Exercise Equipment Repair Service Market Synopsis:

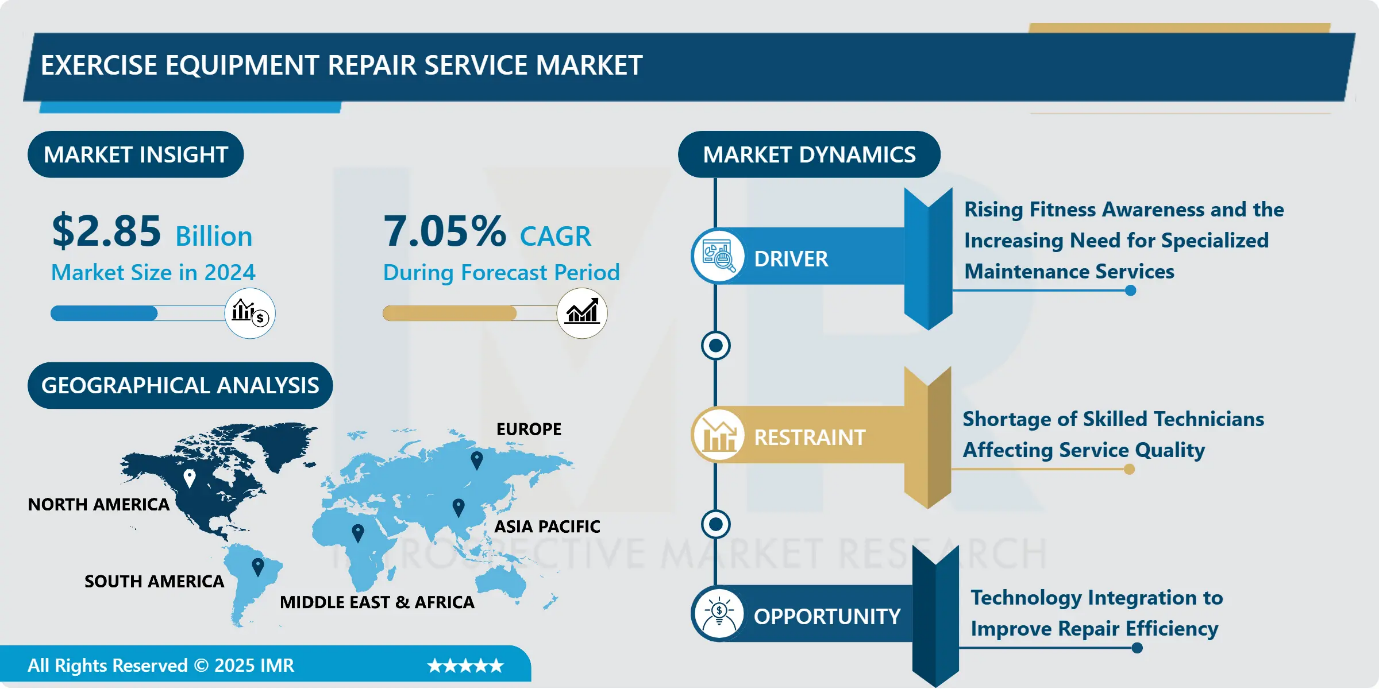

Exercise Equipment Repair Service Market Size Was Valued at USD 2.85 Billion in 2024 and is Projected to Reach USD 4.92 Billion by 2032, Growing at a CAGR of 7.05% From 2024-2032.

An exercise equipment repair service performs routine maintenance on fitness equipment at the gym or in people’s homes. The service diagnoses issues related to exercise equipment, performs services, and assembles machines back into working order. Responsibilities include providing exceptional customer service and preparing the necessary paperwork for billing. Other duties include assisting gym personnel and filling in on other gym duties as needed. Exercise Equipment Repair Service typically works in large institutions like gyms, hospitals, colleges, and apartment complexes.

The exercise equipment repair service industry demonstrates substantial growth due to people increasingly require maintenance services for their fitness equipment. Commercial Gyms and health-conscious peoples engaging in home workouts now demand for professional exercise machine maintenance including treadmills and ellipticals alongside stationary bikes constantly increases.

Exercise Equipment Repair Service Market Growth and Trend Analysis:

Rising Fitness Awareness and the Increasing Need for Specialized Maintenance Services

-

The Exercise Equipment Repair Service Market expands due to gym equipment continues to increase in popularity as its multiple uses in physical fitness, weight loss, and strength development. Fitness centers and growing groups of users who purchase exercise equipments including treadmills, rowing machines and elliptical trainers require increased maintenance and repair services.

- Regular usage results in equipment damage requiring professional maintenance for the purpose of safety together with operational performance. Advanced technology in contemporary fitness equipment like digital tracking and smart screens generates particular repair requirements that require specialized professionals. The increase in corporate fitness centers together with commercial gym establishment created a demand for maintenance agreements that would safeguard equipment from expensive breakdowns.

