Electronic Nose Market Synopsis:

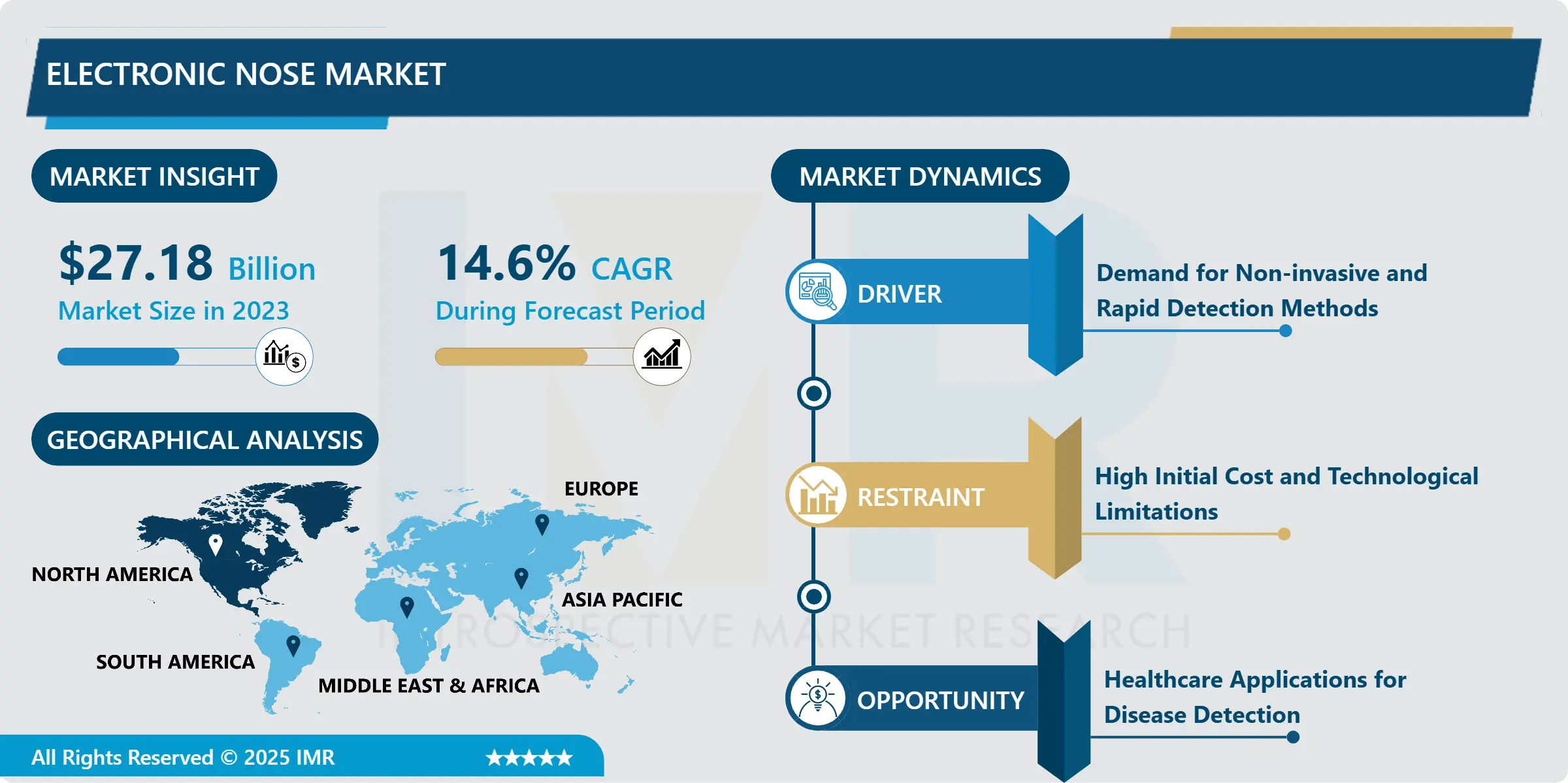

Electronic Nose Market Size Was Valued at USD 27.18 Billion in 2023, and is Projected to Reach USD 92.66 Billion by 2032, Growing at a CAGR of 14.6% From 2024-2032.

The electronic nose (e-nose) market is the technology and devices that are used with the similar purpose to human olfactory system for detecting and analyzing the smells or the volatile organic compounds (VOCs). They find application across many fields for accurate, rapid and noncontact measurements of multicomponent odour samples; making them extremely beneficial in quality assurance, air quality and detection systems.

