Flying Bikes Market Synopsis:

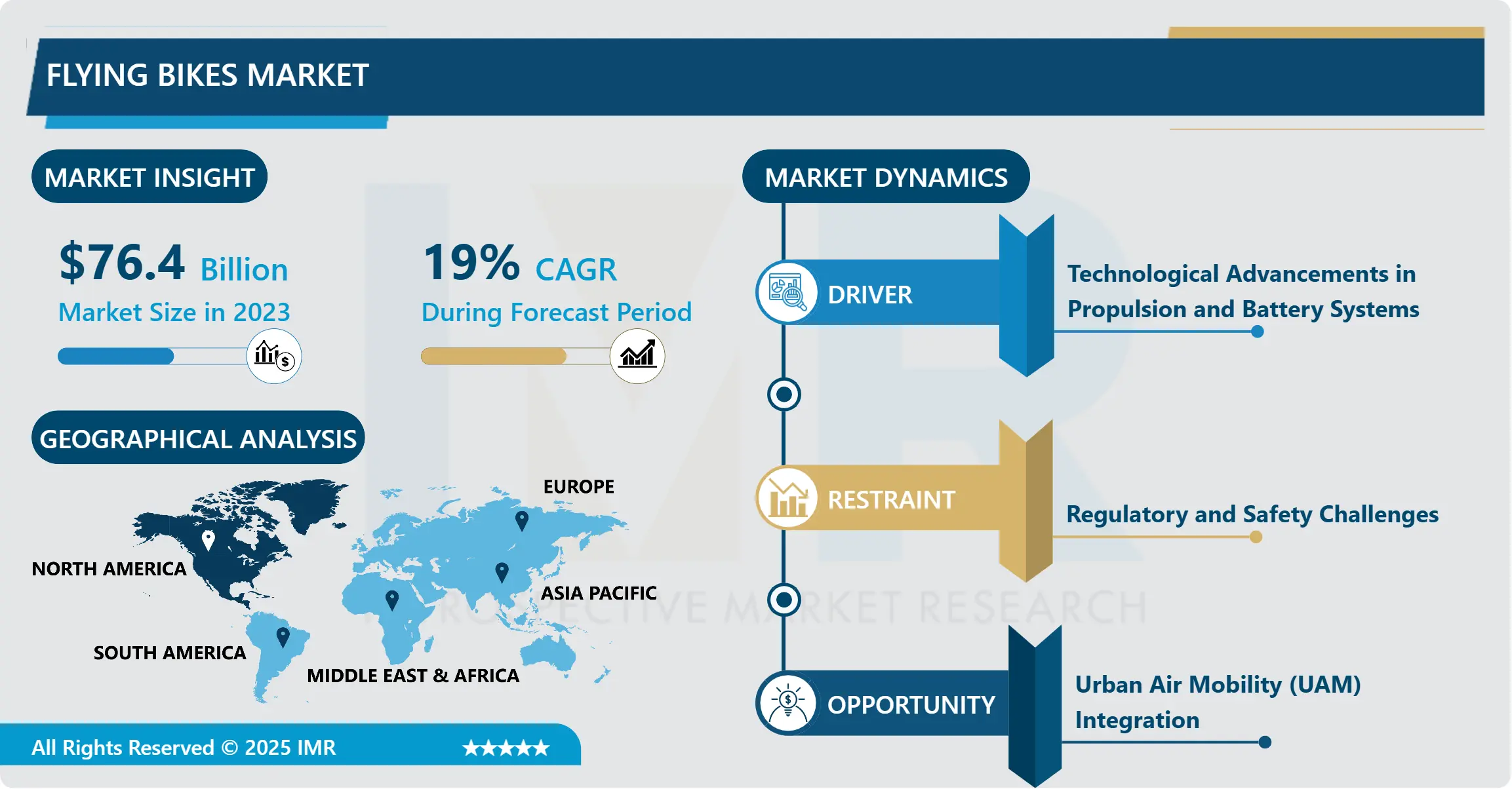

Flying Bikes Market Size Was Valued at USD 76.40 Billion in 2023, and is Projected to Reach USD 365.61 Billion by 2032, Growing at a CAGR of 19% From 2024-2032.

The flying bikes market refers to the emerging segment in personal transportation that combines characteristics of motorcycles and aircraft in order to achieve VTOL capabilities. These vehicles powered by electricity or gas and designed for personal, commercial, and military use shall provide a futuristic solution overcoming traffic congestion and reaching distant areas.

