Private Electric Vehicle (EV) Charging Stations Market Synopsis

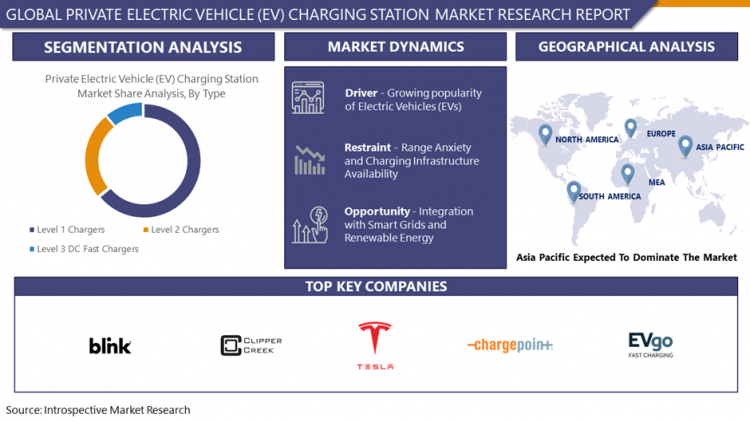

Private Electric Vehicle (EV) Charging Stations Market Size Was Valued at USD 1.3 Billion in 2023, and is Projected to Reach USD 5.5 Billion by 2032, Growing at a CAGR of 17.4% From 2024-2032.

The market for private electric vehicle (EV) charging stations refers to the segment of EV charging networks that is designed with a focus on private or residential applications. Private parking, housing, and apartment buildings are all equipped with specially located secure charging points to facilitate recharging electric cars. Without the aid of private EV charging stations, EV owners who are not able to make use of public charge-points or would prefer to charge their vehicles at home have no option. Generally, these stations comprise of a grid-connected-charging station and are often mounted by EV users and/or property owners to comply with the needs of EV users.

- The demand for such private EV charging stations has elevated significantly in the recent past since the EV market has been growing as well as the popularity of electric vehicles. Even private EVCS installation is also encouraged by some governments and regulatory bodies in a bid to promote EV penetration and reduce the number of greenhouse gases to be emitted into the atmosphere.

- Zero and low emission mobility solutions, EV charging points, home charging, domestic EV charging, and EV market uptake are also key phrases that relate to the private EV charging station market. We expect the market for private EV charging stations to grow in line with the EV market and the associated interest in reliable and user-friendly charging opportunities.

Private Electric Vehicle (EV) Charging Stations Market Trend Analysis

Rapid Growth and Technological Advancements Shape Private Electric Vehicle Charging Station Market.

- The worldwide market for private EV charging stations is growing significantly due to significant global EV uptake. They include the increasing adoption of intelligent features for both convenience and energy efficiency, the ageing infrastructure for charging in residential buildings and malls, and the growing number of EVs, and the integration of smart features. These trends suggest that people are choosing more climate-friendly ways of travelling and that there is a need for reliable and accessible charging options for EV owners.

- One of the key drivers favouring the market for private EV charging stations is the rising demand for charging stations that are both easily accessible and reliable. As electric cars are gaining popularity, more and more people opt to install their own personal chargers right at their home or workplace to ensure they have easy access to the necessary means of providing their cars with the power they need.

- This demand is stimulated by the tendency of more freedom and manoeuvrability as compared to public charging networks and especially concerns those people who need to spend long hours on their vehicle due to a long commute or simply lack of public chargers in the proximity of their home or workplace. Policies and subsidies that seek to increase the popularity and usability of EVs among consumers are also part of the reason why private charging stations are growing, since they try to make ownership of EVs more attractive and viable for drivers.

The burgeoning market for private EV charging stations presents a significant opportunity.

- There is considerable expansion in the availability of market potential for Private EV charging stations, leading to a rapidly increasing demand for high-quality drivers to manage these facilities. Drivers play a crucial role by overseeing everyday processes, monitoring the effective private EV charging stations work, and providing customers with the necessary services. Responsibilities of the individual include supervising charging activities, station maintenance, coordinating responsibilities and ensuring compliance with safety and legal standards. In addition, the chauffeur often becomes the first interaction for those clients who own an electric vehicle (EV) and use the charging station. Hence, they need to have highly developed interpersonal skills coupled with strong analytical skills and problem-solving aptitude in a bid to address customer concerns and ensure any issues that might arise are timely resolved.

