Electronic Access Control Systems Market Synopsis:

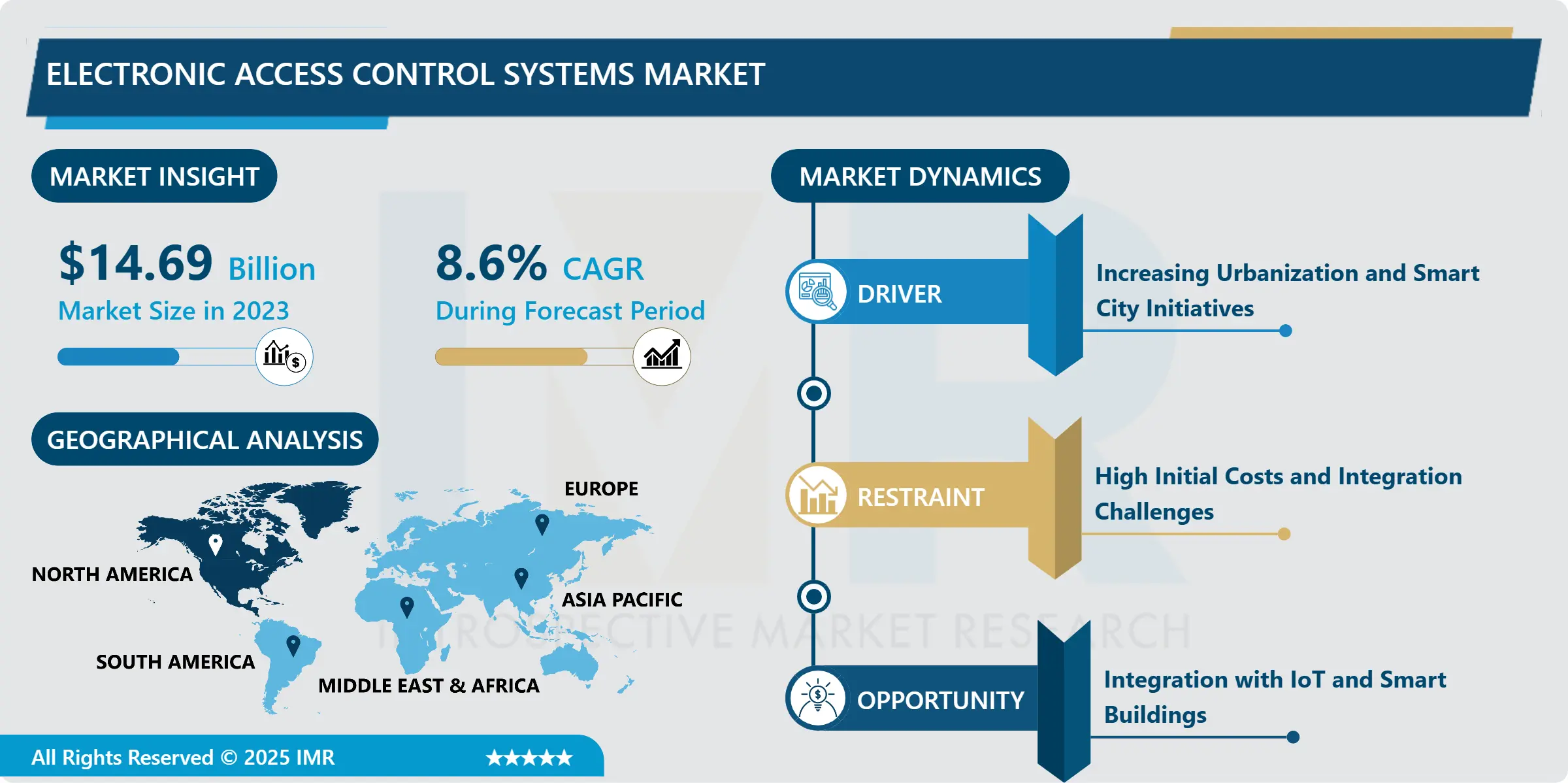

Electronic Access Control Systems Market Size Was Valued at USD 14.69 Billion in 2023, and is Projected to Reach USD 30.87 Billion by 2032, Growing at a CAGR of 8.6% From 2024-2032.

The Electronic Access Control Systems Market constitutes systems and devices that limit access to a location or an object, as well as information by using rights such as identification, biometric, or numeric, or any other means. These systems, acting as a substitute for the conventional lock and key systems, increase safety and security, provide real-time flexibility and scalability for home, office and industrial uses.