The flying bikes market is an innovative and fast-changing sector, driven by developments in aviation technology, electric propulsion systems, and increased interest in alternative transportation solutions. The market is still at a nascent stage with several companies working on prototype designs and trials. Flying bikes are a combination of motorcycles with the ability to take flight, which could potentially revolutionize both urban mobility and recreational transportation. Several driving forces are there in terms of technical advances in battery technology, material development for weight reduction, and improvements in more efficient VTOL configurations.

UAM initiatives and increased traffic density within major cities as well as demand for environment-friendly and effective means of transport have been working well towards the promotion and commercialization of flying bicycles. In addition, advancements in AI-based navigation, autonomous flight systems, and sophisticated safety features enhance investor confidence in this industry. Governments and regulatory bodies are also taking more interest in this industry, with some cities looking to integrate flying vehicles into their transportation systems.

Personal and recreational flying bikes are viewed as the next big step, although commercial applications such as air taxis and delivery services may be more of a significant next step. However, this technology will still face numerous challenges in terms of regulation, infrastructure, and designing vehicles to be safe, affordable, and practical. The market still has a lot to offer, especially with many companies developing prototypes that prove to be workable and test flights.

Flying Bikes Market Trend Analysis:

Electrification of Flying Bikes

- The most significant trend for the flying bikes market is that of increased electrification. As consumers and companies grow more conscious of their impact on the environment, electric flying bikes are gaining ground as they are clean, quiet, and energy-efficient. The rise of electric propulsion systems offers a host of advantages when it comes to sustainability and reduced emissions, making flying bikes more appealing in urban areas looking to reduce air pollution. Advancements in battery technology are also being leveraged to make electric flying bikes more energy dense, lightweight, and cheaper to produce, making them a feasible product for mass-market commercialization.

- Electric flying bikes are changing the future of personal aerial mobility. Being envisioned as possibly revolutionary for transportation, they promise to provide quieter, cleaner, and less expensive alternatives to gas-powered models. In fact, these bikes benefit by saving on maintenance because their engines have fewer moving parts compared to the ones from the internal combustion system. These trends are expected to surge further as electric vehicle technology continues to advance, supported increasingly by governments due to their clean nature and therefore change the market in the future through the next decade.

Urban Air Mobility (UAM) Integration

- One of the most important prospects in the flying bikes market relates to their potential integration into the urban air mobility (UAM) networks. UAM is defined as using the airspace for short-distance travels within urban environments, which might dramatically reduce traffic congestion and travel time while making it easier to improve urban transport efficiency. Flying bikes can easily take off and land vertically, making them a crucial component in this ecosystem. These are best suited for point-to-point rapid travel between city centres to the periphery or reach remote areas inaccessible by ordinary modes of transportation.

- Currently, governments and private agencies alike are investing heavily in establishing UAM infrastructure, for instance, air traffic management systems and designated vertiports (small takeoff and landing zones). This provides a perfect opportunity for flying bike manufacturers to collaborate with urban planners and transportation authorities in designing and deploying vehicles that perfectly integrate into these networks. Demand for such vehicles is likely to increase in denser cities as governments and businesses continue pushing for solutions to urban mobility challenges. The success of such integration could lead to higher adoption rates and thus much larger market opportunities for flying bikes.

Flying Bikes Market Segment Analysis:

Flying Bikes Market is Segmented on the basis of Type, Technology, Component, Mode of Operation, Range, End User, and Region.

By Type, Electric Flying Bikes segment is expected to dominate the market during the forecast period

- The flying bikes market can be divided into two major categories: electric flying bikes and gas-powered flying bikes. Electric flying bikes are the ones gaining traction because of their environmental-friendly nature, low running cost, and the ongoing innovations in the battery technology that have led to enhanced range and reliability. It is going to be more dominant in urban cities where environment regulations and noise pollution will make the option of an electric vehicle preferable. Electric flying bikes are quieter and smoother to ride compared to gas-powered flying bikes. This is an important consideration for urban and residential areas.

- Gas-powered flying bikes still have their market, of course, because they give a greater range and have faster refueling times, so they are often more popular in commercial applications or for the recreational user who wants more power and endurance. While gas-powered bikes will probably continue to hold a big share of the market, the long-term direction is toward electric vehicles.