- The aggressive growth in the overall EV population is expected to lead to an increased need for the residential EV charging stations. This situation literally offers a significant opportunity for chauffeurs who are interested in finding employment in this industry and thereby engaging in a stable and successful career. There is a great need and effort to expand this market while having the right knowledge and skills and as drivers we can get well paid jobs in future at private electric vehicle charging stations which can be a good way of advancing the cause of sustainable transportation.

Private Electric Vehicle (EV) Charging Stations Market Segment Analysis:

Private Electric Vehicle (EV) Charging Stations Market is Segmented on the basis of Charger type, Charging Level, Installation type, and end-users.

By Charger Type, Private Electric Vehicle (EV) Charging Station segment is expected to dominate the market during the forecast period

- The market share of various types of chargers for private charging station for electric vehicles depends on a number of factors which may influence the share in the market volume. The use of AC converters and generally the Level 2 kind of charger is evident across the board in both residential and commercial settings due to its affordability and ease of use. These adapters are commonly used for fast charge up or for a one-night charge and are ideal for companies and individuals looking to offer customers or employees a charging station.

- The DC fast converters although fewer in number are very useful equipment especially in places where rapid charging is crucial or where a lot of driving is done over long distances. These chargers are therefore essential for such drivers who need a faster recharge so as to increase the life of EV’s and reduce the charging times.

By Installation Type, Private Electric Vehicle (EV) Charging Station segment held the largest share in 2023

- The provision of private electric vehicle charging stations for installation techniques in the market mainly consists of wall-mounted chargers and pedestal chargers. The wall-mounted chargers are the most suitable to small dwellings and spaces with high population density because they require a minimal installation process. It is a portable type that takes up little space and can be easily charged overnight in homes and car parks.

- On the other hand, pedestal outlets are independent devices mounted in the workplace of a professional, public, or commercial premises. These stations are suitable for places where visibility and accessibility to these stations have heightened due to a concentration of many users who seek to charge their vehicles at the same time. offices and malls complexes and parking lots are commonly one can come across pedestal chargers which offer charging solutions for the owners of electric cars who are on the road.

Private Electric Vehicle (EV) Charging Stations Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Supportive government policies, growing population, and increasing awareness about climate change and emission-free mobility make the Asia-Pacific region one of the most important and fastest-growing markets for the Private Electric Vehicle (EV) charging stations. As more people in countries like china Japan Korea and India start using EV’s there starts a demand for charging infrastructure.

- The first market for this product – China – is already experiencing a significant increase in the introduction of residential and commercial private charging points for electric vehicles. The ongoing efforts of the Chinese government in the provision of charging infrastructures and popularization of electric vehicle applications play a key role in this regard. One of the factors that is driving growth in private charging networks in Japan and South Korea is the collaborations or cooperation between manufacturers, charging infrastructure suppliers and the governments in the two countries where the sales of EV vehicles are also on the rise.

- The India Private EV Charging Station Market is growing significantly due to Government initiatives in Electric vehicle & Scheme like FAME. However, there are still challenges, like the lack of sufficient public charging stations and the need for the industry to harmonize, which remain a major barrier to market growth in the region.

Active Key Players in the Private Electric Vehicle (EV) Charging Stations Market

- ABB

- BYD

- Xuji Group

- TELD

- Star Charge

- Chargepoint

- Webasto

- Efacec

- Leviton

- Siemens

- IES Synergy

- Pod Point

- Auto Electric Power Plant

- DBT-CEV

- Clipper Creek

- Schneider Electric

- Nitto Kogyo

- Panasonic

- Toyota Home

- Kawamura Electric

- Other Key Players

Key Industry Developments in the Private Electric Vehicle (EV) Charging Stations Market:

- On January 2024 when MAN Truck & Bus co-operated with ABB to solve the problems of electrification in the European transportation fleet with the signing of a cooperation agreement. The agreement primarily focused on accelerating the development of megawatt charging stations, R&D of new integration technologies for EVs, and the development of purpose-built software architectures for EV trucks.

