Natural and Organic Ingredients Market Synopsis

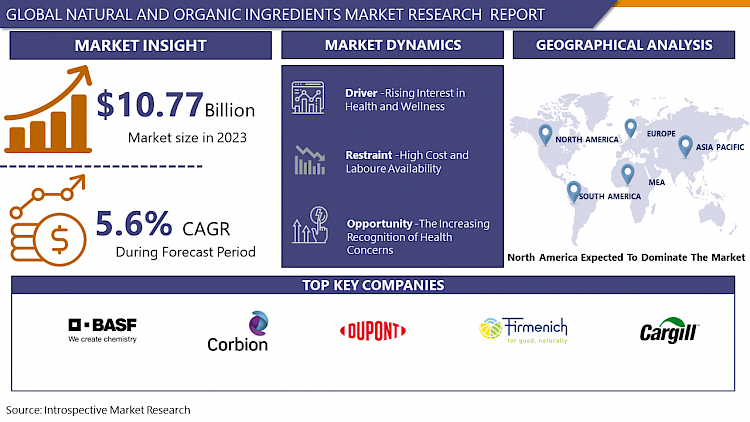

Natural and Organic Ingredients Market Size Was Valued at USD 10.77 Billion in 2023, and is Projected to Reach USD 17.59 Billion by 2032, Growing at a CAGR of 5.6% From 2024-2032.

Items created entirely of natural substances without the use of artificial additives are referred to as natural organic products. Natural and organic ingredients are derived from plants, minerals, or animals and go through little processing to stay true to their original form.

- Organic and natural ingredient refers to crops that are regularly grown in accordance with guidelines established by organisations that certify organic products; these guidelines usually forbid the use of chemical fertilisers, genetically modified organisms, and synthetic pesticides. Because of its supposed cleanliness, ease of access, and low environmental impact, it is well-respected.

- The food industry is finding the integrated criterion more and more valuable, as the cosmetics and personal care industries. The main reasons why consumers are incline to these items are their possible health benefits and minimal probability of encountering unpleasant side effects when compared to products created with chemicals. Using organically grown fruits and vegetables for their chemical-free benefits and aloe vera and camomile for their skin-healing capabilities would be considered desirable attributes.

- Using organic and natural components in production reduces carbon footprints, improves soil health and ecosystems, and supports sustainable farming methods. The general societal trend towards adopting a better lifestyle and emphasising eco-friendly items is believed to be the cause of the move towards natural/organic products.

Natural and Organic Ingredients Market Trend Analysis:

Rising Interest in Health and Wellness

- Encouraging a healthy way of living. Consumers might think that these substances are devoid of possibly dangerous synthetic additives and contain higher amounts of essential elements. Customers are placing more and more value on reading labels and being transparent about brands. In the "clean eating" movement, which promotes natural, unprocessed meals, organic goods are typically recommended.

- Consumers are looking for natural components in personal care products that are healthy and friendly for their skin and hair. People are choosing more and more products that promote ethical sources and sustainable methods because of growing environmental consciousness.

- In comparison to traditionally manufactured goods, the production of natural and organic ingredients frequently complies with higher environmental standards, making them a potentially more sustainable option. This shift is being caused by an increase in conscientious customers who are aware of the risks that artificial additives and chemicals pose to their health.

Restraints

High Cost and Laboure Availability

- Organic and natural farming techniques naturally come with higher costs compared to conventional practices. Multiple factors contribute to this, such as the reliance on manual labour in organic and natural farming for activities such as weeding and pest management, as opposed to conventional agriculture which uses artificial herbicides and pesticides. This raises the expenses for labour connected with organic and natural farming.

- Price sensitivity is not solely determined by the outright price. Accessibility also has a vital role. Limited availability of natural and organic products in regular stores can lead consumers to search for them in specialty stores, which may have higher prices. Broadening distribution avenues by incorporating supermarkets and online vendors may enhance availability and potentially expose these goods to a larger, more cost-conscious.

- The presence and cost of natural and organic ingredients may differ depending on the location. Certain regions may have more organic farms or improved transportation systems that result in reduced costs. Producers and sellers could consider focused marketing and distribution tactics to enhance availability in areas where cost may be a major issue. Producers can offer details on the cost breakdown of manufacturing and obtaining organic ingredients. This level of openness allows consumers to comprehend the rationale for the higher price and builds confidence in the brand. Price sensitivity had a great impact on over all sales of the organic and natural ingredients.

