Fermented Food and Ingredients Market Overview

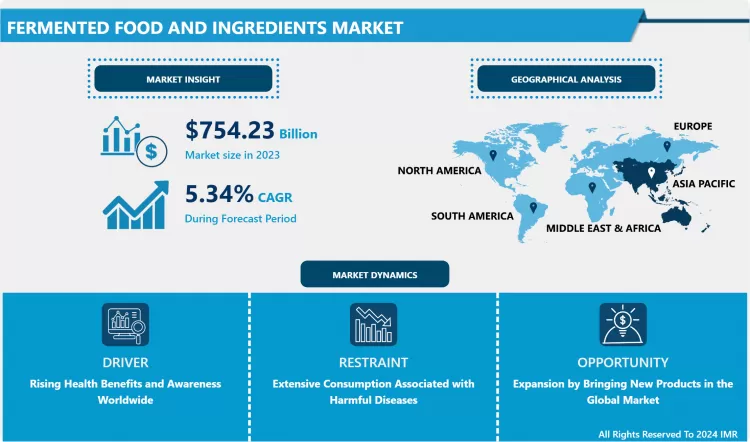

Global market for Fermented Food and Ingredients valued at USD 754.23 Billion in 2023 is projected to reach a revised size of USD 1,204 Billion by 2032, growing at a CAGR of 5.34 % from 2024-2032.

- Fermented Food and Ingredients are products which go through desired microbial action that helps in enhancing their quality and nutritional value. The fermented food and ingredients market include a wide range of food type such as fermented confectionary, fermented beverages, fermented dairy, and bakery products. The increasing prevalence of obesity and digestive problems among the consumers in developing economies is expected to propel the demand for fermented food and ingredients. The increasing use of fermented food worldwide owing to their rising demand, supported by consumer perceptions of fermentation process is the key factor that is expected to boost the market growth.

- Amino acid represents the most vital ingredient in the fermented food and ingredients market. During the forecast period, ingredient areas, such organic acid and industrial enzyme are expected to attain the maximum growth, owing to the huge possibilities of value addition in these ingredient areas. Fermented food and ingredients help in enhancing the quality and texture of food products and are used to add flavour and improve the properties of food products and supplements, which is further estimated to boost the market growth in the projected years.

Market Dynamics And Factors For Fermented Food And Ingredients Market

Drivers:

Rising Health Benefits and Awareness Worldwide

- Fermented food and ingredients market are majorly driven by the consumer’s preference towards the healthy, chemical free and nutritious food and beverage products and growing awareness of natural and organic food products. Various health benefits such as improved human digestive system, increased immunity and brain functions are anticipated to boost the rapid rise in growth of the market. In addition to this, appropriate consumption of Fermented Food and Ingredients can improve the digestion process, prevent the number of diseases such as liver disease, arthritis, pylori infection, lactose intolerance and can also reduce social anxiety. Also, fermented food are presumed to be the fully organic food owing to the presence of bio preservatives and probiotics, and the awareness regarding all these health benefits are driving the market growth of the fermented food and ingredients.

Restraints:

Extensive Consumption Associated with Harmful Disease

- During the fermentation process, microorganisms produce a bioproduct which sometimes has a negative impact on the body. For instance, excessive consumption of fermented soy food can inflate the risk of gastric cancer, further inhibiting the market growth of fermented food and ingredients market. Moreover, the fermentation process also produces Ammonia which is harmful to the human body in some cases. Such harmful diseases due to the extensive consumption of fermented food and ingredients is one of the major challenges and restraint which hinders market growth.

Opportunity:

Expansion Scope by Bringing New Products in the Global Market

- Many consumers in the regional and global market seek for new and innovative products that fit all their health-related requirements. With this changing shift in eating habits, manufacturers of fermented food and ingredients industries are innovating and developing new products and expanding in the market so as to increase the market growth. Such an expansion through introducing new products in the global market is fairly estimated to provide growth opportunities in forecasted years. Since the adoption of fermented food is growing fast globally, the key players of fermented food have a better opportunity to offer fermented food in more and more geographical territories. Fermented food are used for the varied applications and can be further used in different industries which can increase the end-use of the fermented food. Henceforth, manufacturers have a better opportunity to gain potential growth in the fermented food and ingredients market globally over the projected period.

Segmentation Analysis Of Fermented Food And Ingredients Market

- By Food Type, the fermented beverages segment is expected to dominate the fermented food and ingredient market in the upcoming years. It is also one of the fastest growing markets in the recent years. Rising consumption of fermented beverages such as beer is estimated to drive the market growth over the projected period. Additionally, the sedentary lifestyle, changing eating habits and dietary patterns have fueled the market growth of this segment.