By End User, Commercial segment expected to held the largest share

- The market for flying bikes is divided based on end-user applications into commercial, military and defense, and personal and recreational. Commercial includes air taxis, cargo delivery, and urban mobility services. This will grow rapidly with increasing demand for alternative transportation solutions in congested urban areas. Flying bikes in commercial use offer faster travel times, reduced congestion and open up a new outlet for logistics companies to supply goods quickly and efficiently.

- The military and defense field is also a significant end-user sector as flying bikes are also unique solutions for reconnaissance, rapid deployment and fast troop transportation in hostile territory. The ability of flying bikes to fly over obstacles and reach remote locations makes them very valuable in defense operations. The personal and recreational segment caters to enthusiasts who are looking for a new form of adventure and transportation. While this segment may currently represent a smaller share of the market, it is expected to grow as technology advances and flying bikes become more accessible to consumers.

Flying Bikes Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is poised to take a significant portion in flying bikes as it reflects increased investments in aviation and technology regarding transportation, thereby promoting new innovation for consumers to implement innovative solutions. An area in the region like developed infrastructure including existing air traffic control systems and opportunity with regards to urban mobility adds favor to the area, enhancing development and deployment for flying bikes. There is also an emerging regulatory framework for drones and other aerial vehicles, which is likely to make the approval and integration of flying bikes into mainstream transportation systems easier.

- In the United States, companies are working on prototypes and pilot projects in relation to flying bikes. The country holds significant technological leadership, which adds to a strong startup ecosystem and investment in clean energy solutions. This makes the country stand at the leading end of this market. In the future, with its maturity and widespread adaptation, North America will maintain dominance in the global flying bikes market, with enormous demand expected from both commercial as well as personal end-users.

Active Key Players in the Flying Bikes Market:

- AeroMobil (Slovakia)

- Terrafugia (USA)

- PAL-V (Netherlands)

- Joby Aviation (USA)

- Lilium (Germany)

- Vertical Aerospace (UK)

- AeroX (USA)

- Urban Aeronautics (USA)

- Maverick Aviation Group (USA)

- Hyundai Urban Air Mobility (South Korea)

- Vertical Aerospace (UK)

- Alaka'i Technologies (USA)

- Other Active Players

Key Industry Developments in the Flying Bikes Market:

- In November 2024, EHang Holdings Limited announced the launch of an Urban Air Mobility (UAM) Hub at Luogang Central Park in Hefei, Anhui Province, marking the second vertiport established in Luogang Park following the opening of the Urban Air Mobility Operations Center in May, which will serve as a key infrastructure for the future operation of EH216-S pilotless passenger-carrying aerial vehicles.

|

Flying Bikes Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 76.40 Billion |

|

Forecast Period 2024-32 CAGR: |

19% |

Market Size in 2032: |

USD 365.61Billion |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By End User |

|

||

|

By Component |

|

||

|

By Mode of Operation |

|

||

|

By Range |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Flying Bikes Market by Type

4.1 Flying Bikes Market Snapshot and Growth Engine

4.2 Flying Bikes Market Overview

4.3 Electric Flying Bikes

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Electric Flying Bikes: Geographic Segmentation Analysis

4.4 Gas-powered Flying Bikes

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Gas-powered Flying Bikes: Geographic Segmentation Analysis

Chapter 5: Flying Bikes Market by Technology

5.1 Flying Bikes Market Snapshot and Growth Engine

5.2 Flying Bikes Market Overview

5.3 Hovercraft Technology

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Hovercraft Technology: Geographic Segmentation Analysis

5.4 Vertical Take-Off and Landing (VTOL)

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Vertical Take-Off and Landing (VTOL): Geographic Segmentation Analysis

5.5 Multirotor Technology

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Multirotor Technology: Geographic Segmentation Analysis

5.6 Fixed-wing Technology

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Fixed-wing Technology: Geographic Segmentation Analysis

Chapter 6: Flying Bikes Market by End User

6.1 Flying Bikes Market Snapshot and Growth Engine

6.2 Flying Bikes Market Overview

6.3 Commercial

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Commercial: Geographic Segmentation Analysis

6.4 Military and Defense

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Military and Defense: Geographic Segmentation Analysis

6.5 Personal and Recreational

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Personal and Recreational: Geographic Segmentation Analysis

Chapter 7: Flying Bikes Market by Component

7.1 Flying Bikes Market Snapshot and Growth Engine

7.2 Flying Bikes Market Overview

7.3 Propulsion System

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Propulsion System: Geographic Segmentation Analysis

7.4 Power Supply

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Power Supply: Geographic Segmentation Analysis

7.5 Airframe

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Airframe: Geographic Segmentation Analysis

