Fifth-Party Logistics Market Synopsis

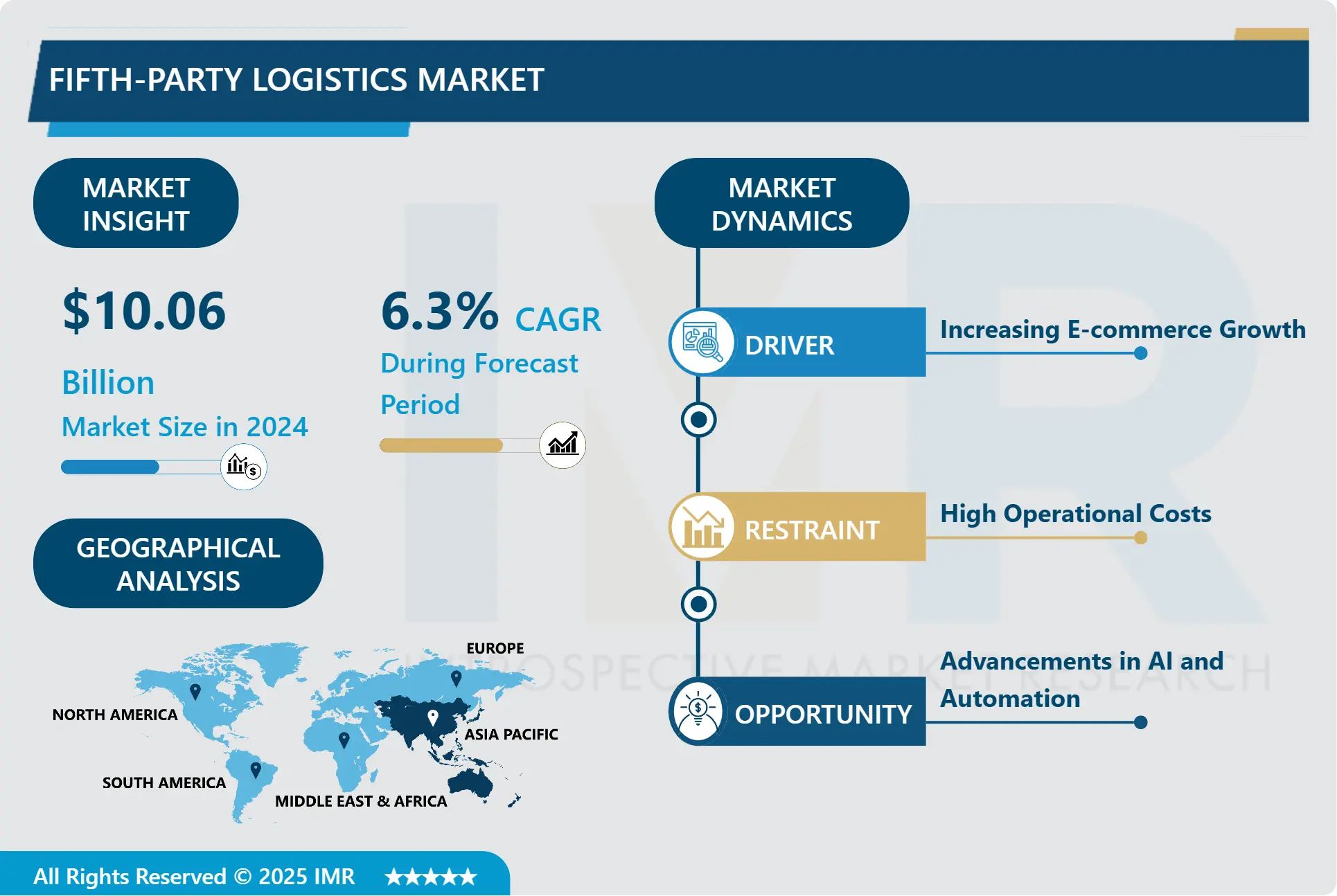

Fifth-Party Logistics Market Size Was Valued at USD 10.06 Billion in 2024 and is Projected to Reach USD 16.4 Billion by 2032, Growing at a CAGR of 6.3% From 2025-2032.