- By Ingredient Type, the Amino acid segment is anticipated to dominate the market in the upcoming years. The increasing need among food and beverage industries to enhance quality, texture and flavor of the food products has led to an increase in utilization of fermented amino acids. These are widely used for the production of beverages and dairy products. In addition, the changing preference for high protein diets among the health-conscious people is driving the amino acid market segment.

- By Distribution Channel, the Online stores segment holds the largest share and is one of the fastest growing segments in fermented food and ingredients market. E-commerce retails are witnessing a rise in demand and growth for fermented food and beverages owing to the rising rate of internet penetration in various developing countries. Furthermore, the cash-on-delivery as well as online payment mode and favorable discounts provided by stores has enabled many consumers to switch to online stores for buying fermented food and beverages.

Regional Analysis Of Fermented Food And Ingredients Market

- The Asia Pacific region is expected to hold the largest share and dominate the fermented food and ingredients market in the projected period. The major key players utilize fermented ingredients in their food manufacturing process for preservation, sensorial and textural properties of food products. The availability of milk in an abundant amount from various parts of Asian Pacific region such as China and India have prominently increased the growth of bakery and dairy sector. The rising population, evolving lifestyle and trends, changing meal and diet patterns and enhanced agricultural growth in various parts of this region have led to a huge growth of the Fermented Food and Ingredients industry and is further expected to witness various opportunities in the region’s market. Additionally, increasing purchase power and advancements in the food and beverages industry is also estimated to drive the market growth of the fermented food and ingredients market over the projected period.

- The European region is dominating the fermented food and ingredients market and is expected to continue its dominance in the forecasted years. The increasing demand for fermented ingredients in the pharmaceutical industry is the key factor that is contributing to the growth of the market. The growing utilization of fermented ingredients in animal feed, along with significant research and development (R&D) activities, are estimated to drive the market growth. Rising health consciousness among the consumers regarding the health benefits of consuming fermented food products is boosting the market growth.

- North America is expected to witness a rapid growth in fermented food and ingredients market over the forecasted period. Increased demand for healthy and nutritious food and beverage products is expected to drive the rapid growth. Additionally, the advancements in biopharmaceutical industry, launch of enhanced products and increasing innovations in the taste, color, texture and flavor of the products is expected to drive the market growth in the North American region. Furthermore, growing preference for high protein diet among the consumers who are health conscious, leads to an increase in revenue and profit margins for the fermented food and ingredients market in North America.

Top Key Players Covered In Fermented Food And Ingredients Market

- Archer Daniels Midland Company (US)

- Ajinomoto Inc. (Japan)

- Angel YeastCo. Ltd. (China)

- Cargill Inc (US)

- CHR Hansen (Denmark)

- CSK Food Enrichment (Netherlands)

- Danone S.A (France)

- Dohler GmbH (Germany)

- General Mills In (US)

- Kerry Group (Ireland)

- KeVit (India)

- NestléS.A (Switzerland)

- Novozymes A/S (Denmark)

- Royal FrieslandCampina N.V (Netherlands)

- Tetra Pak International S.A (Switzerland), and other major players.

Key Industry Development In The Fermented Food And Ingredients Market:

-

In February 2024, Evonik announced a partnership with Jland Biotech to bring vegan collagen to the cosmetics market. This collaboration enabled Evonik to offer commercial quantities of high-quality collagen tailored for skincare applications, including anti-aging and hydrating creams. The partnership combined Evonik's expertise in advanced ingredient development with Jland Biotech's innovative collagen technology. By leveraging sustainable and animal-free processes, the venture addressed the growing consumer demand for ethical and effective skincare solutions.

-

In June 2024, Lesaffre, a global leader in fermentation and microorganisms, announced the acquisition of dsm-firmenich's yeast extract business. This strategic move reinforces Lesaffre’s presence in the savory ingredients market. dsm-firmenich, renowned for its innovations in nutrition, health, and beauty, transferred its yeast extract operations to Lesaffre as part of the transaction. The acquisition aligns with Lesaffre's commitment to providing high-quality, sustainable solutions in food and nutrition. By integrating dsm-firmenich's expertise, Lesaffre aims to strengthen its product portfolio and expand its reach in the global market.

|

Fermented Food and Ingredients Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 754.23 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.34 % |

Market Size in 2032: |

USD 1,204 Bn. |

|

Segments Covered: |

By Food Type |

|

|

|

By Ingredient Type |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Fermented Food and Ingredients Market by Food Type (2018-2032)

4.1 Fermented Food and Ingredients Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Fermented Dairy Products

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Fermented Beverages

Chapter 5: Fermented Food and Ingredients Market by Ingredient Type (2018-2032)

5.1 Fermented Food and Ingredients Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Organic acids

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Amino acids

5.5 Industrial enzymes

Chapter 6: Fermented Food and Ingredients Market by Distribution Channel (2018-2032)

6.1 Fermented Food and Ingredients Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Online stores

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Supermarkets

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Fermented Food and Ingredients Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ASHLANDINC. (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BASF SE(GERMANY)