7.6 Control System

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Control System: Geographic Segmentation Analysis

Chapter 8: Flying Bikes Market by Mode of Operation

8.1 Flying Bikes Market Snapshot and Growth Engine

8.2 Flying Bikes Market Overview

8.3 Autonomous Flying Bikes

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Autonomous Flying Bikes: Geographic Segmentation Analysis

8.4 Manual Flying Bikes

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Manual Flying Bikes: Geographic Segmentation Analysis

Chapter 9: Flying Bikes Market by Range

9.1 Flying Bikes Market Snapshot and Growth Engine

9.2 Flying Bikes Market Overview

9.3 Short Range

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.3.3 Key Market Trends, Growth Factors and Opportunities

9.3.4 Short Range: Geographic Segmentation Analysis

9.4 Medium Range

9.4.1 Introduction and Market Overview

9.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.4.3 Key Market Trends, Growth Factors and Opportunities

9.4.4 Medium Range: Geographic Segmentation Analysis

9.5 Long Range

9.5.1 Introduction and Market Overview

9.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.5.3 Key Market Trends, Growth Factors and Opportunities

9.5.4 Long Range: Geographic Segmentation Analysis

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Flying Bikes Market Share by Manufacturer (2023)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 AEROMOBIL (SLOVAKIA)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 TERRAFUGIA (USA)

10.4 PAL-V (NETHERLANDS)

10.5 JOBY AVIATION (USA)

10.6 LILIUM (GERMANY)

10.7 VERTICAL AEROSPACE (UK)

10.8 AEROX (USA)

10.9 URBAN AERONAUTICS (USA)

10.10 MAVERICK AVIATION GROUP (USA)

10.11 HYUNDAI URBAN AIR MOBILITY (SOUTH KOREA)

10.12 VERTICAL AEROSPACE (UK)

10.13 ALAKA'I TECHNOLOGIES (USA)

10.14 OTHER ACTIVE PLAYERS

Chapter 11: Global Flying Bikes Market By Region

11.1 Overview

11.2. North America Flying Bikes Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size By Type

11.2.4.1 Electric Flying Bikes

11.2.4.2 Gas-powered Flying Bikes

11.2.5 Historic and Forecasted Market Size By Technology

11.2.5.1 Hovercraft Technology

11.2.5.2 Vertical Take-Off and Landing (VTOL)

11.2.5.3 Multirotor Technology

11.2.5.4 Fixed-wing Technology

11.2.6 Historic and Forecasted Market Size By End User

11.2.6.1 Commercial

11.2.6.2 Military and Defense

11.2.6.3 Personal and Recreational

11.2.7 Historic and Forecasted Market Size By Component

11.2.7.1 Propulsion System

11.2.7.2 Power Supply

11.2.7.3 Airframe

11.2.7.4 Control System

11.2.8 Historic and Forecasted Market Size By Mode of Operation

11.2.8.1 Autonomous Flying Bikes

11.2.8.2 Manual Flying Bikes

11.2.9 Historic and Forecasted Market Size By Range

11.2.9.1 Short Range

11.2.9.2 Medium Range

11.2.9.3 Long Range

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Flying Bikes Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size By Type

11.3.4.1 Electric Flying Bikes

11.3.4.2 Gas-powered Flying Bikes

11.3.5 Historic and Forecasted Market Size By Technology

11.3.5.1 Hovercraft Technology

11.3.5.2 Vertical Take-Off and Landing (VTOL)

11.3.5.3 Multirotor Technology

11.3.5.4 Fixed-wing Technology

11.3.6 Historic and Forecasted Market Size By End User

11.3.6.1 Commercial

11.3.6.2 Military and Defense

11.3.6.3 Personal and Recreational

11.3.7 Historic and Forecasted Market Size By Component

11.3.7.1 Propulsion System

11.3.7.2 Power Supply

11.3.7.3 Airframe

11.3.7.4 Control System

11.3.8 Historic and Forecasted Market Size By Mode of Operation

11.3.8.1 Autonomous Flying Bikes

11.3.8.2 Manual Flying Bikes

11.3.9 Historic and Forecasted Market Size By Range

11.3.9.1 Short Range

11.3.9.2 Medium Range

11.3.9.3 Long Range

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Flying Bikes Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size By Type