Opportunity

The Increasing Recognition of Health Concerns

- Consumers are always looking for ways to stay healthy, and they often think that consuming natural and organic goods would help them do so. Fruits, vegetables, and whole grains are common natural ingredient sources that provide vitamins, minerals, and antioxidants thought to have health benefits.

- It creates a need for natural and organic ingredients in different regions, not only in developed nations. consumers with expanding middle classes are placing more importance on health and are ready to spend extra on natural and organic products. This shift is greatly influencing the worldwide natural and organic ingredients market in a variety of ways.

- The natural and organic ingredients market has significant growth potential due to increased awareness of health issues. For instance, when the consumer learns about the connection between eating habits and health outcomes, they start seeking out items that promote health benefits without any negative effects on health. Rising consciousness is a result of easy information access online, the impact of social media, and exaggerated promotions for natural and organic goods. With Increasing Recognition of health Awareness leads to market expansion of the organic and natural ingredient market.

Challenges

Raw Material and Product Availability

- Ingredients that are found in nature are naturally prone to spoilage and contamination. Robust protocols are needed to maintain consistent quality during sourcing, processing, and storage, unlike synthetic products that have longer shelf lives. This requires careful examination procedures, appropriate storage facilities, and strict testing processes to uphold the integrity and effectiveness of the ingredients. Small changes in how products are handled or stored can impact their quality and may result in recalls.

- Ingredients sourced from nature may vary in strength and content because of factors such as climate, soil conditions, and the specific plant part utilized. Creating a uniformity in these components for commercial product usage poses a distinct difficulty.

- Due to the increase in the natural and organic trend, certain companies have turned to deceptive "greenwashing" tactics. This misleading strategy involves utilizing deceptive labels or ambiguous terms such as "natural" without following strict guidelines or certifications. This doesn't just cause confusion for customers but also undermines confidence in the entire industry

Natural and Organic Ingredients Market Segment Analysis:

Natural and Organic Ingredients market is segmented on the basis of Type, Form, Source, Application, Distribution Channel, and Region

By Type, Natural Ingredients (Plant Based) Segment Is Expected to Dominate the Market During the Forecast Period

- One notable leader in the expanding global industry for natural and organic products is plant-based ingredients. More emphasis is being placed by consumers on holistic wellness and preventive health, and they are searching for natural substances that they think to have more nutritional value.

- In addition to appearance, plant-based ingredients provide important functional advantages. For instance, fruits and vegetables typically have a high amount of fibre, whereas herbs and botanicals may provide specific health benefits such as additional antioxidants. The realm of skincare and beauty products is also greatly impacted by the plant-based movement. Botanical extracts from different plants offer natural options instead of artificial chemicals.

- Plant-derived ingredients provide exceptional flexibility, effortlessly blending into diverse sectors and uses. In the food and beverage sector, a variety of products are built upon fruits, vegetables, and herbs. These components offer organic tastes, hues, and consistencies, enabling producers to develop a wide variety of choices to suit various consumer tastes. Plant Based segment is the main base for the organic and natural ingredients.

By Application, Food & Beverages Segment Held the Largest Share In 2023

- Baked goods bursting with the flavour of fresh fruit, drinks infused with plant extracts, and processed foods with a focus on natural ingredients. The vast array of food and drink items creates a significant demand for natural and organic ingredients. This is not limited to a particular target market.

- These components contain important nutrients such as Vitamin C, potassium, and magnesium, which naturally enhance the nutritional content of food and beverage items. The natural and organic ingredients are high in demand in F&B industry due to their innate nutritional benefits. Numerous natural components contain abundant antioxidants that combat free radicals, supporting cellular health and overall wellness. Emphasizing the antioxidant advantages boosts the attractiveness of using natural ingredients in F&B items, as consumers look for choices that support a healthier way of living.

- Numerous natural components contain abundant antioxidants that combat free radicals, supporting cellular health and overall wellness. Emphasizing the antioxidant advantages boosts the attractiveness of using natural ingredients in F&B items, as consumers look for choices that support a healthier way of living. A good health with fresh food, Fresh fruit, drinks with plant extracts, and processed foods with a focus on natural ingredients. Emphasises the demand of natural and organic ingredient in food and beverages Industry.

