Electric Vehicle Wireless Charger Market Synopsis

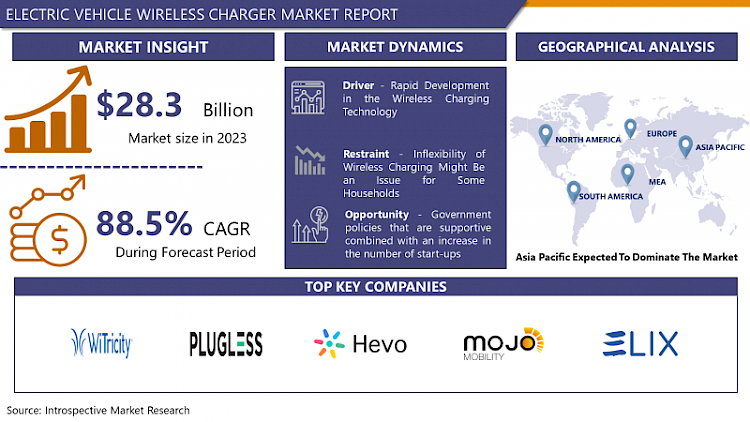

Electric Vehicle Wireless Charger Market Size Was Valued at USD 28.3 Billion in 2023, and is Projected to Reach USD 8,503.3 Billion by 2032, Growing at a CAGR of 88.5% From 2024-2032.

- A spray booth is a specially enclosed area used for spray applications of coatings, paints or similar finishes to various substrates. These booths are usually enclosed compartments that use exhaust systems to minimize the presence of overspray, fumes, and other hazards in the atmosphere for the safety of workers and the environment. The types of spray booths vary in size and complexity depending on the type of work being done from small booths for automotive refinish touch up to large industrial booths for painting airplanes or large agricultural equipment. Some of the most common industrial applications include automobiles, aircraft, lumber mills, metal shops, and furniture makers.

- The key dynamics favoring the global spray booths market include: The spray booths market has been growing steadily in the last few years due to various reasons including rising industrialization, strict laws concerning emissions and safety in the workplace, and the rising demand for high-quality painted surfaces in industries like automotive, aerospace, manufacturing, and woodworking, among others. Spray booths are enclosed industrial workstations that are designed to prevent overspray, fumes, and dust from painting, coating, and finishing materials from escaping into the surrounding environment.

- Another factor that contributes to the spray booths market is the growing industrialization worldwide. The growth of the manufacturing industries, and especially in newly industrializing countries, has been associated with a parallel development in the need for effective painting and finishing solutions to satisfy production needs. Also, the automotive and aerospace industries, for example, require high-quality surface finishes, which also contributes to the increased application of advanced spray booth technologies that provide more control over paint application and curing phases. In addition, the increasing preference for personalization in the vehicles and aircraft industry has increased the demand for spray booths with the ability to cater to more complicated coating demands.

- Government regulations have emerged as a critical element that determines the usage of spray booths in various sectors. Many countries have enacted tough environmental and occupational safety laws to try and reduce air pollution and protect workers from exposure to potentially harmful chemicals found in paint and coatings. Therefore, more companies are focusing on purchasing new spray booth systems that use efficient filters and ventilation to help them meet the regulations and reduce their negative footprint on the environment and the health of employees.

- Technology has emerged as one of the key trends in the spray booths market. Spray booth manufacturers are constantly striving to create more energy-efficient, automated, and flexible solutions to meet the growing demand for an increased level of productivity, lower operational expenses, and higher overall efficiency. This includes smart sensors, robotics, and data analytic to enhance paint application processes while reducing material wastage and for predictive maintenance to provide better control and flexibility to end-users.

Electric Vehicle Wireless Charger Market Trend Analysis

Quick Advancements in Wireless Charging Technologies

- The rapid growth of the global market for EVWCs has been mainly driven by the advancement of wireless charging technology. Recent improvements in wireless power transfer have also made it easier to categorize the wireless power transfer industry due to its application in charging electric vehicles. The efficiency of wireless power transfer has improved the charging rates thus enhancing the overall charging time of electric cars.

- Furthermore, there has been significant improvement in the area of magnetic induction and resonance-based wireless charging, which makes the technology more diverse and able to charge vehicles from further distances, even when the charging stations and cars are slightly misaligned. This has made it much more useful and practical and dealt with one of the biggest customer complaints when it comes to charging EVs.

- This trend is further justified by innovations and constant improvements. Future enhancement tries to enhance wireless charging technologies in details, especially for the wireless charging system efficiency and compatibility of different EV models.

- Furthermore, the progress in the field of wireless charging is traceable in the fact that the industry strives for such solutions based on collective efforts of technology companies and automobile manufacturers. This suggests that wireless charging technology is the growth factor for the global EV wireless charger market. They promise a future where charging stations for electric cars are much more comfortable and accessible.

Positive government policies coupled with an increment in the number of start-ups.