- Individuals who purchase expensive home fitness equipment depend on professional services to achieve proper equipment operation. The Exercise Equipment Repair Service Market shows steady potential growth due to increasing fitness awareness in society. Time-efficient maintenance service providers will serve as critical components for extending fitness machine life expectancy thus facilitating benefits to gym operators and personal users.

Shortage of Skilled Technicians Affecting Service Quality

-

The exercise equipment repair service market shows strong growth potential but needs to overcome multiple challenges. The high cost of maintenance especially affects expensive commercial fitness equipment that stands as a major market restraint. Some equipment repairs surpass the original buying price so customers tend to find it more financially beneficial to buy new equipment instead of repairing their existing machines. Service quality and repair wait times tend to deteriorate when there is an insufficient number of skilled technicians available in specific geographic areas. Customers who search for free online tutorials or DIY repair guides through internet resources often fix their equipment independently which results in fewer requirements for professional equipment maintenance services.

Technology Integration to Improve Repair Efficiency

-

The exercise equipment repair service market shows strong growth potential but needs to overcome multiple obstacles. high expenditures on maintenance influence the major market restraint due to they affect expensive commercial fitness equipment. The cost of restoring certain equipment exceeds its original value compelling customers to find better value by purchasing fresh equipment rather than fixing their current equipment. Service quality together with repair delays both decline due to shortages of competent technicians that operate in defined geographic areas. People who find DIY repair resources through internet search fix their appliances on their own therefore reducing their need for professional equipment maintenance service requirements.

High Cost of Specialized Replacement Parts

-

The primary barriers are the high cost of specialized replacement parts and advanced diagnostic tools, which can increase service costs and deter regular maintenance, especially for budget-conscious home users and small gym operators. Additionally, limited availability of skilled technicians capable of repairing modern, technology-integrated fitness equipment, such as smart treadmills and connected stationary bikes, poses a significant challenge for service providers.

Exercise Equipment Repair Service Market Segment Analysis:

Exercise Equipment Repair Service Market is segmented based on equipment type, service type, customer type, service provider type, safety standards, and region

By Equipment Type, Treadmills segment is expected to dominate the market during the forecast period

-

The treadmill segment dominates the global Exercise Equipment Repair Service Market due to its widespread use, mechanical complexity, and high wear-and-tear rate. Treadmills exist in every gym and many fitness homes where they deliver adaptable cardiovascular workouts which serve fitness levels from beginner to advanced. Regular treadmill operation puts substantial strain on motors and electronic components and belts so users require routine maintenance and component repairs frequently.

- The necessity of treadmills for cardiovascular fitness makes gyms and individual users focus on maintaining these machines to achieve their peak operational potential. The combination of necessary regular maintenance work and updated treadmill features boost up demand for professional treadmill technician services. Treadmill repair services control the largest market segment in the global Exercise Equipment Repair Service sector because machines maintain their market leadership across commercial fitness facilities and personal workout areas.

By Service Type, the Commercial Gyms segment held the largest share in the projected period

-

Commercial Gyms primarily comprised of fitness centers, and health clubs, represent the largest end-user portion. The fitness industry is booming, projected to reach more than USD 200 billion by 2030. The exercise equipment repair service market is expanding due to the rising demand for well-maintained fitness equipment in commercial gyms, which hold the largest market share. Increased investments in gym infrastructure and the surge in fitness club memberships contribute to higher demand for maintenance services.

- As digital fitness solutions integrate with gym equipment, ensuring equipment longevity and functionality remains critical. Gym owners must prioritize preventive maintenance strategies to reduce costs and enhance member satisfaction.

Exercise Equipment Repair Service Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America is expected to dominate the exercise equipment repair service market over the forecast period, driven by a combination of factors, including a high number of gym members and the extensive presence of fitness facilities. The United States alone accounts for 64.19 million gym members, with a huge 55,000 fitness facilities in 2024. The North American fitness equipment market keeps growing due to its residents having high disposable income and major fitness brands and boutique gyms run virtual training sessions.

- The escalating fitness industry will generate more demands for repairs and maintenance services since exercise equipment utilization rates increase leading to increased wear and tear. Manufacturers of top fitness equipment products based in this region maintain a stable distribution system which supports the need for expert maintenance services to uphold machine efficiency and extend operational life. The combined influence of these market factors establishes North America's position as the leading market for exercise equipment repair services through the next few years.

