Embedded Systems Market Synopsis:

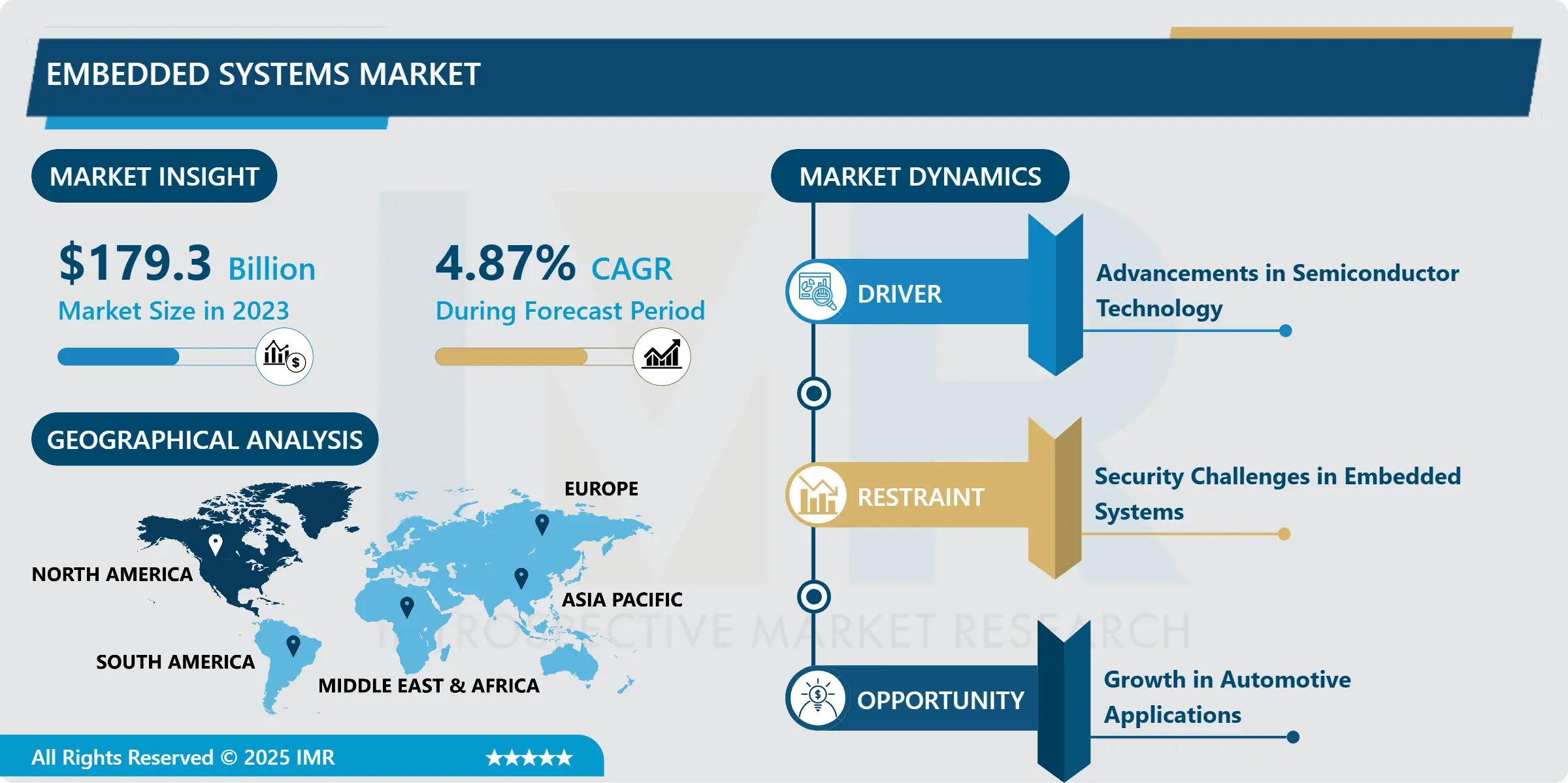

Embedded Systems Market Size Was Valued at USD 179.30 Billion in 2023, and is Projected to Reach USD 275.07 Billion by 2032, Growing at a CAGR of 4.87% From 2024-2032.

