Fluoroscopy Equipment Market Synopsis:

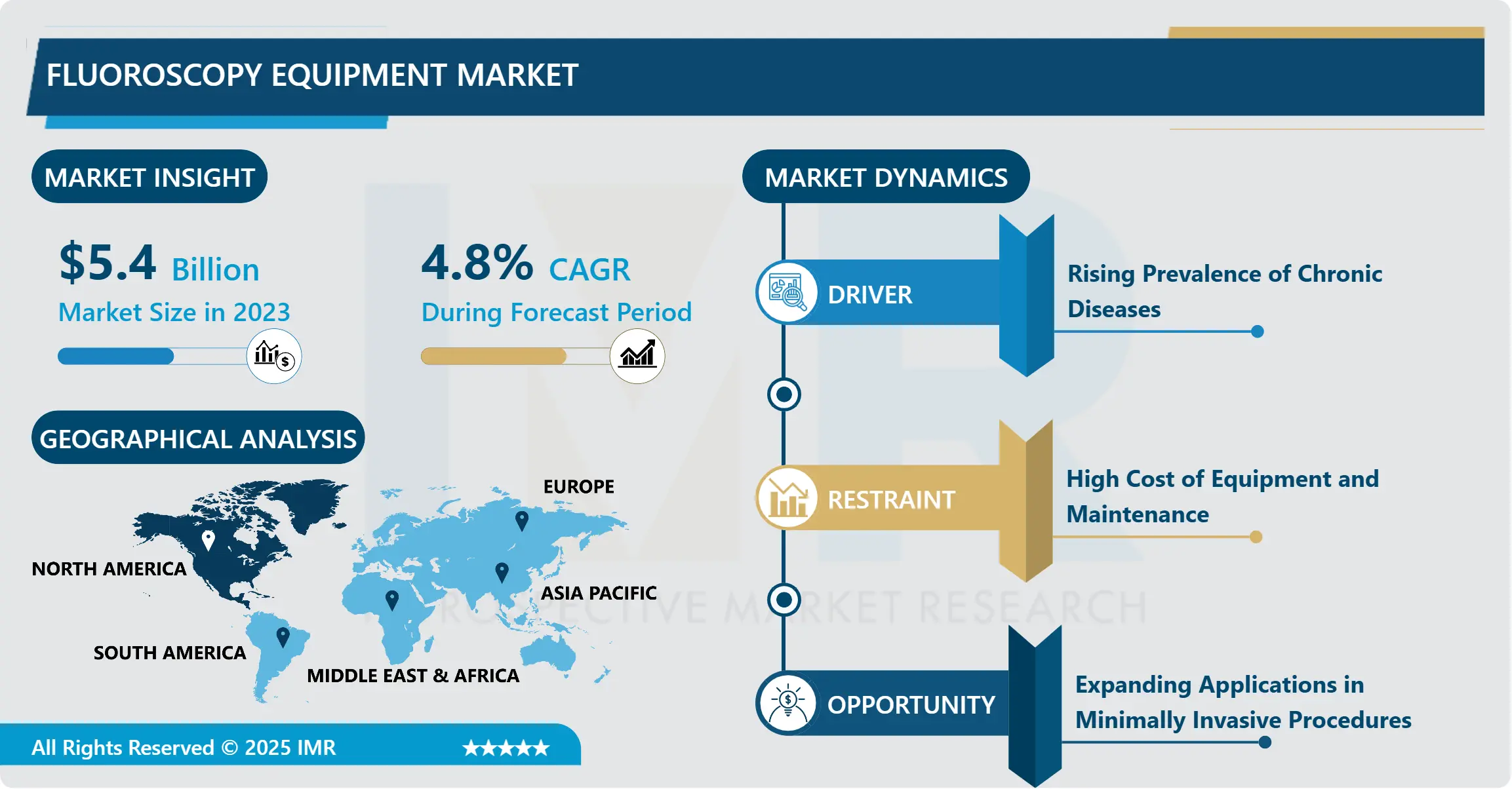

Fluoroscopy Equipment Market Size Was Valued at USD 5.40 Billion in 2023, and is Projected to Reach USD 8.23 Billion by 2032, Growing at a CAGR of 4.80% From 2024-2032.

The fluoroscopy equipment market refers to the development, manufacturing, and sale of medical imaging devices that use X-rays to produce real-time moving images of internal body structures. This technology is used in diagnostic and interventional procedures in many medical specialties, providing accurate visualization for clinicians.

Fluoroscopy equipment represents a critical role in modern health care through dynamic imaging that is applied for both diagnostic and therapeutic and interventional purposes. These devices are central to procedures that require real-time guidance, such as catheter insertions, stent placements, and orthopedic surgeries. The market has seen huge growth due to increased demand for minimally invasive procedures, the aging global population, and technological advancements.

Fluoroscopy systems, through continuous improvements in dose reduction technologies and image quality, have become more efficient and safe. The integration of AI in imaging has enhanced further the decision-making process as well as operational efficiency. Growth of the market is challenged by several factors such as high costs associated with equipment, regulatory issues, and radiation safety concerns.

