Flight Data Recorder Market Synopsis

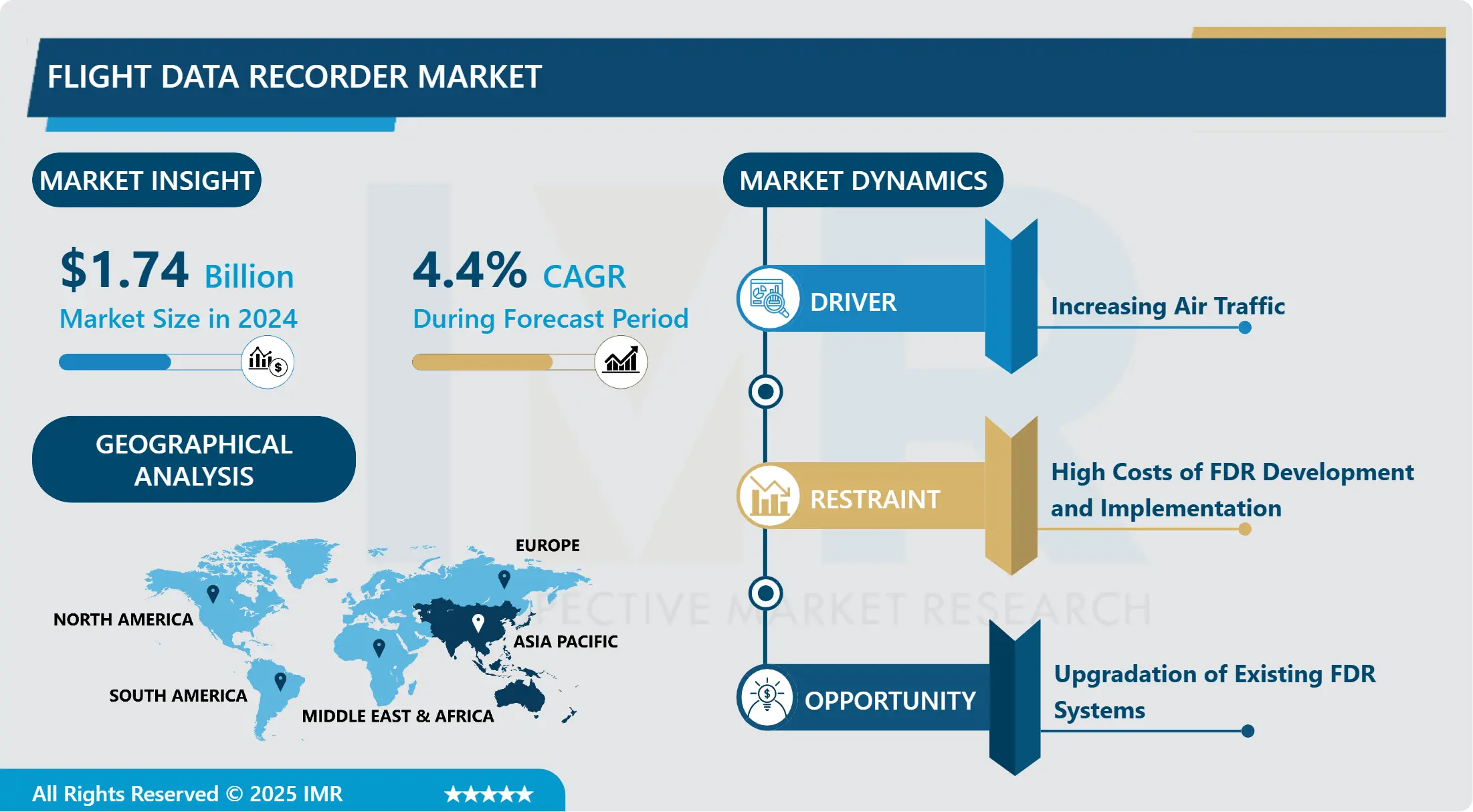

Flight Data Recorder Market Size Was Valued at USD 1.74 Billion in 2024, and is Projected to Reach USD 2.46 Billion by 2032, Growing at a CAGR of 4.4% From 2025-2032.

