Electric Vehicle Charging Socket Market Synopsis

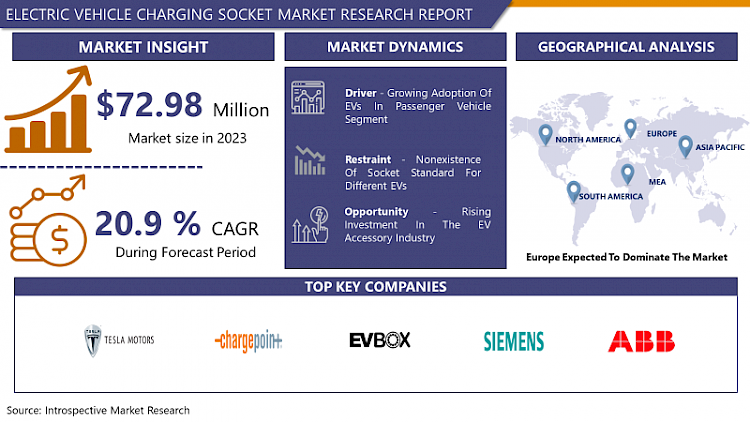

Electric Vehicle Charging Socket Market Size Was Valued at USD 72.98 Million in 2023 and is Projected to Reach USD 402.8 Million by 2032, Growing at a CAGR of 20.9% From 2024-2032.

- An electric vehicle charging socket can be defined as a physical point of contact that connects an electric vehicle (EV) to the source of power required for battery charging. Ordinarily, it comprises a plug on the one side which fits into the car's charging port, and a socket on the other side that gets connected to a power supply. Socket is responsible for bringing electricity to the vehicle safely and effectively through particular rules and protocols, which would depend on the charging system standing behind (AC, DC). g. These include AC charging (called Level 1 and Level 2 charging), and DC fast charging. EV charging ports may differ in form, size and layout, based on local norms or the type of fast charging infrastructure deployed.

- The electric vehicle (EV) charging socket market gained a momentum of growth in recent years due to the growing numbers of electric vehicles introduced into the world market. More governments and industries of the world are pushing the sustainability and emission-free agendas while the need for EV charging sockets are at the all-time high. Manufacturers are capable of designing different types of sockets to meet the specific requirements imposed on different charging standards and vehicle models.

- The integration of fast-charging technology is instrumental in the introduction of powerful charging sockets that are designed to pump quick currents and therefore increase the appeal of electric vehicles. In the line with the electric vehicles (EV) business expansion and the pressure of the renewable energy sources, the EV charging socket market will sustain the growth in the coming years.

- On the other hand, the fact that EV charging infrastructure is focused more on renewable energy sources than in the past is playing a role in shaping the EV charging market. Some charging stations have combined renewable energy generation and storage systems, and the utilization of smart charging sockets that can adjust incoming energy amounts timely while properly managing the demands is essential. In general, the growth of electric vehicle fleets in fields like transportation and logistics is creating demand for durable high-power charging system including scokets able to handle high throughputs as well as simultaneous charging.

- The advent of the wireless charging technology brings new possibilities to the market as producers invest in the production of electric chargers that lack the necessity of any cable connections.

Electric Vehicle Charging Socket Trend Analysis

Wireless Charging Emerges as the Next Big Trend in Electric Vehicle Charging

- The revolutionary innovation of wireless charging for electric vehicles (EVs), therefore, seems to be one of the rapidly developing trends that the EV charging infrastructure is undergoing. The technology has the potential of giving a higher degree of ease and effectiveness for EV users by removing the hinderance of physical wires and plugs. Alternatively, vehicles may charge their batteries only by parking over a wireless charging pad and using electromagnetic induction to deliver power to the vehicle This technology can transform the EV charging paradigm into a more seamless and user-friendly design (e.g., it is very useful in autonomous vehicles and fleet operations where frequent charging is required).

- Wireless charging will help to overcome the problems of charging stations which are not lcoated strategically near busy roads and highways. Though only beginning its infancy at the moment, the increasing interest and investment in wireless charging technology show its promise of becoming a basis for an EV ecosystem of the future, which will make the process of wide usage of EVs more achievable and thus speed up the progress towards sustainable transportation.