Electric access control is an important part of today security systems in residential, commercial and industrial as well as other building structures. From the trends observed, the utilization of connected devices forces companies and other organizations to use complex systems that go beyond access control, like analytics, continuous monitoring, and compatibility with other security systems. These systems apply the best and most modern approaches such as biometric systems, artificial intelligence, Internet of Things, and cloud infrastructure for meaning high levels of security alongside convenience and effectiveness in operations.

There is tremendous growth in the market by the increasing threats of unauthorized access, theft and terrorism and the up-surging security regulation standards. Besides this, use of smart city, increasing population of the world, rising urbanization especially in developing countries and improvement in the biometric technology also has increased the demand of these solutions. Due to the growing focus on security and optimal business functioning, the electronic access control systems market remains in a developing state that adds new features such as facial recognition, access through a mobile application, and predictive capabilities to adapt to customers’ and industries’ requirements.

Electronic Access Control Systems Market Trend Analysis:

Biometric Authentication on the Rise

-

The analysis indicates that biometric authentication is the leading trend in the electronic access control systems market. Being able to using fingerprints thumbs and other body structures like face detection to approve identification, biometric systems have unmatched efficacy and safety measures. Ease of use has increased due to the ever-increasing use of smart devices with embedded biometric sensors that also make the technology acceptable for workplace, airports and secured facilities.

- Increase the reliability of biometric systems and decrease the number of false positives, organizers combine it with artificial intelligence and machine learning. Such innovations are particularly effective in those areas where standard card or keypad systems might be compromised. The pandemic accelerated the requirement for touchless applications such as facial recognition, further boosting this segment as both commercial entities and governments focus on hygiene in addition to security.

Integration with IoT and Smart Buildings

-

The opportunity lies in the connections of EAC with the Internet of Things and smart building technologies. When making access control systems work with IoT connected devices, facility usage, energy and personnel movements among facilities can be better analyzed. For instance, IoT based smart access control for buildings can turn on/off the light and HVAC depending on whether the room is occupied or not besides improving security.

- This integration is especially important for smart city projects, because various components need to be connected to work as part of a whole system. hich becomes also an essential hub when IoT is adopted as the more people also choose the electronic access control system coupled with surveillance systems, alarms, and emergency responses. However, this connectivity does not only work for security benefits but also work as a value-add since it generates data that can be leveraged to ensure the most efficient operations and, thus, deliver a higher value to the end-users.

Electronic Access Control Systems Market Segment Analysis:

Electronic Access Control Systems Market is Segmented on the basis of Type, Component, Technology, Application, End User, and Region

By Type, Biometrics segment is expected to dominate the market during the forecast period

-

Biometric, card, keypad and other forms of access control are used in providing electronic access control in system. Among all technologies used in biometric recognition, fingerprint, facial, and iris recognition systems are the most rapidly developing ones owing to their high security and reliability.

- The systems based on a keypad are George with increasing frequency being replaced due to the possibility of hacking them and stealing passwords. There are others like Mobile based Access control system that are also finding more application since people are looking for remote solutions without physical contact.

By Application, Door Access Control segment expected to held the largest share

-

These are used in door access control, vehicle access control, and in several other unique applications Electronic access control technology is used in door access control. Electromechanical systems dominate this market, being in high demand and application in offices, residential, and industrial buildings. They also allow just only certain persons to gain access to certain structures, while at the same time providing records of activity for compliance purposes.

- Vehicle access control is also very significant at this time especially in parking and logistics management. IOT based smart systems allow vehicles to enter as well as exit without having to wait for much time or causing a traffic jam. While other applications including elevator access and the monitoring of remote facilities are getting more important in such specialized domains as hospitality and data centers.

Electronic Access Control Systems Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America has the largest demand for electronic access control systems due to favourable technological development and high security concerns. The area has a high industry density of leading providers of innovative technologies and services. Furthermore, requirements set by governments or international standards necessary for healthcare facilities, financial organizations and others make sophisticated accesses control necessary.

- Smart city plans and technology conscious consumers give added boost to the market in the region. Security is on the list of priorities in North American businesses, that develop AI, IoT, and cloud-based platforms for creation of integrated solutions. That is why this trend guarantees the region’s leadership in the market.