A Flight Data Recorder (FDR) is an aviation device akin to a black box and is used to record details on several crucialities of a flight. Its main function is to store and process significant information that will help to evaluate the aircraft work, supervise flights, and study events or accidents.

Some of the data recorded by FDR include; speed, height, heading, velocity, and control surface positions among others. This data is crucial because it helps in identifying the chronology of an accident and it enables researchers to work toward making flights safer through better design of planes and better operational methods.

The FDR is usually located inside a hardened enclosure that is able to sustain an abusive environment along with fire and pressure such as those felt during an aircraft crash. The unit responsible for storing data is the solid-state memory which will help in storage of data even in cases of a disaster.

The FDR is closely related with the Cockpit Voice Recorder (CVR) which records the audio broadcasts from the cockpit, documenting both all the aspects of the aircraft status during the flight and the behavior of the pilots. Altogether, these recorders are a set of high practical value to the investigators of accidents, as the data obtained can help develop better safety measures and initiatives in the sphere of aviation.

Besides the crash investigation and analysis purpose, the FDR is also plays a great purpose in normal day flying operations. Airline uses this data in consultation with regulatory agencies to update performance of Aircraft over a given period of time that enhances the compliance with safety standards and report maintenance issues prior they constitute major problems. Since the flight data would be recorded and analyzed over and over again, the operators would be able to identify patterns and chances of certain unpleasant incidents to occur; this is because operators will be able to increase overall flight safety as well as productivity. This continuous assessing aids to obtain better and more dependable airplanes also enhances pilots training undertakings and flight procedures.

Flight Data Recorder Market Trend Analysis

Flight Data Recorder Market Growth Driver- Focus on Cloud-Based Data Storage

- In the recent past, one emerging trend in market for Flight Data Recorder (FDR) is the use of remote cloud solutions for storage of substantial data. Historically, FDR data has remained inside the aircraft being physically removed from the aircraft for data retrieval/analysis in case of an accident or incident. Yet, with a focus on improved technological developments focusing on communication, airlines and aviation authorities are now opting to store data, including collected data, on cloud databases to enhance convenience in data retrieval and analysis.

- Several reasons can be attributed to the utilization of cloud-based storage for FDR data storage and management. Firstly, it grants access to the datas about flights in real-time from any location with Internet connection and allows monitoring and afterward analysis of the aircraft performance. Credited to this method, relevant information is made available at a faster rate, which is of great importance in incident response and accident investigation as they help the stakeholders in coming with the best measures that could offer maximum safety.

- Similarly, flexibility and availability also made cloud-based storage secure and reliable in terms of data. This in turn entails that instead of writing FDR data to the memory of the FDR device itself, which is a possible avenue through which data might be lost should the device undergo physical damage or be lost in some way, FDR data is stored into cloud servers which have backup capabilities. In the same way, it is worth noting that data storage in the clouds may have advanced technologies to work towards providing secure access to flight data that cannot be accessed by any unauthorized third parties under aviation regulations and privacy policies that are strictly observed.

- Apart from that, the cloud-based storage enables the sharing of important data required in the aviation industry among the various stakeholders. Centralizing FDR data in the cloud means that the same dataset will be available for the airlines, manufacturers, if not all, relevant regulatory agencies among others hence the efforts aimed at enhancing dark comprehension, cooperation and consequent optimization of the same constant learning framework for enhanced aviation safety reproduction. Therefore, the developments of the cloud-based data storage solution are expected to further influence the growth of the Flight Data Recorder market and to ultimately contribute to the thirst for improvement of flight safety and reliability.

Flight Data Recorder Market Expansion Opportunity- Integration with Advanced Cockpit Technologies

- This has created a good opportunity that the Flight Data Recorder (FDR) market can explore under integration with advanced cockpit technologist to provoke new safety feature and technology in aviation filed. Technological facilitations, including avionic equipment, automation components, and employing of data analysis tools in the cockpit enable airplane performance observation throughout flying. The enhancement of these advanced technologies in cockpit means that operators of FDR information can gain more insight in the operations and decision-making processes within the flight domain as well as identifying the safety risks that may arise.