Natural and Organic Ingredients Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- People in the region are becoming more conscious about their health and are focusing on purchasing items containing natural or organic components. The increase in this trend is driven by a rising understanding of the possible negative effects of artificial components and a demand for items seen as being safer and more environmentally friendly. Which result as North America to positioned as dominating the natural and organic ingredients market in the upcoming years.

- North American consumers are willing to spend more on products that promote health benefits, are environmentally friendly, and are naturally produced. Because of this need, there has been an influx of natural and organic products in nearly every stage of production, particularly in the food, drink, personal care, and cosmetic sectors. Another reason for North America's strong market condition is the existence of favourable policies and a consistent market environment.

Source: vegetablegrowersnews

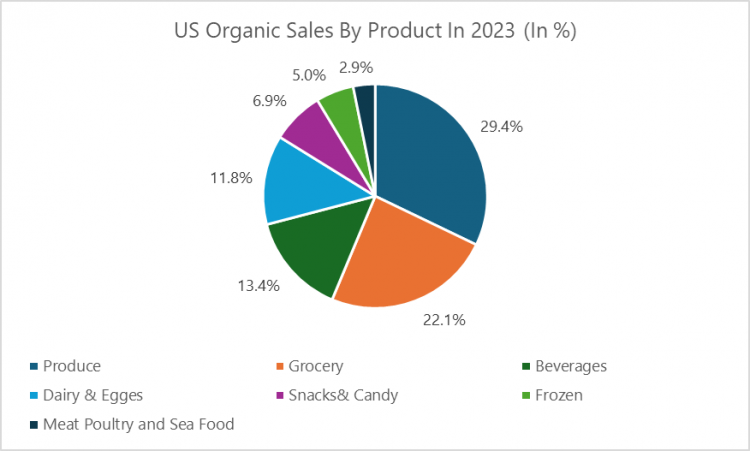

- In US Produce remained the top organic category, in produce is have 29.4% and grocery have 22.1%, Beverage has 13.4%, Dairy&Egges have 11.8%, Snacks&Candy have 6.9%, Frozen have 5.0%, meat poultry and sea food have 2.9% sales. which serving as the main introduction to the organic market for consumers. The consumer's desire for clean, healthy food is satisfied by organic produce, and the significance of organic's key advantage of no toxic synthetic pesticides becomes clear when purchasing organic berries or carrots, as stated in the release.

Natural and Organic Ingredients Market Active Players

- Archer Daniels Midland Company (USA)

- Cargill (USA)

- DuPont (USA)

- Ingredion Incorporated (USA)

- Sensient Technologies Corporation (USA)

- SunOpta Inc. (Canada)

- Associated British Foods plc (UK)

- Symrise AG (Germany)

- Tate & Lyle PLC (UK)

- BASF SE (Germany)

- Doehler GmbH (Germany)

- Naturex S.A. (France)

- Chr. Hansen Holding A/S (Denmark)

- Corbion N.V. (Netherlands)

- Firmenich International SA (Switzerland)

- Givaudan SA (Switzerland)

- Kerry Group (Ireland)

- Koninklijke DSM N.V. (Netherlands)

- Olam International Limited (Singapore)

- Royal Cosun (Netherlands), and Other Active Players

Key Industry Developments in the Natural and Organic Ingredients Market:

- In September 2023, Novozymes launched new bio solution to redefine the plant-based meat experience by enhancing texture and encouraging more consumers to choose plant-based alternatives.

- In January 2023, Friesland Campina formed a partnership with Triplebar Bio Inc., a specialty biotechnology company. The goal of this collaboration is to develop and scale up the synthesis of cell-based proteins by precision fermentation.

|

Global Natural and Organic Ingredients Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.77 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.6% |

Market Size in 2032: |

USD 17.59 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Source |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- NATURAL AND ORGANIC INGREDIENTS MARKET BY TYPE (2017-2032)

- NATURAL AND ORGANIC INGREDIENTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- NATURAL INGREDIENTS (PLANT-BASED INGREDIENTS (FRUITS, VEGETABLES, HERBS), ANIMAL-BASED, INGREDIENTS (DAIRY, HONEY), MINERAL-BASED INGREDIENTS (SALTS, CLAYS))

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- ORGANIC INGREDIENTS (CERTIFIED ORGANIC PLANT-BASED INGREDIENTS, CERTIFIED ORGANIC ANIMAL-BASED INGREDIENTS)