7.4 CARGILL INC. (US)

7.5 CP KELCO (US)

7.6 DOWDUPONT INC. (US)

7.7 HYDROSOL GMBH & CO. KG(GERMANY)

7.8 INGREDION INC. (US)

7.9 KERRY GROUP PLC (IRELAND)

7.10 NEXIRA (NORMANDIE)

7.11 PALSGAARD A/S (DENMARK)

7.12 TATE & LYLE PLC (UK)

7.13 GLANBIAPLC (IRELAND)

7.14 ADVANCED FOOD SYSTEMS INC (NEW JERSEY)

7.15 CHEMELCO (NETHERLANDS)

7.16 ASSOCIATED BRITISH FOODS PLC (UK)

7.17

Chapter 8: Global Fermented Food and Ingredients Market By Region

8.1 Overview

8.2. North America Fermented Food and Ingredients Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Food Type

8.2.4.1 Fermented Dairy Products

8.2.4.2 Fermented Beverages

8.2.5 Historic and Forecasted Market Size by Ingredient Type

8.2.5.1 Organic acids

8.2.5.2 Amino acids

8.2.5.3 Industrial enzymes

8.2.6 Historic and Forecasted Market Size by Distribution Channel

8.2.6.1 Online stores

8.2.6.2 Supermarkets

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Fermented Food and Ingredients Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Food Type

8.3.4.1 Fermented Dairy Products

8.3.4.2 Fermented Beverages

8.3.5 Historic and Forecasted Market Size by Ingredient Type

8.3.5.1 Organic acids

8.3.5.2 Amino acids

8.3.5.3 Industrial enzymes

8.3.6 Historic and Forecasted Market Size by Distribution Channel

8.3.6.1 Online stores

8.3.6.2 Supermarkets

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Fermented Food and Ingredients Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Food Type

8.4.4.1 Fermented Dairy Products

8.4.4.2 Fermented Beverages

8.4.5 Historic and Forecasted Market Size by Ingredient Type

8.4.5.1 Organic acids

8.4.5.2 Amino acids

8.4.5.3 Industrial enzymes

8.4.6 Historic and Forecasted Market Size by Distribution Channel

8.4.6.1 Online stores

8.4.6.2 Supermarkets

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Fermented Food and Ingredients Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Food Type

8.5.4.1 Fermented Dairy Products

8.5.4.2 Fermented Beverages

8.5.5 Historic and Forecasted Market Size by Ingredient Type

8.5.5.1 Organic acids

8.5.5.2 Amino acids

8.5.5.3 Industrial enzymes

8.5.6 Historic and Forecasted Market Size by Distribution Channel

8.5.6.1 Online stores

8.5.6.2 Supermarkets

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Fermented Food and Ingredients Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Food Type

8.6.4.1 Fermented Dairy Products

8.6.4.2 Fermented Beverages

8.6.5 Historic and Forecasted Market Size by Ingredient Type

8.6.5.1 Organic acids

8.6.5.2 Amino acids

8.6.5.3 Industrial enzymes

8.6.6 Historic and Forecasted Market Size by Distribution Channel

8.6.6.1 Online stores

8.6.6.2 Supermarkets

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Fermented Food and Ingredients Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Food Type

8.7.4.1 Fermented Dairy Products

8.7.4.2 Fermented Beverages

8.7.5 Historic and Forecasted Market Size by Ingredient Type

8.7.5.1 Organic acids

8.7.5.2 Amino acids

8.7.5.3 Industrial enzymes

8.7.6 Historic and Forecasted Market Size by Distribution Channel

8.7.6.1 Online stores

8.7.6.2 Supermarkets

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Fermented Food and Ingredients Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 754.23 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.34 % |

Market Size in 2032: |

USD 1,204 Bn. |

|

Segments Covered: |

By Food Type |

|

|

|

By Ingredient Type |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Fermented Food and Ingredients Market research report is 2024-2032.

Archer Daniels Midland Company (US), Ajinomoto Inc. (Japan), Angel Yeast Co. Ltd. (China), Cargill Inc (US), CHR Hansen (Denmark), and other major players.

The Fermented Food and Ingredients Market is segmented food type, ingredient type, distribution channel and region. By Food type, the market is categorized into fermented dairy products and fermented beverages. By Ingredient type, the market is categorized into organic acids, amino acids and industrial enzymes. By Distribution channel, the market is categorized into online stores and supermarkets. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Fermented Food and Ingredients are natural or synthetic products that can be utilized in seeds, plants, and soil to enhance the growth of the plant, by declining the need for fertilizers. These products are resistant to water, and abiotic stresses of plants which drives the market growth of Fermented Food and Ingredients.

Global market for Fermented Food and Ingredients valued at USD 754.23 Billion in 2023 is projected to reach a revised size of USD 1,204 Billion by 2032, growing at a CAGR of 5.34 % from 2024-2032.