11.4.4.1 Electric Flying Bikes

11.4.4.2 Gas-powered Flying Bikes

11.4.5 Historic and Forecasted Market Size By Technology

11.4.5.1 Hovercraft Technology

11.4.5.2 Vertical Take-Off and Landing (VTOL)

11.4.5.3 Multirotor Technology

11.4.5.4 Fixed-wing Technology

11.4.6 Historic and Forecasted Market Size By End User

11.4.6.1 Commercial

11.4.6.2 Military and Defense

11.4.6.3 Personal and Recreational

11.4.7 Historic and Forecasted Market Size By Component

11.4.7.1 Propulsion System

11.4.7.2 Power Supply

11.4.7.3 Airframe

11.4.7.4 Control System

11.4.8 Historic and Forecasted Market Size By Mode of Operation

11.4.8.1 Autonomous Flying Bikes

11.4.8.2 Manual Flying Bikes

11.4.9 Historic and Forecasted Market Size By Range

11.4.9.1 Short Range

11.4.9.2 Medium Range

11.4.9.3 Long Range

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Flying Bikes Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size By Type

11.5.4.1 Electric Flying Bikes

11.5.4.2 Gas-powered Flying Bikes

11.5.5 Historic and Forecasted Market Size By Technology

11.5.5.1 Hovercraft Technology

11.5.5.2 Vertical Take-Off and Landing (VTOL)

11.5.5.3 Multirotor Technology

11.5.5.4 Fixed-wing Technology

11.5.6 Historic and Forecasted Market Size By End User

11.5.6.1 Commercial

11.5.6.2 Military and Defense

11.5.6.3 Personal and Recreational

11.5.7 Historic and Forecasted Market Size By Component

11.5.7.1 Propulsion System

11.5.7.2 Power Supply

11.5.7.3 Airframe

11.5.7.4 Control System

11.5.8 Historic and Forecasted Market Size By Mode of Operation

11.5.8.1 Autonomous Flying Bikes

11.5.8.2 Manual Flying Bikes

11.5.9 Historic and Forecasted Market Size By Range

11.5.9.1 Short Range

11.5.9.2 Medium Range

11.5.9.3 Long Range

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Flying Bikes Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size By Type

11.6.4.1 Electric Flying Bikes

11.6.4.2 Gas-powered Flying Bikes

11.6.5 Historic and Forecasted Market Size By Technology

11.6.5.1 Hovercraft Technology

11.6.5.2 Vertical Take-Off and Landing (VTOL)

11.6.5.3 Multirotor Technology

11.6.5.4 Fixed-wing Technology

11.6.6 Historic and Forecasted Market Size By End User

11.6.6.1 Commercial

11.6.6.2 Military and Defense

11.6.6.3 Personal and Recreational

11.6.7 Historic and Forecasted Market Size By Component

11.6.7.1 Propulsion System

11.6.7.2 Power Supply

11.6.7.3 Airframe

11.6.7.4 Control System

11.6.8 Historic and Forecasted Market Size By Mode of Operation

11.6.8.1 Autonomous Flying Bikes

11.6.8.2 Manual Flying Bikes

11.6.9 Historic and Forecasted Market Size By Range

11.6.9.1 Short Range

11.6.9.2 Medium Range

11.6.9.3 Long Range

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Flying Bikes Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size By Type

11.7.4.1 Electric Flying Bikes

11.7.4.2 Gas-powered Flying Bikes

11.7.5 Historic and Forecasted Market Size By Technology

11.7.5.1 Hovercraft Technology

11.7.5.2 Vertical Take-Off and Landing (VTOL)

11.7.5.3 Multirotor Technology

11.7.5.4 Fixed-wing Technology

11.7.6 Historic and Forecasted Market Size By End User

11.7.6.1 Commercial

11.7.6.2 Military and Defense

11.7.6.3 Personal and Recreational

11.7.7 Historic and Forecasted Market Size By Component

11.7.7.1 Propulsion System

11.7.7.2 Power Supply

11.7.7.3 Airframe

11.7.7.4 Control System

11.7.8 Historic and Forecasted Market Size By Mode of Operation

11.7.8.1 Autonomous Flying Bikes

11.7.8.2 Manual Flying Bikes

11.7.9 Historic and Forecasted Market Size By Range

11.7.9.1 Short Range

11.7.9.2 Medium Range

11.7.9.3 Long Range

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

|

Flying Bikes Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 76.40 Billion |

|

Forecast Period 2024-32 CAGR: |

19% |

Market Size in 2032: |

USD 365.61Billion |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By End User |

|

||

|

By Component |

|

||

|

By Mode of Operation |

|

||

|

By Range |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||