Exercise Equipment Repair Service Market Active Players:

-

AK Treadmill Repair (India)

- BC Fitness Repairs (USA)

- Dragonfly Fitness (USA)

- Expert Leisure (Ireland)

- Fit Fix Repair (USA)

- Fitness Experience (USA)

- Fitness Machine Technicians (USA)

- Flex Fixes Technical Services (UAE)

- GM Services (Leicester) Ltd (UK)

- Gym Repair Tech (USA)

- Indo Fitness Solution (India)

- Max Power Repairs (USA)

- Metro Assembly Services (USA)

- MS Fitness Technology (USA)

- On Point Assembly (USA)

- One Call Fitness Repair (USA)

- ServiceRX (USA)

- The Fitness Mechanic (USA)

- Zimmer Fitness Repair (USA), and Other Active Players

Key Industry Developments in the Exercise Equipment Repair Service Market:

-

In December 2024, A.E.S. Fitness, founded, announced its nationwide franchise opportunity after experiencing consistent growth. Specializing in fitness equipment maintenance and repair, the company expanded its footprint across northeastern states, including Connecticut, Maine, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, and Vermont, with plans for nationwide expansion in the near future.

- In October 2024, Fitnessmith successfully acquired Gym Source USA’s commercial equipment, maintenance, and service divisions, expanding its reach across 47 states. This strategic move strengthened Fitnessmith’s market presence and service capabilities. The company ensured a seamless transition for Gym Source USA’s customers while integrating select staff to maintain operational continuity and uphold service quality standards.

|

Global Exercise Equipment Repair Service Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 2.85 Bn. |

|

Forecast Period 2025-32 CAGR: |

7.05 % |

Market Size in 2032: |

USD 4.92 Bn. |

|

Segments Covered: |

By Equipment Type |

|

|

|

By Service Type |

|

||

|

By Customer Type |

|

||

|

By Service Provider Type |

|

||

|

By Safety Standards |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge Barrier |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Exercise Equipment Repair Service Market by Equipment Type

4.1 Exercise Equipment Repair Service Market Snapshot and Growth Engine

4.2 Exercise Equipment Repair Service Market Overview

4.3 Treadmills and Crosstrainers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Treadmills and Crosstrainers: Geographic Segmentation Analysis

Chapter 5: Exercise Equipment Repair Service Market by Service Type

5.1 Exercise Equipment Repair Service Market Snapshot and Growth Engine

5.2 Exercise Equipment Repair Service Market Overview

5.3 Preventive Maintenance and Repair Services

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Preventive Maintenance and Repair Services: Geographic Segmentation Analysis

Chapter 6: Exercise Equipment Repair Service Market by Customer Type

6.1 Exercise Equipment Repair Service Market Snapshot and Growth Engine

6.2 Exercise Equipment Repair Service Market Overview

6.3 Commercial Gyms and Residential Users

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Commercial Gyms and Residential Users: Geographic Segmentation Analysis

Chapter 7: Exercise Equipment Repair Service Market by Service Provider Type

7.1 Exercise Equipment Repair Service Market Snapshot and Growth Engine

7.2 Exercise Equipment Repair Service Market Overview

7.3 Independent Technicians and Authorized Service Providers

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Independent Technicians and Authorized Service Providers: Geographic Segmentation Analysis

Chapter 8: Exercise Equipment Repair Service Market by Safety Standards

8.1 Exercise Equipment Repair Service Market Snapshot and Growth Engine

8.2 Exercise Equipment Repair Service Market Overview

8.3 ATEX Certified Explosion Proof Temperature Sensors and IECEx Certified Explosion Proof Temperature Sensors

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 ATEX Certified Explosion Proof Temperature Sensors and IECEx Certified Explosion Proof Temperature Sensors: Geographic Segmentation Analysis

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Exercise Equipment Repair Service Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 FITNESS MACHINE TECHNICIANS (USA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 METRO ASSEMBLY SERVICES (USA)

9.4 FITNESS EXPERIENCE (USA)

9.5 GM SERVICES (LEICESTER) LTD (UK)

9.6 MS FITNESS TECHNOLOGY (USA)

9.7 INDO FITNESS SOLUTION (INDIA)

9.8 AK TREADMILL REPAIR (INDIA)

9.9 BC FITNESS REPAIRS (USA)

9.10 FIT FIX REPAIR (USA)

9.11 ON POINT ASSEMBLY (USA)

9.12 MAX POWER REPAIRS (USA)

9.13 GYM REPAIR TECH (USA)

9.14 FLEX FIXES TECHNICAL SERVICES (UAE)

9.15 EXPERT LEISURE (IRELAND)

9.16 ZIMMER FITNESS REPAIR (USA)

9.17 DRAGONFLY FITNESS (USA)

9.18 THE FITNESS MECHANIC (USA)

9.19 ONE CALL FITNESS REPAIR (USA)

9.20 SERVICERX (USA)

9.21 OTHER ACTIVE PLAYERS.

Chapter 10: Global Exercise Equipment Repair Service Market By Region

10.1 Overview

10.2. North America Exercise Equipment Repair Service Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By Equipment Type