- Government incentives and the rise of new market entrants present major potential opportunities for the global market of electric vehicle wireless chargers – EVWC. At the international level the following government programs are implemented for EVs and connected infrastructure: subsidies and tax cuts. These regulations define the environment that supports mass EVWC adoption and hence expanding the market.

- The market is being supported by the emergence of start-ups that are focused on EV tech, particularly wireless charging. Such creative and adaptive businesses sometimes provide new approaches that promote EVWC technical progress. They also bring in new knowledge that promotes progress and the availability of affordable and effective wireless charging technologies.

- Some countries have pledged to reduce carbon emissions and achieve zero emissions in the transport industry. For instance, the demand for EVs has been increased by the agenda of European Union to reduce green house gases emission in the atmosphere, which has also seen an increase in the need for wireless chargers. There are also a lot of start-ups in the world that specialize in the technology of electric cars, such as wireless charging, which speaks about the perspectives in this sphere of car sales.

Electric Vehicle Wireless Charger Market Segment Analysis:

Electric Vehicle Wireless Charger Market is Segmented based on Power Supply, Application, Charging Type and Charging System.

By Charging Type, Stationary Wireless Charging Systems (SWCS) Segment Dominates the market over the forecast period

- One more distinct aspect of SWCS is the possibility to charge EVs without direct physical contact with the car. This ease of use reflects the consumer demand for frictionless charging experiences and supports the development of stationary wireless systems.

- SWCS is accountable for the most effective and safe charging functions. It saves physical contacts hence no stress on charging ports and cables that may impair overall system reliability. Further, these systems have safety features such as an automatic turn off thus reducing the incidences of injuries.

- It should be noted that incentive programs intended to stimulate the development of EV technologies and infrastructure are often aimed at charging systems installed in public places and financially supported by the state.

By Application, Commercial segment held the majority share, approximately 63%, of the global EV wireless charger market revenue in 2023

- A lot of transport and logistics companies are currently adopting the use of electric cars. The need for such convenient and fast charging solutions for these fleets also adds to the market potential of wireless chargers as they save time and facilitate the workers’ schedule.

- The same goes for commercial areas as spaces like parking lots, airports, shopping malls, and office buildings are also investing in the construction of EV charging stations. Wireless chargers also add to the convenience and thus can boost the use of this technology in commercial premises, especially these public places.

- Commercial sectors also are the first to test new technologies in order to find solutions to enhance and reduce costs of operation. This trend can be correlated with the interest in wireless charging as this technology is of interest for commercial entities that are looking for more advanced and comfortable charging stations.

Electric Vehicle Wireless Charger Market Regional Insights:

Asia Pacific holds a significant share during the forecast period

- There is no doubt that industrial and technological innovation in the Asia-Pacific region is rather robust. Many firms in this industry are engaged in the production of EV products and related technologies, such as wireless charging stations.

- The R&D capabilities of countries like South Korea, Japan, and China have supported progress and the adoption of superior wireless charging technologies and has given these products the competitive edge. Intense local competition in the EV wireless charging industry results in technology advancement and lower prices. It promotes specialization and guarantees that there is a diversified market with products that satisfy various demands.

- The first market area to produce EVs and their parts is the Asia-Pacific region. This concentration of manufacturing facilities enhances the region’s hegemony by simplifying the production procedures and ensuring the integration of future EV models with wireless charging systems. The public and commercial sectors in the Asia-Pacific region also aggressively pursue the investment of resources in the development of the charging infrastructure.

- The growth of the EV wireless charger industry in the region can be attributed to its high development in the number of charging networks that include wireless chargers.

Active Key Players in the Electric Vehicle Wireless Charger Market

- WiTricity Corporation

- Plugless Power Inc.

- Tesla, Inc.

- Evatran, LLC

- HEVO, Inc.

- InductEV Inc.

- Mojo Mobility Inc.

- WAVE, Inc.

- FLO Services USA Inc.

- ELIX Wireless

- Siemens

- Webasto Group

- Continental AG

- Delaxchaux Group

- Kempower Oyj

- Electreon, Inc.

- DAIHEN Corporation

- Nissan Motor Co. Ltd.

- Toyota Motor Corporation

- Continental AG

- Other key Players

Key Industry Developments in the Electric Vehicle Wireless Charger Market:

- The technology driver and one of the first companies in aftermarket automotive solutions ABT e-Line and the leader in wireless electric vehicle charging WiTricity intend to launch aftermarket wireless EV charging in Europe in March 2023. ABT e-Line has a long history of working with VW and the first job will be to improve the performance of VW ID. to start selling 4 with wireless charging based on WiTricity technology in early 2024. The company will then consider launching other EV models later.

- Ballingen has announced the first public project for EV wireless charging in Germany in March 2023. The project involves building an ERS and static charging stations on a running bus route with stops. The first segment will be 400 meters long and accommodate two charging points. The second raises this to 1000 metres. Electreon is a major supplier of wireless and in-road EV chargers and will be required to provide static and dynamic wireless technology for the project.