An embedded system is a computer system integrated into a larger system that has a particular function. These systems are fundamental in different fields and perform functionality control as well as operation in consumer electronics to aerospace systems.

Embedded systems are specifically used, closed computer systems adapted for work as the components of larger systems. Unlike other systems that are general-purpose systems, embedded systems are systems that are used for specific purposes only and hence are very efficient and reliable. Microcontrollers or microprocessors are combined with software that the programmer designs to fit the needs of applications.

The growth of the market for embedded systems is fueled by the progress of technologies and growth of differentiated sectors. In the Consumer electronics unit, we have smartphone, Smart TVs and other IoT devices, which are powered through embedded systems. They are critical about for automotive applications and for providing advanced driver assistance systems (ADAS), infotainment, or vehicle control. In the same way, healthcare sub sector incorporates them in used equipments such as pacemakers and diagnosis equipment among other uses in healthcare.

Embedded Systems Market Trend Analysis

Increasing Adoption of IoT in Embedded Systems

-

The Internet of Things (IoT) has become integrated with embed systems as a new trend. Samsung noted that IoT makes embedded systems to connect, gather and share information, improving their performance and usability. For example, in smart homes, IoT- based embedded systems regulate lights, security and other appliances by network connection.

-

It is growing at a fast pace because of the evolution in the wireless networks and IoT devices integration across the fields. In industrial apps IoT is considered as embedded systems propelling the action of Industry 4.0 through automation of operations, health check on equipment and prognosis of breakdown. In this article, the authors argue that IoT and embedded systems are on the verge of dramatically altering product development and service delivery in organisations and industries.

Growth in Automotive Applications

-

The automotive sector is one of the sectors that can provide a lot of growth potential for embedded systems. New generation vehicles are, therefore, dependent on embedded technology for safety, reliability, and connectivity. Functions such as ADAS, EV control , and self-driving systems utilizes a complex solution involving the usage of embedded systems.

-

This opportunity is made even larger with the globalization emphasis on sustainable transport. With the launch of electric and hybrid vehicles, embedded systems play an essential role in the battery, power train and charging system. This growing utilization of embedded system in automotive technology makes it the foundation for future mobility solutions.

Embedded Systems Market Segment Analysis:

Embedded Systems Market is Segmented on the basis of Type, Component, Functionality, Application, End User, and Region

By Type, Hardware segment is expected to dominate the market during the forecast period

-

The classification made on embedded systems includes; the hardware side as well as the software side. This category comprises of microcontrollers, microprocessors, sensors and the memory devices that serve as raw structure in a system. These components are important specifically for guaranteeing the stability and performance of applications in various spheres.

-

Software then refers to operating systems, system software, middle-ware, and specific application software to facilitate functioning of the hardware in carrying out some operations. The hardware and software integration is fundamental to the development of sophisticated seamless systems that can be optimized for certain applications.

By Application, Consumer Electronics segment expected to held the largest share

-

Embedded systems can be determined in almost all industries. In consumer electronics, they are used to operate smartphones, and gaming consoles, and wearable gadgets. In the automobile industry, people apply embedded systems for motor vehicle management as well as entertainment and security systems in the cars, while medical field applications are used in diagnosing equipment and in monitoring patient’s health.

-

In the industrial area, embedded systems operate industries, robotics, and smart manufacturing. For instance, aerospace and defense industries depend on them in aviomics and navigation processes while the communication industries depend on them in the networking and telecommunication industry. This practical usability, essentially confirms the importance of this element in applications of modern informatization processes.

Embedded Systems Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America has the largest market share for embedded systems, because of its technological development and the high take-up rate within various sectors. Automotive, healthcare, and aerospace industries of the region are the primary customers of embedded systems, with the backing of key technology solution providers and research entities.

-

The government policies that are friendly to innovations in some sectors and fields, such as self-driving vehicles, smart manufacturing, work to enhance the market growth in North America. This region is investing a large amount into research and development and has already adopted many of the new technologies within the embedded system market.