Growing Investment In The EV Accessory Sectors

- The rapid growth of the EV industry has definitely been paralleled by the deluge of the EV accessory market. Due to the growing need in EVs investor and entrepreneurs start receiving rewards made by the service that includes those automobiles. EV accessories have successfully penetrated the market on different aspects of EV charging infrastructure and battery technology to innovative accessories such as smart mats, organizers and customized personalized accessories. Therefore, EV accessory industry is rapidly changing to cater to the emerging needs and taste of consumers.

- Sustainability and the environment consciousness impose the advancement in the raw materials and techniques of manufacturing on this exact industry. Given the shifting focus towards user experiences improvement and power efficiency of EVs, the future of EV accessory industry is full of the prospects of growth, change and creativeness..

Electric Vehicle Thermal Management Solutions Market Segment Analysis:

Electric Vehicle Thermal Management Solutions Market is Segmented on the basis of type, and Charging level.

By Type, CCS (Combined Charging System)segment is expected to dominate the market during the forecast period

- Type 1 Sockets: Leading the roots in North America and Japan, being compromised with Nissan Leaf or Mitsubishi i-MiEV.

- CCS (Combined Charging System): A majority of installations took place in the European and North American regions with a reputation for fast charging and compatibility with different EV models which provided a convenience users can deal with.

- Chademo: Developed in Japan, viewed as a good choice for fast charging EVs like some Nissan and Mitsubishi models, and allows for a quick and more efficient charging.

- GB/T Sockets: It is China dominant since its EV sector is strong and the country is making regulations in this area. This is the reason why EV market in this area is growing.

- Tesla Infrastructure: The custom-made plugs and Tesla's Supercharger network designed exclusively for Tesla cars is an ideal representation of Tesla's customer-oriented approach towards a smooth charging experience.

From the market point of view Level 2 segment hold the biggest part in 2023.

- Level 1 charging is the standard charging point for standard household outlets with the lowest charging power. Although useful for charging at home overnight and quieter than other charging levels, Level 1 charging may not be fast enough for drivers requiring more time to charge. Similarly, it is still a critical necessity for EV owners whose charging infrastructure does not have any dedicated charging stations.

- Level 2 charging is a significant step that takes convenience to the next level. These recharging outlets are typically available at workplaces, public parking lots, and residential areas equipped with dedicated equipment for EV charging. Level 2 chargers provide faster charging speed than Level 1 thus, they are more suitable for taking up the EV batteries during short stops or daily charging rhythms.

- The third level of charging - commonly referred to as DC fast charging (rapid charging) is the topmost and fastest option available. These powerful fast chargers are able to very quickly side-load an EV's battery, thus making them perfect for long distance journeys and reducing charging times to a level far higher than that of the Level 1 or Level 2 chargers. Level 3 chargers usually be discovered along highways, important traveling lines and in the commercial areas that meet a demand from drivers who prefer quick charging option..

Electric Vehicle Charging Socket Market Regional Insights:

Europe is another dominating region in the electric vehicle charging socket market.

- Europe will be in the future the region most committed to electric vehicle (EV) charging socket technology. The advent of stricter emissions regulations, widespread emission awareness, and extensive government subsidies that increase the affordability of e-mobility, have led to a dramatic increase in the number of EVs sold in Europe. Therefore, there is a clear impetus for the continental infrastructure elements such as charging stations to be developed.

- The initiatives such as European Union's Clean Vehicles Directive as well as charging networks put into practice by companies Ionity and Tesla have additionally reenforced the EV ecosystem of charging. On the top of it, as way of being active, European countries have adopted high-ambitious goals to bring their fleets ICE vehicles to zero by 2030 and in so doing have been generating investment in EV charging infrastructure. With the already present automakers well engaged in e-mobility, as well as Europe's cities that support urban EV usage, Europe is therefore a key market in terms of electric vehicle charging solutions.

Active Key Players in the Electric Vehicle Charging Socket Market

- Tesla, Inc.

- ChargePoint, Inc.