- FLO is a North-American EV charging company which is making progress in EV charging experiences in September 2023 with WiTricity and Hubject. They also want to enhance the charging experience by focusing on wireless charging and the Plug & Charge feature. Wireless EV charging at FLO’s advanced engineering laboratory to offer cable-free vehicle charging using WiTricity’s Halo® EV charging technology from WiTricity. This signifies FLO’s determination to provide excellent charging experiences and the significance of its collaborations in the creation of EV charging technology.

|

Global Electric Vehicle Wireless Charger Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 53.3 Mn. |

|

Forecast Period 2024-32 CAGR: |

88.5% |

Market Size in 2032: |

USD 8,503.3 Mn. |

|

Segments Covered: |

By Power supply range |

|

|

|

By Application |

|

||

|

By Charging Type |

|

||

|

By Charging System |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ELECTRIC VEHICLE WIRELESS CHARGER MARKET BY POWER SUPPLY RANGE (2017-2032)

- ELECTRIC VEHICLE WIRELESS CHARGER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- 3–<11 KW

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- 11–50 KW

- >50 KW

- ELECTRIC VEHICLE WIRELESS CHARGER MARKET BY APPLICATION (2017-2032)

- ELECTRIC VEHICLE WIRELESS CHARGER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RESIDENTIAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COMMERCIAL

- ELECTRIC VEHICLE WIRELESS CHARGER MARKET BY CHARGING TYPE (2017-2032)

- ELECTRIC VEHICLE WIRELESS CHARGER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DYNAMIC WIRELESS CHARGING SYSTEM

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- STATIONARY WIRELESS CHARGING SYSTEM

- ELECTRIC VEHICLE WIRELESS CHARGER MARKET BY CHARGING SYSTEM (2017-2032)

- ELECTRIC VEHICLE WIRELESS CHARGER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MAGNETIC POWER TRANSFER

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CAPACITIVE POWER TRANSFER

- INDUCTIVE POWER TRANSFER

- WITRICITY CORPORATION

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- PLUGLESS POWER INC.

- TESLA, INC.

- EVATRAN, LLC

- HEVO, INC.

- INDUCTEV INC.

- MOJO MOBILITY INC.

- WAVE, INC.

- FLO SERVICES USA INC.

- ELIX WIRELESS

- SIEMENS

- WEBASTO GROUP

- CONTINENTAL AG

- DELAXCHAUX GROUP

- KEMPOWER OYJ

- ELECTREON, INC.

- DAIHEN CORPORATION

- NISSAN MOTOR CO. LTD.

- TOYOTA MOTOR CORPORATION

- CONTINENTAL AG

- GLOBAL ELECTRIC VEHICLE WIRELESS CHARGER MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Power supply range

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Charging Type

- Historic And Forecasted Market Size By Charging System

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

Potential Market Strategies

|

Global Electric Vehicle Wireless Charger Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 53.3 Mn. |

|

Forecast Period 2024-32 CAGR: |

88.5% |

Market Size in 2032: |

USD 8,503.3 Mn. |

|

Segments Covered: |

By Power supply range |

|

|

|

By Application |

|

||

|

By Charging Type |

|

||

|

By Charging System |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Electric Vehicle Wireless Charger Market research report is 2024-2032.

WiTricity Corporation (U.S.), Plugless Power Inc. (U.S.), Tesla, Inc. (U.S.), Evatran, LLC (U.S.), HEVO, Inc. (U.S.), InductEV Inc. (U.S.), Mojo Mobility Inc. (U.S.), WAVE, Inc. (U.S.), FLO Services USA Inc. (U.S.), ELIX Wireless (Canada), Siemens (Germany), Webasto Group (Germany), Continental AG (Germany), Delaxchaux Group (France), Kempower Oyj (Finland), Electreon, Inc. (Israel), DAIHEN Corporation (Japan), Nissan Motor Co. Ltd. (Japan), Toyota Motor Corporation (Japan), Continental AG (Japan), and Other Major Players.

The Global Electric Vehicle Wireless Charger Market is segmented into By Power Supply Range, Application, Charging Type, Charging System and region. By Power Supply Range, the market is categorized into 3-<11, 11-50, >50 Kw. By Application, the market is categorized into Residential, Commercial. By Charging System the market is categorized into Dynamic Wireless Charging System, Stationary Wireless Charging System. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

An Electric Vehicle Wireless Charger is a system designed to charge electric vehicles without the need for physical cables or plugs. It consists of a charging pad on the ground and a receiver pad on the vehicle, utilizing electromagnetic fields to transfer power. When the vehicle is parked over the charging pad, an alternating current creates a magnetic field that induces a current in the receiver pad, charging the vehicle's battery. This technology offers convenience, reducing wear on charging ports and cables, and potentially enabling automated charging for autonomous vehicles. Despite challenges like efficiency losses and installation costs, ongoing research aims to enhance wireless charging systems, making electric vehicles more accessible and practical for a wider audience.

The Global Electric Vehicle Wireless Charger Market size is expected to grow from USD 28.3 million in 2023 to USD 8,503.3 million by 2034, at a CAGR of 88.5% during the forecast period (2024-2032).