The global Fifth-Party Logistics (5PL) market represents an advanced echelon in the logistics and supply chain management spectrum, encompassing comprehensive supply chain solutions that integrate and optimize the functions of 3PL (third-party logistics) and 4PL (fourth-party logistics) providers. A 5PL provider acts as a logistics aggregator, orchestrating and managing a wide array of services through advanced IT solutions and technologies. This market is particularly characterized by its ability to consolidate services such as warehousing, transportation, inventory management, and reverse logistics into a seamless, technology-driven platform. The adoption of 5PL solutions is gaining traction as businesses seek more strategic and holistic approaches to managing their increasingly complex and global supply chains.

In the overall ecosystem, 5PL providers play a pivotal role by leveraging cutting-edge technologies like artificial intelligence (AI), Internet of Things (IoT), big data analytics, and blockchain. These technologies enable real-time visibility, predictive analytics, and enhanced decision-making capabilities, thus ensuring more efficient and resilient supply chain operations. For example, AI and machine learning can predict demand fluctuations, optimize route planning, and reduce operational costs, while blockchain ensures transparency and traceability throughout the supply chain. This technological integration enhances operational efficiency and gives companies the agility to adapt to dynamic market conditions and consumer demands.

The benefits of the 5PL market to the industry are multifaceted. By offering an integrated approach to supply chain management, 5PL providers enable businesses to focus on their core competencies while outsourcing complex logistics functions. This not only reduces operational costs but also mitigates risks associated with logistics and supply chain disruptions. Furthermore, 5PL solutions facilitate scalability, allowing companies to expand their operations without the need for substantial capital investment in logistics infrastructure. Additionally, by utilizing advanced data analytics, companies can gain deeper insights into their supply chain performance, leading to continuous improvement and innovation in their logistics processes.

In conclusion, the global 5PL market is instrumental in shaping the future of logistics and supply chain management. By providing a comprehensive, technology-driven solution, 5PL providers help businesses navigate the complexities of modern supply chains, enhance their operational efficiency, and remain competitive in a fast-paced global market. The integration of advanced technologies ensures that supply chains are not only more efficient and cost-effective but also more resilient and adaptable to change. As the demand for more sophisticated logistics solutions continues to grow, the 5PL market is poised to play an increasingly vital role in driving the success and sustainability of businesses across various industries.

Fifth-Party Logistics Market Trend Analysis

Fifth-Party Logistics Market Growth Driver- Integration of Advanced Technologies

- The integration of advanced technologies such as Artificial Intelligence (AI), Internet of Things (IoT), and blockchain is revolutionizing the Fifth-Party Logistics (5PL) market. AI-driven algorithms are optimizing supply chain operations by predicting demand, managing inventory levels, and streamlining transportation routes. This leads to increased efficiency, reduced costs, and improved customer satisfaction. IoT devices provide real-time data on the condition and location of goods, enabling better tracking and monitoring throughout the supply chain. These technological advancements are crucial for handling the complexities of modern logistics networks.

- Blockchain technology is enhancing transparency and security in the logistics industry. By providing a decentralized and immutable ledger, blockchain ensures the integrity of transactions and facilitates trust among all parties involved. This is particularly beneficial for 5PL providers who manage multi-party logistics networks. Smart contracts, enabled by blockchain, automate various processes such as payments and customs clearance, further reducing delays and errors. The adoption of these technologies is driving the evolution of 5PL services, making them more reliable and efficient.

- Additionally, the use of data analytics is becoming increasingly important for 5PL providers. Big data analytics allows for the processing of vast amounts of information to uncover patterns and insights that can improve decision-making. Predictive analytics helps in anticipating market trends, potential disruptions, and customer needs. This proactive approach is essential for maintaining a competitive edge in the dynamic logistics market. Overall, the integration of advanced technologies is a key trend that is shaping the future of the global 5PL market.

Fifth-Party Logistics Market Opportunity- Emphasis on Sustainability and Green Logistics

- Sustainability is becoming a major focus in the Fifth-Party Logistics sector as companies and consumers alike prioritize environmentally friendly practices. 5PL providers are increasingly adopting green logistics strategies to reduce their carbon footprint and promote sustainable supply chain operations. This includes the use of energy-efficient transportation modes, such as electric vehicles and hybrid trucks, as well as optimizing delivery routes to minimize fuel consumption and emissions. The push for sustainability is driven by both regulatory requirements and the growing demand from eco-conscious consumers.