- EVBox Group

- ABB Group

- Schneider Electric SE

- Siemens AG

- Webasto SE

- Delta Electronics, Inc.

- Tritium Pty Ltd.

- Blink Charging Co.

- ClipperCreek, Inc.

- SemaConnect, Inc.

- DBT Group (a subsidiary of Engie SA)

- Pod Point Ltd.

- Alfen N.V.

- Enel X

- Efacec Power Solutions

- EO Charging

- KEBA AG

- Leviton Manufacturing Co., Inc.

- NewMotion (a subsidiary of Royal Dutch Shell)

- EVgo Services LLC

- EVBox (a subsidiary of Engie SA)

- SinoEV Tech Co., Ltd.

- Other Key Players

Key Industry Developments in the Electric Vehicle Charging Socket Market:

- September,2022: The latest development in EV charging by BOLT company is the introduction of the all-purpose BOLT lite charging station. It will work by using the existing AC power supply at home and is well-suited for all my EV portable chargers.

- This February, Volkswagen Group Technology is manufacturing electric engine pulse inverters and heating cooling systems. These modules are built using the modular strategical approach that has been applied in other components. This component will be implemented for the first time on the MEB+ platform in the beginning.

- In January of 2023, a popular OEM in the sector of thermal engineering solutions, Modine, released an upgraded version of its EVaranteTM Battery Thermal Management System (BTMS) that can be used in both on-road and off-road electric cars. The L-CON BTMS, which is the innovation, contains an advanced electronic control unit as well as heat exchanger technology essentials to face up to the adverse environmental circumstances.

|

Global Electric Vehicle Charging Socket Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 72.98 Mn. |

|

Forecast Period 2024-32 CAGR: |

20.9% |

Market Size in 2032: |

USD 402.8 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Charging Level |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ELECTRIC VEHICLE CHARGING SOCKET MARKET BY TYPE (2017-2032)

- ELECTRIC VEHICLE CHARGING SOCKET MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- TYPE1

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CCS

- CHADEMO

- GB/T

- TESLA

- ELECTRIC VEHICLE CHARGING SOCKET MARKET BY CHARGING LEVEL (2017-2032)

- ELECTRIC VEHICLE CHARGING SOCKET MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LEVEL 1

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LEVEL 2

- LEVEL 3

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Electric Vehicle Charging Socket Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- TESLA, INC.

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- CHARGEPOINT, INC.

- EVBOX GROUP

- ABB GROUP

- SCHNEIDER ELECTRIC SE

- SIEMENS AG

- WEBASTO SE

- DELTA ELECTRONICS, INC.

- TRITIUM PTY LTD.

- BLINK CHARGING CO.

- CLIPPERCREEK, INC.

- SEMACONNECT, INC.

- DBT GROUP (A SUBSIDIARY OF ENGIE SA)

- POD POINT LTD.

- ALFEN N.V.

- ENEL X

- EFACEC POWER SOLUTIONS

- EO CHARGING

- KEBA AG

- LEVITON MANUFACTURING CO., INC.

- NEWMOTION (A SUBSIDIARY OF ROYAL DUTCH SHELL)

- EVGO SERVICES LLC

- EVBOX (A SUBSIDIARY OF ENGIE SA)

- SINOEV TECH CO., LTD.

- COMPETITIVE LANDSCAPE

- GLOBAL ELECTRIC VEHICLE CHARGING SOCKET MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Charging Level

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Electric Vehicle Charging Socket Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 72.98 Mn. |

|

Forecast Period 2024-32 CAGR: |

20.9% |

Market Size in 2032: |

USD 402.8 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Charging Level |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ELECTRIC VEHICLE CHARGING SOCKET MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ELECTRIC VEHICLE CHARGING SOCKET MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ELECTRIC VEHICLE CHARGING SOCKET MARKET COMPETITIVE RIVALRY

TABLE 005. ELECTRIC VEHICLE CHARGING SOCKET MARKET THREAT OF NEW ENTRANTS

TABLE 006. ELECTRIC VEHICLE CHARGING SOCKET MARKET THREAT OF SUBSTITUTES

TABLE 007. ELECTRIC VEHICLE CHARGING SOCKET MARKET BY TYPE

TABLE 008. TYPE1 MARKET OVERVIEW (2016-2028)