Active Key Players in the Embedded Systems Market

- Intel Corporation (USA)

- Texas Instruments (USA)

- NXP Semiconductors (Netherlands)

- STMicroelectronics (Switzerland)

- Renesas Electronics Corporation (Japan)

- Microchip Technology Inc. (USA)

- Qualcomm Technologies Inc. (USA)

- Cypress Semiconductor Corporation (USA)

- Broadcom Inc. (USA)

- Infineon Technologies (Germany)

- Analog Devices, Inc. (USA)

- ARM Holdings (UK)

- Other Active Players

|

Global Embedded Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 179.30 Billion |

|

Forecast Period 2024-32 CAGR: |

4.87% |

Market Size in 2032: |

USD 275.07 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Embedded Systems Market by Type

4.1 Embedded Systems Market Snapshot and Growth Engine

4.2 Embedded Systems Market Overview

4.3 Hardware

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Hardware: Geographic Segmentation Analysis

4.4 Software

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Software: Geographic Segmentation Analysis

Chapter 5: Embedded Systems Market by Component

5.1 Embedded Systems Market Snapshot and Growth Engine

5.2 Embedded Systems Market Overview

5.3 Microcontrollers

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Microcontrollers: Geographic Segmentation Analysis

5.4 Microprocessors

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Microprocessors: Geographic Segmentation Analysis

5.5 Application-Specific Integrated Circuits (ASICs)

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Application-Specific Integrated Circuits (ASICs): Geographic Segmentation Analysis

5.6 Digital Signal Processors (DSPs)

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Digital Signal Processors (DSPs): Geographic Segmentation Analysis

5.7 Memory

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Memory: Geographic Segmentation Analysis

5.8 Others

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Others: Geographic Segmentation Analysis

Chapter 6: Embedded Systems Market by Application

6.1 Embedded Systems Market Snapshot and Growth Engine

6.2 Embedded Systems Market Overview

6.3 Consumer Electronics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Consumer Electronics: Geographic Segmentation Analysis

6.4 Automotive

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Automotive: Geographic Segmentation Analysis

6.5 Healthcare

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Healthcare: Geographic Segmentation Analysis

6.6 Industrial

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Industrial: Geographic Segmentation Analysis

6.7 Aerospace & Defense

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Aerospace & Defense: Geographic Segmentation Analysis

6.8 Communication

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Communication: Geographic Segmentation Analysis

6.9 Others

6.9.1 Introduction and Market Overview

6.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.9.3 Key Market Trends, Growth Factors and Opportunities

6.9.4 Others: Geographic Segmentation Analysis

Chapter 7: Embedded Systems Market by Functionality

7.1 Embedded Systems Market Snapshot and Growth Engine

7.2 Embedded Systems Market Overview

7.3 Real-Time Embedded Systems

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Real-Time Embedded Systems: Geographic Segmentation Analysis

7.4 Standalone Embedded Systems

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Standalone Embedded Systems: Geographic Segmentation Analysis

7.5 Network Embedded Systems

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Network Embedded Systems: Geographic Segmentation Analysis

7.6 Mobile Embedded Systems

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Mobile Embedded Systems: Geographic Segmentation Analysis

Chapter 8: Embedded Systems Market by End-User

8.1 Embedded Systems Market Snapshot and Growth Engine

8.2 Embedded Systems Market Overview

8.3 Automotive

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Automotive: Geographic Segmentation Analysis

8.4 Healthcare

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Healthcare: Geographic Segmentation Analysis

8.5 Consumer Electronics

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Consumer Electronics: Geographic Segmentation Analysis

8.6 Telecommunication

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Telecommunication: Geographic Segmentation Analysis

8.7 Industrial

8.7.1 Introduction and Market Overview

8.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.7.3 Key Market Trends, Growth Factors and Opportunities

8.7.4 Industrial: Geographic Segmentation Analysis

8.8 Aerospace & Defense

8.8.1 Introduction and Market Overview

8.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.8.3 Key Market Trends, Growth Factors and Opportunities

8.8.4 Aerospace & Defense: Geographic Segmentation Analysis

8.9 Others

8.9.1 Introduction and Market Overview

8.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.9.3 Key Market Trends, Growth Factors and Opportunities

8.9.4 Others: Geographic Segmentation Analysis

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Embedded Systems Market Share by Manufacturer (2023)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 INTEL CORPORATION (USA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 TEXAS INSTRUMENTS (USA)

