 Listeria

8.7.4.3 E.Coli

8.7.4.4 Campylobacter

8.7.5 Historic and Forecasted Market Size by Technology

8.7.5.1 Traditional

8.7.5.2 Rapid

8.7.5.3 Convenience

8.7.5.4 PCR

8.7.6 Historic and Forecasted Market Size by Food Type

8.7.6.1 Meat & Poultry

8.7.6.2 Dairy

8.7.6.3 Processed Food

8.7.6.4 Fruits & vegetables

8.7.6.5 Immunoassay Based

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Food Pathogen Testing Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 16.37 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.40% |

Market Size in 2032: |

USD 31.21 Bn. |

|

Segments Covered: |

By Contaminant |

|

|

|

By Technology |

|

||

|

By Food Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||