- Furthermore, the FDR data contains recorded flight history in terms of mechanical and operational components of the aircraft as well as real-time sensor data from various systems and instruments on board enabling the airline industry to determine and identify potential mechanical and operational difficulties that may likely occur and cause extensive issues. Such a strategy not only increases the dependability of the plane but it also helps to reduce the time that the plane spends under maintenance and the costs of maintaining it, thus increasing the efficiency and satisfaction of passengers.

- Moreover, interaction with other imaginative cockpit systems allows to improve the cockpit pilots’ situational awareness and decision aids while a flight. By feeding FDR data into cockpit displays and avionics systems, pilots can also receive advanced details of aircraft performance and flight environment accompanying the route besides other parameters in real-time. This much information allows pilots to make rational decisions on routing, adapt to unpredicted scenarios, and increase overall flight safety and rate of performance.

- Furthermore, other modern developments in Cockpit of airplane can make use of FDR data to display post-flight debrief and analysis tools which can help pilots to study their performance and find out ways for improvement in the future so that the overall pilot training & flying operation should always be on a high standard.

- Summing up, the use of avionics and other hi-tech solutions available in the aircraft modern cockpit is a promising area for FDR market growth as it creates a win-win situation wherein all participants invest in improved airplane reliability and efficiency. Using the mass of the raw data, which is gathered FDRs, and combining it with modern cockpit technologies and solutions, the stakeholders can expand the potential of their possibilities, and, as a result, achieve better safe operations in aviation.

Flight Data Recorder Market Segment Analysis:

Flight Data Recorder Market is segmented based on Connectivity, Aircraft Type, Aircraft Type, Services, and Region.

By Type, Flight Data Recorder (FDR) is expected to dominate the market during the forecast period

- As for the various segments of the ADS market, the Flight Data Recorder (FDR) segment can be considered dominant in most cases mostly because it provides the main supply of flight parameters that are essential for monitoring the flight and environmental conditions. It is essential to differentiate the FDR from the Cockpit Voice Recorder (CVR), which records audio from the cockpit, or the Quick Access Recorder (QAR), which is essentially an accompagning instrument used for collecting and storing data for normal operational use and monitoring CFIT accidents, as the FDR is designed to collect extensive flight data that is critical during the investigation of accidents, as well as for operational research and compliance purposes.

- Flight Data Recorders are necessary by aviation authorities around the globe and are believed to be one of the important facets of modern aviation safety. These record various aspects of an aircraft’s flying as: air speed, altitude, heading, vertical velocity, control surface movements, and aircraft system performance; they give a clear picture to the investigators of how an aircraft behaves prior to an occurrence or an accident. It is pertinent to have such huge amount of information regarding an accident which helps in reconstruction and helps to investigate in to the major causes that lead to the mishap and then also helps in suggesting certain measures to prevent such mishaps in the future.

- In addition, the technological improvements in FDR products include the availability of the large storage capacity, increased sampling rate, and advanced data Analysis that enhance the dominance of Flight Data Recorder segment in the market. Investors involved in the airline industry, manufacturers of commercial aircraft and other authorities are therefore interested in improving FDR systems in order to meet ever rising standards of security and advances in various industries. Therefore, it can be concluded that, depending on the degree of their regulators’ requirements, continue to stimulate the aircraft FDRs market demand and development, asserting further own leadership in the segment of essential airplane data recording systems.

By Component, Memory Unit segment held the largest share in 2024

- The Memory Unit component has the highest representation in the Flight Data Recorder (FDR) market, mainly because it is the main part in which flight data is recorded and retained. It holds the responsibility for acquiring and preserving page numbers of countless significant flight characteristics and climatic conditions that accompany the functioning of an aircraft. This information is most useful for figuring out what went wrong in an accident and for studying the way systems work in general; for assessing compliance with industrial rules and, finally, for the memory unit’s role in FDR function. Due to the strict norms prescribed by aviation authorities from all over the globe regarding FDR data storage and recovery prerequisites, the requirement for compact, large-capacity storage mediums remains high and encourages urgency as well as rivalry in this sector of the market.

- After the memory unit, the next component with greater market prominence in FDR scope is the electronic controller board. The controller board is the core of the FDR, being responsible for handling the metadata of the recordings as well as the storage and retrieval of those data. It interfaces and controls the various sensory systems, input and output devices and data storage and retrieval systems in order to have a central and most efficient control during the flight.