- Moreover, green warehousing practices are being implemented to further enhance sustainability. These practices involve the use of energy-efficient lighting, temperature control systems, and renewable energy sources like solar panels. Additionally, 5PL providers are focusing on waste reduction through recycling programs and sustainable packaging solutions. By adopting these practices, logistics companies can significantly decrease their environmental impact while also reducing operational costs. Sustainability initiatives are becoming a key differentiator in the competitive 5PL market, attracting clients who prioritize green logistics.

- Another aspect of sustainability in 5PL is the promotion of a circular economy. This involves designing supply chains that facilitate the reuse, refurbishment, and recycling of products and materials. Reverse logistics, which manages the return and disposal of goods, plays a critical role in this process. By efficiently handling returns and recycling, 5PL providers can help their clients reduce waste and recover value from used products. This not only supports environmental sustainability but also enhances the overall efficiency and profitability of supply chain operations. The emphasis on sustainability is a significant trend that is driving innovation and transformation in the global 5PL market.

Fifth-Party Logistics Market Segment Analysis:

Fifth-Party Logistics Market is segmented based on Type and Application

By Type, Transportation Segment is Expected to Dominate the Market During the Forecast Period

- The transportation segment is anticipated to dominate the Global Fifth-Party Logistics (5PL) market due to the increasing demand for efficient and cost-effective movement of goods. The rise of e-commerce has significantly boosted the need for robust transportation solutions to ensure the timely delivery of products to end customers. Furthermore, globalization has expanded the reach of businesses, necessitating advanced logistics strategies to manage cross-border shipments. The integration of technology, such as GPS tracking and real-time data analytics, has also enhanced the efficiency and reliability of transportation services, making them more attractive to companies looking to streamline their supply chains.

- Moreover, transportation services within the 5PL market are increasingly focusing on sustainability and reducing carbon footprints. Companies are investing in eco-friendly vehicles and alternative fuel sources to comply with stringent environmental regulations and meet consumer demand for greener operations. This emphasis on sustainable practices not only aligns with global environmental goals but also presents a competitive advantage for 5PL providers. As businesses and consumers become more environmentally conscious, the transportation segment is poised to capture a significant share of the 5PL market by offering innovative and sustainable logistics solutions.

By Application, E-commerce Segment Held the Largest Share

- E-commerce has emerged as the dominant application segment in the Global Fifth-Party Logistics (5PL) market, driven by the exponential growth of online shopping. The convenience of purchasing products online, coupled with the increasing penetration of smartphones and internet connectivity, has revolutionized the retail landscape. E-commerce platforms require highly efficient logistics solutions to manage high volumes of orders, quick turnaround times, and seamless last-mile delivery. As a result, 5PL providers are increasingly collaborating with e-commerce companies to offer integrated logistics solutions that enhance customer satisfaction and operational efficiency.

- Additionally, the COVID-19 pandemic has accelerated the shift towards online shopping, further solidifying the dominance of the e-commerce segment in the 5PL market. With physical stores temporarily closed or operating under restrictions, consumers turned to online platforms for their shopping needs. This surge in online orders has necessitated sophisticated logistics networks capable of handling large-scale distribution and delivery operations. E-commerce companies are now investing heavily in advanced logistics technologies and partnering with 5PL providers to maintain their competitive edge and meet the rising expectations of customers for fast and reliable delivery services.

Fifth-Party Logistics Market Regional Insights:

Asia-Pacific Region is Expected to Dominate the Market Over the Forecast Period

- The Asia-Pacific region is anticipated to lead the global Fifth-Party Logistics (5PL) market due to its rapid economic growth and robust industrialization. Countries like China, India, and Japan are major manufacturing hubs with extensive supply chain networks, creating a substantial demand for advanced logistics solutions. The region's burgeoning e-commerce sector further drives the need for 5PL services, as businesses seek more efficient and integrated logistics solutions to handle increased online shopping and cross-border trade. Additionally, favorable government policies promoting infrastructure development and technological advancements in logistics are significant contributors to the region's dominance.

- Another critical factor is the increasing adoption of technology and automation within the Asia-Pacific logistics sector. Companies are leveraging big data, AI, IoT, and blockchain to optimize supply chain operations, enhance transparency, and improve decision-making processes. The integration of these technologies allows for more efficient route planning, inventory management, and real-time tracking, which are essential for 5PL providers to deliver value-added services. The competitive landscape in the region is also driving innovation, with many logistics firms investing heavily in research and development to stay ahead of market demands and maintain a competitive edge.