The market for electronic nose has grown steadily due to increase in sensers’ technologies that increases sensibility to different odors. An e-nose is an electronic device involving an array of chemical sensors, which is employed for detecting and characterizing odors from composite atmospheres. Their work is based on the ability of some chemical substances that emit odours to be detected by the equipment known as the volatile organic compounds (VOCs). Models like the biological olfactory system of the electronic nose is very effective especially if the intent is to get specific information concerning the chemical constitution of the odor and this is why the electronic nose is widely used in the food and beverage industries.

The e-nose technology in the food and beverages industry is widely used to check whether various products meet the required standards regarding their smell or freshness and general quality, etc. Healthcare applications are centered on the use of breath analysis, because some diseases, such as diabetes or cancer, for example, have a certain smell that can be identified by an electronic nose. Environmental management also takes advantage of this technology; e-noses of pollutants or hazardous gases enhance air quality. In agriculture, the technology is employed in the evaluation of the quality of the food and or plants, identification of pests, or surveillance of the surrounding to enhance crop productivity.

The electronic nose market is set to experience an upsurge in demand as more and more sectors seek better ways of identifying diseases, contaminants and compounds without the use of invasive invasive, time-consuming and accurate methods. An exciting driver in the global market is the application of artificial intelligence and machine learning, which improves the efficiency of electronic noses by making the latter learn and become better at detecting odours. Furthermore, increasing awareness over pollution and the actual need of efficient monitoring systems is expected to drive the market over the future years.

Electronic Nose Market Trend Analysis:

Advancements in AI and Machine Learning Integration

-

The utilization of chemical sensor interfaces with the assistance of AI and ML to improve the capabilities of the device. Using the essence of a sophisticated mathematic formula, AI facilitates e-noses’ in their effort to sort out real complicated data and leads them to being able to differentiate between one smell from another. Through enhanced accuracy in deciphering chemical signals, these systems are able to recognize odours with far more efficiency in comparing with complex blends, which is vital in area such as medical diagnosis or food analysis.

-

It also enables electronic noses to learn from fresh data, or grow more sensitive and precise as a result of the algorithms used in AI and ML. This self-learning property makes e-noses more effective in many uses such as environmental detection which involves the detection of specific gases in large spaces, in defense and security engineering where the identification of chemical or biological agents may be of great importance. Since the advancement of AI and ML technology is going on continuously the uses of electronic nose will also be improvised and thus established firmly to its different fields.

Healthcare Applications for Disease Detection

-

The application of the electronic nose in healthcare is one of the most promising opportunities for its market development since breath diagnostics is an effective method of disease diagnosis. A type of e-noses can identify certain bio-markers that are used to diagnose certain diseases including cancer, diabetes or respiratory diseases by detecting volatile materials in exhaled breath. This non invasive procedure outlined can be a new opportunity in early diagnosis of diseases hence leading to an efficient diagnose as compared to the time tested methods such as blood tests or scans.

-

The chance to redesign the diagnostics of healthcare is very great. For instance, the screening out of lung cancer since in most cases the disease is diagnosed at an advanced stage can be eased by e-nose. Furthermore, diseases such as diabetes in which high levels of blood glucose result in smelly breath may be far easier to manage. The potential to perform such analyses at home or clinics translates to enormous reductions in healthcare costs as well as early diagnosis, easily making the electronic nose a promising market for growth in the medical field.

Electronic Nose Market Segment Analysis:

Electronic Nose Market is Segmented on the basis of Technology, Application, End User, and Region

By Technology, Metal Oxide Semiconductor (MOS) segment is expected to dominate the market during the forecast period

-

The market of electronic nose can be divided by several technologies which in turn define its capabilities and usage of e-noses. The Metal Oxide Semaphore (MOS) technology is one of the most used, based on the interaction of the metal oxide surfaces with volatile compounds so as to cause a variation of resistance which is then measured for the identification of particular odors. MOS sensors are affordable and versatile in giving a response to a large number of substances hence applicable in food quality control, health, and environment.

-

The other technologies that exist in the market are Quartz Crystal Microbalance (QCM) technology, Surface Acoustic Wave (SAW) technology, and Conducting Polymers’ technology. The working principle of QCM sensors is based on the variation of the frequency of a quartz crystal resonator when interacting with gases; therefore, this type of sensors is suitable for the identification of low concentrations of a compound in a sample. SAW sensors work on the basis of acoustic waves that happen to affect chemical substances in the air, they offer short response time and high sensitivity. E-noses incorporate conducting polymers because they change conductivity whenever they are exposed to a certain gas. These sensors prove viable where gases are present in industrial or agricultural setting. The marriage of these technologies is deemed necessity to offer accurate and a variety of odor detection opportunities in line with different industries.

