US Potato Chips Market Overview

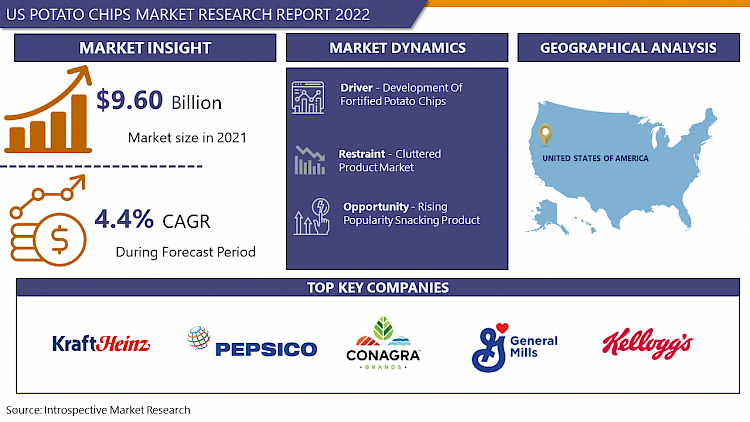

The US Potato Chips Market size is expected to grow from USD 10.02 billion in 2022 to USD 14.14 billion by 2030, at a CAGR of 4.4% during the forecast period (2023-2030).

The potato chips market is quite established as well as mature in the country. This can be attributed to the fact that they are very easily affordable and owing to the relatively cheap price of potato chips compared to other snacks even for the premium products, it has gained popularity among all age groups. The youngsters amongst the ever-growing population are the key demographic segment owing to which the potato chips market is on the rise. This is due to the availability of potato chips in a variety of flavours such for instance salty, chilly, and other flavours.

The rise in disposable incomes, rapidly changing lifestyles, and growing urbanization will remain strong factors for the growth of this market during the forecast period. When it comes to the type of flavor that goes into potato chips, people are more likely to choose the plain/salted potato chips on the backdrop of the fact that they are quite conscious and wisely choose the ingredients constituting artificial ones that can hamper their health. Although, the plain/salted segment dominated the market in 2016, the U.S potato chips market will witness significant growth in flavoured potato chips. This is due to the continuous efforts made by the players in the market to bring in fortified products in all-natural flavors.

Market Dynamics And Factors For US Potato Chips Market

Driver:

Development Of Fortified Potato Chips

The rapid socio-economic development that has taken place over the decades has also resulted in the rise of diseases such as heart disease, cancer and diabetes to various segments of the population. The growing health consciousness has resulted in consumers preferring fortified savory snacks such as potato chips with added health benefits. It has been noted recently that the antioxidants are being added to the potato chips in order to increase the shelf life of the frying oil. The changing lifestyles that encourage on the go eating and a growing trend to replace meals with smaller nutritional snacks have lead to an increase in adoption of potato chips in their daily diet.

The trend of being proactive to chronic health problems has spurred the demand for potato chips as they contain essential ingredients for instance plant extracts containing proteins that improve the overall health of consumers. The global trends that are moving towards personalized nutrition is expected to have a positive impact on positive impact on market growth of these products. The growing concerns among the about heart health, malnutrition and obesity can increase the demand for potato chips among the population. The rising healthcare expenditure cost due to improper food consumption is expected to drive demand for potato chips with health benefits. The fast-paced lifestyle couple with growing health awareness can increase the demand for these products.

Restraint:

Cluttered Product Market

The attractiveness of savory snacks market has caught the attention of many consumer companies. The consumer companies that have a deep understanding of changing consumer tastes and proper research coupled with new product development has led to the introduction of a large number of products. The entry of so many new companies has resulted in a product clutter in the savory snacks market.

The market is characterized by the presence of established as well as local players. These industry participants have led to the formation of clusters based on flavours, product, and health benefits. The changing consumer trends and lifestyles along with the industry’s efforts to develop products that suit these lifestyles have led to the product clutter in the savory snacks industry. However, despite the product clutter, the industry is growing. Going forward, the established players would have to trim down their product offerings to suit consumer demands. The consumer awareness about savory snacks is expected to increase and this would result in consumers opting for some specific products rather than experimenting with many products.