- In February 2024, Raizen Power has signed a memorandum of understanding with Chinese-manufactured BYD brand in an effort to accelerate the adoption of sustainable electric mobility in Brazil. In the hope of providing users with a better recharging experience and clean and renewable energy on a much larger public network of electric stations, this endeavor envisions a significant increase in the number of public electric stations. The company plans to expand the infrastructure for the recharging of electric vehicles by approximately 600 DC charge points and ensuring that the installed power capacity for electromobility increases by 18 MW in Brazil by achieving its goal of capturing 25% of the market for electromobility vehicles in Brazil.

- Nevertheless, BP January 2024 has introduced an application for the management of EV fleets together with Geotab. Integrating Geotab’s telematics data with bp pulse’s Omega charge management software presents an opportunity to provide fleet operators with the best solutions at one platform. Through this combined approach, which is available on the Geotab Marketplace, an electric vehicle charging business can be streamlined based on the vehicles present and the less expensive energy. Combining the capabilities of both platforms for fleet optimization with the vast amount of information offered by Geotab’s vehicle telemetry system allows fleet managers to gain insights into vehicle location and state of charging systems.

|

Global ### Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

17.4 % |

Market Size in 2032: |

USD 5.5 Bn. |

|

Segments Covered: |

By Charger Type |

|

|

|

Charging Level |

|

||

|

By Installation Type |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATIONS MARKET BY CHARGER TYPE (2017-2032)

- PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATIONS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AC CHARGERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DC FAST CHARGERS

- PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATIONS MARKET BY CHARGING LEVEL (2017-2032)

- PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATIONS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LEVEL 1 CHARGING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LEVEL 2 CHARGING

- PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATIONS MARKET BY INSTALLATION TYPE (2017-2032)

- PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATIONS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- WALL-MOUNTED CHARGERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PEDESTAL CHARGERS

- PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATIONS MARKET BY END USERS (2017-2032)

- PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATIONS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- INDIVIDUAL OWNERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FLEET OWNERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATIONS Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ABB

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- BYD

- XUJI GROUP

- TELD

- STAR CHARGE

- CHARGEPOINT

- WEBASTO

- EFACEC

- LEVITON

- SIEMENS

- IES SYNERGY

- POD POINT

- AUTO ELECTRIC POWER PLANT

- DBT-CEV

- CLIPPER CREEK

- SCHNEIDER ELECTRIC

- NITTO KOGYO

- PANASONIC

- TOYOTA HOME

- KAWAMURA ELECTRIC

- COMPETITIVE LANDSCAPE

- GLOBAL PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATIONS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Charger Type

- Historic And Forecasted Market Size By Charging Level

- Historic And Forecasted Market Size By Installation Type

- Historic And Forecasted Market Size By End Users

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global ### Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

17.4 % |

Market Size in 2032: |

USD 5.5 Bn. |

|

Segments Covered: |

By Charger Type |

|

|

|

Charging Level |

|

||

|

By Installation Type |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET COMPETITIVE RIVALRY

TABLE 005. PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET THREAT OF NEW ENTRANTS

TABLE 006. PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET THREAT OF SUBSTITUTES

TABLE 007. PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET BY LEVEL OF CHARGING

TABLE 008. LEVEL 1 MARKET OVERVIEW (2016-2028)

TABLE 009. LEVEL 2 MARKET OVERVIEW (2016-2028)

TABLE 010. LEVEL 3 MARKET OVERVIEW (2016-2028)

TABLE 011. PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET BY VEHICLE TYPE

TABLE 012. PLUG-IN HYBRID VEHICLE (PHEV) MARKET OVERVIEW (2016-2028)

TABLE 013. BATTERY ELECTRIC VEHICLE (BEV) MARKET OVERVIEW (2016-2028)

TABLE 014. HYBRID ELECTRIC VEHICLE (HEV) MARKET OVERVIEW (2016-2028)