By Application, Food & Beverages segment expected to held the largest share

-

The e-noses find usage in various fields such as locomotive, aerospace, automotive, biomedical, food and beverages leading industry among others. E-noses are used in this industry to monitor and maintain quality and standard of products; the material, half finished, and the final products. Some are employed in the identification of spoiling agents, in tracking the fermentation processes as well as the flavors and the smells. These capabilities make electronic noses witchless testing and valuable for ensuring consistent food quality test and packaging.

-

In healthcare, capabilities of applying e-noses in the early diagnosis of diseases are growing rapidly. The technology can recognize particular biomarkers in a patient’s breath; early diagnosis of conditions such as diabetes or cancer. Another important application is environmental monitoring: e-noses are employed to identify dangerous gases and emissions, and to conform with environmental standards. Furthermore, e-noses are applied to the defense and security fields for obtaining chemical or biological threats; the primary benefit is that e-noses can quickly and nonintrusively detect threats during security and surveillance.

Electronic Nose Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North American electronic nose market is at present leading the industry with strong healthcare facilities, technological innovation, and escalating funding towards smart health solutions. Its critics have forecasted a replacement of traditional technology with the E-noses, particularly in the United States, owing to the mounting use of this technology in the health care industry.

-

North America also has vast market for electronic noses used in the environmental analysis and in the food industry. New concerns over pollution and safety of foods a re continually directing both government and private sectors to embrace e-nose technologies. Additionally, the research and development laboratories deployed in the region have not relented on the development of e-nose applications making it possible for North America to retain the dominance of the world market.

Active Key Players in the Electronic Nose Market

- AirSense Analytics (Germany)

- Figaro Engineering Inc. (Japan)

- Alpha MOS (France)

- Smiths Detection (USA)

- Sensigent Inc. (USA)

- Owlstone Inc. (UK)

- Odotech Inc. (Canada)

- Breath Diagnostics Inc. (USA)

- Airsense GmbH (Germany)

- Odorico (Belgium)

- Nanometrics (USA)

- Electronic Sensor Technology (USA)

- Other Active Players

|

Global Electronic Nose Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 27.18 Billion |

|

Forecast Period 2024-32 CAGR: |

14.6% |

Market Size in 2032: |

USD 92.66 Billion |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Electronic Nose Market by Technology

4.1 Electronic Nose Market Snapshot and Growth Engine

4.2 Electronic Nose Market Overview

4.3 Metal Oxide Semiconductor (MOS)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Metal Oxide Semiconductor (MOS): Geographic Segmentation Analysis

4.4 Quartz Crystal Microbalance (QCM)

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Quartz Crystal Microbalance (QCM): Geographic Segmentation Analysis

4.5 Surface Acoustic Wave (SAW)

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Surface Acoustic Wave (SAW): Geographic Segmentation Analysis

4.6 Conducting Polymer

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Conducting Polymer: Geographic Segmentation Analysis

4.7 Others

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Others: Geographic Segmentation Analysis

Chapter 5: Electronic Nose Market by Application

5.1 Electronic Nose Market Snapshot and Growth Engine

5.2 Electronic Nose Market Overview

5.3 Food & Beverages

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Food & Beverages: Geographic Segmentation Analysis

5.4 Healthcare

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Healthcare: Geographic Segmentation Analysis

5.5 Environmental Monitoring

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Environmental Monitoring: Geographic Segmentation Analysis

5.6 Agriculture

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Agriculture: Geographic Segmentation Analysis

5.7 Defense & Security

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Defense & Security: Geographic Segmentation Analysis

5.8 Others

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Others: Geographic Segmentation Analysis

Chapter 6: Electronic Nose Market by End-User

6.1 Electronic Nose Market Snapshot and Growth Engine

6.2 Electronic Nose Market Overview

6.3 Industrial

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Industrial: Geographic Segmentation Analysis

6.4 Commercial

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Commercial: Geographic Segmentation Analysis

6.5 Residential

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Residential: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Electronic Nose Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AIRSENSE ANALYTICS (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 FIGARO ENGINEERING INC. (JAPAN)