Segmentation Analysis of US Potato Chips Market

By Flavour, the Plain/Salted product segment is expected to have the highest share of the US Potato Chips Market in the forecast period. This segment has attained maturity and the primary reason for it can be attributed to the millennial population who don’t go for trying new flavours and experimenting. Another reason for the people in the U.S to stick with the conventional taste is that they are health conscious and carefully examine all the ingredients that goes into the products including artificial flavours. Growing demand for surface finished products coupled with presence of number of U.S Potato Chips manufacturers is likely to drive market demand over the forecast period.

The Flavoured segment market is characterized by the presence of established as well as local players. These industry participants have led to the formation of clusters based on flavours, product, and health benefits. The market is quite competitive in terms of the innovative and exotic flavours introduced by the companies. For instance, PepsiCo in January 2016 introduced eight new flavours, which involved the fusion of both Indian and Japanese cuisines.

By Distribution Channel, the Supermarket/Hypermarket product segment is expected to have the highest share of the US Potato Chips Market in the forecast period. Supermarkets/hypermarkets are the major distribution channel for the sale of potato chips in the US. The discount on large quantity purchases and the ease of shopping offered by supermarkets is expected to drive the demand of these products through this distribution channel. The rising number of supermarkets has resulted in improved access to these products for consumers. The rising health awareness coupled with improved convenience is expected to drive the demand for potato chips through supermarket/hypermarket distribution channel.

Convenience stores are predicted to have the second-highest share of the US Potato Chips Market. Convenience store is a retail format that stocks a large number of everyday items such as groceries, snack foods, toiletries, soft drinks, tobacco products, magazines, and newspapers. They are majorly located along the roadside, busy areas or transport hubs. The location is the major influencing factor that drives the demand of savory snacks through this distribution channel.

Independent retailers form an important component of the distribution channel for any potato chips manufacturer. The U.S potato chips market is experiencing an increase in the number of independent retailers that are boosting the penetration of potato chips in the country. Other distribution channels in the US potato chips market are service stations, drug stores, and online retail. The important components of the service station distribution channel are the petrol pumps or repair centres which are located on the roadside. The service station distribution channel has gained relatively less importance and is not expected to show much potential to generate more sales than other distribution channel.

COVID-19 Impact Analysis On US Potato Chips Market

The outbreak of COVID-19 resulted in unprecedented stress on the supply chain of potatoes, resulting in a negative impact on the overall growth of the potato chip of the market. For instance, exports of dehydrated potatoes declined by 16% and fresh by 13% in 2020 as compared to the fiscal year 2019 in the United States. Despite the disruptions in the supply chain of potatoes, the forced lockdown across the world and extended work from home scenario actively supported the at-home food consumption as well growth in snack products, which, in turn, augmented the demand for potato chips. The COVID-19 pandemic has resulted in the generation of opportunities for many private players to emerge in the markets to cater to the inflated demand for potato chips. Moreover, the high adoption rate of snack products among US individuals owing to COVID-19 has propelled the growth of the US Potato Chips Market. The pandemic has escalated the consumption of snack products owing to the long shelf life of these goods. Usage of snack products restricted individuals from leaving home and thus lowered the chances of contact with the COVID-19 virus. The inclinations towards online services have promoted the expansion of the US Potato Chips Market as ordering potato chips through web services has become more convenient. The demand for potato chips will likely rise again after the COVID-19 restrictions are relaxed.

Top Key Players Covered In The US Potato Chips Market

- Kraft Heinz Company

- Pepsico Inc

- ConAgra Foods

- Calbee Foods

- Diamond Foods

- General Mills

- Arca Continental

- Kellogg Company

- The Hain Celestial Group

Key Industry Developments In The US Potato Chips Market

In December 2016, PepsiCo, Inc. has announced a global sustainability agenda, with a focus on creating a healthier relationship between people and food. With a time goal of 2025 to transform PepsiCo’s food and beverage product portfolio, contribute to a more sustainable global food system and help make local communities more prosperous.

