Femtocell Market Synopsis

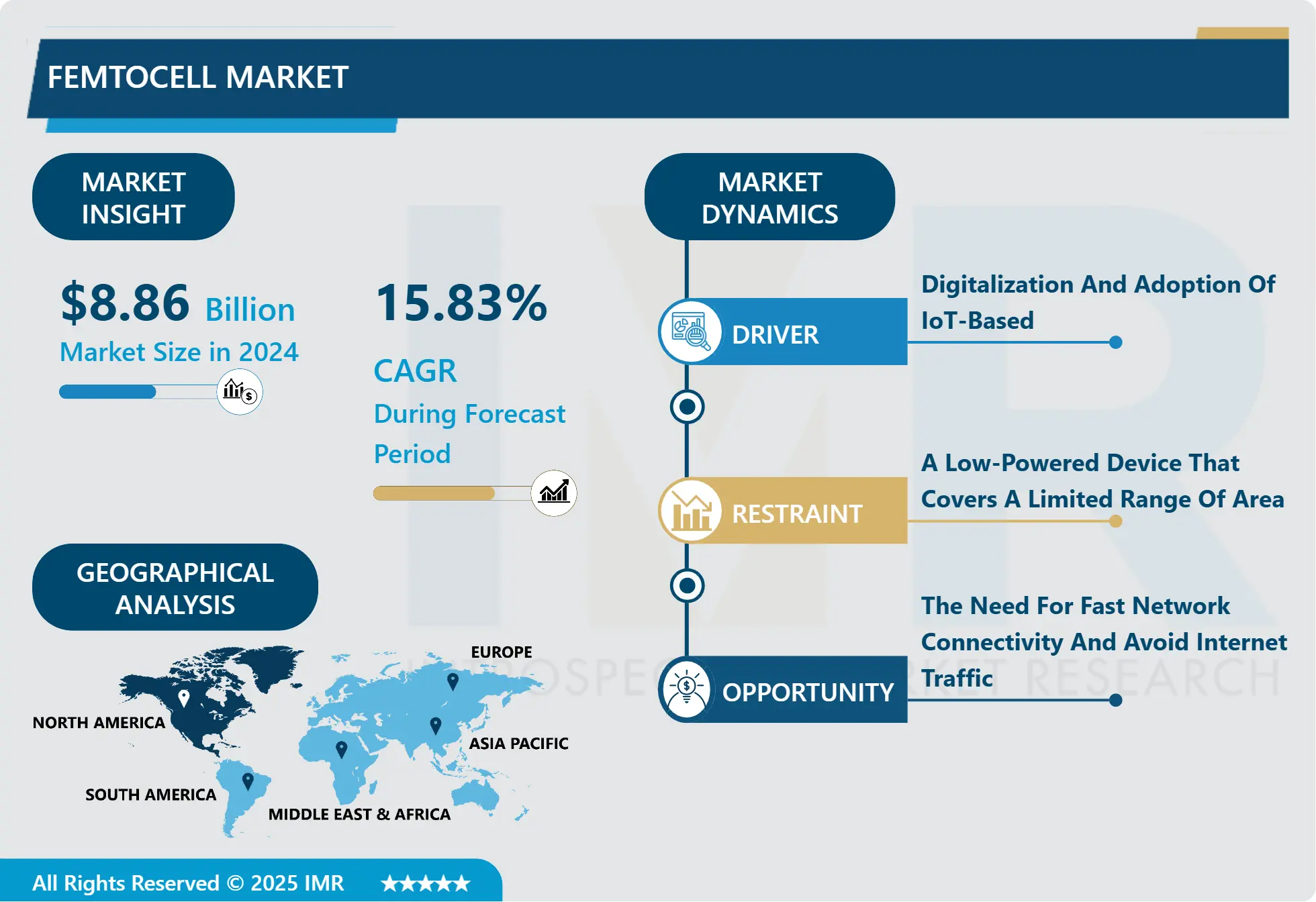

Femtocell Market Size Was Valued at USD 8.86 Billion in 2024 and is Projected to Reach USD 28.71 Billion by 2032, Growing at a CAGR of 15.83% From 2025-2032.