- In the field of avionics, both avionics systems and data processing systems are improving constantly, which makes the segment of electronic controller boards continue to develop, spurred by demand on higher performance, better efficiency, and improved reliability of the FDR systems.

- However, the input devices, power supplies, and signal beacons are also parts of Flight Data Recorders that are also critical to the general functioning of FDRs because all of the above-mentioned components are vital to its working process. Sensors, data acquisition modules and other acquisition devices record actual time-flight data, power supplies maintain FDR systems operational.

- Depending on the type of application of signal beacons, they help to identify and recover FDRs after accidents or incidents in order to provide investigators with data needed for anamnesis. Althouth none of these components may be a market leader in FDR on their own, the optimisation of interface between these three components and the memory units and electronic controller boards does provide a valuable input to the operation and success of Flight Data Recorder systems.

Flight Data Recorder Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Rising spending on the aviation industry and necessity in procuring new aircrafts, especially from emerging power houses like China and India will further complement the development of the market in the region. In January 2024, IATA prounounced that the airlines in the Asia-Pacific reported 126. International traffic for the year ending Dec-23 was a 1% increase compared to Dec-22 and was the only region to display the most significant Y-o-Y traffic increase in traffic.

- As for the industry that consists of commercial and military aircraft, there have been noticeable recent developments in China. For instance, in November 2023, Boeing stated that, China will account for one fifth of international airplane demand over the next twenty years. This means that China needs about 6,500 single aisle aircraft of the type of 737 Max and more than 1,500 twin aisle, aircraft similar to Dreamliner in performance.

- Some of these included – China, India and Japan that were some of the significant countries in the region ordering several aircrafts. For example, in July 2023 Indigo collaborated with Airbus where it ordered 500 A320neo aircraft expected to be delivered over the course of 2030-2035. Similarly in June 2023, Air India signed a contract in which Company Airbus will provide 250 aircraft and Boeing only 220 aircraft. Furthermore, in September, 2023 China Eastern Airlines signed another contract with Comac to supply hundred C919 for a total of 10 billion US Dollars. The delivery of the planes is planned in more gradually, starting from 2024 and ending in 2031.

- Due to changes in the nature and level of demand with specific reference with the air crash incident involving China Eastern, a Boeing 737 carrying 132 people on board which met its tragic end in Guangxi Zhuang Autonomous Region due to pilot negligence according to the data from the aircraft flight recorders, the chinese aviation industry has witnessed an increasing trend in the production of these devices. Thus, the Japanese government, seeking to improve the safety of flights after severe crashes in Japan, has shifted its attention to the issue. Currently, key aviation authorities in Japan are bearing much concentration in the installation of more enhanced aircraft flight recorders, particularly those which are capable of withstanding higher temperatures.

- Increased spending for defense and acquisition of next-generation fighter jets used by India, China and Japan are promoting the advancement of the industry. According to SIPRI yearbook 2021, China and India being the world’s second and fourth largest defense spenders in 2023, allocated a defense budget of USD 296 billion and USD 83. 6 billion, respectively. Due to rise in defense spending by nations in A-Pac on military aircraft, there are chances that advanced aircraft flight recorder systems are developed.

- For instance, in December 2023, the Indian MoD gave its nod to an indigenously built aircraft for USD 13 billion. The procurement comprises of fighter aircraft, 97 LCA Tejas Mark 1A for the Indian Air Force and 156 Prachand to be used by both IAF and Indian army. Hence, based on the global trends, the market will witness an upbeat prospect and growth during the forecast period because of the purchase of new planes for the commercial as well as the military by various countries and the anticipated enhanced spending by different countries in Asia-Pacific in the aviation industry.

Active Key Players in the Flight Data Recorder Market

- Elbit Systems Ltd. (Israel)

- RTX, (U.S.)

- Safran (France)

- Honeywell International Inc. (U.S.)

- GENERAL ELECTRIC (U.S.)

- Leonardo DRS (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- Curtiss-Wright Corporation (U.S.)

- Teledyne Controls LLC (U.S.)

- AstroNova, Inc. (U.S.)