- NATURAL AND ORGANIC INGREDIENTS MARKET BY FORM (2017-2032)

- NATURAL AND ORGANIC INGREDIENTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- POWDER

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LIQUID

- CAPSULES & TABLETS

- OILS

- NATURAL AND ORGANIC INGREDIENTS MARKET BY SOURCE (2017-2032)

- NATURAL AND ORGANIC INGREDIENTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BOTANICAL EXTRACTS (HERBS AND SPICES, FLOWERS, LEAVES, ROOTS)

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MARINE EXTRACTS (ALGAE, SEAWEED, FISH OILS)

- MICROBIAL EXTRACTS (PROBIOTICS, YEASTS)

- ANIMAL DERIVATIVES (COLLAGEN, GELATIN)

- MINERALS (TRACE ELEMENTS, SALTS)

- SOURCEF

- NATURAL AND ORGANIC INGREDIENTS MARKET BY APPLICATION (2017-2032)

- NATURAL AND ORGANIC INGREDIENTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FOOD & BEVERAGES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COSMETICS & PERSONAL CARE

- PHARMACEUTICALS

- OTHERS (PET FOOD, AGRICULTURE)

- NATURAL AND ORGANIC INGREDIENTS MARKET BY DISTRIBUTION CHANNEL (2017-2032)

- NATURAL AND ORGANIC INGREDIENTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SUPERMARKETS/HYPERMARKETS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SPECIALTY STORES

- PHARMACIES/DRUGSTORES

- ONLINE SALES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- Natural and Organic Ingredients Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ARCHER DANIELS MIDLAND COMPANY (USA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ASSOCIATED BRITISH FOODS PLC (UK)

- BASF SE (GERMANY)

- CARGILL (USA)

- CHR. HANSEN HOLDING A/S (DENMARK)

- CORBION N.V. (NETHERLANDS)

- DOEHLER GMBH (GERMANY)

- DUPONT (USA)

- FIRMENICH INTERNATIONAL SA (SWITZERLAND)

- GIVAUDAN SA (SWITZERLAND)

- INGREDION INCORPORATED (USA)

- KERRY GROUP (IRELAND)

- KONINKLIJKE DSM N.V. (NETHERLANDS)

- NATUREX S.A. (FRANCE)

- OLAM INTERNATIONAL LIMITED (SINGAPORE)

- ROYAL COSUN (NETHERLANDS)

- SENSIENT TECHNOLOGIES CORPORATION (USA)

- SUNOPTA INC. (CANADA)

- SYMRISE AG (GERMANY)

- TATE & LYLE PLC (UK)

- COMPETITIVE LANDSCAPE

- GLOBAL NATURAL AND ORGANIC INGREDIENTS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Form

- Historic And Forecasted Market Size By Source

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

-

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

-

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Natural and Organic Ingredients Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.77 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.6% |

Market Size in 2032: |

USD 17.59 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Source |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. NATURAL AND ORGANIC INGREDIENTS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. NATURAL AND ORGANIC INGREDIENTS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. NATURAL AND ORGANIC INGREDIENTS MARKET COMPETITIVE RIVALRY

TABLE 005. NATURAL AND ORGANIC INGREDIENTS MARKET THREAT OF NEW ENTRANTS

TABLE 006. NATURAL AND ORGANIC INGREDIENTS MARKET THREAT OF SUBSTITUTES

TABLE 007. NATURAL AND ORGANIC INGREDIENTS MARKET BY PRODUCT TYPE

TABLE 008. FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 009. AGRICULTURE MARKET OVERVIEW (2016-2028)

TABLE 010. PERSONAL CARE MARKET OVERVIEW (2016-2028)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 012. NATURAL AND ORGANIC INGREDIENTS MARKET BY APPLICATION

TABLE 013. FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 014. PERSONAL CARE MARKET OVERVIEW (2016-2028)

TABLE 015. PHARMACEUTICALS MARKET OVERVIEW (2016-2028)

TABLE 016. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA NATURAL AND ORGANIC INGREDIENTS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 018. NORTH AMERICA NATURAL AND ORGANIC INGREDIENTS MARKET, BY APPLICATION (2016-2028)

TABLE 019. N NATURAL AND ORGANIC INGREDIENTS MARKET, BY COUNTRY (2016-2028)