TABLE 009. CCS MARKET OVERVIEW (2016-2028)

TABLE 010. CHADEMO MARKET OVERVIEW (2016-2028)

TABLE 011. GB/T MARKET OVERVIEW (2016-2028)

TABLE 012. TESLA MARKET OVERVIEW (2016-2028)

TABLE 013. ELECTRIC VEHICLE CHARGING SOCKET MARKET BY CHARGING LEVEL

TABLE 014. LEVEL 1 MARKET OVERVIEW (2016-2028)

TABLE 015. LEVEL 2 MARKET OVERVIEW (2016-2028)

TABLE 016. LEVEL 3 MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA ELECTRIC VEHICLE CHARGING SOCKET MARKET, BY TYPE (2016-2028)

TABLE 018. NORTH AMERICA ELECTRIC VEHICLE CHARGING SOCKET MARKET, BY CHARGING LEVEL (2016-2028)

TABLE 019. N ELECTRIC VEHICLE CHARGING SOCKET MARKET, BY COUNTRY (2016-2028)

TABLE 020. EUROPE ELECTRIC VEHICLE CHARGING SOCKET MARKET, BY TYPE (2016-2028)

TABLE 021. EUROPE ELECTRIC VEHICLE CHARGING SOCKET MARKET, BY CHARGING LEVEL (2016-2028)

TABLE 022. ELECTRIC VEHICLE CHARGING SOCKET MARKET, BY COUNTRY (2016-2028)

TABLE 023. ASIA PACIFIC ELECTRIC VEHICLE CHARGING SOCKET MARKET, BY TYPE (2016-2028)

TABLE 024. ASIA PACIFIC ELECTRIC VEHICLE CHARGING SOCKET MARKET, BY CHARGING LEVEL (2016-2028)

TABLE 025. ELECTRIC VEHICLE CHARGING SOCKET MARKET, BY COUNTRY (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA ELECTRIC VEHICLE CHARGING SOCKET MARKET, BY TYPE (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA ELECTRIC VEHICLE CHARGING SOCKET MARKET, BY CHARGING LEVEL (2016-2028)

TABLE 028. ELECTRIC VEHICLE CHARGING SOCKET MARKET, BY COUNTRY (2016-2028)

TABLE 029. SOUTH AMERICA ELECTRIC VEHICLE CHARGING SOCKET MARKET, BY TYPE (2016-2028)

TABLE 030. SOUTH AMERICA ELECTRIC VEHICLE CHARGING SOCKET MARKET, BY CHARGING LEVEL (2016-2028)

TABLE 031. ELECTRIC VEHICLE CHARGING SOCKET MARKET, BY COUNTRY (2016-2028)

TABLE 032. YAZAKI: SNAPSHOT

TABLE 033. YAZAKI: BUSINESS PERFORMANCE

TABLE 034. YAZAKI: PRODUCT PORTFOLIO

TABLE 035. YAZAKI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. TE CONNECTIVITY: SNAPSHOT

TABLE 036. TE CONNECTIVITY: BUSINESS PERFORMANCE

TABLE 037. TE CONNECTIVITY: PRODUCT PORTFOLIO

TABLE 038. TE CONNECTIVITY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. SUMITOMO: SNAPSHOT

TABLE 039. SUMITOMO: BUSINESS PERFORMANCE

TABLE 040. SUMITOMO: PRODUCT PORTFOLIO

TABLE 041. SUMITOMO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. SCHNEIDER ELECTRIC: SNAPSHOT

TABLE 042. SCHNEIDER ELECTRIC: BUSINESS PERFORMANCE

TABLE 043. SCHNEIDER ELECTRIC: PRODUCT PORTFOLIO

TABLE 044. SCHNEIDER ELECTRIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. HUBER+SUHNER: SNAPSHOT

TABLE 045. HUBER+SUHNER: BUSINESS PERFORMANCE

TABLE 046. HUBER+SUHNER: PRODUCT PORTFOLIO

TABLE 047. HUBER+SUHNER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. TESLA: SNAPSHOT