- Moreover, the strategic geographical location of the Asia-Pacific region plays a pivotal role in its market dominance. Situated at the crossroads of major global trade routes, the region serves as a critical logistics hub, facilitating the seamless flow of goods between the East and the West. This geographic advantage, combined with the presence of major ports and well-developed transportation infrastructure, enhances the efficiency of logistics operations. As global trade volumes continue to rise, the Asia-Pacific region's strategic importance in the global supply chain is expected to grow, further solidifying its position as the leading market for Fifth-Party Logistics.

Active Key Players in the Fifth-Party Logistics Market

- Toll Holdings Limited (Australia)

- Deloitte (United States)

- Maine Pointe (United States)

- MGL Global Logistics (United States)

- DHL International (Germany)

- McKinsey & Company (United States)

- Boston Consulting Group (BCG) (United States)

- Renaissance Network Reinvent (United States)

- Bain & Company Inc. (United States)

- Other Active Players

Key Industry Developments in the Fifth-Party Logistics Market

- In April 2023, Toll Group announced the opening of a new healthcare warehouse and distribution facility in the Brisbane suburb of Richlands. The cutting-edge facility is an A$10 million investment over the next ten years that will support the delivery of patient-critical healthcare products to Queensland communities.

|

Global Fifth-Party Logistics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 10.06 Bn. |

|

Forecast Period 2025-32 CAGR: |

6.3% |

Market Size in 2032: |

USD 16.4 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Fifth-Party Logistics Market by Type (2018-2032)

4.1 Fifth-Party Logistics Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Transportation

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Warehousing

4.5 Other

Chapter 5: Fifth-Party Logistics Market by Application (2018-2032)

5.1 Fifth-Party Logistics Market Snapshot and Growth Engine

5.2 Market Overview

5.3 E-commerce

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Traders

5.5 Logistics company

5.6 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Fifth-Party Logistics Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 TOLL HOLDINGS LIMITED (AUSTRALIA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 DELOITTE (UNITED STATES)

6.4 MAINE POINTE (UNITED STATES)

6.5 MGL GLOBAL LOGISTICS (UNITED STATES)

6.6 DHL INTERNATIONAL (GERMANY)

6.7 MCKINSEY & COMPANY (UNITED STATES)

6.8 BOSTON CONSULTING GROUP (BCG) (UNITED STATES)

6.9 RENAISSANCE NETWORK REINVENT (UNITED STATES)

6.10 BAIN & COMPANY INC. (UNITED STATES)

6.11 OTHER KEY PLAYERS

Chapter 7: Global Fifth-Party Logistics Market By Region

7.1 Overview

7.2. North America Fifth-Party Logistics Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Transportation

7.2.4.2 Warehousing

7.2.4.3 Other

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 E-commerce

7.2.5.2 Traders

7.2.5.3 Logistics company

7.2.5.4 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Fifth-Party Logistics Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Transportation

7.3.4.2 Warehousing

7.3.4.3 Other

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 E-commerce

7.3.5.2 Traders

7.3.5.3 Logistics company

7.3.5.4 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Fifth-Party Logistics Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Transportation

7.4.4.2 Warehousing

7.4.4.3 Other

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 E-commerce

7.4.5.2 Traders

7.4.5.3 Logistics company

7.4.5.4 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Fifth-Party Logistics Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Transportation

7.5.4.2 Warehousing

7.5.4.3 Other

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 E-commerce

7.5.5.2 Traders

7.5.5.3 Logistics company

7.5.5.4 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Fifth-Party Logistics Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Transportation

7.6.4.2 Warehousing

7.6.4.3 Other

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 E-commerce

7.6.5.2 Traders

7.6.5.3 Logistics company

7.6.5.4 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Fifth-Party Logistics Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Transportation

7.7.4.2 Warehousing

7.7.4.3 Other

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 E-commerce

7.7.5.2 Traders

7.7.5.3 Logistics company

7.7.5.4 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Fifth-Party Logistics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 10.06 Bn. |

|

Forecast Period 2025-32 CAGR: |

6.3% |

Market Size in 2032: |

USD 16.4 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||