- SECO S.p.a. (Italy)

- FLIGHT DATA SYSTEMS (Australia)

- AERTEC (Spain)

- SLN Technologies (India)

- AMETEK. Inc. (U.S.)

- Flight Data Vision (U.S.)

- HR Smith Group of Companies (U.K.)

- FLYHT Aerospace Solutions Ltd. (Canada)

- Aversan (Canada)

- Latitude Technologies Corporation (Canada)

- LX navigation d.o.o. (Slovenia)

- niron-sys (Israel)

- uavnavigation (Spain)

- Other Active Players

Key Industry Developments in the Flight Data Recorder Market:

- In May 2024, Saudia signed a deal with Airbus where the company was to provide 54 A321neo to the Saudi airline while the subsidiary of Saudia, which is Flyadeal, signed a deal of providing 12 A320neo and 39 A321neo for the value of USD 19 billion. The del

|

Global Flight Data Recorder Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.74 Bn. |

|

Forecast Period 2025-32 CAGR: |

4.4% |

Market Size in 2032: |

USD 2.46 Bn. |

|

Segments Covered: |

By Type

|

|

|

|

By Component |

|

||

|

By Function |

|

||

|

By Recording Time |

|

||

|

By Aircraft Type |

|

||

|

By Installation Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Flight Data Recorder Market by Type (2018-2032)

4.1 Flight Data Recorder Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Flight Data Recorder (FDR)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cockpit Voice Recorder (CVR)

4.5 Quick Access Recorder (QAR)

Chapter 5: Flight Data Recorder Market by Component (2018-2032)

5.1 Flight Data Recorder Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Memory Unit

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Electronic Controller Board

5.5 Input Devices

5.6 Power Supply

5.7 Signal Beacon

5.8 Others

Chapter 6: Flight Data Recorder Market by Function (2018-2032)

6.1 Flight Data Recorder Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Parametric Flight Data

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Record Flight Crew Audio

6.5 Data Link Communication

6.6 Others

Chapter 7: Flight Data Recorder Market by Recording Time (2018-2032)

7.1 Flight Data Recorder Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Above 20 Hours

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 2 – 20 Hours

7.5 Up to 2 Hours

Chapter 8: Flight Data Recorder Market by Aircraft Type (2018-2032)

8.1 Flight Data Recorder Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Narrow Body

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Wide Body

8.5 Rotorcrafts

8.6 Business Jets

8.7 Turboprop

8.8 Others

Chapter 9: Flight Data Recorder Market by Installation Type (2018-2032)

9.1 Flight Data Recorder Market Snapshot and Growth Engine

9.2 Market Overview

9.3 New Installation

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 Retrofit

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Flight Data Recorder Market Share by Manufacturer (2024)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 ELBIT SYSTEMS LTD. (ISRAEL)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 RTX

10.4 (U.S.)