10.2.4.1 Treadmills and Crosstrainers

10.2.5 Historic and Forecasted Market Size By Service Type

10.2.5.1 Preventive Maintenance and Repair Services

10.2.6 Historic and Forecasted Market Size By Customer Type

10.2.6.1 Commercial Gyms and Residential Users

10.2.7 Historic and Forecasted Market Size By Service Provider Type

10.2.7.1 Independent Technicians and Authorized Service Providers

10.2.8 Historic and Forecasted Market Size By Safety Standards

10.2.8.1 ATEX Certified Explosion Proof Temperature Sensors and IECEx Certified Explosion Proof Temperature Sensors

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Exercise Equipment Repair Service Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By Equipment Type

10.3.4.1 Treadmills and Crosstrainers

10.3.5 Historic and Forecasted Market Size By Service Type

10.3.5.1 Preventive Maintenance and Repair Services

10.3.6 Historic and Forecasted Market Size By Customer Type

10.3.6.1 Commercial Gyms and Residential Users

10.3.7 Historic and Forecasted Market Size By Service Provider Type

10.3.7.1 Independent Technicians and Authorized Service Providers

10.3.8 Historic and Forecasted Market Size By Safety Standards

10.3.8.1 ATEX Certified Explosion Proof Temperature Sensors and IECEx Certified Explosion Proof Temperature Sensors

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Exercise Equipment Repair Service Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By Equipment Type

10.4.4.1 Treadmills and Crosstrainers

10.4.5 Historic and Forecasted Market Size By Service Type

10.4.5.1 Preventive Maintenance and Repair Services

10.4.6 Historic and Forecasted Market Size By Customer Type

10.4.6.1 Commercial Gyms and Residential Users

10.4.7 Historic and Forecasted Market Size By Service Provider Type

10.4.7.1 Independent Technicians and Authorized Service Providers

10.4.8 Historic and Forecasted Market Size By Safety Standards

10.4.8.1 ATEX Certified Explosion Proof Temperature Sensors and IECEx Certified Explosion Proof Temperature Sensors

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Exercise Equipment Repair Service Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By Equipment Type

10.5.4.1 Treadmills and Crosstrainers

10.5.5 Historic and Forecasted Market Size By Service Type

10.5.5.1 Preventive Maintenance and Repair Services

10.5.6 Historic and Forecasted Market Size By Customer Type

10.5.6.1 Commercial Gyms and Residential Users

10.5.7 Historic and Forecasted Market Size By Service Provider Type

10.5.7.1 Independent Technicians and Authorized Service Providers

10.5.8 Historic and Forecasted Market Size By Safety Standards

10.5.8.1 ATEX Certified Explosion Proof Temperature Sensors and IECEx Certified Explosion Proof Temperature Sensors

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Exercise Equipment Repair Service Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By Equipment Type

10.6.4.1 Treadmills and Crosstrainers

10.6.5 Historic and Forecasted Market Size By Service Type

10.6.5.1 Preventive Maintenance and Repair Services

10.6.6 Historic and Forecasted Market Size By Customer Type

10.6.6.1 Commercial Gyms and Residential Users

10.6.7 Historic and Forecasted Market Size By Service Provider Type

10.6.7.1 Independent Technicians and Authorized Service Providers

10.6.8 Historic and Forecasted Market Size By Safety Standards

10.6.8.1 ATEX Certified Explosion Proof Temperature Sensors and IECEx Certified Explosion Proof Temperature Sensors

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Exercise Equipment Repair Service Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By Equipment Type

10.7.4.1 Treadmills and Crosstrainers

10.7.5 Historic and Forecasted Market Size By Service Type

10.7.5.1 Preventive Maintenance and Repair Services

10.7.6 Historic and Forecasted Market Size By Customer Type

10.7.6.1 Commercial Gyms and Residential Users

10.7.7 Historic and Forecasted Market Size By Service Provider Type

10.7.7.1 Independent Technicians and Authorized Service Providers

10.7.8 Historic and Forecasted Market Size By Safety Standards

10.7.8.1 ATEX Certified Explosion Proof Temperature Sensors and IECEx Certified Explosion Proof Temperature Sensors

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Exercise Equipment Repair Service Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 2.85 Bn. |

|

Forecast Period 2025-32 CAGR: |

7.05 % |

Market Size in 2032: |

USD 4.92 Bn. |

|

Segments Covered: |

By Equipment Type |

|

|

|

By Service Type |

|

||

|

By Customer Type |

|

||

|

By Service Provider Type |

|

||

|

By Safety Standards |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge Barrier |

|

||

|

Companies Covered in the Report: |

|

||