TABLE 020. EUROPE NATURAL AND ORGANIC INGREDIENTS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 021. EUROPE NATURAL AND ORGANIC INGREDIENTS MARKET, BY APPLICATION (2016-2028)

TABLE 022. NATURAL AND ORGANIC INGREDIENTS MARKET, BY COUNTRY (2016-2028)

TABLE 023. ASIA PACIFIC NATURAL AND ORGANIC INGREDIENTS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 024. ASIA PACIFIC NATURAL AND ORGANIC INGREDIENTS MARKET, BY APPLICATION (2016-2028)

TABLE 025. NATURAL AND ORGANIC INGREDIENTS MARKET, BY COUNTRY (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA NATURAL AND ORGANIC INGREDIENTS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA NATURAL AND ORGANIC INGREDIENTS MARKET, BY APPLICATION (2016-2028)

TABLE 028. NATURAL AND ORGANIC INGREDIENTS MARKET, BY COUNTRY (2016-2028)

TABLE 029. SOUTH AMERICA NATURAL AND ORGANIC INGREDIENTS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 030. SOUTH AMERICA NATURAL AND ORGANIC INGREDIENTS MARKET, BY APPLICATION (2016-2028)

TABLE 031. NATURAL AND ORGANIC INGREDIENTS MARKET, BY COUNTRY (2016-2028)

TABLE 032. AMAR BIO-ORGANICS INDIA PVT LTD: SNAPSHOT

TABLE 033. AMAR BIO-ORGANICS INDIA PVT LTD: BUSINESS PERFORMANCE

TABLE 034. AMAR BIO-ORGANICS INDIA PVT LTD: PRODUCT PORTFOLIO

TABLE 035. AMAR BIO-ORGANICS INDIA PVT LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. DUPONT: SNAPSHOT

TABLE 036. DUPONT: BUSINESS PERFORMANCE

TABLE 037. DUPONT: PRODUCT PORTFOLIO

TABLE 038. DUPONT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. ARCHER DANIAL MIDLAND: SNAPSHOT

TABLE 039. ARCHER DANIAL MIDLAND: BUSINESS PERFORMANCE

TABLE 040. ARCHER DANIAL MIDLAND: PRODUCT PORTFOLIO

TABLE 041. ARCHER DANIAL MIDLAND: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. INTERNATIONAL FLAVORS AND FRAGRANCES (IFF): SNAPSHOT

TABLE 042. INTERNATIONAL FLAVORS AND FRAGRANCES (IFF): BUSINESS PERFORMANCE

TABLE 043. INTERNATIONAL FLAVORS AND FRAGRANCES (IFF): PRODUCT PORTFOLIO

TABLE 044. INTERNATIONAL FLAVORS AND FRAGRANCES (IFF): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. THE FOODIE FLAVORS LTD: SNAPSHOT

TABLE 045. THE FOODIE FLAVORS LTD: BUSINESS PERFORMANCE

TABLE 046. THE FOODIE FLAVORS LTD: PRODUCT PORTFOLIO

TABLE 047. THE FOODIE FLAVORS LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. T. HASEGAWA: SNAPSHOT

TABLE 048. T. HASEGAWA: BUSINESS PERFORMANCE

TABLE 049. T. HASEGAWA: PRODUCT PORTFOLIO

TABLE 050. T. HASEGAWA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. CARGILL INCORPORATED: SNAPSHOT

TABLE 051. CARGILL INCORPORATED: BUSINESS PERFORMANCE

TABLE 052. CARGILL INCORPORATED: PRODUCT PORTFOLIO

TABLE 053. CARGILL INCORPORATED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. THE LUBRIZOL CORPORATION: SNAPSHOT

TABLE 054. THE LUBRIZOL CORPORATION: BUSINESS PERFORMANCE

TABLE 055. THE LUBRIZOL CORPORATION: PRODUCT PORTFOLIO

TABLE 056. THE LUBRIZOL CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. JARROW FORMULAS INC.: SNAPSHOT

TABLE 057. JARROW FORMULAS INC.: BUSINESS PERFORMANCE

TABLE 058. JARROW FORMULAS INC.: PRODUCT PORTFOLIO

TABLE 059. JARROW FORMULAS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. CRODA INTERNATIONAL LLC: SNAPSHOT

TABLE 060. CRODA INTERNATIONAL LLC: BUSINESS PERFORMANCE

TABLE 061. CRODA INTERNATIONAL LLC: PRODUCT PORTFOLIO

TABLE 062. CRODA INTERNATIONAL LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. BARE ESCENTUALS BEAUTY INC: SNAPSHOT