Fluoroscopy Equipment Market Trend Analysis:

Integration of Artificial Intelligence in Fluoroscopy Equipment

- The integration of AI into fluoroscopy systems is revolutionizing the market. AI-driven algorithms are increasingly being used to enhance imaging precision, automate processes, and reduce radiation exposure. For example, AI can optimize imaging parameters in real time, ensuring that clinicians obtain the clearest possible images while minimizing harm to patients.

- This trend is especially true for interventional radiology, which necessitates high accuracy and fast imaging. AI-fluoroscopy systems can further assist in anomaly detection, ensuring more accurate diagnosis and planning. With such advanced solutions gradually being integrated into hospitals and clinics, the standards of fluoroscopy applications will probably be transformed by AI

Expanding Applications in Minimally Invasive Procedures

- The adoption of minimally invasive procedures represents a massive opportunity for fluoroscopy equipment. Such procedures require maximum reliance on real-time imaging to navigate complex anatomy, rendering fluoroscopy indispensable in such applications. The general preference for minimally invasive techniques stems from their benefits that include short recovery times, diminished surgical risks, and cheaper healthcare.

- Areas in cardiovascular interventions, neurological procedures, and orthopedic surgeries will observe an increased usage of fluoroscopy systems. Because device miniaturization and imaging technologies are continually advancing, fluoroscopy's scope is bound to expand in minimally invasive treatments, thus paving opportunities for tremendous market growth.

Fluoroscopy Equipment Market Segment Analysis:

Fluoroscopy Equipment Market is Segmented on the basis of product type, application, end user, and Region

By Product Type, Fixed Fluoroscopy Equipment segment is expected to dominate the market during the forecast period

- Fixed fluoroscopy equipment is usually used in big health care facilities such as hospitals. They provide high performance and detailed imaging capabilities. Such systems are very useful for specialized procedures requiring high-resolution imaging, such as cardiovascular surgeries. However, they are expensive and require much space and infrastructure.

- On the other hand, mobile fluoroscopy equipment is more flexible and increasingly used in outpatient centers and smaller facilities. These systems allow imaging at multiple locations within a healthcare facility, making them a cost-effective and versatile solution for diagnostic and interventional needs.

By Application, Orthopedic segment expected to held the largest share

- The key applications of fluoroscopy, particularly in orthopedics, include fracture visualization for guiding joint replacement. Additionally, it has a broad application in cardiovascular procedures involving angioplasty and implantation of pacemakers, providing critical real-time imaging that makes the interventions successful.

- Neurological conditions and spinal injuries can be properly diagnosed and treated through fluoroscopy. Additionally, it extensively finds its way in both gastrointestinal and urology to guide interventions that range from ureteroscopy to the endoscopic retrograde cholangiopancreatography. The versatile use in multiple applications proves the real value of fluoroscopy in medical science.

Fluoroscopy Equipment Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America dominates the fluoroscopy equipment market with its advanced healthcare infrastructure, high adoption of innovative technologies, and rising prevalence of chronic diseases. The well-established reimbursement policies and government support for adopting modern imaging solutions in this region further bolster the dominance of the market.

- Besides, the leading players in the region have a high presence rate, ensuring continuous availability of advanced products. The United States drives growth with its focus on minimally invasive procedures and early adoption of AI-enhanced imaging technologies.

Active Key Players in the Fluoroscopy Equipment Market:

- GE Healthcare (United States)

- Siemens Healthineers (Germany)

- Philips Healthcare (Netherlands)

- Canon Medical Systems Corporation (Japan)

- Hologic, Inc. (United States)

- Shimadzu Corporation (Japan)

- Ziehm Imaging GmbH (Germany)

- Carestream Health (United States)

- Fujifilm Holdings Corporation (Japan)

- Hitachi, Ltd. (Japan)

- Koninklijke Philips N.V. (Netherlands)

- Varian Medical Systems (United States)

- Other Active Players

Key Industry Developments in the Fluoroscopy Equipment Market:

- In November 2023, the Norwegian Vestre Viken Health Trust, in collaboration with Philips, announced the implementation of AI-enabled clinical care to assist radiologists in enhancing patient care. Philips AI-enabled clinical applications platform will accelerate the diagnosis of bone fractures, delivering quicker, more efficient, and high-quality care to patients throughout Norway.

|

Fluoroscopy Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.40 Billion |

|

Forecast Period 2024-32 CAGR: |

4.80% |

Market Size in 2032: |

USD 8.23 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Fluoroscopy Equipment Market by Product Type

4.1 Fluoroscopy Equipment Market Snapshot and Growth Engine

4.2 Fluoroscopy Equipment Market Overview

4.3 Fixed Fluoroscopy Equipment

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Fixed Fluoroscopy Equipment: Geographic Segmentation Analysis

4.4 Mobile Fluoroscopy Equipment

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Mobile Fluoroscopy Equipment: Geographic Segmentation Analysis

Chapter 5: Fluoroscopy Equipment Market by Application

5.1 Fluoroscopy Equipment Market Snapshot and Growth Engine

5.2 Fluoroscopy Equipment Market Overview

5.3 Orthopedic

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Orthopedic: Geographic Segmentation Analysis

