EV Battery Recycling Market Synopsis

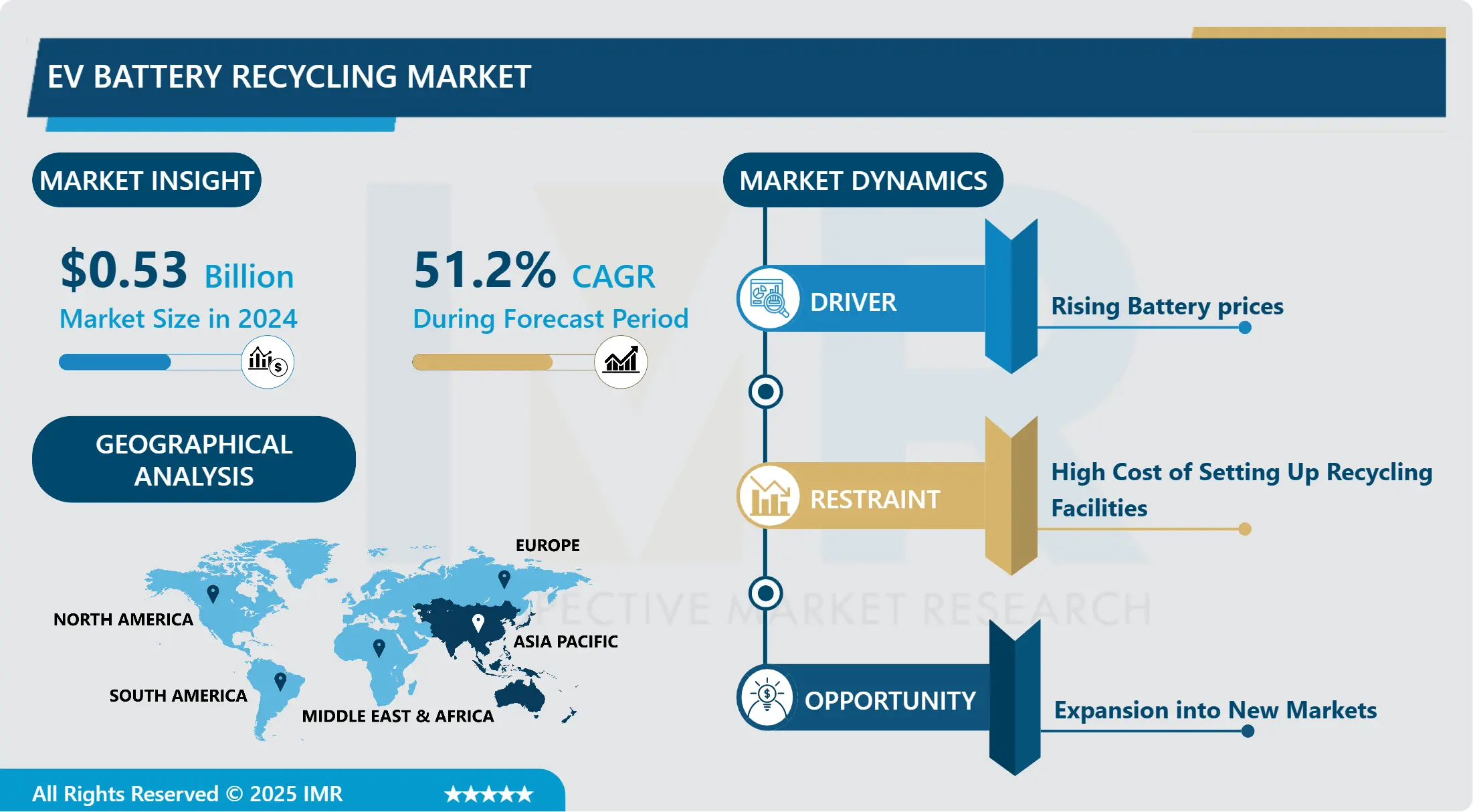

EV Battery Recycling Market Size Was Valued at USD 0.53 Billion in 2024 and is Projected to Reach USD 14.48 Billion by 2032, Growing at a CAGR of 51.2% From 2025-2032.

Battery recycling is the reprocessing of the battery that has been used in electric vehicles reduced to its constituent materials. These are often Lithium Ion batteries and suffer from what is known as the ‘memory effect’, where the batteries slowly lose their ability to amass a charge. The recycling of EV batteries has been initiated to address issues with battery disposal as most dump batteries have the potential of causing harm to land and underground water sources by discharging toxic compounds.

Rebuff lost precious elements like lithium, cobalt, and nickel as they are narrow, although qualificatory important for electronics functioning and are difficult to obtain from the ground.