In June 2016, Kellogg Company established eighteen94 capital (1894) to make minority investments in companies pursuing next-generation innovation, bolstering access to cutting-edge ideas and trends. The investment mandate includes start-up businesses pioneering new ingredients, foods, packaging, and enabling technology.

|

US Potato Chips Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data : |

2017 to 2022 |

Market Size in 2022: |

USD 10.02 Bn. |

|

Forecast Period 2022-28 CAGR: |

4.4% |

Market Size in 2030: |

USD 14.14 Bn. |

|

Segments Covered: |

By Flavour |

|

|

|

By Distribution Channel |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Flavour

3.2 By Distribution Channel

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: US Potato Chips Market by Flavour

5.1 US Potato Chips Market Overview Snapshot and Growth Engine

5.2 US Potato Chips Market Overview

5.3 Flavoured

5.3.1 Introduction and Market Overview

5.3.2 Key Market Trends, Growth Factors and Opportunities

5.3.3 Impact of Covid-19

5.3.4 Historic and Forecasted Market Size (2016-2028F)

5.3.5 Key Market Trends, Growth Factors and Opportunities

5.3.6 Flavoured: Geographic Segmentation

5.4 Plain/Salted

5.4.1 Introduction and Market Overview

5.4.2 Key Market Trends, Growth Factors and Opportunities

5.4.3 Impact of Covid-19

5.4.4 Historic and Forecasted Market Size (2016-2028F)

5.4.5 Key Market Trends, Growth Factors and Opportunities

5.4.6 Plain/Salted: Geographic Segmentation

Chapter 6: US Potato Chips Market by Distribution Channel

6.1 US Potato Chips Market Overview Snapshot and Growth Engine

6.2 US Potato Chips Market Overview

6.3 Supermarket/Hypermarket

6.3.1 Introduction and Market Overview

6.3.2 Key Market Trends, Growth Factors and Opportunities

6.3.3 Impact of Covid-19

6.3.4 Historic and Forecasted Market Size (2016-2028F)

6.3.5 Key Market Trends, Growth Factors and Opportunities

6.3.6 Supermarket/Hypermarket: Geographic Segmentation

6.4 Independent Retailers

6.4.1 Introduction and Market Overview

6.4.2 Key Market Trends, Growth Factors and Opportunities

6.4.3 Impact of Covid-19

6.4.4 Historic and Forecasted Market Size (2016-2028F)

6.4.5 Key Market Trends, Growth Factors and Opportunities

6.4.6 Independent Retailers: Geographic Segmentation

6.5 Convenience Stores

6.5.1 Introduction and Market Overview

6.5.2 Key Market Trends, Growth Factors and Opportunities

6.5.3 Impact of Covid-19

6.5.4 Historic and Forecasted Market Size (2016-2028F)

6.5.5 Key Market Trends, Growth Factors and Opportunities

6.5.6 Convenience Stores: Geographic Segmentation

6.6 Other

6.6.1 Introduction and Market Overview

6.6.2 Key Market Trends, Growth Factors and Opportunities

6.6.3 Impact of Covid-19

6.6.4 Historic and Forecasted Market Size (2016-2028F)

6.6.5 Key Market Trends, Growth Factors and Opportunities

6.6.6 Other: Geographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 US Potato Chips Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 US Potato Chips Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 US Potato Chips Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 KRAFT HEINZ COMPANY

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 PEPSICO INC

7.4 CONAGRA FOODS

7.5 CALBEE FOODS

7.6 DIAMOND FOODS

7.7 GENERAL MILLS

7.8 ARCA CONTINENTAL

7.9 KELLOGG COMPANY

7.10 THE HAIN CELESTIAL GROUP

Chapter 8 Investment Analysis

Chapter 9 Analyst Viewpoint and Conclusion

|

US Potato Chips Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data : |

2017 to 2022 |

Market Size in 2022: |

USD 10.02 Bn. |

|

Forecast Period 2022-28 CAGR: |

4.4% |

Market Size in 2030: |

USD 14.14 Bn. |

|

Segments Covered: |

By Flavour |

|

|

|

By Distribution Channel |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. US POTATO CHIPS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. US POTATO CHIPS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. US POTATO CHIPS MARKET COMPETITIVE RIVALRY

TABLE 005. US POTATO CHIPS MARKET THREAT OF NEW ENTRANTS

TABLE 006. US POTATO CHIPS MARKET THREAT OF SUBSTITUTES

TABLE 007. US POTATO CHIPS MARKET BY FLAVOUR

TABLE 008. FLAVOURED MARKET OVERVIEW (2016-2028)

TABLE 009. PLAIN/SALTED MARKET OVERVIEW (2016-2028)

TABLE 010. US POTATO CHIPS MARKET BY DISTRIBUTION CHANNEL

TABLE 011. SUPERMARKET/HYPERMARKET MARKET OVERVIEW (2016-2028)

TABLE 012. INDEPENDENT RETAILERS MARKET OVERVIEW (2016-2028)

TABLE 013. CONVENIENCE STORES MARKET OVERVIEW (2016-2028)