7.4 ALPHA MOS (FRANCE)

7.5 SMITHS DETECTION (USA)

7.6 SENSIGENT INC. (USA)

7.7 OWLSTONE INC. (UK)

7.8 ODOTECH INC. (CANADA)

7.9 BREATH DIAGNOSTICS INC. (USA)

7.10 AIRSENSE GMBH (GERMANY)

7.11 ODORICO (BELGIUM)

7.12 NANOMETRICS (USA)

7.13 ELECTRONIC SENSOR TECHNOLOGY (USA)

7.14 OTHER ACTIVE PLAYERS

Chapter 8: Global Electronic Nose Market By Region

8.1 Overview

8.2. North America Electronic Nose Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Technology

8.2.4.1 Metal Oxide Semiconductor (MOS)

8.2.4.2 Quartz Crystal Microbalance (QCM)

8.2.4.3 Surface Acoustic Wave (SAW)

8.2.4.4 Conducting Polymer

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Food & Beverages

8.2.5.2 Healthcare

8.2.5.3 Environmental Monitoring

8.2.5.4 Agriculture

8.2.5.5 Defense & Security

8.2.5.6 Others

8.2.6 Historic and Forecasted Market Size By End-User

8.2.6.1 Industrial

8.2.6.2 Commercial

8.2.6.3 Residential

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Electronic Nose Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Technology

8.3.4.1 Metal Oxide Semiconductor (MOS)

8.3.4.2 Quartz Crystal Microbalance (QCM)

8.3.4.3 Surface Acoustic Wave (SAW)

8.3.4.4 Conducting Polymer

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Food & Beverages

8.3.5.2 Healthcare

8.3.5.3 Environmental Monitoring

8.3.5.4 Agriculture

8.3.5.5 Defense & Security

8.3.5.6 Others

8.3.6 Historic and Forecasted Market Size By End-User

8.3.6.1 Industrial

8.3.6.2 Commercial

8.3.6.3 Residential

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Electronic Nose Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Technology

8.4.4.1 Metal Oxide Semiconductor (MOS)

8.4.4.2 Quartz Crystal Microbalance (QCM)

8.4.4.3 Surface Acoustic Wave (SAW)

8.4.4.4 Conducting Polymer

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Food & Beverages

8.4.5.2 Healthcare

8.4.5.3 Environmental Monitoring

8.4.5.4 Agriculture

8.4.5.5 Defense & Security

8.4.5.6 Others

8.4.6 Historic and Forecasted Market Size By End-User

8.4.6.1 Industrial

8.4.6.2 Commercial

8.4.6.3 Residential

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Electronic Nose Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Technology

8.5.4.1 Metal Oxide Semiconductor (MOS)

8.5.4.2 Quartz Crystal Microbalance (QCM)

8.5.4.3 Surface Acoustic Wave (SAW)

8.5.4.4 Conducting Polymer

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Food & Beverages

8.5.5.2 Healthcare

8.5.5.3 Environmental Monitoring

8.5.5.4 Agriculture

8.5.5.5 Defense & Security

8.5.5.6 Others

8.5.6 Historic and Forecasted Market Size By End-User

8.5.6.1 Industrial

8.5.6.2 Commercial

8.5.6.3 Residential

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Electronic Nose Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Technology

8.6.4.1 Metal Oxide Semiconductor (MOS)

8.6.4.2 Quartz Crystal Microbalance (QCM)

8.6.4.3 Surface Acoustic Wave (SAW)

8.6.4.4 Conducting Polymer

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Food & Beverages

8.6.5.2 Healthcare

8.6.5.3 Environmental Monitoring

8.6.5.4 Agriculture

8.6.5.5 Defense & Security

8.6.5.6 Others

8.6.6 Historic and Forecasted Market Size By End-User

8.6.6.1 Industrial

8.6.6.2 Commercial

8.6.6.3 Residential

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Electronic Nose Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Technology

8.7.4.1 Metal Oxide Semiconductor (MOS)

8.7.4.2 Quartz Crystal Microbalance (QCM)

8.7.4.3 Surface Acoustic Wave (SAW)

8.7.4.4 Conducting Polymer

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Food & Beverages

8.7.5.2 Healthcare

8.7.5.3 Environmental Monitoring

8.7.5.4 Agriculture

8.7.5.5 Defense & Security

8.7.5.6 Others

8.7.6 Historic and Forecasted Market Size By End-User

8.7.6.1 Industrial

8.7.6.2 Commercial

8.7.6.3 Residential

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Electronic Nose Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 27.18 Billion |

|

Forecast Period 2024-32 CAGR: |

14.6% |

Market Size in 2032: |

USD 92.66 Billion |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||