9.4 NXP SEMICONDUCTORS (NETHERLANDS)

9.5 STMICROELECTRONICS (SWITZERLAND)

9.6 RENESAS ELECTRONICS CORPORATION (JAPAN)

9.7 MICROCHIP TECHNOLOGY INC. (USA)

9.8 QUALCOMM TECHNOLOGIES INC. (USA)

9.9 CYPRESS SEMICONDUCTOR CORPORATION (USA)

9.10 BROADCOM INC. (USA)

9.11 INFINEON TECHNOLOGIES (GERMANY)

9.12 ANALOG DEVICES INC. (USA)

9.13 ARM HOLDINGS (UK)

9.14 OTHER ACTIVE PLAYERS

Chapter 10: Global Embedded Systems Market By Region

10.1 Overview

10.2. North America Embedded Systems Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By Type

10.2.4.1 Hardware

10.2.4.2 Software

10.2.5 Historic and Forecasted Market Size By Component

10.2.5.1 Microcontrollers

10.2.5.2 Microprocessors

10.2.5.3 Application-Specific Integrated Circuits (ASICs)

10.2.5.4 Digital Signal Processors (DSPs)

10.2.5.5 Memory

10.2.5.6 Others

10.2.6 Historic and Forecasted Market Size By Application

10.2.6.1 Consumer Electronics

10.2.6.2 Automotive

10.2.6.3 Healthcare

10.2.6.4 Industrial

10.2.6.5 Aerospace & Defense

10.2.6.6 Communication

10.2.6.7 Others

10.2.7 Historic and Forecasted Market Size By Functionality

10.2.7.1 Real-Time Embedded Systems

10.2.7.2 Standalone Embedded Systems

10.2.7.3 Network Embedded Systems

10.2.7.4 Mobile Embedded Systems

10.2.8 Historic and Forecasted Market Size By End-User

10.2.8.1 Automotive

10.2.8.2 Healthcare

10.2.8.3 Consumer Electronics

10.2.8.4 Telecommunication

10.2.8.5 Industrial

10.2.8.6 Aerospace & Defense

10.2.8.7 Others

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Embedded Systems Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By Type

10.3.4.1 Hardware

10.3.4.2 Software

10.3.5 Historic and Forecasted Market Size By Component

10.3.5.1 Microcontrollers

10.3.5.2 Microprocessors

10.3.5.3 Application-Specific Integrated Circuits (ASICs)

10.3.5.4 Digital Signal Processors (DSPs)

10.3.5.5 Memory

10.3.5.6 Others

10.3.6 Historic and Forecasted Market Size By Application

10.3.6.1 Consumer Electronics

10.3.6.2 Automotive

10.3.6.3 Healthcare

10.3.6.4 Industrial

10.3.6.5 Aerospace & Defense

10.3.6.6 Communication

10.3.6.7 Others

10.3.7 Historic and Forecasted Market Size By Functionality

10.3.7.1 Real-Time Embedded Systems

10.3.7.2 Standalone Embedded Systems

10.3.7.3 Network Embedded Systems

10.3.7.4 Mobile Embedded Systems

10.3.8 Historic and Forecasted Market Size By End-User

10.3.8.1 Automotive

10.3.8.2 Healthcare

10.3.8.3 Consumer Electronics

10.3.8.4 Telecommunication

10.3.8.5 Industrial

10.3.8.6 Aerospace & Defense

10.3.8.7 Others

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Embedded Systems Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By Type

10.4.4.1 Hardware

10.4.4.2 Software

10.4.5 Historic and Forecasted Market Size By Component

10.4.5.1 Microcontrollers

10.4.5.2 Microprocessors

10.4.5.3 Application-Specific Integrated Circuits (ASICs)

10.4.5.4 Digital Signal Processors (DSPs)

10.4.5.5 Memory

10.4.5.6 Others

10.4.6 Historic and Forecasted Market Size By Application

10.4.6.1 Consumer Electronics

10.4.6.2 Automotive

10.4.6.3 Healthcare

10.4.6.4 Industrial

10.4.6.5 Aerospace & Defense

10.4.6.6 Communication

10.4.6.7 Others

10.4.7 Historic and Forecasted Market Size By Functionality

10.4.7.1 Real-Time Embedded Systems

10.4.7.2 Standalone Embedded Systems

10.4.7.3 Network Embedded Systems

10.4.7.4 Mobile Embedded Systems

10.4.8 Historic and Forecasted Market Size By End-User

10.4.8.1 Automotive

10.4.8.2 Healthcare

10.4.8.3 Consumer Electronics

10.4.8.4 Telecommunication

10.4.8.5 Industrial

10.4.8.6 Aerospace & Defense

10.4.8.7 Others

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Embedded Systems Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By Type