TABLE 015. PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET BY END USERS

TABLE 016. RESIDENTIAL MARKET OVERVIEW (2016-2028)

TABLE 017. COMMERCIAL MARKET OVERVIEW (2016-2028)

TABLE 018. NORTH AMERICA PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET, BY LEVEL OF CHARGING (2016-2028)

TABLE 019. NORTH AMERICA PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 020. NORTH AMERICA PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET, BY END USERS (2016-2028)

TABLE 021. N PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET, BY COUNTRY (2016-2028)

TABLE 022. EUROPE PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET, BY LEVEL OF CHARGING (2016-2028)

TABLE 023. EUROPE PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 024. EUROPE PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET, BY END USERS (2016-2028)

TABLE 025. PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET, BY COUNTRY (2016-2028)

TABLE 026. ASIA PACIFIC PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET, BY LEVEL OF CHARGING (2016-2028)

TABLE 027. ASIA PACIFIC PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 028. ASIA PACIFIC PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET, BY END USERS (2016-2028)

TABLE 029. PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET, BY COUNTRY (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET, BY LEVEL OF CHARGING (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET, BY END USERS (2016-2028)

TABLE 033. PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET, BY COUNTRY (2016-2028)

TABLE 034. SOUTH AMERICA PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET, BY LEVEL OF CHARGING (2016-2028)

TABLE 035. SOUTH AMERICA PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 036. SOUTH AMERICA PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET, BY END USERS (2016-2028)

TABLE 037. PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET, BY COUNTRY (2016-2028)

TABLE 038. ABB LTD: SNAPSHOT

TABLE 039. ABB LTD: BUSINESS PERFORMANCE

TABLE 040. ABB LTD: PRODUCT PORTFOLIO

TABLE 041. ABB LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. CHARGEPOINT INC: SNAPSHOT

TABLE 042. CHARGEPOINT INC: BUSINESS PERFORMANCE

TABLE 043. CHARGEPOINT INC: PRODUCT PORTFOLIO

TABLE 044. CHARGEPOINT INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. EVGO SERVICES LLC: SNAPSHOT

TABLE 045. EVGO SERVICES LLC: BUSINESS PERFORMANCE

TABLE 046. EVGO SERVICES LLC: PRODUCT PORTFOLIO

TABLE 047. EVGO SERVICES LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. ALLEGO: SNAPSHOT