Active Key Players in the Electronic Access Control Systems Market

-

Honeywell International Inc. (United States)

- Bosch Security Systems GmbH (Germany)

- ASSA ABLOY AB (Sweden)

- HID Global Corporation (United States)

- Axis Communications AB (Sweden)

- Schneider Electric SE (France)

- Dormakaba Holding AG (Switzerland)

- Johnson Controls International plc (Ireland)

- Allegion plc (Ireland)

- Identiv, Inc. (United States)

- IDEMIA (France)

- Siemens AG (Germany)

- Other Active Players

|

Global Electronic Access Control Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 14.69 Billion |

|

Forecast Period 2024-32 CAGR: |

8.6% |

Market Size in 2032: |

USD 30.87 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Electronic Access Control Systems Market by Component

4.1 Electronic Access Control Systems Market Snapshot and Growth Engine

4.2 Electronic Access Control Systems Market Overview

4.3 Hardware

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Hardware: Geographic Segmentation Analysis

4.4 Software

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Software: Geographic Segmentation Analysis

4.5 Services

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Services: Geographic Segmentation Analysis

Chapter 5: Electronic Access Control Systems Market by Type

5.1 Electronic Access Control Systems Market Snapshot and Growth Engine

5.2 Electronic Access Control Systems Market Overview

5.3 Biometrics

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Biometrics: Geographic Segmentation Analysis

5.4 Card-based

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Card-based: Geographic Segmentation Analysis

5.5 Keypad-based

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Keypad-based: Geographic Segmentation Analysis

5.6 Others

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Others: Geographic Segmentation Analysis

Chapter 6: Electronic Access Control Systems Market by End User

6.1 Electronic Access Control Systems Market Snapshot and Growth Engine

6.2 Electronic Access Control Systems Market Overview

6.3 Residential

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Residential: Geographic Segmentation Analysis

6.4 Commercial

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Commercial: Geographic Segmentation Analysis

6.5 Industrial

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Industrial: Geographic Segmentation Analysis

6.6 Government

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Government: Geographic Segmentation Analysis

Chapter 7: Electronic Access Control Systems Market by Technology

7.1 Electronic Access Control Systems Market Snapshot and Growth Engine

7.2 Electronic Access Control Systems Market Overview

7.3 Bluetooth

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Bluetooth: Geographic Segmentation Analysis

7.4 RFID

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 RFID: Geographic Segmentation Analysis

7.5 Wi-Fi

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Wi-Fi: Geographic Segmentation Analysis

7.6 Infrared

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Infrared: Geographic Segmentation Analysis

7.7 Others

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Others: Geographic Segmentation Analysis

Chapter 8: Electronic Access Control Systems Market by Application

8.1 Electronic Access Control Systems Market Snapshot and Growth Engine

8.2 Electronic Access Control Systems Market Overview

8.3 Door Access Control

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Door Access Control: Geographic Segmentation Analysis

8.4 Vehicle Access Control

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Vehicle Access Control: Geographic Segmentation Analysis

8.5 Other

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Other: Geographic Segmentation Analysis

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Electronic Access Control Systems Market Share by Manufacturer (2023)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 HONEYWELL INTERNATIONAL INC. (UNITED STATES)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 BOSCH SECURITY SYSTEMS GMBH (GERMANY)

9.4 ASSA ABLOY AB (SWEDEN)

9.5 HID GLOBAL CORPORATION (UNITED STATES)

9.6 AXIS COMMUNICATIONS AB (SWEDEN)

9.7 SCHNEIDER ELECTRIC SE (FRANCE)

9.8 DORMAKABA HOLDING AG (SWITZERLAND)

9.9 JOHNSON CONTROLS INTERNATIONAL PLC (IRELAND)

9.10 ALLEGION PLC (IRELAND)

9.11 IDENTIV INC. (UNITED STATES)

9.12 IDEMIA (FRANCE)

9.13 SIEMENS AG (GERMANY)

9.14 OTHER ACTIVE PLAYERS

Chapter 10: Global Electronic Access Control Systems Market By Region

10.1 Overview

10.2. North America Electronic Access Control Systems Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By Component

10.2.4.1 Hardware

10.2.4.2 Software

10.2.4.3 Services

10.2.5 Historic and Forecasted Market Size By Type

10.2.5.1 Biometrics

10.2.5.2 Card-based

10.2.5.3 Keypad-based

10.2.5.4 Others

10.2.6 Historic and Forecasted Market Size By End User

10.2.6.1 Residential

10.2.6.2 Commercial

10.2.6.3 Industrial

10.2.6.4 Government

10.2.7 Historic and Forecasted Market Size By Technology

10.2.7.1 Bluetooth

10.2.7.2 RFID

10.2.7.3 Wi-Fi

10.2.7.4 Infrared

10.2.7.5 Others

10.2.8 Historic and Forecasted Market Size By Application

10.2.8.1 Door Access Control

10.2.8.2 Vehicle Access Control

10.2.8.3 Other

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Electronic Access Control Systems Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By Component