TABLE 048. TESLA: BUSINESS PERFORMANCE

TABLE 049. TESLA: PRODUCT PORTFOLIO

TABLE 050. TESLA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. BOSCH: SNAPSHOT

TABLE 051. BOSCH: BUSINESS PERFORMANCE

TABLE 052. BOSCH: PRODUCT PORTFOLIO

TABLE 053. BOSCH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. ITT: SNAPSHOT

TABLE 054. ITT: BUSINESS PERFORMANCE

TABLE 055. ITT: PRODUCT PORTFOLIO

TABLE 056. ITT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. AMPHENOL: SNAPSHOT

TABLE 057. AMPHENOL: BUSINESS PERFORMANCE

TABLE 058. AMPHENOL: PRODUCT PORTFOLIO

TABLE 059. AMPHENOL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. SIEMENS AG: SNAPSHOT

TABLE 060. SIEMENS AG: BUSINESS PERFORMANCE

TABLE 061. SIEMENS AG: PRODUCT PORTFOLIO

TABLE 062. SIEMENS AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. ABB: SNAPSHOT

TABLE 063. ABB: BUSINESS PERFORMANCE

TABLE 064. ABB: PRODUCT PORTFOLIO

TABLE 065. ABB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. AND FUJIKURA: SNAPSHOT

TABLE 066. AND FUJIKURA: BUSINESS PERFORMANCE

TABLE 067. AND FUJIKURA: PRODUCT PORTFOLIO

TABLE 068. AND FUJIKURA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 069. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 070. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 071. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ELECTRIC VEHICLE CHARGING SOCKET MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ELECTRIC VEHICLE CHARGING SOCKET MARKET OVERVIEW BY TYPE

FIGURE 012. TYPE1 MARKET OVERVIEW (2016-2028)

FIGURE 013. CCS MARKET OVERVIEW (2016-2028)

FIGURE 014. CHADEMO MARKET OVERVIEW (2016-2028)

FIGURE 015. GB/T MARKET OVERVIEW (2016-2028)

FIGURE 016. TESLA MARKET OVERVIEW (2016-2028)

FIGURE 017. ELECTRIC VEHICLE CHARGING SOCKET MARKET OVERVIEW BY CHARGING LEVEL

FIGURE 018. LEVEL 1 MARKET OVERVIEW (2016-2028)

FIGURE 019. LEVEL 2 MARKET OVERVIEW (2016-2028)

FIGURE 020. LEVEL 3 MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA ELECTRIC VEHICLE CHARGING SOCKET MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE ELECTRIC VEHICLE CHARGING SOCKET MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC ELECTRIC VEHICLE CHARGING SOCKET MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA ELECTRIC VEHICLE CHARGING SOCKET MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA ELECTRIC VEHICLE CHARGING SOCKET MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Electric Vehicle Charging Socket Market research report is 2024-2032.

Tesla, Inc., ChargePoint, Inc., EVBox Group, ABB Group, Schneider Electric SE, Siemens AG, Webasto SE, Delta Electronics, Inc., Tritium Pty Ltd. Blink Charging Co.and Other Major Players.

The Electric Vehicle Thermal Management Solutions Market is segmented into Type, Charging Level and region. By Type, the market is categorized into Type1, CCS, Chademo, GB/, Tesla. By Charging Level, the market is categorized into Level 1, Level 2, Level 3. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

An electric vehicle charging socket is a physical interface used to connect an electric vehicle (EV) to a power source for recharging its battery. It typically consists of a plug on one end that fits into the vehicle's charging port and a socket on the other end that connects to a power supply. The socket is designed to deliver electricity safely and efficiently to the vehicle's battery, following specific standards and protocols depending on the type of charging system being used (e.g., AC charging, DC fast charging). Electric vehicle charging sockets come in various shapes, sizes, and configurations, depending on regional standards and the type of EV charging infrastructure in use.

Electric Vehicle Charging Socket Market Size Was Valued at USD 72.98 Million in 2023, and is Projected to Reach USD 402.8 Million by 2032, Growing at a CAGR of 20.9% From 2024-2032.