10.5 SAFRAN (FRANCE)

10.6 HONEYWELL INTERNATIONAL INC. (U.S.)

10.7 GENERAL ELECTRIC (U.S.)

10.8 LEONARDO DRS (U.S.)

10.9 L3HARRIS TECHNOLOGIES INC. (U.S.)

10.10 CURTISS-WRIGHT CORPORATION (U.S.)

10.11 TELEDYNE CONTROLS LLC (U.S.)

10.12 ASTRONOVA INC. (U.S.)

10.13 SECO S.P.A. (ITALY)

10.14 FLIGHT DATA SYSTEMS (AUSTRALIA)

10.15 AERTEC (SPAIN)

10.16 SLN TECHNOLOGIES (INDIA)

10.17 AMETEK. INC. (U.S.)

10.18 FLIGHT DATA VISION (U.S.)

10.19 HR SMITH GROUP OF COMPANIES (U.K.)

10.20 FLYHT AEROSPACE SOLUTIONS LTD. (CANADA)

10.21 AVERSAN (CANADA)

10.22 LATITUDE TECHNOLOGIES CORPORATION (CANADA)

10.23 LX NAVIGATION D.O.O. (SLOVENIA)

10.24 NIRON-SYS (ISRAEL)

10.25 UAVNAVIGATION (SPAIN)

10.26 OTHER KEY PLAYERS

Chapter 11: Global Flight Data Recorder Market By Region

11.1 Overview

11.2. North America Flight Data Recorder Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size by Type

11.2.4.1 Flight Data Recorder (FDR)

11.2.4.2 Cockpit Voice Recorder (CVR)

11.2.4.3 Quick Access Recorder (QAR)

11.2.5 Historic and Forecasted Market Size by Component

11.2.5.1 Memory Unit

11.2.5.2 Electronic Controller Board

11.2.5.3 Input Devices

11.2.5.4 Power Supply

11.2.5.5 Signal Beacon

11.2.5.6 Others

11.2.6 Historic and Forecasted Market Size by Function

11.2.6.1 Parametric Flight Data

11.2.6.2 Record Flight Crew Audio

11.2.6.3 Data Link Communication

11.2.6.4 Others

11.2.7 Historic and Forecasted Market Size by Recording Time

11.2.7.1 Above 20 Hours

11.2.7.2 2 – 20 Hours

11.2.7.3 Up to 2 Hours

11.2.8 Historic and Forecasted Market Size by Aircraft Type

11.2.8.1 Narrow Body

11.2.8.2 Wide Body

11.2.8.3 Rotorcrafts

11.2.8.4 Business Jets

11.2.8.5 Turboprop

11.2.8.6 Others

11.2.9 Historic and Forecasted Market Size by Installation Type

11.2.9.1 New Installation

11.2.9.2 Retrofit

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Flight Data Recorder Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size by Type

11.3.4.1 Flight Data Recorder (FDR)

11.3.4.2 Cockpit Voice Recorder (CVR)

11.3.4.3 Quick Access Recorder (QAR)

11.3.5 Historic and Forecasted Market Size by Component

11.3.5.1 Memory Unit

11.3.5.2 Electronic Controller Board

11.3.5.3 Input Devices

11.3.5.4 Power Supply

11.3.5.5 Signal Beacon

11.3.5.6 Others

11.3.6 Historic and Forecasted Market Size by Function

11.3.6.1 Parametric Flight Data

11.3.6.2 Record Flight Crew Audio

11.3.6.3 Data Link Communication

11.3.6.4 Others

11.3.7 Historic and Forecasted Market Size by Recording Time

11.3.7.1 Above 20 Hours

11.3.7.2 2 – 20 Hours

11.3.7.3 Up to 2 Hours

11.3.8 Historic and Forecasted Market Size by Aircraft Type

11.3.8.1 Narrow Body

11.3.8.2 Wide Body

11.3.8.3 Rotorcrafts

11.3.8.4 Business Jets

11.3.8.5 Turboprop

11.3.8.6 Others

11.3.9 Historic and Forecasted Market Size by Installation Type

11.3.9.1 New Installation

11.3.9.2 Retrofit

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Flight Data Recorder Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size by Type

11.4.4.1 Flight Data Recorder (FDR)

11.4.4.2 Cockpit Voice Recorder (CVR)

11.4.4.3 Quick Access Recorder (QAR)

11.4.5 Historic and Forecasted Market Size by Component

11.4.5.1 Memory Unit

11.4.5.2 Electronic Controller Board

11.4.5.3 Input Devices

11.4.5.4 Power Supply

11.4.5.5 Signal Beacon

11.4.5.6 Others

11.4.6 Historic and Forecasted Market Size by Function

11.4.6.1 Parametric Flight Data

11.4.6.2 Record Flight Crew Audio

11.4.6.3 Data Link Communication

11.4.6.4 Others

11.4.7 Historic and Forecasted Market Size by Recording Time

11.4.7.1 Above 20 Hours

11.4.7.2 2 – 20 Hours

11.4.7.3 Up to 2 Hours

11.4.8 Historic and Forecasted Market Size by Aircraft Type

11.4.8.1 Narrow Body

11.4.8.2 Wide Body

11.4.8.3 Rotorcrafts

11.4.8.4 Business Jets

11.4.8.5 Turboprop

11.4.8.6 Others

11.4.9 Historic and Forecasted Market Size by Installation Type

11.4.9.1 New Installation

11.4.9.2 Retrofit

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Flight Data Recorder Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size by Type