Recycling also has its phases and they include collection, disintegration, and separation of materials, shredding, and refining. The batteries undergo disassembling where solid components are segregated according to the chemical type. The batteries are then shredded for disposal to enable the uncovering of materials that can be retrieved. In the last stage, the recovered materials are further collected and processed for recycling or to be recycled for new batteries or any other usage that shuts the cycle of the battery.

Recycling batteries used in EVs not only solves environmental issues but also supports the future growth of the EV business through the concept of resource efficiency and circulation system innovation.

EV Battery Recycling Market Trend Analysis

Increasing adoption of lightweight materials

- The shift to using lightweight materials in the EV battery recycling market is a result of the industry’s push to model ways to improve efficiency and increase driving distance. Aluminum and composite materials thus enjoy frequent usage due to the prospects they hold in reducing the overall weight of the electric vehicle which in turn enhances energy efficiency and power.

- Therefore, these materials are gradually being adopted in EV design as a means of meeting the strict fuel economy requirements and user expectations of advanced EVs with higher driving ranges.

- In particular, the use of lightweight materials is helpful in recycling not only because of the marked effect it has on a product’s weight but also due to other benefits that can be seen with the aid of such materials in the actual recycling process. They often require less energy to manage and sort, and they are typically lighter than other, denser materials, meaning that it is easier to dismantle recycling plants that work with them.

- Furthermore, many lightweight materials are moderately CFRPs (carbon fiber reinforced plastics) which are lighter in comparison to other normal materials in transportation, and when recycled need considerably less energy to recycle them completely, thus reflecting the sustainability agenda of the EV market. All in all, the weight reduction trend seen today not only positively impacts the Electric vehicle from the functional standpoint but also gives a boost to the present prospects of the EV battery recycling market.

Development of new battery chemistries

- The opportunities that the new battery chemistries offer the EV battery recycling market are myriad, and the key points include: First, changed by the introduction of new battery technologies, old battery technologies may either be outdated or not so popular in the market.

- This transition defines the need for proper management or recycling of the old batteries and at the same time, the efficient recovery of metals for new uses. To discuss, by coming up with value-added recycling processes that are relevant to these changing chemistries, the industry can improve the management of resources and the resulting environmental expenditures.

- The development of new battery chemistries frequently presents enhancements in battery power density, efficiency, and durability and, thus, can spur on more utilization of electric vehicles. While the EV manufacturers do this as a way to improve the performances of their automobiles, the resultant effect will be more batteries with the new chemistries required to improve the cars.

- Thus, given the fact that higher volumes of spent batteries are being disposed of in the recycling process, the recycling market has the potential to benefit. By enhancing and upgrading recyclability, recycling solutions for these progressing chemistries will create new opportunities for the benefit of stakeholders of electric vehicles, promoting a circular economy approach for a more sustainable recycling and resource recovery.

EV Battery Recycling Market Segment Analysis:

EV Battery Recycling Market Segmented based on Type, Sources, Vehicle type and Region.

By Type, lithium-ion is expected to dominate the market during the forecast period

- Analyzing the structure of the market, it can be seen that the segment with the lithium-ion battery has dominated the EV battery recycling market in recent years. This popularity is a result of the energy density, the long cycle span, lighter and superior to the conventional Lead-acid batteries utilized in a variety of electronic apparatus and electric cars in particular.

- Since the electric vehicle market has adopted very fast due to forces such as environmental conservationism and incentives given by governments among others, lithium-ion batteries have been in high demand. As a result, the volume of spent Li-ion batteries that enter the recycling chain has also been rising, thus boosting the lithium-ion recycling market segment.

- In addition, there are great prospects in recycling lithium-ion batteries, as we said before, laying special emphasis on the recovery of such components as lithium, cobalt, nickel, and manganese required for the production of lithium-ion batteries. These are _limited resources_ since they are finite in supply and given the increasing costs of extracting these resources from the earth, recycling batteries offers a sustainable way of meeting the increasing demand for these battery materials.

- In addition, recycling technologies have progressed to make lithium-ion materials easy to recycle, meaning that recycling these materials from old lithium-ion batteries becomes less expensive, hence making the lithium-ion segment control the EV battery recycling market. With the global transition to electric vehicles being highly likely, it also remains expected the lithium-ion segment will remain at the helm of driving the EV battery recycling market.