10.5.4.1 Hardware

10.5.4.2 Software

10.5.5 Historic and Forecasted Market Size By Component

10.5.5.1 Microcontrollers

10.5.5.2 Microprocessors

10.5.5.3 Application-Specific Integrated Circuits (ASICs)

10.5.5.4 Digital Signal Processors (DSPs)

10.5.5.5 Memory

10.5.5.6 Others

10.5.6 Historic and Forecasted Market Size By Application

10.5.6.1 Consumer Electronics

10.5.6.2 Automotive

10.5.6.3 Healthcare

10.5.6.4 Industrial

10.5.6.5 Aerospace & Defense

10.5.6.6 Communication

10.5.6.7 Others

10.5.7 Historic and Forecasted Market Size By Functionality

10.5.7.1 Real-Time Embedded Systems

10.5.7.2 Standalone Embedded Systems

10.5.7.3 Network Embedded Systems

10.5.7.4 Mobile Embedded Systems

10.5.8 Historic and Forecasted Market Size By End-User

10.5.8.1 Automotive

10.5.8.2 Healthcare

10.5.8.3 Consumer Electronics

10.5.8.4 Telecommunication

10.5.8.5 Industrial

10.5.8.6 Aerospace & Defense

10.5.8.7 Others

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Embedded Systems Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By Type

10.6.4.1 Hardware

10.6.4.2 Software

10.6.5 Historic and Forecasted Market Size By Component

10.6.5.1 Microcontrollers

10.6.5.2 Microprocessors

10.6.5.3 Application-Specific Integrated Circuits (ASICs)

10.6.5.4 Digital Signal Processors (DSPs)

10.6.5.5 Memory

10.6.5.6 Others

10.6.6 Historic and Forecasted Market Size By Application

10.6.6.1 Consumer Electronics

10.6.6.2 Automotive

10.6.6.3 Healthcare

10.6.6.4 Industrial

10.6.6.5 Aerospace & Defense

10.6.6.6 Communication

10.6.6.7 Others

10.6.7 Historic and Forecasted Market Size By Functionality

10.6.7.1 Real-Time Embedded Systems

10.6.7.2 Standalone Embedded Systems

10.6.7.3 Network Embedded Systems

10.6.7.4 Mobile Embedded Systems

10.6.8 Historic and Forecasted Market Size By End-User

10.6.8.1 Automotive

10.6.8.2 Healthcare

10.6.8.3 Consumer Electronics

10.6.8.4 Telecommunication

10.6.8.5 Industrial

10.6.8.6 Aerospace & Defense

10.6.8.7 Others

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Embedded Systems Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By Type

10.7.4.1 Hardware

10.7.4.2 Software

10.7.5 Historic and Forecasted Market Size By Component

10.7.5.1 Microcontrollers

10.7.5.2 Microprocessors

10.7.5.3 Application-Specific Integrated Circuits (ASICs)

10.7.5.4 Digital Signal Processors (DSPs)

10.7.5.5 Memory

10.7.5.6 Others

10.7.6 Historic and Forecasted Market Size By Application

10.7.6.1 Consumer Electronics

10.7.6.2 Automotive

10.7.6.3 Healthcare

10.7.6.4 Industrial

10.7.6.5 Aerospace & Defense

10.7.6.6 Communication

10.7.6.7 Others

10.7.7 Historic and Forecasted Market Size By Functionality

10.7.7.1 Real-Time Embedded Systems

10.7.7.2 Standalone Embedded Systems

10.7.7.3 Network Embedded Systems

10.7.7.4 Mobile Embedded Systems

10.7.8 Historic and Forecasted Market Size By End-User

10.7.8.1 Automotive

10.7.8.2 Healthcare

10.7.8.3 Consumer Electronics

10.7.8.4 Telecommunication

10.7.8.5 Industrial

10.7.8.6 Aerospace & Defense

10.7.8.7 Others

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Embedded Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 179.30 Billion |

|

Forecast Period 2024-32 CAGR: |

4.87% |

Market Size in 2032: |

USD 275.07 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||