TABLE 063. BARE ESCENTUALS BEAUTY INC: BUSINESS PERFORMANCE

TABLE 064. BARE ESCENTUALS BEAUTY INC: PRODUCT PORTFOLIO

TABLE 065. BARE ESCENTUALS BEAUTY INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 066. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 067. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 068. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. NATURAL AND ORGANIC INGREDIENTS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. NATURAL AND ORGANIC INGREDIENTS MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 012. FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 013. AGRICULTURE MARKET OVERVIEW (2016-2028)

FIGURE 014. PERSONAL CARE MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 016. NATURAL AND ORGANIC INGREDIENTS MARKET OVERVIEW BY APPLICATION

FIGURE 017. FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 018. PERSONAL CARE MARKET OVERVIEW (2016-2028)

FIGURE 019. PHARMACEUTICALS MARKET OVERVIEW (2016-2028)

FIGURE 020. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA NATURAL AND ORGANIC INGREDIENTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE NATURAL AND ORGANIC INGREDIENTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC NATURAL AND ORGANIC INGREDIENTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA NATURAL AND ORGANIC INGREDIENTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA NATURAL AND ORGANIC INGREDIENTS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Natural and Organic Ingredients Market research report is 2024-2032.

Archer Daniels Midland Company (USA),Associated British Foods plc (UK),BASF SE (Germany),Cargill (USA),Chr. Hansen Holding A/S (Denmark),Corbion N.V. (Netherlands),Doehler GmbH (Germany),DuPont (USA),Firmenich International SA (Switzerland),Givaudan SA (Switzerland),Ingredion Incorporated (USA),Kerry Group (Ireland),Koninklijke DSM N.V. (Netherlands),Naturex S.A. (France),Olam International Limited (Singapore),Royal Cosun (Netherlands),Sensient Technologies Corporation (USA),SunOpta Inc. (Canada),Symrise AG (Germany),Tate & Lyle PLC (UK), and Other Active Players.

The Natural and Organic Ingredients Market is segmented into Type, Form, Source, Application, Distribution Channel, and region. By Type, the market is categorized into Natural Ingredients {Plant-based Ingredients (Fruits, Vegetables, Herbs), Animal-based, Ingredients (Dairy, Honey), Mineral-based Ingredients (Salts, Clays) and Organic Ingredients (Certified Organic Plant-based Ingredients, Certified Organic Animal-based Ingredients)}. By Form, the market is categorized into Powder, Liquid, and Capsules & Tablets, Oils. By Source, the market is categorized into Botanical Extracts (Herbs and Spices, Flowers, Leaves, Roots), Marine Extracts (Algae, Seaweed, Fish Oils), and Microbial Extracts (Probiotics, Yeasts), Animal Derivatives (Collagen, Gelatin), Minerals (Trace Elements, Salts). By Application, the market is categorized into Food & Beverages, Cosmetics & Personal Care, Pharmaceuticals, and Others (Pet Food, Agriculture). By Distribution Channel, The Market Is Categorized into Supermarkets/Hypermarkets, Specialty Stores, Pharmacies/Drugstores, Online Sales. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Natural organic products are items made from natural ingredients that have not been altered by artificial additives. Ingredients that are natural come from plants, minerals, or animals and undergo minimal processing to maintain their original state. Organic, in contrast, pertains to crops that are consistently cultivated following regulations set by organic certification organizations, typically prohibiting synthetic pesticides, GMOs, and chemical fertilizers. It is highly regarded for its alleged cleanliness, accessibility, and minimal environmental impact. The use of integrated criteria is gaining popularity in the food industry, as well as in cosmetics and personal care. Consumers are drawn to these products primarily because of the potential health benefits and lower risk of negative side effects compared to chemically made products. Using natural ingredients like aloe vera and chamomile for their healing properties, as well as organic fruits and vegetables without chemicals, is seen as appealing.

Natural and Organic Ingredients Market Size Was Valued at USD 10.77 Billion in 2023, and is Projected to Reach USD 17.59 Billion by 2032, Growing at a CAGR of 5.6% From 2024-2032.