5.4 Cardiovascular

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Cardiovascular: Geographic Segmentation Analysis

5.5 Neurology

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Neurology: Geographic Segmentation Analysis

5.6 Gastrointestinal

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Gastrointestinal: Geographic Segmentation Analysis

5.7 Urology

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Urology: Geographic Segmentation Analysis

5.8 General Surgery

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 General Surgery: Geographic Segmentation Analysis

5.9 Others

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 Others: Geographic Segmentation Analysis

Chapter 6: Fluoroscopy Equipment Market by End User

6.1 Fluoroscopy Equipment Market Snapshot and Growth Engine

6.2 Fluoroscopy Equipment Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals: Geographic Segmentation Analysis

6.4 Diagnostic Centers

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Diagnostic Centers: Geographic Segmentation Analysis

6.5 Specialty Clinics

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Specialty Clinics: Geographic Segmentation Analysis

6.6 Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Fluoroscopy Equipment Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 GE HEALTHCARE (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SIEMENS HEALTHINEERS (GERMANY)

7.4 PHILIPS HEALTHCARE (NETHERLANDS)

7.5 CANON MEDICAL SYSTEMS CORPORATION (JAPAN)

7.6 HOLOGIC INC. (UNITED STATES)

7.7 SHIMADZU CORPORATION (JAPAN)

7.8 ZIEHM

7.9 IMAGING GMBH (GERMANY)

7.10 CARESTREAM HEALTH (UNITED STATES)

7.11 FUJIFILM HOLDINGS CORPORATION (JAPAN)

7.12 HITACHI

7.13 LTD. (JAPAN)

7.14 KONINKLIJKE PHILIPS N.V. (NETHERLANDS)

7.15 VARIAN MEDICAL SYSTEMS (UNITED STATES)

7.16 OTHER ACTIVE PLAYERS

Chapter 8: Global Fluoroscopy Equipment Market By Region

8.1 Overview

8.2. North America Fluoroscopy Equipment Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product Type

8.2.4.1 Fixed Fluoroscopy Equipment

8.2.4.2 Mobile Fluoroscopy Equipment

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Orthopedic

8.2.5.2 Cardiovascular

8.2.5.3 Neurology

8.2.5.4 Gastrointestinal

8.2.5.5 Urology

8.2.5.6 General Surgery

8.2.5.7 Others

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Hospitals

8.2.6.2 Diagnostic Centers

8.2.6.3 Specialty Clinics

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Fluoroscopy Equipment Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product Type

8.3.4.1 Fixed Fluoroscopy Equipment

8.3.4.2 Mobile Fluoroscopy Equipment

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Orthopedic

8.3.5.2 Cardiovascular

8.3.5.3 Neurology

8.3.5.4 Gastrointestinal

8.3.5.5 Urology

8.3.5.6 General Surgery

8.3.5.7 Others

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Hospitals

8.3.6.2 Diagnostic Centers

8.3.6.3 Specialty Clinics

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Fluoroscopy Equipment Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product Type

8.4.4.1 Fixed Fluoroscopy Equipment

8.4.4.2 Mobile Fluoroscopy Equipment

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Orthopedic

8.4.5.2 Cardiovascular

8.4.5.3 Neurology

8.4.5.4 Gastrointestinal

8.4.5.5 Urology

8.4.5.6 General Surgery

8.4.5.7 Others

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Hospitals

8.4.6.2 Diagnostic Centers

8.4.6.3 Specialty Clinics

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Fluoroscopy Equipment Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product Type

8.5.4.1 Fixed Fluoroscopy Equipment

8.5.4.2 Mobile Fluoroscopy Equipment

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Orthopedic

8.5.5.2 Cardiovascular

8.5.5.3 Neurology

8.5.5.4 Gastrointestinal

8.5.5.5 Urology

8.5.5.6 General Surgery

8.5.5.7 Others

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Hospitals

8.5.6.2 Diagnostic Centers

8.5.6.3 Specialty Clinics

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Fluoroscopy Equipment Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product Type

8.6.4.1 Fixed Fluoroscopy Equipment

8.6.4.2 Mobile Fluoroscopy Equipment

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Orthopedic

8.6.5.2 Cardiovascular

8.6.5.3 Neurology

8.6.5.4 Gastrointestinal

8.6.5.5 Urology

8.6.5.6 General Surgery

8.6.5.7 Others

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Hospitals

8.6.6.2 Diagnostic Centers

8.6.6.3 Specialty Clinics

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Fluoroscopy Equipment Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product Type

8.7.4.1 Fixed Fluoroscopy Equipment

8.7.4.2 Mobile Fluoroscopy Equipment

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Orthopedic

8.7.5.2 Cardiovascular

8.7.5.3 Neurology

8.7.5.4 Gastrointestinal

8.7.5.5 Urology

8.7.5.6 General Surgery

8.7.5.7 Others

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Hospitals

8.7.6.2 Diagnostic Centers

8.7.6.3 Specialty Clinics

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Fluoroscopy Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.40 Billion |

|

Forecast Period 2024-32 CAGR: |

4.80% |

Market Size in 2032: |

USD 8.23 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||