TABLE 048. ALLEGO: BUSINESS PERFORMANCE

TABLE 049. ALLEGO: PRODUCT PORTFOLIO

TABLE 050. ALLEGO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. SCHEINDER ELECTRIC: SNAPSHOT

TABLE 051. SCHEINDER ELECTRIC: BUSINESS PERFORMANCE

TABLE 052. SCHEINDER ELECTRIC: PRODUCT PORTFOLIO

TABLE 053. SCHEINDER ELECTRIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. BLINK CHARGING CO: SNAPSHOT

TABLE 054. BLINK CHARGING CO: BUSINESS PERFORMANCE

TABLE 055. BLINK CHARGING CO: PRODUCT PORTFOLIO

TABLE 056. BLINK CHARGING CO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. WI TRICITY CORPORATION: SNAPSHOT

TABLE 057. WI TRICITY CORPORATION: BUSINESS PERFORMANCE

TABLE 058. WI TRICITY CORPORATION: PRODUCT PORTFOLIO

TABLE 059. WI TRICITY CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. TOSHIBA CORPORATION: SNAPSHOT

TABLE 060. TOSHIBA CORPORATION: BUSINESS PERFORMANCE

TABLE 061. TOSHIBA CORPORATION: PRODUCT PORTFOLIO

TABLE 062. TOSHIBA CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. AEROVIROMENT INC: SNAPSHOT

TABLE 063. AEROVIROMENT INC: BUSINESS PERFORMANCE

TABLE 064. AEROVIROMENT INC: PRODUCT PORTFOLIO

TABLE 065. AEROVIROMENT INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. MOJO MOBILITY INC: SNAPSHOT

TABLE 066. MOJO MOBILITY INC: BUSINESS PERFORMANCE

TABLE 067. MOJO MOBILITY INC: PRODUCT PORTFOLIO

TABLE 068. MOJO MOBILITY INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. GENERAL ELECTRIC: SNAPSHOT

TABLE 069. GENERAL ELECTRIC: BUSINESS PERFORMANCE

TABLE 070. GENERAL ELECTRIC: PRODUCT PORTFOLIO

TABLE 071. GENERAL ELECTRIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. ROBERT BOSCH GMBH: SNAPSHOT

TABLE 072. ROBERT BOSCH GMBH: BUSINESS PERFORMANCE

TABLE 073. ROBERT BOSCH GMBH: PRODUCT PORTFOLIO

TABLE 074. ROBERT BOSCH GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 075. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 076. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 077. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET OVERVIEW BY LEVEL OF CHARGING

FIGURE 012. LEVEL 1 MARKET OVERVIEW (2016-2028)

FIGURE 013. LEVEL 2 MARKET OVERVIEW (2016-2028)

FIGURE 014. LEVEL 3 MARKET OVERVIEW (2016-2028)

FIGURE 015. PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET OVERVIEW BY VEHICLE TYPE

FIGURE 016. PLUG-IN HYBRID VEHICLE (PHEV) MARKET OVERVIEW (2016-2028)

FIGURE 017. BATTERY ELECTRIC VEHICLE (BEV) MARKET OVERVIEW (2016-2028)

FIGURE 018. HYBRID ELECTRIC VEHICLE (HEV) MARKET OVERVIEW (2016-2028)

FIGURE 019. PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET OVERVIEW BY END USERS

FIGURE 020. RESIDENTIAL MARKET OVERVIEW (2016-2028)

FIGURE 021. COMMERCIAL MARKET OVERVIEW (2016-2028)

FIGURE 022. NORTH AMERICA PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. EUROPE PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. ASIA PACIFIC PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. MIDDLE EAST & AFRICA PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. SOUTH AMERICA PRIVATE ELECTRIC VEHICLE (EV) CHARGING STATION MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Private Electric Vehicle (EV) Charging Station Market research report is 2024-2032.

Tesla, Inc. (US), ChargePoint, Inc. (US), ClipperCreek, Inc. (US), Blink Charging Co. (US), EVgo Services LLC (US), SemaConnect, Inc. (US), Electrify America LLC (US),eMotorWerks (Enel X) (US), Greenlots (US), Bosch Automotive Service Solutions Inc. (US), Flo | AddÉnergie (Canada), Siemens AG (Germany), Webasto Group (Germany), Pod Point Ltd (UK), EVBox Group (Netherlands), NewMotion (Netherlands), Schneider Electric SE (France), Enel X (Italy), JuiceBar EV Charging (Norway), Power Electronics (Spain), ABB Ltd. (Switzerland), Eaton Corporation (Ireland), Delta Electronics, Inc. (Taiwan), Chargefox Pty Ltd (Australia), Tritium Pty Ltd (Australia) and Other Major Players.

The Private Electric Vehicle (EV) Charging Stations Market is segmented into Type, Charger level, Installation type, and End User. By Charger Type that market segmented in to Ac charger and Dc charger. In charging level market divided in to Charging level 1&2. By installation type divided in to Wall mounted and Pedestal Chargers. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The market for private electric vehicle (EV) charging stations pertains to the sector of EV charging infrastructure that is specifically engineered for private or residential purposes. Charging stations are strategically placed in private parking spaces, residences, and apartment complexes to enable the recharging of electric vehicles. For EV owners who lack access to public charging infrastructure or prefer the convenience of recharging their vehicles at home, private EV charging stations are indispensable. Typically, these stations consist of a grid-connected charging unit and are frequently installed by EV owners or property owners to accommodate the requirements of EV users.

Private Electric Vehicle (EV) Charging Stations Market Size Was Valued at USD 1.3 Billion in 2023, and is Projected to Reach USD 5.5 Billion by 2032, Growing at a CAGR of 17.4% From 2024-2032.