Since femtocells can increase indoor wireless coverage and capacity, they have been able to meet the growing need for high-quality mobile connectivity, which has led to the market's constant expansion. Femtocells are tiny cellular base stations that are intended to provide focused coverage in indoor spaces such as workplaces and houses. They have several advantages for service providers as well as customers.

Service providers can reduce congestion and enhance network performance by shifting traffic from macrocell networks to femtocells, which enhances the user experience overall.

In addition to residential applications, the femtocell industry is expanding to cover small and medium-sized businesses (SMEs), commercial buildings, and outdoor areas, which is fueling market growth.

Femtocells are an appealing alternative for both because they provide an affordable way to increase capacity and coverage in inside locations when compared to typical macrocell deployments.

Femtocell Market Trend Analysis- Femtocell Technology Enhances Carrier Benefits

- Advantages include replacing fixed-mobile service, increasing average revenue per user (ARPU), and enhancing connection in suburban areas that are indoors and away from the city. By facilitating the replacement of fixed-mobile phones, femtocell technology transforms carrier services and increases Average Revenue Per User (ARPU).

- It solves enduring coverage issues and greatly increases connectivity in indoor and far suburban locations. This not only improves user experience but also opens up new revenue streams for carriers, as subscribers are willing to pay more for improved indoor coverage and reliable connectivity in suburban and remote areas. Carriers can reach previously underserved areas by deploying femtocells, providing seamless connectivity and high-quality services to customers. All things considered, femtocell technology improves mobile communication standards and increases carrier income possibilities.

The Need For Fast Network Connectivity And Avoid Internet Traffic

- The need for quick network access is critical in a world going more and more digital. Femtocells are tiny cellular base stations that are intended for use in homes or small businesses. They provide targeted coverage, reducing the load on regular networks and preventing internet traffic jams.

- As a result, there may be room for growth in the femtocell industry as more people and companies look for dependable, fast connectivity. Femtocells facilitate smooth communication and data access for users, boosting their happiness and productivity. As a result, the femtocell market is well-positioned to benefit from the increasing demand in today's networked world for effective, localized network solutions.

Femtocell Market Segment Analysis:

Femtocell Market is Segmented based on type, technology, and application.

By Type, 4G Segment Is Expected To Dominate The Market During The Forecast Period

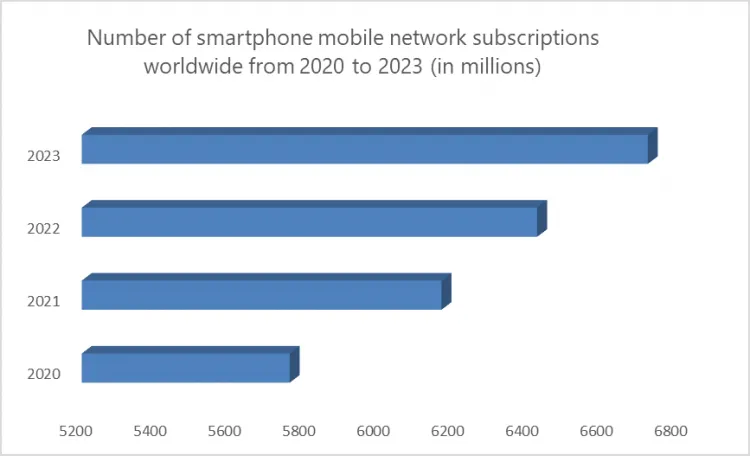

- The growing demand for low-powered internet devices and the pervasive usage of smartphones across the globe contributed to the dominance of the 4G femtocell sector in the global market. It is anticipated that this tendency will continue for the duration of the projection.