10.3.4.1 Hardware

10.3.4.2 Software

10.3.4.3 Services

10.3.5 Historic and Forecasted Market Size By Type

10.3.5.1 Biometrics

10.3.5.2 Card-based

10.3.5.3 Keypad-based

10.3.5.4 Others

10.3.6 Historic and Forecasted Market Size By End User

10.3.6.1 Residential

10.3.6.2 Commercial

10.3.6.3 Industrial

10.3.6.4 Government

10.3.7 Historic and Forecasted Market Size By Technology

10.3.7.1 Bluetooth

10.3.7.2 RFID

10.3.7.3 Wi-Fi

10.3.7.4 Infrared

10.3.7.5 Others

10.3.8 Historic and Forecasted Market Size By Application

10.3.8.1 Door Access Control

10.3.8.2 Vehicle Access Control

10.3.8.3 Other

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Electronic Access Control Systems Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By Component

10.4.4.1 Hardware

10.4.4.2 Software

10.4.4.3 Services

10.4.5 Historic and Forecasted Market Size By Type

10.4.5.1 Biometrics

10.4.5.2 Card-based

10.4.5.3 Keypad-based

10.4.5.4 Others

10.4.6 Historic and Forecasted Market Size By End User

10.4.6.1 Residential

10.4.6.2 Commercial

10.4.6.3 Industrial

10.4.6.4 Government

10.4.7 Historic and Forecasted Market Size By Technology

10.4.7.1 Bluetooth

10.4.7.2 RFID

10.4.7.3 Wi-Fi

10.4.7.4 Infrared

10.4.7.5 Others

10.4.8 Historic and Forecasted Market Size By Application

10.4.8.1 Door Access Control

10.4.8.2 Vehicle Access Control

10.4.8.3 Other

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Electronic Access Control Systems Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By Component

10.5.4.1 Hardware

10.5.4.2 Software

10.5.4.3 Services

10.5.5 Historic and Forecasted Market Size By Type

10.5.5.1 Biometrics

10.5.5.2 Card-based

10.5.5.3 Keypad-based

10.5.5.4 Others

10.5.6 Historic and Forecasted Market Size By End User

10.5.6.1 Residential

10.5.6.2 Commercial

10.5.6.3 Industrial

10.5.6.4 Government

10.5.7 Historic and Forecasted Market Size By Technology

10.5.7.1 Bluetooth

10.5.7.2 RFID

10.5.7.3 Wi-Fi

10.5.7.4 Infrared

10.5.7.5 Others

10.5.8 Historic and Forecasted Market Size By Application

10.5.8.1 Door Access Control

10.5.8.2 Vehicle Access Control

10.5.8.3 Other

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Electronic Access Control Systems Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By Component

10.6.4.1 Hardware

10.6.4.2 Software

10.6.4.3 Services

10.6.5 Historic and Forecasted Market Size By Type

10.6.5.1 Biometrics

10.6.5.2 Card-based

10.6.5.3 Keypad-based

10.6.5.4 Others

10.6.6 Historic and Forecasted Market Size By End User

10.6.6.1 Residential

10.6.6.2 Commercial

10.6.6.3 Industrial

10.6.6.4 Government

10.6.7 Historic and Forecasted Market Size By Technology

10.6.7.1 Bluetooth

10.6.7.2 RFID

10.6.7.3 Wi-Fi

10.6.7.4 Infrared

10.6.7.5 Others

10.6.8 Historic and Forecasted Market Size By Application

10.6.8.1 Door Access Control

10.6.8.2 Vehicle Access Control

10.6.8.3 Other

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Electronic Access Control Systems Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By Component

10.7.4.1 Hardware

10.7.4.2 Software

10.7.4.3 Services

10.7.5 Historic and Forecasted Market Size By Type

10.7.5.1 Biometrics

10.7.5.2 Card-based

10.7.5.3 Keypad-based

10.7.5.4 Others

10.7.6 Historic and Forecasted Market Size By End User

10.7.6.1 Residential

10.7.6.2 Commercial

10.7.6.3 Industrial

10.7.6.4 Government

10.7.7 Historic and Forecasted Market Size By Technology

10.7.7.1 Bluetooth

10.7.7.2 RFID

10.7.7.3 Wi-Fi

10.7.7.4 Infrared

10.7.7.5 Others

10.7.8 Historic and Forecasted Market Size By Application

10.7.8.1 Door Access Control

10.7.8.2 Vehicle Access Control

10.7.8.3 Other

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Electronic Access Control Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 14.69 Billion |

|

Forecast Period 2024-32 CAGR: |

8.6% |

Market Size in 2032: |

USD 30.87 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||