11.5.4.1 Flight Data Recorder (FDR)

11.5.4.2 Cockpit Voice Recorder (CVR)

11.5.4.3 Quick Access Recorder (QAR)

11.5.5 Historic and Forecasted Market Size by Component

11.5.5.1 Memory Unit

11.5.5.2 Electronic Controller Board

11.5.5.3 Input Devices

11.5.5.4 Power Supply

11.5.5.5 Signal Beacon

11.5.5.6 Others

11.5.6 Historic and Forecasted Market Size by Function

11.5.6.1 Parametric Flight Data

11.5.6.2 Record Flight Crew Audio

11.5.6.3 Data Link Communication

11.5.6.4 Others

11.5.7 Historic and Forecasted Market Size by Recording Time

11.5.7.1 Above 20 Hours

11.5.7.2 2 – 20 Hours

11.5.7.3 Up to 2 Hours

11.5.8 Historic and Forecasted Market Size by Aircraft Type

11.5.8.1 Narrow Body

11.5.8.2 Wide Body

11.5.8.3 Rotorcrafts

11.5.8.4 Business Jets

11.5.8.5 Turboprop

11.5.8.6 Others

11.5.9 Historic and Forecasted Market Size by Installation Type

11.5.9.1 New Installation

11.5.9.2 Retrofit

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Flight Data Recorder Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size by Type

11.6.4.1 Flight Data Recorder (FDR)

11.6.4.2 Cockpit Voice Recorder (CVR)

11.6.4.3 Quick Access Recorder (QAR)

11.6.5 Historic and Forecasted Market Size by Component

11.6.5.1 Memory Unit

11.6.5.2 Electronic Controller Board

11.6.5.3 Input Devices

11.6.5.4 Power Supply

11.6.5.5 Signal Beacon

11.6.5.6 Others

11.6.6 Historic and Forecasted Market Size by Function

11.6.6.1 Parametric Flight Data

11.6.6.2 Record Flight Crew Audio

11.6.6.3 Data Link Communication

11.6.6.4 Others

11.6.7 Historic and Forecasted Market Size by Recording Time

11.6.7.1 Above 20 Hours

11.6.7.2 2 – 20 Hours

11.6.7.3 Up to 2 Hours

11.6.8 Historic and Forecasted Market Size by Aircraft Type

11.6.8.1 Narrow Body

11.6.8.2 Wide Body

11.6.8.3 Rotorcrafts

11.6.8.4 Business Jets

11.6.8.5 Turboprop

11.6.8.6 Others

11.6.9 Historic and Forecasted Market Size by Installation Type

11.6.9.1 New Installation

11.6.9.2 Retrofit

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Flight Data Recorder Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size by Type

11.7.4.1 Flight Data Recorder (FDR)

11.7.4.2 Cockpit Voice Recorder (CVR)

11.7.4.3 Quick Access Recorder (QAR)

11.7.5 Historic and Forecasted Market Size by Component

11.7.5.1 Memory Unit

11.7.5.2 Electronic Controller Board

11.7.5.3 Input Devices

11.7.5.4 Power Supply

11.7.5.5 Signal Beacon

11.7.5.6 Others

11.7.6 Historic and Forecasted Market Size by Function

11.7.6.1 Parametric Flight Data

11.7.6.2 Record Flight Crew Audio

11.7.6.3 Data Link Communication

11.7.6.4 Others

11.7.7 Historic and Forecasted Market Size by Recording Time

11.7.7.1 Above 20 Hours

11.7.7.2 2 – 20 Hours

11.7.7.3 Up to 2 Hours

11.7.8 Historic and Forecasted Market Size by Aircraft Type

11.7.8.1 Narrow Body

11.7.8.2 Wide Body

11.7.8.3 Rotorcrafts

11.7.8.4 Business Jets

11.7.8.5 Turboprop

11.7.8.6 Others

11.7.9 Historic and Forecasted Market Size by Installation Type

11.7.9.1 New Installation

11.7.9.2 Retrofit

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

|

Global Flight Data Recorder Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.74 Bn. |

|

Forecast Period 2025-32 CAGR: |

4.4% |

Market Size in 2032: |

USD 2.46 Bn. |

|

Segments Covered: |

By Type

|

|

|

|

By Component |

|

||

|

By Function |

|

||

|

By Recording Time |

|

||

|

By Aircraft Type |

|

||

|

By Installation Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||