By Sources, End of life segment held the largest share in 2024

- The battery recycling market grouped according to the phase of a battery’s lifecycle makes a bigger part of the EV battery recycling market focus on the end-of-life segment. This is because batteries with high depth, volume, and density of discharge are nearing their cycle in EVs. Many countries particularly in Asia Pacific, Europe, and North America are implementing policies that promote the use of electric vehicles and as the adoption spreads it will only be reasonable to expect more electric vehicles on the road.

- Therefore there is a large supply of spent batteries which originate from these vehicles to offer for recycling. End-of-life batteries include batteries that are no longer capable of delivering power due to natural wear and tear or because they have come full circle in their operational cycle and need to be recycled for raw materials that can be used to manufacture new batteries or other relevant products

- Though the EO-Life segment shall continue to form a large proportion of the EV Battery Recycling market shortly, the production scrap segment is also expected to gather pace. Production scrap embraces batteries that are dilapidated or which are more than the required amount as a result of manufacturing electric vehicles and their batteries.

- Scavenging and recycling from the automotive industry to the electric vehicle industry remains a crucial sector of resource conservation as more and more manufacturers increase the efficiency of production, and reduce waste. Nonetheless, born of a previously unanticipated abundance of perfectionism, the practice of minimizing production scrap is widely maintained, which leaves an unavoidable degree of waste inherent to manufacturing processes. Recycling of production scrap is the process of reusing materials after they have been part of a manufacturing process which in the long run reduces the environmental footprint by having to go to the production line to make new stuff. The innovations that have taken place in the production of electric vehicles have an implication on the End-of-life and production scrap segments that are very essential for the growth of the EV Battery recycling market.

EV Battery Recycling Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The following are some of the reasons why Asia Pacific is leading the EV battery recycling market As explained above, Asia Pacific leads the EV battery recycling market for the following reasons. In the first instance, the region is a manufacturing hub for electric vehicles, with prominent economies such as China, Japan, and South Korea, which are the pioneers in manufacturing electric vehicles and related components including batteries.

- The concentration of EV manufacturing activities draws a large amount of spent battery, which creates a need for recycling solutions. In the same effort to address the end-of-life of EV batteries, strict environmental laws in countries such as China have pushed policymakers and key players to recycle the batteries promoting the recycling market’s growth in the area.

- Asia Pacific is said to have a proper structure and skilled manpower to deal with recycling infrastructure and related technology. East Asian nations such as South Korea and Japan have traditionally been identified with the growth of technology especially in areas that touch on materials science and engineering disciplines. The technological advancement thus facilitates the enhancement of efficient recycling strategies which works well in the reclamation of useful material from the batteries.

- In addition, many recycling facilities are located in the region and have established partnerships with battery manufacturers, which enhances the capability of collecting, processing, and reusing them to cater to the growth of the EV battery recycling market. In conclusion, the Asia Pacific region comes out as a key player in EV manufacturing encouraged by technology know-how and favorable policies thus making the Asia Pacific region a global hub in the EV battery recycling market.

Active Key Players in the EV Battery Recycling Market

- Accurec Recycling GmbH (Germany)

- American Manganese Inc. (Canada)

- Aqua Metals Inc. (United States)

- Battery Solutions LLC (United States)

- DOWA Eco-System Co., Ltd. (Japan)

- GEM Co., Ltd. (China)

- Glencore International AG (Switzerland)

- Li-Cycle Corp. (Canada)

- Neometals Ltd. (Australia)

- Raw Materials Company Inc. (Canada)

- Recupyl (France)

- Redux GmbH (Germany)

- Redwood Materials (United States)

- Retriev Technologies Inc. (United States)

- Retriev Technologies Inc. (United States)

- SNAM (Italy)

- SNAM (Italy)

- Tes-Amm (Singapore)

- The Doe Run Company (United States)

- Umicore (Belgium)

- Other Active Players

Key Industry Developments In the EV Battery Recycling Market

- In March 2024, Renault is pioneering a groundbreaking initiative to develop a closed-loop recycling process for EV batteries in Europe, positioning itself as a trailblazer in the industry and aiming to significantly diminish Europe’s reliance on imported battery materials, particularly from China.