TABLE 014. OTHER MARKET OVERVIEW (2016-2028)

TABLE 015. US POTATO CHIPS MARKET, BY FLAVOUR (2016-2028)

TABLE 016. US POTATO CHIPS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 017. US POTATO CHIPS MARKET, BY COUNTRY (2016-2028)

TABLE 018. KRAFT HEINZ COMPANY: SNAPSHOT

TABLE 019. KRAFT HEINZ COMPANY: BUSINESS PERFORMANCE

TABLE 020. KRAFT HEINZ COMPANY: PRODUCT PORTFOLIO

TABLE 021. KRAFT HEINZ COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 021. PEPSICO INC: SNAPSHOT

TABLE 022. PEPSICO INC: BUSINESS PERFORMANCE

TABLE 023. PEPSICO INC: PRODUCT PORTFOLIO

TABLE 024. PEPSICO INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 024. CONAGRA FOODS: SNAPSHOT

TABLE 025. CONAGRA FOODS: BUSINESS PERFORMANCE

TABLE 026. CONAGRA FOODS: PRODUCT PORTFOLIO

TABLE 027. CONAGRA FOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 027. CALBEE FOODS: SNAPSHOT

TABLE 028. CALBEE FOODS: BUSINESS PERFORMANCE

TABLE 029. CALBEE FOODS: PRODUCT PORTFOLIO

TABLE 030. CALBEE FOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 030. DIAMOND FOODS: SNAPSHOT

TABLE 031. DIAMOND FOODS: BUSINESS PERFORMANCE

TABLE 032. DIAMOND FOODS: PRODUCT PORTFOLIO

TABLE 033. DIAMOND FOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. GENERAL MILLS: SNAPSHOT

TABLE 034. GENERAL MILLS: BUSINESS PERFORMANCE

TABLE 035. GENERAL MILLS: PRODUCT PORTFOLIO

TABLE 036. GENERAL MILLS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. ARCA CONTINENTAL: SNAPSHOT

TABLE 037. ARCA CONTINENTAL: BUSINESS PERFORMANCE

TABLE 038. ARCA CONTINENTAL: PRODUCT PORTFOLIO

TABLE 039. ARCA CONTINENTAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. KELLOGG COMPANY: SNAPSHOT

TABLE 040. KELLOGG COMPANY: BUSINESS PERFORMANCE

TABLE 041. KELLOGG COMPANY: PRODUCT PORTFOLIO

TABLE 042. KELLOGG COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. THE HAIN CELESTIAL GROUP: SNAPSHOT

TABLE 043. THE HAIN CELESTIAL GROUP: BUSINESS PERFORMANCE

TABLE 044. THE HAIN CELESTIAL GROUP: PRODUCT PORTFOLIO

TABLE 045. THE HAIN CELESTIAL GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. US POTATO CHIPS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. US POTATO CHIPS MARKET OVERVIEW BY FLAVOUR

FIGURE 012. FLAVOURED MARKET OVERVIEW (2016-2028)

FIGURE 013. PLAIN/SALTED MARKET OVERVIEW (2016-2028)

FIGURE 014. US POTATO CHIPS MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 015. SUPERMARKET/HYPERMARKET MARKET OVERVIEW (2016-2028)

FIGURE 016. INDEPENDENT RETAILERS MARKET OVERVIEW (2016-2028)

FIGURE 017. CONVENIENCE STORES MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 019. US POTATO CHIPS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the US Potato Chips Market research report is 2023-2030.

Kraft Heinz Company, Pepsico Inc, ConAgra Foods, Calbee Foods, Diamond Foods, General Mills, Arca Continental, Kellogg Company, The Hain Celestial Group, Other Major Players

The US Potato Chips Market is segmented into Flavours, Distribution Channel, and Region. By Flavour, the market is categorized into Flavoured, Plain/Salted. By Distribution Channel, the market is categorized into Supermarket/Hypermarket, Independent Retailers, Convenience Stores, Other.

Potato chips are one of the most convenient food options currently available for people to keep pace with their busy lifestyles. It shortens the meal preparation time and can be served in the form of a quick snack or part of the meal. Crisps are savory snacks that are particularly popular in Western countries, they constitute a significant part of the snack food market.

The US Potato Chips Market size is expected to grow from USD 10.02 billion in 2022 to USD 14.14 billion by 2030, at a CAGR of 4.4% during the forecast period (2023-2030).