- But due to the introduction of 5G technology, the 5G femtocell market had the fastest growth. 5G technology is set to transform the femtocell market with its low latency networking capabilities and capacity to deliver high-speed internet at 1 Gbps data speeds. The growing use of 5G technology, which holds the promise of affordable and fast internet connectivity, is expected to fuel this expansion. The fast development of 5G technology is anticipated to have a substantial impact on the femtocell market's overall growth trajectory in the upcoming years, even though the 4G femtocell sector is still the market leader.

By Application, Residential Segment Held The Largest Share of in 2025

- Due to the strong demand for wireless internet services in residential areas, which is a trend that is anticipated to continue, the residential femtocell sector led the femtocell market in terms of revenue. The prevalent problem of weak signal strength in residential buildings is addressed by femtocells, which are designed to improve indoor cellular coverage.

- Femtocells guarantee dependable connectivity for voice calls and data services indoors, where typical macrocell towers could find it difficult to reach, by offering a localized cellular network. The desire for low-power, high-speed, secure internet connections in commercial areas has led to the greatest growth in the commercial market, which is expected to continue at this rate.

Femtocell Market Regional Insights:

North America Is Expected To Dominate The Market Over The Forecast Period

- Due to the adoption of 5G technology and the growing demand for internet provider devices that can handle high internet traffic, North America has emerged as the leading revenue generator in the femtocell market. This trend is anticipated to continue.

- Femtocell technology utilization has increased significantly throughout Asia-Pacific. This is explained by the region's high population density, which has given telecom providers access to a sizable pool of mobile subscribers. Furthermore, forecasts suggest that Asia-Pacific will continue to develop in the years to come, making it the region that contributes the most to the worldwide total number of mobile internet subscribers.

- The continuous digital transformation and technology improvements are expected to fuel significant femtocell deployments in the area, especially in nations like South Korea, Japan, and China. This indicates that the femtocell market's global growth trajectory will be significantly shaped by Asia-Pacific.

Femtocell Market Top Key Players:

- Cisco (United States)

- Ericsson (Sweden)

- Nokia (Finland)

- Huawei (China)

- Samsung (South Korea)

- ZTE Corporation (China)

- Airvana (United States)

- NEC Corporation (Japan)

- ip.access (United Kingdom)

- Alcatel-Lucent (France)

- Cellcomm Solutions Limited (India)

- Comba Telecom (Hong Kong)

- NEC Corporation of America (United States)

- SpiderCloud Wireless (United States)

- Huawei Technologies Co. Ltd. (China)

- Sagemcom (France)

- Telrad Networks (Israel)

- Ubiquiti Inc. (United States)

- Nextivity Inc. (United States)

- SoftBank Corp. (Japan)

- Gemtek Technology Co., Ltd. (Taiwan)

- Corning Incorporated (United States)

- Amarisoft (France)

- Baicells Technologies Co., Ltd. (China)

- Alpha Networks Inc. (Taiwan)

- Contela Inc. (South Korea)

- Casa Systems Inc. (United States)

- Accelleran (Belgium)

- AccelerComm (United Kingdom)

- Qucell Inc. (China) and Other Active players

Key Industry Developments in Femtocell Market:

- In February 2023, At the Mobile World Congress in Barcelona, Cisco and T-Mobile unveiled plans to introduce Cisco Meraki's inaugural 5G cellular gateways, the MG51 and MG51E, aimed at providing businesses with fixed wireless access (FWA) solutions.