- In January 2023, Aqua Metals, Inc. a pioneer in sustainable lithium battery recycling, announced the completion of due diligence on a property in Tahoe-Reno, as well as plans to commence phased development of a five-acre recycling campus designed to process more than 20 million pounds of lithium-ion battery material each year with its innovative Li AquaRefining™ technology.

|

Global EV Battery Recycling Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 0.53 Bn. |

|

Forecast Period 2025-32 CAGR: |

51.2% |

Market Size in 2032: |

USD 14.48 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: EV Battery Recycling Market by Type (2018-2032)

4.1 EV Battery Recycling Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Lithium-ion

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Lead Acid

4.5 Others

Chapter 5: EV Battery Recycling Market by Source (2018-2032)

5.1 EV Battery Recycling Market Snapshot and Growth Engine

5.2 Market Overview

5.3 End of life

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Production Scrap

Chapter 6: EV Battery Recycling Market by Vehicle Type (2018-2032)

6.1 EV Battery Recycling Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Passenger Cars

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Buses

6.5 Vans

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 EV Battery Recycling Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AVID TECHNOLOGY LIMITED (UNITED KINGDOM)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BORGWARNER INC. (UNITED STATES)

7.4 CALSONIC KANSEI CORPORATION (JAPAN)

7.5 CONTINENTAL AG (GERMANY)

7.6 DANA INCORPORATED (UNITED STATES)

7.7 DENSO CORPORATION (JAPAN)

7.8 EBERSPAECHER CLIMATE CONTROL SYSTEMS GMBH & CO. KG (GERMANY)

7.9 GENTHERM INCORPORATED (UNITED STATES)

7.10 GOTION HIGH-TECH COLTD. (CHINA)

7.11 HANON SYSTEMS (SOUTH KOREA)

7.12 LG CHEM (SOUTH KOREA)

7.13 MAHLE BEHR GMBH & CO. KG (GERMANY)

7.14 MAHLE GMBH (GERMANY)

7.15 MODINE MANUFACTURING COMPANY (UNITED STATES)

7.16 PANASONIC CORPORATION (JAPAN)

7.17 RICARDO PLC (UNITED KINGDOM)

7.18 ROBERT BOSCH GMBH (GERMANY)

7.19 SAMSUNG SDI (SOUTH KOREA)

7.20 VALEO SA (FRANCE)

7.21 VISTEON CORPORATION (UNITED STATES)

7.22 OTHER KEY PLAYERS

7.23

Chapter 8: Global EV Battery Recycling Market By Region

8.1 Overview

8.2. North America EV Battery Recycling Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Lithium-ion

8.2.4.2 Lead Acid

8.2.4.3 Others

8.2.5 Historic and Forecasted Market Size by Source

8.2.5.1 End of life

8.2.5.2 Production Scrap

8.2.6 Historic and Forecasted Market Size by Vehicle Type

8.2.6.1 Passenger Cars

8.2.6.2 Buses

8.2.6.3 Vans

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe EV Battery Recycling Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Lithium-ion

8.3.4.2 Lead Acid

8.3.4.3 Others

8.3.5 Historic and Forecasted Market Size by Source

8.3.5.1 End of life

8.3.5.2 Production Scrap

8.3.6 Historic and Forecasted Market Size by Vehicle Type

8.3.6.1 Passenger Cars

8.3.6.2 Buses

8.3.6.3 Vans

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe EV Battery Recycling Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Lithium-ion

8.4.4.2 Lead Acid

8.4.4.3 Others

8.4.5 Historic and Forecasted Market Size by Source

8.4.5.1 End of life

8.4.5.2 Production Scrap

8.4.6 Historic and Forecasted Market Size by Vehicle Type

8.4.6.1 Passenger Cars

8.4.6.2 Buses

8.4.6.3 Vans

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific EV Battery Recycling Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Lithium-ion

8.5.4.2 Lead Acid

8.5.4.3 Others

8.5.5 Historic and Forecasted Market Size by Source

8.5.5.1 End of life

8.5.5.2 Production Scrap

8.5.6 Historic and Forecasted Market Size by Vehicle Type

8.5.6.1 Passenger Cars

8.5.6.2 Buses

8.5.6.3 Vans

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa EV Battery Recycling Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Lithium-ion

8.6.4.2 Lead Acid

8.6.4.3 Others

8.6.5 Historic and Forecasted Market Size by Source

8.6.5.1 End of life

8.6.5.2 Production Scrap

8.6.6 Historic and Forecasted Market Size by Vehicle Type

8.6.6.1 Passenger Cars

8.6.6.2 Buses

8.6.6.3 Vans

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America EV Battery Recycling Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Lithium-ion

8.7.4.2 Lead Acid

8.7.4.3 Others

8.7.5 Historic and Forecasted Market Size by Source

8.7.5.1 End of life

8.7.5.2 Production Scrap

8.7.6 Historic and Forecasted Market Size by Vehicle Type

8.7.6.1 Passenger Cars

8.7.6.2 Buses

8.7.6.3 Vans

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global EV Battery Recycling Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 0.53 Bn. |

|

Forecast Period 2025-32 CAGR: |

51.2% |

Market Size in 2032: |

USD 14.48 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||