- In February 2023, Cisco and NTT have joined forces to offer private 5G services to businesses across diverse industries, utilizing the Cisco Meraki platform and Intel technology.

|

Global Femtocell Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

8.86 Billion |

|

Forecast Period 2025-32 CAGR: |

15.83% |

Market Size in 2032: |

28.71 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Technology |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Femtocell Market by Type (2018-2032)

4.1 Femtocell Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Organic

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Conventional

Chapter 5: Femtocell Market by Application (2018-2032)

5.1 Femtocell Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Residential

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Public places

Chapter 6: Femtocell Market by Technology (2018-2032)

6.1 Femtocell Market Snapshot and Growth Engine

6.2 Market Overview

6.3 IMS/SIP Femtocell Technology

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 IU-H Femtocell Technology

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Femtocell Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CISCO (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ERICSSON (SWEDEN)

7.4 NOKIA (FINLAND)

7.5 HUAWEI (CHINA)

7.6 SAMSUNG (SOUTH KOREA)

7.7 ZTE CORPORATION (CHINA)

7.8 AIRVANA (UNITED STATES)

7.9 NEC CORPORATION (JAPAN)

7.10 IP.ACCESS (UNITED KINGDOM)

7.11 ALCATEL-LUCENT (FRANCE)

7.12 CELLCOMM SOLUTIONS LIMITED (INDIA)

7.13 COMBA TELECOM (HONG KONG)

7.14 NEC CORPORATION OF AMERICA (UNITED STATES)

7.15 SPIDERCLOUD WIRELESS (UNITED STATES)

7.16 HUAWEI TECHNOLOGIES CO. LTD. (CHINA)

7.17 SAGEMCOM (FRANCE)

7.18 TELRAD NETWORKS (ISRAEL)

7.19 UBIQUITI INC. (UNITED STATES)

7.20 NEXTIVITY INC. (UNITED STATES)

7.21 SOFTBANK CORP. (JAPAN)

7.22 GEMTEK TECHNOLOGY COLTD. (TAIWAN)

7.23 CORNING INCORPORATED (UNITED STATES)

7.24 AMARISOFT (FRANCE)

7.25 BAICELLS TECHNOLOGIES COLTD. (CHINA)

7.26 ALPHA NETWORKS INC. (TAIWAN)

7.27 CONTELA INC. (SOUTH KOREA)

7.28 CASA SYSTEMS INC. (UNITED STATES)

7.29 ACCELLERAN (BELGIUM)

7.30 ACCELERCOMM (UNITED KINGDOM)

7.31 QUCELL INC. (CHINA) OTHER KEY PLAYERS

Chapter 8: Global Femtocell Market By Region

8.1 Overview

8.2. North America Femtocell Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Organic

8.2.4.2 Conventional

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Residential

8.2.5.2 Public places

8.2.6 Historic and Forecasted Market Size by Technology

8.2.6.1 IMS/SIP Femtocell Technology

8.2.6.2 IU-H Femtocell Technology

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Femtocell Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Organic

8.3.4.2 Conventional

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Residential

8.3.5.2 Public places

8.3.6 Historic and Forecasted Market Size by Technology

8.3.6.1 IMS/SIP Femtocell Technology

8.3.6.2 IU-H Femtocell Technology

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Femtocell Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Organic

8.4.4.2 Conventional

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Residential

8.4.5.2 Public places

8.4.6 Historic and Forecasted Market Size by Technology

8.4.6.1 IMS/SIP Femtocell Technology

8.4.6.2 IU-H Femtocell Technology

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Femtocell Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Organic

8.5.4.2 Conventional

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Residential

8.5.5.2 Public places

8.5.6 Historic and Forecasted Market Size by Technology

8.5.6.1 IMS/SIP Femtocell Technology

8.5.6.2 IU-H Femtocell Technology

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Femtocell Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Organic

8.6.4.2 Conventional

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Residential

8.6.5.2 Public places

8.6.6 Historic and Forecasted Market Size by Technology

8.6.6.1 IMS/SIP Femtocell Technology

8.6.6.2 IU-H Femtocell Technology

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Femtocell Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Organic

8.7.4.2 Conventional

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Residential

8.7.5.2 Public places

8.7.6 Historic and Forecasted Market Size by Technology

8.7.6.1 IMS/SIP Femtocell Technology

8.7.6.2 IU-H Femtocell Technology

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Femtocell Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

8.86 Billion |

|

Forecast Period 2025-32 CAGR: |

15.83% |

Market Size in 2032: |

28.71 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Technology |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||